“New launch developments are getting too small and too expensive!” This is a line we often hear from buyers entering the property market today. More often than not, condo buyers are either pro-resale or pro-new launch, and may have many preconceptions and even misconceptions that could cloud their better judgement. So in this article, we lay it all out with an in-depth analysis into the advantages of new launch vs resale condos, and how they should inform the condo buying decision.

Advantages of buying a new launch condo

Aside from that new home feeling, here’s a list of benefits for buying a new launch condo instead of resale.

More units to choose from

Buyers get to choose among all the units on sale to best suit their needs and preferences. In many cases, however, this is dependent on their ballot number and is based on a first come first serve basis. Buyers of resale condos, on the other hand, have limited choices as they can only buy the units put up for sale

First Mover’s Advantage

It is a common trend for developers to offer early bird or VVIP discounts to early buyers usually in the first and second phase of launch to create hype. After a few months or quarters have passed, a new launch project will typically get more expensive, depending on the market sentiments and how the project performs in its launch phase. And sometimes, when it is near completion, balance units tend to move slightly upwards in terms of psf based on market sentiments of course.

The other first mover advantage lies with the fact that the developer may be in a hurry to sell a new launch project’s balance units before completion and offer attractive discounts on these units. Either way, buyers have a high likelihood of making paper gains on a new launch unit upon the project attaining its Temporary Occupation Permit (TOP)

The rationale behind capital appreciation upon completion is the presence of buyers willing to pay a premium to enjoy immediate occupation at a new condo, contributing to what is known as the TOP effect. Buyers who have an investment mindset can take advantage of this First Mover’s Advantage for potential capital gains.

Higher chance of seeing an appreciation: But is it guaranteed?

There is a common myth that new launch condos are a definite profit generating investment vehicle because of its potential for capital appreciation. It is also believed that first owners of new launch developments can usually earn more at the time of reversion because they bought at a much lower developer’s price at launch date as compared to future resale buyers, which limits the upside potential of resale unit owners looking to liquidate their investment. Moreover, there are occasions when developers see a need or are motivated to clear its balance units nearing their ABSD due dates. However, most developers locally have a very strong holding power, and such cases are quite rare.

However, is this true all the time? Yes, we do see an increasing trend of new launch buyers reaping their pot of gold when they liquidate their property at an appreciated price. However, we have also observed cases where new launch developments undergo depreciation in price. Ultimately, what sets a profitable new launch project apart from others is its inherent qualities that embodies a thick MOAT. This can be achieved by choosing an investment property at a good location with high demand that encompasses a few anchoring factors.

Here at PLB, we have curated a comprehensive Moat Analysis, where we select properties with a 10-15 point investment analysis checklist to ensure that the investment is viable, has a safety benchmark against worst case scenarios, and has low vacancy rates plus other attributes to take advantage of the market when it is appealing in terms of demand and appreciation.

No Payment of Cash Over Valuation (COV):

For resale units, there might be a difference between the seller’s asking price and the actual valuation of the development accepted by the bank. This difference in valuation is known as the ‘Cash Over Valuation’ and has to be covered by the buyer in cash (use of CPF is not applicable). Buyers of new launch condo can however avoid incurring such additional costs because the banks accept the developer’s price as the actual value (most of the time).

One-off advantage during TOP stage:

We have observed a very common behavioural pattern amongst buyers of new launch projects. Interested buyers would first head down to the respective show flats, commit to purchasing their desired unit, and eagerly await for the project to obtain it’s TOP. Upon the attainment of the TOP, first owners of these new launch projects typically have 3 choices: move into the comfort of their new home, rent out their unit, or hopefully sell off their investment property at an appreciated price.

What happens more commonly is that these first owners would have the same mindset and choose to sell off their unit at an appreciated price, and the first profitable transaction into the resale market usually sets the benchmark for future transactions. What this means is that all other owners will benefit from this surge in their property value. Therefore, this phenomenon is one of the key drivers to making new launch projects so popular in the housing market!

