The global economy is intricately interconnected, and any major economic event in one part of the world can have far-reaching consequences for other regions. In recent times, bank run causing Silicon Valley Bank (SVB) to collapse in the United States (US) has been a concern for investors and economists alike. The impact of such an event would be felt not only in the US but also in other parts of the world, including Singapore’s property market.

Singapore has a dynamic and thriving real estate market, with property prices rising steadily over the years. The city-state’s economy is heavily reliant on international trade and finance, making it vulnerable to external economic shocks. In this article, we will explore the potential effects of the US bank collapse on Singapore’s property market, examining the various factors that could come into play.

Potential Negative Spillovers for Singapore

The US is so far away, how can a small island on the other side of the globe like Singapore be affected by it? Despite being on the other side of the globe, Singapore is deeply interconnected with the global economy, and any significant economic event, including a US bank collapse, could have far-reaching consequences for the city-state.

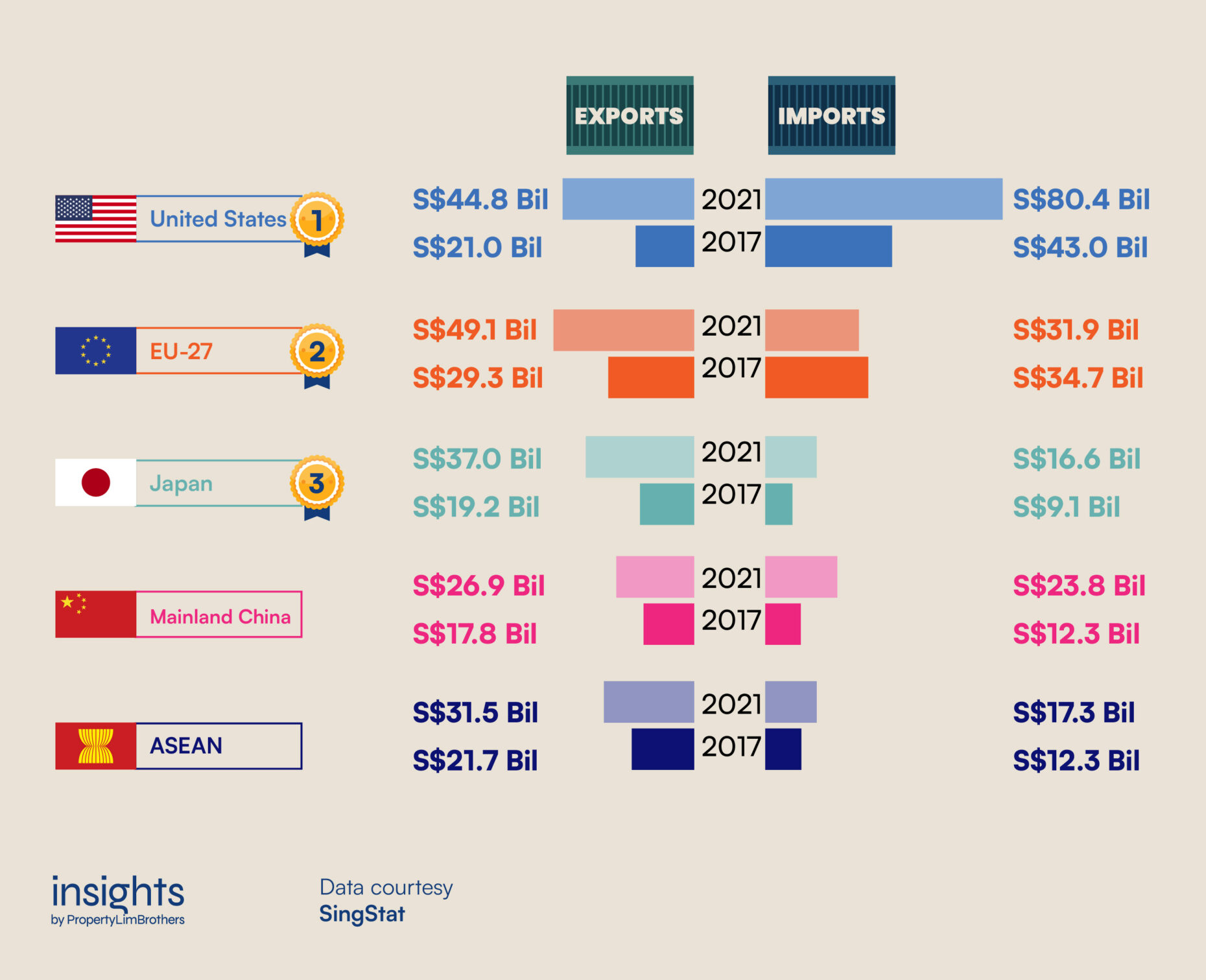

One reason why Singapore’s economy is closely linked to the US is because the US is Singapore’s largest trading partner, surpassing EU, Japan, China, and ASEAN. Any economic shock to the US would, therefore, have a knock-on effect on Singapore’s export-driven economy. A US bank collapse could lead to a decline in demand for Singaporean exports, resulting in a slowdown in economic growth and a decrease in demand for Singaporean real estate. The effects on US imports to Singapore will be more complex depending on the reaction of the US dollar and credit markets.

Additionally, Singapore is home to many multinational corporations and financial institutions that have significant operations in the US. A US bank collapse could lead to a loss of confidence in the US financial system and a decrease in investment in US-based companies. This could lead to a ripple effect on businesses in Singapore with US operations, potentially leading to job uncertainty if the SVB bank run is contagious.

