Amidst Singapore’s ever-evolving real estate landscape, the allure of owning more than one property represents a modern version of the Singaporean Dream – property investment. With property investment associated with the prospect of long-term capital appreciation and the ability to generate rental income, it is no wonder that people aspire to own multiple properties. But is it truly possible to own both an HDB flat and a condo in today’s context?

The answer is a resounding ‘yes,’ and in this article, we will explore the advantages, avenues, and actionable steps to make this dream a reality.

Why a HDB + Private Property Combination?

Singapore offers an array of different property types, however, there are limited multiple property ownership options available in Singapore. For instance, it is not allowed to own more than one HDB flat regardless of citizenship status. Instead, a typical property portfolio for multiple-property owners will either be a combination of a HDB flat and a private property or solely private properties only.

Owning a HDB flat and a private property can be a relatively accessible entry point to multiple property ownership in Singapore. HDB flats are typically priced lower than private properties, making them accessible to a broader segment of the population. As a result, lower maintenance fee translates to higher rental yields for HDB properties as compared to private properties.

Nonetheless, it is important to note that while HDB flats are accessible, it comes with stringent eligibility criteria and regulations. To achieve the HDB and private property combination, one must first own the HDB property before expanding their portfolio to include a private property (with exception to some inherited properties). That is because private property owners are not eligible to purchase HDB flats without letting go of their private properties. Furthermore, the government introduced a 15-month wait-out period for private property owners right-sizing or downgrading to a HDB flat in the September 2022 cooling measures, making it harder for private property owners to restructure their property portfolio in the short-term.

What is Minimum Occupation Period (MOP)?

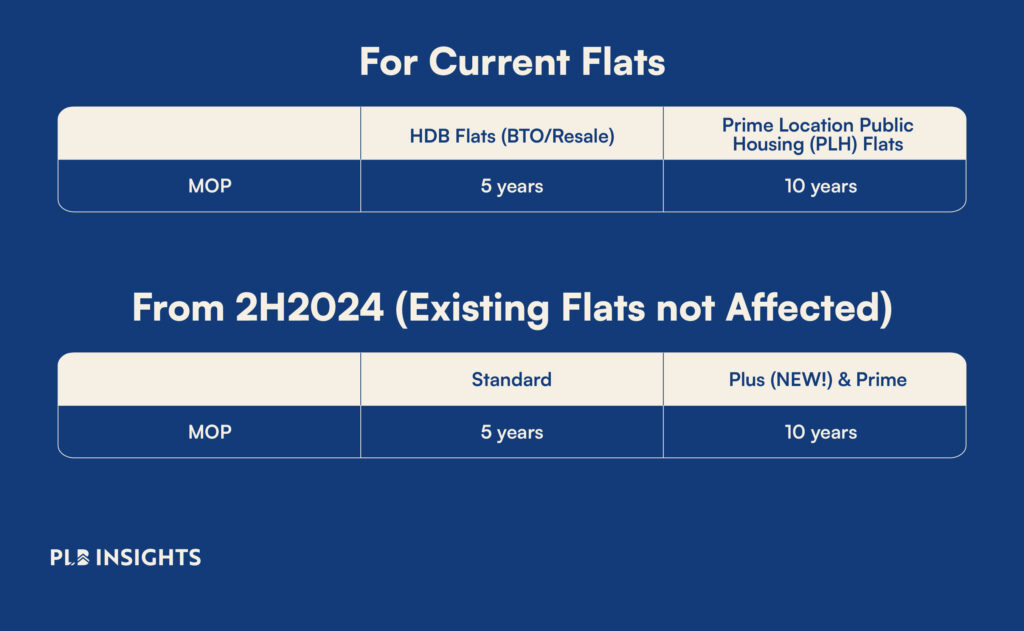

The Minimum Occupation Period (MOP) is a critical requirement for HDB flats, regardless of BTO/resale status. During the MOP, property owners and occupants are not permitted to own or acquire private properties. Renting out the entire HDB flat is also restricted until the end of the MOP.

The duration of the MOP will either be 5 years or 10 years, depending on whether the project falls under the Prime Location Housing (PLH) scheme. From the second half of 2024, flats that fall under the Plus category will also be required to serve a 10-year MOP. Calculated from the date when the keys are received, the end of MOP marks the point at which the owner gains the ability to explore options.

One important caveat to note here is that HDB flats with a 10-year MOP are also slapped with a rental restriction – owners are not able to rent out the entire flat even after MOP. This means that even if you purchase a private property after fulfilling the MOP, you can only rent out the private property and not the HDB.

With these understandings in mind, let’s now explore the different avenues for achieving dual ownership of an HDB and private property after fulfilling the MOP.

Route #1: Pay Additional Buyer’s Stamp Duty (ABSD)

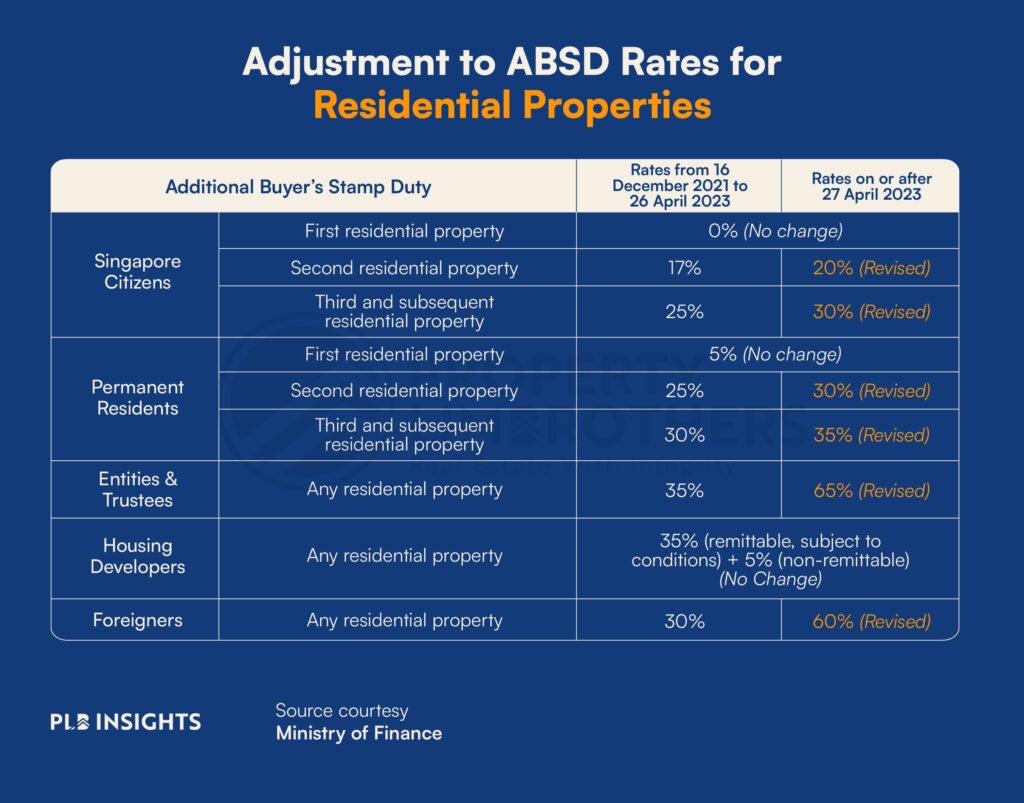

The first method of attaining a private property is through paying Additional Buyer’s Stamp Duty (ABSD). Multi-property purchasers have to pay this ABSD on top of the standard Buyer’s Stamp Duty (BSD).

Paying ABSD is undeniably the most expensive approach to securing a second property. Given that ABSD is calculated based on the purchase price or market value, multiplied by the prevailing ABSD rate, homeowners are subjected to significant upfront costs.

To put this into perspective, let’s consider a scenario where Singaporean citizens purchase a condominium on 30 October 2023 for $1,100,000, reflecting the market value. The ABSD for this condominium would amount to $220,000 (20% of $1,100,000), which, like part of the down payment, other taxes, and legal fees, must be paid in cash.

One of the common scenarios that prompt homeowners to choose this path is when they apply for their HDB flat under a family nucleus scheme. A family nucleus typically includes a spouse, family member, or other eligible family configurations. In such cases, it becomes inevitable for these homeowners to pay the ABSD if they wish to own another property. Family dynamics, as well as personal objectives, can further influence the decision to pay ABSD.

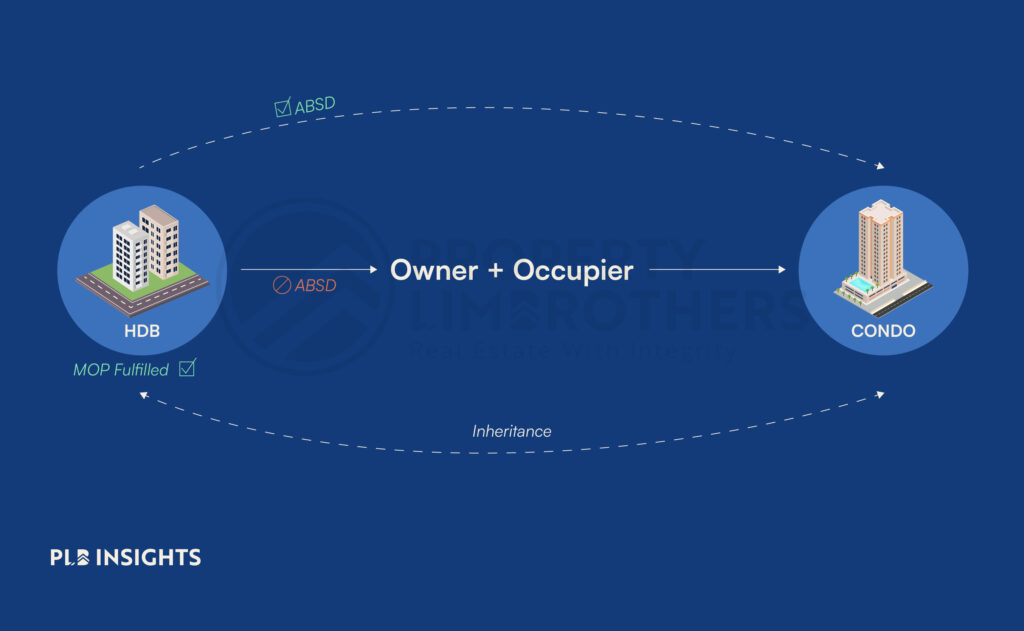

Route #2: Owner + Essential Occupier

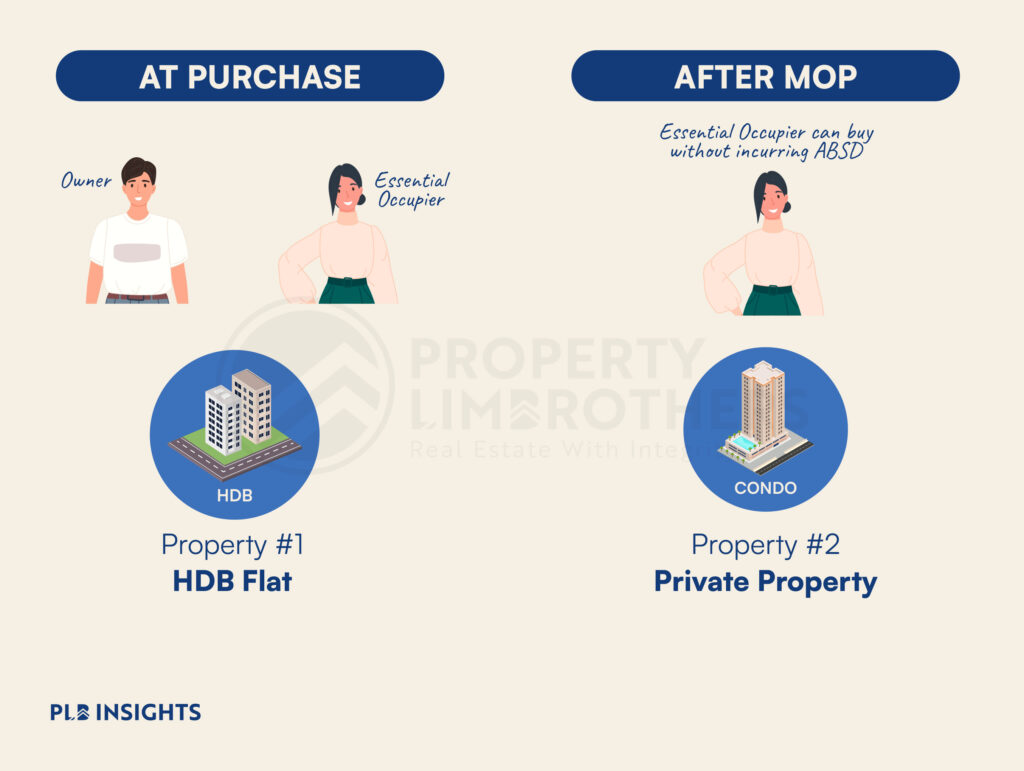

The second route to dual property ownership is commonly known as the “owner-occupier route” or “decoupling.” This process typically occurs either at the point of HDB purchase or through a separate application with HDB.

With this manner of holding for the HDB flat, the essential occupier’s property count remains as zero. This means that upon MOP, the occupier can proceed to purchase a private property without incurring ABSD.

At the time of purchase, the above ownership structure can be declared during the BTO application process or through conveyancing lawyers for resale flats. For those seeking a restructuring of ownership, it is a much more complicated process. Since 2016, the transfer of ownership can only be between immediate family members on a case-by-case basis.

To clarify some key terms:

Owner/Co-owner

An owner has legal rights over a property. If there is more than one owner, the manner of ownership will either be Joint Tenancy or Tenancy-in-common. For joint tenancy, co-owners will be jointly assessed for the loan and are able to use both their CPF to service the mortgage. On the other hand, for tenancy-in-common, only the owner’s income will be assessed for the loan and only the owner’s CPF can be used.

Essential Occupier

An essential occupier is one who forms a family nucleus with the applicant to qualify for a flat from HDB. This occupier must stay in the flat during MOP, otherwise, the flat cannot be sold at the end of MOP. They will also not be allowed to be jointly assessed for the housing loan and will not be able to utilise their CPF to pay for the flat.

It is best to declare the owner + essential occupier status at the point of purchasing the HDB flat if it is within financial means. Changing home ownership after purchase can be a lengthy process and may involve additional costs for all parties involved. For instance, withdrawing owners may be subject to Seller Stamp Duty (SSD) if their interest in the property is less than 3 years old. Additionally, the remaining owner must continue to be eligible under HDB’s various schemes, subject to HDB’s approval.

Ultimately, while decoupling may be a method to save on ABSD, it places a significant financial burden on the owner. The loan and repayment of the property will be based on the owner’s income and CPF savings. Stringent debt requirements make it challenging to secure a loan for a second property, especially with the income of a single individual. This begs the question of whether private property ownership will be out of reach for younger Singaporeans.

Evaluating investment goals is also crucial. As previously discussed, owning fewer properties may be the key to achieving higher capital appreciation, particularly for long-term investment and retirement planning.

Route #3: Inheritance

It is essential to clarify that the information provided below is intended solely for general guidance and informational purposes and should not be considered as legal advice. Property laws and regulations can be complex and may change over time, so it is crucial to seek legal advice and consult with relevant authorities or legal professionals when making decisions related to property ownership, inheritance, and compliance with the law.

Before the implementation of cooling measures in the Singaporean real estate market, purchasing a second property was notably more accessible. These measures, introduced by the government to curb property speculation and ensure housing affordability, have brought about significant changes in property ownership dynamics.

Previously, prospective property buyers, including existing HDB flat owners, enjoyed greater flexibility when it came to acquiring additional properties. Many homeowners could expand their property portfolios without incurring the high ABSD costs and stringent regulations that are now in place. Inheriting a property, whether from a family member or other sources, can lead to dual property ownership as well.

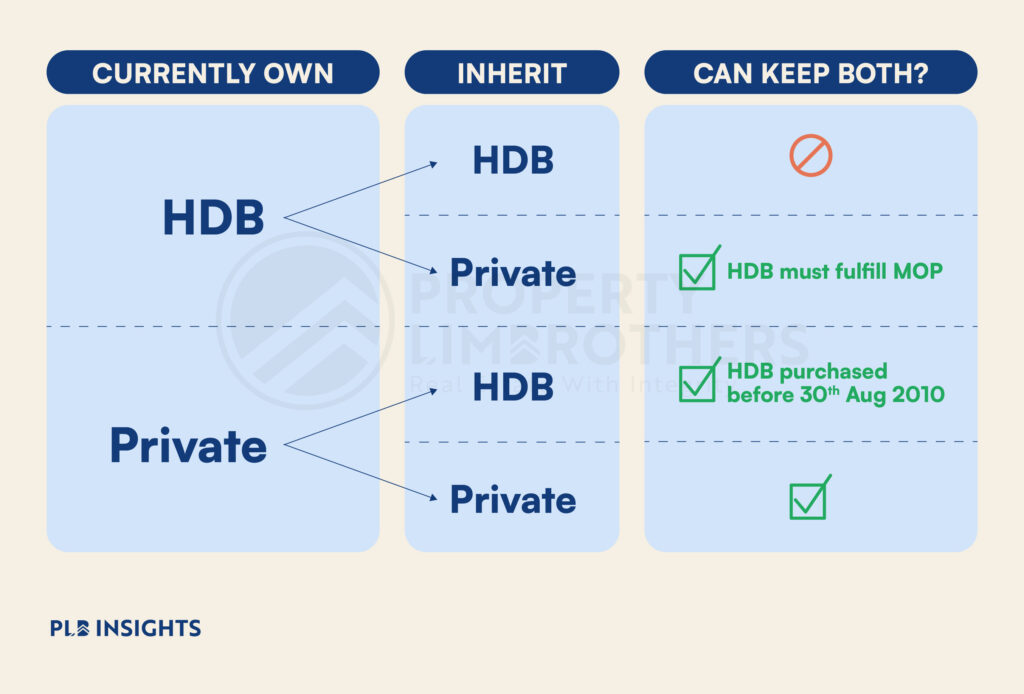

In terms of property inheritance, there are two main scenarios to consider, assuming the previous owner had sole ownership:

Firstly, when a HDB flat is passed down, the new owner must decide which property to retain. As mentioned previously, one cannot concurrently hold onto two HDB properties. Even if HDB is willed out to an individual with private property, it does not automatically grant them the right to keep both. If the inherited HDB flat was purchased before 30th August 2010, both properties may be retained. However, if it was bought after that date, one of the two properties must be sold. Additionally, the household must reside in the HDB flat and is not allowed to rent it out.

Secondly, when a private property is inherited, an individual may retain both properties as long as the MOP for the HDB flat is fulfilled. Non-Singapore citizens can inherit non-landed private properties or landed properties with permission from the Singapore Land Authority (SLA).

The positive aspect of inheriting properties in Singapore is that it typically does not incur additional costs in terms of taxes. Property inheritance tax was abolished in 2009, and stamp duties do not apply in such cases.

Final Thoughts

In October 2022, an interesting trend emerged in the Singaporean real estate landscape. Approximately 3% of HDB flat owners were found to be owners of at least one private residential property, marking a shift in property ownership dynamics. What’s even more intriguing is that a staggering 45% of these HDB flat owners chose to lease out their HDB flats instead of residing in them, highlighting the increasing significance of property investment and rental income as part of their financial strategies.

The above proves that it is indeed possible to have a HDB and private property simultaneously. Either through paying ABSD, owner-occupier route/decoupling, or inheritance, Singaporeans are finding innovative ways to realise the dream of dual property ownership. This trend showcases the adaptability and resourcefulness of homeowners, who leverage the available avenues to navigate the evolving landscape of Singapore’s real estate market. As the future unfolds, the pursuit of property investment, financial stability, and long-term prosperity will likely continue to shape the decisions of homeowners and the dynamics of the Singaporean Dream.

If you are figuring out your property investment portfolio and have further questions regarding ownership structuring and timeline management, feel free to reach out to our experienced consultants.

Till next time!