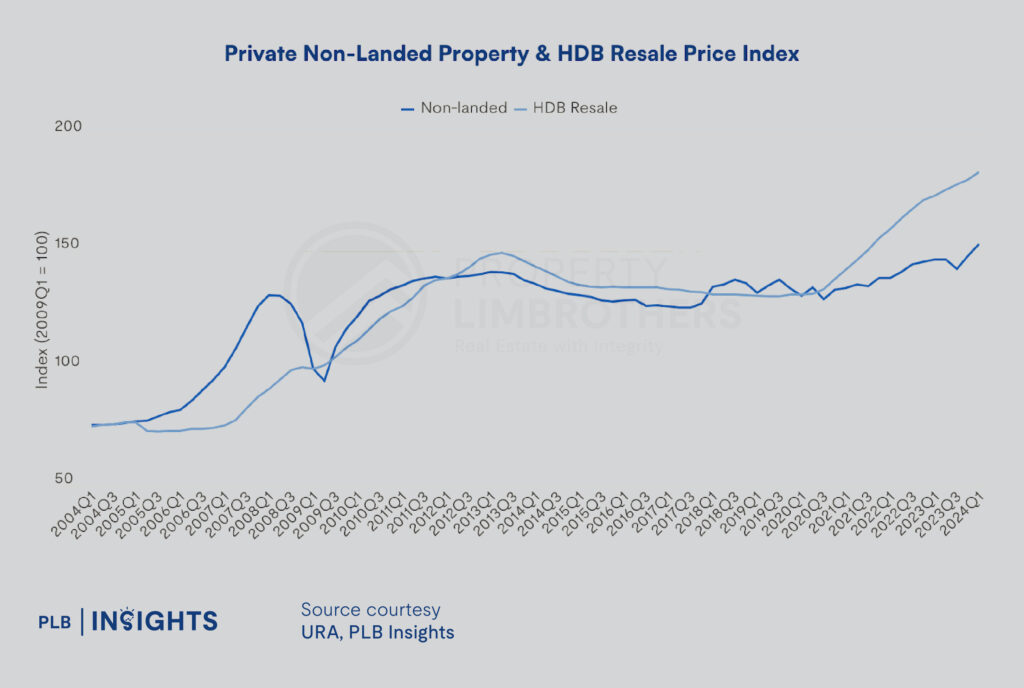

Singapore Housing Market: On the Brink of a Crash or a Gentle Correction? Since the onset of the COVID-19 pandemic, Singapore’s housing market has experienced significant price growth. As of 1Q2024, non-landed property prices have increased by approximately 30%, while HDB resale prices have surged nearly 40%, reflecting robust demand and limited supply amid the pandemic-driven economic changes.

Recent data from the Urban Redevelopment Authority (URA) and the Housing & Development Board (HDB) further illustrate these trends:

HDB Resale Market: HDB resale prices rose by 0.5% in August 2024 compared to July 2024. On a year-on-year basis, HDB resale prices increased by 7.5% in August 2024 compared to August 2023. This upward trajectory highlights ongoing demand in the public housing segment, despite broader economic uncertainties.

Condo Resale Market: The overall resale price of condominiums also increased, with prices rising by 5.5% in August 2024 compared to August 2023. This growth in condo prices indicates sustained interest in private residential properties, albeit at a slightly slower rate than the HDB market.

While the US inflation rate has been slowing down, it remains above the Federal Reserve’s target of 2%, with the most recent data indicating a rate of 2.89% in July. Although a recession in 2024 is broadly considered unlikely, various economic indicators suggest that an economic slowdown or recession could materialise in the future, potentially in 2025.

According to Forbes, the US Employment Situation Report for August 2024 showed unemployment at 4.3%, up from 3.8% a year earlier. Some economists found this increase to be a concern.

Hence, this begs the question: could the Singapore housing market be on the verge of a crash?

The real estate market is often seen as a barometer of economic health, with rising property prices reflecting economic growth and prosperity. However, rapid and unsustainable increases in property prices can also indicate the formation of a property bubble. In this situation, property prices are inflated beyond their intrinsic value due to speculative demand spurred by short-term market activity. When such a bubble bursts, it can lead to significant economic disruptions, affecting homeowners, investors, and the broader economy.

