The market for short-term rental investments has witnessed robust growth over recent years, driven largely by the popularity of platforms like Airbnb. For many investors, these arrangements require the acquisition of a property, subsequently transformed into a short-term (shorter than 3 months) rental asset. However, in Singapore, such investments encounter regulatory challenges, as local restrictions prohibit short-term rentals in private residences.

This backdrop has set the stage for a rising interest in an alternative investment vehicle: the condotel. Before we dive into the condotel investment, let’s look at two typical Singaporean household property life cycles.

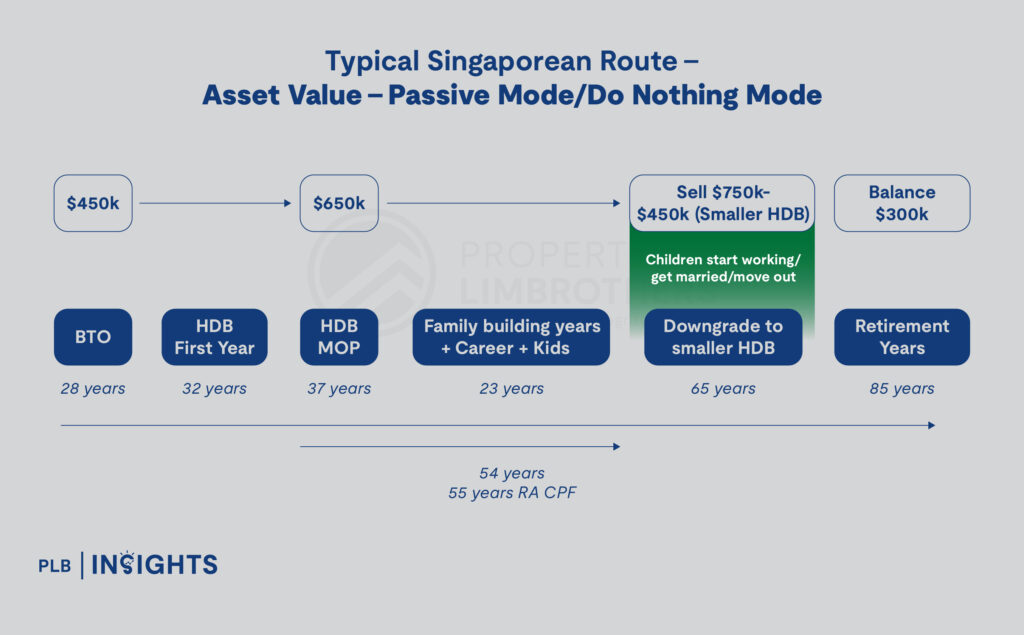

Case Study 1: Typical Singaporean Route – Passive/”Do Nothing” Mode

Phase 1: Initial Property Purchase and Appreciation

For many Singaporeans, the first step into property ownership often begins with purchasing a Build-to-Order (BTO) flat. In this example, a couple purchases a BTO flat at the age of 28 for approximately $450,000. Following a standard 4-year construction period, they receive the keys at age 32.

With Singapore’s public housing regulations, a Minimum Occupation Period (MOP) of 5 years is required before the flat can be sold on the open market. By the end of this period, at around age 37, the property appreciated, reaching a valuation of approximately $650,000. This capital appreciation signifies the strong potential of HDB flats as an asset class in the Singapore market.

Phase 2: Family-Building Years and Stability

For the next 23 years, from age 37 to 60, the couple typically focuses on career advancement, raising children, and family-building. During these years, the HDB flat serves as both a stable home and an appreciating asset. Upon reaching age 65, with children now independent, the couple decides to monetise the gains by selling their HDB flat, which has appreciated further to $750,000.

Phase 3: Downsizing and Realisation of Gains

Upon sale of the original HDB property, the couple acquires a smaller $450,000 HDB flat, freeing up approximately $300,000 as realised profit. This capital now represents liquid funds that can support their retirement and diversify their investment portfolio.

Investment Options For Realised Profits

With $300,000 in liquid funds, the couple faces various investment avenues:

Equities: Although potentially volatile, equities can offer high returns over the long term. However, the risk profile may be a concern for those approaching retirement.

Real Estate Investment Trusts (REITs): For a relatively safer option, REITs provide exposure to real estate with the added benefit of Singapore Exchange (SGX) regulations, ensuring sound governance and oversight. Additionally, REITs offer quarterly or half-yearly dividends, creating a source of passive income.

Alternative Investments: To diversify further, they could consider alternative investments, such as condotels, which share similar traits to REITs or Trusts in that these entities provide dividends in the form of passive income, except that dividends are tied to the Trust’s bottom-line – their net property income. Additionally, when investing in the Trust’s stocks, investors can also gain capital appreciation depending on the performance of the Trust.

Similarly, condotels allow investors to receive monthly passive income linked directly to the hotel’s profit and loss (P&L). Some base it on their bottom-line, while others base it on their top-line P&L. In addition, investors receive a Strata Title for each unit they purchase, which can be sold on the secondary market or back to the developer, depending on the investor’s portfolio goals or preferences, which may be altered due to unforeseen circumstances.

When the condotel holds a freehold tenure, the income-generating structure is also timeless, providing an asset that generates passive income which can also be passed onto future generations.

Note: Alternative Investments apply primarily to individuals who are well-positioned or have maximised their Singapore residential portfolio, allowing them to consider alternative investments for portfolio expansion.

