Executive Summary

Inflation continues to dominate headlines everywhere. With the US Federal Reserve’s recent pivot to an aggressive monetary tightening policy, its key overnight interest rate was increased by another 25 basis points, situating it between 5.25% and 5.50% to further curb the inflationary pressures. The Fed is prepared to raise interest rates further if inflation remains high in the coming months, which begs the question of whether it will bring about the crash that everyone is waiting for.

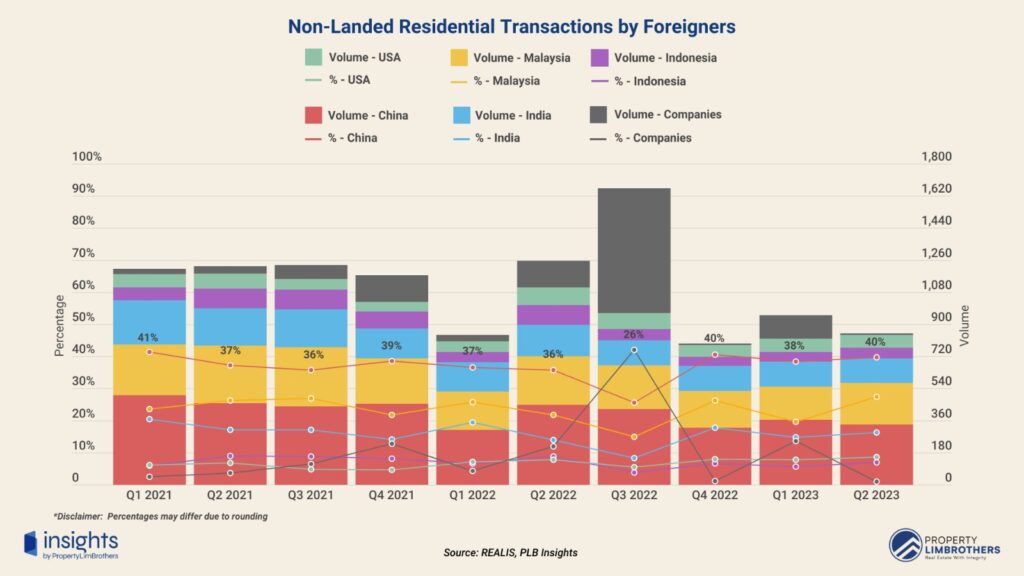

On the other hand, there is a deceleration of economic momentum around the world, with escalating tensions between the G2. China’s gloomy property market outlook may prompt more Chinese investors to seek alternative investment avenues and safe havens to park their wealth. In recent years, Chinese investors have been the largest group of foreign nationals buying residential property in Singapore, due to its reputation as a safe haven with a stable political and economic climate.

The Singapore government’s active role in the real estate industry has substantial consequences for investors and homeowners alike. Responding to heightened demand for private residences and the upward trajectory of property prices, the government took action in April 2023 by implementing further cooling measures. These measures entailed raising the rates of Additional Buyer’s Stamp Duty (ABSD) for Singaporean Citizens and Permanent Residents (PRs) purchasing their second or subsequent properties. The ABSD rate for foreigners, entities, and trustees also saw the biggest jump in this round of cooling measures.

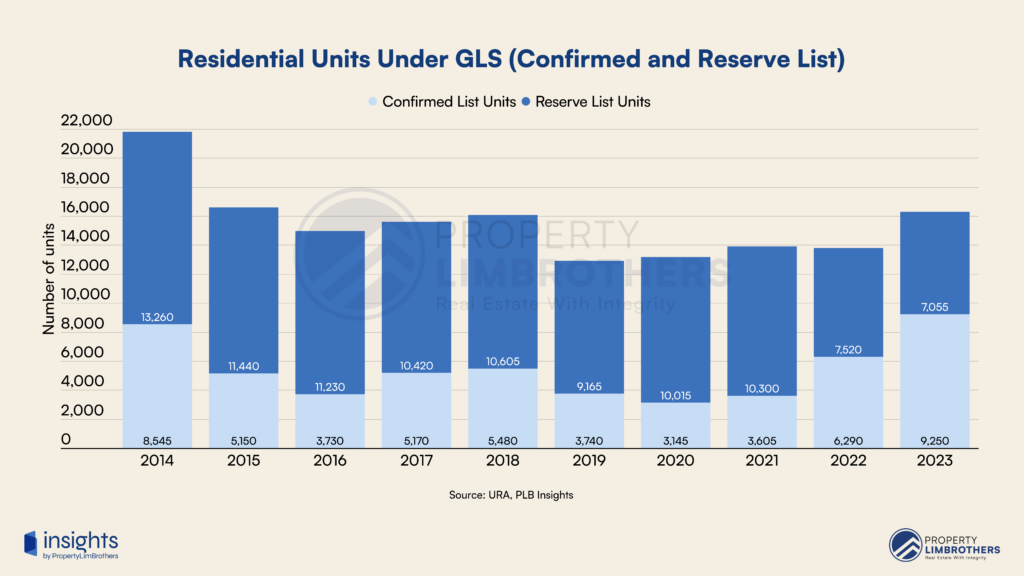

Concurrently, Government Land Sales (GLS) have been ramped up to maintain stability in the market and to prevent excessive price increases caused by inflationary pressures and foreign investor interest. Addressing the pressing issue of housing affordability has become a top priority for policymakers, prompting them to consider further changes to ease public anxieties. As a result, these policy shifts are expected to reverberate throughout the entire real estate sector.

Based on the real estate data for Q2 2023, as provided by the Urban Redevelopment Authority (URA), the Property Price Index for private residential properties experienced its first decline in three years, primarily due to a deceleration in sales activity. Despite a deceleration in the volume of resale transactions, prices for newly launched condominiums are expected to remain relatively stable.

Foreword by Melvin Lim

CEO, Co-founder PropertyLimBrothers (PLB)

Since the latest round of cooling measures in April 2023—specifically, the doubling of the Additional Buyer’s Stamp Duty (ABSD) for foreign buyers and investors in Singapore’s residential properties — we’ve observed mixed trends. As we wrap up Q3 and head into Q4, indices for Landed homes, HDB flats, OCR, and CCR condos have maintained stability or seen slight upticks. RCR, however, has experienced its first dip in its price index in many years.

On the ground, prices haven’t shown signs of declining. Data from various property portals align with this, showing a drop in inventory levels when market sentiment isn’t bullish. Homeowners aren’t in a rush to sell; most properties are owner-occupied, including Landed homes and private residences. We’ve noticed that homeowners are holding onto their properties longer since the introduction of the Seller’s Stamp Duty (SSD) several years ago. Singapore’s real estate market has reached a stage of remarkable stability after 15 rounds of cooling measures, fostering more thoughtful investment and less speculative activity.

The current mindset among property owners seems to be: “If I find a property I like, I’ll consider selling my existing one — but not at a bargain.” This reflects a shift towards “needs-based selling” or “needs-based transition.” Gone are the days of fire sales. Even those owning multiple properties continue to enjoy strong rental yields, with 4-room HDB flats commanding astonishingly high rents of around $4,000 in most estates.