More flexibility on buyer’s cash flow

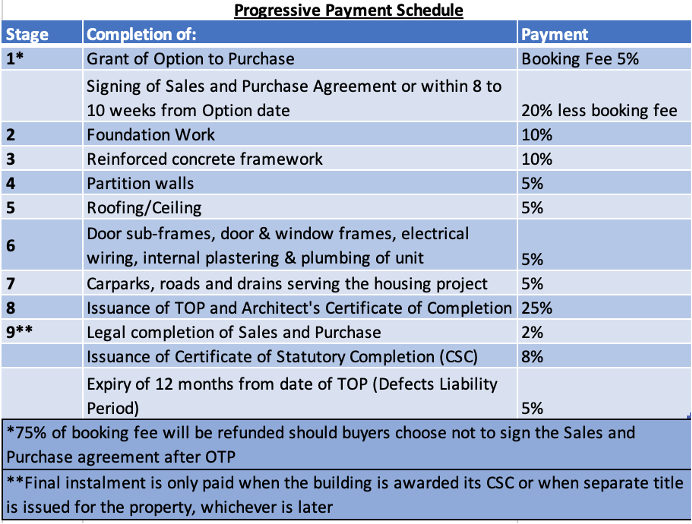

With the Progressive Payment Scheme (PPS), buyers of new launch condos can make repayments based on the completion status of the development. This is not the case for buyers of resale condo as they are obligated to make full repayment within 8-10 weeks of exercising their OTP. This large commitment of capital at the beginning stages places a huge strain on the buyer’s cash flow. We hav

e included a payment schedule calculator here.

Referring to the table above, the Progressive Payment Scheme is applicable to buildings under construction, where buyers disburse payment based on the development’s construction progress via an interim Building Under Construction (BUC) loan. A BUC loan allows buyers to enjoy ownership of the property without forking out the full mortgage instalment on the purchase price until full completion, when the actual property loan begins.

The PPS protects buyers in cases where developers are unable to complete their project because of financial difficulties, defaults, or risk of bankruptcy, which was the case in Sycamore Tree and Laurel Tree Condominium. That being said, buyers must also be mindful as the increase in repayment amounts over time could outpace their financial ability to repay the loan instalments.

For example, when developers submit completion of multiple stages within the same period, coupled with high floating mortgage rates, it can cause repayment amounts to inflate. Buyers should also note that payments must reach the developer within 14 days of receipt of notice from the developer, where failure to do so will result in late payment charges.

Developers would sometimes offer non-price incentives to make the sale of their new launch more attractive, and to provide buyers with more flexibility on their cash flow. These incentives include promotional packages like renovation subsidy or a free bundle of white goods.

Other perks that we’ve seen developers offer included extended defects liability period, rental guarantee (common for commercial properties), mortgage interest subsidy, free legal fees, and alternative payment schemes such as Deferred Payment Scheme (DPS).

Lease Decay issue for 99-year leasehold tenure condos

Newly launched condominiums have a fresh lease and hence it would be quite unlikely that buyers would face any issues with reduced property value due to tenure of the development. It would also be quite rare for buyers to face any difficulties in financing the purchase in terms of maximum loan quantum.

Moreover, with a fresh lease period, owners of a new 99-year leasehold condominium can pass down the development to the next generation. This is taking into consideration that leasehold condo values tend to fall after a third of its lease has elapsed.

New facilities, features, and minimal renovation costs

New launch condos are more relevant to the lifestyle and preferences of today’s buyers, just like how resale condos were once relevant to the lifestyle and preferences of buyers back then. For example, swimming pools in new condos are far larger than condo pools in the 90s, and function rooms with a full suite of kitchen appliances and dining tables were unheard of back then.

On top of that, new launch condominiums are also incorporating technological features like never before, such as smart home systems, intelligent cooling, automated windows/blinds/doors/curtains, smart security systems, smart appliances and even electric car charging stations. Not only are these features usually not found in resale units, they would also require large sums of money to implement and upgrade, meaning it will never be approved by condo management.

Moreover, since new launch condominiums are newly designed and renovated, buyers can spend a minimal amount on renovation costs upon moving in.

