This year, conflicting news and announcements of housing measures stirred the local real estate scene. Despite reports of a record low in Q4 2023 for private home sales, Singapore’s real estate market has remained rather resilient, especially evident in the impressive performances of certain new launches.

We recently hosted a webinar discussing key insights and outlook for the non-landed residential property market in 2024. This article summarises some of the crucial aspects shared during the session, offering valuable pointers for those considering a condominium either for own-occupation or investment purposes.

Analysing Singapore’s Real Estate Market Performance in 2023

Before delving into details, let’s take a look at how the real estate market has performed up till the tail end of 2023.

Using 2023 as a benchmark for data analysis is prudent, as it provides a conservative viewpoint, avoiding potential inflation in property prices during bullish years.

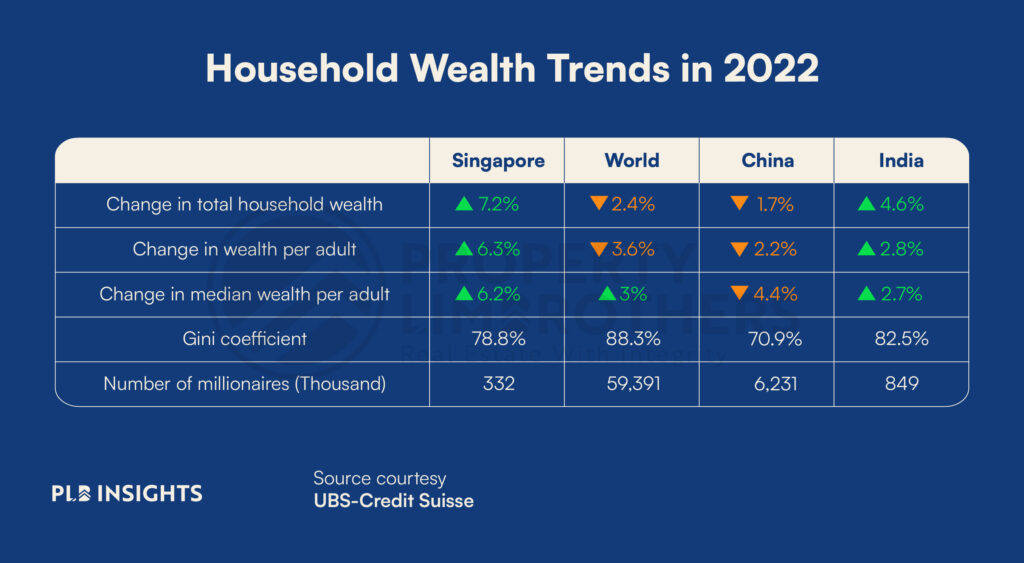

Despite challenges such as ongoing wars, soaring interest rates, global bank collapses, the latest cooling measures, and the lingering impact of the Covid pandemic, Singapore’s real estate market has shown resilience. According to a 2022 Credit Suisse report, Singapore’s household wealth outperformed other major global cities, and its median household income ranked strongest among 30 major cities worldwide.