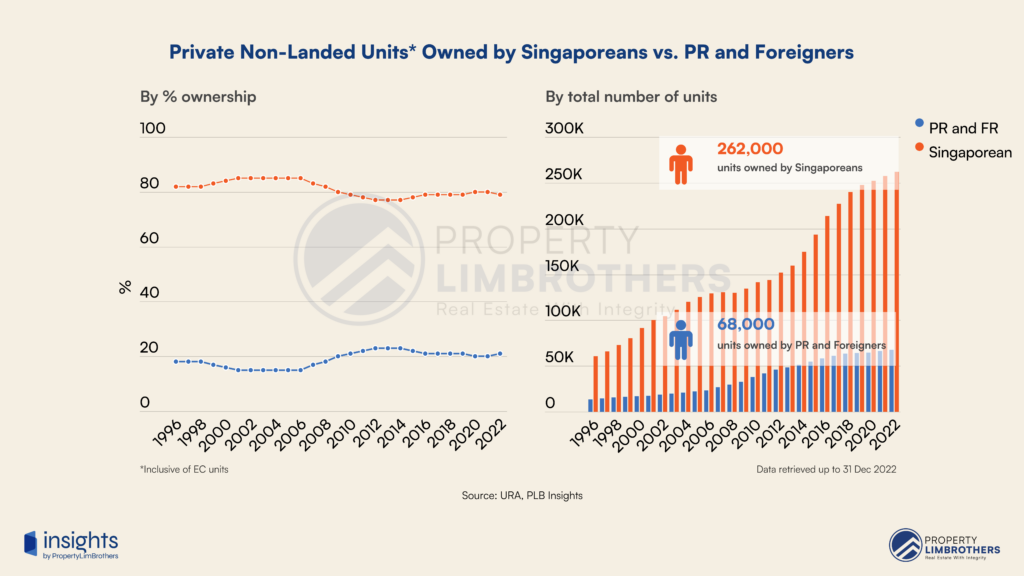

Some may think the 60% ABSD signals a market decline, but the opposite may be true. Currently, there are around 360,000 non-landed private units, 25% of which are foreign or corporate-owned. Most prefer holding onto these properties, given the new 60% ABSD rate would apply if they sell and repurchase. Their existing properties, purchased at previous, lower ABSD rates, continue to generate rental income. Furthermore, the strength of the Singapore dollar adds another layer of incentive for these investors.

If you’re uncertain about the market, my advice is to stay in it. Timing the market, particularly when it involves your primary residence, can be a risky strategy. If market dynamics shift favourably, existing sellers and developers will seize the opportunity to adjust prices upward. Therefore, invest time in educating yourself—watch our podcasts, read our articles. Our team continues to share knowledge gained from years of experience in real estate, as well as invaluable lessons from our investors and clients.

By not prepping your property to stand out for the crowd, you are not realising the maximum potential value of the property

Only consider selling your home after thorough planning: understand your financial standing, develop a marketing plan, and identify 3-5 projects or types of homes you and your family are interested in.

I hope you find this quarterly report, prepared by our Research and Editorial team, insightful and useful.

All the best, and take care.

Melvin Lim

CEO, Co-founder of PropertyLimBrothers

Methodology

The information presented in this report is primarily sourced from URA data, but may also incorporate data from other sources such as Squarefoot, Edgeprop, S&P Global, TradingEconomics, and Statista to complement it. In addition, we use data from reputable banks and consulting firms’ corporate reports as well as economic data from various government websites in Singapore, the United States, and other countries, including data from Central Banks worldwide.

Our report focuses on significant global macroeconomic trends and examines how they could impact Singapore’s real estate market, taking into account changes in monetary policy and growth projections. We carefully consider both demand and supply factors in Singapore’s property market and use a combination of macro and micro conditions to provide an in-depth analysis. Based on our assessment, we offer our perspective on the likely performance of the real estate market in the upcoming quarters.

The micro analysis primarily focuses on examining price and volume movements within the real estate market. To identify any disparities in the performance of various market segments, we utilise a non-parametric subsampling method. We obtain performance data from URA and then create sub-samples for analysis, which are divided based on factors such as property type, size, location, and other characteristics. The approach we use is mainly descriptive in nature, but we also incorporate some qualitative analysis and comments on consumer sentiment and behaviour.

This Q2 report builds on the previous reports, which highlighted how the persistent macroeconomic challenges, including high inflation and interest rates accompanied by low growth, would continue to have an impact on Singapore’s real estate market in 2023.

Contents

Macro

- Interest Rate Direction for Q2 2023 & Beyond

- Deceleration of Economic Momentum Around the World

- Government Intervention in Real Estate

Micro

- Quarterly Growth in Residential Real Estate Segments

- Quarterly Growth in Commercial Real Estate Segments

- In Focus — Opportunity Spaces for 2023Q3 and Beyond

Interest Rate Direction for Q2 2023 & Beyond

Inflation continues to dominate headlines everywhere. With the US Federal Reserve’s recent pivot to an aggressive monetary tightening policy, its key overnight interest rate was increased by another 25 basis points, situating it between 5.25% and 5.50% to further curb the inflationary pressures. Investors and market participants might be left wondering when we might anticipate a reversion of the inflationary equilibrium.

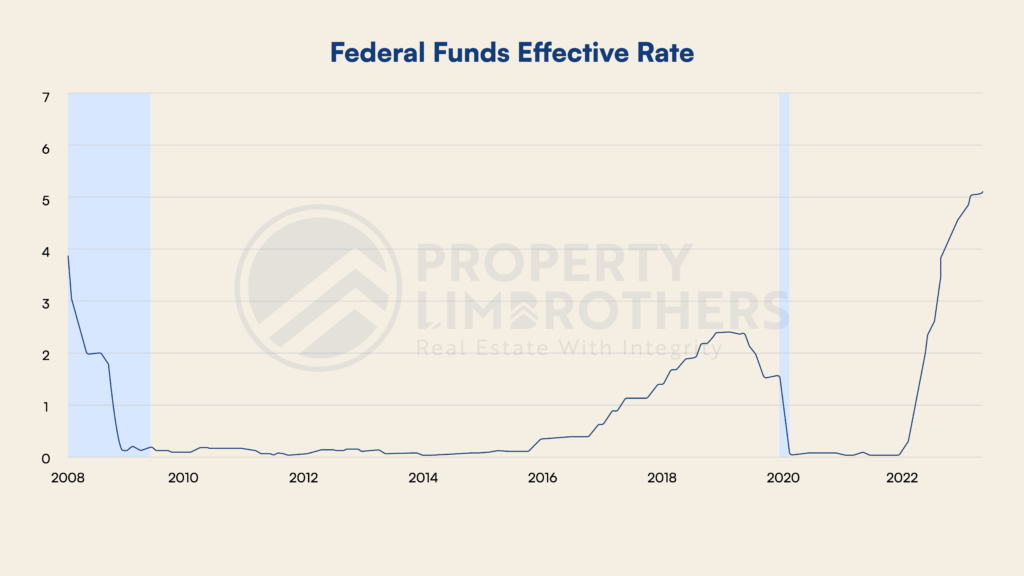

The current Fed Funds Rate is the highest in 15 years, after a series of rate hikes post-pandemic. Since the start of the rate hike, it has increased by a total of 475 basis points – which has not happened in 42 years. The Fed is prepared to raise interest rates further if inflation remains high in the coming months, which begs the question of whether it will increase recessionary expectations.

