Deciding on a new condo to purchase can be daunting and overwhelming, with many considerations to take into account. Factors to consider include location, your budget, property size, amenities, developer reputation, and future potential for rental income or capital appreciation. You have come to the right place, if you are reading this while in the process of exploring a New Launch residential project.

In this PLB Ultimate New Launch Guide we will cover the A-Zs as well as some of the pitfalls you will want to be aware of if you are considering purchasing a New Launch project.

We will be covering the criteria that you should consider when selecting a New Launch project with the aid of our PLB MOAT Analysis tool. We will also be breaking down the expected finances you will need to prepare during the different stages of the construction period. Whether it is ahead of the balloting process or when the project is approaching the Temporary Occupation Permit (TOP) stage. Lastly, the biggest fear of every buyer, pitfalls that you may be unaware of during the process.

Which New Launch To Buy?

The perennial question and most initial question when we dive into the topic of a New Launch property. Oftentimes, the two intentions of considering a New Launch property are to expect some form of capital gains or to own a brand new home for you and your family to stay in.

The MOAT Analysis is a proprietary tool by PLB that presents a meticulous technique for estimating a property’s value, considering a wide array of influential factors. This strategy involves a comparative study of the property against others, grounded on ten key dimensions, to deliver an unbiased assessment of its attractiveness to the broader market in Singapore.

Utilising the PLB MOAT Analysis tool will help to address the initial doubts on which project to purchase. At a glance, the MOAT Analysis will be able to break down the scores of the different projects within the surrounding area to provide an indication of whether a New Launch project is worth considering. For example, if you are purchasing a New Launch project with the intention to put it up for rental when the construction is done, then the rental demand score from the surrounding projects will give you an indication of the rental potential of the New Launch project being considered.

PayNow or PayLater?

The initial downpayment required for a New Launch project and a resale project is the same. Minimally 25% of the purchase price is required in cash and/or CPF while the remaining 75% can be covered by the maximum mortgage Loan-To-Value (LTV) from a financial institution. However the disbursement, as most of our readers would know, is quite different. The full disbursement of the funds for a resale property would kick in on completion of the purchase, which is usually 2-3 months from the point of acquiring an Option To Purchase (OTP) for a resale unit. The disbursement of the funds for a New Launch project stretches for 2-3 years instead.

One advantage of buying a New Launch project is the Progressive Payment scheme. The lower financial commitment during the initial stages, allows buyers more time to prepare for the heavier mortgage payments closer to receiving keys for their unit. It is important to note that prior to receiving the TOP or the Certificate of Statutory Completion, the monthly mortgage is almost half compared to after full disbursement of the loan.

For our readers who have been sharp enough to notice the monthly payments at Stage 1 which seems to be the same, they are. This is because the drawdown requirement during the Completion of the Foundation works is a total of 10%. But this component has been broken down into 5% + 5% with the remaining initial cash/CPF downpayment covering one portion of the requirement.

At this point, you may be thinking “What if I do not purchase a unit at the launch stage and come in later?” Simply put, the mortgage drawdown amount will be from the stage at which you enter. If you had purchased a unit while the project is at construction stage 5, at the Completion of Wiring/Plumbing, the initial downpayment of minimally 25% is the same and your banks will disburse 30% of the mortgage loan to the developer. Immediately, you would be paying a monthly mortgage of roughly $2,500.

Timeline for Purchasing a New Launch Condo

Day -14:

Yes you read that right Day MINUS 14. Before the day of booking a flat, enthusiastic New Launch buyers will start to gather all the information they can on the potential purchase. Heading down to the showflat is the best way to get a feel of the space that you will be purchasing. Afterall, you will only see your physical home 2-3 years down the road even though you have already paid for it. At this point, it is also when you speak to the banks to get an In-Principle Approval (IPA) for a mortgage loan. This will determine your affordability.

