Following the success of Pinetree Hill, Ulu Pandan’s first new launch condominium project in 14 years, which has sold 70% of its 520 units at the time of writing, Nava Grove is set to inject another 552 private residential units into the Pine Grove area.

Jointly developed by MCL Land and Sinarmas Land, Nava Grove will be perched on elevated ground, surrounded by landed enclaves in the Mount Sinai and Pandan Valley estate. With lush greenery and green nodes like Clementi and Dover Forests in the vicinity, on top of the close proximity to Ulu Pandan Park Connector and the 24km Rail Corridor, this development promises a private and serene living environment.

In this new launch review, we will explore the key features, location and pricing analysis, as well as how Nava Grove fits into the broader context of the District 21’s ongoing rejuvenation and what this means for potential buyers and investors.

*This article was written in October 2024 and does not reflect data and market conditions beyond.

Project Details

Location Analysis

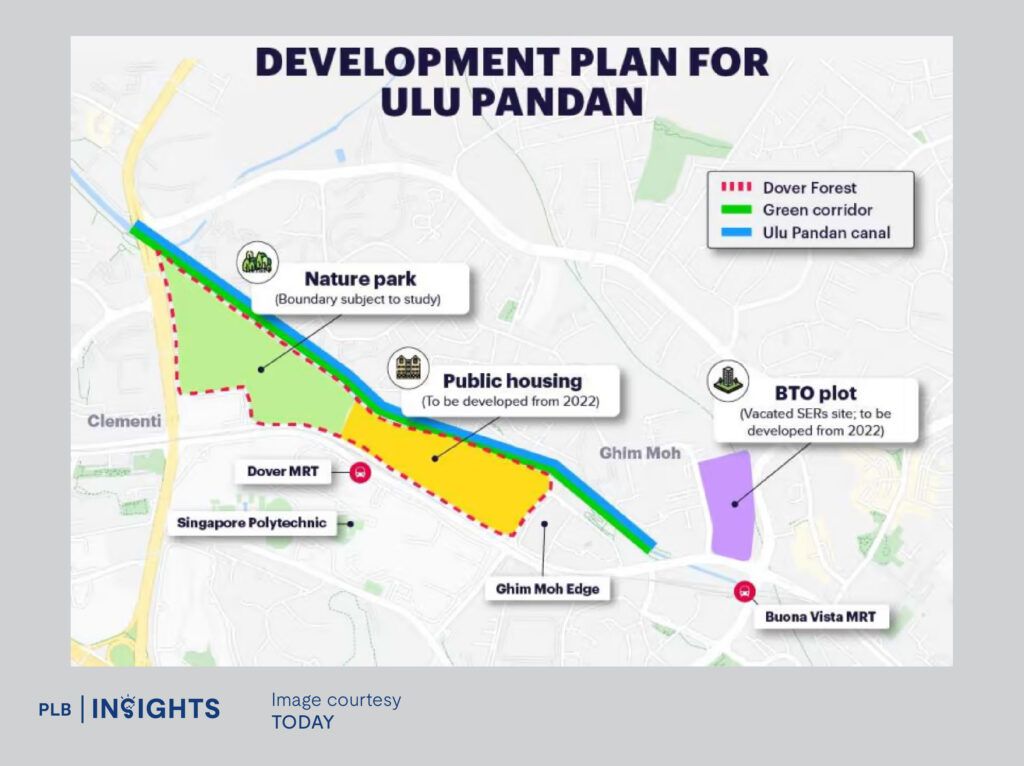

Located next to the Ulu Pandan Park Connector, Nava Grove is surrounded by nature and boasts lush greenery facings towards either Clementi Forest in the north or Dover Forest in the south. It will also overlook the GCB and landed enclaves in the Mount Sinai and Pandan Valley estate. However, a large portion of the Dover Forest is being cleared to make way for residential housing, with a few BTO sites launched already at the time of writing.