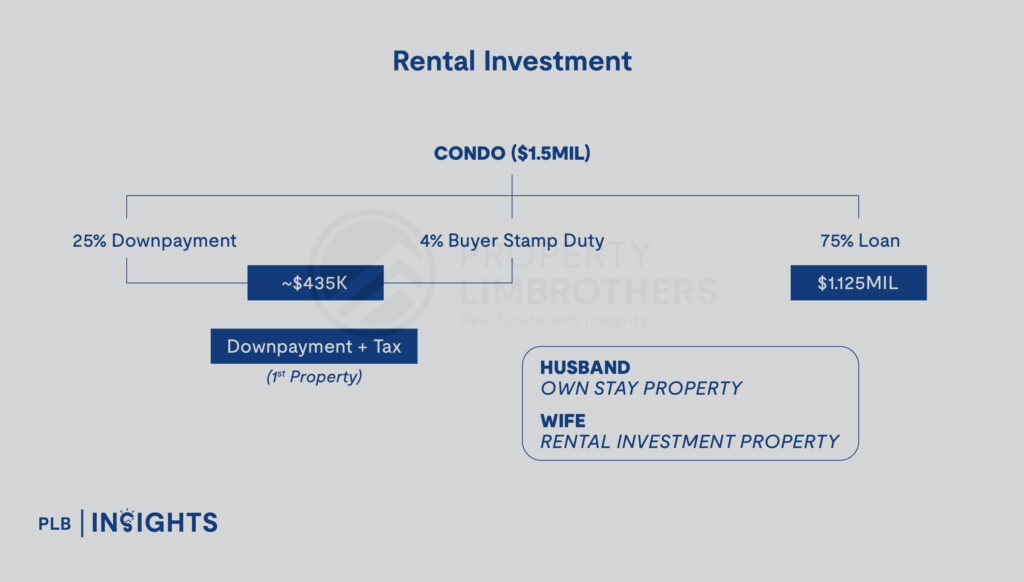

Case Study 2: Husband And Wife Investing In A $1.5 Million Condo In The OCR region

In this scenario, let’s consider the financial requirements and expected returns of purchasing a $1.5 million condominium in Singapore’s Outside Central Region (OCR) for rental investment. This example assumes a family setup where the husband and wife already own a primary residence in Singapore and are now looking to acquire an additional property as a rental investment.

Initial Financial Commitments

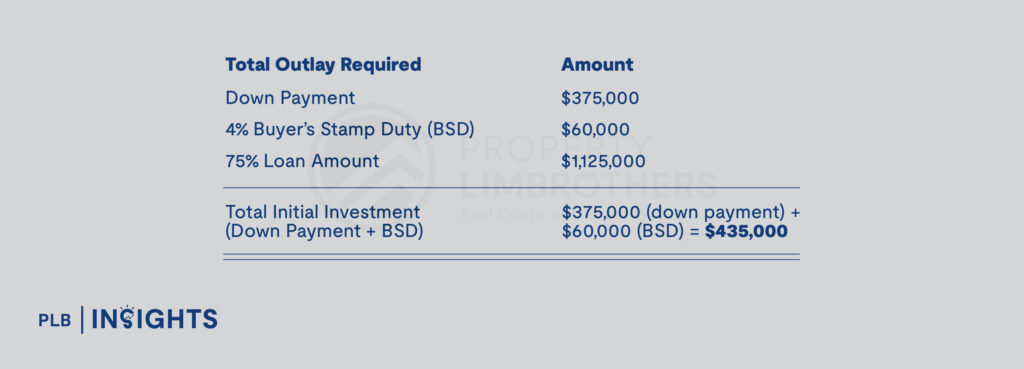

For a $1.5 million condo purchase, here’s the breakdown of upfront costs and financing:

This total initial outlay of $435,000 covers the down payment and taxes required to acquire the condo, assuming it is the couple’s first investment property.

Monthly Mortgage Instalment:

Assuming a 30-year loan tenure with an interest rate of 2.75%, the monthly mortgage instalment on the $1.125 million loan would be approximately $4,600.

