In Q3 2024, Singapore’s private residential market experienced a cooling trend with an overall price decrease of 1.1% compared to Q2 2024, marking the first significant decline in over a year. Non-landed property prices fell by 0.3% quarter-on-quarter (q-o-q), while landed property prices dropped more significantly by 3.8% q-o-q. Despite this recent cooling phenomenon, prices have increased by 1.1% year-to-date and have risen 34.0% from the low point in Q1 2020 during the COVID-19 downturn.

This quarter marked the first time private property prices declined by more than 1% since Q3 2016, which saw a 1.5% q-o-q decrease. For comparison, during Q1 2020, at the start of the COVID-19 pandemic, prices dropped by a smaller margin of 1.0% q-o-q.

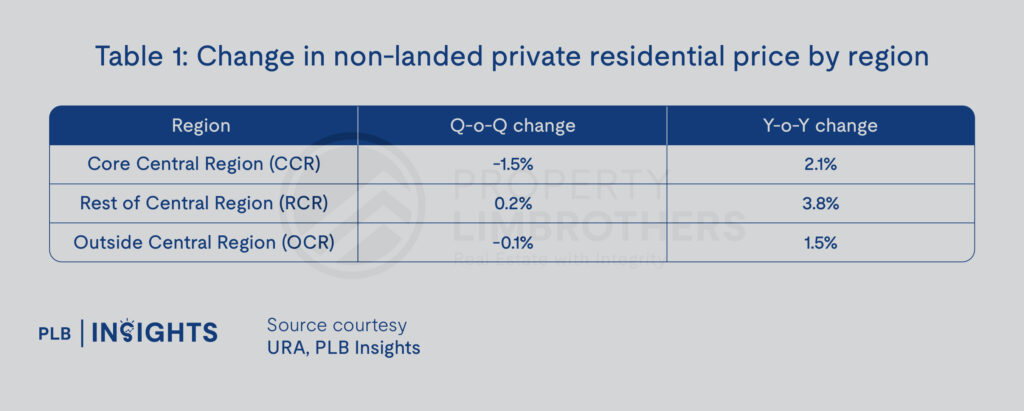

Price Trends by Region

In addition, we have also broken down the q-o-q and year-on-year (y-o-y) change by region below.

The price changes show varying conditions across regions. The CCR experienced the most significant drop, possibly due to discounts by developers on unsold units. In contrast, the OCR had a slight 0.1% decline q-o-q, following a flat 0.2% growth in Q2 2024. The RCR, however, bucked the trend with a modest 0.2% increase q-o-q. This can be attributed to the launch of 8@BT, where 52.5% of the units were sold at an average price of $2,719 PSF during its launch weekend.

Year-to-date, price growth stands at 1.5% for CCR, 2.1% for RCR, and 0.3% for OCR, reflecting varied demand and supply dynamics in each area.

Tepid Developer Sales

In the first half of 2024, new sales volumes dropped to 1,889 units, marking the lowest half-year sales on record, even falling below the 1,977 units sold in 2H 2008 during the Global Financial Crisis. New home sales have continued to struggle in Q3 2024, with 1,054 units sold—an increase of 45.4% from Q2 2024’s low of 725 units, but still only about half the five-year quarterly average of 2,214 units.

This slowdown has been accompanied by sluggish developer sales since early 2024, driven by weak economic conditions, buyer fatigue, and growing resistance to high property prices. These factors have led to lower-than-expected sales volumes, as buyers are increasingly reluctant to pay premiums for new developments, contributing to a cooling trend in the market.

Additionally, developers have been very cautious and selective in land acquisition due to narrow profit margins, cautious homebuyer sentiment, and overall market uncertainties. The ongoing mismatch between developers’ and sellers’ pricing expectations has also hampered the successful completion of private residential land sales, as seen from the unsuccessful bids for Media Circle long-stay serviced apartment site and Marina Gardens Crescent site. The Ministry of National Development (MND) has reduced the number of units available in the Confirmed List for the Government Land Sales (GLS) program in the second half of 2024. This reduction amounts to 400 fewer units compared to the 5,450 private residential units that were offered in the first half of the year. This adjustment marks the first decrease following seven consecutive increases, reflecting a cautious approach in light of current market conditions.