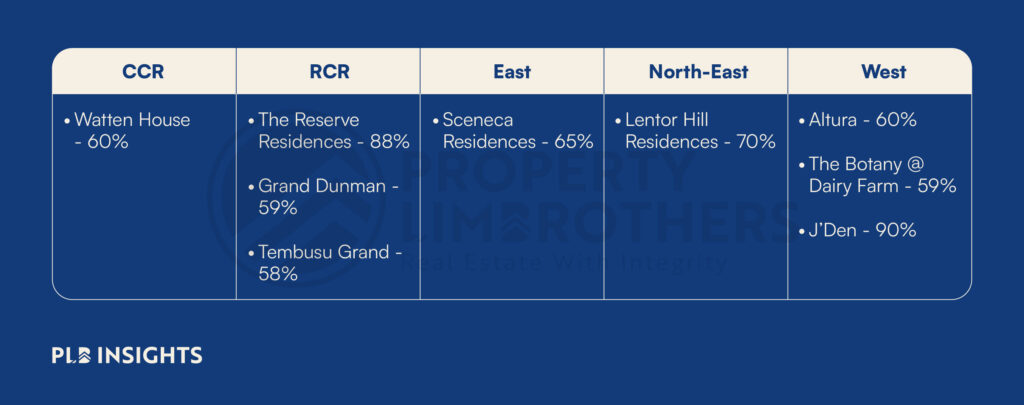

Moreover, the sales volume of new condominium launches in 2023 suggests a robust and stable local real estate market, indicating a continued strong demand for private condominiums. Over half of the 47 new launches in 2023 have successfully sold more than 50% of their units. The table below illustrates some of the impressive performances, detailing the percentage sold since their respective launch dates up to November 19, 2023.

The following list highlights the top 5 new launches with the highest number of units sold from their respective launch dates, accurate as of November 19, 2023:

A Sneak Peek at Prominent New Property Launches in 2024

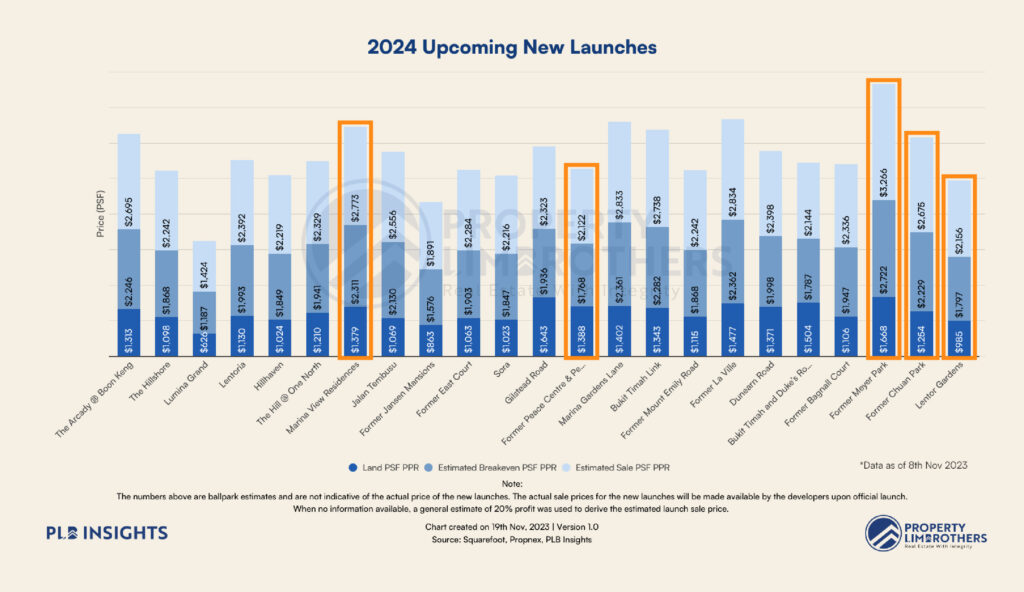

After evaluating notable 2023 performances, we’ve identified 5 upcoming 2024 launches with potentially significant anticipation, highlighted in red in the table below.

Former Chuan Park

An En Bloc redevelopment adjacent to the Lorong Chuan MRT. With an estimated total of 916 units in the project, it is in the list of Top 5 as major developments are usually highly anticipated especially in an area where new launches have been lacking in recent years.

Marina View Residences

Another major development with an estimated 905 units that is positioned amid the Central Business District (CBD) rejuvenation plan. Also benefiting from designated development sites in the Marina Bay area outlined in the URA Master Plan, this project holds the potential for significant anticipation.

Former Peace Centre & Peace Mansion

Estimated to accommodate 370 units, this project stands out as an enticing option primarily due to its estimated launch price of $2,122 per square foot (PSF). This project could potentially be a highly anticipated option in terms of both price per square foot and overall quantum price.