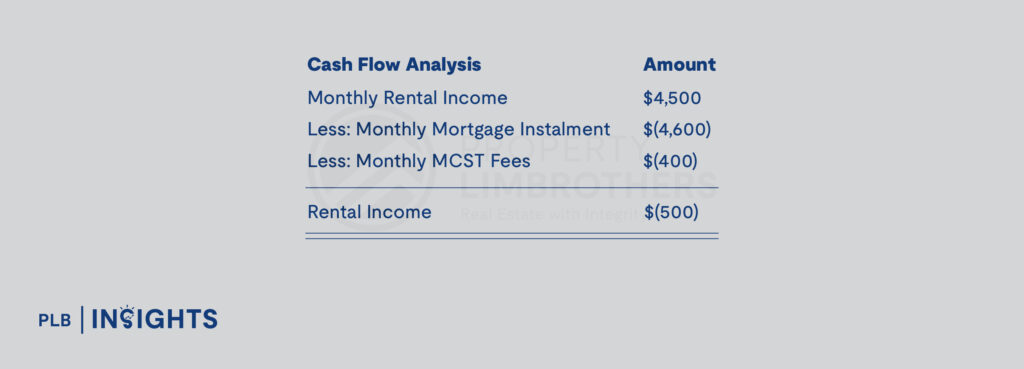

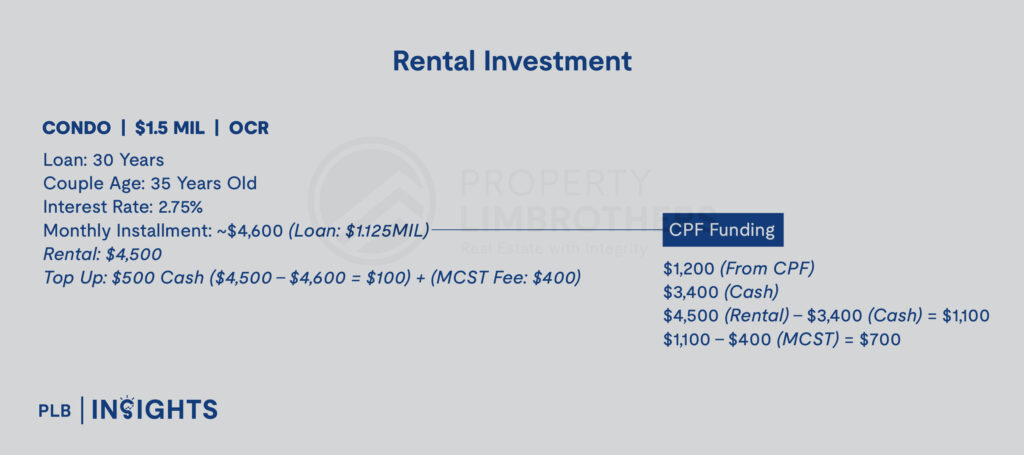

1. Potential Rental Income And Cash Flow Analysis: Scenario For Self-Employed Investors Without CPF Offset

In the current market, a three-bedroom condo in the OCR region could generate a rental income of around $4,500 per month. Based on this rental rate, let’s evaluate the cash flow:

Thus, without any additional support, the investor would need to top up $500 monthly to cover the mortgage and maintenance costs.

2. Potential Rental Income And Cash Flow Analysis: Cash Flow Adjustment With CPF

For employed individuals in Singapore, CPF (Central Provident Fund) contributions can help reduce the cash outlay. Assuming the investor can use $1,200 from their CPF each month, here’s the adjusted cash flow:

With CPF usage, the investor can effectively receive $700 in positive cash flow per month after covering all expenses, making the investment more manageable.

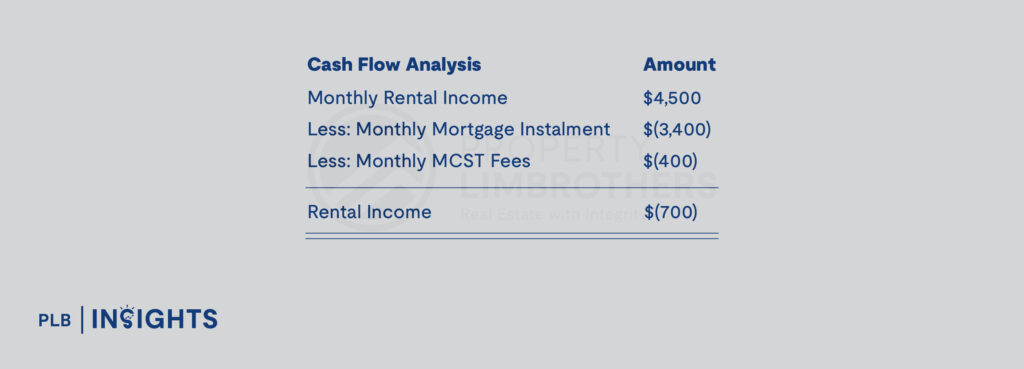

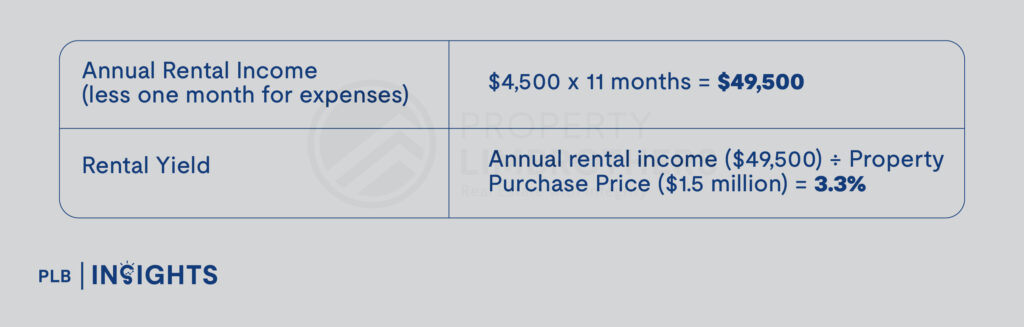

Expected Annual Rental Yield

For rental property investments, understanding the net rental yield is essential as it tells the investors the return on their real estate investment if they were to rent it out. Here’s the calculation based on the monthly rental income:

Assuming a time period of 11 months per year as we keep 1 month rental income for other expenses such as MCST and professional fees

Capital Appreciation Considerations

In Singapore, property investments are often driven by capital appreciation rather than rental yield alone, as the rental income in many cases does not fully cover the mortgage and associated costs, especially in the OCR region.

If the property value appreciates, it can significantly enhance the investment’s overall return. However, if appreciation is minimal, the investor’s return on investment (ROI) may be impacted, as rental yields alone may not be able to cover the monthly instalment of the investment property as seen from the case of a self-employed investor without CPF offset above.

Alternative Investment Consideration

For investors approaching retirement or those looking to downsize, an alternative to traditional rental property investment might be more suitable. For instance, after selling off a larger condo and freeing up capital, an investor may seek an investment that requires lower ongoing expenses and provides stable passive income. Instead of committing $1.5 million to a property generating a 3.3% rental yield, they could explore other options like REITs, condotel investments, or other asset classes that might offer comparable or better returns with less hands-on management.

