It is no secret that Singapore’s property market is on an upward trend, be it residential or commercial properties. For some, owning a property is a financial challenge at the moment, and hence many turn to renting properties in the short term instead. With increasing mortgage rates, comes increasing rental prices as well. This may have given sellers the upper hand, being able to inflate prices and still have offers due to the high demand of renters. However, there is evidence that shows that this trend might be halting soon and buyers may have more leverage to source for properties within a smaller budget instead. What are the signs that are showing this early trend of rental prices dropping?

Slowing Rental Market

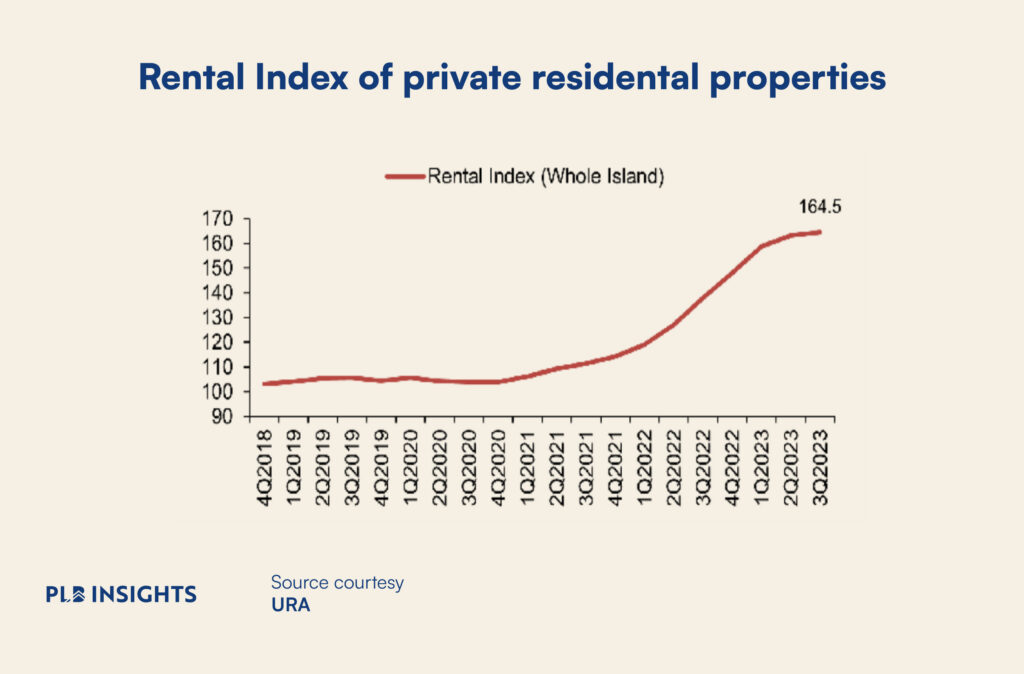

Q1 2021 marked the start of the exponential growth in property rental prices, owing to the Covid-19 pandemic as many sought to have their own spaces away from family given the high stress and tension working from home at the time. We can see signs of a slowing rental market, as compared to Q3 2022 that increased rental prices by 30%, Q3 2023 looks to be stabilising.

At the beginning of 2023, word from the ground was that tenants were struggling with the escalating rents due to landlords transferring the additional expenses from inflated mortgages given the high interest rate environment and elevated cost of living from inflation. However, the competition among tenants started to decrease as more condominiums were completed in the latter half of 2023. The sentiment has softened, and there has been a decline in inquiries and house viewings from potential tenants. The question that arises is whether the current slowdown in rental prices is a temporary blip or a correction after a series of quarterly increases.

There are two critical factors that point towards this shift in rental sentiment, and it all boils down to the fundamentals of economics.

1) Slowing Demands

According to URA, a total of 56,098 rental contracts excluding Executive Condominiums (ECs) were registered for residential properties from January to August 2023, indicating a decrease compared to the corresponding periods of 2022 which saw a total of 61,801 contracts and 2021 with 66,603 contracts.

The Core Central Region (CCR) experienced the most significant decline in rental demand, dropping by 11.5% year-on-year during the first eight months of 2023. The Outside Central Region (OCR) segment also suffered a depreciation of 10.5%, while the Rest of Central Region (RCR) segment experienced a comparatively lower decline of 5.8%.

The pandemic had a significant impact on the housing market in Singapore as 90% of BTOs were delayed past their estimated completion date as a result of Covid-19. As a result, many opted to rent apartments due to construction delays. Another factor would be work-from-home arrangements. With each household confined to their own property everyday, it takes a toll on productivity. This could have prompted working adults to become tenants for a few months to tide over the pandemic period. Hence, as more people complete their rental leases, it has resulted in an increase in the vacancy rate for completed private residential units, which has risen from 6% to 6.3% in the second quarter of 2023.

