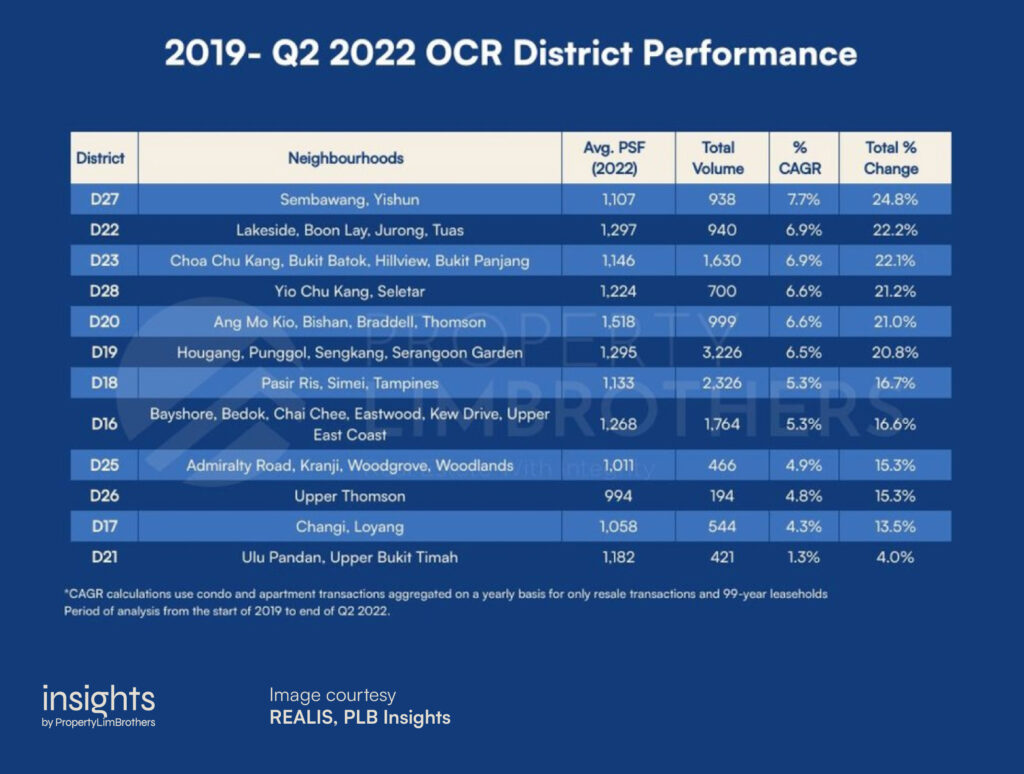

The northeast region of Singapore is home to many. The large residential areas span Hougang, Punggol, Sengkang, and parts of Serangoon along the North East MRT Line (Purple). It is no surprise then that District 19 has the highest number of transactions in the OCR from 2019 to 2022 Q2.

District 19 has the highest volume and wins by a large margin as compared to District 18 which comes in second. Hougang, Punggol, Sengkang, and parts of Serangoon have also grown considerably in price in the post-pandemic era. So much so that it almost placed within the Top 5 OCR Districts for growth.

In this special feature for the highest volume OCR District, D19 achieved an impressive CAGR of 6.5% and a total Absolute growth of 20.8%. All this growth from 2019 to 2022 Q2 is quite a feat, especially when there is a large number of transactions. It would mean that on an aggregate of this huge number of transactions, high growth was still achieved. Kind of like having the whole school full of ace students.

Let’s jump right to the Top 5 resale leasehold condos in District 19!

Fifth Place: Rio Vista

Coming in at fifth place, we have Rio Vista, a 99-year leasehold condominium with its lease starting in 2001. This condo was completed in 2004 with a total of 716 units. More than two-thirds of the units are sized between 1,201 to 1,300 sqft. Overall, this condo has comfortably sized homes for families.

From 2019 to 2022 Q2, Rio Vista transacted at an average of $952 psf. It had a volume of 103 transactions in the same period and achieved a CAGR of 5.8% and an Absolute growth of 18.3%. This is a decent amount of growth for a condo of its age.