Linking back to Case Study 2 above, while rental investment in the OCR region can provide moderate returns, it often requires a substantial initial outlay, ongoing cash flow management, and reliance on capital appreciation to maximise ROI. Investors should carefully evaluate their financial goals, CPF availability, and alternative investment options before committing to a long-term property investment in Singapore.

Understanding Condotels

A condotel, or “condominium-hotel,” is a hybrid model that combines individual property ownership with hotel-style operations. Investors purchase units within a hotel property and receive Strata Titles for the units they own. These units are then managed by a professional property management team.

This approach provides investors with an asset-yielding income through short-term rentals, while operational burdens remain entirely under the purview of the hotel management. This is in contrast to traditional investment properties, where landlords must manage tenants, repairs, and operating costs. Investors receive a share of the hotel’s revenue, while the hotel management handles day-to-day operations—an ideal setup for investors seeking passive income without hands-on management.

Hotel101: An Innovative Revenue-Sharing Model

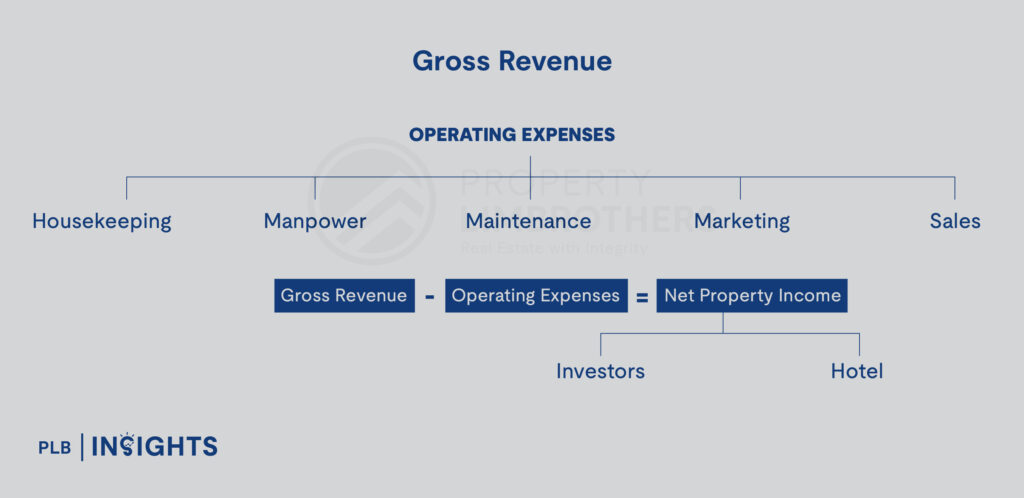

Figure 4: Hotel101’s Innovative Revenue-Sharing Model

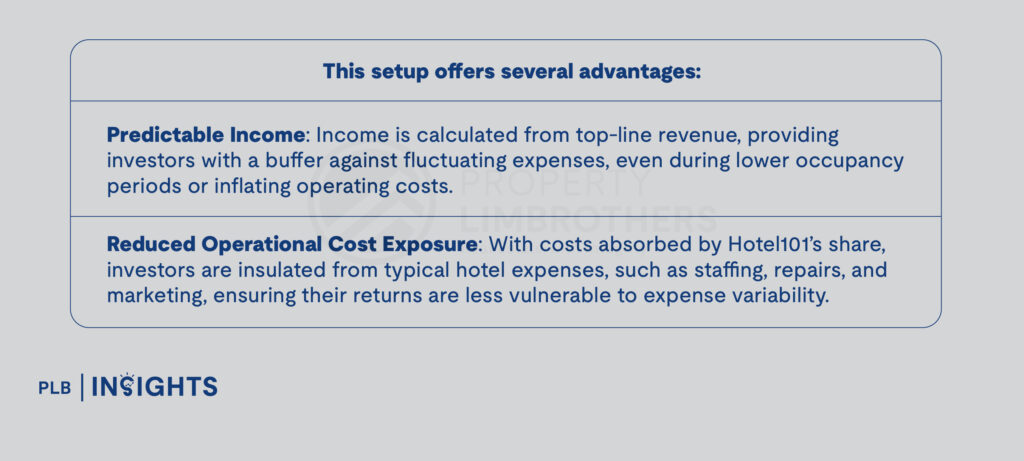

Hotel101 stands out in the condotel sector with a unique revenue-sharing structure. Traditionally, condotel revenue is distributed to owners after deducting the operating expenses. Essentially, investors’ revenue is based on the company’s bottom-line of its P&L which comes as Net Revenue as seen in Figure 5. This results in investors’ returns varying depending on the hotel’s operational costs.

However, Hotel101 flips this model by distributing 30% of the gross revenue to investors before expenses are deducted, while the hotel retains the remaining 70% to cover operational costs, as seen in Figure 4. This structure is based on the company’s top-line P&L – allowing investors to not bear any of the operating costs which are subjected to inflation and macroeconomic factors. This arrangement offers increased predictability in returns and creates a worry-free investment as investors do not have to be concerned with increasing operating expenses.

This model makes Hotel101 particularly appealing to those who value stable returns without operational involvement, giving it an attractive advantage over traditional condotels.

