Home sales, both resale and new launches, usually dip during the Hungry Ghost Festival. However, August 2024 saw new home sales hitting a 17-year low since official data became available in 2007. Including new Executive Condominium sales, only 244 units were sold—falling below the previous low of 325 units during the Global Financial Crisis in 2008.

With developers adopting a more cautious approach, as reflected in the lacklustre bids for Government Land Sales (GLS) sites at De Souza Avenue and Canberra, Singapore’s real estate market appears to be heading towards a downturn. This raises key questions for discerning homebuyers: Is now the right time to purchase a new launch residential property? Could investing in a new launch now lead to financial losses?

In this article, we’ll explore the record low new home sales in August 2024 and offer insights and predictions on what this means for the future of Singapore’s real estate market.

Overview of August 2024’s New Homes Sales Rate

Amid sustained high interest rates, weak economic outlook, and poor sentiments towards the local real estate market, transaction volume for new homes in 2024 is shaping up to be the weakest since 2008 when 4,264 new homes were sold, as market sentiment remained cautious since late 2023.

August’s new home sales, including Executive Condominiums (ECs), saw a sharp 60% drop, falling from 608 units in July to 244 in August. This is also 62% lower than the 649 units sold in August last year, according to Urban Redevelopment Authority (URA) data released on 16 September 2024. Excluding ECs, only 208 private non-landed residences were sold in August, marking a 64% decline from July’s 571 units. Of these 208 units, 60% (123 units) were located in the Outside Central Region (OCR), 31% (65 units) in the Rest of Central Region (RCR), and 9% (20 units) in the Core Central Region (CCR).

Despite the drop in developer sales in August, the median price of new non-landed private homes surged by 42% month-on-month, rising from $1.7 million in July to nearly $2.4 million. This sharp increase has deepened scepticism among potential buyers, many of whom are hesitant, fearing they will be priced out of the market as new launch prices continue to climb.

When Is the Right Time To Buy A New Launch?

We always recommend staying active in the market, rather than attempting to time it. The main reason is that home prices, especially for new launches, are expected to keep rising. Remaining on the sidelines could result in missing out on your ideal new launch home or investment. Experts predict that further interest rate cuts later this year could boost market sentiment. However, the resulting increase in property transactions is likely to drive residential property prices higher due to increased demand.

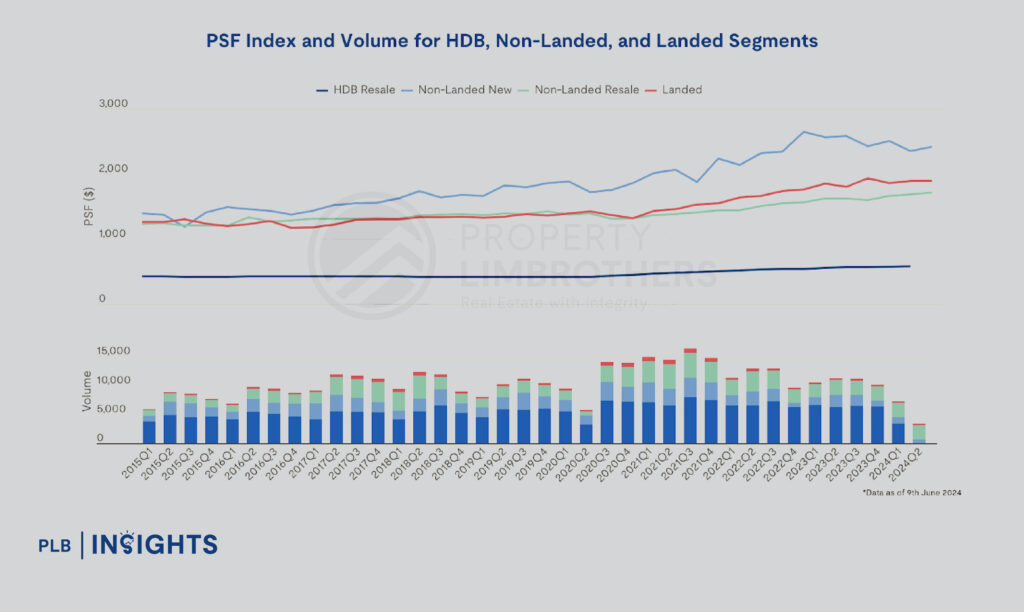

Between Q2 2020 and Q2 2024, prices of new non-landed private residences rose by 40%. Although the sharp increases seen during the COVID-19 period are now starting to level off, prices are expected to continue rising, though at a more moderate pace. Despite signs of the market shifting towards a buyer’s market, Singapore’s economy remains strong compared to the global landscape. This strength is likely to keep the real estate market resilient, with buyers ready to invest in the right residential properties.

