August was a record-breaking month, boasting a whopping 54 resale HDB flats being transacted over $1 million. In May this year, a Tiong Bahru HDB flat was transacted for $1.5 million even with a 49 year balance lease left. Is this a sign for sellers to bump up their prices and buyers to prepare more cash for their upcoming purchases? While the rise in property prices is nothing new, this should not be a signal for prices in general to start sky-rocketing. For the savvy buyer, zooming out and looking for the pros and cons of buying resale HDBs over condominiums is the best analysis to have before coming to a decision. This is particularly true for HDBs, where you will need to take into account its 99-year lease status. While there may be million dollar transactions even for properties with a shorter lease left, they should not be taken as a market standard. For the average buyer, a property’s remaining lease should be a factor to be taken into account in your purchase. With the recent news of million-dollar HDB transactions, will this result in a shift in demand toward HDB resale flats?

Are property prices set to jump significantly?

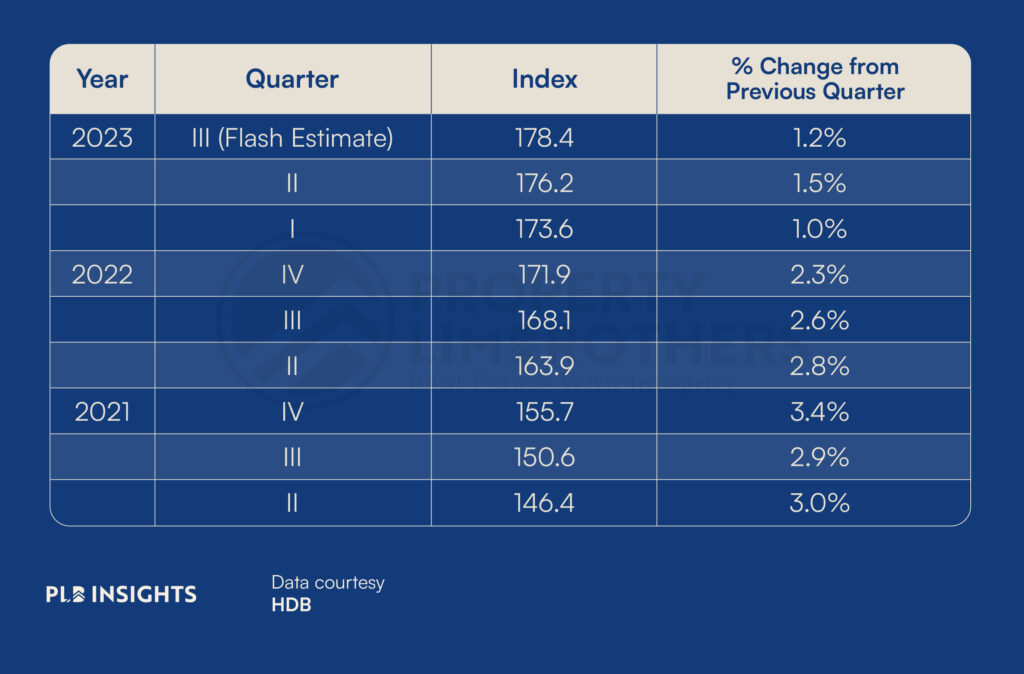

The biggest question posed by many after reading articles of HDB flats breaking new transaction records every few months is whether this means that property prices will follow suit as a whole. To answer this question, we need to take a macro view of the property market. Concerning HDB resale prices, if we were to compare this to previous years, we are showing a very minor increase in prices. According to HDB’s Resale Prices Index (RPI), it reveals that the changes in price in 2023 is lesser compared to the same periods in 2022 and 2021. For quarters 1 to 3, 2023 registered a growth of 3.7%, 2022 saw a 7.8% increase and 2021 recorded the highest increase of 8.9%. Hence, while increases are steadily increasing, 2023’s property market does not indicate a sharp increase in price changes as compared to 2022 and 2021 within the first three quarters of the year.

Uptick in Million-dollar flats transacted

As more million-dollar flats have been purchased, the more desensitised we have become to it. Purchasing a HDB flat over a million dollars would have raised eyebrows 10 years ago but it is becoming more and more common now, espeiclaly with the ever-booming property market. As noted in the chart below, the past ten years has seen an exponential growth in the number of properties going past the million-dollar mark. Since 2018, the million-dollar mark is not exclusively reserved for bigger flats such as 5-room flats but also 4-room flats. This is especially true for 2023, with the biggest number of million-dollar 4-room transactions so far of 77 units. This illustrates an increase of 49% compared to other years and is the biggest increase so far. Prices of apartments might be jacked up more if there are panoramic views, near amenities or near primary schools too.