This revenue-sharing approach positions Hotel101 as a suitable option for Singaporean investors looking to diversify into a more stable, cash-generating asset in the long run and for legacy potential. Currently, two Hotel101 projects are available to international investors under Hotel101 Global:

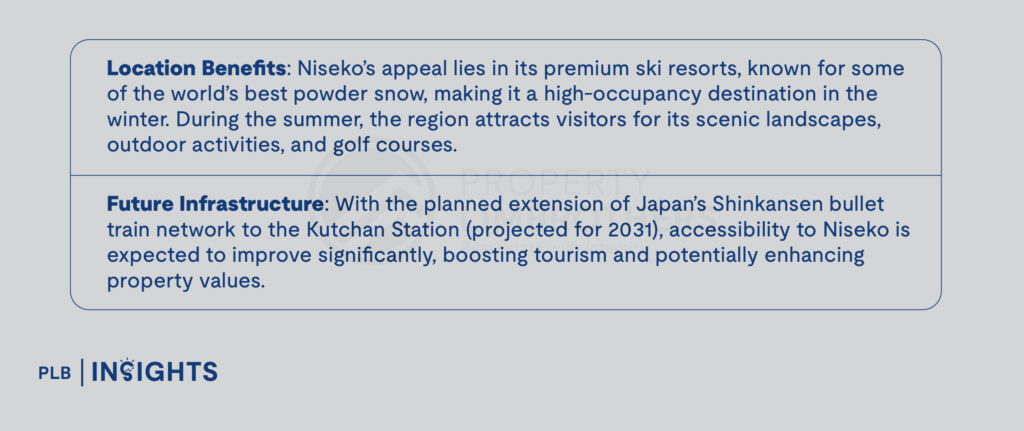

Hotel101 Niseko (Japan): Located in Hokkaido and near a popular ski destination known for high-quality powder snow. Niseko attracts both winter sports enthusiasts and year-round tourists.

Hotel101 Madrid (Spain): Situated near Madrid’s F1 track and major business and sports centres, this property appeals to both leisure and business travellers.

Detailed Review Of Hotel101 Projects

1. Hotel101 Niseko (Japan)

As a premier skiing destination in Japan’s Hokkaido region, Niseko draws visitors globally, especially during peak winter seasons. Hotel101 Niseko, set to be completed by 2026, will house 482 rooms in a single-room layout called the “Happy Room” – which is consistent throughout Hotel101’s room type. Consistency across all rooms simplifies maintenance and enhances guest experience, with features including an en-suite bathroom, a kitchenette, and additional amenities suitable for families or solo travellers. Even during off-peak seasons, the hotel anticipates steady demand from travellers who come for outdoor activities, golf, and local sightseeing.

With Japan’s upcoming expansion of the Shinkansen bullet train network to Niseko, projected for completion in 2031, connectivity improvements are expected to drive further growth in visitor numbers and property value in the region, adding a long-term capital appreciation angle for investors. Currently, the track record for Hotel101’s occupancy rates have been stable at 80% throughout.

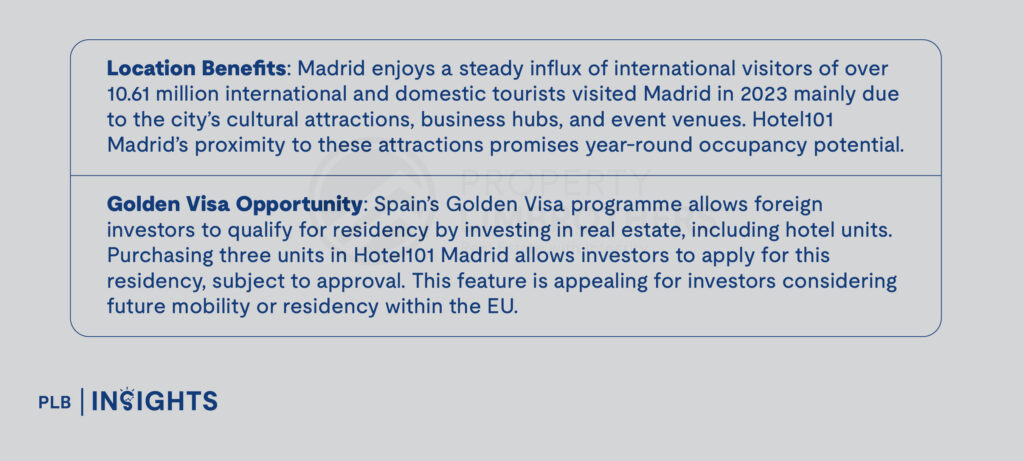

2. Hotel101 Madrid (Spain)

Hotel101 Madrid, anticipated to complete by the end of 2025, is ideally located for business and leisure tourists. Located right beside Madrid’s F1 track at Real Madrid Sports Complex, as well as IFEMA convention centre, Hotel101 Madrid is poised to attract both business and leisure travellers.

The property features 680 rooms, each built to a consistent “Happy Room” layout. Madrid’s tourism remains strong year-round, where IFEMA convention centre saw approximately 4 million visitors yearly. This has created a steady flow of guests which will provide the stable pool of hotel guests, boosting the hotel’s occupancy rates.

In addition, international investors are also entitled to Spain’s Golden Visa program, subject to conditions. Investors who purchase three units could apply for a residency permit, subject to approval. This feature may appeal to those considering residency options in the EU, as well as those seeking long-term development opportunities in the EU.

Both properties have been developed with a freehold title, which allows investors to enjoy long-term ownership and provide them the option to retain or resell their units, either on the secondary market or back to the developers. Due to its freehold nature, those who retain their units can pass on this condotel investment to the next generations – allowing children to enjoy the timeless monthly passive income too.