The disparity between rent prices offered by tenants and those demanded by landlords has led to a decrease in the number of rental agreements as well. Rent prices have reached unprecedented levels, setting new records in the second quarter of 2023. The limited housing supply has allowed landlords to command higher rents, as the risk of losing tenants remained low. As a result, some tenants have opted to stay with their parents in the meantime, while others have chosen to move out of Singapore entirely. This has led to a shift in the housing market, with landlords having to adjust their rental prices to attract tenants currently.

2) Increase in Housing Supply

The injection of available units for purchase in the private market has given buyers more options in choosing their housing situation.

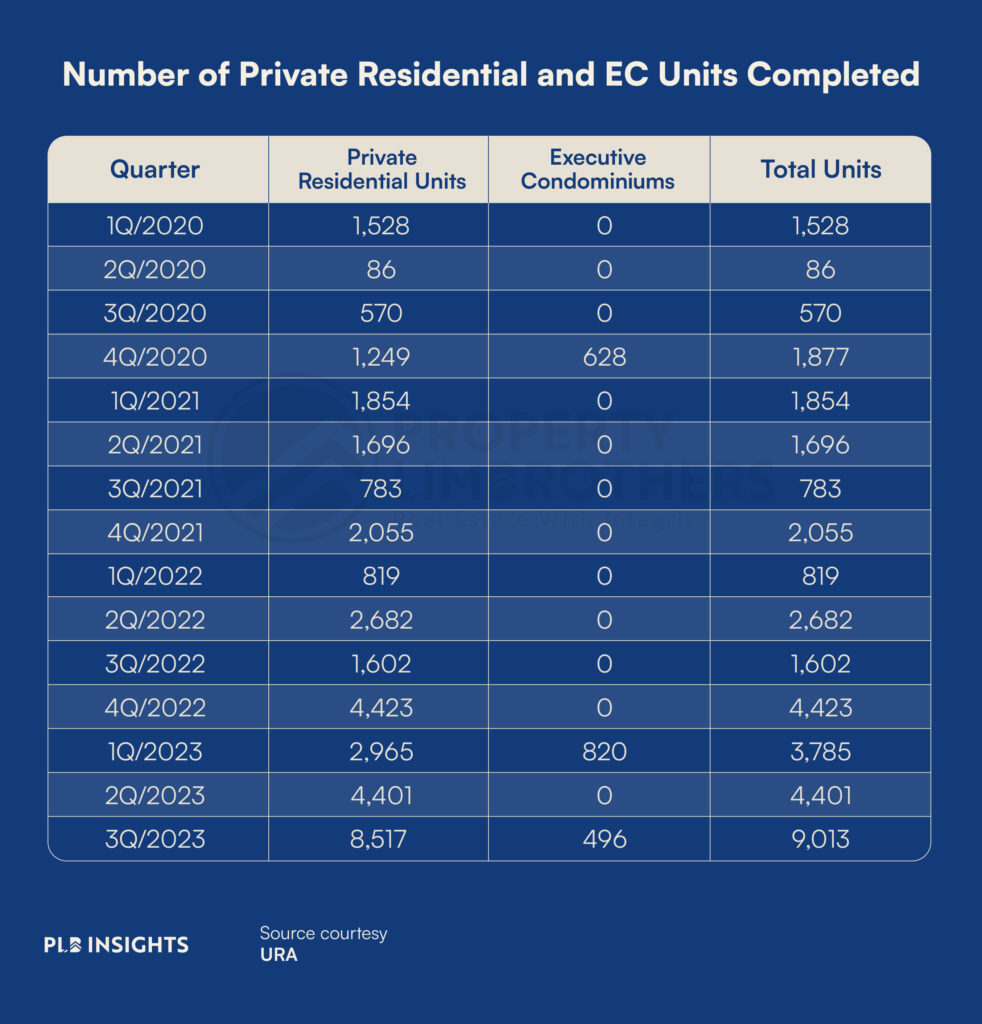

The increase in the number of completed private residential homes, including ECs, in the first half of 2023 is a positive development for the housing market in Singapore. With over 8,000 homes completed, there is a significant increase in supply compared to the same period in 2022 and 2021. This increase in supply is expected to ease the fierce competition among tenants to secure homes, which has been a major challenge for many renters in recent years. In Q3 2023 especially, there will be 9013 units completed, the highest number of units completed since Q4 2022.

In addition to the increase in private residential homes, the public housing stock has also risen, with a growing number of HDB flats reaching their Minimum Occupation Period (MOP). Especially those who moved in right before the pandemic, this is set to release a big wave of flats ready to be sold after its MOP. This means that more public housing units are becoming available for rent or purchase, which is good news for those who are looking for affordable housing options. BTOs that were delayed by the pandemic are being completed steadily, with more than half of the backlogged BTOs being completed in January of this year.

The existing stock of public and private housing is expected to continue to build up as local renters gradually exit the market. This could be due to a variety of factors, such as job relocations, changes in family circumstances, or the desire to upgrade to a larger home. As more homes become available, renters will have more options to choose from, which could lead to a more balanced and competitive rental market.

