In Singapore’s property investing scene, there exists many schools of thought on how to do it best. From buying multiple private properties for rental yield, diversifying your portfolio to include REITs and overseas properties, to going for the apex of property types – Landed houses. While there is no one size fits all approach, we explain in this article why landed houses in Singapore are the “hardest” residential asset class.

When property investors select an investment strategy, it is often from the influence of agents, influencers, or peers. A variety of factors, including but not limited to financial status, lifestage, and goals also contribute to the plethora of existing strategies we see today. Even though investors might have a certain “style” or preference in property investing, one should keep their mind open to ideas especially when investing in such high quantums.

There are some undeniable truths about Singapore’s landed property segment that make it one of the most appealing and resilient forms of real estate investment. With inherent advantages such as scarcity, exclusivity, and long-term capital growth, landed homes are fortified by powerful economic and social moats that continue to enhance their value over time. These factors position landed properties as a unique asset class that stands apart from other types of residential real estate. As market dynamics evolve, landed homes remain a symbol of enduring wealth and status, benefiting from trends that safeguard and propel their value into the future.

In this article, we will explore the key reasons why landed houses have surged into the spotlight, despite their limited supply and sky-high prices. We will examine why this asset class remains in high demand even after significant price increases, analysing its price inelasticity and unique appeal. From the scarcity of available land to the growing interest from global high-net-worth individuals, we will break down the factors that keep landed properties at the pinnacle of Singapore’s real estate market.

Scarcity of Landed Properties in Singapore

One of the primary reasons landed properties remain a highly sought-after asset in Singapore is their inherent scarcity. Land has always been a limited resource on this small island nation, and property investors have long understood this as a fundamental truth in the real estate market. However, what often goes unrecognised is the extreme scarcity of landed houses compared to other residential property types such as HDB flats and condominiums. This makes landed properties not just scarce, but exceptionally rare, amplifying their desirability and value over time.

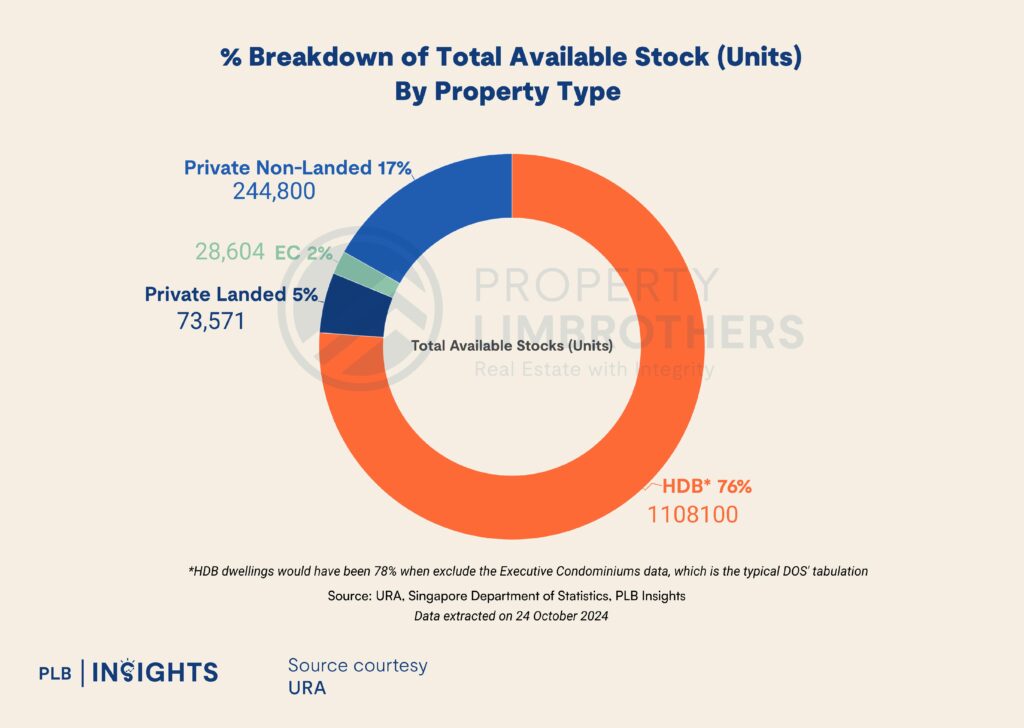

While discussions about land scarcity typically emphasise how this constraint drives the overall success of Singapore’s real estate market, what is frequently understated is the relative scarcity of landed homes specifically. This segment represents less than 5% of all residential properties in Singapore, further intensifying demand. In a landscape dominated by high-rise developments and mass-market housing, landed properties provide an unparalleled sense of space and exclusivity. For homeowners and investors, owning a piece of actual land—whether it be a terrace house, semi-detached, or bungalow—becomes not only a status symbol but also a highly protected asset class.