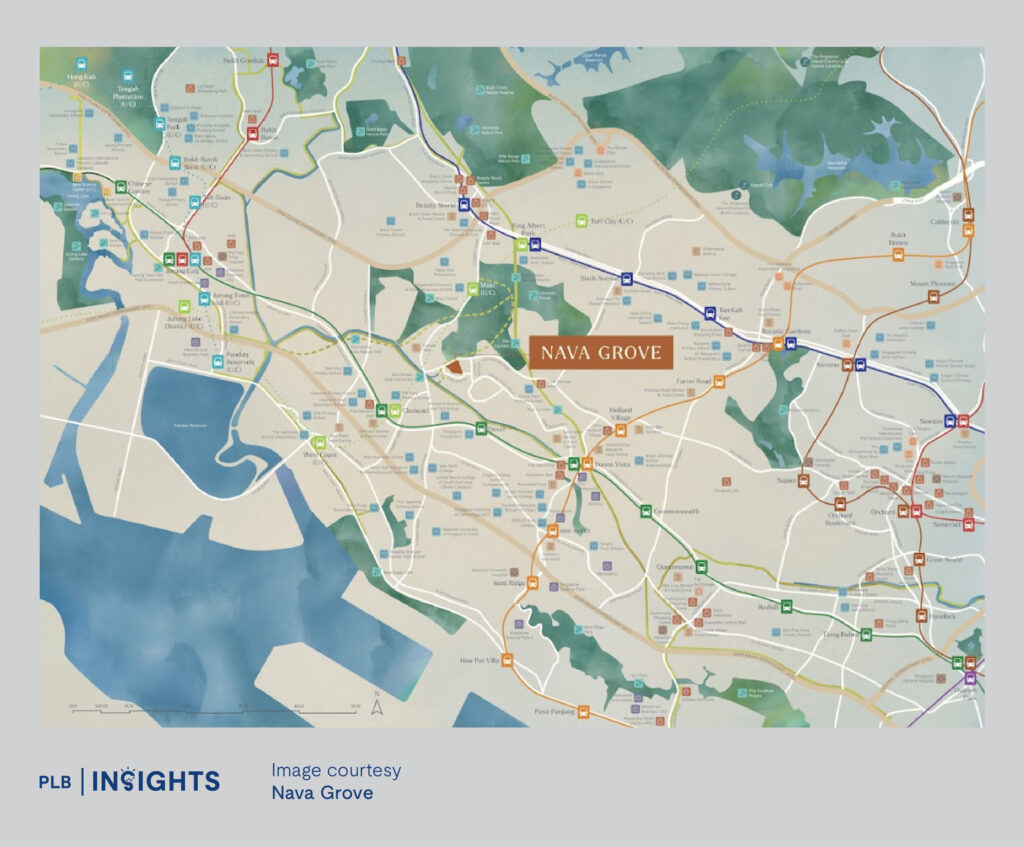

In terms of connectivity, Nava Grove will be a 10 to 12-minute walk from Dover MRT station on the East-West Line (EWL). The upcoming Maju MRT station on the Cross Island Line (CRL) will also enhance the connectivity to the central, northeastern, and eastern areas of Singapore, with Clementi MRT station becoming an interchange of the CRL by 2032. Once the CRL is operational, major hubs like the Jurong Lake District, Punggol Digital District, and Changi will be connected by a single MRT line.

While the immediate vicinity is not served by any major shopping malls, there is no lack of shopping and dining options with Nava Grove’s proximity to Clementi and Holland Village, both of which are less than a 5-minute drive away. For non-drivers, The Star Vista and Rochester Mall are located near Buona Vista MRT, just a stop away from Dover MRT.

Speaking of non-drivers, bus 560 serves the private estates around Mount Sinai and Ulu Pandan by offering a direct connection to the CBD. Future residents will be able to get to Suntec in around 30 minutes, providing a more convenient alternative route to the city.

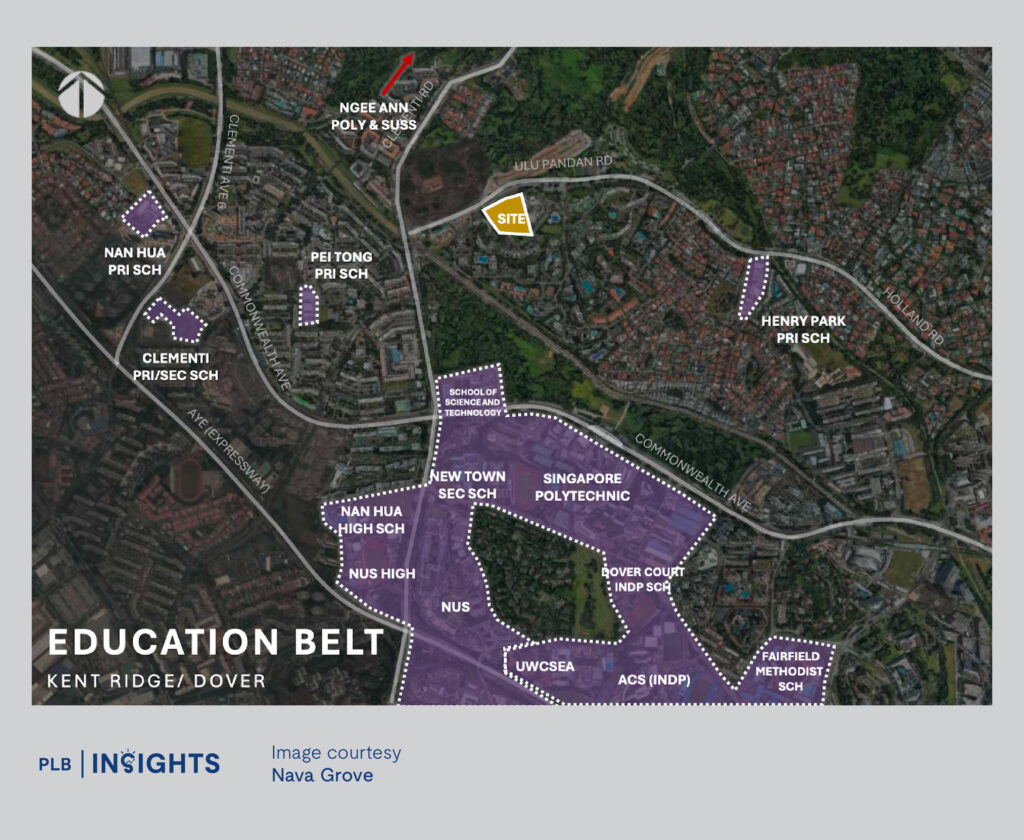

Nava Grove is also conveniently located near the Kent Ridge/Dover education belt. Primary schools in the area includes Pei Tong Primary and Henry Park Primary. Older students will have New Town Secondary, Nan Hua High School, NUS High School, Singapore Polytechnic, and Ngee Ann Polytechnic, and National University of Singapore (NUS).

