During mid-2021, as the United States was pumping more money into the economy through stimulus checks to businesses and its population, the phrase “inflation is transitory” was the headline across news outlets worldwide.

More recently in Dec 2021, the tone has changed and the consensus is that “inflation is no longer transitory”. We recognise what inflation is, and its impact on the economy. However, what does this mean for us in Singapore? And what does inflation have to do with real estate? In this article, we cover the impact of inflation on real estate prices, and explain the allure of real estate as a hedge against inflation.

But first, to understand the 7 unique characteristics of real estate, be sure to take a look at this previously published article.

How we normally understand inflation: Consumer Price Index (CPI)

We often joke about inflation by comparing how many plates of chicken rice a $10 bill can buy 30 years ago versus the present. However, not everyone eats chicken rice, so there must be a better measure that can apply across the population of Singapore.

The Consumer Price Index (CPI) is a benchmark for consumer inflation in Singapore. It measures the average price changes in a fixed basket of consumption goods and services commonly purchased by the resident households over time. This was a standard created to generalise how the prices that residents regularly encounter are changing over the years. More importantly, the CPI does not include the price of every single item in the economy, which means that it is not entirely reflective of price inflation of individual items or product classes.

While CPI appears to be representative of all the things we pay for in our lives, it is not entirely complete. Interestingly, real estate is included in the list as the cost of rental, and so appreciation of the actual value of the property is not considered in the CPI.

What this means is that the 2% reported inflation is not representative of the inflation going on in the real estate market. This therefore directs our attention to asset inflation, studying how the prices of real estate has and will continue to go up.

Feeling the impacts of inflation: Real Versus Nominal Value

When we talk about inflation, the concept of real value versus nominal value comes to play. As the name suggests , nominal – meaning ‘in name’ – value, is just the numerical amount that is assigned to money. For example, the $10 bill in your wallet is still $10 in Singapore no matter how many years have passed. However, as time passes by and everything else gets more expensive, the same $10 bill cannot buy you as many things as it used to. The nominal value of the bill stays at $10 but the actual value of the bill has decreased.

Thus, the recommendation is usually to not hold cash when possible as it loses its value in an inflationary environment. Instead, store the value of the cash in assets which appreciate in-line with inflation so at the very least, it does not lose value over time.

To see the impact that inflation has on property values, we can simply look back in time to the 1970s when a 4-room HDB flat was worth $30,000. These same flats are now worth $500,000, an almost 17 times increase over 55 years, thanks to the compounding effect of yearly inflation.