In the current and future real estate landscape, this scarcity will only be exacerbated by government land-use policies, which prioritise high-density developments to accommodate Singapore’s growing population. As a result, the supply of landed properties will remain extremely limited, driving up prices and enhancing the appeal of these homes as long-term investments. Investors and homeowners alike are acutely aware that while the supply of condominiums and apartments can be expanded through vertical growth, the amount of land available for landed housing is essentially fixed. This ensures that landed homes will continue to hold their value—and, more likely, appreciate significantly—in the coming years.

This imbalance between supply and demand for landed properties makes them one of the most stable and secure forms of real estate investment. In a market where condominiums and high-rise apartments are subject to fluctuations in demand and price sensitivity, landed properties offer something far more inelastic. The allure of owning land in one of the world’s most land-scarce nations is not just about securing a home; it’s about safeguarding a generational asset that is becoming increasingly unattainable for future buyers.

The price trajectory of landed properties in Singapore has outpaced that of non-landed properties over the years, driven by a combination of limited supply and rising demand. Over the past 5 years, landed prices have increased approximately 41% whereas non-landed prices have increased approximately 31%. While prices for both property types have increased steadily due to Singapore’s economic growth and population expansion, landed homes have experienced a sharper, more sustained rise. This is largely due to their scarcity and exclusivity, factors that are amplified in a land-constrained city-state. As Singapore’s population continues to grow and urbanise, the demand for land, particularly for residential purposes, has intensified. However, the supply of landed properties remains highly restricted, pushing prices upwards at a faster rate than their non-landed counterparts.

In recent years, this divergence in price trends has become even more apparent. While private condominiums and HDB flats have seen moderate price increases, the landed property segment has surged ahead, often setting record-breaking transactions in prime and even suburban areas. According to data from the Urban Redevelopment Authority (URA), the landed property price index has consistently outperformed the non-landed property index, reflecting the unique position of landed homes in Singapore’s property market. This price disparity highlights the inelastic nature of landed property demand, where buyers are often high-net-worth individuals or families seeking not just a home but an enduring, tangible asset that offers both stability and long-term value appreciation.

