In the heart of Singapore’s bustling real estate scene, Executive Condos (ECs) stand out as an attractive option for homebuyers looking for an entry into the private market. They’ve carved a niche, merging the affordability of public housing with the allure of private facilities. This unique blend has not only kept them in the spotlight but also marked them as a lucrative investment despite their premium pricing.

In this article, we unravel the journey of ECs, spotlighting their growth, the magic behind their appeal, and the trends that predict their continued profitability.

The Remarkable Rise of Executive Condos

In recent years, ECs have experienced significant growth, with transactions reaching record levels. However, it’s worth noting that they have experienced a more gradual appreciation compared to other private housing options.

For instance, the median price for new landed properties jumped from $1,053 PSF to $2,242 PSF (a rise of 112.9%), and from $1,664 PSF to $2,486 PSF (a rise of 49.4%) for new non-landed properties between 2019 and 2023. In contrast, prices for ECs within the same period have risen by 28.9% from $1,101 to $1,417 PSF.

The slower degree of price appreciation with ECs compared to other housing options could be due to various reasons such as the restrictions on the ownership and resale of executive condos, the limited pool of buyers resulting from the eligibility criteria requirements, and a regulated supply of these properties.

Despite the slower rate of price appreciation, ECs are still highly sought after. We could say that this factor, amongst others, contributes to the overall appeal of ECs.

Price Comparison: ECs Over the Years

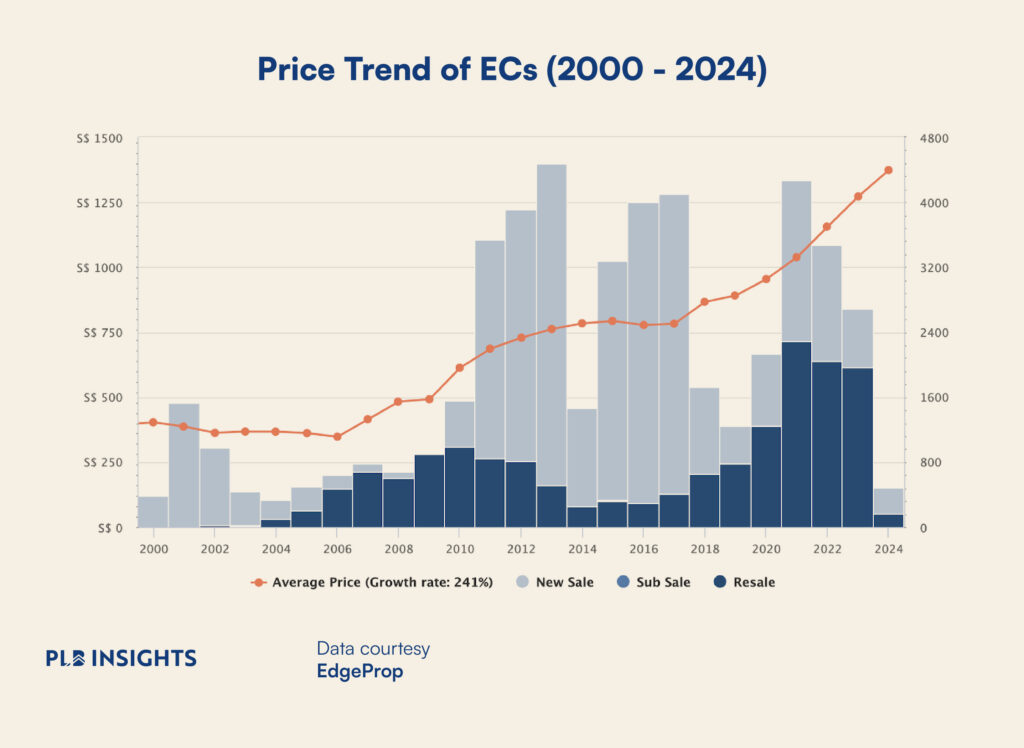

In analysing the price trends of ECs over the decades, it is evident that the different contributing factors such as market dynamics, economic situations, and the pandemic have all played an essential role in shaping the pricing of these residential properties. The prices of ECs over the last two decades have experienced a growth rate of 241 per cent, with a steady and gradual increase from the early 2000s to present, including pre and post-pandemic.

As we can see on the graph, the average price of ECs from the year 2000 to 2010 was consistently under $700 PSF, while gradually increasing from $403 PSF to $613 PSF. The EC prices from the pre-pandemic and post-pandemic period illustrate a steady but slightly steeper rise, with prices going from an average of just under $1,000 PSF in 2020 to $1,374 at present.

Pre- and post-pandemic, the prices of ECs continued to appreciate, going from $954 PSF in 2020 to $1,156 PSF in 2022. Despite the challenges posed by the pandemic over the last few years, the prices of ECs have shown growth throughout the crisis. The sustained demand for this housing type, along with government support and a limited supply could be contributing factors for the price appreciation.

