Property ownership is a dream for many Singaporeans, and marks a major milestone in your journey to building wealth while you establish a place where you can call home. The vast majority of Singaporeans take advantage of financing from banks in order to purchase a property sooner, rather than purchasing the property for its full price in cash. There are many reasons to take advantage of getting a mortgage on your property, namely, the ability to benefit from increased leverage and own a property sooner rather than having to wait many more years before you have enough money to purchase the property.

In this article, we will evaluate the mortgage options available to property buyers in Singapore before discussing whether you should pay your mortgage loan off early, or ahead of schedule.

Bank Loans vs HDB Loans

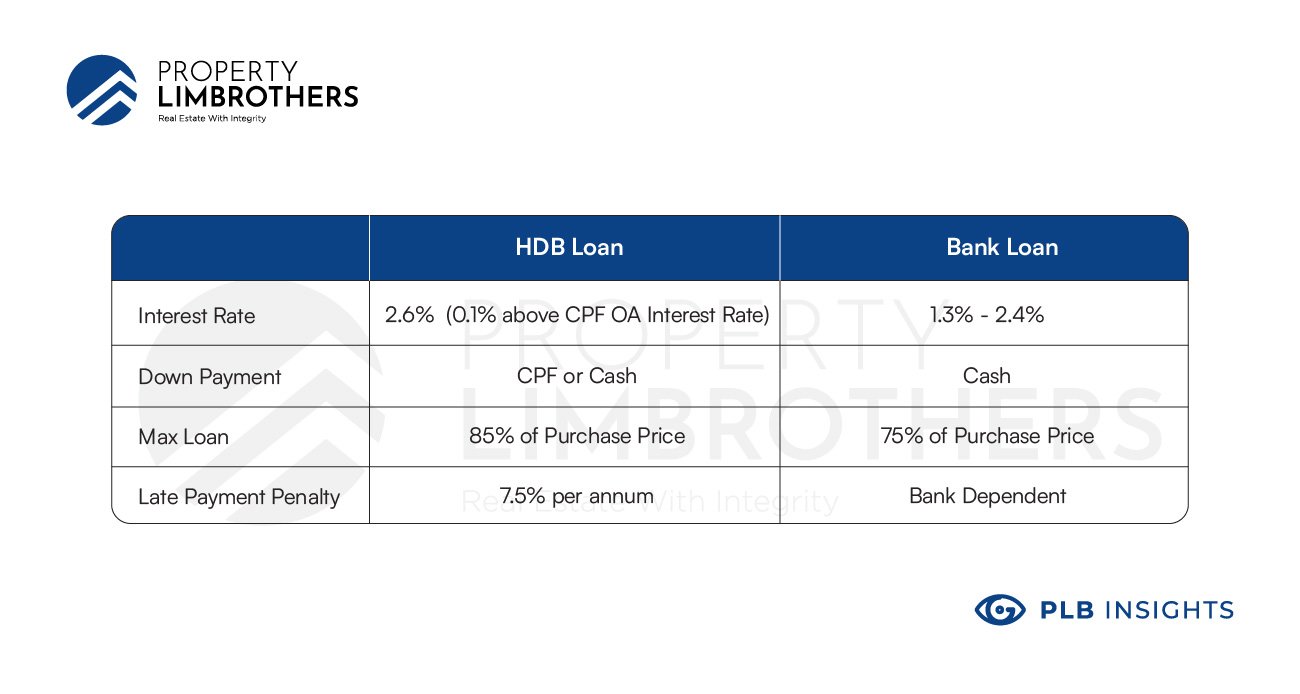

Because your mortgage options will vary based on whether you are buying an HDB property or not, the first type of mortgage we want to consider is an HDB loan.

In an HDB loan, property buyers can finance the property with a lower down payment. HDB mortgages are subject to slightly increased interest rates compared to bank loans, but the upside is that HDB loans only require a 15% down payment. HDB loans also benefit from low volatility in interest rate fluctuations.

For an HDB loan the initial interest rate is approximately 2.6%.