Site Plan

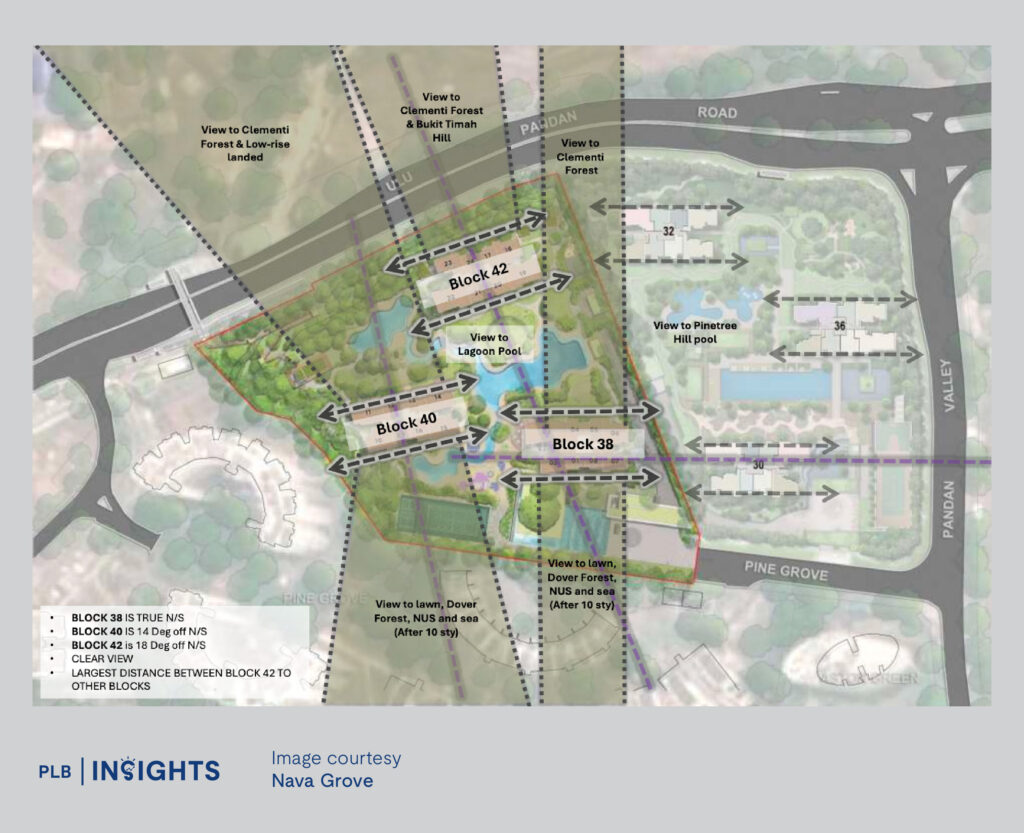

Nava Grove will be served by a cul-de-sac at Pine Grove, leading to the main gate of the development. The three residential blocks are well segregated, with most of the facilities scattered in between and around them. There will be a mix of indoor facilities (Resident’s Lounge, Function Room, Children’s Playroom, Gym, and Clubhouse) and outdoor facilities (50m Lagoon Pool, Jacuzzi, Hydrotherapy Pockets, Lazy River, Pavilions, Cabanas, Pets’ Lawn, and a sunken tennis court).

In terms of the orientation, block 38 has a true north-south orientation while blocks 40 and 42 are a few degrees off. North facing units at all blocks will get a greenery facing towards Clementi Forest. South facing units at block 42 will have an internal view of the pool while units at blocks 38 and 40 will get a view towards Dover Forest.

