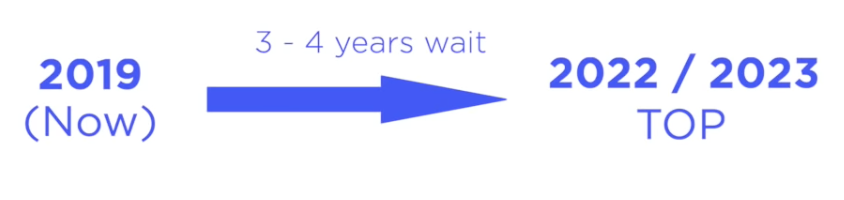

We dive into the key differences between a New Launch Property under construction versus a Private Resale Property that’s ready to move in. We will address a few things: the key behaviour of new launch property upon TOP stage concerning pricing behaviour, and how it compares to that of a resale property. What is the general behaviour of owners who have invested in new launches at show flats and are waiting for the TOP period three to four years later? Find out which is more suitable for a person looking to purchase a Condominium or Private Property in Singapore.

Here’s a look at the first instalment of our brand new educational #InvestorSeries, where we keep buyers and investors up to date on all they need to know about property investing in Singapore.

The million-dollar question for property buyers: Resale or New Launch? When we talk about buying a resale property vs a new launch, different factors come to play as each has its pros and cons. Besides the obvious fact that one is older and the latter is newer, the pricing behaviours that revolve around sellers of these properties also differ. Want to know how to spot them? Keep on reading, and we’ll guide you along!

New Launch Flats

Let’s say you bought a new launch flat at SGD 1 million. When the TOP date rolls around, you get asked by a buyer to sell your apartment as they want a new launch. (FYI: TOP stands for temporary occupation permit, and this is the period where the developer writes to your lawyer to inform you to book an appointment to collect your keys, check for defects, start renovation and move into a new launch property).

If you are keen on selling, you’re not going to sell at the exact SGD 1 million cost price as you invested the few years waiting for the TOP. Depending on market sentiments, you could probably sell between the ranges of $1.15 – $1.2 million. However, if there are no buyers, you will likely stay in that property or rent it out.

Here is an advantage with regard to new launches: the upsurge

Be on your toes: there is a one-off period within the entire life cycle of a project. There will be a target price every property owner in that development will be willing to exit at. Once the very first unit of the new launch is sold in the resale market, the price it is sold at becomes the benchmark for the entire development in terms of resale price. This then creates an upsurge in pricing, and all the other owners in the development can benefit from it as they can now negotiate for higher selling prices.

Interested in new launch projects? We review the buzzworthy Pasir Ris 8 here and the 2022 TOP dated Coastline Residences here.

Resale Properties

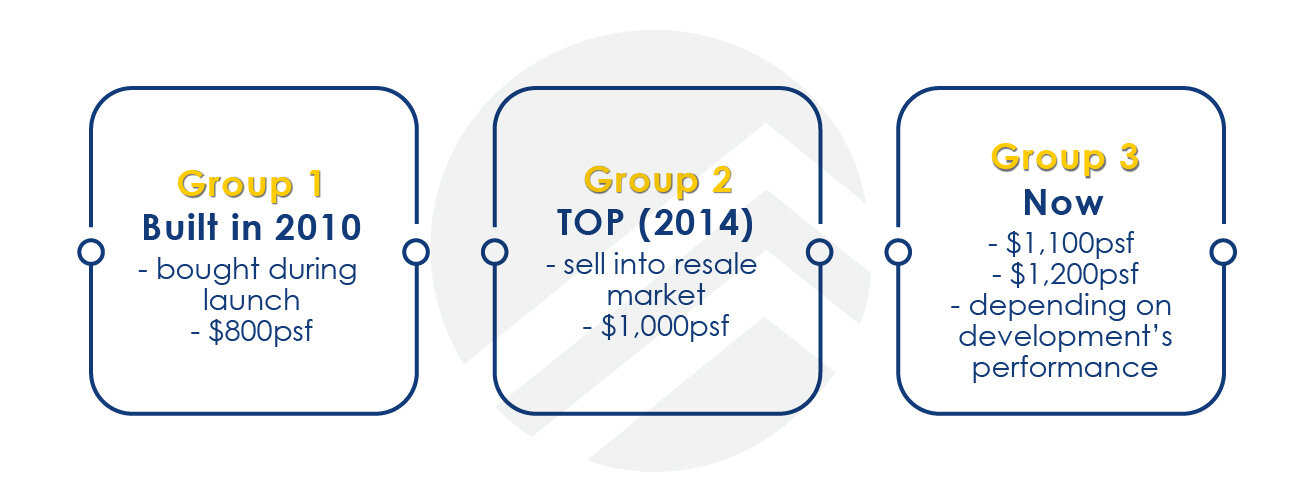

Now let’s look at behaviours with resale properties. There are three groups of buyers concerning resale properties:

For those in group 3, that development has already enjoyed its one off upsurge advantage during its TOP period. So for a resale property to appreciate in price, there are two factors to consider.

Increment in transacted prices over the years

If there is a gradual increment of the price for the units sold in that development throughout the years, this can cause a gradual uptrend in valuation as buyers are willing to pay more. Most buyers are influenced by the latest transactions in the past months and will use that as a guide. Although there are exceptions such as if a particular property underwent a really thorough renovation and the buyers can justify a higher amount for it. Hence, a gradual uptrend is possible if there are frequent transactions and if the transactions increase

En-bloc fever

When a property gets en-bloc fever, it brings positive news and confidence to the market and in turn you get upbeat buyers who will react to this positive news. Due to the positive sentiment, banks are able to match above valuation and buyers willing to pay a bit more as well.

Now for projects with stagnant transactions, meaning that the price has not been increasing over the past few transactions and there aren’t many transactions for the property, this can be a potential concern for owners looking to sell. The valuation of such properties with stagnant transactions will not be as upbeat as a project with frequent transactions.

Volume of units in a property

Properties with a large volume of units are more resistant to price dips. For example, suppose a buyer goes on a fire sale and sells his property below valuation. In that case, one of two scenarios may happen. If his unit is in a boutique property that houses only ten units, this will cause the rest of the properties to decrease in bank valuation. Buyers eyeing that property or those around the area of that property now have more bargaining power against sellers in that property. But if he sold his unit in a property with 100 units, the property is able to be more resistant to price fluctuations and can withstand such occurrences in the market.

Conclusion

Now you know what to look out for, no matter if you are a buyer or seller of such properties! If you are keen on buying or selling your own property but still have uncertainties, don’t fret because we are here to help. Get in touch with us here and the team will get back to you shortly!

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.

Love living in luxe? Looking for a resale? We give our take on the undervalued luxurious resale condominium Reignwood Hamilton Scotts here!

Ps: Place this hashtag #InvestorsSeries in front of any questions you might have for us in our comments section below, or feel free to email us at [email protected]. We would love to answer your queries surrounding property investing in Singapore!