Getting a Bank Loan

However, do keep in mind that HDB Concessionary Loans are not as stringent as other bank loans on the open market. For a bank loan, the standard LTV ratio is 75%, assuming you meet the bank’s criteria for lending. Standard bank loan interest rates vary from 1-3%, depending on the bank and the borrower’s qualifications.

Fixed Monthly Payment or Variable Mortgages

The next major consideration for anyone looking to take on a mortgage for their property is if they want to have a mortgage payment that stays the same every month for the life of the loan, or a mortgage payment that can change over time.

For a fixed interest rate mortgage, the monthly payment will stay the same every month regardless of any economic changes or uncertainty. For buyers who enjoy stability and consistency, and a predictable monthly mortgage that facilitates easier financial planning, fixed rate mortgages are a great product.

Variable Rate Mortgages

For individuals who want their mortgage to be based on prevailing market conditions, the variable or floating interest rate is a great solution. Floating rate mortgages are “pegged”, or connected to, how well the economy is performing. The interest rate on these mortgages is tied to the cost of money established by the Singapore government in rates such as the Singapore Overnight Rate Average (SORA) or Singapore Interbank Offer Rate (SIBOR).

So as the Singapore government establishes a higher interest rate on money, the cost of your mortgage and its monthly payment will increase slightly. And when the cost of funding is lower, meaning interest rates are down, your mortgage will go down slightly.

Image courtesy theindependant.sg

Which Mortgage is Right For Me?

There is no perfect formula to explain which mortgage is a better product for prospective property buyers. The best way to evaluate your ideal mortgage is to evaluate your own personal preferences and risk tolerances. If your priority is to have a consistent monthly mortgage so you do not have to wonder if your payment will change, then the fixed rate mortgage is your best option. Do keep in mind that the fixed rate mortgages may change to a floating rate after a certain number of years, unless the loan is refinanced again to a fixed rate mortgage.

If you prefer your mortgage to ebb and flow with current market conditions and don’t mind the payment changing, then the variable or floating rate mortgage could be a better fit for you.

Lock-in Period

Do note that for both bank loans as well as HDB loans, many of these mortgages are subject to an initial interest rate that can slightly increase after the first 2-4 years. The reason for this increase is that many banks offer lower interest rates in the beginning of the loan as a promotion, in order to sell more mortgages.

So as you purchase a property and finance it with a mortgage, do be aware of how the payment can potentially increase after the lock-in period expires.

How Much Money Do I Need to Put Down For My Purchase?

One of the most critical considerations in purchasing a property will be how much money one needs to put down on the property in order to qualify for a mortgage.

Getting an HDB Concessionary Loan

HDB flats benefit from increased government assistance and flexibility. As a result, prospective property purchasers who acquire HDB Concessionary Loans have a maximum Loan-to-Value (LTV) ratio of 85%, assuming you meet the bank’s criteria for lending. What this means is that you can borrow up to 85% of the price of the property you are purchasing. So if you are looking to purchase a $450,000 HDB flat you can borrow $382,500 and only need to put down $67,500 on the property. This amount can be financed entirely with CPF savings.

Terms and Conditions for the Mortgage

Do keep in mind that as you review your mortgage options, there are certain rules and regulations that govern each mortgage. Banks and the HDB are able to make their own determinations on how much LTV you are eligible for on your property. So if your credit score is not ideal, your income is below their standards, or you have other loans that may affect their ability to repay your mortgage, the banks and HDB may require you to put more money down on your property.

In addition, some banks penalise their customers if they repay the loan too early or refinance the loan too early. Do keep in mind that if your bank offers a lock-in period for interest rates, they will likely charge a penalty fee if you repay the loan early or refinance during the lock-in period. The reason for this penalty is that banks are offering a lower interest rate during the lock-in period; so if you are leaving the loan before the interest rate increases, the bank may attempt to recoup some of the money they were hoping to earn from you later on.

Repaying Your Mortgage

After having evaluated your options to acquire a mortgage, including how much money is needed for a down payment on a property as well as the interest rate to borrow the money at, your next major consideration is the length of the loan.