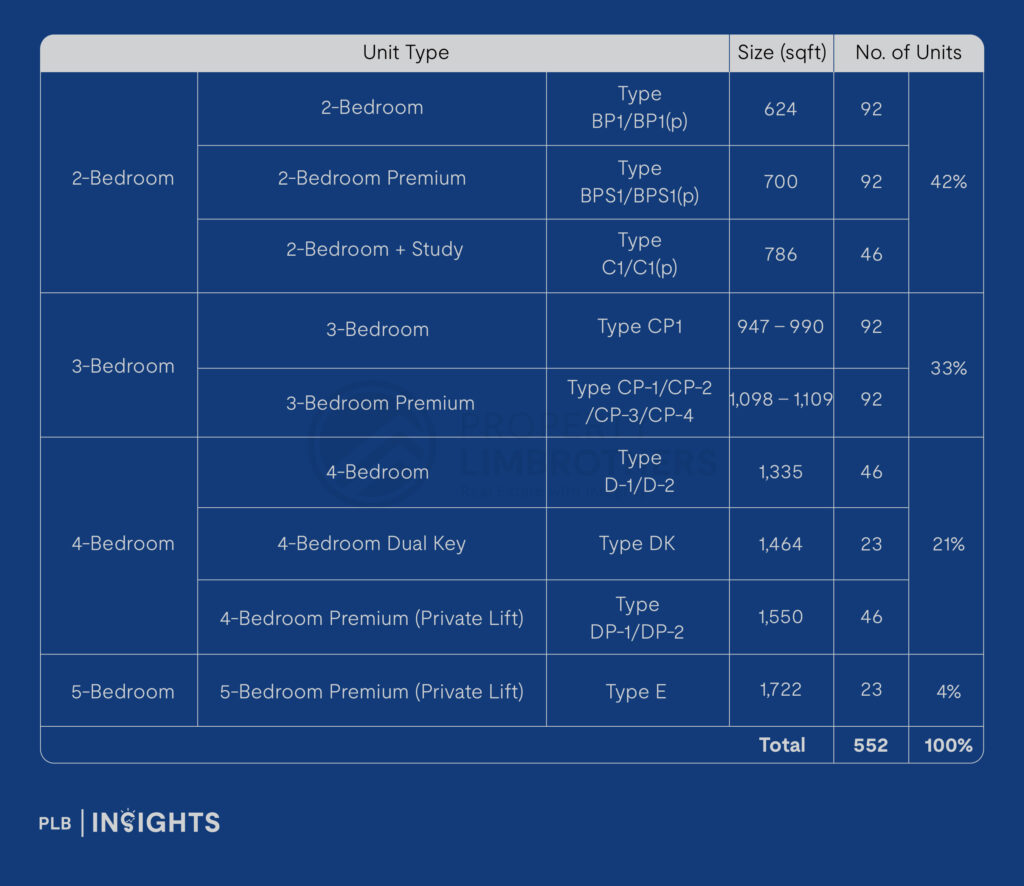

Unit Distribution

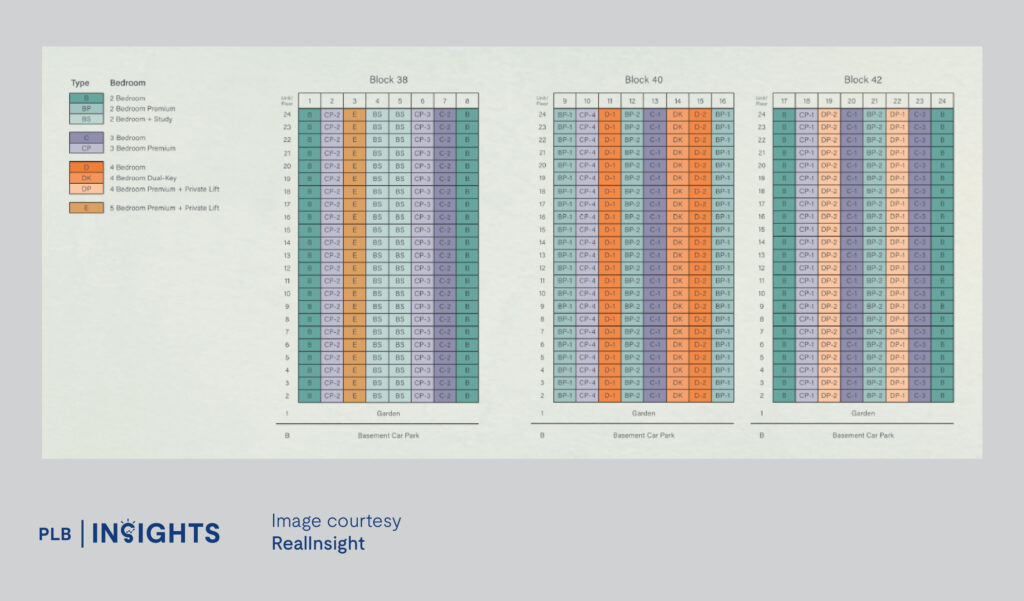

Nava Grove will feature unit types from 2-Bedroom to 5-Bedroom, with 2 and 3-Bedroom types available in every block. 4-Bedroom types can only be found in blocks 40 and 42, while the largest 5-Bedroom type can only be found in a single stack at block 38.

The exclusive 4-Bedroom Dual-Key units can only be found in a single stack at block 40, which will have a north facing towards Clementi Forest and the low-rise landed enclave.

Looking at the unit distribution, 75% of the units at Nava Grove will be made up of 2 and 3-Bedroom types, with 4-Bedroom types making up 21% and 5-Bedroom types making up 4% of the unit mix. Given this unit mix, the main target audience of Nava Grove will be hybrid investors as well as small families looking to live near the Mount Sinai area.

Floor Plan Analysis

In this segment, we will highlight various types of floor plans available at Nava Grove. Our aim is to furnish you with useful knowledge that will assist you in choosing the perfect unit tailored to your preferences and lifestyle needs.

Take note that Nava Grove’s floor area calculations will be based on URA’s GFA harmonisation rule, which includes strata areas and excludes non-strata/void spaces.

If you’d like to visit the showflat units in person and get an in-depth analysis of the real estate market, do sign up for our upcoming seminar at the Nava Grove Sales Gallery. More details and RSVP here.