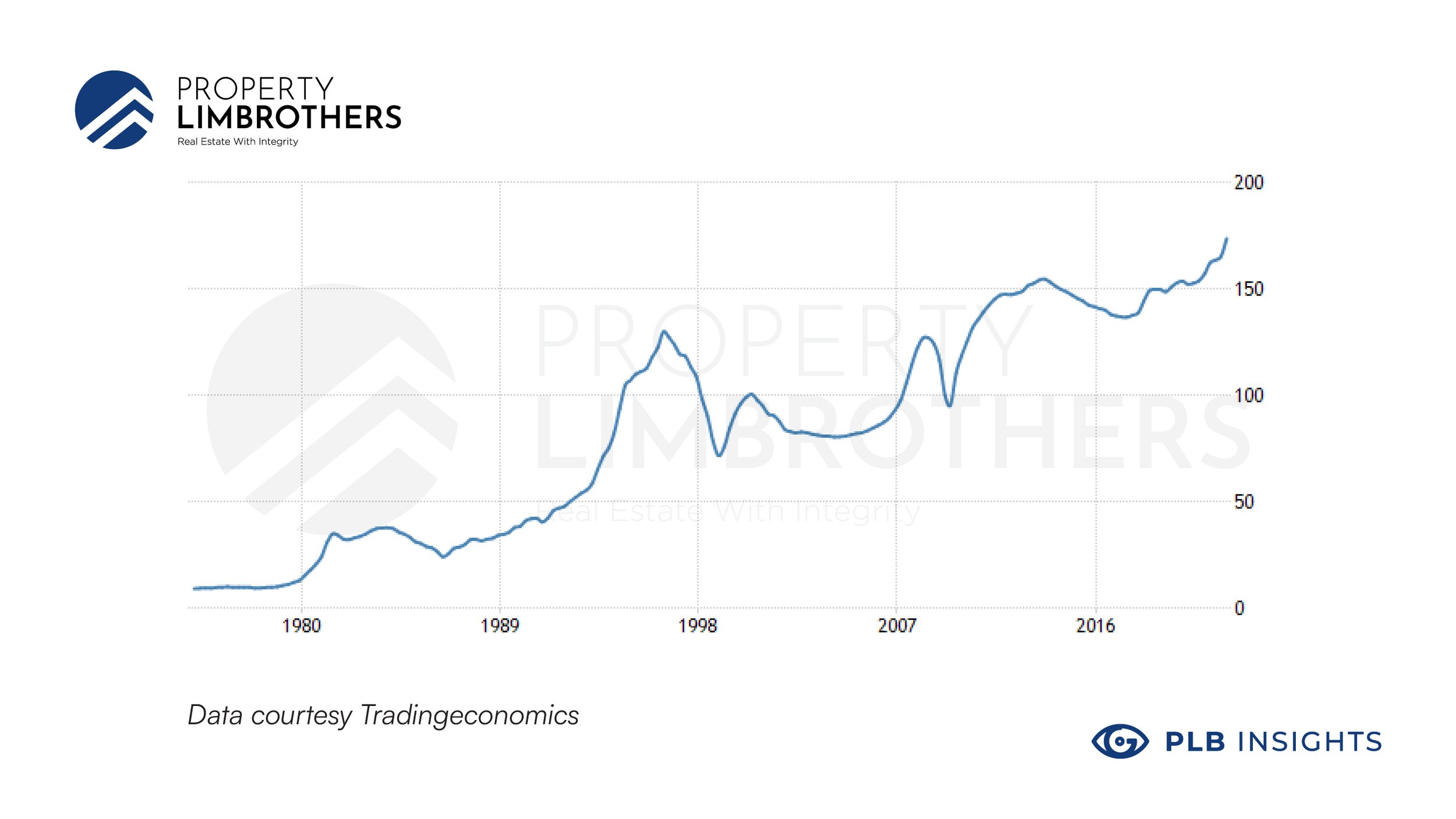

Data from historical price index also shows that the HDB flat we used as an example above is not an outlier. Across all types of residential property, PPI has increased 17 times from 10 to 170 in the same period.

Singapore Historical Property Price Index (PPI)

However, regular CPI inflation cannot account for such a huge increase in price.

