A recent bulk buying story has gone around Singapore’s property news like wildfire. News of a Chinese investor buying 20 units at CanningHill Piers has been circulated around Yahoo news, mothership, 99.co, and edgeprop. Sensational as it might be, this event begs the question if we will see more of this happening in the near future.

Will we see more foreign investors bulk buy Condos like what we have seen at CanningHill Piers? Many will be tempted to treat this as a one-off event. An anomaly. A special case. But there may be something in this story that we are missing. While such events are few and far between, it does not mean that they are entirely divorced from each other.

They could be part of a larger trend, only one that is spaced out further across time. In our previous articles, we covered the luxury market in three different pieces. We covered the role of real estate in high net worth portfolios, Singapore as an investment decision, and our post-pandemic strategy for Singapore’s luxury property market.

In this article, we will cover more on how this sensational piece of news might be a part of a larger puzzle in the luxury property market. We also summarise our previous articles on the luxury property market and link it to this event.

Bulk Buying Singaporean Condos — Does it even make sense?

The thought of bulk buying condominiums in Singapore seems ludicrous. It is mind-bending to even conceive the total sum of the transaction. But it doesn’t stop there. It is almost as if it is a theatrical drama, trying to make a point in the market. How does one even stomach paying so much in Additional Buyer’s Stamp Duty? That could easily take up a huge chunk of cash in the entire transaction.

All these reasons seem to point to madness. Is there any method to this madness? Let us break down the transaction and work backwards to think about what might be going through the buyer’s mind. (And I bet you might be curious as to how rich this person actually is).

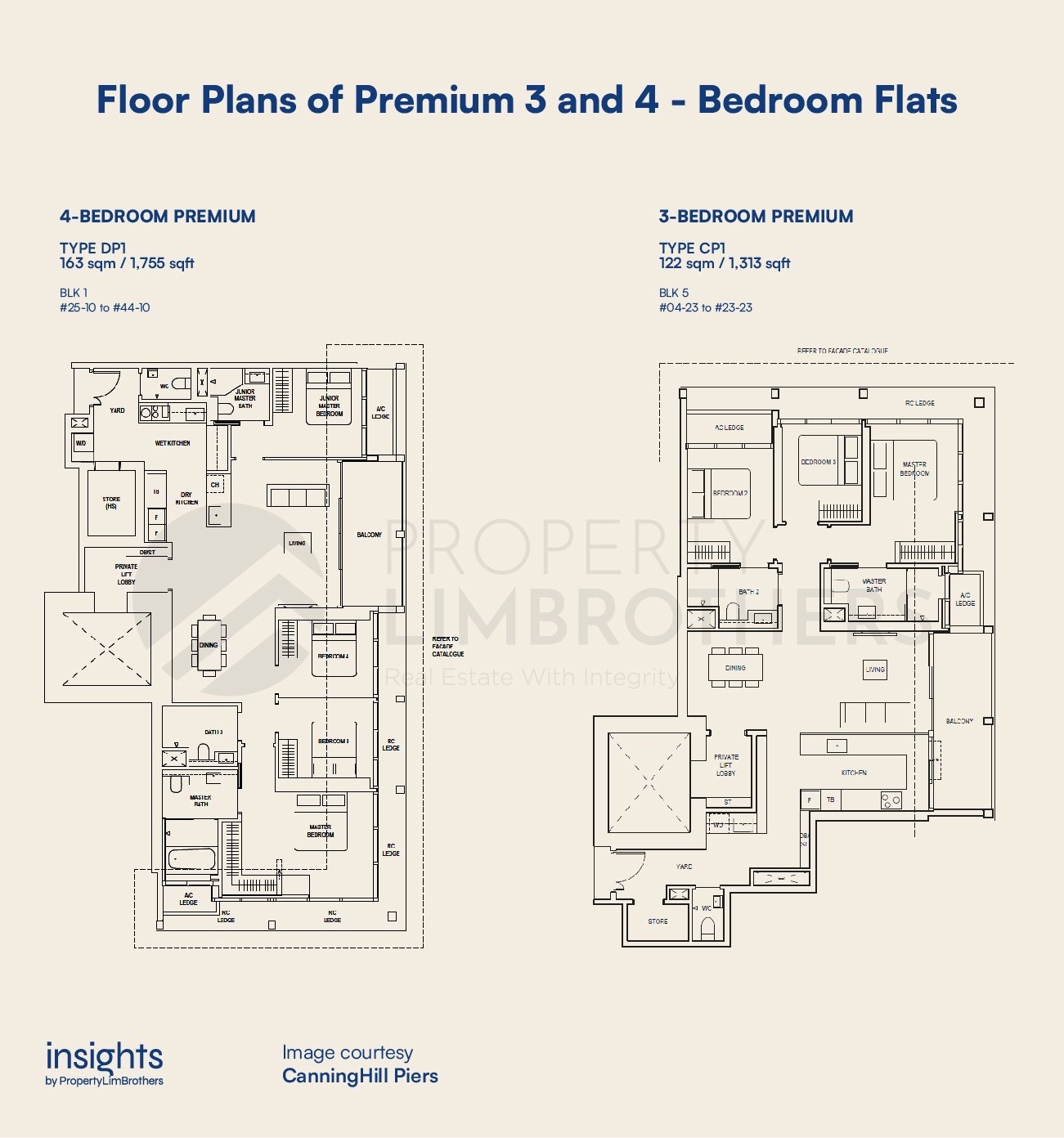

From Yahoo news, it seems that the transaction involved six large 3-Bedders (est. $3.3M each), five small 3-Bedders (est. $3.1M each), and nine 4-Bedders (est $5.5M each). For the properties alone, this would sum up to roughly $84.8M. This is close to the $85M estimate given by other news sources.