This cautious approach is expected to continue through the remainder of the year, likely keeping activity in the residential land sales market subdued.

Disparity Effect

Meanwhile, secondary sales have held steady in Q3 2024, suggesting that liquidity remains in the market.

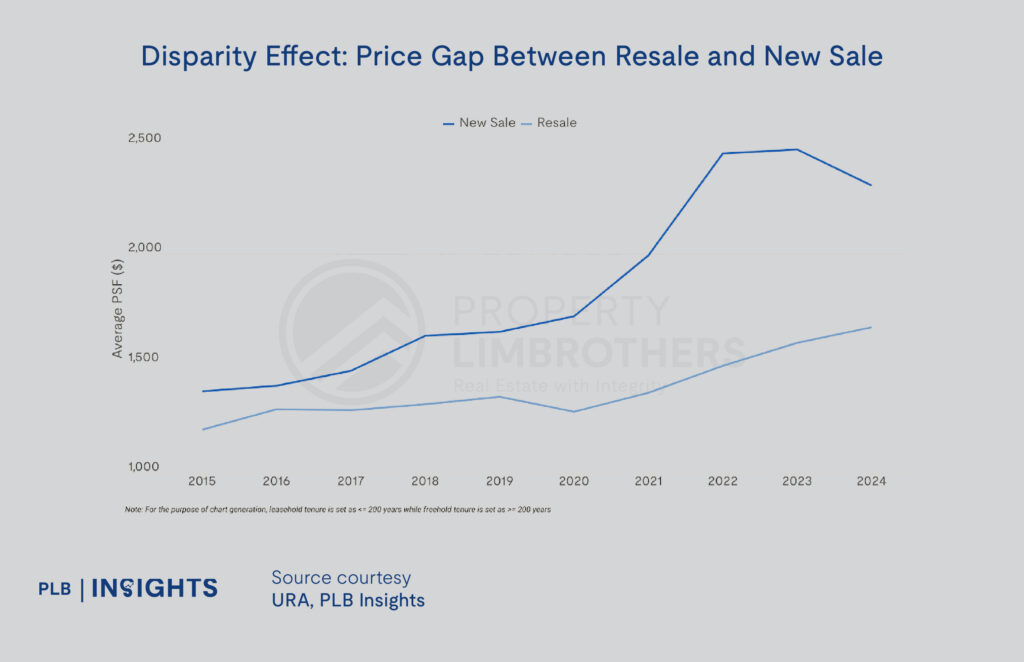

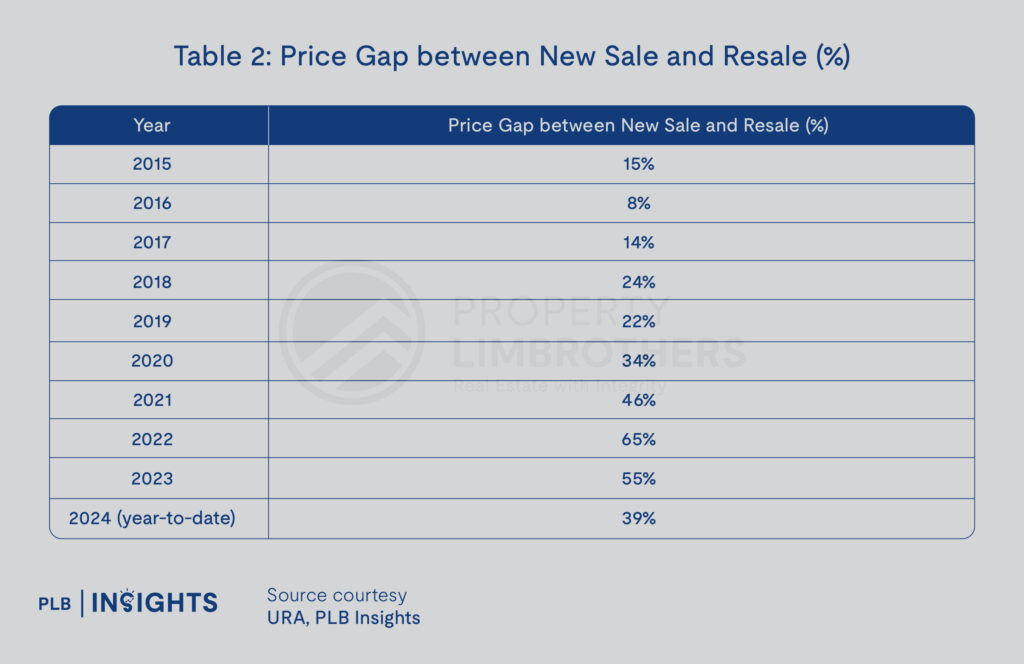

As seen from Figure 1 and Table 1, the price gap between new and resale condos widened significantly since the onset of COVID-19, with the price gap between new sale and resale prices peaking around 2022 at 65%. This gap started narrowing from 2023 and dropped to 39% in 2024 (year-to-date), as price-sensitive buyers increasingly turned to the secondary market. High property prices for new launches and a decline in transaction volumes have heightened buyer resistance, particularly as economic uncertainties and high mortgage rates persist. This resistance has been further amplified in early 2024, influenced by economic uncertainties and persistently high mortgage rates.

Recent URA data reflects this trend, with secondary sales volumes reaching 3,293 units in Q3 2024, close to Q2’s 4,190 units and above the 2023 quarterly average of 3,156 units. This suggests a growing preference for resale options, driven by relatively more affordable options and reduced financial pressure.

Despite a significant decline in resale transactions, the prices of resale condos largely held steady. However, they still faced a minor decline q-o-q, reflecting resilience amid a challenging market environment. This stability, despite lower transaction volumes, highlights continued demand for resale properties.

Interest Rate Cuts

The U.S. Federal Reserve (Fed) recently reduced interest rates by 50 basis points on September 18, lowering the target range to 4.75% to 5%. This marks the Fed’s first monetary easing in four years, aimed at supporting its dual mandate of promoting maximum employment and stabilising prices. By reducing borrowing costs, the Fed seeks to stimulate economic growth through increased investment and consumer spending, particularly amid current economic headwinds.