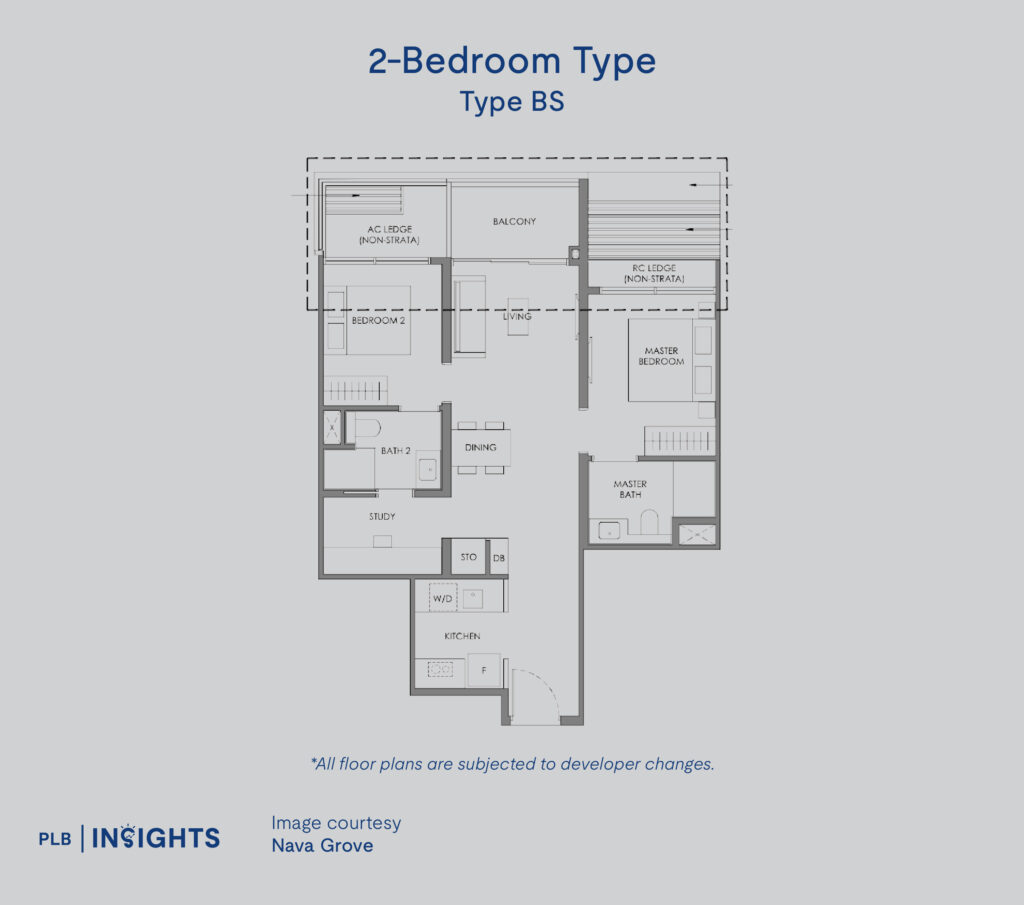

2-Bedroom Type

There are four layout variations for the 2-Bedroom type – the standard Type B, two premium Type BP-1 and BP-2 layouts, as well as the 2 + Study Type BS layout. The featured layout is the variation that comes with an additional study.

Standing at 786 sqft, the Type BS layout features an efficient dumbbell layout which has the bedrooms placed on opposite ends of the unit. The layout is very squarish in nature, which means that there is not a lot of wasted corridor space.

We like that the common bathroom is done in a jack-and-jill fashion, with dual entrances from the common bedroom and the study. This allows visitors to access the common bathroom via the study without having to intrude on the privacy of the bedroom. Otherwise, there is also the option of enclosing the study and making it part of the common bedroom, which would appeal to tenants if you are renting out.

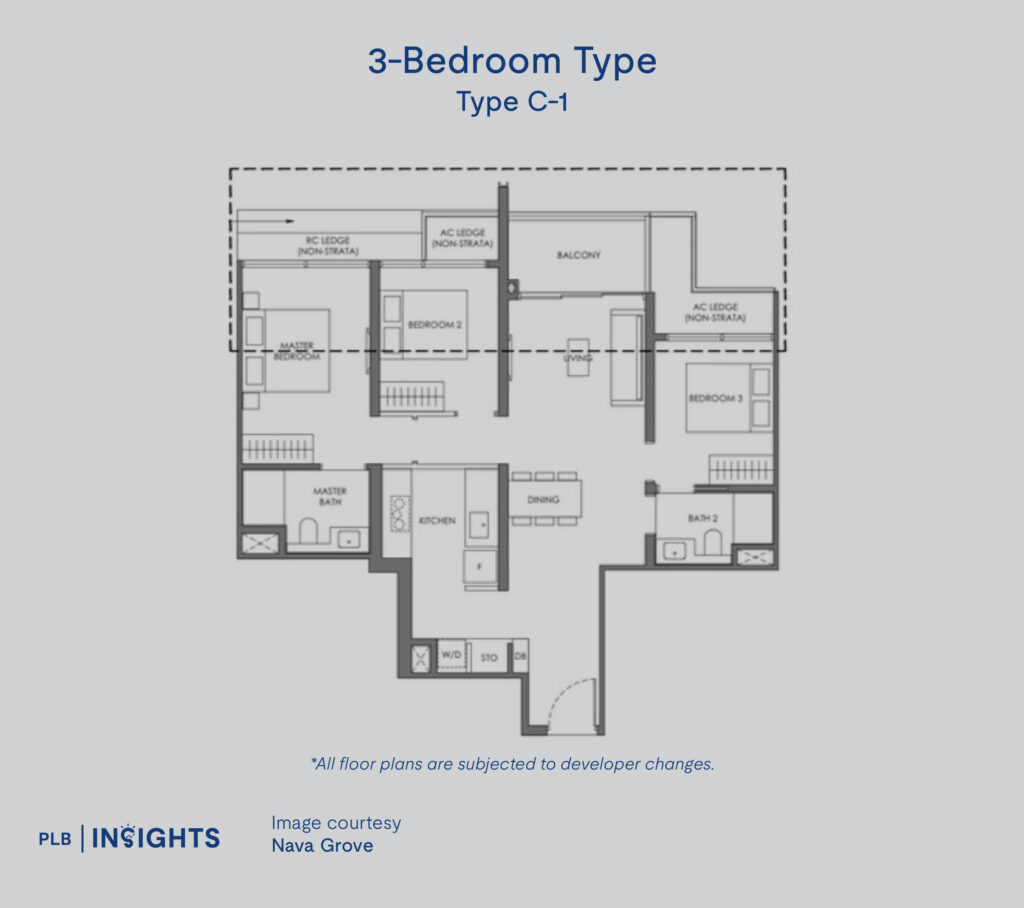

3-Bedroom Type

The 3-Bedroom type has the most number of layout variations, with three standard (Type C-1 to C-3) and four premium (Type CP-1 to CP-4) layouts. The featured layout (Type C-1) is the only 3-Bedroom layout that boasts a dumbbell layout, with bedroom 3 placed on one end of the unit while the other two bedrooms occupy the opposite end.

Coming into the unit, there is a slightly elongated foyer area before reaching the kitchen and dining area. The L-shaped kitchen is efficiently designed, with dual counter tops for meal preps and the washer/dryer and store flushed against the wall.

The common bathroom here is also a jack-and-jill bathroom with dual entrance from bedroom 3 and the living/dining area, allowing visitors to access the toilet without passing through the bedrooms.

