Landed properties in Singapore are a highly sought-after asset class, known for their exclusivity and limited availability. As of recent estimates, there are approximately 73,500 landed properties in Singapore, which represents only 4.8% of the total housing stock. This scarcity has contributed to price stability and growth potential for landed assets as compared to other property types.

Additionally, landed houses offer two key asset advantages: land ownership and the flexibility to enhance the property’s structure, allowing for value-added improvements.

In this article, we will discuss two key components of the PLB Landed Frameworks for Decision Making: the Four Categories and the Four Horses DNA. The purpose is to help you identify which of these categories a landed property may fall into and equip you with the knowledge to make informed decisions when considering the purchase of a landed home.

Landed Property Categorisation: The Four Categories of Landed House

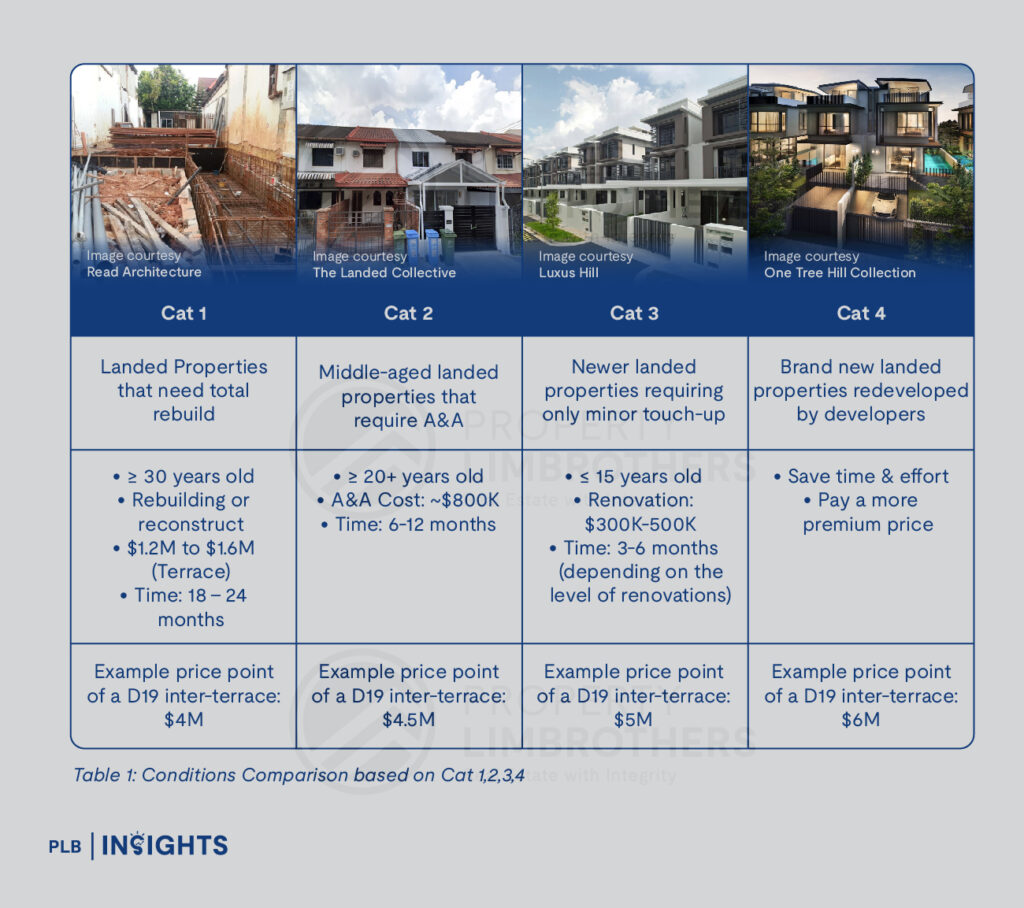

Under PLB’s Landed Framework, we categorise landed houses based on four categories of Cat 1, Cat 2, Cat 3, Cat 4, as follows:

Depending on the type of landed property a buyer is interested in, there are various types within the four categories, each with distinct potential, as shown in Table 1. For instance, if a buyer purchases a Cat 1 inter-terrace property in D19 for around $4M and invests approximately $1.5M for reconstruction over two years, the property could then move into Cat 4. With market appreciation, this newly upgraded landed property might be valued at over $6M two years later, benefiting from both its enhanced condition and potential market growth.