From a financial perspective, it is therefore important to stay active in the real estate market, supported by a solid understanding of local market dynamics. Equally important is identifying properties with the highest investment potential.

Insights For Picking The Ideal New Launch

Rather than waiting for the perfect time to buy a new launch property, it’s crucial to equip yourself with a strong understanding of the local real estate market. This will help you identify a property with the best potential for optimal investment returns. Here are some key factors to consider when searching for the ideal new launch property. Keep in mind, while these tips may increase your chances of making a successful investment, they do not guarantee it.

Future Development Plans

Staying informed about upcoming infrastructure projects and urban development plans in the area can offer valuable insights into future property value. Existing or planned developments, such as new transportation hubs and added amenities, can significantly enhance the appeal and value of nearby residential properties. From an investment perspective, these conveniences not only boost capital appreciation but may also attract potential tenants, making the property ideal for rental income. Therefore, it’s crucial to keep an eye on the URA Master Plan to identify future developments near your chosen new launch, as they could be major value drivers.

Supply & Demand Dynamics

When selecting a specific unit type for your new launch, it’s helpful to analyse resale listings of similar properties in your chosen district. Look at the number of listings and how long they take to sell, as this can indicate demand for that property type in the area. For example, if you’re considering a 3-bedroom unit, check real estate portals for the number of 3-bedroom resale listings in the area. A high number of listings could signal increased competition when you eventually sell, potentially impacting your asking price and how long it takes to close the sale.

Price Trends & Comparisons

Compare the price per square foot (PSF) of your chosen new launch with other developments in the same district, including older properties and upcoming projects. While opting for the lowest price may be tempting, it’s important to consider the property’s long-term growth potential. A slightly higher PSF in a well-located, thoughtfully designed project might deliver better returns. At the same time, avoid being swayed by marketing hype and overpaying for a property. PropertyLimBrothers’ proprietary MOAT Analysis, which includes the Region and District Disparity analysis, helps you evaluate how your property compares to others in the same region and district. A lower score in these metrics indicates that more affordable options for similar configurations exist within the same region or district.

Location & Connectivity

Location is one of the most important factors in property investment. New launches in established or fast-growing areas, especially those near upcoming MRT stations, business hubs, or schools, are more likely to appreciate in value. Properties with easy access to transport, shopping, and recreational amenities tend to attract higher demand. Proximity to schools and workplaces will also further increase its appeal to potential future buyers. Moreover, a new launch development near HDB estates might attract HDB owners looking to upgrade, while a 2-bedroom unit near landed enclaves could appeal to empty nesters in the future.

Design of Unit Layout and Stack Facing

The design of a unit’s layout and stack facing plays a key role in both daily living and future resale value. Higher floors often offer better views, privacy, and ventilation, but the premium price may not always be worth it—evaluate if the benefits outweigh the cost. Stack and orientation are equally important; units with scenic views or optimal sunlight exposure tend to attract more buyers, while those facing busy roads may struggle to do so. Additionally, an efficient layout that maximises space for daily activities and includes practical storage solutions is crucial for long-term value. Consider these factors to ensure your unit appeals to future buyers and provides a solid investment.

In Summary

As Singapore’s real estate market continues to shift, understanding the key market dynamics is essential for making well-informed decisions. The current slowdown in new home sales, coupled with rising prices, has left many potential buyers uncertain. However, with the recent interest rate cut, we may see improved market sentiment and an uptick in property transactions, which could drive prices higher.

Buyers and investors who stay engaged in the market and informed about future developments, supply and demand trends, and price movements will be well-positioned to identify the best opportunities. Despite the challenges, Singapore’s strong economy and ongoing urban development suggest that real estate remains a reliable investment, particularly for those who make careful choices. New launches, especially those in well-connected and growing areas, are expected to continue appreciating, offering long-term value for buyers and investors.

Looking ahead, keeping a close eye on market conditions and acting on opportunities as they arise will be crucial to securing the right property for both personal and investment goals.Have questions or need help with your real estate journey? Reach out to us today. Our expert consultants are ready to guide you through every step, ensuring you enjoy a smooth and fulfilling retirement.