With effect from the August 2023 Build-to-Order (BTO) Exercise, stricter penalties will be imposed on couples who do not select a flat when invited by the Housing and Development Board (HDB) to do so. A new priority category benefiting first-timer families applying for their first BTO flat was also introduced.

In his Committee of Supply speech on 2 March 2023, Minister of National Development Desmond Lee announced that applicants who do not book a flat when invited to do so will accumulate non-selection counts, which will affect their future flat applications. He also announced a new priority category for the BTO and SBF exercises. In this article, we will explore the potential implications of these measures and what it means for homebuyers down the road.

New Rules for Non-Selection of BTO/SBF Flats

For first-time buyers, if they accumulate one non-selection count (reduced from the previous two), they will be considered second-time buyers for a period of one year.

Similarly, second-time buyers who accrue one non-selection count (reduced from the previous two) will have to wait for one year before they can apply for a flat again.

According to HDB, 40% of applicants invited to book a flat upon successful balloting reject the chance to do so, which in turn crowds out applicants with more urgent housing needs. This measure aims to ensure fair distribution of available BTO flats while encouraging eligible applicants to remain active in the housing market.

However, HDB has also recognised that buying a home is a significant financial decision and has outlined certain exceptions to the non-selection count rule.

Applicants with limited options, such as those with 10 or fewer BTO flats to choose from or five or fewer Sale of Balance (SBF) flats to choose from, will have their non-selection count waived. Additionally, the HDB may choose to waive the non-selection count in cases of extenuating circumstances, according to Lee.

While it is essential to enforce the non-selection deterrent to ensure that applicants take their flat selection seriously, HDB understands that certain situations call for flexibility. By providing exceptions to the rule, HDB hopes to make the home buying process fairer and more accessible to all applicants.

New Priority Category for First-Timer Families

Currently, first-timer families are given the greatest priority in the ballot for BTO and SBF exercises, with up to 95% of flat supply being set aside for this group.