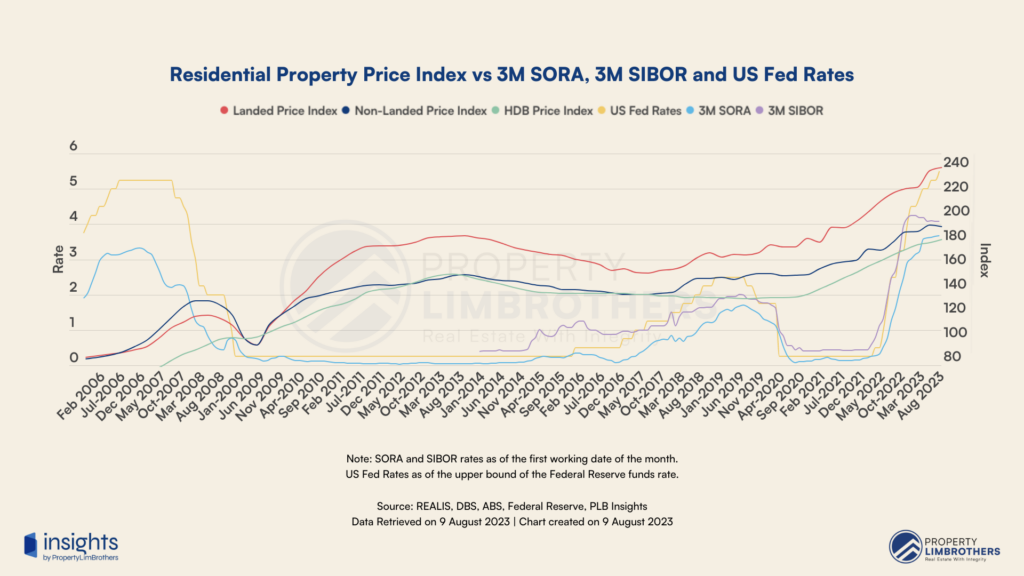

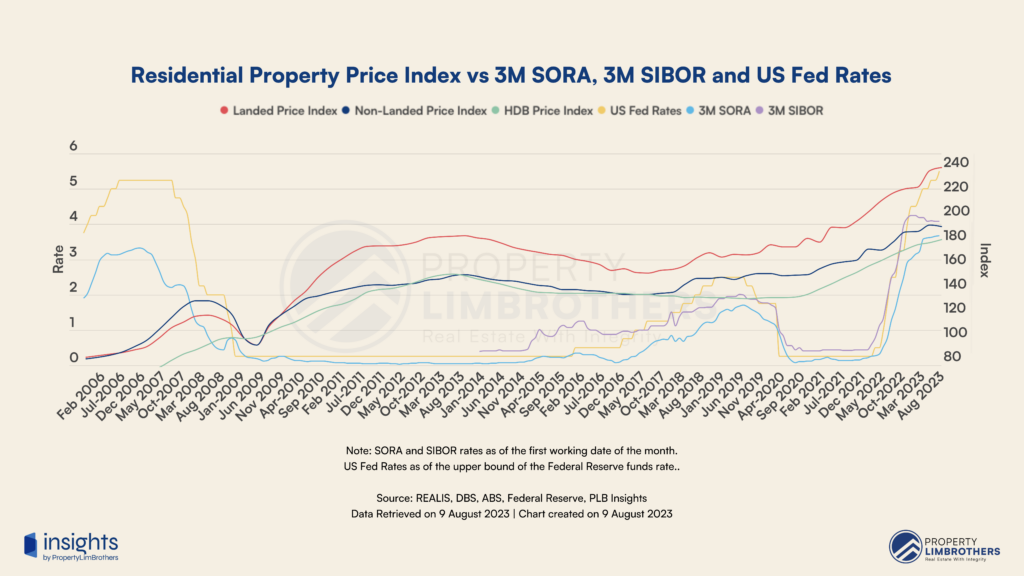

The direction of Singapore’s interest rates is closely linked to US interest rates. As the US Fed continues hiking to fight inflation, the high interest rate environment will persist for some time before we see interest rates start coming down. Based on the chart above, the general observation is that SIBOR rates have been increasing at a faster rate compared to SORA rates. Those on a floating home loan should expect some respite from persistent hikes. Homeowners, investors, as well as aspiring homeowners should continue to watch their budget and ensure that there is enough room for higher loan repayments.

Deceleration of Economic Momentum Around the World

There’s a palpable deceleration of economic momentum, with manufacturing and trade slowing in tandem. Business outlooks have thus become more reserved. The shocking collapse of Silicon Valley Bank (SVB) in March 2023 led to a chain effect and created turmoil in the whole banking sector. The foundation of the financial sector, which is trust, is now being tested as clients, stakeholders, and regulators examine the broader impacts of SVB’s failure. Investors are hastily recalibrating their risk assessments, and precautionary measures by banks when assessing loan applications, coupled with the high interest rate environment, are effectively deterring borrowing. March 2023 is undoubtedly marked as a month of turbulence in finance which has reverberated into Q2 2023 and will likely continue to have an impact in the quarters ahead.

The escalating tensions between the G2 could also result in surges and supply disruptions. This could reshape global trade as businesses lean towards nearshoring, friend-shoring, and duplication of supply chains. Moreover, China might reevaluate its investment in U.S. Treasury bonds.

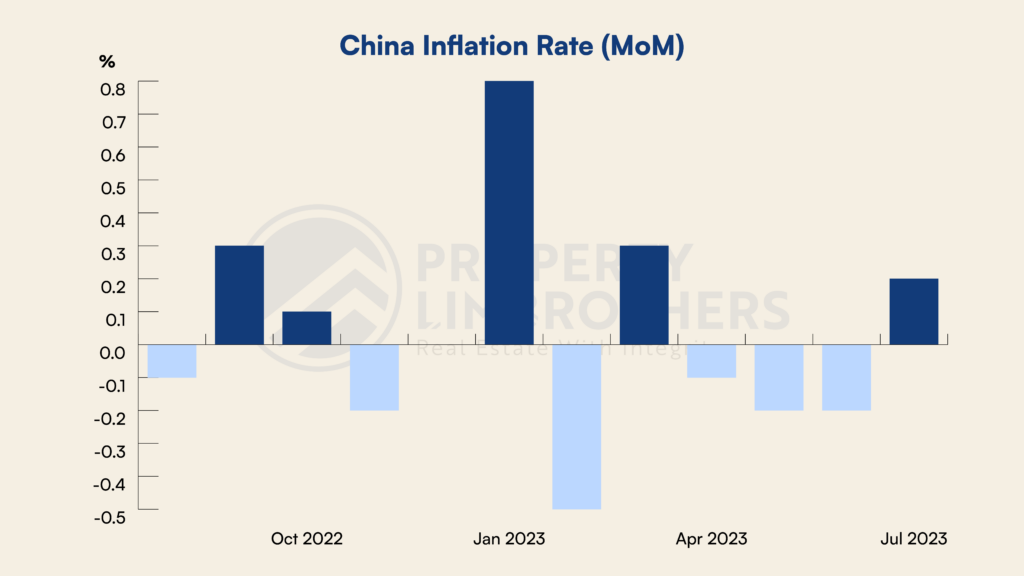

On the brighter side, a slowdown in the economic cycle also signals that monetary policy tightening might come to an end. We might see a rotation of strength between the G2 with China’s markets gearing up for a bullish surge due to the monetary easing and is expected to outperform the Western market. There might be a further rate cut of China’s one-year loan prime rate by another 10 basis points in the second half of 2023. From the chart above, CORE CPI picked up for the first time from the negative territory in six months.

The accumulation of Chinese Yuan deposits in 2023 is significant, as reported by the People’s Bank of China (PBOC). By the end of July, the M2 money supply stood at a staggering 285.4 trillion yuan, marking an annual increase of 10.7%. The growth rate was 0.6 percentage points lower than the end of the previous month and 1.3 percentage points below the rate from the same time last year. This whopping amount of “excessive household savings” is believed to have been built as a result of Covid restrictions and/or precautionary savings.

The sharp build-up of household savings will play a crucial factor in contributing to the economic recovery of China, anticipating a growth in investment and spending. To further encourage spending, additional stimulus packages are likely to roll out from the Chinese government. A clear indication of this is the recent interest rate cuts, with the prevailing China Loan Prime rate standing at a record low of 3.45%. Asian countries are expected to gain benefits from the recovery of the Chinese economy, especially on the tourism front.

Due to the depreciation of Chinese yuan against USD, coupled with the ripple effects from the Evergrande crisis leading to a gloomy outlook in the China property market, it could prompt Chinese investors to start looking for alternative investment avenues and safe havens to park their wealth. According to data retrieved from REALIS, Chinese investors make up the largest group of foreign nationals buying residential property in Singapore. Over the years, Singapore has emerged as a safe haven for property investors due to the stable political and economic climate. This has become even more apparent after the Covid-19 pandemic.

Government Intervention in Real Estate

In this 2023 Q2 report, we discuss government intervention in two broad ways. Firstly, the government can implement measures that influence both demand and supply dynamics in the property market. Such interventions often have swift impacts as they influence the choices of those active in the property market. Secondly, the government can actively control the land supply which will be developed after some years through the Government Land Sales (GLS) Programme. This directly affects the number of residential or commercial spaces available, though there’s a time lag due to development time.