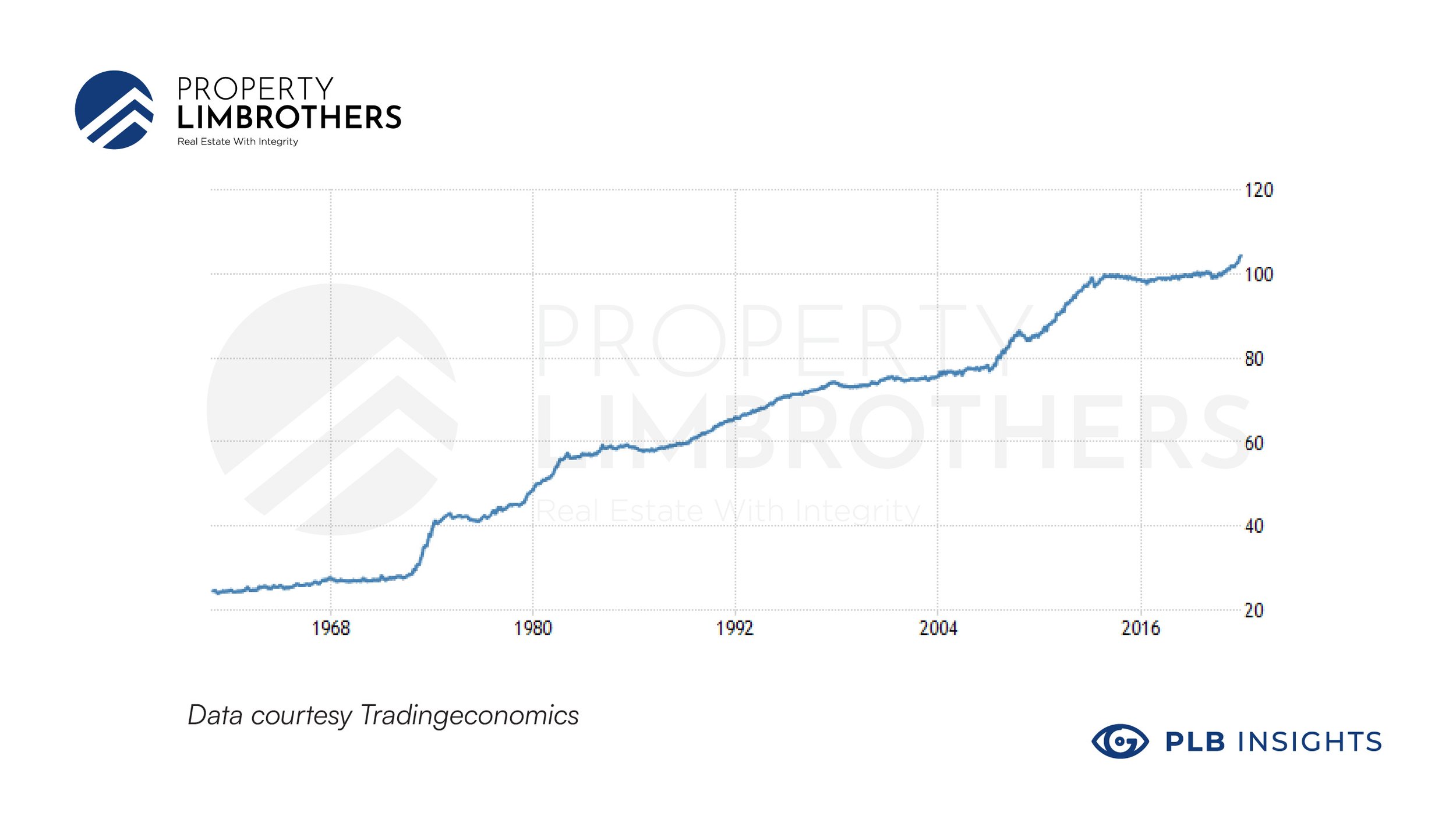

If we consider CPI inflation from 1968 up to 2021, we see that the CPI has increased from 25 to 100, only a 4 times increase. From this, we can see that inflation is not uniform across all goods and services. Real estate prices have experienced high inflation compared to the rest of the prices in Singapore.

Singapore Historical CPI

The inflation experienced by real estate is a combination of CPI inflation and asset inflation.

A different kind of inflation: Asset Inflation

CPI inflation is driven by consumers having more money to spend in the economy and hence pushing prices higher. Asset inflation is caused by investors wanting to park their money in assets and hence increasing the demand for these assets. With increased demand and a limited supply comes increased prices. We have seen this happening across many asset classes from stocks, cryptocurrencies, luxury goods, and real estate. These asset classes are expected to appreciate faster than inflation, which makes them so attractive in an inflationary environment where cash loses its value.

The current inflationary environment.

Inflation has always been the standard in Singapore since the 1990s. In fact, U.S. inflation has been positive since after the 1940s – why the urgency this time round?

The worry with recent inflation is that it is not only high, but it is no longer “transitory”. It is expected that inflation rates will stay higher than average for a few years which can have ripple effects on the economy.

In Singapore, the CPI has been higher in the last 2 years mainly because of quantitative easing policies taken by the United States in response to the pandemic. With businesses unable to operate and at the risk of collapsing the economy, the U.S. government was forced to carry out Quantitative Easing to allow the economy to recover.

