When it comes to getting a property, you have two options to go about it, Renting it or Buying it. However, as property prices continue to rise in Singapore, many Singaporeans are taking a more cautious approach when it comes to buying a property in the next six months.

What is Rentvesting?

“Rentvesting” is a strategy whereby a person would rent a place to stay and invest in a cheaper property. This strategy is commonly used in countries such as Australia and New Zealand, where property prices in highly sought-after areas are extremely high. Thus, many turn to rental homes or houses in suburbs where prices are more affordable. This strategy is also slowly being picked up in the United Kingdom where the property market is similar.

Rentvesting may come across as a relatively strange strategy for us Singaporeans as a huge majority of us would prefer to own the property that we are living in (which are mostly flats built by the Housing Development Board or HDB). Can Rentvesting be used in Singapore?

Is Rentvesting a Good Idea?

Let’s take a look at an example. A family of 6 is looking for a bigger space as they have outgrown their current Jumbo HDB Unit. They would like the new place to have at least 5-bedrooms and a large enough living space to host family and friends.

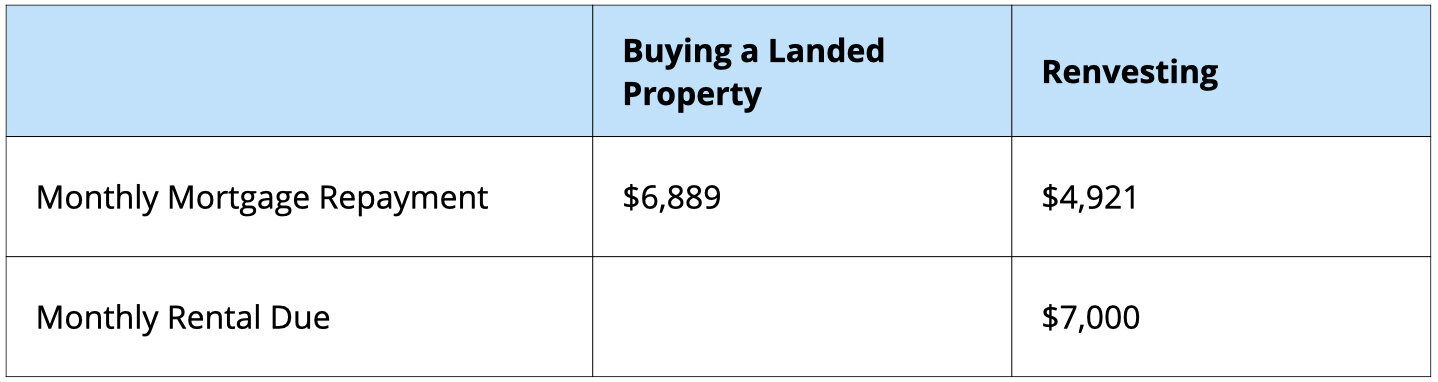

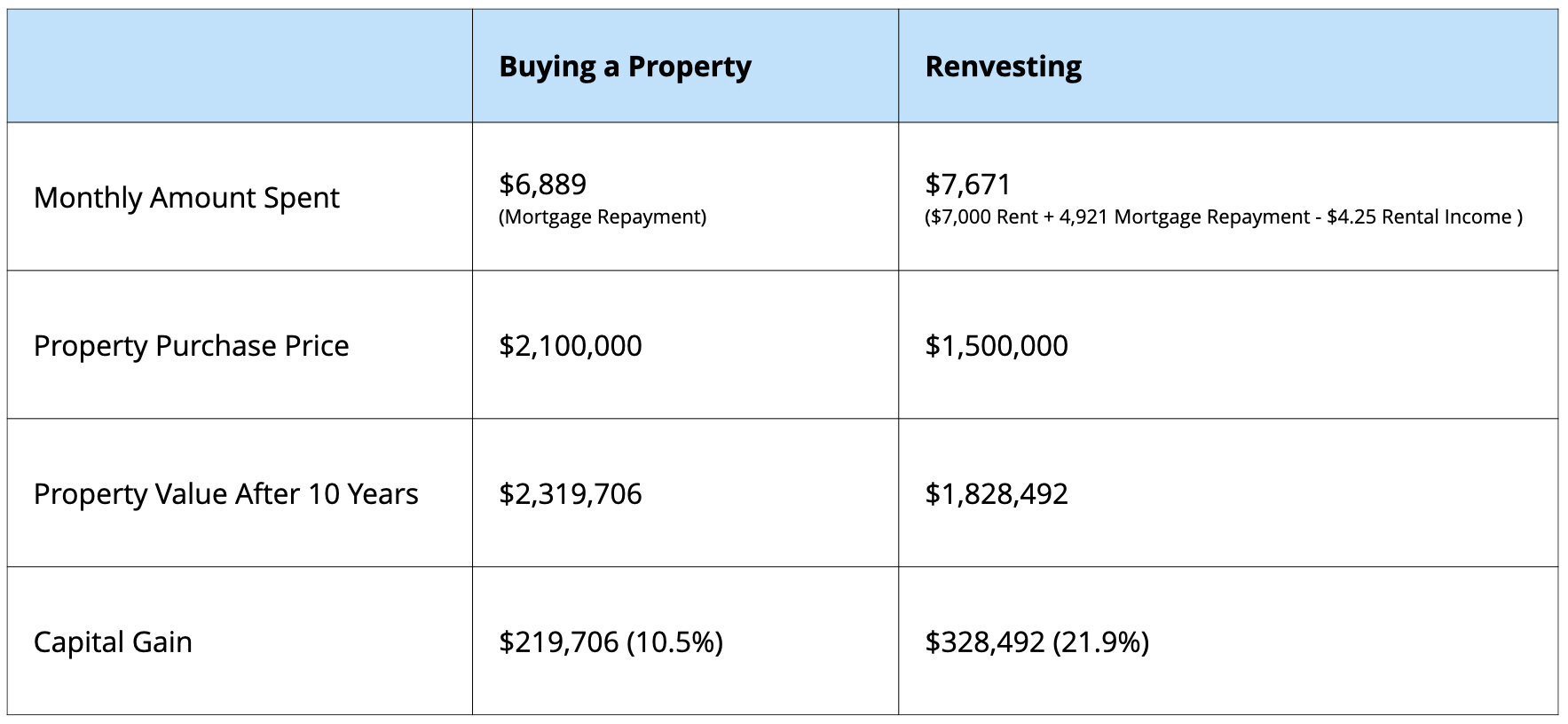

The type of property that best fulfils the requirements set by this family would be a landed property. The landed property of that size would cost about $2.1 Million. With a 75% loan of 2.3% p.a. on a 25-year loan, your monthly mortgage repayment will be about $6,889.