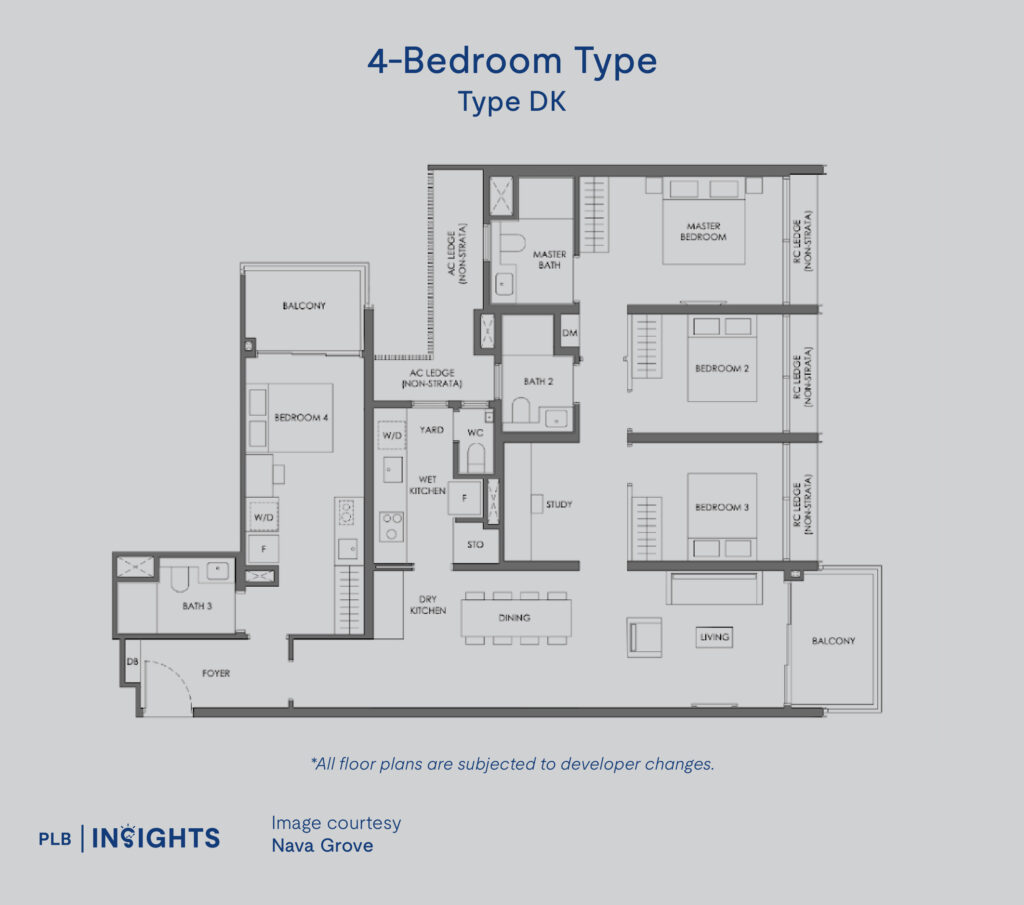

4-Bedroom Type

The 4-Bedroom type is the only unit type that will come with a dual-key configuration. Standing at 1,464 sqft, the layout is rather interesting.

Coming into the unit, you will be greeted with a foyer area with dual entrances into a studio part and the main 3-bedder. The studio part is designed like a typical hotel-type layout, with a bedroom, bathroom, wardrobe, and small kitchenette in place.

The main 3-bedder part of the layout is where things get interesting. The living and dining area takes the length of the unit in a super elongated landscape layout, and all of the bedrooms are lined up in a landscape format as well. The unit will come with a dry and wet kitchen, as well as a yard towards the back. It will also come with a study that is as wide as bedroom 3, which can be used as a workstation or for additional storage purposes.

Overall, the 4-Bedroom Dual-Key layout (Type DK) is very efficiently designed, with the main living areas nicely segregated from the bedrooms. For additional privacy, there is also the option of installing a sliding door to further segregate the living area and bedrooms.