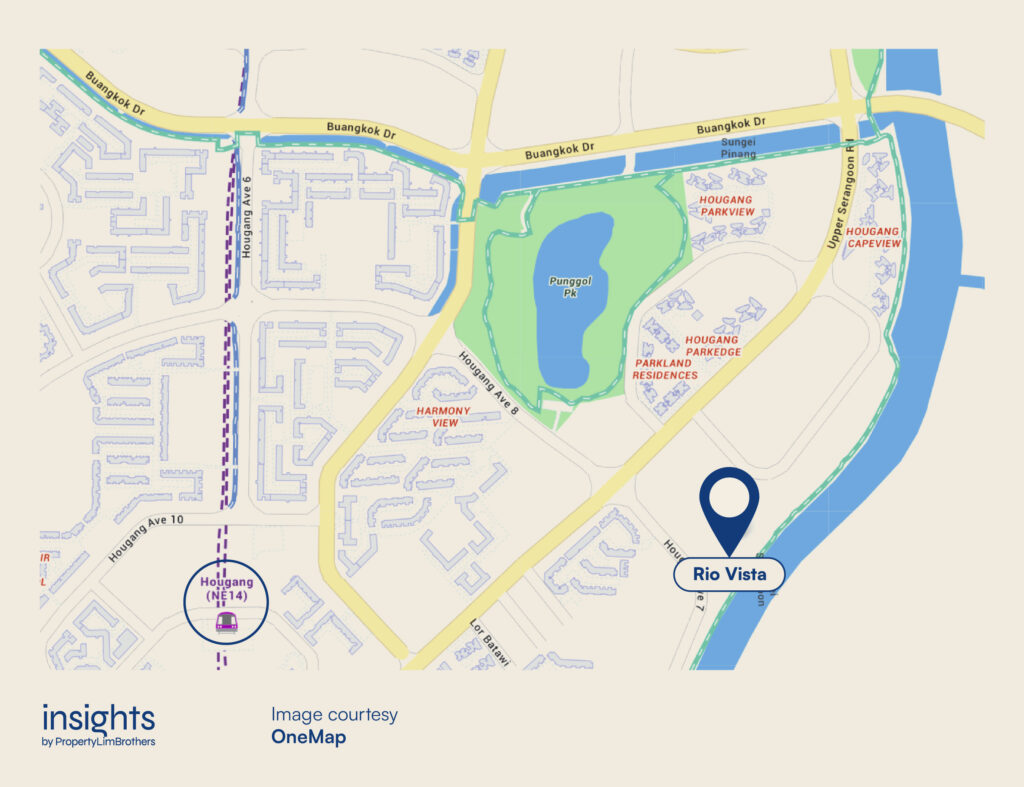

Rio Vista is located in Hougang, next to Sungei Serangoon. Nearby, we have Serangoon Secondary School, CHIJ OLN, and Holy Innocents’ High School. Punggol Primary School is also located within a 1km radius. In the surrounding area, we also have many pre-schools available for the young family demographic. This neighbourhood is a good mix of private and public housing, and has the much needed educational institutions to help reduce travelling distance for young families who have children 16 and under.

Hougang Mall and MRT station are also approximately 1km away from Rio Vista. In addition, there is plenty of green and blue in the form of Sungei Serangoon and Punggol Park, giving this neighbourhood a decent dose of nature.

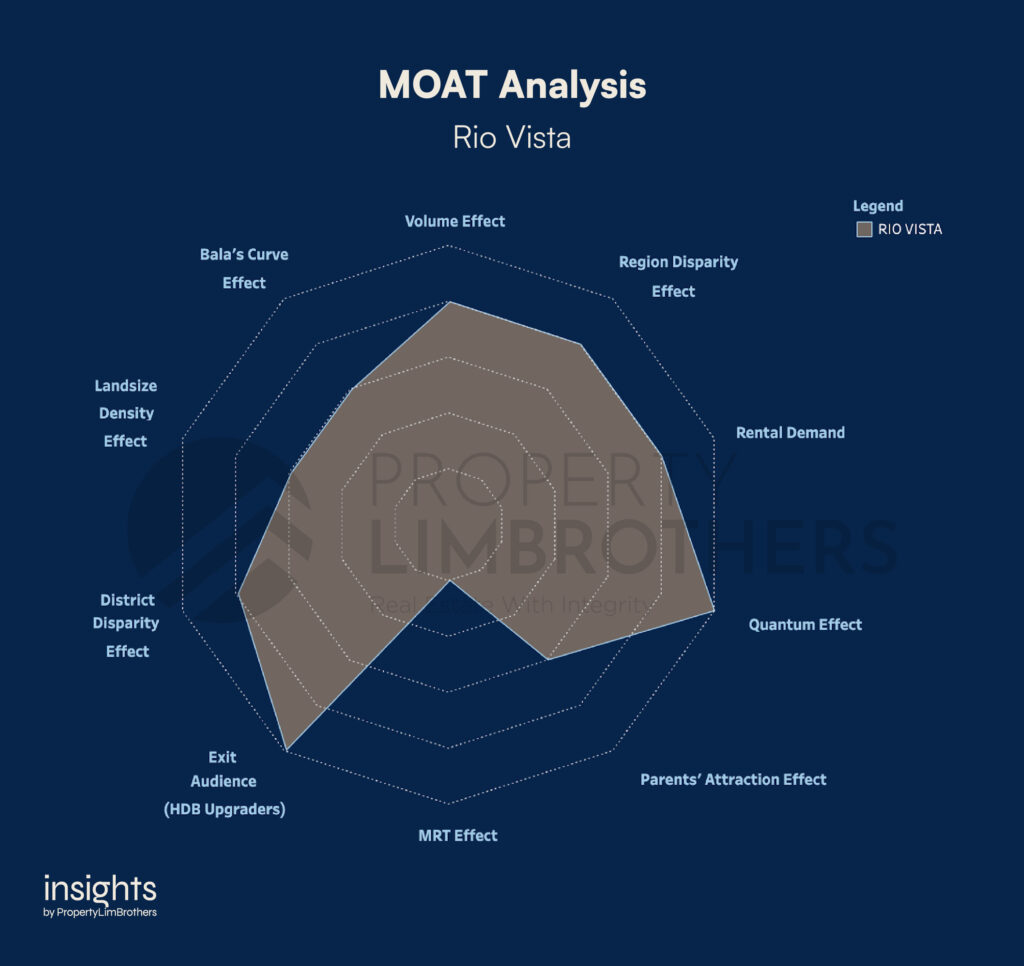

Rio Vista does very well on the MOAT Analysis, with a total score of 72%. It scores a 5 for Quantum Effect and Exit Audience. And it is generally a well-rounded development with the exception of it being slightly further away from the MRT Station. Notably, Rio Vista still scores a 4 for Region and District Disparity, signalling that the current prices are reasonable.