Fresh Round of Cooling Measures

The government stepped in with a fresh round of cooling measures in April 2023 on the back of high-profile purchases of residential properties by foreign investors. Additional Buyers’ Stamp Duty (ABSD) rate for foreign buyers was doubled to 60%, a drastic move that caught many market participants off guard.

While the ABSD hike might deter most foreign investors, ultra-high-net-worth individuals (UHNWIs) may continue looking towards Singapore as a safe haven to park their wealth in spite of the high taxes involved. Some who are serious about sinking their roots in Singapore may even apply for permanent residency ahead of their planned timeline to soften the blow of the steep ABSD rate. Nationals and Permanent Residents of Iceland, Liechtenstein, Norway, and Switzerland, as well as Nationals of the United States of America are also still able to purchase residential property in Singapore without incurring any ABSD under the Free Trade Agreement (FTA).

ABSD rate hikes are seen as a pre-emptive move to dampen foreign investor interest in the residential property market. It is preliminary to say whether the ABSD rate will be hiked any further than this, primarily because demand is unlikely to drop completely as long as Singapore real estate is still seen as an attractive option. To affluent foreign investors, ABSD is merely the price to pay for the infrastructure, as well as political and economic stability.

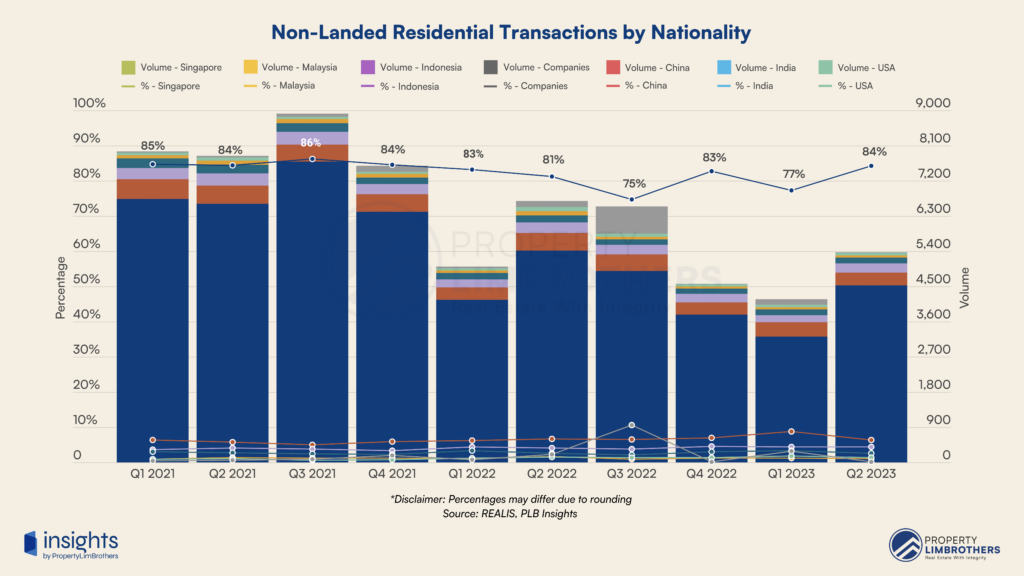

On that note, it is important to remember that Singaporeans continue to make up the majority of residential property transactions and that residential transactions by foreign buyers only make up between 10-20% of the market. As observed from the charts above, transaction volumes for foreign purchases of residential property did fall slightly after the ABSD rate was doubled for foreigners.

But the ABSD hike has far deeper implications on the property market than future transactions. Currently, out of the roughly 350,000 private non-landed stock in the market, approximately 60,000 to 90,000 are owned by foreigners and companies. These foreigners and companies are unlikely to let go of these properties now because they will incur the hefty 60%/65% ABSD if they were to buy another property here. So they would rather hold and rent it out, or use them as vacation homes. This means that the available stock in the private non-landed market may be lower than we perceive.

However, this was a necessary move on the government’s part, even when foreign transactions only make up 10-20% of overall transactions. And that is because of the concerning trend of foreigners buying up private non-landed residential properties in the Outside Central Region (OCR). These properties are seen by the government as “protected” as they are catered to Singaporean families as more affordable options than Central Core Region (CCR) and Rest of Central Region (RCR) properties.

Highest Residential Supply Since 2013

Addressing the pressing issue of housing affordability has become a top priority for policymakers, prompting the government to keep a close eye on the property market to ease public anxieties. Aside from cooling measures, another form of government intervention is to increase supply if prices are growing at unsustainable levels.

For the third year in a row, the provision of private housing under GLS has been increased, with 2023 seeing a record Confirmed List supply of approximately 9,250 units, the highest in a decade. This is also a 26% increase in 2H 2023 from 1H 2023. In addition to cooling measures implemented by the government to stabilise the property market, this increase in supply will push the overall upcoming stock of private housing (including ECs) to roughly 63,500 units, meeting the strong demand.

On the public housing front, supply has also been ramped up. Back in March 2023, the government announced that 100,000 HDB flats will be completed by 2025. According to a press release by HDB in July 2023, a total of 13,000 BTO flats will be offered in 2H 2023. This is around 31% more than the 9,923 flats launched in 1H 2023.

Singapore’s residential property price index is deeply tied to the inflation rates, which can be observed from the US Fed rates correlating to our SORA and SIBOR rates. The historical trend shows us two main crashes in our housing market – the first in 2008 after the collapse of Lehman Brothers, and the second in 2013 after a round of cooling measures by the government introduced the Total Debt Servicing Ratio (TDSR). Since 2021, our residential property price index has been climbing at a rate almost identical to that of the two crashes in the past. This concerning trend, coupled with the ramping up of GLS, prompts market participants to wonder whether our property market will experience a similar crash and see prices across all property types fall significantly.

With more pandemic-affected projects being completed in the 2023/24 period and more supply being added, the market might be getting some relief from fast-pace price increases and market participants will get a wider range of options to choose from. This could prompt them to hold out longer to wait for better or more suitable options to become available, signalling a slowdown in the price and transaction momentum in the coming quarters.

Quarterly Growth in Residential Real Estate Segments

In this section, we examine residential real estate segments. This refers to resale HDBs, ECs, Condominiums, Apartments, and Landed properties including Pure Landed and Strata Landed. The percentage values refer to the quarter-on-quarter change in Total Transaction Value (TTV), and the colour gradient of the boxes are based on the percentage change from Q1 2023 to Q2 2023. The size of the boxes refers to the relative TTV to other segments, which tells us which segments have the most ‘activity’ in terms of value being transacted.

Resale HDB

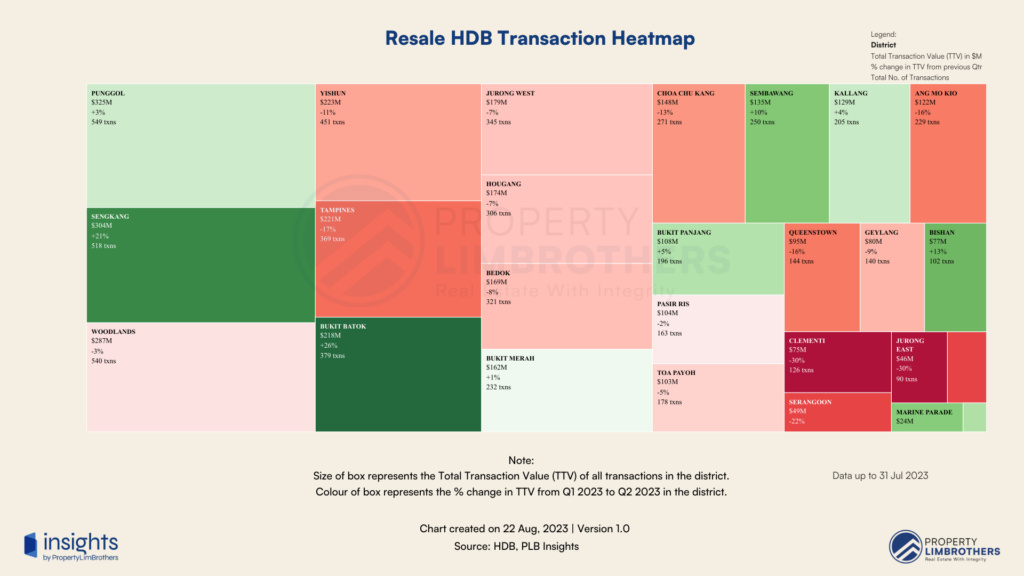

For the resale HDB subgroup, the heatmap shows more reds than greens. This means that transaction activity has generally slowed down compared to the previous quarter. Planning areas that saw a positive growth in TTV from Q1 2023 to Q2 2023 include Punggol, Sengkang, Bukit Batok, Bukit Merah, Sembawang, Kallang, Bukit Panjang, Bishan, and Marine Parade. The planning areas with the highest transacted value remain to be Punggol, Sengkang, Woodlands, Yishun, and Tampines (TTV for Yishun surpassed Tampines compared to the previous quarter).