By purchasing long-term bonds from the open market, the government increases the supply of money in the economy. With increased money supply, banks can now lend to the public at lower interest rates. Businesses that were previously struggling to continue their operations during COVID due to lockdowns and dwindling cash reserves can now borrow from banks at almost zero interest to tide them over. In addition, businesses that were already doing well can also use the opportunity of low interest loans to expand their operations. The net effect of this is that businesses are able to operate as per normal and retain employees even as their sales are affected by Covid.

Quantitative Easing driving up real estate inflation.

Not only did consumer prices increase in 2020 and 2021, real estate prices were skyrocketing around the world. This was particularly drastic in housing-scarce locations like Hong Kong and Singapore.

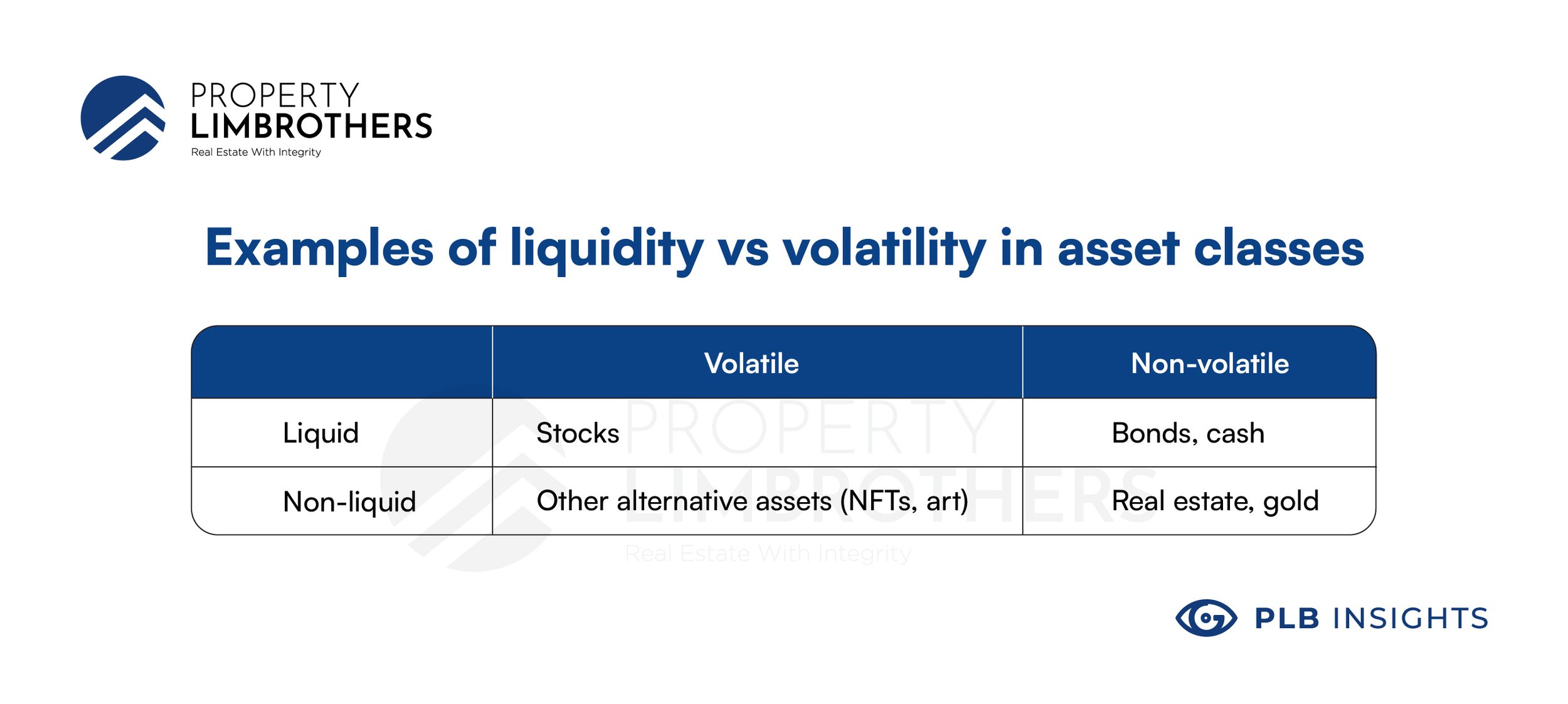

This did not happen by coincidence. Real estate tends to be the final location that excess money ends up being stored. As more money entered the hands of the public, it flowed into the stock market because stocks served as an attractive high-return investment compared to unattractive bonds that were hit by lowered interest rates. Profits started to accumulate in successful stock market investors over the year. Having made profits in a volatile market, investors wanted to shift to less volatile assets to store their cash. The money then moved into less liquid assets like real estate – the traditional asset for storing value and protecting capital. With more demand came heavy competition for the limited supply of homes available. Naturally, competing buyers flush with excess cash can offer higher prices to secure the property they desire.

Demand was not the only driver of the price increase. This was a culmination of price increases in other aspects of real estate components – manpower, materials, land – driven by supply chain constraints.

In some cases, even when cost increases were not an issue, there was simply not enough manpower to fulfill construction. Given Singapore’s heavy reliance on imports and foreign labour for property construction, our construction industry was badly affected. Workers were blocked from entering the country, and later not allowed to work due to Covid outbreaks, leading to projects delays lasting from months to years.

Combining these price inflation of all of these components, coupled by increased prices due to demand, we have a way to measure real estate inflation – the price of homes measured in PSF or price quantums.

