1. What information can you find in the HFE letter?

Previously, the HLE letter can only confirm your eligibility for the HDB housing loan. Your eligibility for HDB flat, HDB loan, and HDB grants are also assessed at different checkpoints in the application process. The new HFE letter aims to be a comprehensive document that allows you to access all the necessary information in one letter and through a single process. The information provided in the new HFE letter includes your eligibility to:

The information provided in the new HFE letter includes your eligibility to:

- Purchase a new flat from HDB or a resale flat;

- Receive CPF housing grants, and the grant amount you are eligible to receive;

- Take up an HDB housing loan, and the loan amount you are eligible for.

2. How do you apply for the HFE letter?

The application process for the HFE letter consists of two steps that must be finished within a 30-day period of each other on the HDB Flat Portal. In line with HDB’s efforts to improve the flat buying experience, the HDB Flat Portal will have greater integration with Singpass and will be integrated with the HDB Resale Portal as well, becoming an all-in-one integrated platform for both new and resale HDB flat applicants.

The first step is the Preliminary HFE Check. You will have to use your Singpass to access the HDB Flat Portal, retrieve your personal information from Myinfo, and provide details such as household income and private property ownership. Based on this information, HDB will promptly give you a preliminary outcome that shows your household’s eligibility for purchasing a flat, obtaining CPF housing grants, and taking out an HDB housing loan. If you are certain about buying a flat, you can proceed to the next phase and apply for an HFE letter. You may do so either immediately after finishing the first step or within a 30-day time frame.

The second step is applying for the HFE letter itself. To obtain an HFE letter, all applicants and occupiers (if applicable) must log in to the HDB Flat Portal using their Singpass to complete the application process. You will also be prompted to upload supporting documents if necessary. HDB will send the HFE letter within 21 working days after receiving the completed application, which will state your eligibility for purchasing a new and/or resale flat, as well as the amount of CPF housing grants and HDB housing loan you qualify for. Once the HFE letter is available, you will be notified by SMS to log in to the HDB Flat Portal to retrieve it.

The letter will remain valid for 6 months from the date of issuance, same as the existing HLE letter.

The application process for the HFE letter consists of two steps that must be finished within a 30-day period of each other on the HDB Flat Portal. In line with HDB’s efforts to improve the flat buying experience, the HDB Flat Portal will have greater integration with Singpass and will be integrated with the HDB Resale Portal as well, becoming an all-in-one integrated platform for both new and resale HDB flat applicants.

The first step is the Preliminary HFE Check. You will have to use your Singpass to access the HDB Flat Portal, retrieve your personal information from Myinfo, and provide details such as household income and private property ownership. Based on this information, HDB will promptly give you a preliminary outcome that shows your household’s eligibility for purchasing a flat, obtaining CPF housing grants, and taking out an HDB housing loan. If you are certain about buying a flat, you can proceed to the next phase and apply for an HFE letter. You may do so either immediately after finishing the first step or within a 30-day time frame.

The second step is applying for the HFE letter itself. To obtain an HFE letter, all applicants and occupiers (if applicable) must log in to the HDB Flat Portal using their Singpass to complete the application process. You will also be prompted to upload supporting documents if necessary. HDB will send the HFE letter within 21 working days after receiving the completed application, which will state your eligibility for purchasing a new and/or resale flat, as well as the amount of CPF housing grants and HDB housing loan you qualify for. Once the HFE letter is available, you will be notified by SMS to log in to the HDB Flat Portal to retrieve it.

The letter will remain valid for 6 months from the date of issuance, same as the existing HLE letter.