A Real-Life Example: The Subprime Mortgage Crisis

The 2008 housing market crash was a major catalyst for the global financial crisis, severely disrupting the economic stability of economies worldwide.

In the early 2000s, the Fed lowered interest rates to 1% arising from the dot-com bubble between the late-1990s and 2000 and the September 11, 2001 terrorist attacks. Low interest rates provided cheap credit, and more people borrowed money to purchase homes. Backed by a strong demand, housing prices rose. Many subprime (low-credit) mortgage borrowers were unable to afford a longer-term loan and took interest-only/floating-rate mortgages as these had lower monthly payments.

When the Fed tried to correct the market through the introduction of rising interest rates to cool the overheated market, many homeowners were unable to afford their payments. They were also unable to refinance or sell their homes due to the real estate market slowing down. The only option was for homeowners to default on their loans.

A surge of subprime mortgage lender bankruptcies started in early 2007 as increasing numbers of homeowners began to default. By the end of the crisis, 20 of the top 25 subprime mortgage lenders had either closed, ceased lending, or gone bankrupt.

Several factors contributed to the US housing market crash, but two are particularly significant.

- The US housing bubble burst: A housing bubble happens when housing market values rise rapidly, followed by an even faster decline, leading to a ‘crash’ or ‘bursting of the bubble.’ In simple terms, house prices in the US were extremely overinflated, market sentiment was excessively optimistic, and a market correction was inevitable.

- Borrowers couldn’t repay their loans: This is known as the subprime mortgage crisis. A subprime mortgage is a loan given to borrowers with low credit ratings, meaning they can’t qualify for a prime mortgage due to the high risk of default.

Crucially, the US housing market was saturated with subprime mortgages, and borrowers began defaulting on loans that should never have been issued. US lending institutions effectively created a housing market time bomb. The fuse was lit in 2007 and exploded in 2008. The fallout from this economic bomb spread globally, triggering the financial crisis.

And so, one would ask: what are the indicators of a bubble burst? With the continued rise in housing prices, how then can we have some visibility of where the property market is heading?

Below are the key indicators of a property bubble burst, which we will discuss whether or not the Singapore housing market shows signs of a bubble burst.

Key Indicators of a Property Bubble Burst

Rapid and Unsustainable Price Increases

Historical Trends: One of the clearest indicators of a property bubble is a rapid and sustained increase in property prices over a short period. For instance, if property prices in Singapore have been increasing at an annual rate far exceeding the growth of income levels and GDP, this could signal a bubble.

Comparison with Fundamentals: Comparing property price growth with economic fundamentals such as income growth and rental yields can reveal discrepancies. When property prices grow much faster than these fundamentals, it indicates that the prices are driven by speculation rather than actual demand.

High Levels of Speculative Buying

Investor Activity: A surge in property purchases by investors, especially those buying multiple properties, can indicate speculative activity. In Singapore, if there is a significant increase in the number of properties bought by foreign investors or individuals owning multiple properties, this could signal speculative buying.

Divergence from Long-Term Price Trends

Price-to-Income Ratios: Monitoring the price-to-income ratios can help identify bubbles. If property prices are rising much faster than household incomes, it indicates a potential bubble. In Singapore, analysing these ratios over time can reveal whether current prices are sustainable.

Price-to-Rent Ratios: Similarly, the price-to-rent ratio compares property prices with rental income. A high and increasing price-to-rent ratio suggests that property prices are not supported by rental yields, indicating speculative demand.

Understanding the Housing Prices Trend in Singapore

Residential prices including prime residentials in Singapore have remained strong, supported by robust domestic and foreign demand. The latter was further underpinned by the stronger Singapore dollar relative to regional currencies, which makes Singapore an attractive haven for investments.

As discussed earlier, the housing market in Singapore has been experiencing a steep increase of more than 30% over the last five years. However, the property market was not left alone in the hands of the market. The Singapore Government has actively intervened with various cooling measures such as raising the stamp duty rates to cool the overheated market.