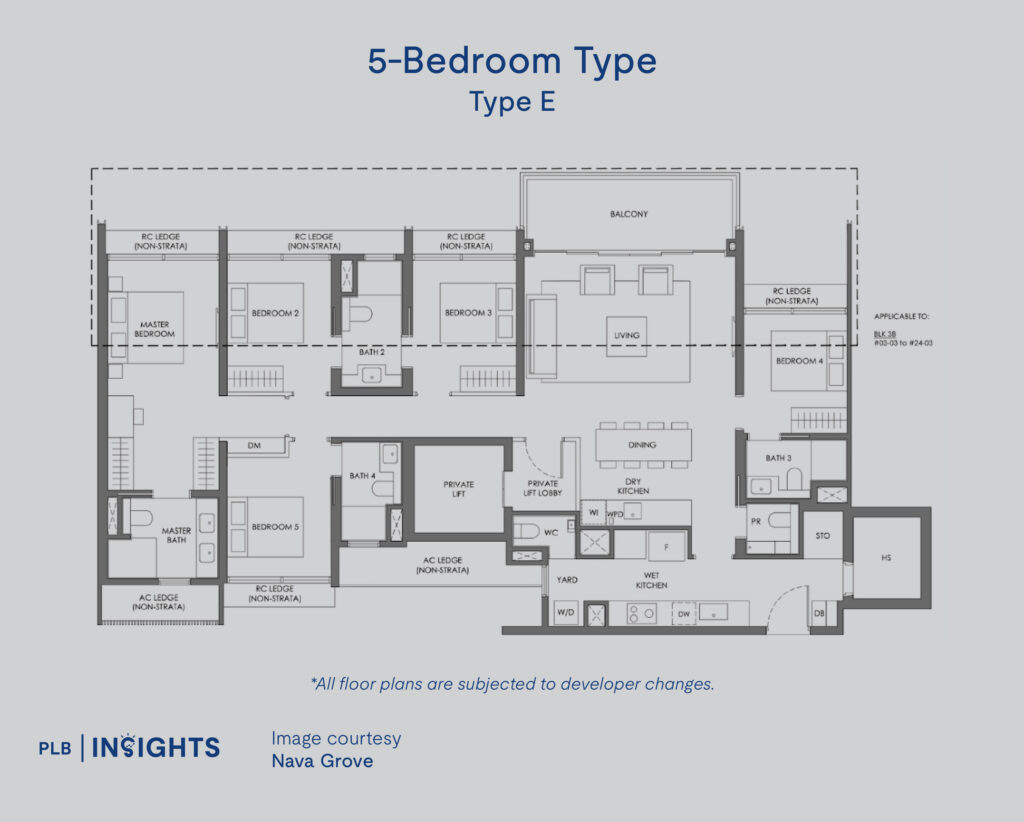

5-Bedroom Type

Lastly, the 5-Bedroom type will only have one layout variation, considering that there will only be 23 of such units in the development. The 5-Bedroom Premium will come with a private lift access, opening right into the living area of the unit.

The layout also boasts a dumbbell layout, with bedroom 4 placed on one end of the unit away from the remaining bedrooms on the opposite side. There are two bedrooms with ensuite bathrooms in this layout – bedroom 4 and bedroom 5, and bedrooms 2 and 3 will share a jack-and-jill bathroom. Because there are no bathrooms that can be accessed without passing through the rooms, the developers have thoughtfully included a powder room right outside the kitchen for visitors to use.

The layout will include a dry kitchen that can serve as a pantry right next to the dining area, and an elongated wet kitchen that extends to the yard and household shelter plus store on opposite ends.

Comparative Market Analysis

Pricing Analysis

There are no indicative guide prices for Nava Grove at the time of writing, but we expect the launch PSF pricing to be pegged closely to that of Pinetree Hill, which is averaging at $2,5XX PSF. Based on initial estimations by EdgeProp based on the developer’s land bid price of $1,223 PSF PPR, the indicative price range will start at roughly $2,331 PSF.

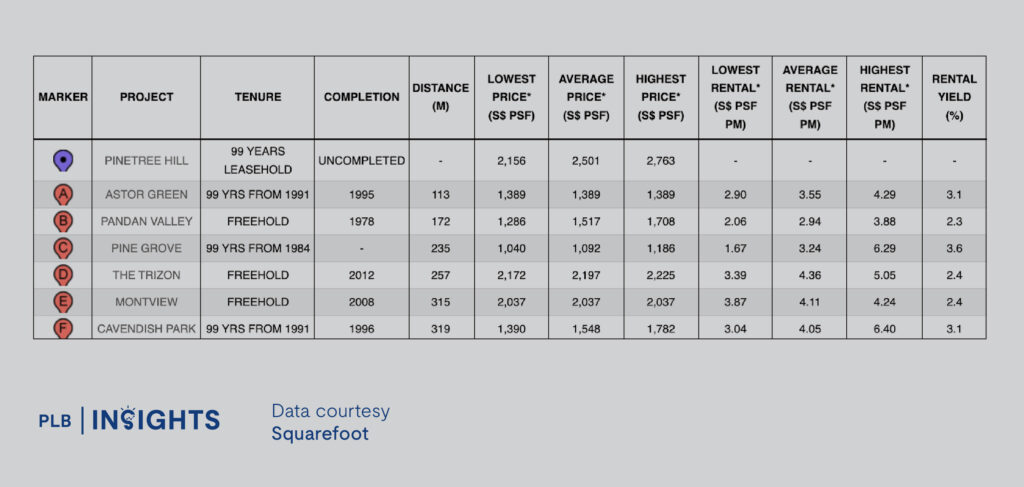

Looking at the resale condos in the vicinity, 99-year leasehold projects are transacting at an average of $1,0XX to $1,5XX while freehold projects are transacting between $1,5XX to $2,1XX. However, we have to take into account that most of the leasehold projects have a balance lease of less than 70 years. And the freehold project that is transacting at $2,1XX PSF is The Trizon, completed in 2012.