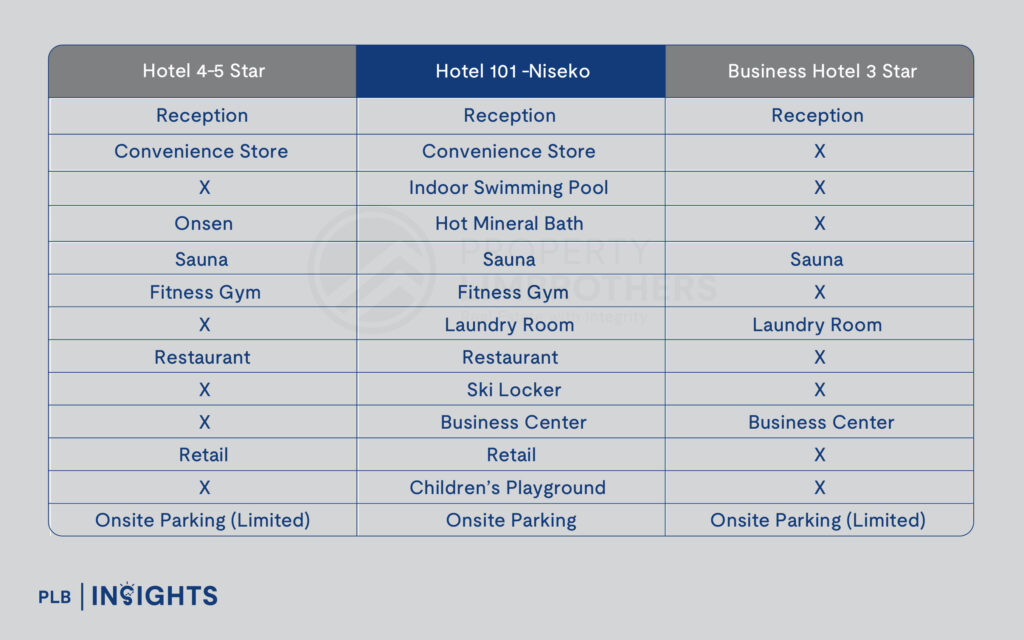

The Concept

Hotel 101 aims to fill a “value gap” in the hospitality market, offering a broader range of amenities than typical 3-star business hotels, while remaining more accessible than luxury 4-5-star hotels. Specifically, we look at how Hotel 101-Niseko compares (Figure 8):

Amenities Provided: Hotel 101-Niseko offers features like an indoor swimming pool, hot mineral bath, sauna, fitness gym, laundry room, and a ski locker—amenities generally expected at higher-end hotels. These additions place it above the offerings of a standard 3-star hotel but still below some of the luxury elements seen in 4-5-star hotels, such as an onsen.

Target Market Position: By providing essential conveniences like a convenience store, business centre, and children’s playground, Hotel 101-Niseko provides both utility and affordability. This mix of facilities makes it appealing to families, business travellers, and tourists who desire comfort without the high costs associated with luxury stays.

Comparative Advantage: With a more consistent range of amenities than typical 3-star hotels, Hotel 101-Niseko stands out by offering a “premium economy” experience. This attracts travellers seeking quality amenities without the luxury price tag, effectively bridging the gap between budget and upscale hotel experiences.

This positioning could prove advantageous, especially in high-demand locations like Niseko, where travellers value both convenience and comfort including onsen etc., but may not want to pay for full luxury accommodations. This strategic middle-ground approach strengthens Hotel 101-Niseko’s appeal as a viable, investment-friendly option in the condotel market.

Investment Analysis

For Singaporean investors, financial returns are a core consideration, and Hotel101’s revenue-sharing model offers potentially competitive yields compared to Case Study 2 described above, where investing in an OCR property for rental would yield the couple a 3.3% return in the current market.

1. Hotel101’s Investment Costs And Structure

- Hotel101 Niseko: Starting at approximately SGD 384,896 (around USD 290,627), based on current exchange rates as of 29 October 2024, investors purchase freehold units that grant long-term ownership with the option to resell.

- Hotel101 Madrid: Units are available for approximately SGD 344,7691 (around USD 260,328), based on current exchange rates as of 29 October 2024, with a similar freehold structure.