Asset inflation outpaces CPI inflation across Singapore’s real estate market

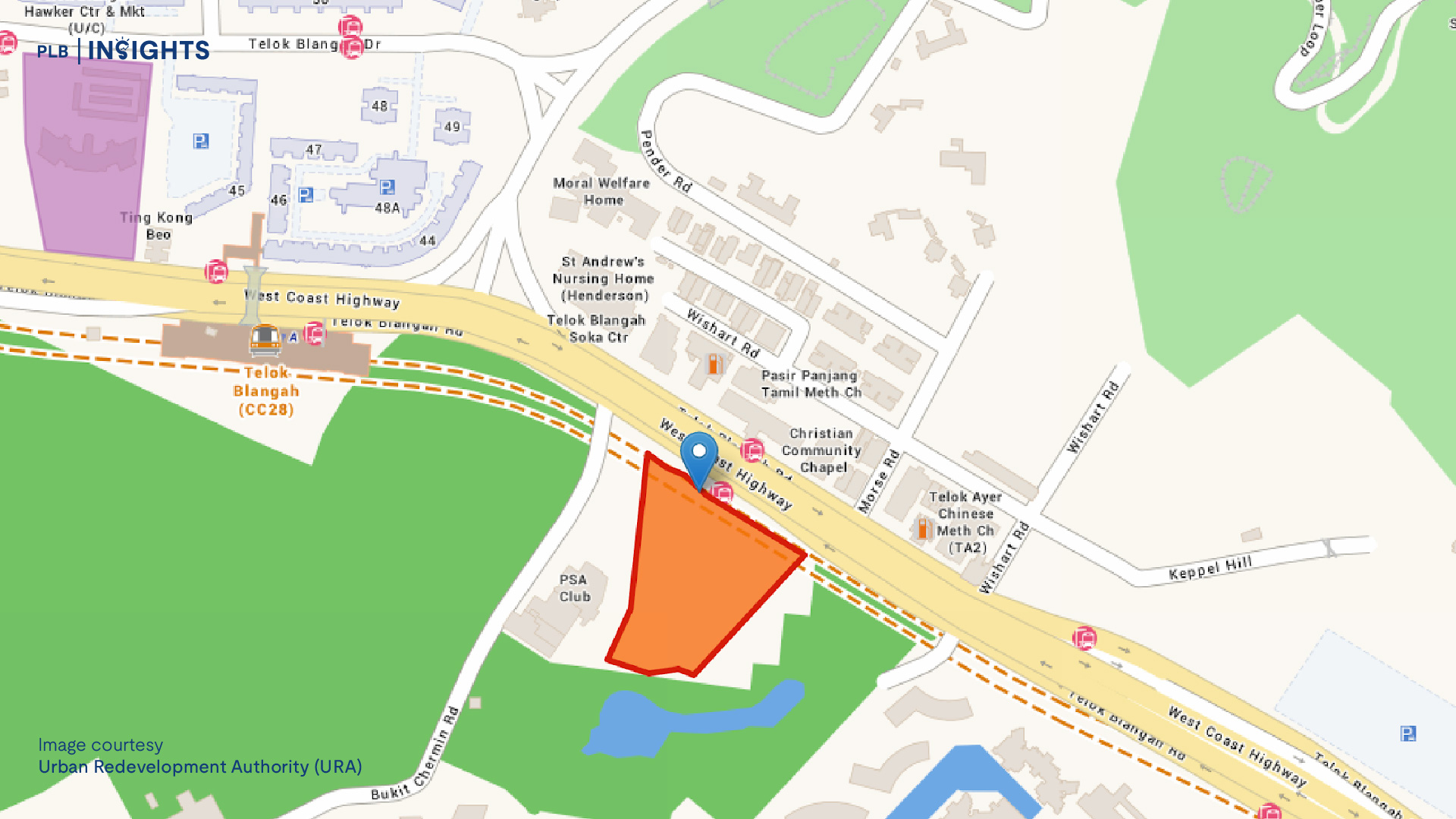

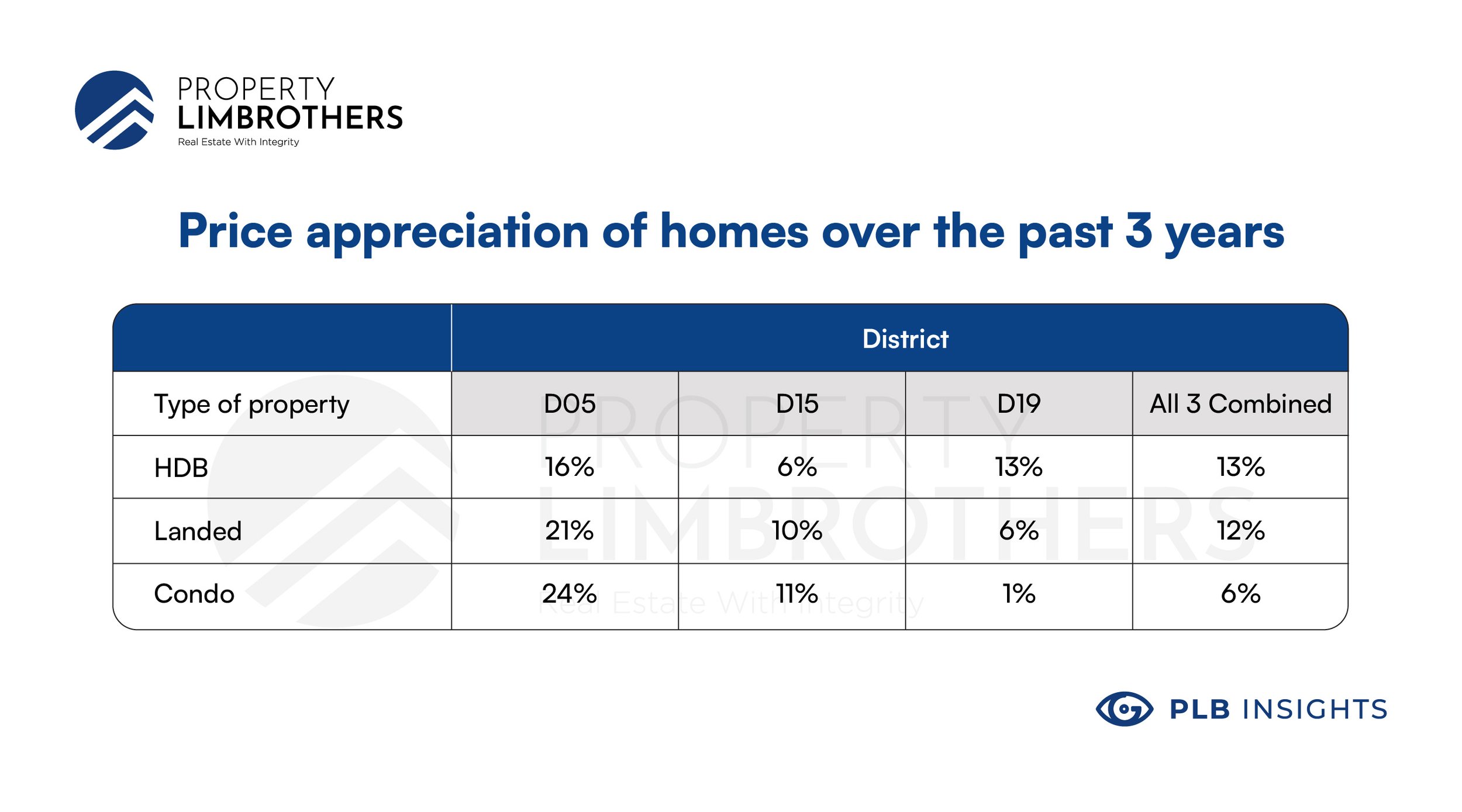

The drastic inflation faced specifically by the real estate asset class is real and reflected in price data. In the recent months, we have looked into the landed property price performance of D05, D15 and D19. As part of our research, we looked at HDB, condominium , and landed prices for each of these districts over the past 3 years.

What we found was that the price increases in each of the property types and districts surpass the national CPI inflation rate of 2% per year, indicating that asset inflation is much more significant than CPI inflation.

Riding out the wave of inflation: Forward Planning

Inflation is countered by prudent allocation of investments to different asset classes. A portfolio that balances volatility, liquidity, and returns is ideal to benefit from the money that is flowing into asset inflation.

While portfolio allocation is the domain of financial advisors, real estate usually features strongly for most people in Singapore.