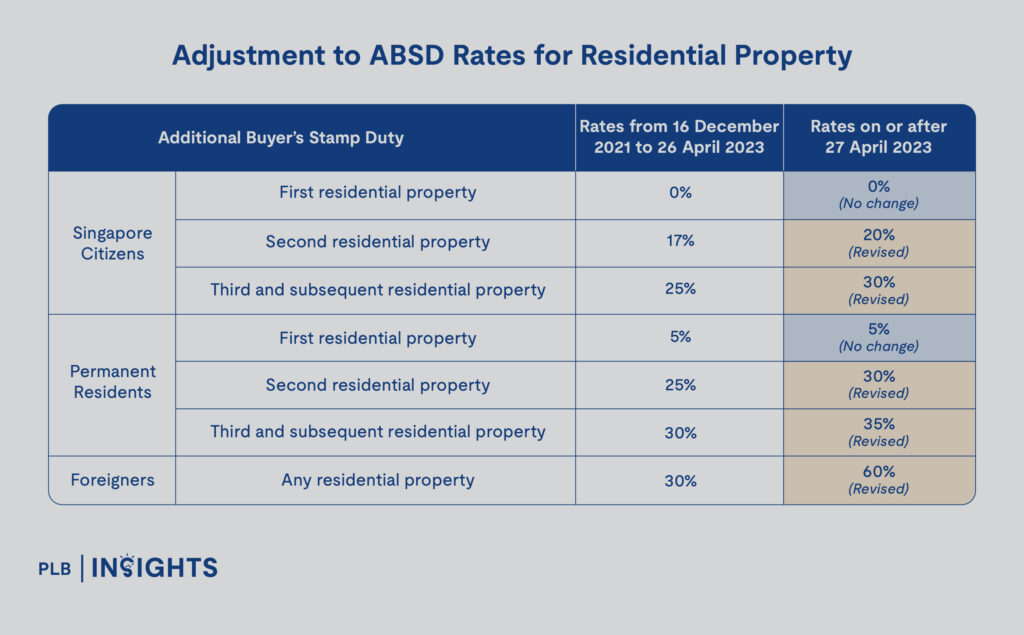

Singapore’s property cooling measures include higher Additional Buyer’s Stamp Duty (ABSD) rates: Singapore Citizens now pay 20% on their second property and 30% on their third. Foreigners face a 60% ABSD, double the previous rate of 30%. These measures aim to reduce speculative buying and prevent property prices from surging unsustainably, thereby minimising the risk of a housing bubble.

Recently, the LTV limit was also reduced from 80% to 75% for HDB loans. To date, such property cooling measures seem to be effective in moderating housing. Since the second half of 2023, residential property price growth indicated signs of moderating, and both the public and private prices reached a steadier state. The increasing supply of Built-To-Order (BTO) flats, especially in choice districts, has also shifted demand away from resale HDB and residential private markets. The rate of growth in housing prices also started to slow down in 1Q2024 as private home sales increased by 1.4% quarter-on-quarter (q-o-q) in 1Q2024, lower than the 2.8% q-o-q increase in 4Q2023.