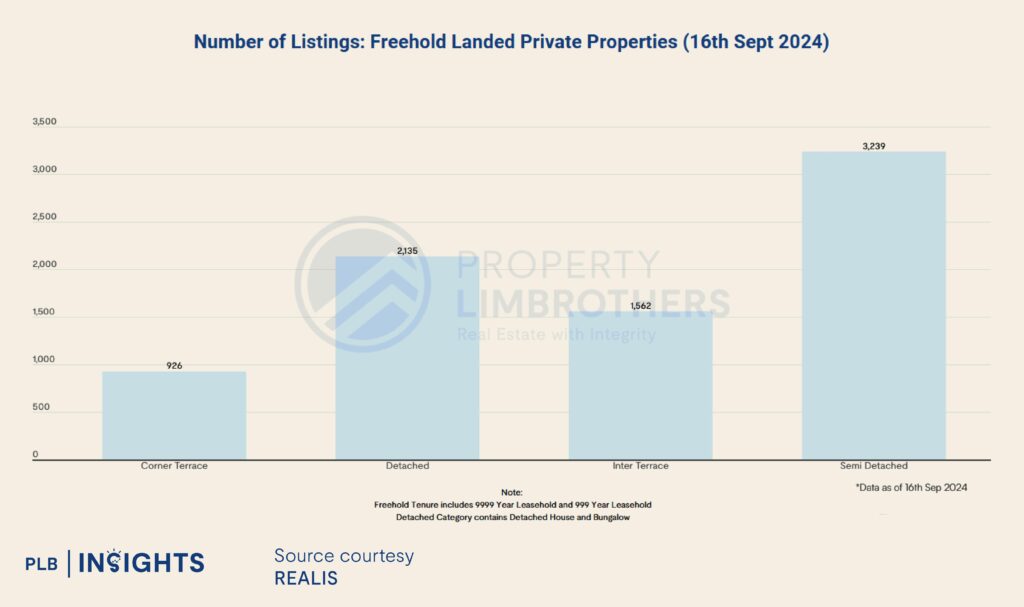

Freehold landed houses in Singapore represent an asset class that remains relatively underrated, despite their immense potential for long-term value appreciation. This is largely due to their extreme scarcity. Unlike leasehold properties, which are bound by fixed terms, freehold landed homes offer indefinite ownership, making them highly desirable in the context of Singapore’s land constraints. However, the focus on scarcity in the broader real estate market tends to revolve around leasehold landed properties or luxury condominiums, overshadowing the true potential of freehold landed properties. These freehold assets, often passed down through generations, provide both a sense of permanence and security that is unparalleled by other types of property in Singapore.

One reason for their underrated status is the limited availability of freehold landed properties, especially when compared to the overall supply of leasehold properties, HDBs, or even luxury condominiums. The government’s careful management of land resources means that the opportunity to develop new freehold landed homes is virtually non-existent, leading to a tightly held, illiquid market. As a result, potential buyers often overlook this segment in favour of more readily available, albeit temporary, alternatives like 99-year leasehold landed homes or high-end condos. However, for those with the foresight and financial capability, investing in a freehold landed property offers unmatched value preservation and capital growth potential, given its perpetual ownership status in an increasingly land-scarce country.

Moreover, freehold landed properties tend to attract buyers who are more focused on legacy planning and long-term wealth preservation. Unlike other property types that may fluctuate with market cycles or are subject to lease depreciation, freehold landed homes are seen as a permanent asset class. This segment may be overlooked by some due to higher entry barriers, but it is exactly this scarcity that makes them a more valuable and resilient investment. As land becomes scarcer and freehold properties increasingly rare, this underrated asset class is poised to experience even stronger demand, making it an invaluable component of any diversified property portfolio.

Immigration Boom and Family Nuclearisation

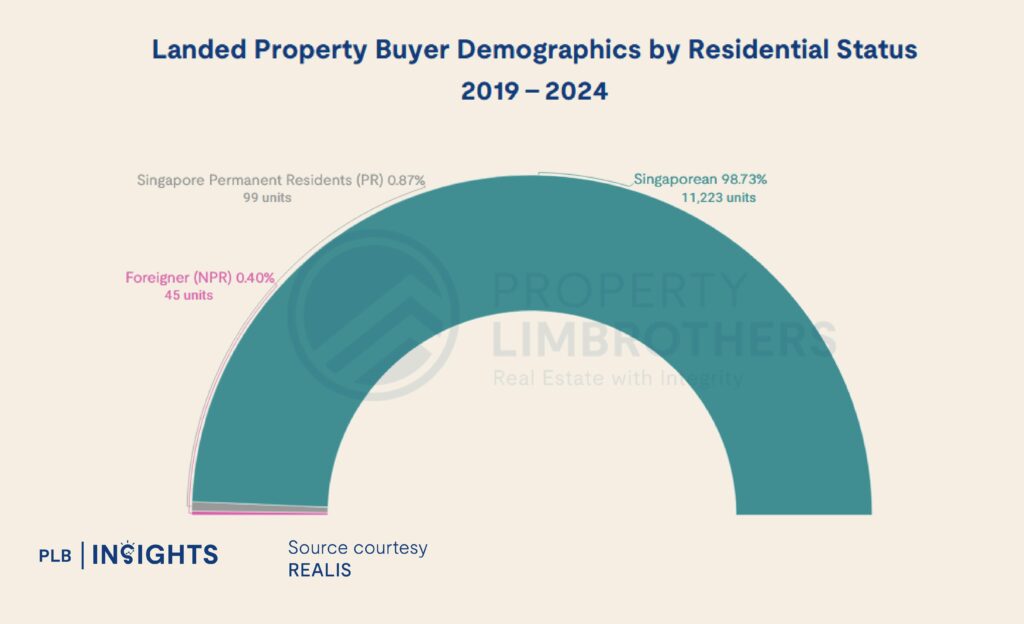

Singapore’s landed property market is predominantly driven by local buyers, with Singaporeans accounting for approximately 98% of landed property transactions. This high concentration of local ownership in the landed segment reflects a broader market trend where landed homes are seen as a prized asset, often passed down through generations. However, as Singapore experiences an immigration boom and a rise in new family formations, the impact of these demographic shifts is more likely to be felt first in the non-landed segments of the market, particularly in HDB flats and condominiums.