As we have discussed in a previous article, the traits of real estate are that it is illiquid but offers attractive leverage and flexibility in use for living or rental. The illiquid nature requires proper planning to ensure that one is not forced to sell their property when they are not ready to.

Must-haves to enter real estate

First, we recommend having enough cash to guarantee at least 6-12 months of mortgage payments in case of emergency. Even so, one must plan beyond that to ensure that future income will be enough to cover the monthly payments. This includes having contingencies in case one is unable to work or monthly cash flow decreases.

An example would be renting out the entire property and finding an alternative accommodation – parents or other family members – in an emergency situation. The income from rent can be used to pay the mortgage while the emergency is resolved.

Second, we recommend that buyers are confident in their ability and motivation to hold the property for at least 3 years. This way, they do not sell the property and incur hefty SSD fees. Ideally, property purchases are for the mid-to-long term, so one should not need to rush to sell a property.

Conclusion

Inflation has been the hot topic leading up to 2022. While most people have associated inflation with price hikes in our daily lives, asset inflation is also very real. Real estate investors should be wary that asset inflation is happening at a much faster rate than the usual consumer inflation we see reported in the news. Given real estate’s position as the ideal asset class for storing value, many have already flocked to putting their money into high-value properties in a red-hot housing market. Singapore in particular is experiencing a massive demand surge and supply glut which only serve to push property prices higher.

At the end of the day, the country only has so much land to reclaim, rebuild, and redevelop. For investors looking to enter the real estate market, it is crucial to leverage on the favourable conditions for home purchases. Real estate investment requires prudent planning and knowledge of the market. If you are interested in the property market, or need any other real estate advice, feel free to reach out to us here at PropertyLimBrothers, always happy to show you the place.