Purchasing a property in Singapore is an admirable personal achievement, given that Singapore remains one of the most expensive real estate markets in the world. And when you are executing your exit strategy, it is crucial to understand the legal process that dictates how the property is properly transacted.

In this article, we are going to focus on the role of the conveyancing process in the real estate transaction, and why it is crucial to have an understanding of the process. By the end of this article you will be armed with the specific, step-by-step knowledge of the conveyancing process so you can complete your transaction as a fully-informed seller. Read on to learn more.

What Is Conveyancing?

Conveyancing is the legal process whereby a real estate title is transferred from one person to another. Do keep in mind that as a result of the critical importance of the conveyancing process, it can take quite some time. By some estimates, it can take up to 12 weeks for the conveyancing process to complete, simply because the process is so important and thorough.

The conveyancing process starts once the property buyer receives the Option-to-Purchase, or OTP. The Option to Purchase is exchanged with option money given by the buyer to the seller so the buyer has the ability to purchase the property within a certain amount of time at an agreed upon price.

A Conveyancing Lawyer

Regardless of whether you are transacting a private property or an HDB resale property, do seek out an experienced conveyancing lawyer. The transaction of a major purchase such as a home requires expert due diligence, and many of the steps in the transaction listed below require completion by a conveyancing attorney.

Private Property vs HDB Sales

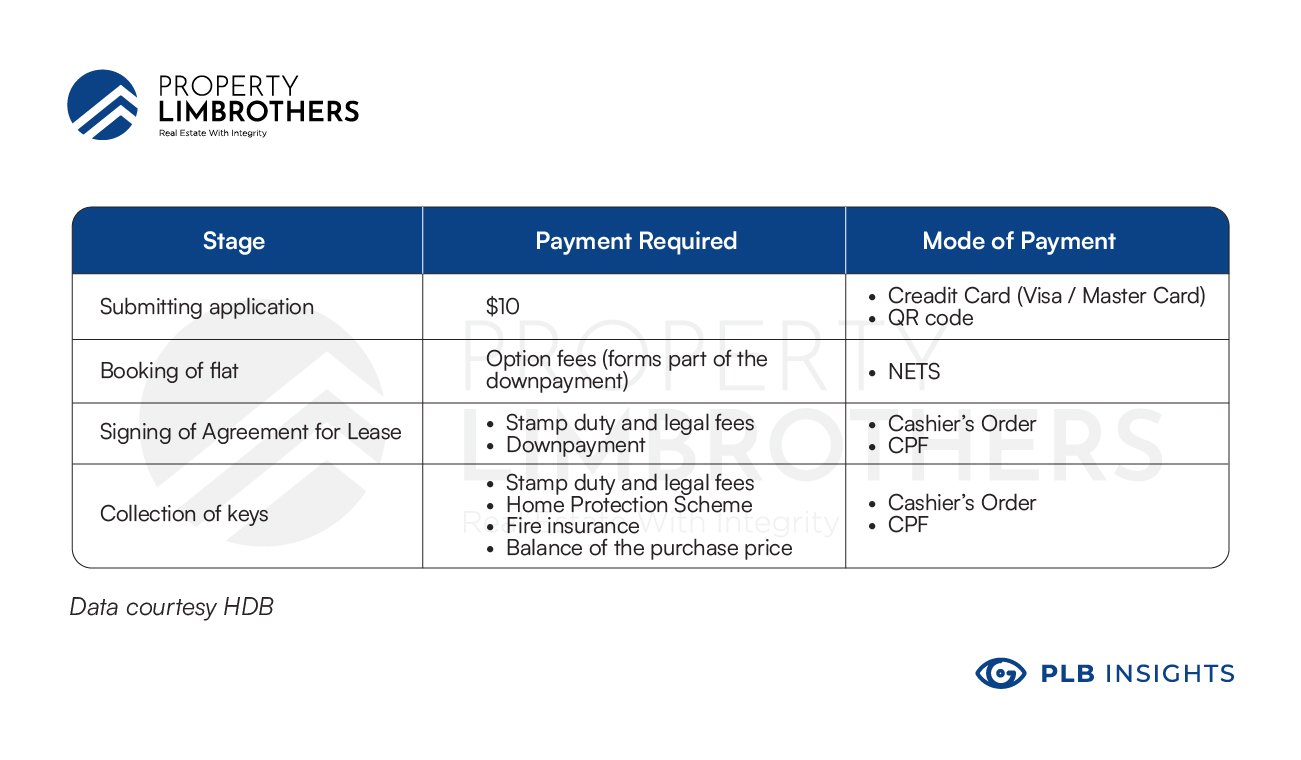

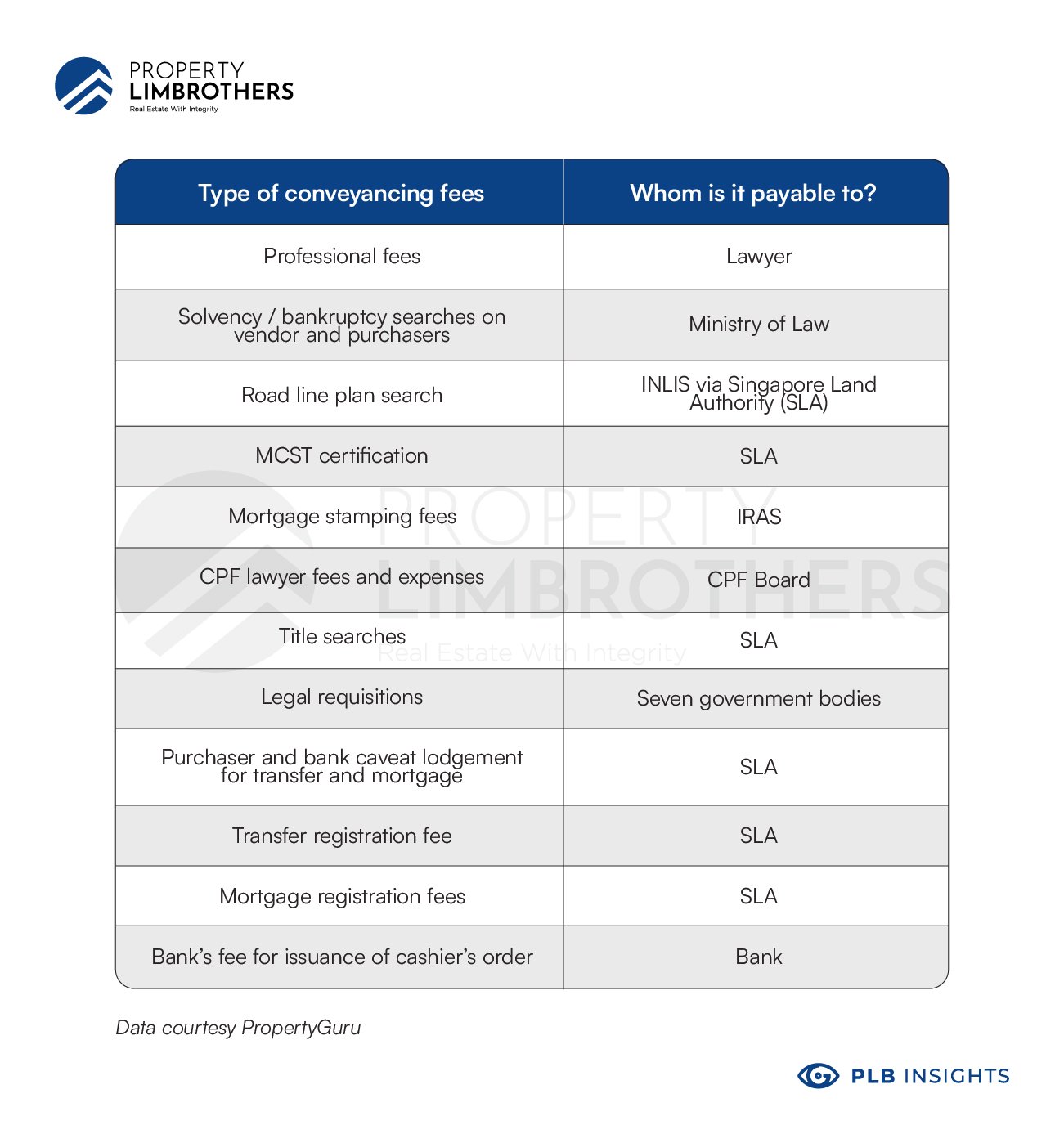

Do keep in mind that the conveyancing process and its associated fees vary depending on whether it is a private property sale, or the sale of an HDB or executive condominium property. In an HDB resale, the HDB Solicitor will operate on the buyer’s behalf and has their own set of costs and fees, listed below.