Given the remaining lease, the psf of the condo is still at a very affordable price of $952 psf. This might be of growing interest to future homebuyers as the purchasing power is being cut by the recent cooling measures we have seen from the government.

Fourth Place: Regentville

In fourth place, we have Regentville, a 99-year leasehold condo with its lease starting in 1996. It was completed in 1999 with a total of 580 units. For this development, the target audience might have been for younger or smaller families. Most of the units are sized between 900 to 1,200 sqft, with almost half of them in the 1,101 to 1,200 sqft range.

From 2019 to 2022 Q2, the average transacted psf for Regentville is at a very reasonable $868. It had a total volume of 91 transactions in the same period and achieved a good CAGR of 6.0% and Absolute growth of 18.9%.

Similar to the previous entry, Regentville is located in a neighbourhood with a good mix of public and private housing. There are plenty of schools within the vicinity of the condo. We can find Hougang Primary & Secondary, Xinmin Primary & Secondary, Rosyth School, Yio Chu Kang Primary, Bowen Secondary, and AWWA School within a 1km radius of the condominium.

Regentville is around 1.8km away from Hougang MRT. However, Serangoon North MRT on the upcoming Cross Island Line is around 600m away. This new MRT is estimated to be completed around 2030. The immediate neighbourhood is also a rather dense residential area.

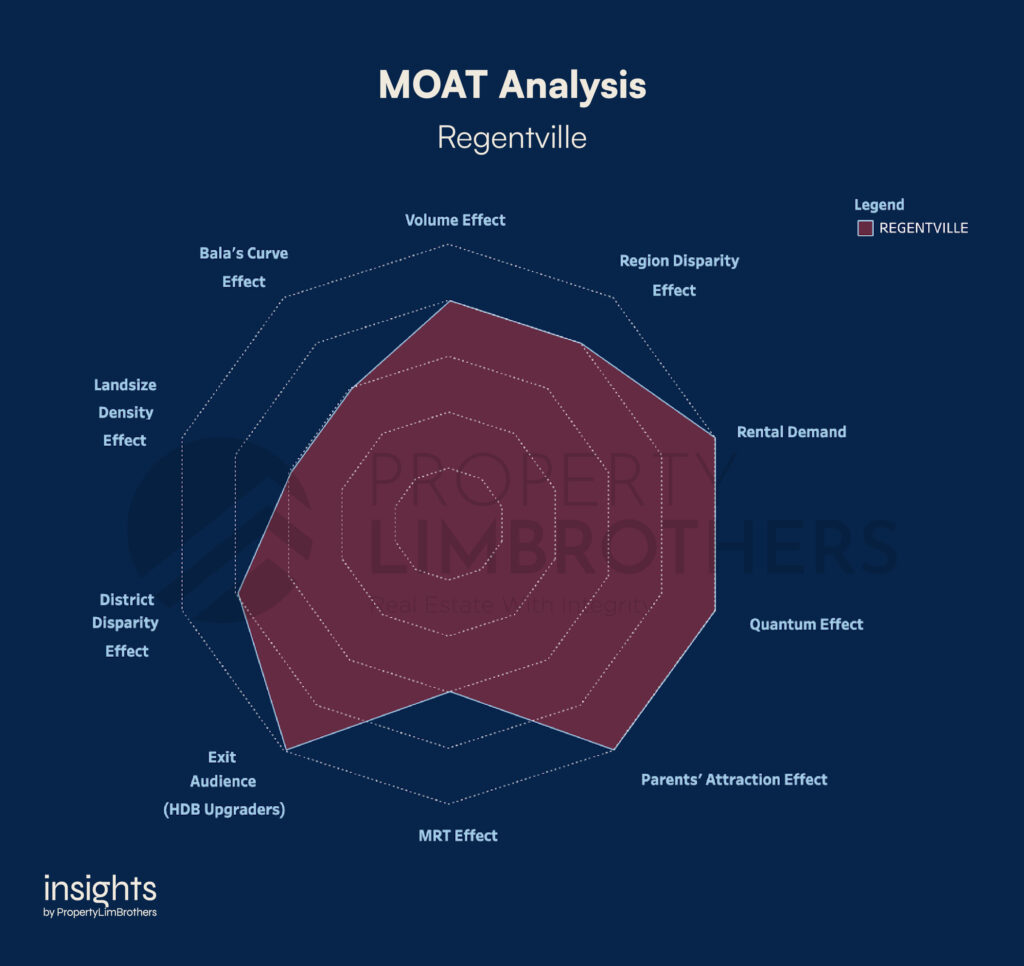

Amazingly, Regentville has an extremely high score of 82% on the MOAT Analysis. This is mainly due to the score of 5 on Rental Demand, Quantum Effect, Parents’ Attraction Effect, and Exit Audience. It also does well on Volume Effect, Region and District Disparity Effects with a score of 4.