2. Projected Returns

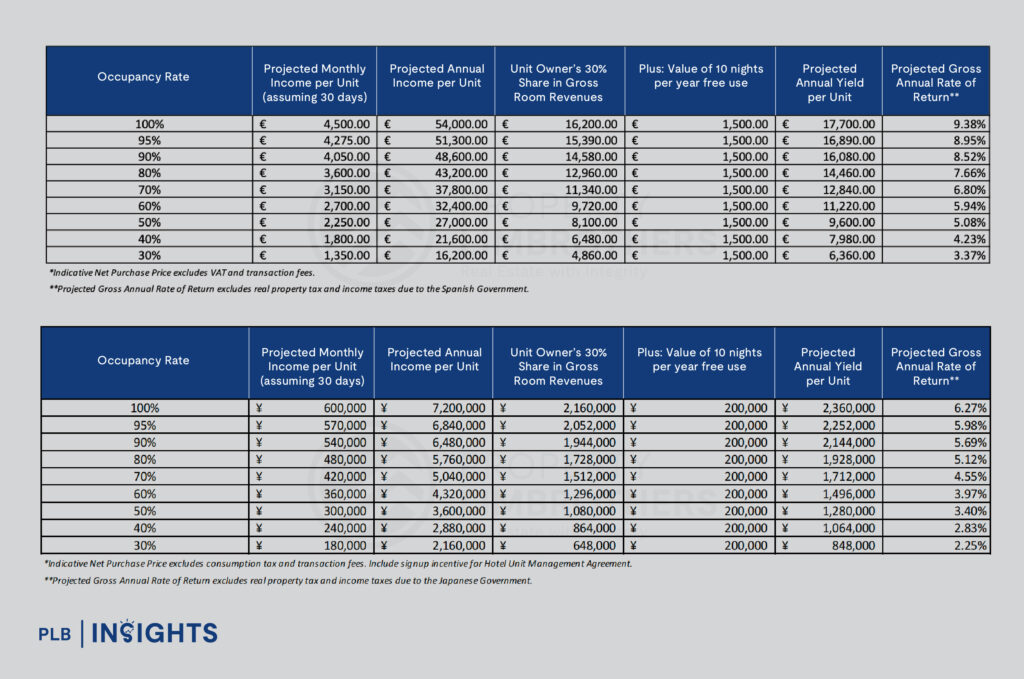

Projected returns for Hotel101 vary based on occupancy rates:

- At 80% occupancy: Hotel101 Madrid yields an estimated 7% annually, while Hotel101 Niseko offers around 5%.

- At 30% occupancy: Even in low-demand scenarios, Hotel101 Madrid is projected to yield a 3.37% return, and Hotel101 Niseko around 2.25%, providing a baseline that is competitive with local 3.3% rental yield in Singapore’s OCR, as explained in the Case Study 2 above.

Strategic Advantages Of The Hotel101 Investment Model

Predictable, Passive Income

Hotel101’s revenue-sharing model is designed to provide consistent returns, especially valuable to investors focused on income stability. By calculating returns based on gross revenue, this model insulates investors from the volatility of operational expenses, a benefit over many conventional condotel investments.

Low Regulatory Barriers and No ABSD

Singaporean investors, facing high ABSD on additional property purchases domestically, benefit from Hotel101’s international structure. Because it does not fall under Singaporean residential property regulations, investors avoid ABSD, which would otherwise reduce investment returns significantly on third-property purchases in Singapore.

Legacy Planning with Freehold Ownership

As freehold properties, units in Hotel101’s condotels allow investors to hold and pass down their investment as part of legacy planning. Investors can resell their units on the secondary market or retain them for long-term income generation, providing flexibility for future financial planning.

Geographic and Currency Diversification

Investing in Hotel101 projects offers exposure to international real estate, providing a buffer against the potential fluctuations in Singapore’s property market. Additionally, currency diversification enables Singaporean investors to leverage exchange rate movements. For instance, if the Singapore dollar strengthens, investment costs effectively decrease. Conversely, if the foreign currency appreciates, investors benefit from capital gains potential.

While Hotel101 Offers Compelling Benefits, There Are Considerations Investors Should Be Aware Of

Foreign Exchange (FX) Risk: Currency fluctuations can impact returns, especially if the Singapore dollar strengthens too much relative to the currency of the invested property, the translation of gross revenue in its local terms (Japanese Yen and the Euro) would result in higher translation loss when converted to SGD. Investors can mitigate this risk by monitoring FX trends and potentially leveraging currency hedging strategies if significant fluctuations occur.

Market Demand and Occupancy Variations: Seasonal changes and global travel trends can impact occupancy rates, with some periods experiencing significantly lower demand than peak times. However, Hotel101’s 30% gross revenue distribution model helps mitigate the impact of these fluctuations by providing a stable income base tied to occupancy. Additionally, its strategic locations in high-demand areas help sustain occupancy rates, even during off-peak seasons.

Long-Term Investment Horizon: Given the nature of condotel investments, this model is best suited for those who can commit to a long-term investment horizon. However, the freehold nature of Hotel101’s properties provides an exit strategy through resale of the units in the secondary market or back to the developers – which in turn allows investors to alter their portfolio in times of needs and varying circumstances.The Hotel101 Condotel Model Is Designed To Appeal To Specific Types Of Investors

1. Seasoned Property Investors: Singaporean investors who have already maximised their residential property investments domestically (e.g., owning two private properties) and are considering diversification abroad may find Hotel101 an attractive option. Given Singapore’s Additional Buyer’s Stamp Duty (ABSD) rates of up to 30% on third properties, Hotel101 offers international diversification without additional tax burdens.

2. Retirees and Passive Income Seekers: Investors aged 55 and older who have already downsized or have capital reserves may use Hotel101 as a hassle-free source of passive income. With monthly distributions from top-line gross revenue and no requirement for active operational management, Hotel101 could align well with retirement income goals.

3. Single Professionals Seeking Portfolio Expansion: Individuals with existing property assets who wish to diversify beyond traditional property options but prefer not to manage properties themselves may find Hotel101’s hands-off model appealing. This allows for income generation from a professionally managed asset without the direct involvement typically required for rental properties.