Let’s compare that with the cost of renting a landed property and investing in a private property. Renting a landed property of a similar size would cost about $7,000 a month. Investing in a 2 Bedroom private property would cost $1.5 Million. With a 75% loan of 2.3% p.a. on a 25-year loan, your monthly mortgage repayment will be about $4,921.

Assuming that your investment property is in a prime location, it will yield a higher growth of about 2% p.a. as compared to a 1% p.a. growth for landed properties. Over 10 years, the landed property would appreciate to $2.32 Million whereas the investment property would appreciate to $1.83 Million. Giving you a capital gain of $220K (10.5%) and $328K (21.9%) respectively. It is important to point out that there’s a huge range of variables that could affect the prices shown above such as your age, salary, properties you have on hand, etc. Nonetheless, these numbers should help you form a clearer idea of the potential benefits of Rentvesting.

Is it Suitable for You?

Well, it depends on your financial circumstances and needs. But before you dive straight into buying, renting or investing in a property, do make sure that you have the resources to do so. Just because an investment property is cheaper than your dream home doesn’t necessarily mean that you can afford it, and just because renting feels like throwing away money doesn’t automatically mean you should mortgage yourself to the hilt.

Though there is a multitude of resources available online to help you in your decision-making process, you would benefit greatly by seeking advice from the experts. If you need advice on this or are unsure of which strategy best suits you, book a non-obligations appointment with us! Our team would be glad to assist you.