This suggests that young families who are expecting or have young children might be attracted to the multiple schooling options nearby (for primary and secondary education). And more importantly, the condo looks to be an affordable option with strong rental demand. This will be an important selling point in tougher buyer markets.

Third Place: Evergreen Park

Coming in third place, we have Evergreen Park. This 99-year leasehold apartment started its lease in 1995 and was completed around 1999 with a total of 394 units. Half of its units are sized between 1,000 to 1,100 sqft and the remaining units are all larger. From 2019 to 2022 Q2, Evergreen Park transacted at an average psf of $858 with a total volume of 56 transactions. Evergreen Park achieved a CAGR of 6.0% and an Absolute Growth of 19.0%.

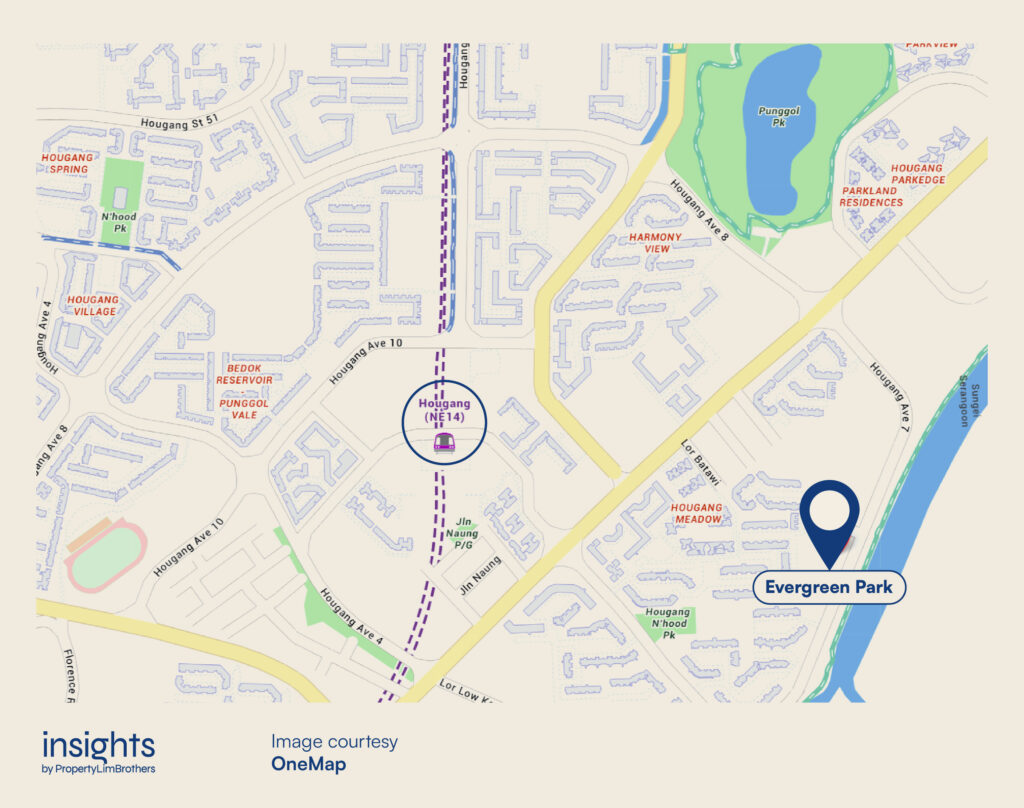

Evergreen Park is located along the Serangoon River (or Sungei Serangoon), which is further south of Rio Vista (5th place). Hougang MRT and Mall is 800m away from the apartment complex. Within the 800m radius of Evergreen park, we have Holy Innocents’ Primary and High School, CHIJ Our Lady of the Nativity, and Serangoon Secondary.

The location is slightly better than the previous entries in this list due to the closer proximity to the MRT and amenities. The number of schools available in the direct vicinity is also decent. The close access to the Serangoon River and Punggol Park provides some natural space for residents.