Moreover, Singapore’s financial system is highly interconnected with the global financial system, and severe disruption to the global financial markets could affect Singapore’s financial stability. Widespread bank collapse in the US could trigger a broader economic slowdown and potentially cause a domino effect on other financial institutions around the world, including those in Singapore. This could lead to a decrease in lending and investment activity, which could in turn affect demand for Singaporean real estate. However, US Regulators have stepped in to reassure consumers that their deposits are safe. In MAS’ recent media release, it was stated that “The Singapore banking system has insignificant exposures to these failed banks in the US” and that banks in Singapore remain resilient.

In conclusion, while Singapore may be far from the US geographically, it is intricately connected to the global economy, and any significant economic event, such as SVB’s collapse, could have far-reaching consequences for Singapore’s property market and broader economy. It is, therefore, essential for policymakers and investors in Singapore to remain vigilant and prepare for the potential risks and challenges that may arise from such events. This will be a larger concern to Singapore if we see a contagion from the SVB collapse affecting mainstream banks.

Can this even be a bullish news for Singapore?

One of the most significant potential impacts of a US bank collapse on Singapore’s property market is the flight of capital from the US to Singapore. In times of economic uncertainty, investors tend to seek out safe havens for their money, and Singapore’s stable economy and sound financial system make it an attractive destination for capital. If US banks were to collapse, there might be a significant outflow of capital from the US, and Singapore’s financial and property market could potentially be one of the beneficiaries of this capital flight.

The concept of a “safe haven” refers to an investment that is expected to retain or increase its value during times of economic uncertainty or instability. Historically, Singapore has been considered a financial safe haven due to its stable political and economic climate, sound financial system, and robust regulatory framework. In the event of a US bank collapse or any other major global economic crisis, Singapore’s status as a safe haven could attract capital inflows from investors seeking to protect their wealth and hedge against volatility in other markets.

Singapore’s real estate market has long been a popular destination for foreign investors due to its strong economic fundamentals, attractive tax policies, and relatively stable property prices. In recent years, however, the government has implemented a series of measures to cool the property market, including increasing buyers stamp duties and tightening interest rate floors for loan-to-value limits. These measures have had some success in slowing down property price growth, but they have also made it more challenging for foreign investors to enter the market.

However, it is important to note that any positive impact on Singapore’s property market would need to be balanced against the potential negative effects of a US bank collapse, such as a decline in demand for Singaporean exports or a decrease in foreign investment in Singaporean businesses. Furthermore, a significant increase in foreign capital could exacerbate the already-high property prices in Singapore, making it more difficult for locals to afford homes and potentially worsening income inequality.

Despite these potential challenges, Singapore’s reputation as a financial safe haven could provide a competitive advantage in the aftermath of a US bank collapse. As investors seek out secure assets and trusted financial institutions, Singapore could potentially emerge as a preferred destination for foreign capital, leading to a boost in demand for its property market and broader economy.

Contagion Risk in the Finance Sector

The potential contagion risk in the finance sector is a critical consideration when assessing the impact of the SVB bank collapse on Singapore’s property market. As Singapore has a moderately high exposure to the finance industry, taking up 13.5% of nominal GDP in 2022. This is the third largest component of Singapore’s nominal GDP and might potentially make it vulnerable to systemic risks in the global financial system that could cause a ripple effect throughout the economy, including the real estate market.

A contagion of bank collapses (if it happens), triggered by the SVB bank run, could quickly spread to Singapore’s financial system if mainstream banks are severely affected by mass panicked withdrawals, leading to a loss of confidence in local banks and a reduction in liquidity. This could cause a significant tightening of credit conditions, making it more difficult for homebuyers to secure loans and for property developers to obtain financing.

Moreover, a bank collapse in Singapore’s context could lead to a sharp reduction in overall economic activity, reducing the purchasing power of potential homebuyers and leading to a decline in demand for real estate. A contraction in the economy could also lead to a rise in unemployment, putting further pressure on household budgets and leading to a slowdown in property sales.

The impact on Singapore’s real estate market would depend on the severity of the contagion and the strength of Singapore’s financial system. Singapore’s financial regulators have implemented a range of measures to mitigate the risks of financial contagion, such as stress tests for banks and regulations on lending practices. These measures have helped to ensure the stability of Singapore’s financial system during periods of stress like the one we are experiencing now. So the current risk of contagion to Singapore would seem to be moderately low.

However, in the event of a severe financial crisis, these measures may not be sufficient to prevent a significant downturn in the real estate market. The 2008 global financial crisis demonstrated that contagion risks could quickly spread throughout the financial system, causing significant damage to real estate markets around the world. In Singapore, the government has taken additional steps to mitigate the risks to the real estate market, including the implementation of cooling measures to maintain price stability and reduce speculation in the market. These measures have helped to ensure that the real estate market remains stable and sustainable, even during periods of economic stress.

It is important to note that the impact of a US bank collapse on Singapore’s property market would depend on the severity of the collapse and the wider economic fallout. If the collapse were limited to a single bank and contained within the US banking system, the impact on Singapore’s property market would likely be minimal. However, if the collapse were more widespread and led to a broader economic slowdown, the impact on Singapore’s property market could be significant.

Closing Thoughts

The potential impact of SVB’s collapse on Singapore’s property market is a complex and multifaceted issue. While there are both potential upsides and downsides to this scenario, it is difficult to predict the exact outcome. Ultimately, the extent of the impact would depend on a variety of factors, including the severity of the collapse, the reaction of investors, and the wider economic fallout. Nonetheless, the possibility of a US bank collapse highlights the interconnectedness of the global economy and serves as a reminder of the need for investors and policymakers to be aware of the potential risks and consequences of major economic events.

To stay up to date with the latest developments in Singapore’s property market, follow our NOTG YouTube channel and our Editorial. You can also contact us here if you need private and tailored advice on your own real estate journey.