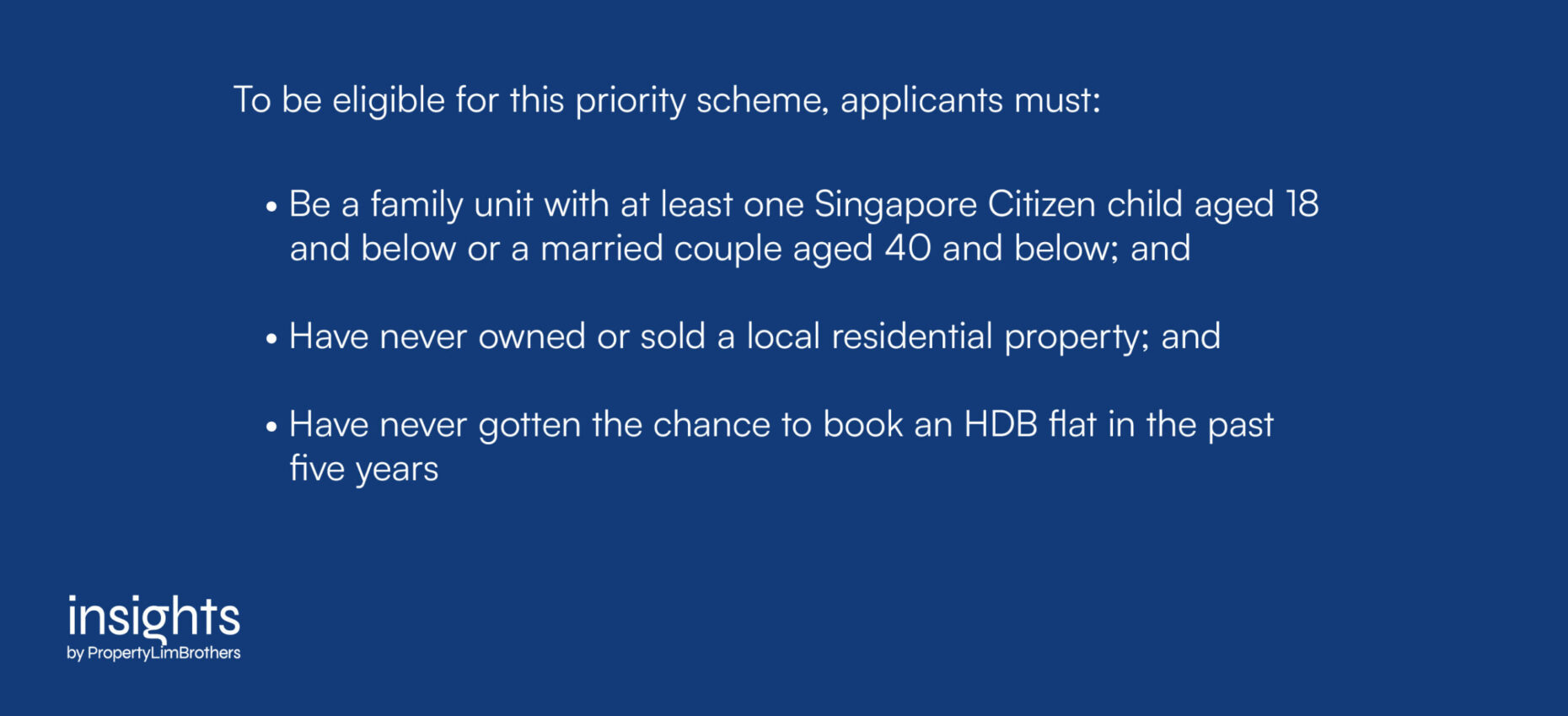

The new category, coined the First-Timer (Parents and Married Couples) category or FT(PMC), aims to provide additional support for married couples and families buying their first home. Lee estimates that around 10% of all first-timer families fall into this category.

This newly introduced category will not apply to individuals who have previously owned or sold private property, individuals who have purchased an unsubsidised resale flat, and fiancé/fiancée couples.

According to Lee, due to the tight supply of flats at the moment, the scheme is currently only targeted at those who are already married or have children.

Under this new priority scheme, applicants will receive an additional ballot chance when applying for a BTO or SBF flat on top of the two ballot chances they already receive as first-timer families. Married couples aged 40 and below, with or without children, will also be eligible for the Family and Parenthood Priority Scheme (FPPS). More flats will be set aside for applicants under this scheme.

FT(PMC) applicants applying for 4-room and smaller BTO flats in non-mature estates are also given more support. They will receive first priority for flats set aside for FPPS, which gives them a higher chance at being invited to select a flat.

What This Means for Homebuyers

Because of the long waiting time expected for the BTO process, many applicants apply for the sake of it or simply to try their luck, resulting in a large number of fall-outs which crowds out others who may need it more.

The new measure serves to make BTO applicants think through the decision more carefully and thoroughly before applying, weeding out non-serious applicants and those who are not ready for the commitment.

According to Lee, some applicants would rather give up the opportunity to select a flat now, and wait longer for a better flat. He also added that some applicants are rather selective, wanting only flats on high floors. The new measure forces homebuyers to be less selective when choosing their flat, or risk imposing the penalty which will affect their future eligibility.

The increased support for married couples who may have more pressing housing needs to bring up their children or to start a family is also timely, given the recent report of Singapore’s record low fertility rate. With the government aiming to roll out BTO projects with a shorter waiting time, families with children and young married couples will greatly benefit from the implementation of these priority schemes.

Addressing Affordability and Accessibility of HDB Flats

The affordability and accessibility of HDB flats have been a big topic in Singapore over the past few years, on the back of rising cost of living as well as the rise of million-dollar HDB flats. Many aspiring homeowners are also exasperated by the difficulty to secure a flat through the BTO balloting system and the high cost of resale flats in the open market.

The government has been monitoring the situation closely, and are pushing out new measures to address the concerns of Singaporeans. Some of these measures were announced recently in the Budget speech by Deputy Prime Minister Lawrence Wong on 14 February 2023.

To provide more support for Singaporeans with more pressing housing needs, the government has increased grant support for first-time buyers purchasing a resale flat. An additional $30,000 for buyers purchasing a 2- to 4-room HDB resale flat and additional $10,000 for buyers purchasing a 5-room or larger HDB resale flat was rolled out with immediate effect. On top of the Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG), this brings the total grant amount available to $190,000, up from the previous $160,000.

Closing Thoughts

Through the implementation of these stricter regulations and increased support to higher-priority applicants, the government aims to achieve a delicate balance between meeting the pressing housing needs of applicants and ensuring fairness to successful balloters.

What do you think of these new measures? Are they effective in ensuring fairness in the BTO process? If you have any questions or need further clarifications and advice, feel free to contact us here.