PLB Four Horses DNA

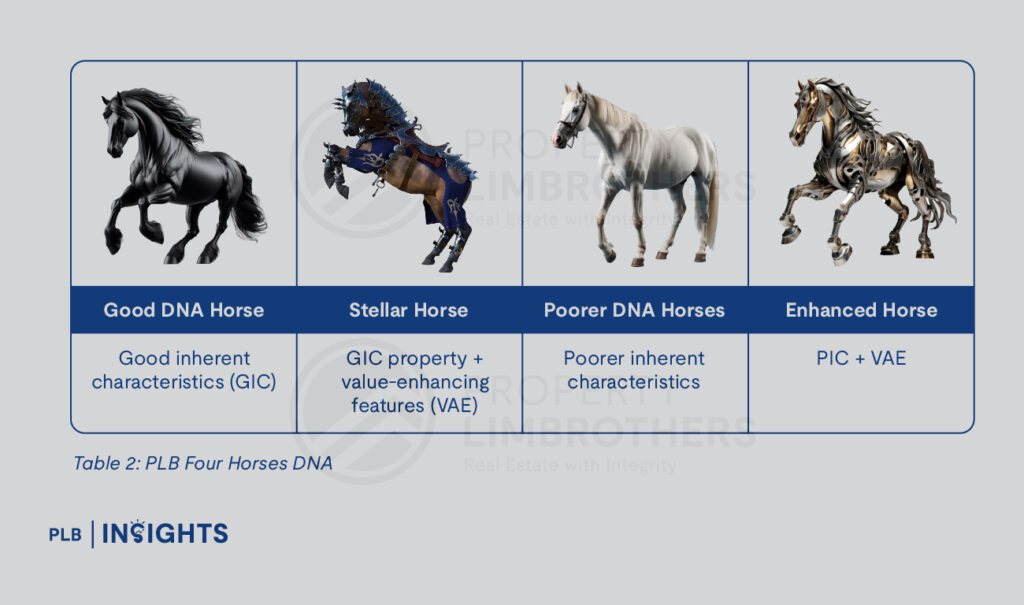

The Four Horses DNA framework is primarily based on the inherent characteristics of a landed property that are unchangeable, unless external factors like government development come into play, which are beyond individual control. This framework focuses on evaluating aspects of the property’s location and surroundings that impact its long-term value and desirability, recognising that some traits are permanent while others can only change with external intervention.

It classifies properties as:

This framework is valuable because it provides insight into the entry price by aligning each landed property with a specific horse type, based on its inherent characteristics. Understanding this classification helps buyers gauge the property’s value and investment potential, ensuring a more informed decision when evaluating landed properties. By categorising properties as Good DNA, Stellar, Poorer DNA, or Enhanced Horses, buyers can make better comparisons and identify opportunities that align with their budget and desired property features.

This methodology is most effective when combined with PLB’s Four Categories of Landed Houses. Buyers should first identify the category of the property they are interested in, as this classification will help establish its baseline characteristics and value range. Once the category is known, the Horse’s DNA can be applied to further refine the evaluation, providing a more nuanced understanding of the property’s potential and helping to align it with the buyer’s investment goals and expectations.

Once we have these two key metrics—PLB’s Four Categories of Landed Houses and the Horses DNA framework—alongside pricing, we can make a well-informed decision. This combined approach allows us to assess both the property’s baseline characteristics and its inherent value potential. By understanding the category and horse type, buyers gain a comprehensive view of the property’s positioning and market worth, ultimately aiding in a strategic and informed purchasing decision.

Examine Broader Market with The Remaining Two Frameworks Under PLB’s Methodologies

The two additional Landed Frameworks, the Disparity Effect and Built Up Framework, which we have not discussed about, provide further insights into landed evaluation. These frameworks complement the Horses DNA and Category Framework by examining value disparities and building PSF price in comparison with the broader real estate market. For more detailed explanations on how these frameworks function, you can view additional resources and information here or through our official PropertyLimBrothers YouTube channel.

In Conclusion

PLB’s Landed Frameworks offer a comprehensive approach to evaluating landed properties in Singapore. By understanding the Four Categories and Four Horses DNA, buyers can assess both the structural requirements and inherent characteristics of properties, helping in strategic and informed decision-making. Combining these frameworks with the Disparity Effect and Built Up Framework provides a deeper understanding of market positioning as compared to the broader real estate market. Together, these tools equip buyers with the insights needed to make informed investments and align their purchases with long-term goals and preferences.

Let’s Get In Touch

Curious to learn more or interested in leveraging PLB’s Methodology for your decision-making? Whether you’re a first-time homebuyer, a seasoned investor, or simply exploring your choices, our team of consultants is here to guide and support you steps of the way.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.