Strong Track Record Of Hotel’s Developer And Management

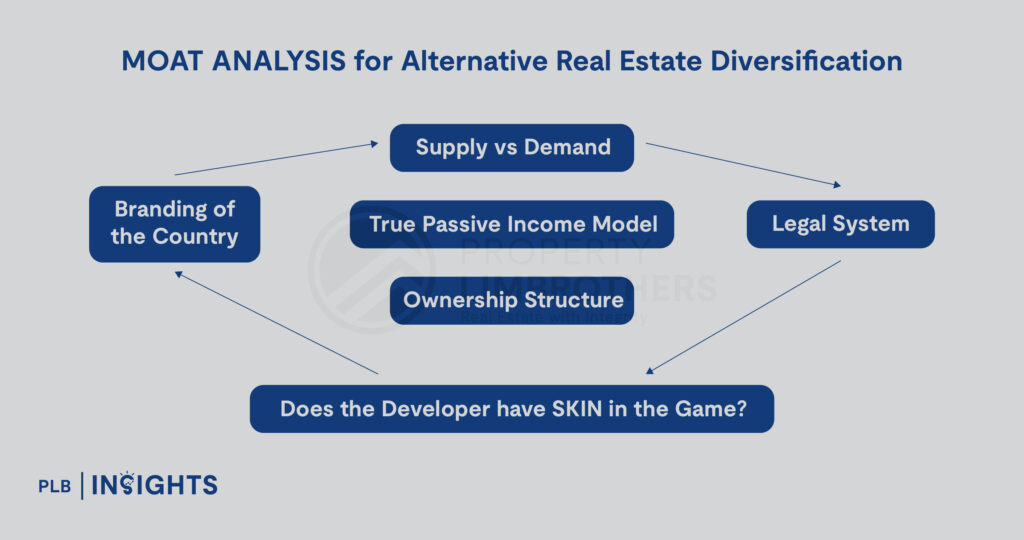

When exploring alternative real estate investments, it is essential for investors to conduct thorough due diligence. Beyond understanding the investment’s potential returns, it’s critical to evaluate the foundational factors that safeguard and enhance the investment’s value. The MOAT Analysis framework for alternative investments we have provided gives a structured approach to assess the robustness of an alternative real estate investment, helping investors make informed decisions.

- Supply vs Demand: The balance between supply and demand is a cornerstone of any real estate investment. For alternative investments, such as condotels or niche real estate projects, understanding the demand drivers and the competitive landscape is essential. For example, a project in a high-demand tourist area with limited available accommodations is likely to perform better than one in an oversupplied market. Investors should assess current and projected demand to ensure that the asset has sustained occupancy potential.

- True Passive Income Model: A key attraction of alternative real estate investments is the potential for passive income. However, the structure of this income stream matters significantly. A “True Passive Income Model” implies that the investor receives regular, predictable income with minimal operational involvement. In models where income is derived from gross revenue rather than net revenue (after deducting operational expenses), such as Hotel101’s approach, investors can benefit from a more stable cash flow. This factor is particularly relevant for those seeking predictable, hands-off income.

- Ownership Structure: The ownership structure of the investment affects both security and flexibility. For alternative real estate investments, investors should evaluate whether they are acquiring freehold or leasehold ownership, as this impacts the asset’s long-term value and legacy potential. Freehold ownership provides more control, the option for resale and passing on this investment to the next generations. Additionally, it is essential to confirm that the investor’s rights are clearly defined and protected under the contract.

- Legal System: Investing in overseas real estate involves understanding the legal framework of the host country. A transparent and well-regulated legal system provides investors with confidence, knowing that their ownership rights and revenue-sharing agreements are protected. Countries with established property laws and protections for foreign investors are generally more attractive, as they reduce the risk of unexpected legal or regulatory changes that could impact the investment’s value.

- Developer’s “Skin in the Game”: The commitment of the developer is a crucial indicator of the investment’s long-term viability. If the developer has “skin in the game,” meaning they have significant financial and operational involvement, it demonstrates a vested interest in the project’s success. A developer with a reputable track record and ongoing stake in the investment’s performance is more likely to manage the property diligently, ensuring its success and, by extension, the returns for investors.

- Branding of the Country: The reputation and branding of the country where the investment is located play an influential role in attracting demand. Countries with strong tourism appeal, stable economies, and a positive international image often draw consistent interest from both travellers and investors. For instance, investments in countries with renowned hospitality sectors, like Japan, may benefit from high demand and brand recognition.

About Hotel101 Global

Finally, Hotel101 Global Pte. Ltd., is a registered company in Singapore. It is the global hotel expansion arm of the Philippine-based DoubleDragon Corporation. DoubleDragon is a prominent property company listed on the Philippine Stock Exchange, with approximately US$3 billion in total assets. The corporation has a vast and diverse portfolio of 1.2 million square metres of office, retail and industrial assets including Jollibee Tower, DD Meridian Park, CityMall community centres, CentralHub industrial warehouses, and Hotel101 projects both locally and internationally.

As of June 30, 2023, DoubleDragon reports a Total Equity of ₱81.64 Billion (~US$ 1.48 Billion) and Total Cash Position of ₱6.54 Billion (~US$ 118.91 Million). It’s noteworthy that the company has achieved the highest PhilRatings PRS Triple A Credit Rating.

DoubleDragon is led by Edgar “Injap” J. Sia II and Tony Tan Caktiong, the founders of Mang Inasal and Jollibee, the largest and fastest growing fast-food brands in the Philippines. The company intends to list Hotel101 Global on NASDAQ, projecting that over 95% of its revenues will soon originate outside the Philippines.

The initial overseas ventures for Hotel101 are planned in Niseko (Japan), Madrid (Spain), and California (USA), laying the foundation for the brand’s global expansion. The vision for Hotel101 Global is to mark its presence in 25 countries by 2026.

This article is produced in conjunction with our YouTube video, “Why Hotel101 Could be a Game-Changer for Overseas Property Investors”.

Let’s Get In Touch

If you are interested in the alternative investment opportunities provided by Hotel101, feel free to get in touch with us.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.