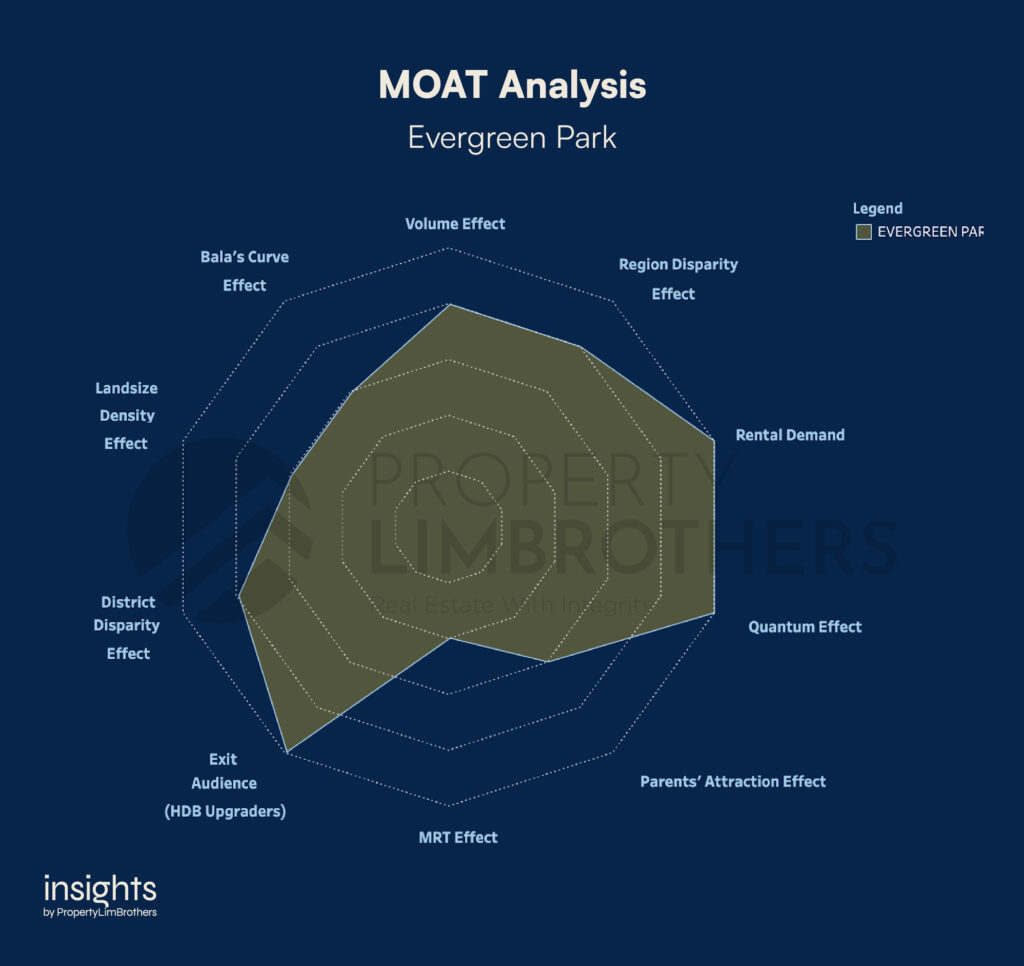

Evergreen Park performs well on the MOAT Analysis with a total score of 76%. With a score of 5 on Rental Demand, Quantum Effect, and Exit Audience, there seems to be demand for this area and the quantum is affordable for most Singaporeans. The Region and District Disparity Effect along with Volume Effect scores a decent 4.

Evergreen Park has an attractive price point and may be a popular and affordable option for those who wish to stay in Hougang. For HDB Upgraders looking to still stay near their parents in the neighbourhood, this might appeal to them. Evergreen Park is also priced below the average of the private property located near it. Buyers will need to take note of the age of this apartment as well.

Second Place: Chiltern Park

In second place, we have Chiltern Park. This is a 99-year leasehold condo with its lease starting in 1991. It was completed in 1995 with a total of 500 units. This condo has a great variety of unit sizes which may cater to a greater spread of buyer profiles. While this condo only has around 68 years of lease left on its clock, it has still grown considerably in the past 4 years.

From 2019 to 2022 Q2, Chiltern Park transacted at an average of $1,223 psf. It had a total volume of 57 transactions in this period and achieved a CAGR of 7.2% and Absolute growth of 23.1%. Having such high growth for an older condo such as this is not common. The growth might be driven by strong demand for the property due to the perks of its location.