Former Meyer Park

A freehold En Bloc redevelopment along Meyer Road, this project is estimated to offer 295 units. It could hold a significant appeal for homebuyers in search of a freehold property in the Meyer area, especially given that the last new launch in the vicinity occurred in 2019.

Lentor Gardens

Positioned to potentially benefit from the spillover effect from recent launches like Lentor Hill Residences, Lentor Modern, and Hillock Green, this project could hold a strong appeal for those interested in the Lentor area. With an estimated modest launch price of $2,156 per square foot (PSF) and its strategic location within a 1-KM radius of the renowned CHIJ St Nicholas Girls School, it is poised as a potentially highly anticipated development.

Insights and Guidelines for Investing in Resale Non-Landed Private Homes

Utilising our in-house analytical tools, we’ve crafted rough guidelines for those considering a resale condominium. Derived from extensive research and analysis by our team, it’s essential to note that these are general guidelines and insights, and should not be taken as a buy or sell recommendation. Every property is unique, with its own unique selling points, and any decision should only be made after thorough research into specific projects and financial analysis.

We’ve categorised this segment into Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR).

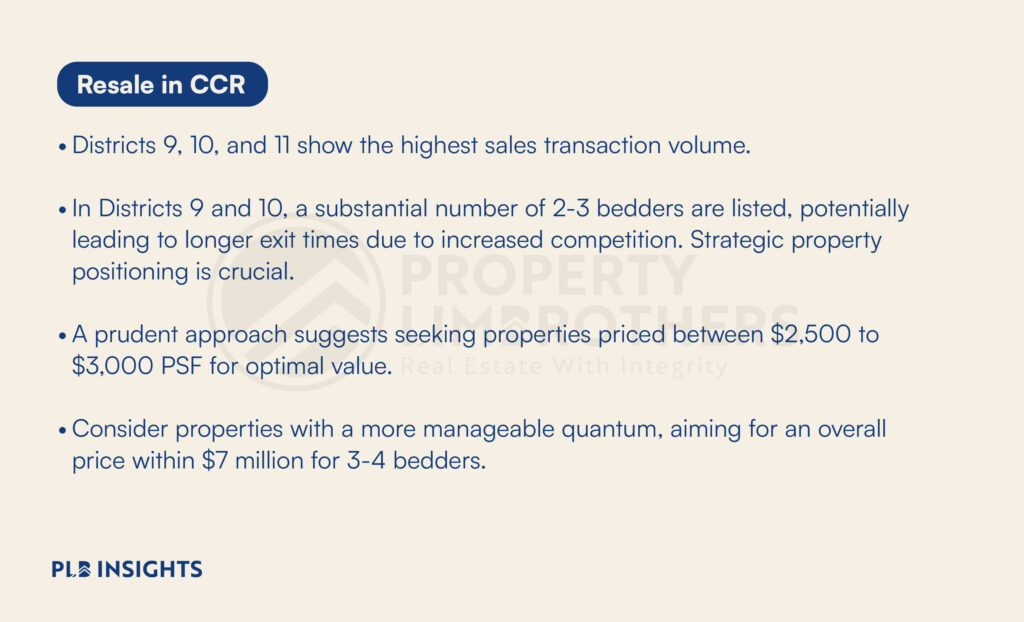

Resale in CCR

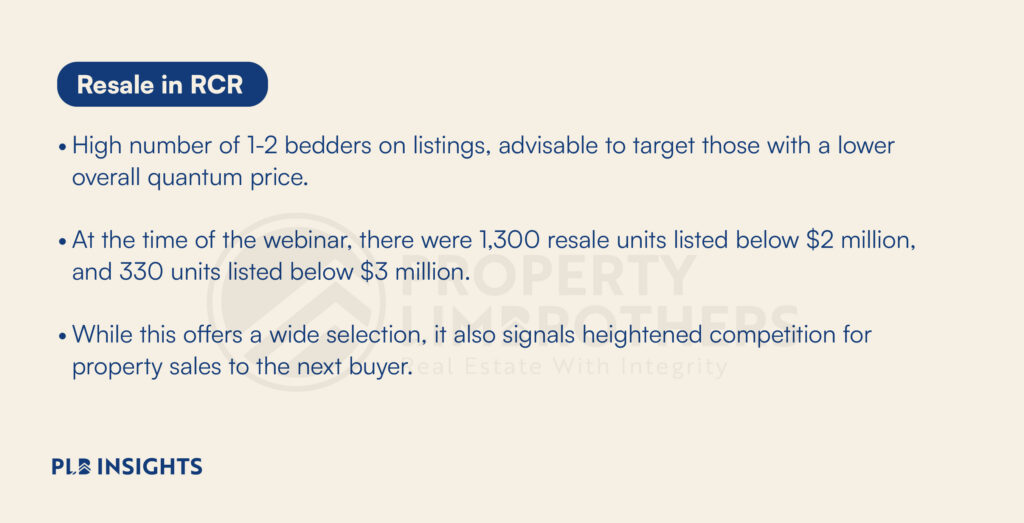

Resale in RCR

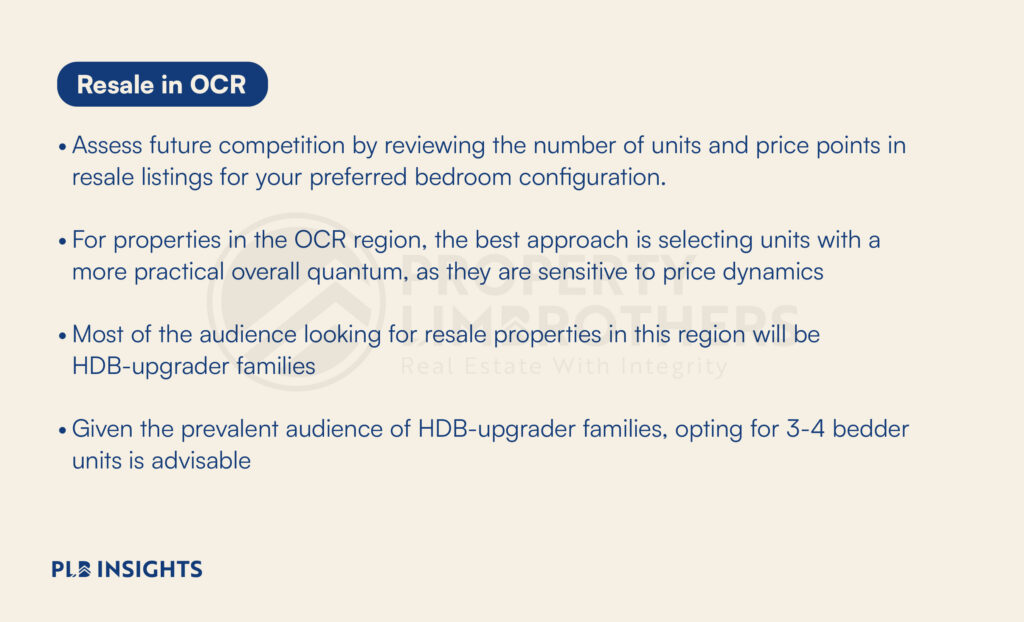

Resale in OCR

Resale or New Launch Condo: How Do You Decide?

This common question among property buyers lacks a one-size-fits-all solution. The choice between new launches and resale properties is not always straightforward. However, specific considerations should guide your decision-making process.

Renovation and Repairs Costs

A resale unit would typically require a higher cost of renovation and repairs. However, for resale units, it is possible to “shop around” and find tastefully renovated ones with layouts that match your ideal theme/concept/style. In that case, minimal renovation would be needed, which would help to reduce costs.

