Frequently, rumours of potential En Bloc sales generate excitement among certain homeowners or the public. In this article, we offer a detailed guide to the En Bloc sale process, providing comprehensive insight into its intricacies specifically tailored for private residential developments.

It’s crucial to emphasise that, at PropertyLimBrothers, we strongly discourage actively seeking properties with perceived ‘high En Bloc potential’ in hopes of a lucrative windfall. Instead, prospective homeowners should place deep considerations into their lifestyle preferences, long-term financial goals, and aspirations when choosing a property, whether it’s their first or subsequent purchase. En Bloc attempts have a success rate of only 1 in 10, making the probability of achieving success extremely low. Furthermore, the extended duration of an En Bloc sale process can leave many homeowners in financial limbo, disrupting their plans and goals.

What is an En Bloc Sale?

An En Bloc sale is the collective sale of an entire residential project, as opposed to individual units sold separately. This process applies to both non-landed private residential and HDB developments. In an En Bloc sale, the usual buyers are property developers for private residential projects and the Housing Development Board (HDB) for HDB developments. To initiate an En Bloc sale, a minimum of 80% of owners in a private residential project must agree to sell simultaneously. This 80% consensus is required for projects that are 10 years or older since obtaining the Temporary Occupation Permit (TOP). For projects below the 10-year mark, a higher consensus of at least 90% among owners is necessary. Once the 80% or 90% consensus is reached, the remaining owners who disagree with the sale are obliged to sell their units.

The En Bloc sales process may also commence if an interested buyer, typically a property developer, extends an offer to purchase the entire project.

Significance of En Bloc Sales

En Bloc sales often attract the attention of homeowners hoping to ‘hit the jackpot’ by collectively selling their residential project. Property developers usually pay above market value for individual units, seeking profits through the redevelopment of older projects into newer, higher-density ones. This strategy enables them to sell more units at a higher per square foot (PSF) price, leading to substantial profits from the eventual sale of the redevelopment.

From a vantage point, En Blocs are good for Singapore’s economy and in keeping up with contemporary architectural design and function. Moreover, it is beneficial for the ever-growing population of this island nation in terms of improved infrastructure and amenities. When the property developer redevelops an En Bloc site, it sometimes involves consolidation of smaller land parcels, but in most cases, the redevelopment will be of higher-density. This means an increase in housing supply for Singapore’s residents, contributing to the mitigation of the ‘lack of housing’ concerns. Besides that, the newer features of redevelopments ensure that the evolving lifestyle preferences of homeowners and latest technological advancements are met. On a broader level, the completion of En Bloc redevelopments can positively affect the value of neighbouring residential properties as it may enhance the overall appeal of the locale.

The entire process would require the expertise of various professionals – from architects and contractors to legal and financial experts – this network forms a mini economy in itself that further helps to spur the overall economy of the country. Lastly, with the above-the-value proceeds received from the successful En Bloc sale, homeowners can have the option to either upgrade their homes into a higher category, or reinvest the surplus to other income generating assets. This further aids in boosting the overall economy.

En Bloc Process: Step-by-Step Guide

Initiation Phase

To kickstart an En Bloc process, a Collective Sales Committee (CSC) must first be formed. The CSC consists of members who are the homeowners initiating the En Bloc sale. The CSC in an En Bloc process is the pivotal vehicle in orchestrating the entire process and acts as a representative body for the property owners.

At least 20% of homeowners of that particular development must consent to the sale before a CSC can be formed, as stipulated by the Land Title (Strata) Act. In developments with subsidiary proprietorships, a minimum of 25% is required before a CSC can be formed. By definition, subsidiary proprietorships are “proprietors who own or are entitled to the unit as well as a share of the common property”.

If the development had previously gone through a failed En Bloc attempt, the threshold is 50% of homeowners before a CSC can be formed.

Important to note, these aforementioned percentages are the requirements for forming a CSC. The committee cannot proceed with any formalities until the 80% or 90% consensus discussed earlier on is achieved.

Sales Committee’s Role

The key responsibilities of the CSC includes the following:

Coordination and Communication

The CSC is responsible for coordinating efforts among property owners and facilitating open communication channels. This involves conducting meetings, disseminating information, and ensuring that all owners are kept informed about the progress of the en bloc sale.