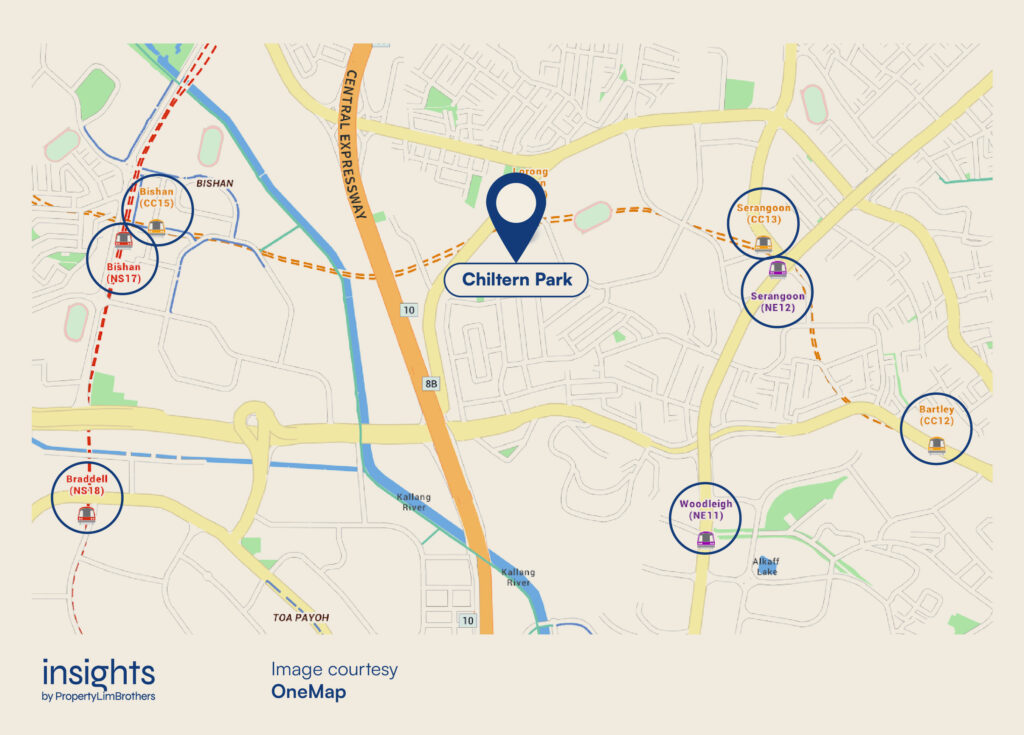

Chiltern Park is located within 200m of Lorong Chuan MRT station. In the immediate vicinity, we have St Gabriel’s Primary, Nanyang JC, Yangzheng Primary, and Zhonghua Secondary. The extremely close proximity to the MRT is a key factor in the attractiveness of this condo. While there is no shopping mall above the MRT, New Tech Park (NTP+) across the street from Lorong Chuan has some food options.

The psf of Chiltern Park is substantially higher than the other entries in our Top 5 list for District 19. This is because of the more centrally located feature of Chiltern Park, which is smack between Bishan and Serangoon. It also has access to the CTE with a short drive. This puts accessibility as the main selling point of Chiltern Park.

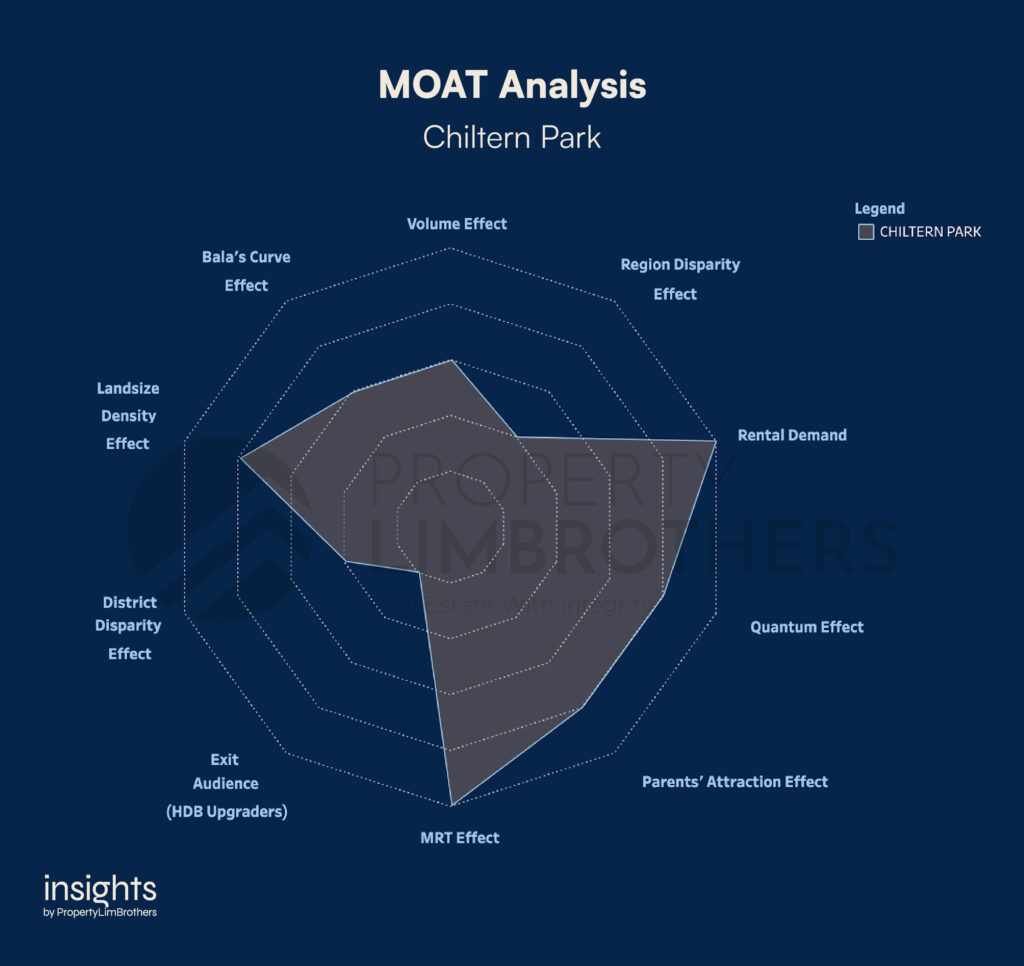

Chiltern Park has a total score of 66% on the MOAT Analysis. While this is the lowest MOAT score in this Top 5 list, it is still quite clear why this condo was able to be priced so high with strong growth. The Rental Demand and MRT Effect has a score of 5, pointing once again to the appeal of accessibility for this project.

This might be a great option for renters or homebuyers who mostly use public transportation. Even for those who own cars, having quick access to the CTE is a great way to get to the city fast. Chiltern Park has no chill when it comes to being connected.