Punggol and Sengkang stood out as the segments with the most transaction activity, with over 1,000 transactions combined. Sengkang also had one of the biggest percentage increases (21%) in TTV from Q1 2023 to Q2 2023 among all segments. This once again solidifies District 19 as the district with the highest volume of transactions.

Another segment that stood out was Bukit Batok. With a total number of 379 transactions, it has grown 26% and has the largest percentage change in TTV from Q1 2023 to Q2 2023. Seeing as both Bukit Batok and Bukit Panjang’s TTV are ‘in the green’, this could signal a healthy growth and appreciation potential in District 23.

Executive Condominium

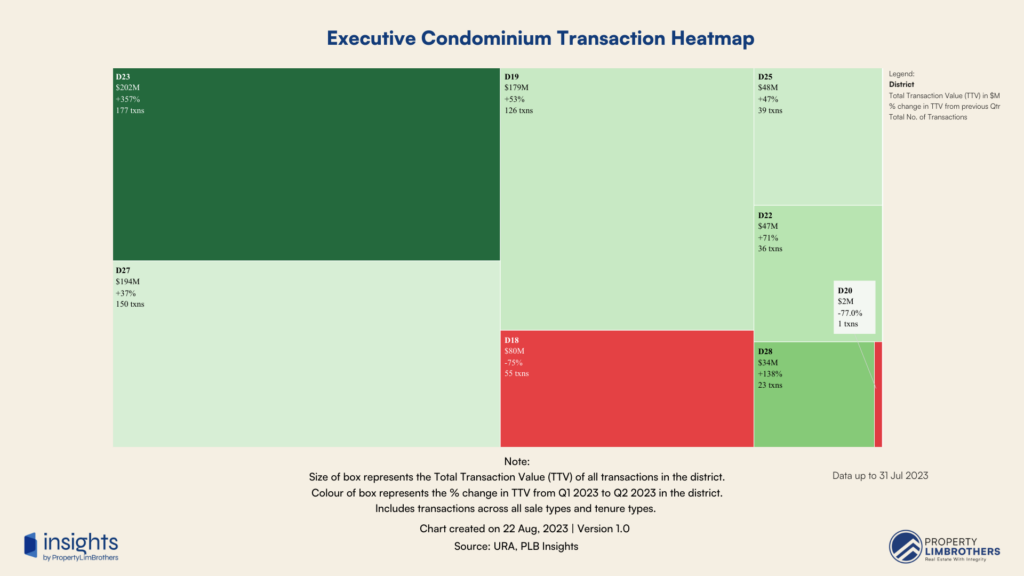

In the Executive Condominium (EC) subgroup, the quarterly growth numbers based on TTV predominantly point to a high upside. The quarterly growth in TTV ranges from -77% to +357%, with the range mostly on the positive side. The districts with the highest TTV are District 23 (Bukit Panjang, Choa Chu Kang), District 27 (Sembawang, Yishun), and District 19 (Punggol, Sengkang).

District 23 is the largest part of the EC subgroup, and saw the biggest jump in TTV (+357%) between Q1 2023 and Q2 2023, with a total transaction value of $202 million. The massive jump in TTV could be attributed to a large pool of HDB upgraders in the area, as well as the performance of Sol Acres – a mega-sized EC in District 23 that was completed in 2018 and recently achieved its MOP in 2023. Since its MOP, the average PSF of Sol Acres has grown by a whopping 70% compared to its launch prices in 2014, and already has at least 150 transactions at the time of writing.

The performance of District 27 and District 19 ECs are not surprising as well, given the strong presence of HDB upgrader demographic in both districts. District 19, especially Punggol and Sengkang, has the most number of ECs in Singapore, giving aspiring private property owners more options to choose from.

Apartment & Condominium

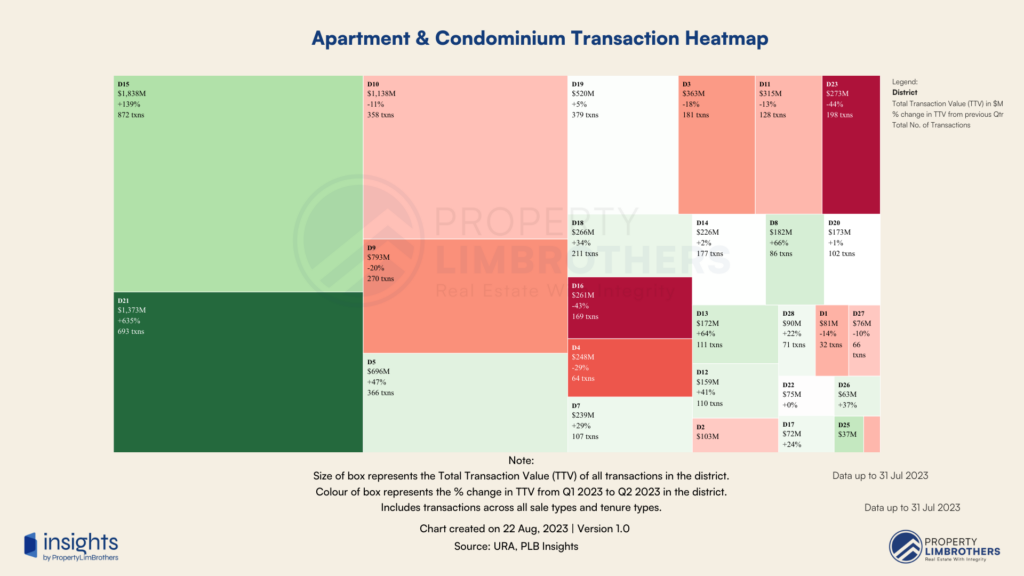

Looking at the Apartment & Condominium subgroup, we also see a dip in transaction activity across several segments. The growth rate of TTV ranges from -44% to +635%, with the range mostly on the positive side. The districts with the highest TTV are District 15 (Marine Parade, Katong), District 21 (Upper Bukit Timah, Clementi Park), and District 10 (Bukit Timah, Holland Village).

It is no surprise that District 15 came out top in terms of transaction activity, given several high-profile new launches in the area – namely Grand Dunman, Tembusu Grand, and The Continuum. District 15 has been a top choice to live in in Singapore, especially for expats as well as locals who enjoy the close proximity to the Katong-Joo Chiat food haven and East Coast Park. The new launches add an exciting element into the area which is predominantly made up of older freehold developments, and will be part of the area’s rejuvenation plan. We expect District 15 apartments and condominiums to continue performing well given the government’s future plans for the area as outlined in the URA Master Plan.

The segment that stood out, perhaps even more than District 15, is District 21 which saw a steep 635% increase in TTV compared to the previous quarter. One of the reasons can be attributed to the phenomenal success of The Reserve Residences, which sold 71% of its units (520 units) over its launch weekend. Its rarity as an integrated development in the Rest of Central Region (RCR) and attractive price point were key factors that contributed to its success.