In Singapore, the most common timeframe to repay the mortgage is 30 years up to age 65 of the borrower, while the maximum loan length for an HDB loan is 25 years. While the length of the mortgage can vary based on the existing lease of the property you are purchasing, as well as your age, most property owners who are financing their property with a mortgage ought to expect to repay the loan over 30 years.

Does It Make Sense to Pay Off Your Mortgage Early?

In order to evaluate whether a property owner should pay off their mortgage ahead of schedule depends on a few critical considerations. First and foremost, the property owner must keep in mind both the financial cost of paying the loan down faster, as well as the opportunity cost of doing so. While this part is slightly more technical in a financial sense, every property owner ought to sit down in order to properly calculate the financial implications of their decisions.

Calculate Your Numbers

Consider the following example. You take out a 25 year, $300,000 mortgage at 2.6% interest on a property with a value of $400,000. Your monthly mortgage payment is $1,361. As a result, as the property owner, you are paying the bank or HDB 2.6% per year for the money they lent you.

However, a 2.6% interest rate is a relatively low interest rate, especially given the cost of other mortgages around the world. For the purposes of our example we will assume that you could invest your money into other stock exchanges or investments and earn potentially 9% annually in investment growth.

If you forego investing your money into other assets that can produce a gain larger than the cost of your mortgage, which is 2.6%, from a purely financial perspective you are not maximising the potential utility of your capital.

By choosing not to invest your capital into investments that can produce 9% annually, and instead using that capital to pay off your mortgage, you are sacrificing 6.4% of growth your capital could be producing in other investments.

The Financial Cost of Paying Your Mortgage Off Too Early

Continuing our example, let’s assume you have an extra $1,361 each month that can pay off your mortgage faster, or it can be invested. If you start with $100 and invest $1,361 on a monthly basis into assets that generate returns of 9% per year, after 10 years you would have $263,618.

And if you instead opted to double your mortgage payments by contributing the $1,361 per month to your mortgage, you would have decreased your mortgage by $163,320.

As a result, the investment account earning 9% would be worth $100,298 more than if you had instead paid off your mortgage by an extra $1,361 per month.

So if you evaluate whether you should pay your mortgage off early from a financial perspective you’re far better off investing surplus capital into investments that generate a higher return than the cost of your mortgage. Especially when the mortgage interest rates are so low in Singapore. The average mortgage cost of 2.6% is lower than the average annual inflation rate of 3% in Singapore; so inflation is actually already making the cost of repaying your home mortgage a little lower every year.

The Emotional Benefit of Paying Your Mortgage Early

Of course, the examples we have considered have only been evaluated from a financial perspective. The reality is that when it comes to financial decisions, a holistic approach considers both the psychological and emotional benefits and costs of each investment decision. And the psychological reality is that for many human beings, owning large liabilities or large amounts of debt is stressful. Having a large mortgage on your personal balance sheet with a monthly payment owed to a bank is stressful for many people.

One very real benefit to paying off your mortgage early is that you reduce the liability a mortgage represents on your personal balance sheet much faster, while easing the psychological weight of knowing you owe so much money to a bank. If you paid an extra $1,361 towards your mortgage every month, you would complete the payments in 15 years rather than 30.

In addition, you would earn equity in your property at double the speed. You can use this equity as collateral for lending if needed, provided it is not an HDB property.

Ultimately, Paying Off Your Mortgage Early Depends On You

In this article we’ve evaluated the requirements to obtain different types of mortgages, as well as the implications for each type of mortgage. And ultimately answering the question of paying off your mortgage early will depend on your personal preferences.

For many people, the thought of owing a bank or the HDB hundreds of thousands of dollars on their mortgage is stressful. When viewed through this lens, it certainly makes sense to pay off your mortgage early in order to reduce debt on your personal balance sheet so you can breathe easier.

However, if you can tolerate the debt of a mortgage on your personal balance sheet and remain disciplined enough to invest your capital into investments that produce a higher rate of return than the cost of your mortgage, you will have the opportunity to increase the utility of your capital much more dramatically than paying off your mortgage earlier.

The best financial strategies typically balance these competing desires. If you have questions about finding the right property for you, we recommend you reach out to the team for expert opinions on picking the right property and deciding on the optimal mortgage repayment schedule.