Cost of maintenance

Since facilities and equipment are new, newly developed condominiums are less vulnerable to defects and wear and tear, which means that maintenance costs will likely stay constant. In contrast, older resale condos may see facilities and essential amenities deteriorating, necessitating increases in maintenance fee over the years that can prove costly to buyers.

Moreover, new launch condominiums have a 12-month defects liability period, where developers are obligated to fix any defects for free, as compared to resale units where caveat emptor applies.

Advantages of buying a resale condo

Resale condos have their own set of plus points over new launch condos, here’s a whole list of them:

Healthy demand for resale condominium

According to the SRX monthly report, transaction volume hit a 10 year high in March 2021, demonstrating that the demand for private resale condo units remains high especially in the OCR.

Although the resale price index is on an uptrend, resale condos in general are still more affordable on a per square foot (psf) basis as compared to new launch condominiums, so buyers might feel like they are getting more value, not to mention a larger floor area, with a resale property

That said, some buyers may be having second thoughts about buying resale property now because it’s a seller’s market, and cash over valuation is high. Resale buyers might also be attempting to time the market, thinking that cooling measures might bring prices back down soon.

Spill-over demand

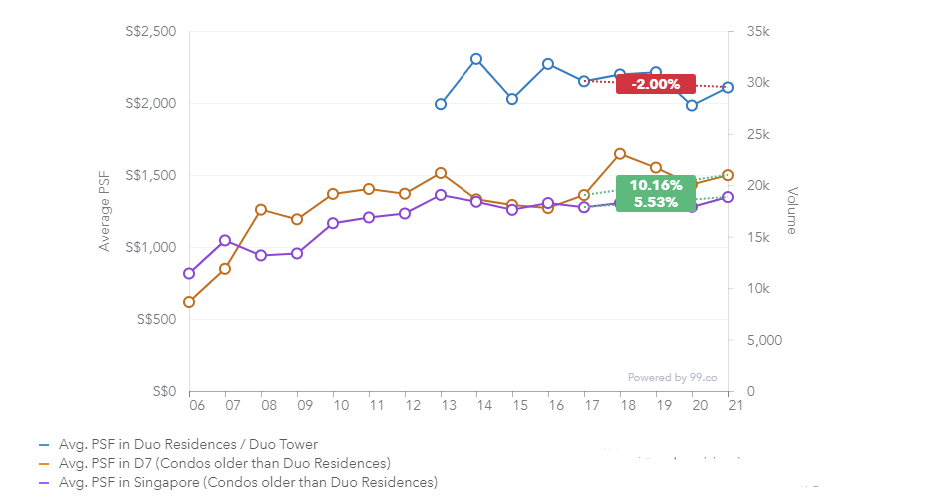

The launch of a new condominium in an area could contribute to the increase in demand and value of resale condominiums within the same area. For example, the resale market in district 7 saw a 6.08% increase YoY in March 2021, which is likely attributed to the spill-over demand from the introduction of new launch developments like Midtown Modern into the vicinity.

Obviously, another factor that can increase demand for housing and t

he resale value of condos is new amenities and infrastructure such as MRT stations.

Resale buyers hoping for capital gain can tap into this latent advantage for higher rental yield and potential capital gain in the future. Furthermore, the launch of a higher-end newly developed condominium can improve the image and status of the neighbour, like Duo Residences did for District 7 some years back. The chart below shows the robust price performance of D7 condos following the completion of Duo Residences:

Image courtesy 99.co

Lower investment risk

Investor-buyers can easily predict the rental income for a unit in a completed condo based on the historical rent of the condo. These buyers can also more easily discern, with the help of their agents, estimated vacancy rate of the resale unit.

As such, it is also easier to make an accurate estimation of rental yield and potential capital appreciation when buying a resale condo versus a new launch because it is ultimately hard to make an accurate estimation based on historical rent of neighbouring condos, which might differ in attributes.