Running Expenses

Resale condos incur immediate full mortgage payments, including interest, upon ownership transfer, along with maintenance fees and property tax. In contrast, new launches offer progressive payment schemes during construction, with maintenance and property tax starting only after the project obtains TOP status.

Rental Expenses

Considering the completion timeline of a new launch and the need for interim accommodation is crucial. New launches usually take 3-4 years, and in some cases, almost 5 years, to complete. If renting before completion is necessary, it adds a significant expense to your overall budget.

Expert Insights and Tips for a Successful Real Estate Journey

To Time or Not to Time?

This common question often arises among discerning buyers: Is it advisable to time the market when seeking a property? To address this, let’s delineate the distinctions between investing in the stock market and real estate.

Considering the factors outlined above, attempting to “time the market” in real estate investment would be unwise. Real estate, as a longer-term asset class, offers stability and serves as an ideal wealth storage instrument. Moreover, the high rate of homeownership in Singapore ensures a constant demand for housing, contributing to a consistent upward trend in property prices. Despite concerns about stringent regulations and cooling measures, these measures have actually bolstered property prices, fostering a stable and resilient market and mitigating the risk of a real estate bubble.

In our well-researched and analysed perspective, we advocate the principle that “doing something is always better than doing nothing” when aiming to build wealth in the real estate market. This, however, comes with a caveat – it underscores the importance of maintaining financial prudence, devising a strategic plan, remaining flexible and adaptable based on life-stage considerations, and consistently engaging in the market.