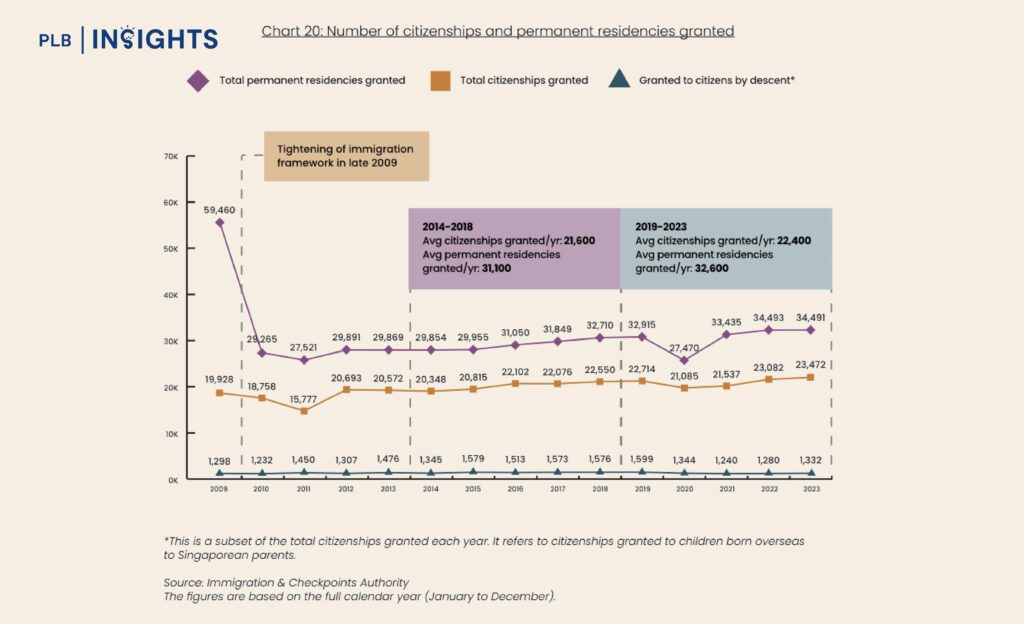

In recent years, Singapore has seen a steady increase in the number of new citizens, with citizenships granted over the past five years rising significantly. As the government continues to grow the population to maintain economic vitality and counter the effects of an ageing population, it is likely that this trend will persist. Many of these new citizens will enter the property market by purchasing HDB flats or private condominiums, adding pressure to these segments and driving prices upward. This rising demand, spurred by an influx of newly naturalised immigrants and newly formed Singaporean families, will act as a catalyst in propping up the baseline property market.

As prices in the HDB and condo sectors rise due to increased demand, existing homeowners will benefit from appreciating property values, enabling them to upgrade to more premium housing options over time. This natural progression from HDBs to condos, and eventually to landed homes, will sustain and even increase demand for landed properties. As long as Singapore continues to grant citizenships to strengthen its population base, this pattern of upgrading and capital growth will likely persist, pushing up prices in the landed property market and maintaining its status as the pinnacle of residential assets in the country.

Singapore as a Haven for Global High Net Worth Individuals

Singapore has emerged as a prime destination for ultra-high-net-worth (UHNW) individuals, drawn by its political stability, robust financial infrastructure, and attractive real estate market. With a rapidly growing number of millionaires, centimillionaires, and billionaires, the demand for premium properties, particularly landed homes, has surged. Currently, Singapore is home to 244,800 resident millionaires, 336 centimillionaires, and 30 billionaires, underscoring the city’s increasing appeal to the global wealthy. In 2023 alone, 3,400 high-net-worth individuals (HNWIs) relocated to Singapore, a testament to the country’s attractiveness as a wealth haven.

While the exact number of these UHNW individuals who have been naturalised as Singapore citizens remains unknown, their presence in the market cannot be understated. These affluent buyers often seek exclusive and prestigious properties that offer privacy and space, making landed homes an ideal investment. With limited supply and ever-increasing demand, landed properties stand as a top choice for those looking to secure and grow their wealth in Singapore’s competitive real estate market.