What you see is what you get

Show flats of new launch condominiums are often embellished to make the development more attractive. For resale condominium, potential buyers can do their due diligence by going down to the development physically to check on several determining factors, such as the noise level and crowd at the condominium facilities, quality of neighbours, effectiveness of management committee, upkeep of common condominium facilities, accessibility and overall ambience of the development. For a new launch condo, it’s hard to gauge the noise level and view of, say, the 16th floor unit from the ground level.

The unpredictability of neighbours is another thing about new launches. We have all certainly heard of that one disruptive neighbour who plays mahjong late into the night, or pungent smelling food oozing from the next door neighbour. Therefore the ability to do due diligence physically is a huge advantage because you certainly do not want to be at the mercy of neighbourly disputes, nor do you want to pay obscene maintenance fees for badly maintained facilities in the development! This is why buyers of new launch condominium development would be more willing to pay a premium and gravitate towards projects led by reputable developers.

Ability to move in quickly

Individuals, newly-wed couples, or couples with kids who are in need of a new apartment can move into their resale property within a couple of months after signing on the Option to Purchase, instead of having to wait a few years for a new launch condo to attain TOP.

For investors, buying a resale condo unit also allows them to rent out their premises immediately for rental income. To investors, this incentive can sometimes offset some of the advantages of early bird discounts provided by new launch condominiums.

More room for negotiation

The final transaction price of the property is ultimately subjected to the result of the negotiations with the seller. Buyers may also come across the opportunity to buy units at a steal depending on the seller’s motivation. Sellers might want to liquidate their property quickly because of various motivating factors, such as financial difficulties; divorced couples wanting to get rid of their apartment to avoid bad memories; urgent need to obtain extra cash for personal reasons/new investment opportunities; or some could simply just be looking to leave the country or to relocate.

Typically bigger units

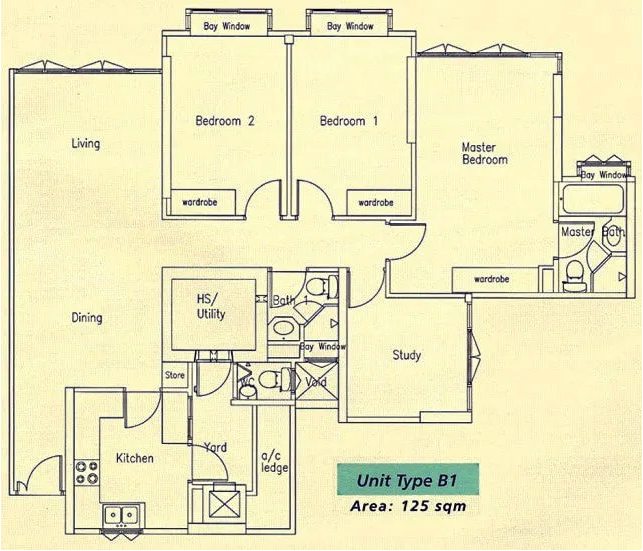

There is a healthy demand for resale condo units simply because they typically have larger floor areas. Let’s dive in and take a look at the evolution of floor plans of 3 bedroom units of resale developments in the RCR from the different eras:

Leedon 2 was a development completed in the year 1997. This is the floor plan of a 3 bedroom apartment with a unit size of 1,550 sqft. A typical 3 bedroom apartment at this development ranges from 1,421-1,830 sqft.

Image courtesy: 99.co

This is the floor plan of a 3 bedroom apartment with a unit size of 1,345 sqft at Bishan Loft, a resale development completed in 2000.

Image courtesy: propertyprosg

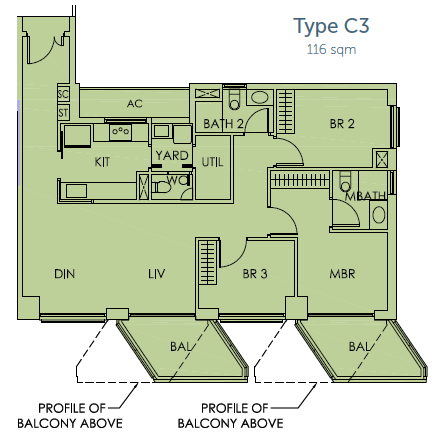

Next up, this is a floor plan of a 3 bedroom apartment at Sky Habitat, which was completed in 2015. A typical apartment of such unit size ranges from 1,216 – 1,249 sqft.