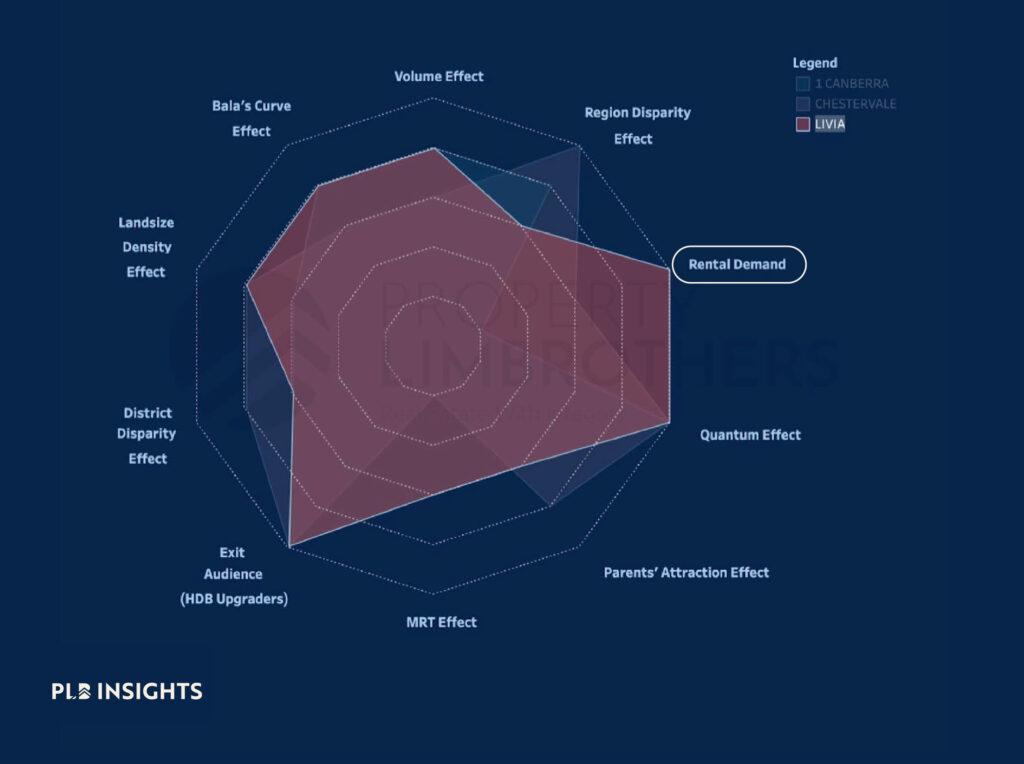

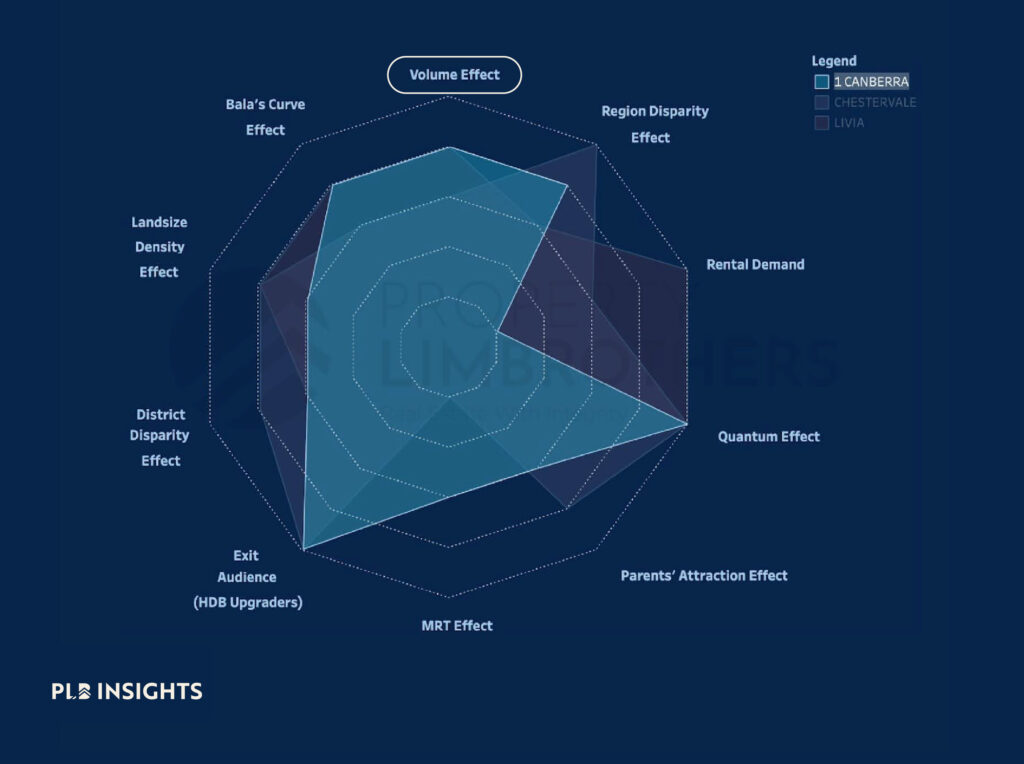

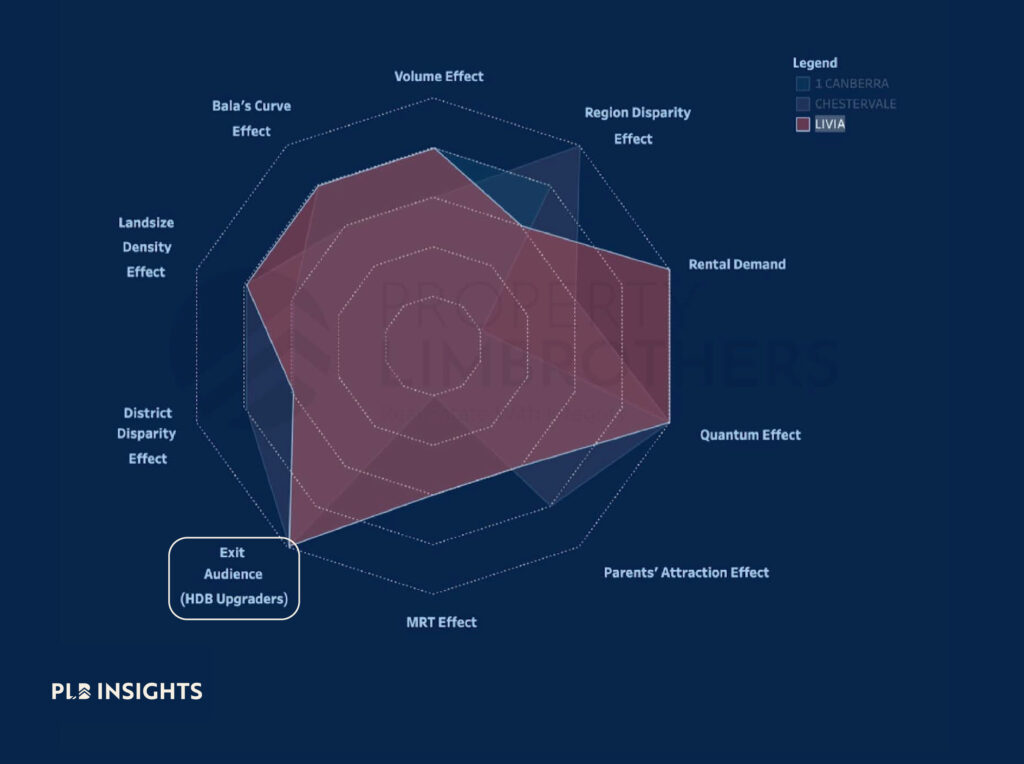

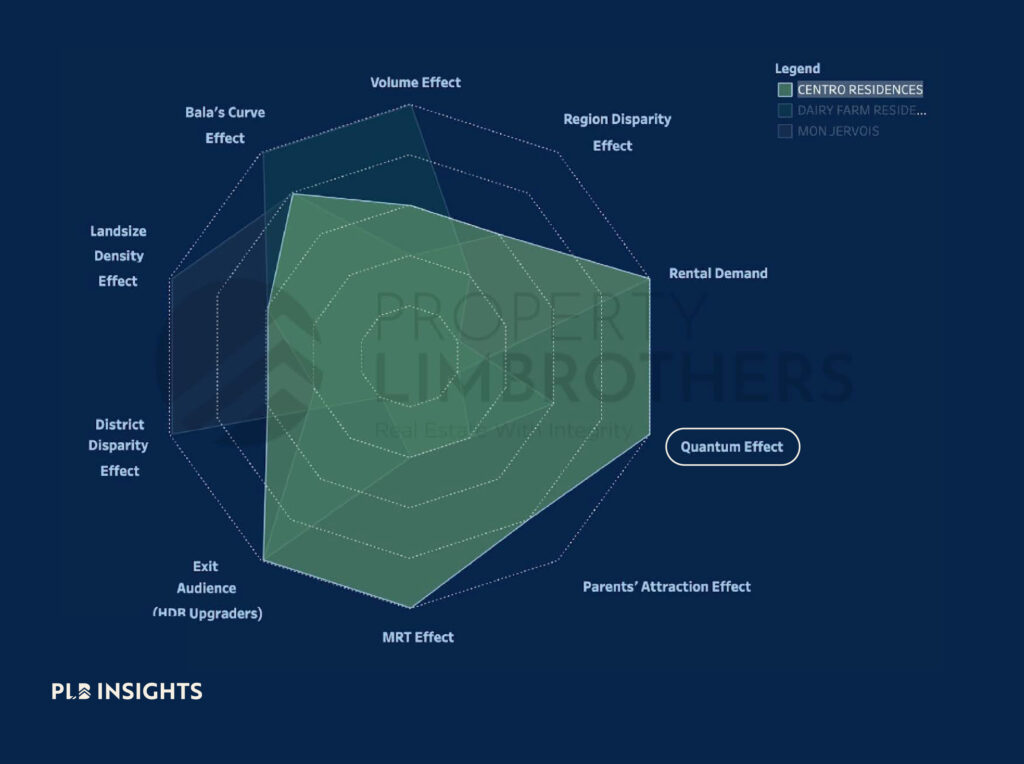

7 Analytical Factors

At PropertyLimBrothers, we’ve developed specific frameworks and methodologies to assist clients in choosing the optimal property based on their unique needs and aspirations. One such method is assessing the 7 Analytical Factors, where we delve deep and analyse some of the key elements influencing a property’s price.