Assuming that Stamp Duty is not included in the purchase price, the regular Buyer’s Stamp Duty will be approximately $108.6K for the small 3-Bedders, $116.6K for large 3-Bedders, and $204.6K for the 4-Bedders. This will sum up to around $3.084M in Buyer’s Stamp Duty for the 20 units. To some, this is already mind blowing as you could probably buy a decent condo unit with the stamp duty alone. Now, for the ABSD of the 20 units. It would total up to around $3.57M. The total duties paid would be around $6.654M

Looking at the deal, a cash amount of approximately $28M. This is assuming that a loan could be taken for all the properties at 75% Loan-to-Valuation. If not, the total deal size would be around $91.5M. Further assuming a loan tenure of 30 years and 2.5% interest, the loan amount of $63.6M would mean a total monthly mortgage payment of $251K.

Indeed, these are mind blowing numbers. And there are some ways we can estimate the net worth of the person buying these properties. How rich must you be to afford 20 units at CanningHill Piers without feeling a pinch?

High Net Worth Portfolios

Using a portfolio approach, HNW portfolios typically allocate around 10 to 15% of their entire portfolio to real estate investments. Out of this 10-15%, it is likely that there is some level of diversification in the portfolio. In this case, let’s assume that it is a 5% allocation to the 20 units at CanningHill Piers (very conservative estimate). That would leave us with an estimated net worth of between $560M (with loan) and $1.83B (cash payment). It is very likely that the actual allocation is only around 1% or less, with a full cash payment, that would be an estimated net worth of $9.15B.

This is a huge range to work with. Our goal is not so much to find the actual identity of the investor as it is to find out how wealthy you would have to be to afford a move such as this without feeling a pinch.

In the portfolio article, we discuss how a HNW portfolio typically looks like and how it should be managed to meet all the needs and wants of the individual investor. Very often, the obsession with just returns on investment could tunnel vision the investor into making sub-optimal decisions for their own personal goals. The portfolio should be able to deliver on all needs, including legacy and estate planning needs. At this size of a portfolio, it is often not so much about returns as it is about certainty and stability.

This particular investment move is an interesting way to go “All-In” on the property development. Sometimes, diversification is costly. First, there is a cost to search and go through many separate transactions. There are some benefits to bulk-buying a single development on an administrative and legal basis. Next, diversification lowers risk but also has the potential to lower average returns. This of course depends on a handful of other factors. The basic premise is that you do not want to diversify into poorer performing assets just for the sake of diversifying your portfolio.

Diversification for a HNW portfolio is a debatable topic. There is no one-size-fits-all approach to portfolio construction. Nonetheless, for a HNW portfolio, it is likely that a decent degree of diversification is built into the portfolio in terms of the different asset classes that are already allocated.

It might or might not be a good idea to further diversify within the asset classes themselves. The reason to do so must be well justified and serves directly, the purposes of the investment portfolio.

Singaporean Luxury Properties — More Bulk Buys in the Future?

This is not the first and definitely not the last property bulk buy episode we see in Singapore. Earlier in March, another Condo bulk buying move caught the public’s attention. Though they are few and far between, we expect to see more of this moving forward into the future. Despite the rising ABSD levels for foreign and local investors, it might not be enough to deter HNW individuals from growing their property portfolios.

Even at a 30% ABSD, we see foreigners unafraid to dip their hands deep into Singapore’s property market. This makes sense if the property is freehold or at least has a fresh 99-year lease in the form of a new launch. With a long investment horizon, the cost of duties can be accrued, with the potential of realising good gains still.

Compared to other destinations for real estate investment, Singapore consistently rates as one of the best. Apart from development and investment prospects, Singapore is well-known for its geo-political stability and hub status. With ever improving infrastructure and a supportive government to back it, investor confidence in Singapore is high and still growing.

The land-scarce state of Singapore is not going to be much different in the future. With the URA “Space for Our Dreams” exhibition, it only shows how carefully the authorities plan the use of land on the island. With this much attention in the development of our city-state, coupled with the little land that we have, investors are very confident that the future of their property investments is likely to be secure.

Will we see more foreign interest and bulk buying moving forward? Very likely. For instance, Chinese HNW individuals are looking to park their capital overseas investments. Diversification across geographies will grow in popularity as the world enters a state of growing geo-political tension. With the Ukrainian war and ballooning commodity prices, tensions are strung tight. When HNW individuals choose to diversify across different countries, Singapore stands out as a good candidate.

Apart from the above mentioned reasons, rule of law is strong in Singapore. Owing much of this to our founding leaders, the reason why people live, work, and start businesses in Singapore is because of a strong legal system that is respected and enforced. With the appropriate legal infrastructure, businesses are able to operate with greatly reduced threat of corruption or getting away with contract violations. The strong financial institutions and regulatory bodies also add to the appeal of Singapore as an investment destination.

With all the reasons above, we ought to see the Singaporean real estate market continue to take the leaderboards as one of the best (if not the best) destinations for foreign investors.

Closing Thoughts

That being said, HNW individuals often rely on their personal networks to source for trustworthy individuals who could help them transact in other geographies. This concern is valid and of utmost importance in a deal this big.

The real estate industry, however, is not that commonly associated with those traits. Nonetheless, there are many good realtors that really serve the best interests of their customers.

PLB’s aspiration has always been to conduct itself to the highest standards of integrity. We look to improve and build our expertise day-by-day. And not grow complacent of our abilities in a fast-paced and ever-changing environment.

If you’re interested to know more about HNW portfolios and how real estate can help you meet your personal goals and needs, you may reach out to our experts here. Alternatively, you can drop a direct message to your favourite IST member.