Image courtesy: Skyhabitat

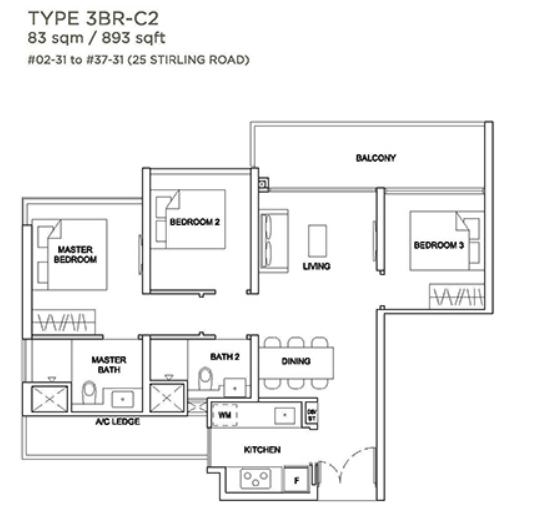

Lastly, this is the floor plan of a 3 bedroom apartment at Stirling Residences, slated for completion in 2022, with a unit size of 893 sqft.

Image courtesy: Stirling Residences

The larger unit size of older resale units means buyers are paying a lower price psf as compared to those in newly developed projects, making it an attractive proposition for buyers with big families. However, this usually comes with the tradeoff of a lower future resale value because of the lease decay effect, with the exception of condos with freehold tenure of course.

Previous owner’s ‘treasure’ – Savings on renovation (if the unit is renovated nicely)

Although new launch condos do come with brand new white goods, we have come across a fair number of sellers who intend to leave behind expensive and well-maintained equipment and furniture, such as branded/high quality kitchen countertops, designer furniture and expensive tiling. These can greatly reduce a resale homebuyer’s renovation outlay and make the home a value buy.

Final Verdict: Should buyers choose a New Launch or Resale Condo?

There are some factors you need to consider before signing on that dotted line; How urgently do you need to move in? What is your current financial situation? What is the objective of such capital intensive purchase: is it purchased as an investment vehicle, or is it for own-stay purposes?

Investment property:

A new launch condominium can be a serious contender for buyers who are consciously on a look out for capital gains on their real estate investments. New launch condominiums typically attain some sort of appreciation upon completion and investors stand to make paper gains even before generating rental income on the property. Moreover, the Progressive Payment Scheme of a new launch condominium further reduces buyers’ initial outlay

It should however be noted that buyers should do their own due diligence before making any purchase decision, as there have been condos that have their value decrease upon completion.

On the flip side, buyers who are looking to generate rental income can consider resale condominium as a viable option. Best of all, buyers can sometimes even spot resale units selling below market rate.

For Primary Pivot Home

For buyers who are looking to move in immediately, a resale condominium is the obvious choice. However, buyers can also opt to pay a premium to occupy a newly TOP-ed development. With that said, we feel that comfort should be prioritised above all else. New launch condominiums typically have new and better facilities, and require minimal renovation, whereas resale condominiums usually have bigger space, lower price psf, and most importantly, allows buyers to do their due diligence on-site.

Ultimately, buyers should consider what they value most and make a decision that best suits their needs and preferences.

For buyers who are still on the fence, feel free to contact any of our agents for a more comprehensive understanding to guide your next purchase decision!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.

Connect with PLB

Subscribe to Our YOUTUBE Channel:

► http://youtube.com/PropertyLimBrothers/?sub_confirmation=1

Visit Our Website:

► http://PropertyLimBrothers.com

Like Us on Facebook:

► http://facebook.com/PropertyLimBrothers

Follow Our Instagram:

► http://instagram.com/propertylimbrothers

Tik Tok

► www.tiktok.com/@propertylimbrothers?lang=en