Comparison with Fundamentals

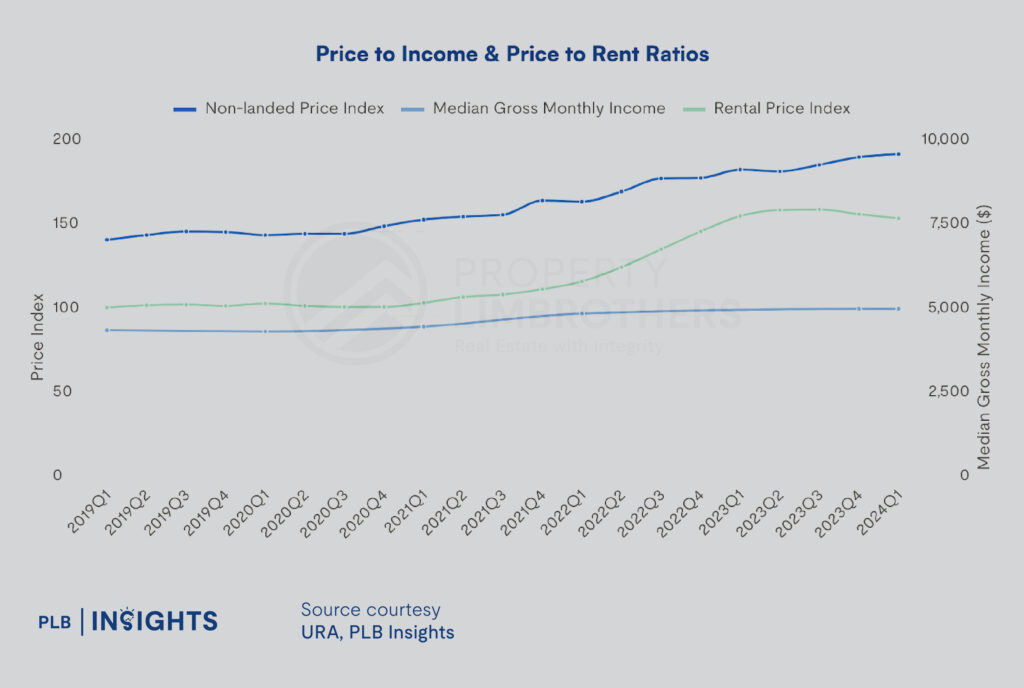

The price-to-rent and price-to-income ratios are key indicators for evaluating whether the property market is overvalued. These metrics help determine if property prices are aligned with the rental yields and household incomes, respectively, offering insights into affordability. High ratios suggest that buyers may struggle to manage their mortgage payments, signalling potential overvaluation in the market. Essentially, these ratios act as warning signs or “bubble indicators” for the residential property market, highlighting when prices may be unsustainable relative to income and rental returns.

When housing prices are rising at a faster rate as compared to rents or income, it signals an unhealthy market dynamic where property prices are at risk of a bubble burst.

Simply put, some of us pay mortgages with rental income while others pay through income earned from being employed. When rental income falls short of mortgage obligations, it creates a situation of high leverage, which can be unsustainable in the long term. This high leverage means that you are highly dependent on rental income to meet your financial commitments, and any decline in rental income or increase in mortgage rates could strain your finances.

Taking a quick look at recent data allows us to have a sense of where the property market is heading:

Comparing the 5-year trend from 2019 to 2024, the non-landed property price index increased by approximately 38%, while the rental price index rose by about 52%, as illustrated in Figure 2 above. In contrast, median household income in Singapore grew by around 14% from 1Q2019 to 1Q2024. The significant rise in the rental index, which has outpaced the increase in the non-landed property price index, suggests that property price growth is supported by even stronger rental demand.

This alignment between rising property and rental prices provides some reassurance that the market may not be heading towards a bubble, as the increase in property values is backed by robust rental performance.

Although median household income has grown at a slower pace compared to property and rental indices, it still reflects healthy economic conditions over the past five years. However, the disparity in growth rates underscores the need to closely monitor affordability.

Based on the data, it appears that the housing market in Singapore is not currently in a bubble nor at immediate risk of crashing.

Active Government Intervention

Apart from the property cooling measures, the Monetary Authority of Singapore (MAS) has maintained stringent lending standards through the LTV ratio, ensuring that borrowers are not overly leveraged. The maximum LTV limit for both HDB and bank loans are currently capped at 75%.

Furthermore, based on the MAS’ data on housing and bridging loans published quarterly, the LTV ratio as of 1Q2024 is at a multi-year low of 42.4%, compared to 43.9% one year earlier. This suggests a higher upfront down payment made by borrowers and highlights the resilience of housing loans’ credit quality – signifying a smaller risk of widespread defaults in the event of a market correction – hence suggesting a lower risk of property bubble burst.

Additionally, Singapore’s economy remains strong, with robust GDP growth of 2.9% y-o-y in the second quarter of 2024, low unemployment, and a stable financial system. These fundamentals support the property market and reduce the likelihood of a severe downturn.

Final Thoughts

While the steep rise in housing prices post-COVID might suggest the presence of a property bubble, the proactive measures implemented by the government — along with Singapore’s strong economic fundamentals and strict lending standards — serve as protective factors against a severe market downturn. Any slowdown in the property market is likely a normalisation of activity following years of rapid growth, rather than an indication of a crisis. This suggests a more balanced trajectory for Singapore’s housing sector in the near future.

We understand that it may be challenging to navigate the property market, especially with fluctuating cycles. We are here to provide you with up-to-date information to support informed decision-making. Whether you are a first-time homebuyer, an experienced investor, or just considering your options, our team of experienced consultants is ready to assist you.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.