Engagement of Professionals

The CSC engages professionals, including property consultants, legal advisors, and financial experts, to guide property owners through the complexities of the en bloc process. These professionals play a crucial role in providing expertise on market conditions, legal requirements, and financial considerations.

Compilation of Necessary Documentation

The committee is tasked with compiling all necessary documentation required for the en bloc sale, including the Collective Sale Agreement (CSA) and any supporting legal and financial documents. This process demands meticulous attention to detail and adherence to legal regulations.

Representation in Negotiations

During negotiations with potential buyers, the CSC represents the collective interests of property owners. They play a pivotal role in ensuring that the terms of the sale are favourable and align with the owners’ expectations.

Obtaining the Mandate

The CSC needs to secure a mandate from the requisite percentage of property owners to proceed with the en bloc sale. This mandate is a crucial endorsement that signifies majority consent.

Property Valuation

This is the stage where property, financial, valuation and legal experts play a pivotal role, though their appointments can sometimes be protracted due to differences in opinions among CSC members and/or homeowners. Once appointed, their invaluable input will be significant in helping finalise the agreement on apportionment of sales proceeds.

There are 3 most commonly used methods for apportionment: based on the homeowner’s share value, based on the homeowner’s strata area, and based on valuation. The valuation method is typically used in mixed-use developments and commercial properties.

Thereafter, with the help of the appointed marketing agent and valuer, the reserve price will be collectively agreed upon. The following is a non-exhaustive list of the most common factors influencing a property’s reserve price:

Securing Consent from Owners

As required by law, the minimum 80% or 90% consensus must be obtained within 12 months from the date of the first recorded signature on the consent form. This can prove to be an uphill task oftentimes, as stakeholders in an En Bloc process will have conflicting opinions regarding the sale.

After obtaining the minimum consensus, marketing agents or property consultants will initiate the property sale through a public tender. The highest bidder typically wins. Legal representatives then coordinate with the CSC to verify the documents’ terms and conditions. If there are no bidders, owners can engage in private negotiations with developers. As mandated by law, a buyer must be secured within 12 months after obtaining the minimum consent and filing the application with the Strata Titles Board. If not, the CSC can opt to relaunch the development for sale, but this must also be done within the same 12-month period.

The CSC is then responsible for applying for a Sales Order from the Strata Titles Board (STB) once a buyer has been found. The STB is the vetting authority for En Bloc sales, and in the event where there is a 100% consent for the sale, STB’s approval is not required.

Impact on Existing Residents

The sale concludes once approvals are secured. Homeowners, who opt for a rent-free stay with the developer, typically have a 3-6 month grace period. They receive 95% of the sales proceeds immediately. Upon vacating within 3-6 months, the remaining 5% is released within 10-15 days. Homeowners choosing to vacate immediately receive 100% of the proceeds upon leaving.

En bloc sales are seldom straightforward, often involving obstacles, disputes, and a barrage of complaints for the Collective Sale Committee (CSC). Unfortunately, the 10% or 20% of homeowners who disagree with the sale are obliged to face the challenge of finding a new home, dealing with associated financial and emotional burdens.