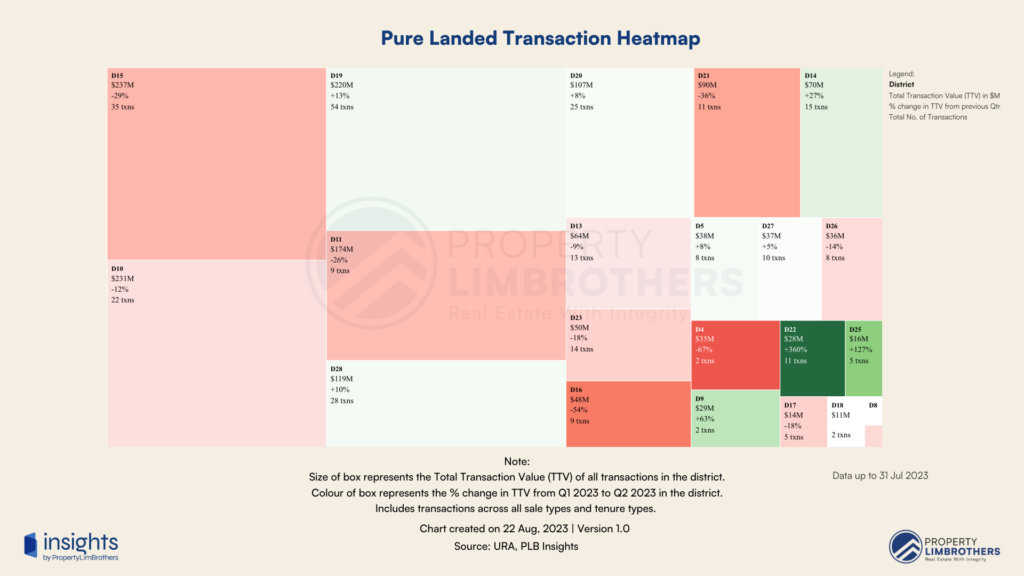

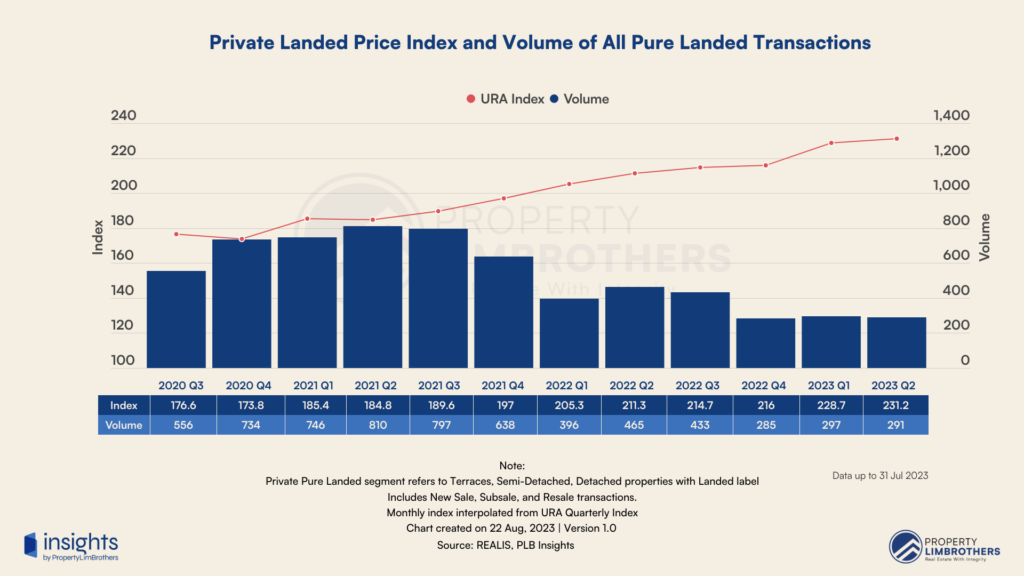

Pure Landed

Coming to the Pure Landed subgroup, we see that the transaction activity has mostly slowed across the different segments. Most segments, even the largest segment in terms of TTV, saw a dip in transaction activity. The growth rate of TTV ranges from -67% to +360%, with the range mostly on the negative side. While this shows that transaction activity has slowed compared to the previous quarter, it does not mean that prices for pure landed properties have started to come down. In fact, the private landed price index has increased despite volume coming down slightly in Q2 2023 compared to Q1 2023.

District 15 (Marine Parade, Katong) came out top again for the Pure Landed subgroup in terms of TTV, even though the TTV is 29% lower than the previous quarter. With a total transaction value of $237 million and 35 transactions, the average quantum of pure landed transactions in Q2 2023 comes up to around $6,770,000. District 10 (Bukit Timah, Holland Village) and District 19 (Kovan, Serangoon) also stood out, with the former experiencing a slight 12% dip in TTV while the latter saw a 13% growth in TTV compared to the previous quarter.

District 22 (Boon Lay, Jurong) and District 25 (Admiralty, Woodlands) also had a stellar TTV growth rate of 360% and 127% respectively, but one caveat to note here is the low transaction volume of pure landed properties in these areas. District 22 had 11 transactions and District 25 had 5 transactions in Q2 2023. Given the low volume of transactions and the nature of landed properties in Singapore (especially freehold pure landed properties), the transaction activity and trend in the coming quarters may be volatile and we might see some fluctuation.