Private Property Conveyancing Fees

As part of the purchase’s conveyancing process, the property buyer will be expected to pay the fees listed in the table below.

Home Titles

The titles on a house are divided into two categories: freehold, and leasehold.

With a freehold title, the owner has property ownership forever. In contrast, with a leasehold title the property is leased form the government and ownership will be returned to the government at the expiration of the lease. The most common lease lengths on new properties are 99 years, and they can vary from 6 months up to 99 years.

Leases with a length of 999 years do exist but do keep in mind they are rare. For all intents and purposes, these leases are considered to be freehold leases in this article.

Do keep in mind that the majority of real estate in Singapore has a leasehold title. As a result, freehold land typically commands a premium in the marketplace.

Certain Property Sale Restrictions

Landed residential property in Singapore is highly desirable due to large amounts of space and typically no leasehold on the property. As a result of the Residential Property Act, a buyer who qualifies as a “foreign person” cannot purchase landed residential property unless they have the approval from the Land Dealings Approval Unit of SLA.

So, if you find yourself in the opportune position of selling landed residential property, do make sure you are conducting a transaction with an eligible buyer.

An additional property transaction restriction that applies to HDB flats is the ethnic integration policy that can vary from neighbourhood to neighbourhood.

The Conveyancing Process

The conveyancing process typically begins with the buyer hiring a conveyancing lawyer. Next, the conveyancing lawyer will conduct a title search of the property in question. The buyer will want to verify the property title and length of lease, if applicable, and confirm whether the property has a freehold or leasehold title.