The data indicating price growth in the EC market throughout the years highlights the segment’s strength and its position as a preferred choice for buyers seeking quality housing options for affordable prices in Singapore.

Transactions with the Highest Profits

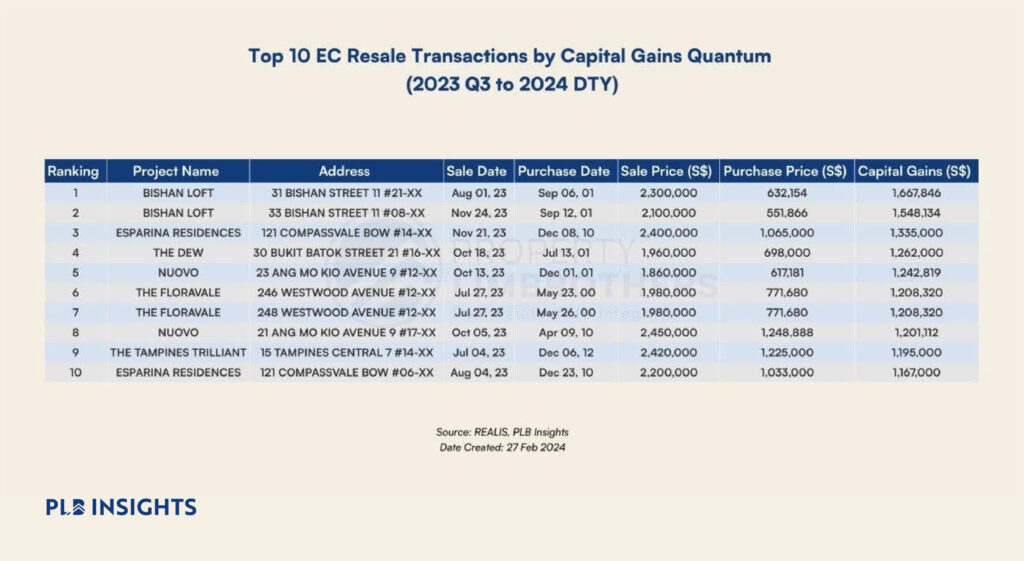

When researching the potential benefits of purchasing a property, buyers should take into account the potential for capital gains to get an estimate of how profitable their property will be if they decide to sell it to new buyers. Analysing factors such as location, market trends, the condition of the property, and developer reputation can provide buyers with a comprehensive understanding of why certain properties may achieve higher capital gains than others. Additionally, looking at the transaction history of properties close by can give buyers further insights.

The top 10 EC transactions reported gains of $1,167,000 to $1,667,846, not including any fees and costs (i.e stamp duty) incurred based on the data we gathered from URA Realis. The unit at Bishan Loft saw the highest profit of $1,667,846–which was over double the price the previous owner bought the property for, at $632,154. Similarly, the other units with substantial profits, as indicated in the table, were sold for nearly double, if not more, than the initial purchase price of the property.

Please take note that the table does not reflect the holding period of the previous owners but rather, how much the prices of these properties have appreciated since the time of their launch.

Factors Contributing to the Success of ECs

Several factors have and continue to contribute to the growing success of ECs, making them the winning choice for many first-time homebuyers and those looking for an upgrade from public housing options.

Affordability

The first and one of the key factors contributing to the success and popularity of ECs is the affordability of this housing option compared to other private housing options. Due to their public-private hybrid nature, ECs are priced lower than their private counterparts. This makes them a good choice for buyers seeking an upgrade from an HDB flat or first-time homebuyers. Of course, owning an executive condo also comes with certain regulations and eligibility criteria that buyers must qualify for.

Amenities and Features

ECs come with a range of facilities and amenities that residents can take advantage of. These include communal spaces, swimming pools and gyms. These amenities enhance the overall living experience for residents and add value to the property without the premium price that private condos have.

Government Regulations and Subsidies

The government has regulations and eligibility criteria including income ceilings and restrictions in place to ensure that the exclusivity and affordability of ECs are maintained within Singapore’s property market. In addition to this, grants and subsidies that are available for eligible buyers further incentivise the purchase of ECs by homebuyers.

Potential for Capital Appreciation

Another factor contributing to the success of ECs over the years is the potential these properties have for capital appreciation. As they reach their MOP, the restrictions on resale are partially lifted – Singapore Permanent Residents (SPRs) will become eligible to purchase. When an EC reaches 10 years, foreigners will be eligible to purchase. This enables EC owners to benefit from a larger buyer pool, making it an attractive investment opportunity.

Closing Thoughts

As buyers continue to seek value and the potential for high returns in the housing market, executive condos continue to remain as a winning option for homebuyers in Singapore. The factors driving the success of ECs, coupled with the developments that highlight significant profit margins, highlight the wealth building potential and investment opportunities on top of the benefits of living in ECs for buyers.

If you are planning on starting your property journey this year or are looking to expand your portfolio, feel free to contact us here. Our consultants will be happy to help you on your journey.

Until then, see you in the next one.