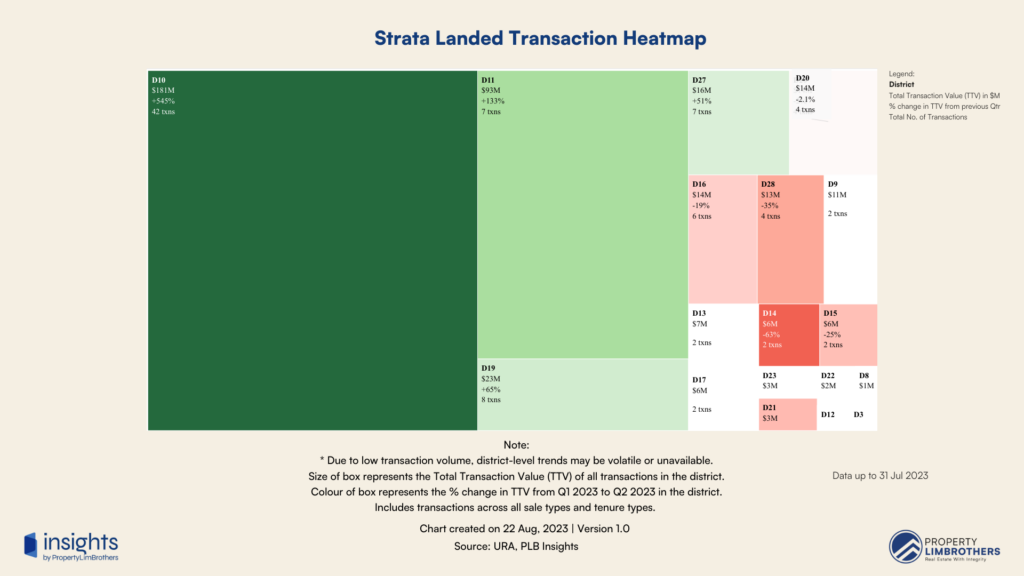

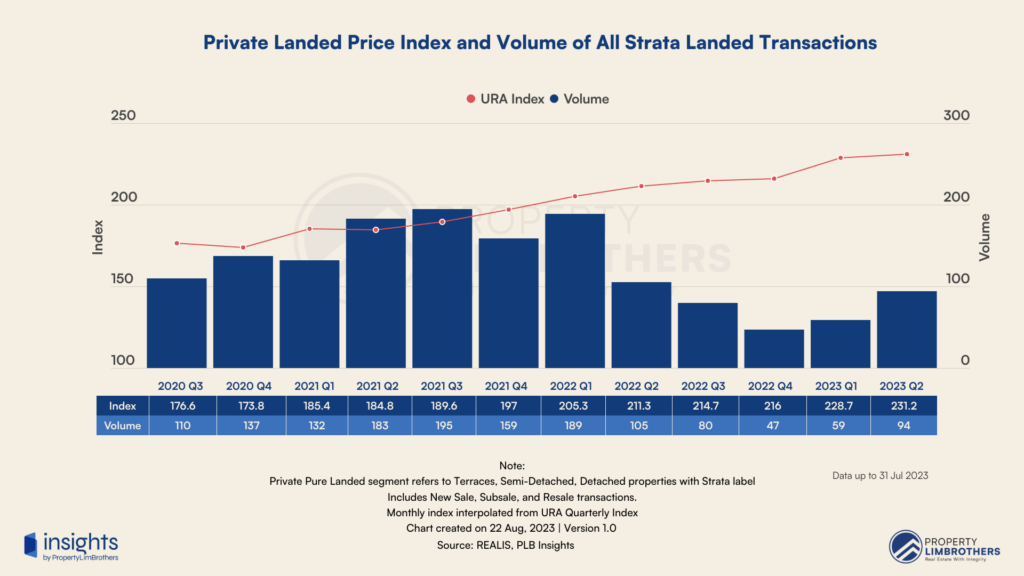

Strata Landed

Last but not least, the quarterly growth numbers of the Strata Landed subgroup in terms of TTV mostly point to a positive upside. The quarterly growth ranges from -63% to +545%, with the range mostly on the positive side. The volume of strata landed transactions also saw a significant 159% increase from the previous quarter. However, the caveat to note here is that district-level trends may be volatile or unavailable due to the low transaction volume in certain districts.

District 10 came out top as the largest segment, with almost half of the total strata landed transactions coming from this segment. This is likely due to the 48 semi-detached, strata landed cluster homes at Eleven@Holland that were put up for mortgagee sale in June 2023. As a result, TTV for District 10 increased by 545% from Q1 2023.

District 11 (Newton, Novena), District 19 (Punggol, Serangoon), and District 27 (Sembawang, Yishun) also stood out with TTV growth rates of 133%, 65%, and 51% respectively. However, each of these districts had less than 10 transactions, which means that this trend may be volatile and could fluctuate in the next quarters.

Quarterly Growth in Commercial Real Estate Segments

In this section, we examine commercial real estate segments. This refers to commercial offices, shophouses, and retail shops. With the ABSD rate for foreigners doubled to 60%, foreign investors might be looking towards non-residential segments such as commercial and industrial properties to avoid the hefty tax. We look at the transaction activity in the commercial space to get a general idea of how the segment is doing.

The percentage values in the charts refer to the quarter-on-quarter change in Total Transaction Value (TTV), and the colour gradient of the boxes are based on the percentage change compared to the previous quarter. The size of the boxes refers to the relative TTV to other segments, which tells us which segments have the most ‘activity’ in terms of value being transacted.

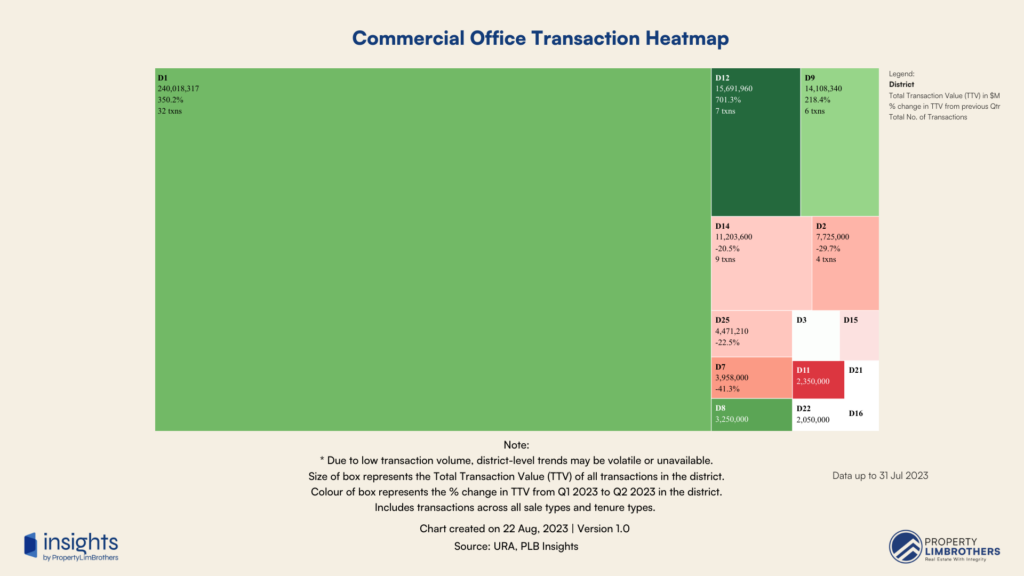

Commercial Office

For the Commercial Office subgroup, the transaction heatmap shows a quarterly growth range of -41.3% to +701.3%. Even though there are more segments with a negative TTV growth compared to the previous quarter, the subgroup is still in the positive overall due to the larger segments.

Unsurprisingly, District 1 continues to be the largest segment with the most transaction activity as businesses continue to seek out commercial office spaces in the Central Business District (CBD). Transaction activity for District 1 commercial offices grew by 350.2% compared to Q1 2023, with 32 transactions amounting to a total value of over $240 million.

District 12 (Balestier, Toa Payoh) and District 9 (Orchard, River Valley) also stood out, with TTV growth rates of 701.3% and 218.4% respectively. However, the low volume of transactions (13 transactions combined) would mean that the trend might be volatile and could fluctuate in coming quarters.

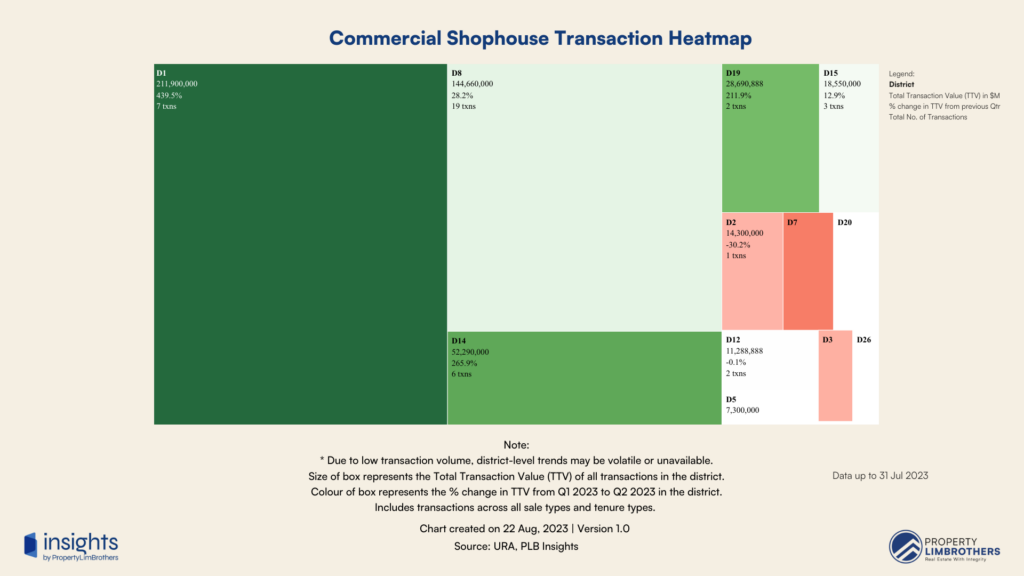

Commercial Shophouse

Coming to the Commercial Shophouse subgroup, the quarterly growth numbers are generally trending on the positive side. The quarterly growth ranges from -30.2% to 439.5%, with the range mostly on the positive side. Shophouses are typically the best performing segment among commercial real estate from a historical perspective. That is because of the limited supply, especially for conservation shophouses.

Last quarter, we saw District 8 (Farrer Park, Serangoon Road) post strong quarterly gains of 40.2% with the highest transaction value. In Q2 2023, District 1 (CBD) surpassed it to become the largest segment, posting $211.9 million in transaction value and a 439.5% growth in TTV from the previous quarter. However, the performance of District 8 commercial shophouses remain strong, posting a 28.2% growth in TTV in Q2 2023, with a total of 19 transactions – the district with the highest number of transactions.