The next step in the title search process includes an inquiry of existing “encumbrances”, if they exist. An encumbrance includes a mortgage on the property, or a caveat. A caveat is essentially a legal document submitted to the Singapore Land Authority (SLA) from someone who has an interest in the property.

When Do Caveats Appear?

The most common occurrence of lodging a caveat during the transaction of a property is when the buyer is seeking to protect his or her interest in the property. Typically a deposit has been paid and they have chosen to exercise their Option to Purchase or executed a transaction agreement in relation to the property.

Do keep in mind that the bank granting a mortgage, and the CPF Board when funds are released for the purchase of a property, can lodge a caveat on the property to protect their interests as well.

The caveat is essentially the buyer’s method of protecting themselves during the transaction so that no other parties can claim interest on the property before the buyer has completed their purchase.

Property Ownership Check

This step in the title search is for the buyer to explore whether there are multiple owners of the property. Multiple owners can own the property in one of two ways.

The first way is as joint tenants. Joint tenants all own the property in equal rights, regardless of how much they contributed to the purchase. On the other hand, tenants-in-common have divided ownership of the property that is proportional to how much they contributed to the purchase of the property.

Good Root Of Title

Above all else, the primary objective during the title search process will be to confirm that the seller has “good root of title.” If the seller does not have good root of title, then the transaction will typically be paused or cancelled until the issues with the title are resolved. An example of what is not considered a good root of title is a land area mismatch with what was lodged initially.

Buyer’s Caveat Lodge

Once the buyer of your property has decided to purchase the property and has signed the Option to Purchase or the sale and purchase agreement, the buyer’s lawyer will lodge a caveat on the property with the SLA. At the time of exercising the option of purchase, the buyer will pay the seller the exercise fee as agreed in the option to purchase through the seller’s solicitor’s conveyancing account.

The Buyer’s Legal Requisitions

Do keep in mind that after the buyer exercises their option to purchase, their lawyer will send out additional reviews of the property to seven different bodies of government. These reviews notify the government organizations about the upcoming transaction and are typically required by law.

Payments To The Seller

After lodging the caveat, the rest of the funds required for the transaction will begin to change hands. The buyer will give conveyancing money and the rest of the down payment to his attorney, who will in turn pay the funds to the seller. Money is most commonly exchanged through an escrow account between the buyer and seller, until the transaction is fully completed.

Receiving The Property

Once the property in the transaction is prepared for final transfer, the seller will transfer possession of the vacant property to the buyer of the property. Do keep in mind that as the seller, you must have the property properly prepared for the buyer to take over.

Some sellers and buyers agree that the property will be sold “as is” with furniture or other flat belongings included, or the property will be sold completely “vacant.” If there are any issues with the property, do keep in mind the buyer may report issues that can slow down the transaction.

After the buyer inspects the property and confirms everything is in order, the buyer will receive the certificate of title, the transfer form, and the seller’s property keys.

At this point the transaction is complete and the buyer has officially purchased the property.

Property Fees

Do note that upon completion of the transaction, the property buyer’s attorney will contact IRAS, as well as other appropriate government agencies, about the property’s new ownership.

As a result, all fees relating to maintenance, property taxes, plus other charges that may be imposed by the local town council or the condominium management corporation strata title (MCST), will then become the buyer’s responsibility.

Possible Early Mortgage Repayment Fees

Do keep in mind that as the seller, it is possible that you may owe early mortgage repayment fees, depending on the type of mortgage you borrowed for your property. Many times the seller’s conveyancing lawyer will check on the status of your mortgage to review whether you owe an early repayment penalty.

Although the mortgage repayment fee may be small enough that selling your property is still the most logical decision, it is always advisable to be aware of any fees that may affect your disposition of the property.

If CPF Funds Were Used For Initial Purchase

In addition to investigating whether an early repayment penalty is owed by the seller upon the sale of the property, the seller’s conveyancing lawyer should also check what amounts, if any, are owed in repayment of CPF funds.

If CPF funds were used for the initial purchase, then the seller will owe the full amount of the funds borrowed, plus the interest those funds would have earned from his CPF Ordinary Account.

The Importance Of Conveyancing For The Seller

Ultimately, this article has demonstrated that the conveyancing process to transact real estate in Singapore can be a lengthy process. With many highly specific steps that can take upwards of three months from start date to date of completion, the conveyancing process requires expert counsel and advisement from start to finish.

And as the seller on the property, it is crucial to understand the process so that you can work with the buyer to successfully complete the transaction while ensuring your interests are protected.

Many of the steps in the conveyancing process are the buyer’s responsibility. However, the smoothest transactions occur when the buyer and the seller are both familiar with each step of the process and work with each other to produce a favorable outcome.

If you are looking for assistance in successfully marketing and selling your property, do contact the team at PropertyLimBrothers. With nearly 2000 real estate transactions completed since the firm’s inception, we offer expert advice on selling or buying your property and are happy to connect you with reputable conveyancing attorneys as needed.