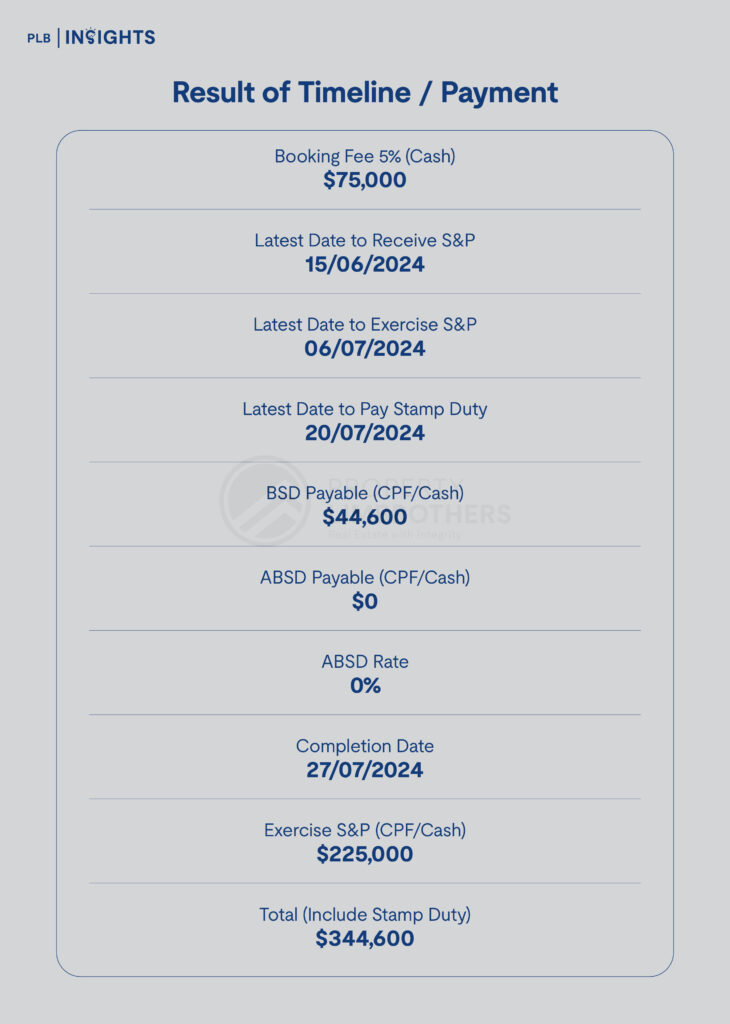

Congratulations, it is booking day and you managed to book the unit you have planned for. There are some important checkpoints to look out for after booking your flat:

Day 1:

Pay 5% booking fee for the unit you have selected. The booking fee will need to be paid in cash which will make up for the minimum cash requirement. In exchange you will receive the OTP for your unit. You will need to submit a copy of the OTP to the banks to get an approved Letter of Offer for your mortgage loan. At the same time, you will also need to appoint the law firm you will be proceeding with.

Week 2:

The developers will send the Sales & Purchase agreement (S&P) to your law firm within 2 weeks. Afterwhich, the lawyers will advise you on any concerns regarding the documents.

Week 5:

At this point, you will have the last opportunity to decide if you are moving forward with your purchase within 3 weeks of receiving the S&P. You will need to head down to your law firm to exercise the OTP and sign the S&P agreement if you are. Otherwise, the OTP will lapse and you will be refunded 75% of your booking fee.

Week 7:

You will also need to pay the applicable stamp duties for the purchase within 2 weeks of exercising the OTP and signing the S&P. In most cases, your law firm will advise you to prepare the necessary amounts in either a Cheque or Cashier’s Order during the signing of the OTP and S&P to avoid making a separate trip down.

Week 8:

Congratulations! At this point, you would be completing the purchase of your brand new home. The law firm will complete the drawdown of the necessary CPF funds as well as home loan and you will start paying monthly mortgage repayments.

Download the full New Launch Buyer’s Guide

Exploring the new launch condo market and unsure where to start? Download our full PLB Ultimate New Launch Buyer’s Guide with comprehensive payment timelines and frameworks below!

Other Considerations

Interest Rate

Although your initial monthly mortgage repayments seem lower compared to a resale property’s mortgage, you are likely subjected to a higher interest rate. Fixed Interest rates for Completed Properties at the time of writing are ranging close to around 3%. While interest rates for Uncompleted Properties are ranging around 4%. Meaning, you are paying slightly more interest on a New Launch purchase. Thankfully, the drawdown amounts during the construction phase are broken into smaller amounts to keep your interest expense lower.

Additional Buyer’s Stamp Duty (ABSD)

Most people may not know this, but you are able to purchase a New Launch Project and get ABSD remission if you currently own a residential property. This is provided you fulfil certain requirements such as being a married couple with the inclusion of a Singapore Citizen. The New Launch project must also be purchased under both names and the first existing residential property must be sold within 6 months after issuance of the Temporary Occupation Permit (TOP) / Certificate of Statutory Completion (CSC), whichever is earlier. Full information on the remission criteria can be found here.

Final Thoughts

Possibly the largest purchase of your lifetime, the perennial decision to go for a brand new condo or a resale condo will forever differ from individual to individual. Every individual and family have their own unique requirements and lifestyle preferences, so there is no one-size-fits-all recommendation. But if you need a second opinion, tune in to our upcoming webinar on the 28th June to find out more and decide which is more profitable as an investment!

AND! Get ready for the ultimate new condo showcase: PLB x Seedly New Launch Convention 2024! View and compare more than 80+ New Launch condominiums in Singapore through this one-stop expo for investors and homebuyers.

If you’re still on the fence and considering a new launch property, this is the best place to be! Join us this July 7th at Suntec Convention Centre, Hall 404 and gain access to PLB’s latest investment strategies and exclusive frameworks for choosing the right condo. Early bird tickets are now available here: https://www.propertylimbrothers.com/plb-new-launch-convention-2024/

If you need any guidance in your property journey or if you’re in need of a second opinion on market options, feel free to connect with us here. Our PLB Consultants, with their eagerness and experience, stand ready to offer you a personalised consultation session.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.