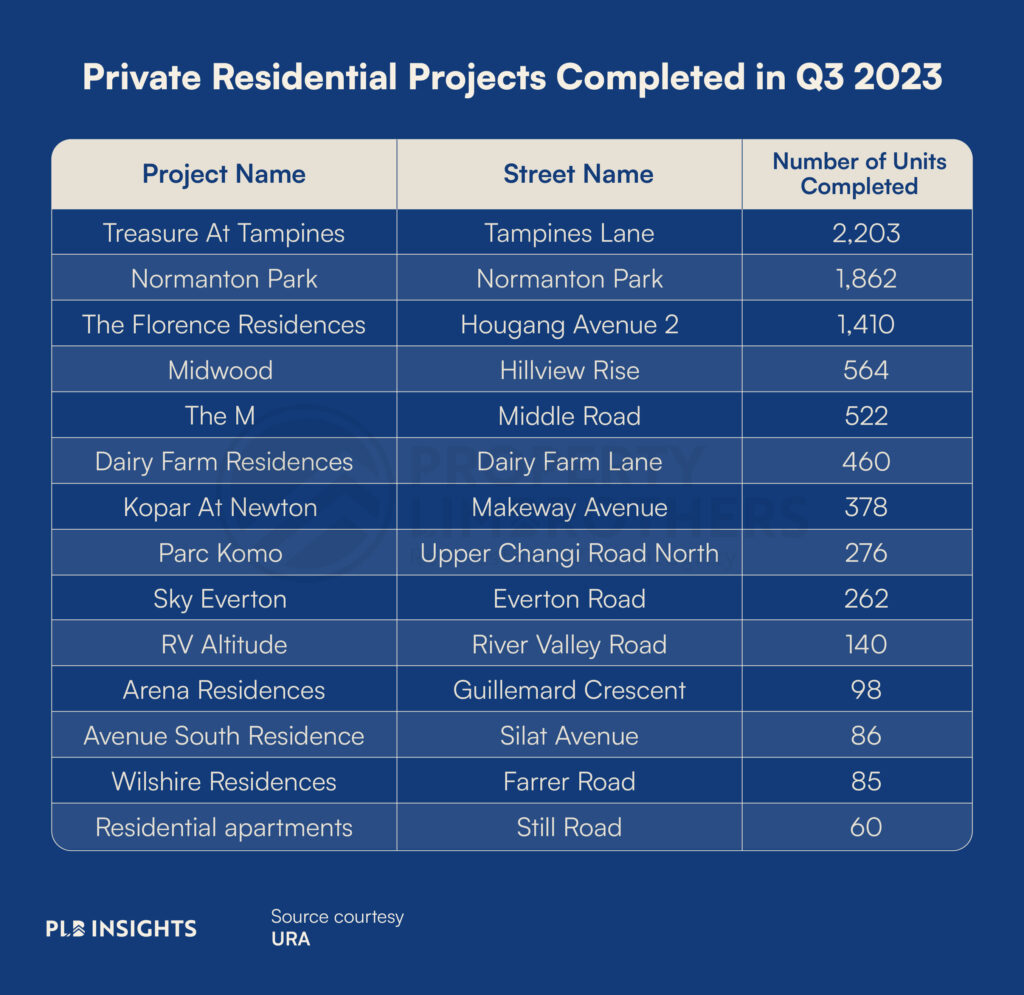

Notably, the cumulative total of completed units for the first three quarters of 2023 reached an impressive 17,199, surpassing the number of units completed during the same period in 2022 by more than threefold. Noteworthy projects completed during this quarter include mega developments such as Treasure At Tampines (2,203 units), and Normanton Park (1,862 units).

What goes up must come down

The full realisation of this is yet to come to fruition as we are still in the early stages. Despite a sluggish market and the growing housing supply, numerous landlords are steadfastly maintaining exorbitant asking prices, hesitant to reduce them due to escalating costs and mounting mortgages. This hesitancy, combined with a disparity between landlords and tenants’ expectations, could potentially result in a continued decline in rental volume as the market undergoes an adjustment phase. This decline may coincide with the customary year-end slowdown in the final quarter.

However, if rental prices moderate further, there is a possibility that market activity may rebound next year, particularly if more tenants opt to renew or sign new leases that offer more affordable rents. Anticipating further corrections in rental prices, tenants may also prefer shorter lease terms, leading to an upsurge in transactions.

Closing Thoughts

The Singaporean rental market is poised for change, with two key factors driving this shift. First, a slowdown in rental demand, partly due to the impact of the pandemic and delayed construction, is leading to a decline in the number of rental agreements. Second, an increase in housing supply, including private and public properties, is giving renters more options. This is expected to ease the competitive rental market. While landlords are hesitant to lower their prices, a further decline in rental rates could stimulate market activity, particularly if tenants opt for shorter lease terms.

If you are in the market to rent a property, whether as a renter or a landlord, and would like guidance or a second opinion in your rental journey, do contact us here and our team of experienced consultants will be more than happy to assist you. PropertyLimBrothers, always happy to show you the place.