3. When do I apply for an HFE letter?

For New Flat Buyers

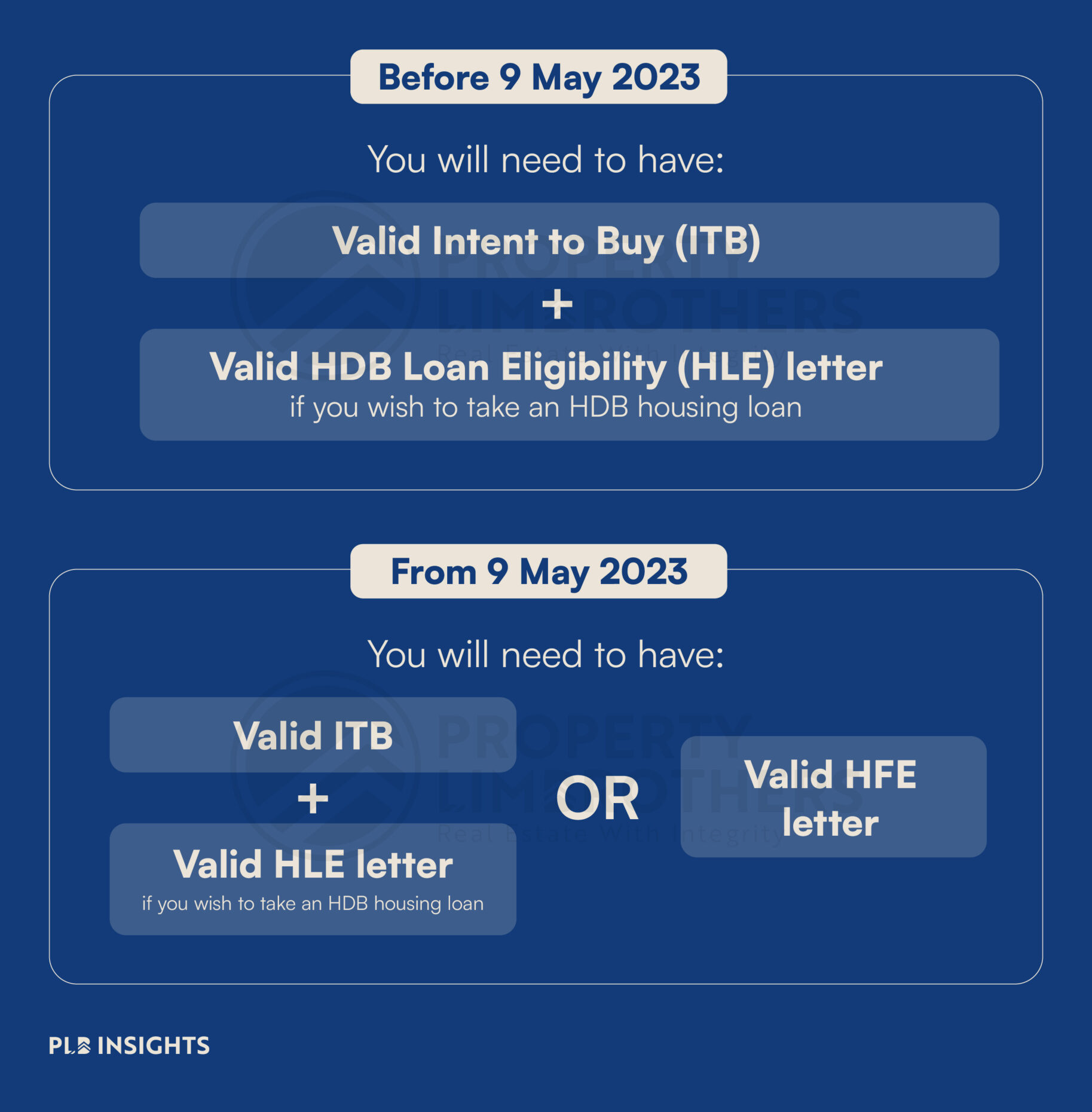

If you had applied for a flat from HDB before 9 May 2023, you do not need an HFE letter. HDB will invite you to apply for an HLE letter instead before you book a flat, if you wish to take an HDB housing loan. If you are applying for a flat in the May 2023 sales exercise, you should complete step 1 on the HDB Flat Portal before submitting your application. After submitting the application, you should complete step 2 within 30 calendar days of step 1. If you are successful in getting a queue number in the sales exercise, you must have a valid HFE letter before you attend your first HDB appointment. From the August 2023 sales exercise onwards, you must have a valid HFE letter to apply for a flat.For Resale Flat Buyers

When you obtain an Option to Purchase (OTP) from a resale flat seller, and when you submit a resale application thereafter, take note of the following: