Many believe that buying property is a foolproof way to secure profitable investments, especially with the skyrocketing property prices in recent years. However, contrary to popular belief, not all property investments guarantee a profit, even in a booming market. Despite rising property prices, some private condominium transactions have ended unprofitable, challenging the notion of real estate as a ‘safe haven’. In this article, we will delve into five such unprofitable condo transactions that happened in 2024, analysing why these investments did not pan out as expected despite the market’s upward trend.

We leveraged our analytics tool, the MOAT Analysis, to explore the underlying factors contributing to this year’s unprofitable sale transactions.

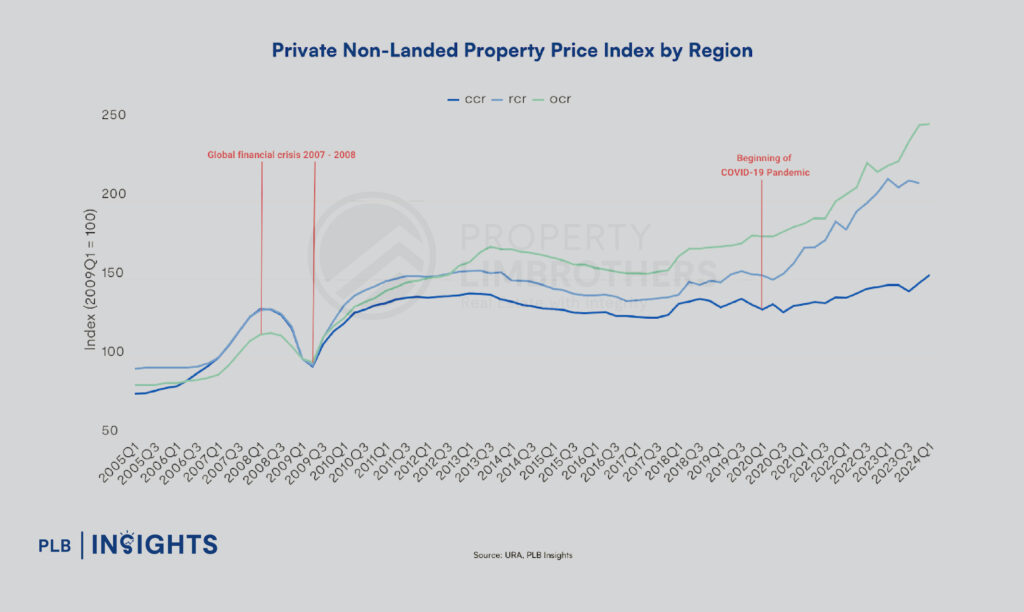

Historical Price Trend of Private Non-Landed Property by Region

Examining historical trends reveals some noteworthy movements, including a sharp decline in the price index during the global financial crisis (GFC) between the first quarter of 2008 and the third quarter of 2009. Additionally, there has been a continuous upward trajectory in prices following the post-COVID recovery period.

This price trend is significant as it provides an overview of the most opportune and least favourable times to enter or exit the market. It also provides context and insight as we delve into the unprofitable transactions below, shedding some light on how timing can significantly impact investment outcomes.

Five Unprofitable Condo Transactions in 2024

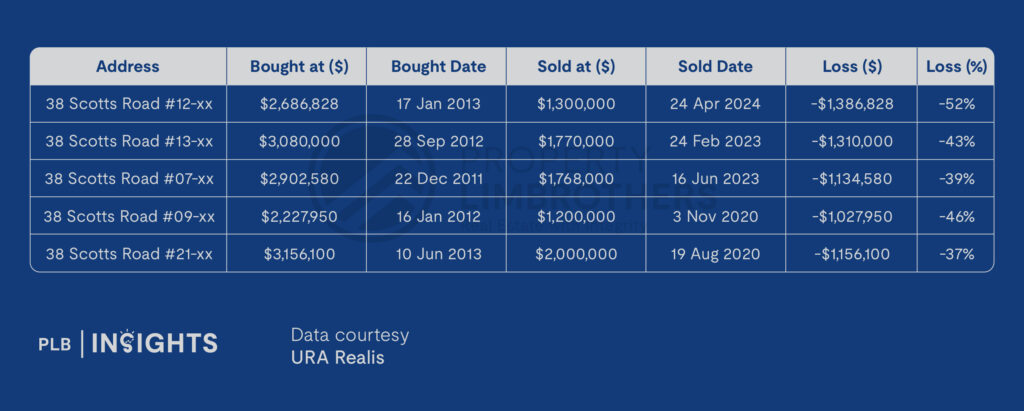

1. The Scotts Tower

The Scotts Tower, a leasehold property which obtained its Temporary Occupation Permit (TOP) in 2016, recorded one of the highest losses this year. According to data provided by URA, the unit was originally purchased for $2,686,828 during the new sale launch on 17 January 2013, but was sold for just $1,300,000 on 24 April 2024, resulting in a substantial 52% loss.

Additionally, some past transactions at The Scotts Tower have also shown unprofitable outcomes, with losses ranging from 37% to 46% as seen from table 1 below.

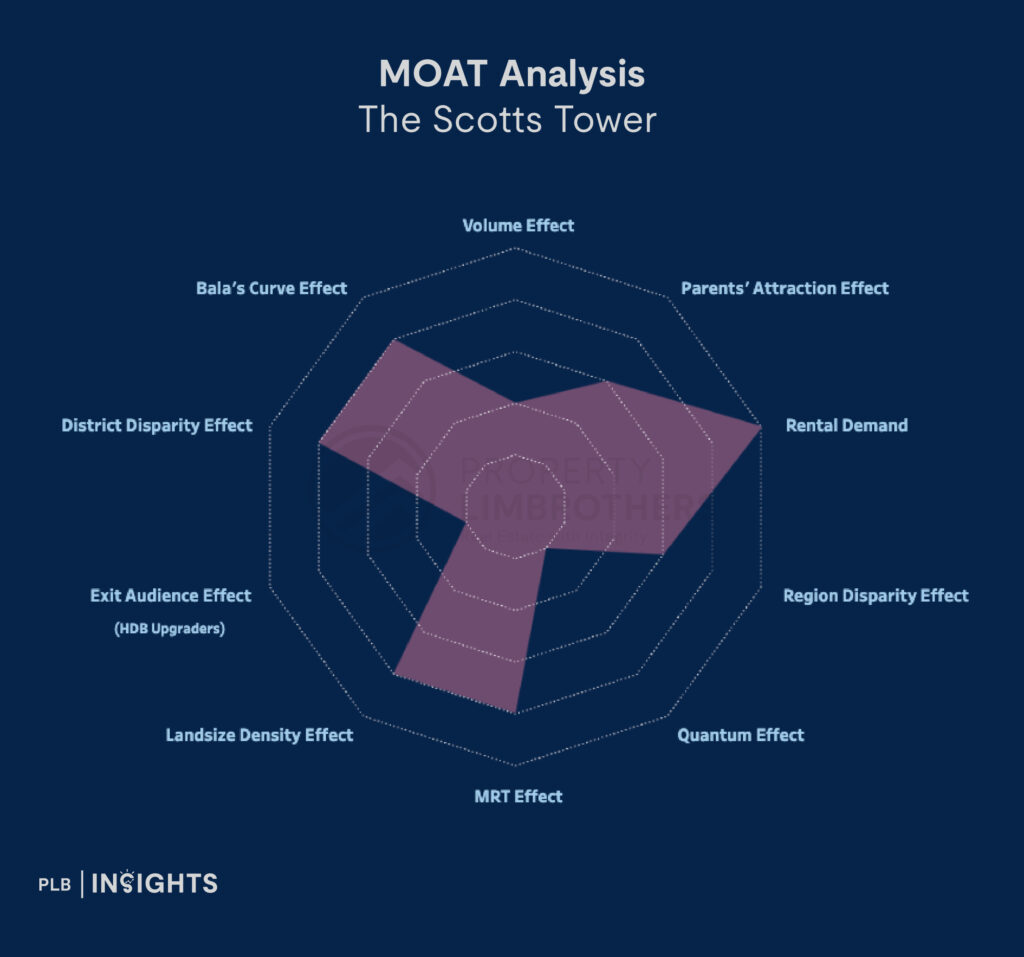

MOAT Analysis

Situated on the fringe of the CBD in the prestigious District 9, The Scotts Tower enjoys a prime location just minutes from Orchard Road. This 31-storey development not only offers nice views but also stands out with its distinctive architecture.

Unsurprisingly, such desirable attributes come at a premium—during its new launch, the average unit was priced at an impressive $2,581 PSF, reflecting the development’s exclusive appeal. It is also worth noting that the majority of units in the development are Small Office Home Office (SOHO) units or one-bedroom apartments.

This then begs the questions – are such attributes boon or bane?

The Scotts Tower achieved a 62% score in the MOAT Analysis, with a perfect score in Rental Demand. This indicates that the property is highly desirable for rental, which is not surprising given its proximity to the CBD. Its strategic location makes it particularly attractive to expatriates and professionals seeking convenient access to the city’s core, thereby driving strong rental demand.

However, it scored poorly in the Quantum Effect, indicating the property’s higher entry price as compared to other properties. This suggests that the steep price tag may limit its appeal primarily to higher-net-worth individuals, pricing out the average buyer and therefore narrowing the pool of prospective purchasers. Additionally, since the condominium primarily consists of mainly SOHO and one-bedroom units, it is less appealing to families seeking a property for long-term residence.

Note that The Scotts Tower was launched during a period when the prices of non-landed properties in the Core Central Region (CCR) were almost at their peak post-GFC, as shown in Figure 1 above. In addition, the April 2023 property cooling measures included adjustments to the Additional Buyer’s Stamp Duty (ABSD) rates, with the most significant change being the doubling of the ABSD rate for foreigners purchasing any property in Singapore from 30% to 60% in 2023. This significant increase in ABSD rates likely dampened demand from foreign buyers, leading to reduced market activity for this project.

The MOAT Analysis also revealed that the project scored relatively low in the Volume Effect, indicating low number of transactions in the last one year. This low transaction volume may have impacted the property’s valuation and price movement, contributing to its weaker market performance.

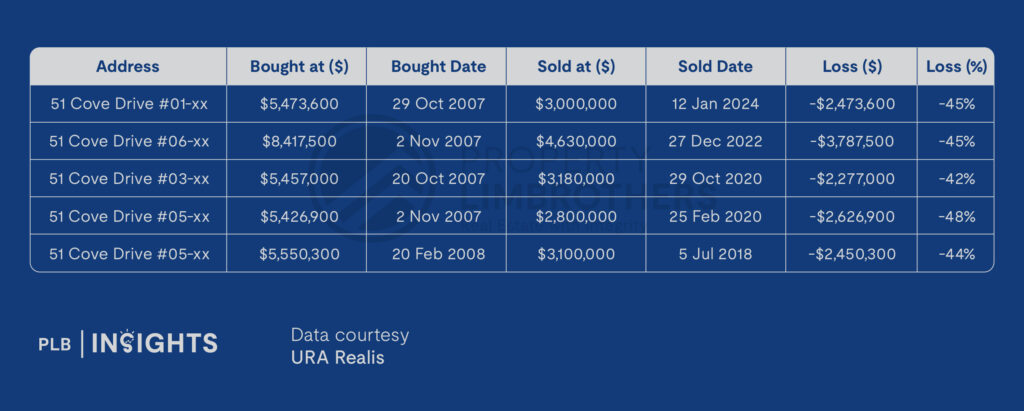

2. Turquoise

Turquoise, a 99-year leasehold property which obtained its Temporary Occupation Permit (TOP) in 2010, also recorded one of the highest losses this year. The unit was originally purchased for $5,473,600 during the new sale launch on 29 Oct 2007, but was sold for just $3,000,000 on 12 January 2024, resulting in a substantial 45% loss.

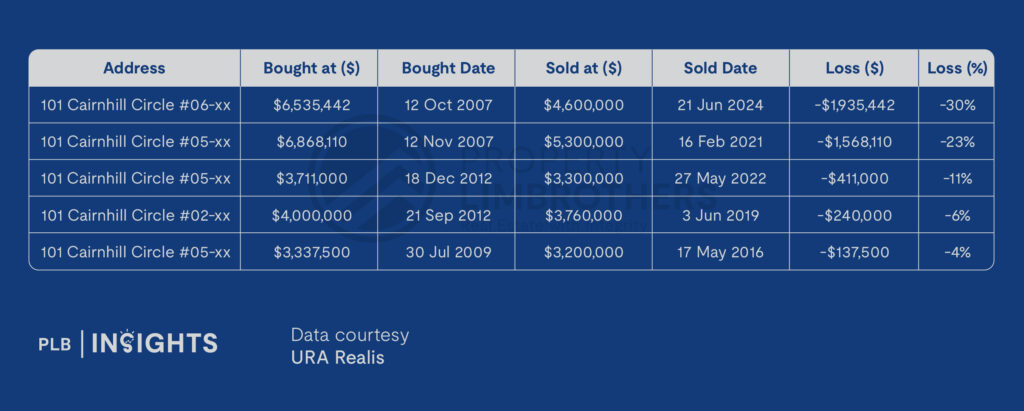

Some past transactions at Turquoise have also shown unprofitable outcomes, with losses ranging from 42% to 48% as seen from table 2 below.

Turquoise is one of the few leasehold condominiums located in the exclusive Sentosa Cove residential enclave. Unlike other condos in the area—such as Seascape, Cape Royale, The Oceanfront @ Sentosa Cove, and The Coast @ Sentosa Cove—which offer sea-facing views, most units at Turquoise overlook the marina.

Properties in Sentosa Cove are often bought by affluent foreign buyers who use them as vacation homes or retreats. However, these buyers are subject to the highest stamp duty rates: the ABSD that has now doubled to 60% following the most recent cooling measures.

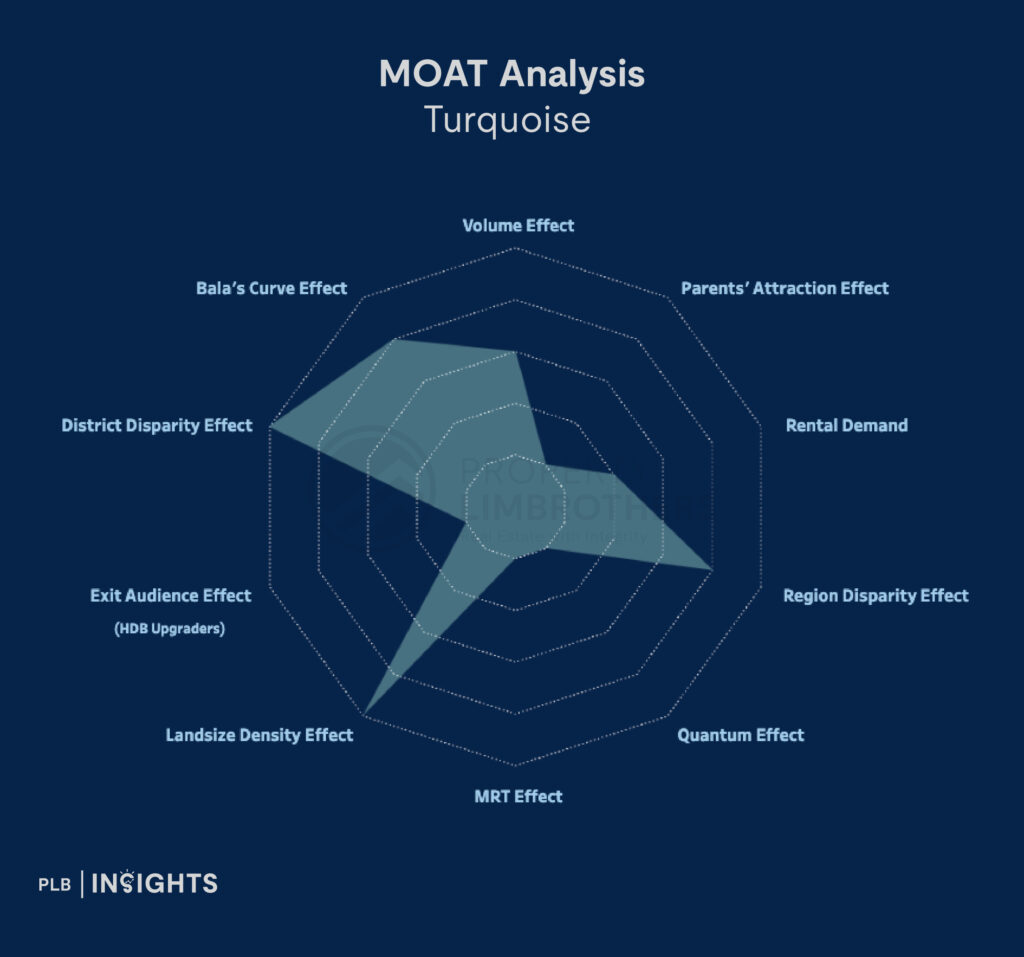

MOAT Analysis

Turquoise achieved a 54% score in the MOAT Analysis, with a perfect score in Land Size Density Effect and District Disparity Effect. The commendable score in the District Disparity Effect comes as no surprise, as its PSF price is notably lower than the surrounding district’s median, offering a more affordable option within this prestigious area.

However, among other effects, it scored poorly in both the Quantum Effect and MRT Effect. These scores suggest that its entry price is higher as compared to other properties, and its greater distance from the nearest MRT station further diminishes its appeal. Most Singaporeans are unlikely to opt for Sentosa as a place of residence due to its inconvenience, particularly for those who do not drive.

At such a quantum (averaging over $5,000,000), locals and Permanent Residents often prefer more affordable freehold properties in prestigious areas like Orchard or Tanglin, which also offer better accessibility due to their proximity to MRT stations.

Additionally, these unprofitable transactions saw market entry at a period when the housing market was at a boom in 2007/2008, as seen from Figure 1, before the market went down after the GFC.

3. Hilltops

Hilltops, a freehold condo development located in Newton, District 9 obtained its TOP in 2011, saw unprofitable transactions in recent years. Just this year, a unit changed hands at a loss of 30%.

Some past transactions at Hilltops have also shown unprofitable outcomes, with losses ranging from 4% to 30% as seen from table 3 below.

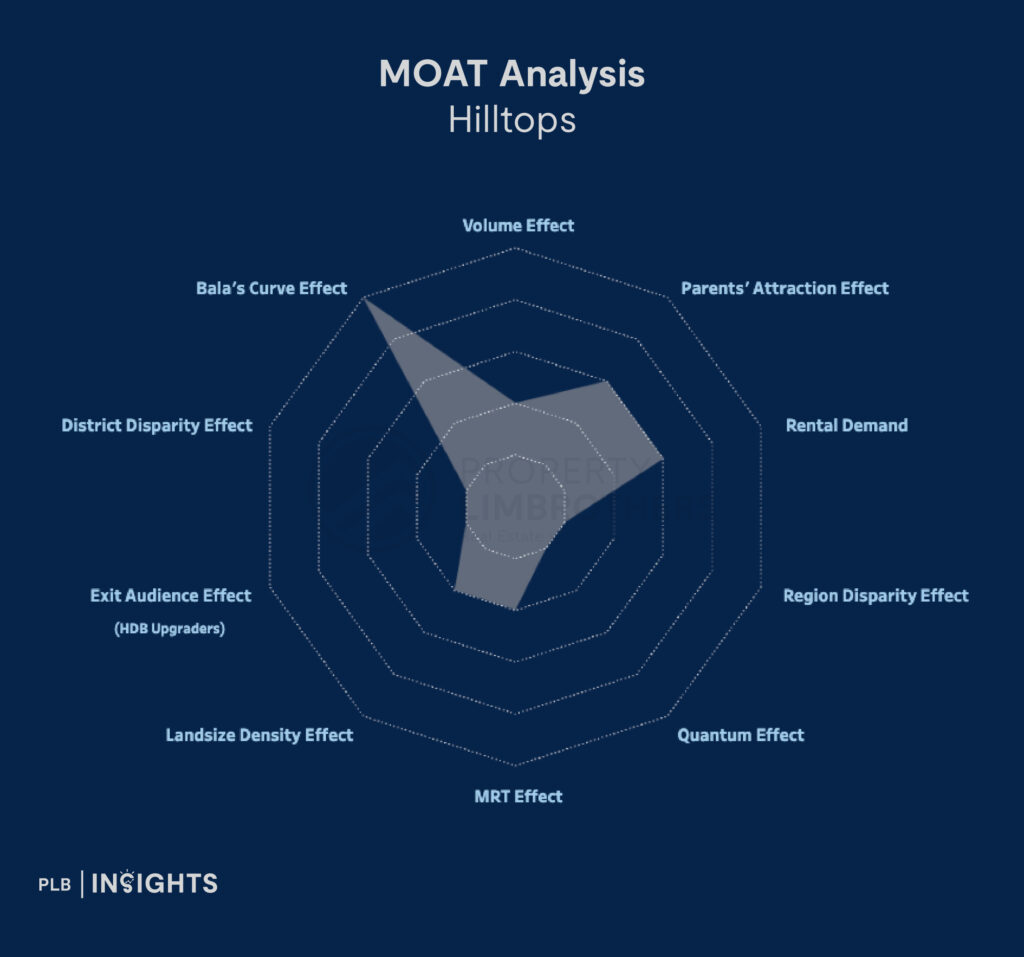

MOAT Analysis

Hilltops achieved a 42% score in the MOAT Analysis, earning a perfect score in Bala’s Curve Effect due to its freehold nature which does not experience lease decay. However, it performed poorly in the Quantum Effect, MRT Effect, Exit Audience Effect and District Disparity Effect. Its higher price point and greater distance from MRT stations compared to nearby developments likely contributed to its limited appeal and lower popularity among buyers.

According to data provided by URA, the median PSF price for new sales during the launch of the project was $3,672. In contrast, the unit that suffered a 30% loss this year was purchased at $4,216 PSF in 2007, significantly above the median launch price. As a result, the high entry quantum of this unit has hindered any potential price appreciation.

In addition, Hilltops also scored poorly in the Volume Effect, indicating low transaction activity, which may have also hindered valuation and price appreciation.

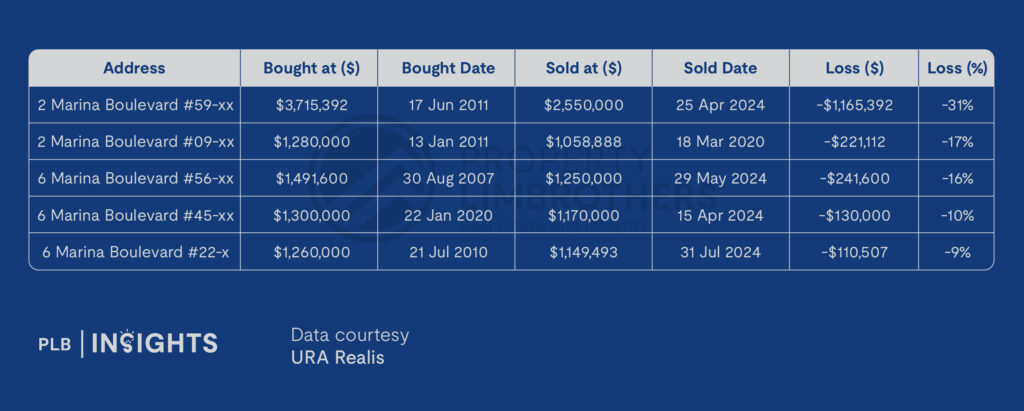

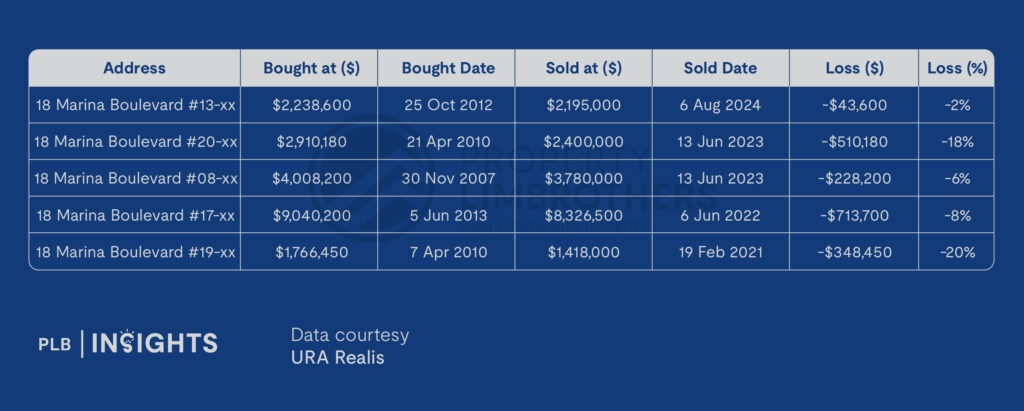

4. The Sail @ Marina Bay

The Sail @ Marina Bay is situated in the heart of the CBD, but even its prime location hasn’t spared it from the several unprofitable transactions. As shown in Table 4, losses range from 9% to 31%, with the highest loss occurring this year.

The seller of the most unprofitable transaction in Table 4 bought the unit in 2011 for $3,387 PSF in the resale market, which is way above the average price of $1,012 PSF for the new sale launched in 2007. The seller sold the unit for $2,154 PSF in 2024, which was higher than the average resale price of $2,065 PSF. However, the higher resale PSF price was not sufficient to offset the initial overpayment.

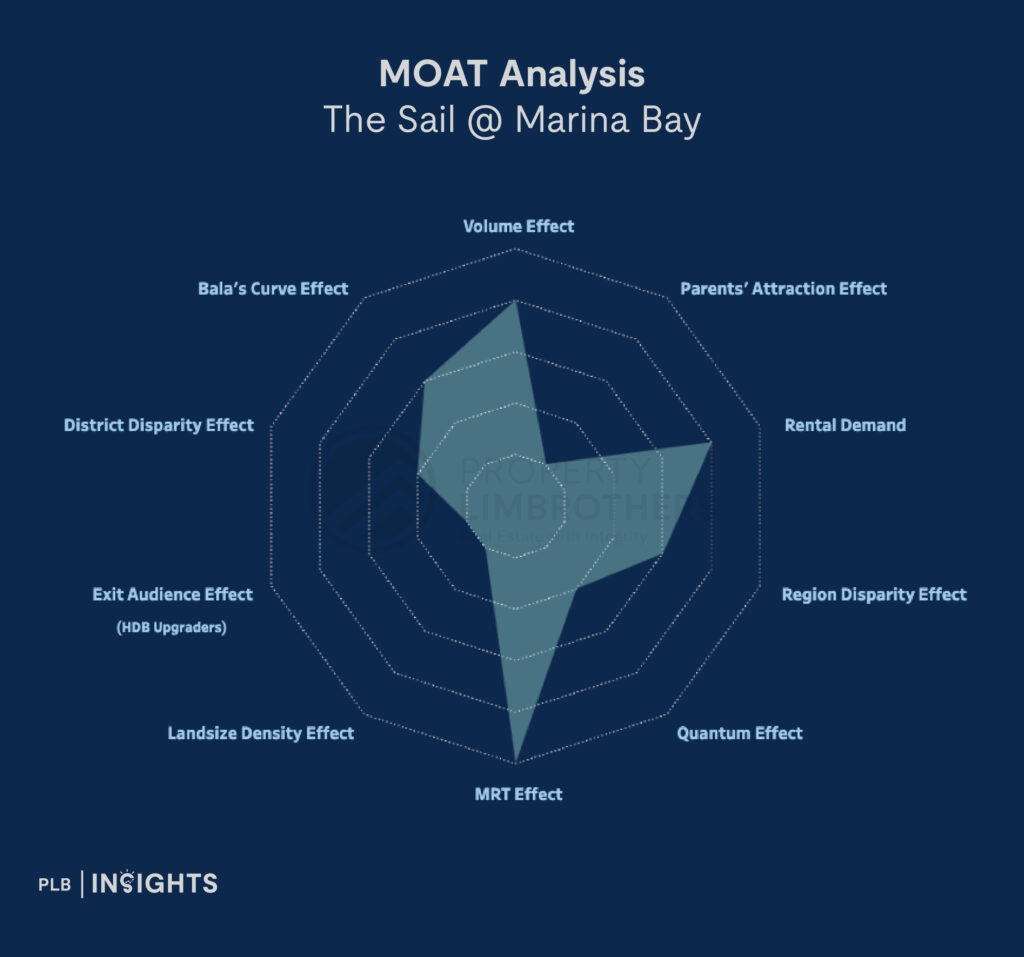

MOAT Analysis

According to the MOAT Analysis, the project scored 52% overall, performing well in the MRT Effect, Rental Demand, and Volume Effect. However, it scored poorly in the Quantum Effect, Exit Audience Effect, and Parents’ Attraction Effect. This again suggests that the project’s relatively high price would limit its pool of buyers, as families and average households may not find it appealing.

Even then, expatriates seeking accommodation near their CBD offices have plenty of options. Within a 500-metre radius of The Sail @ Marina Bay, there are six residential projects offering a total of 3,310 units, including newer developments like Marina Bay Suites (completed in 2013) and Marina One Residences (completed in 2017). Moreover, tenants could get a larger unit for the same price if they move away from the central region.

Furthermore, one and two-bedroom units comprise 56% of the total units, making the development more appealing to investors seeking rental income or capital appreciation rather than owner-occupiers. This dynamic can limit the pool of potential resale buyers.

5. Marina Bay Residences

Situated in District 1, Marina Bay Residences was completed in 2010 and features a 99-year leasehold with 428 units. The apartments range from one- to four-bedroom layouts, nine penthouse units, along with a triplex penthouse.

Despite its prime location and variety of unit types, this condo has seen several unprofitable transactions as seen from Table 5 below.

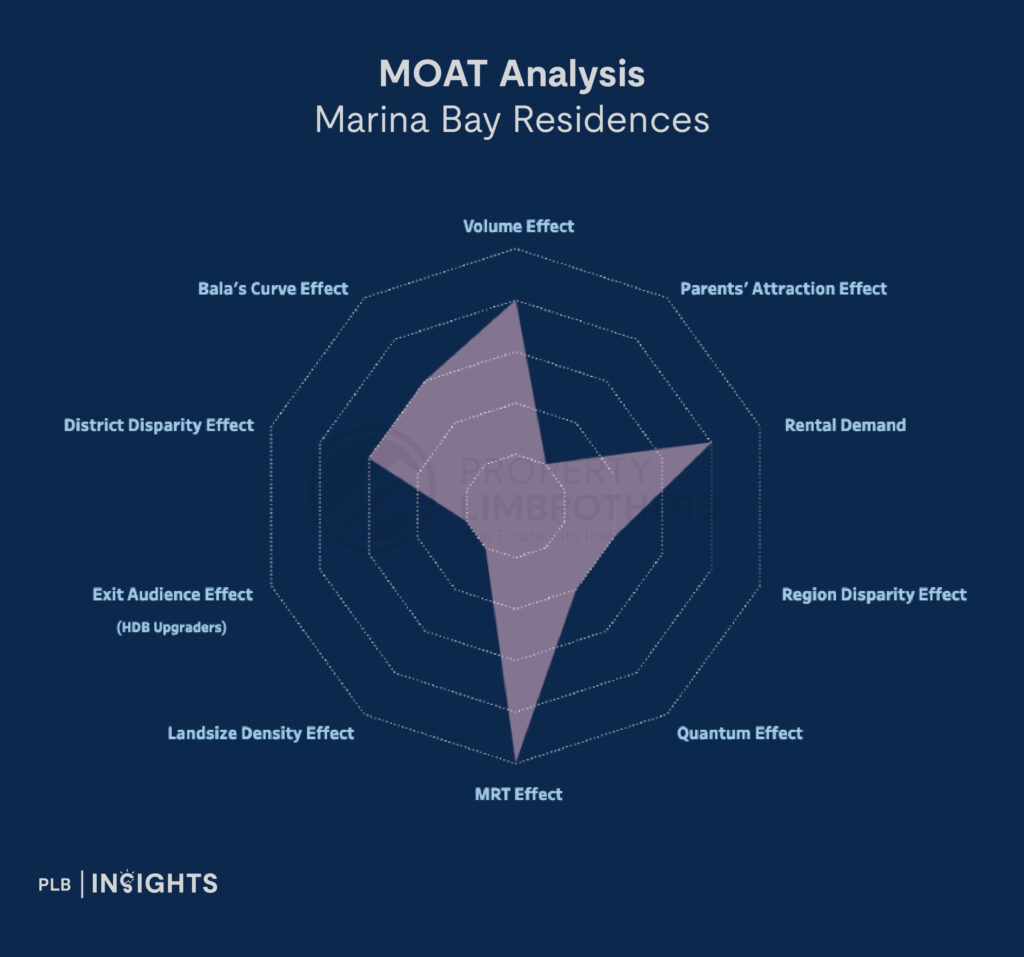

MOAT Analysis

According to the MOAT Analysis, the project scored 52% overall, performing well in the MRT Effect and Rental Demand categories. However, it earned low scores in the Quantum Effect, Exit Audience Effect, Land Size Density Effect, and Parents’ Attraction Effect. The relatively high entry price, coupled with its location lacking schools within a 1km radius and its high-density nature, may have reduced its appeal among potential buyers.

According to data provided by URA, the average price for new sales was $1,871 PSF, while the average resale price was $2,369 PSF. Units that incurred losses were typically purchased above the median new sale PSF price and sold below the average resale PSF price. For example, a unit that experienced a 20% loss was bought in 2010 at $2,449 PSF (much higher than median new sale PSF price) and later sold in 2021 at $1,937 PSF (much lower than resale PSF price).

PSF prices for projects in the prime locations/CCR are generally priced higher relative to other regions. Additionally, recent cooling measures, such as the increased ABSD for foreigners, combined with the limited appeal to average Singaporean households, may have further dampened demand for this project and constrained its potential for price appreciation.

This dynamic may have brought forth the several unprofitable transactions seen in the market.

Final Thoughts

Several key observations were made regarding these unprofitable transactions, which align with the findings from the PLB MOAT Analysis. A common factor among the five projects was their low scoring in the Quantum Effect, reflecting high entry prices that likely hindered significant price appreciation and reduced the pool of potential buyers in the resale market. Additionally, recent cooling measures, such as the doubling of ABSD for foreigners, have dampened market activity in prime locations in recent years, further affecting transaction volumes.

Overall, it is crucial to conduct thorough due diligence when making an investment decision, ensuring that you do not overpay for a property. Careful evaluation of market conditions, pricing, and long-term prospects can help mitigate the risks and enhance the potential for a profitable investment.

We recognise that it may be complex to navigate the property market amid fluctuating property cycles. Our goal is to provide you with up-to-date information to support informed decision-making. Whether you are a first-time homebuyer, an experienced investor, or just considering your options, our team of experienced consultants is ready to assist you at every stage.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.