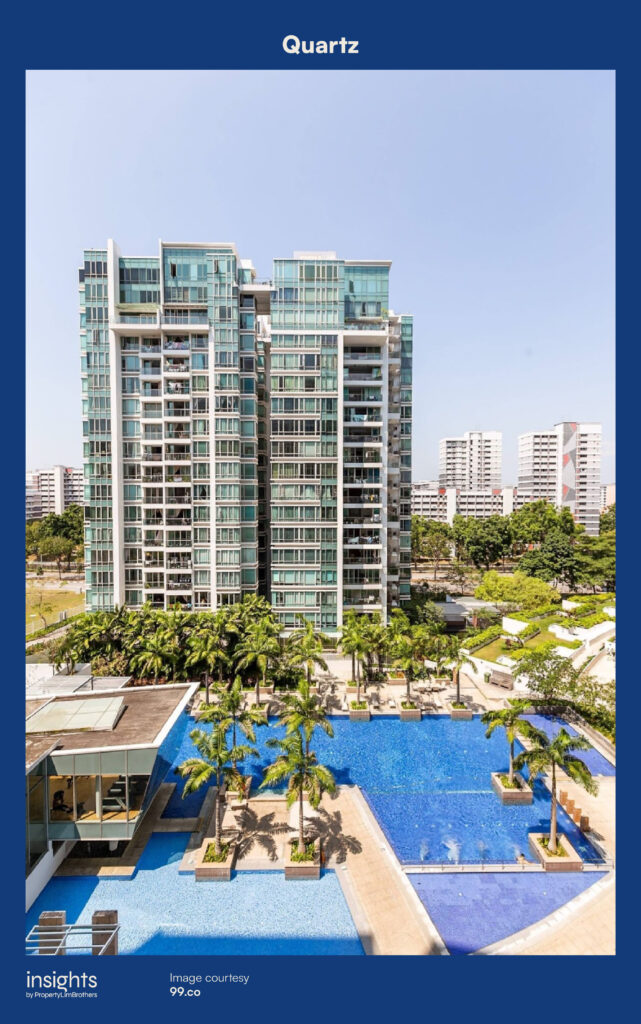

First Place: The Quartz

On the top of the podium, we have The Quartz, which is a 99-year leasehold condo with its lease starting in 2005. It was completed in 2009 with a total of 625 units. Over 70% of the units are sized between 1,000 to 1,200 sqf, and there are some more options for slightly larger units.

From 2019 to 2022 Q2, The Quartz had an average psf of $1,224 with a total volume of 93 transactions. The Quartz achieved a high CAGR of 7.5% and an Absolute growth of 24.1%. The Quartz is still a relatively young condo but was able to grow an impressive amount. Moving forward, The Quartz might still have enough lease to benefit from future developments in Buangkok.

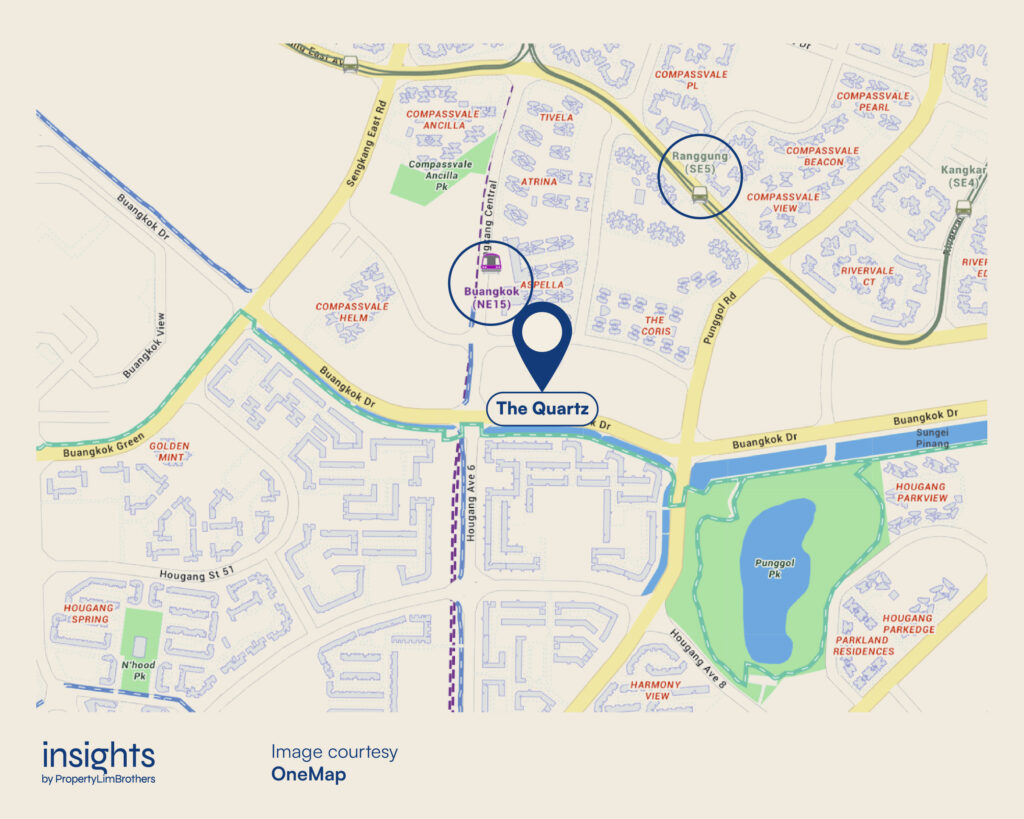

The Quartz is located across the road from Buangkok MRT. Sengkang Grand Mall is currently under construction and will provide the much needed amenities for the area upon completion. The expected completion date is around the end of 2023. It is a mixed-use development with residential spaces available. This might put The Quartz in a favourable position as Buangkok becomes more desirable and The Quartz is positioned as an affordable disparity play.