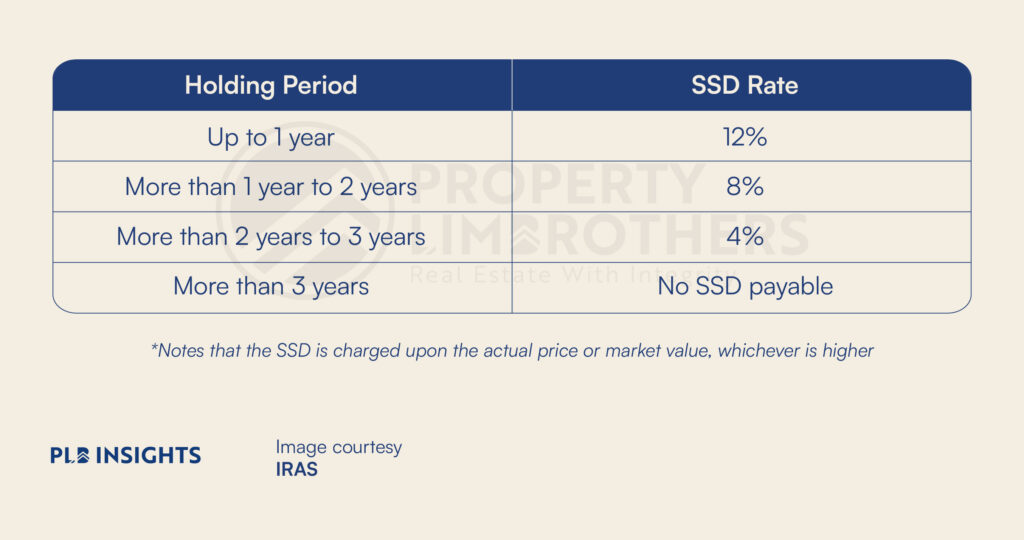

Additionally, due to the Seller’s Stamp Duty (SSD), homeowners owning a property for 3 years and less are obligated to sell. At the time of writing, the latest SSD rates are outlined in the table below:

Success Stories and Case Studies

Highlighting three successful En Bloc sales, let’s explore Bagnall Court, Meyer Park, and Holland Tower. Bagnall Court, situated along Upper East Coast Road, achieved a successful sale through a private treaty to a consortium led by Roxy-Pacific Holdings, amounting to $115.28 million. The redevelopment is expected to increase the unit count from 43 to 113. Meyer Park, located along Meyer Road, was successfully sold for $392.18 million to UOL Group and Singapore Land Group, with an estimated unit increase from 60 to 295. Lastly, Holland Tower along Holland Heights secured a successful sale at $76.3 million to a wholly owned subsidiary of Wing Tai Holdings.

The developers were drawn to these developments due to their appealing reserve prices, freehold tenures, and strategic locations.

Features contributing to ‘high En Bloc potential’ usually include being in sought-after neighbourhoods, proximity to MRT stations, and having scenic views. Additionally, developers consider the size of existing projects and total redevelopment costs in their decision-making process.

Challenges and Risks

Disputes among homeowners in En Bloc sales can arise for various reasons. Some may resist the sale due to potential liabilities, like the SSD for ownership less than three years. Emotional attachment to their homes or concerns about the mandatory 15-month waiting period before purchasing a resale HDB under the latest cooling measures can also fuel reluctance. Regardless of the reasons, failure to secure unanimity among homeowners at any stage can severely impact the entire process.

Navigating through the volatilities of the real estate market, deep understanding of market dynamics and legalities of the process requires the invaluable input of the various appointed professionals. As such, delays in their appointments arising from differences in opinions among the homeowners will severely impede the whole process.

In exceptional cases where disinterested parties object to the sale, the Strata Titles Board (STB) may call for mediation. During this process, if the STB determines that the disinterested party may suffer financial losses or receive an insufficient sum to meet mortgage payments, the sale application may be rejected. If the En Bloc sale fails to conclude within the 12-month period, the CSC can relaunch the development for sale. However, a 12-month waiting period must be observed, and the entire process has to be restarted from the beginning. As discussed in this article, the entire En Bloc process can span up to two years, leading to stress and uncertainties for homeowners. Renovation plans may need to be delayed, and homeowners face dilemmas regarding whether to seek a new home immediately or wait to monitor the sale outcome.

Developers evaluating En Bloc opportunities must consider risk factors such as the reserve price and the site’s maximum redevelopment potential. Under current cooling measures, developers face a 35% Additional Buyer’s Stamp Duty (ABSD), only remittable if all units are sold within 5 years. Prudent decision-making regarding the total number of redevelopment units is crucial for developers.

Additional Resources

Check out our NOTG video podcast session featuring Mr. Karamjit Singh – CEO of Delasa and En Bloc sales expert, for valuable insights. Watch the video below.

Conclusion

En Bloc sales can bring positive outcomes for homeowners but might be challenging for some. Understanding real estate, the economy, and legal aspects is crucial. Involving professionals early in the process would ensure a smoother process, with achieving unanimity among homeowners as a cornerstone.

For prospective homebuyers, staying informed about potential En Blocs is wise to avoid liabilities and the hassle of searching for a new home right after moving in. This awareness is also beneficial for existing homeowners preparing for their next steps in the real estate journey. Importantly, we strongly discourage choosing a property solely for its ‘high En Bloc potential.’ Purchasing a property requires a thorough examination of personal finances and life goals. If you’re currently in the property market or need guidance in your real estate journey, feel free to reach out to us here. Our expert consultants are ready to assist you in fulfilling your aspirations.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.