Furthermore, as Singapore continues to attract HNWIs from around the globe, the local landed property market benefits from a ripple effect. The influx of global wealth boosts overall demand for premium assets, pushing prices higher and further solidifying landed properties as one of the most sought-after segments. With over 29,000 centimillionaires globally, Singapore’s status as a hub for this exclusive group ensures that its landed property market remains resilient and poised for long-term growth.

Inflationary Erosion of Purchasing Power & Luxury Property Assets

The inflationary pressures on the real estate market have significantly eroded the purchasing power of individuals, making it harder to afford properties today compared to the past. In the 1990s, both landed and non-landed properties were much more accessible to middle- and upper-income households in Singapore. The median household income in 1995 was around S$3,135 per month, while the average price of a landed property hovered between S$1 million to S$2 million. This meant that with prudent savings and a manageable loan, many Singaporeans could afford to purchase landed properties. Non-landed homes, like condominiums, were even more affordable, with average prices ranging from S$500,000 to S$800,000.

However, as the years went by, property prices began to escalate far faster than incomes. By 2023, the median household income had risen to around S$10,000 per month, but the prices of landed properties skyrocketed, averaging S$4 million to S$5 million in central locations and upwards of S$2.5 million in more suburban areas. This rapid increase outpaced income growth, creating a significant affordability gap for those looking to invest in landed properties.

In addition to rising prices, government cooling measures implemented over the years have further intensified the challenges for potential homeowners. Stricter regulations, such as lower loan-to-value (LTV) limits and higher cash outlay requirements, mean that buyers now need to save significantly more to secure a landed property. Previously, buyers could finance a larger portion of their purchase through loans, making homeownership more accessible. However, with LTV limits tightened to 75% or lower for non-citizens and additional stamp duties on foreign buyers, the financial burden on potential homeowners has increased, creating a high barrier of entry in the market.

Meanwhile, non-landed properties such as condominiums, while more affordable, have also seen substantial price hikes, with average prices now ranging from S$1.5 million to S$2 million, effectively tripling over the last 30 years. The combination of skyrocketing property prices and stringent financing measures has made it increasingly difficult for many buyers to achieve their dreams of owning a landed home, reinforcing the perception of landed properties as a luxury asset that requires significant savings and financial planning.

This inflationary erosion of purchasing power is even more pronounced in the luxury property market. While average landed property prices have risen, luxury landed homes—particularly in prime districts—have experienced even steeper price escalations. In the 1990s, high-end landed properties in areas like Bukit Timah or Orchard were priced at around S$3 million. Today, these same properties can command prices of S$10 million or more, representing a three- to four-fold increase in value. Meanwhile, income growth has been far more moderate, with wage increases not keeping pace with the rising cost of luxury real estate.

For many aspiring homeowners, this disparity between income growth and property prices means that the dream of owning a landed home, especially a luxury one, is becoming increasingly out of reach. In the past, a family with a stable upper-middle-class income could reasonably aim to own a landed property after years of saving. Now, even the most diligent savers struggle to amass the financial resources needed to afford such assets. The widening gap between property prices and household incomes underscores the growing exclusivity of the landed property market.

Looking ahead, inflationary pressures are expected to persist, making landed homes an even more desirable and scarce asset class. Those who can afford these properties see them not only as a place to live but also as a store of value and a hedge against inflation. As property prices continue to rise, luxury landed properties will likely become even more valuable, further pushing them beyond the reach of average homeowners. This dynamic reinforces the notion that landed properties are not only a scarce and prestigious asset but also one that will continue to appreciate over time, driven by inflation and increasing demand from high-net-worth individuals.

Closing Thoughts

In conclusion, the landscape of Singapore’s real estate market, particularly regarding landed properties, reveals a complex interplay of scarcity, economic factors, and evolving social dynamics. The increasing demand for landed houses, driven by immigration trends, the influx of high-net-worth individuals, and the rising purchasing power erosion, underscores their enduring appeal as a premium asset class. However, as property prices soar, the challenges of affordability and stringent government measures complicate the path to ownership. As Singapore continues to navigate these intricate market dynamics, it is clear that landed properties will remain the “hardest” residential asset class, appealing to both investors and homeowners alike, albeit with a heightened need for strategic financial planning and adaptability to the changing environment.

Let’s get in touch

If you are in the midst of hunting for an investment property, or are looking to restructure your property portfolio, but are unsure of the approach in the current landscape, do reach out to us here and we’ll be more than happy to help you make sense of the market.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.