Between July and September, however, buyers in the private residential market became increasingly cautious, reacting to persistently high mortgage rates with a ‘wait-and-see’ approach. This trend reflects heightened sensitivity to borrowing costs, as potential homebuyers paused their decisions in anticipation of further adjustments.

Looking ahead, continued interest rate cuts and a potential reduction to a terminal rate of 2.9% by 2026 could boost buyer confidence. This anticipated easing may positively influence sales in Q4 2024, particularly with a pipeline of attractive new launches, such as Meyer Blue, Nava Grove at Pine Grove, Norwood Grand in Champions Way, and Novo Place EC. As financing conditions improve, these developments could drive a gradual recovery in market sentiment and transaction volumes by year-end.

In Conclusion

In summary, Q3 2024 saw Singapore’s private residential market cool off, with a 1.1% price decline amid a mix of economic challenges, high mortgage rates, and cautious buyer sentiment. Regionally, the CCR faced the largest drop due to developer discounts, while the RCR and OCR showed modest resilience.

The narrowing disparity effect between new sale and resale condos reflects a shift in the secondary market. Although recent interest rate cuts may boost buyer confidence, market recovery will likely remain cautious, shaped by selective buying and a focus on affordability through year-end.

Let’s Get in Touch

Our aim is to provide insightful and useful content that can help you make informed decisions in your property journey. Whether you’re a first-time homebuyer, an experienced investor, or just exploring your options in the market, our team of consultants is here to guide and support you through every step of the process.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.