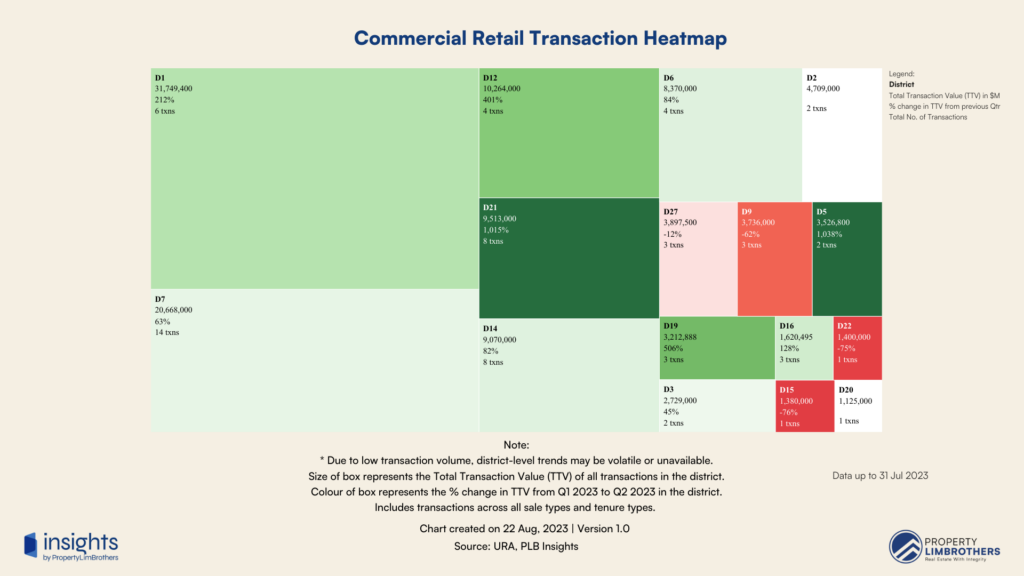

Commercial Retail

Lastly, the Commercial Retail subgroup shows a quarterly TTV growth range of -76% to 1,038%. At a glance, this may be a wide range, but the numbers are reflective of the transaction activity in the previous quarters. The low volume of transactions in this space is natural, given that most businesses choose to rent from mall operators such as CapitaLand and Far East Organisation rather than purchasing their own commercial unit.

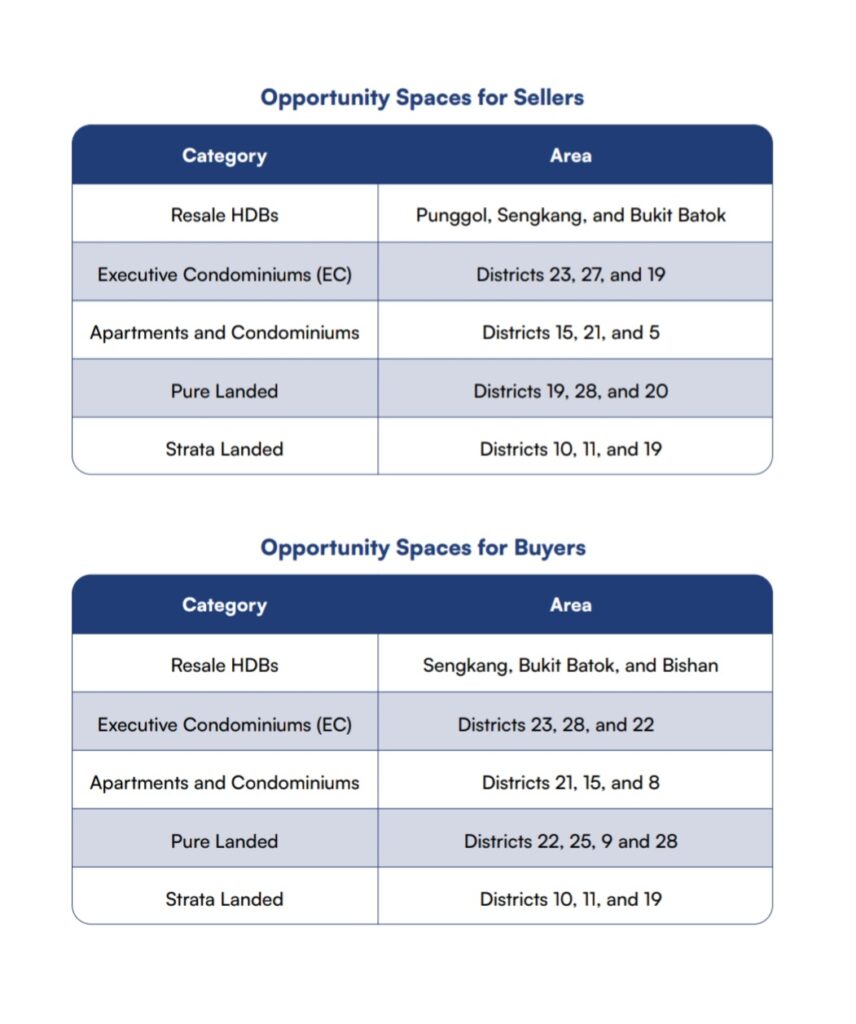

In Focus — Opportunity Spaces for 2023Q3 and Beyond

As the high interest rate environment persists, recessionary pressures continue to pose a significant challenge for investors and market participants. Real estate is often seen as a hedge against downturns in today’s economic landscape, but its performance can vary depending on the type of property and its location. As global economic uncertainty grows, these differences may become even more noticeable. Those interested in the real estate sector, whether as investors, homeowners, or market players, should consider the potential opportunities in the residential segment. However, this is not a buy or sell recommendation. In this section, we are pointing out areas worth further detailed analysis based on individual projects and investment objectives.

Opportunity Spaces for Sellers: Resale HDBs in Punggol, Sengkang, and Bukit Batok. ECs in Districts 23, 27, and 19. Apartments and Condos in Districts 15, 21, and 5. Pure Landed in Districts 19, 28, and 20. Strata Landed in Districts 10, 11, and 19.

Opportunity Spaces for Buyers: Resale HDBs in Sengkang, Bukit Batok, and Bishan. ECs in Districts 23, 28, and 22. Apartments and Condos in Districts 21, 15, and 8. Pure Landed in Districts 22, 25, 9, and 28. Strata Landed in Districts 10, 11, and 19.

Writer’s Note:

In August 2023, police seized over S$1 billion in assets in one of Singapore’s biggest anti-money laundering probes. These assets include more than S$23 million in cash, luxury bags, gold bars, watches, jewellery, and Bearbrick collectibles. Prohibition of disposal orders were issued against more than 62 vehicles and 110 properties. One of the suspects was also found to have financed the purchase of 10 new launch units at luxury condominium Canninghill Piers. As the probe continued, the total value of assets seized had ballooned to S$2.4 billion at the time of writing. The Council for Estate Agencies (CEA) has also launched an investigation into real estate salespersons who might have facilitated property transactions relating to the case. The case is set to be in focus in parliament, along with the new public housing classifications. A ministerial statement will be released in October 2023.

While the full effects remain to be seen in the property market, we will likely see the ripple in the next quarter. Could we possibly see a tightening of due diligence checks in property transactions and other measures to clamp down on money laundering? Stay tuned and we will keep you updated on any developments in the real estate space.

Caveats & Disclaimers

The analysis and conclusions presented in our report are based on the data provided by the sources we have used. Therefore, the accuracy and reliability of our report depend on the integrity of the data provided by these sources.

The information contained in this report should not be construed as financial or real estate advice. It is recommended that you conduct your own thorough research and analysis before making any financial commitments or property decisions. It is essential to consult with qualified professionals to ensure that you have a comprehensive understanding of your financial situation and that your decisions are aligned with your best interests.

If you are interested in connecting with our team of real estate experts, please don’t hesitate to reach out to us. We would be delighted to engage with you on a deeper level and explore how the insights presented in this report could be relevant to your specific property journey.