The Land Lease Decay Risk

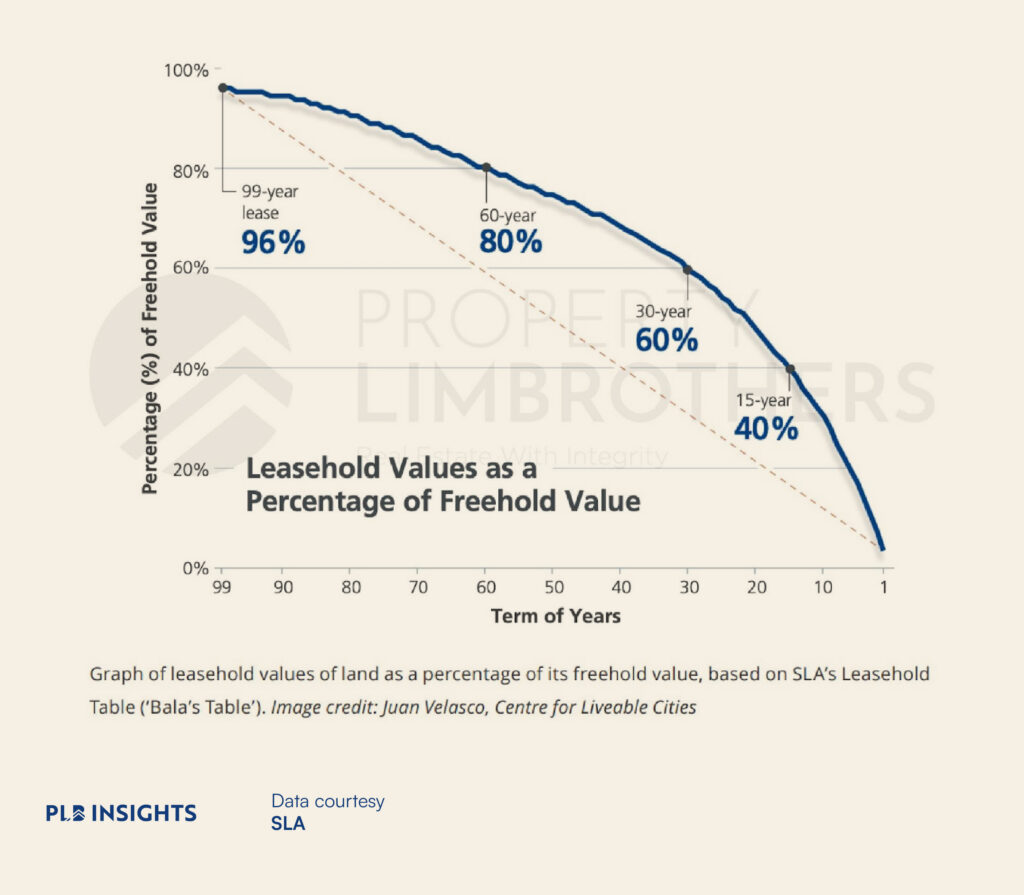

All HDB flats are leasehold by the government, with a 99-year lease. Upon reaching the 39-year mark of your HDB lease, with 60 years remaining, it is possible that potential sellers may give lesser consideration to your unit. This is due to the restricted usage of CPF funds for payment of the property, as well as the tightened regulations surrounding bank loans. This is further corroborated by the Leasehold Values chart by Singapore Land Authority, the biggest drop in the value of your property is when it has 69 to 79 years left, hence it is most favourable for sellers to sell their HDB within the first 20-30 years of its lease.

Additionally, we can see the overall depreciation in property value through the same chart. At the start of the lease, the leasehold property is at 95% of an equivalent property value, which drops to 88.5% at 75 years, 74.7% at 50 years and 54.6% at 25 years.

Not to mention, after the end of this 99 years of lease, the HDB flat will be returned to the state where it will be rebuilt into a newer flat. This makes the value of your home drop to $0 and you will need to vacate. While this has yet to happen, with the exception of Geylang Lorong 3, it is still a real concern that could come to pass.

What about the Selective En-bloc Redevelopment Scheme (SERS)?

SERS may present itself as a favourable solution for those living in HDB flats nearing the end of the 99-year lease. SERS is the Housing and Development Board’s equivalent of an en bloc, where older properties are typically selected for redevelopment. This occurs when the government deems that a particular land plot is not optimally utilised or is strategically located, and in return, compensates you for relinquishing your residence in order to repurpose the land.

However, it is important to temper expectations as the likelihood of this happening is much less common than en blocs. According to Prime Minister Lee’s National Day Parade Rally in 2018, only approximately 5% of flats are deemed suitable for SERS. Furthermore, it is crucial to note that the decision lies solely with the government and not multiple developers trying to bid for a condominium in the case of en bloc.

In the same rally, PM Lee also announced a new scheme called Voluntary Early Redevelopment Scheme (VERS). Residents within the precinct will be required to participate in the voting process for VERS, similar to the Home Improvement Programme. In the event that the residents vote in favour of VERS, the government will proceed with the repurchase of the entire precinct, including all the flats, for the purpose of redevelopment. It is important to note that this plan is intended for long-term implementation, but it will start within the next 20 years. This time frame allows for sufficient preparation in terms of selecting the appropriate precincts, strategically pacing the redevelopment process, and establishing the specific terms and conditions.

Don’t Fall Prey to Increasing Prices

While the surge in million-dollar HDB flats may incite sellers to think about inflating prices, it is advisable to refrain from increasing your listing price haphazardly. Prospective buyers who are on the lookout for resale HDBs in popular locations may have the option of considering Prime and PLH flats that are priced more affordably. Although there may be constraints on financial gains from purchasing a HDB resale due to tighter restrictions, a lower entry price can help mitigate this. With the introduction of more public transport lines, decentralised office spaces and improvement in amenities in various areas, this could lead to a reduction in the relative premium fetched by popular HDBs. Should your HDB flat also have a shorter lease, this may pose an additional problem for you.

Closing Thoughts

While the recent surge in million-dollar transactions for resale HDB flats may suggest rising property prices, a closer examination of the broader market reveals more moderate increases in 2023 compared to previous years. Buyers should be cautious of land lease decay and the long-term 99-year leasehold nature of HDB flats. Although schemes like SERS and VERS provide hope for HDB owners, they are still subject to government decisions. In this ever-changing landscape, both sellers and buyers should exercise prudence, as there are affordable alternatives in popular locations that present viable options. The evolving urban environment may also impact premiums on HDBs.

In conclusion, making well-informed decisions is crucial for navigating the resale HDB market, and this includes a thorough analysis of both potential opportunities and risks. Contact us today if you need a second opinion on your options in the market and our consultants will be more than happy to help you in your property journey.