The recent developments in Buangkok have helped The Quartz appreciate in value. As the estate continues to mature, there might be more opportunities for further appreciation. There are also Palm View and North Vista Primary schools nearby, which help to improve the condo’s appeal to the parent buyer demographic.

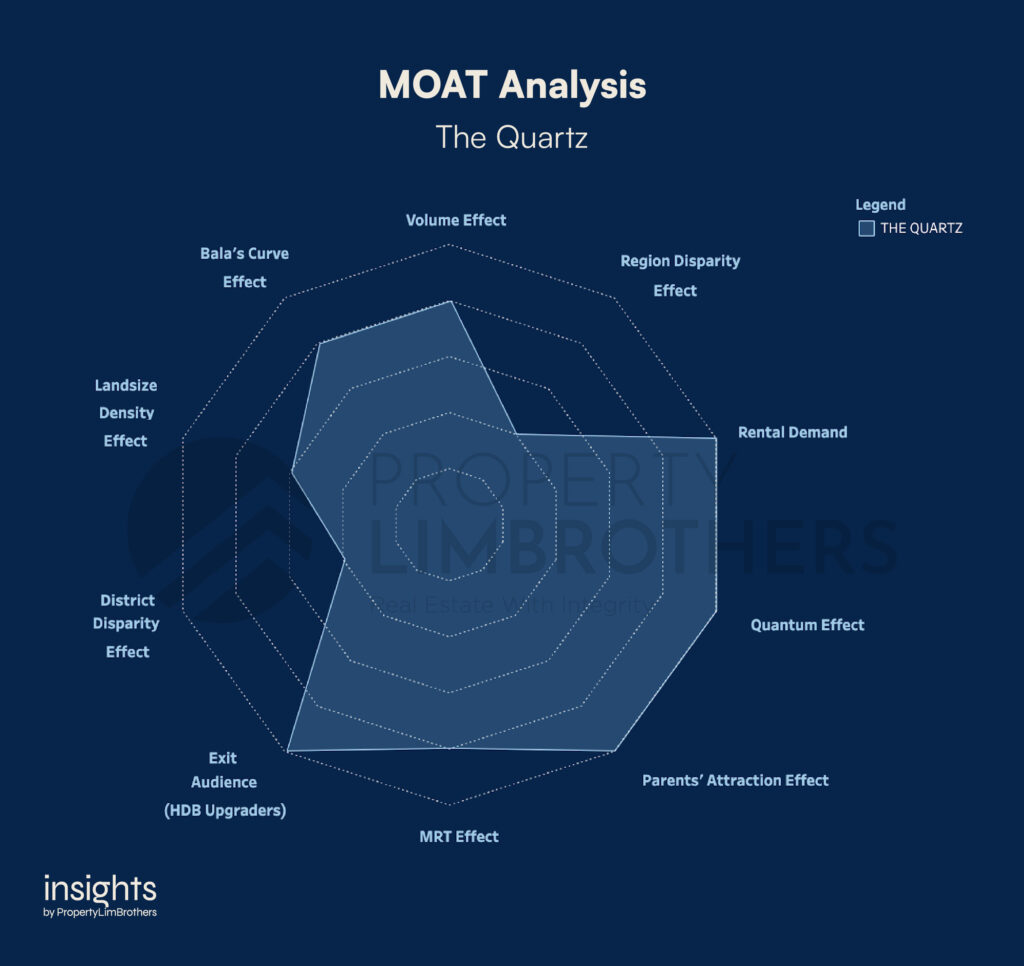

The Quartz has a high score of 78% on the MOAT Analysis. It has a score of 5 on Rental Demand, Quantum Effect, Parents’ Attraction Effect, and Exit Audience. It also does well on MRT Effect, Volume Effect, and Bala’s Curve Effect with a score of 4. This gives the condo a strong profile despite being priced above the median for region and district levels.

The demand for The Quartz might still be high even with the lower disparity scores. For this particular condo, prices might continue to see an upside once Sengkang Grand Mall completes development. The increased amenities around the area is reason to see further upside in demand for renters and buyers.

Closing Thoughts

To conclude, most of the top growth condos in District 19 are clustered around the Hougang area or on the fringes of Hougang. Some exceptions such as Chiltern Park performed exceptionally well due to the benefits of its accessible location.

There is some variation in the MOAT Scores of the Top 5 condos in District 19 but most of them score above 70%. If you live in this district or are considering to buy a private property in this district, you may want to consider this as an additional filtering criteria to improve and speed up the search process.

Overall, we see that private property located near schools does better in this residential district. Catering to the needs of young families helps to appeal to a strong demographic of Millennial parents. And improves the demand situation for properties in this district.