1. URA Transformation Plan

When choosing a property for own-occupation or investment, review the URA Master Plan for anticipated developments in the chosen area. Future commercial, residential, and major projects can boost housing and rental demand, in turn boosting the prices in the area. Assess if the property aligns with your lifestyle preferences. Crucially, consider the timing of the transformation in relation to your exit plan.

2. Parents Attraction

Proximity to sought-after schools significantly boosts demand, particularly in primary schools with limited slots. Singapore citizens residing within 1km have priority, followed by those between 1km and 2km, and then those living beyond 2km.

3. MRT Effect

According to our analyses, a project in close proximity to an MRT station, especially within a 1km radius, experiences higher demand, both from own-occupier families and rental tenants.

4. Rental Demand

Particularly important if the property is for investment, its proximity to a MRT Station, transportation hubs, business nodes, workplaces, and nearby amenities is of crucial importance.

5. Volume Effect

Opting for a property within a larger development can be a wise choice. This is because the chances of units being sold upon the project’s TOP status could be higher. This, in turn, facilitates a smoother capital appreciation. Past sales transactions within the development set benchmarks for future property prices, creating a potential positive domino effect.

6. Exit Audience

Before making a decision, analyse the project and its surroundings to identify the potential exit audience. Assess nearby HDB developments that may attract buyers once their MOP is fulfilled. Consider empty nesters in nearby landed enclaves looking to right-size for retirement. Proximity to good schools, transportation nodes, and amenities should also ensure a diverse exit audience pool.

7. Right Entry Price

Choosing the right property involves more than a prime location, it’s about securing it at the correct price point. Consider the overall quantum price and assess its future attractiveness to potential buyers. While PSF is a factor, the overall quantum price is paramount, as it determines the loan amount eligibility, Total Debt Servicing Ratio (TDSR), and monthly mortgage commitments.

Guiding Principles for Your Real Estate Venture

This article has highlighted crucial insights from our recently concluded webinar. Here are key takeaways to apply in your real estate journey:

Unwise to time the real estate market

Real estate differs significantly from stock investing, making market timing imprudent. Successful real estate investing demands continuous research, analysis, and consideration of factors aligned with individual aspirations.

Never buy hastily with emotions

Resist the urge to follow trends during bullish periods. Instead, use analytical tools, including our 7 analytical factors, to guide decisions thoughtfully.

Remain flexible

Constant market presence and adaptability to micro and macroeconomic factors, as well as life-stage considerations, are essential for sustained success in your wealth-building journey through real estate.

Always have an Exit Plan in mind

Even if your current intention is for own-stay and to retain the property indefinitely, it remains prudent to devise a well-thought-out exit strategy. Homeowners often overlook potential factors that may impact their lifestyle and real estate portfolio in the future. Thus, thorough planning and analysis are imperative for an effective Exit Plan.

Every property has unique selling points

While data analysis is crucial in guiding your property selection, remember that each property has its strengths and drawbacks. Therefore, effective positioning is essential to highlight its appeal when deciding to sell.

Closing Thoughts

In conclusion, we hope this article has given you valuable insights and practical tips for your property journey. The insights and recommendations shared in this article offer just a glimpse into the diverse methodologies we employ to assist clients in identifying their ideal property. Our consultations leverage a range of analytical tools, including our proprietary MOAT analysis tool, all to help our clients make an informed decision.

If you’re currently in the market for a property, or are looking for guidance in expanding your property portfolio, don’t hesitate to reach out to our consultants here. We are eager to support you on your real estate journey.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.