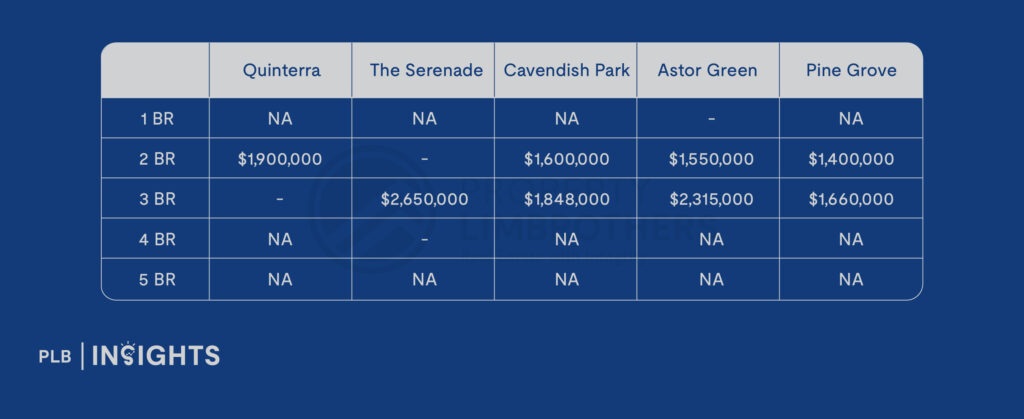

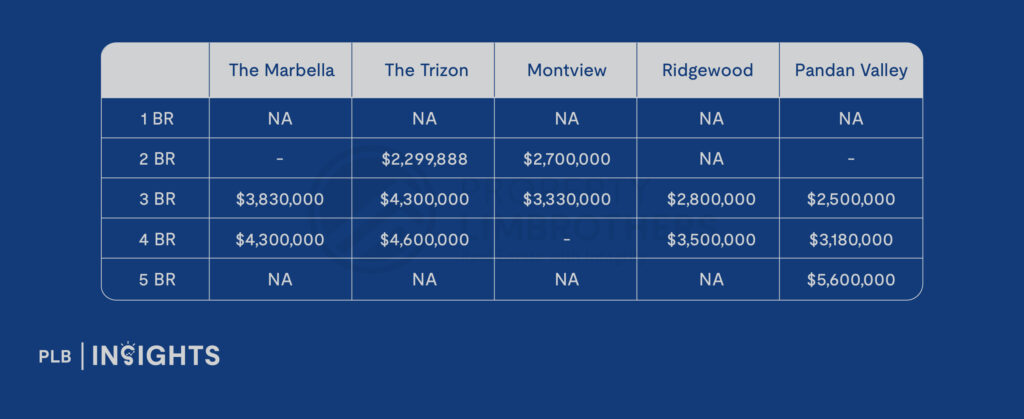

Zooming in to the various unit types, we can see that the quantum prices at Pinetree Hill are rather competitive compared to other projects across market segments of new launches, leasehold, as well as freehold status. This might be because of the larger unit sizes at the older resale condos and the pre-harmonisation rule which includes void spaces, which is why the quantum prices are still higher despite a lower PSF. On the other hand, although the average PSF of new launches are higher, unit sizes are smaller which keeps the quantum more palatable for buyers. Since Nava Grove will be launching under the post-harmonisation era, we expect PSF prices to be slightly higher but quantum to be kept lower.

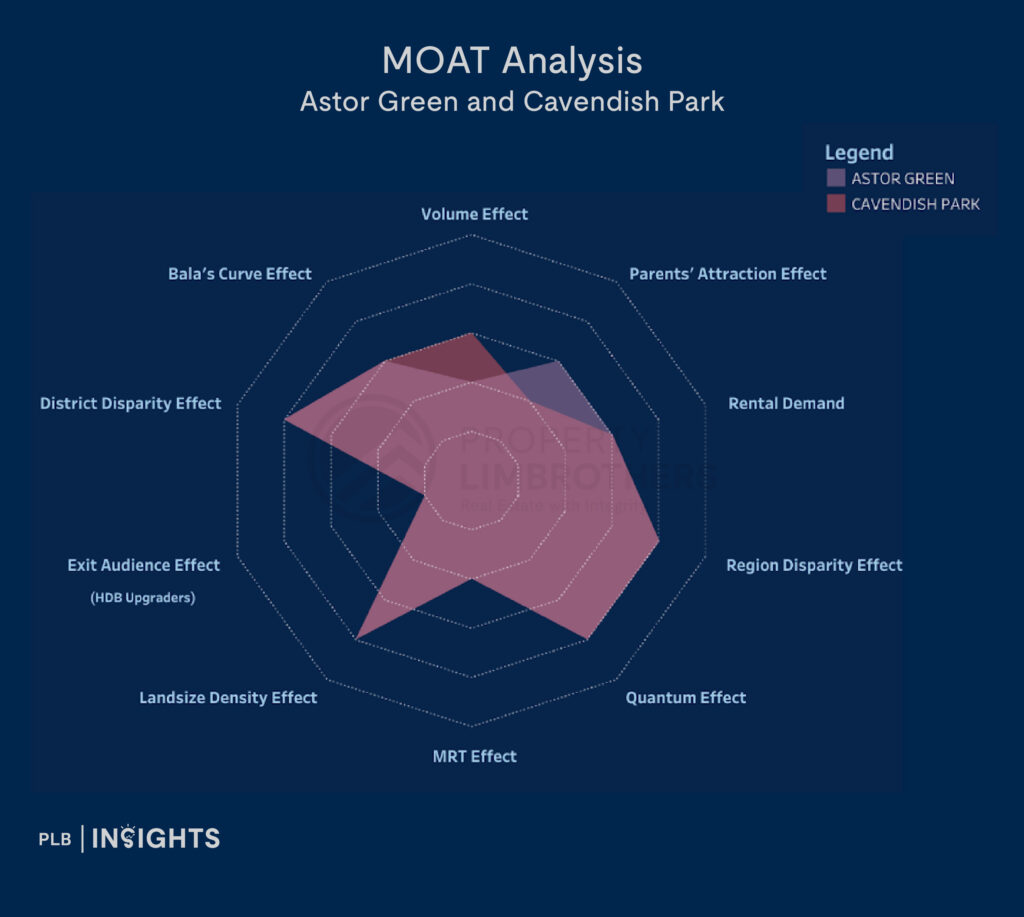

MOAT Analysis

Due to insufficient information to perform a MOAT analysis on Nava Grove, we will be comparing the two closest projects within the vicinity – Astor Green and Cavendish Park. We will provide insights and commentary on how Nava Grove may compare to these developments, using the same key metrics in the MOAT analysis.

Stay tuned for our upcoming PLB New Launch MOAT Analysis Tool, which will provide key insights into a new launch project’s future potential appreciation using similar metrics used to assess existing condominiums.

Both Astor Green and Cavendish Park achieved a MOAT score of 60%, scoring especially well in the Quantum Effect and Region Disparity Effect. Typically, we would classify projects that score above 60% as having high appreciation potential.

Both projects scored 4 out of 5 for the Quantum Effect, which means that their quantum prices are considered affordable when pegged against the latest national median income. They also scored 4 out of 5 for District and Region Disparity Effect, meaning that they are priced more affordably compared to other projects in the district and region.

On the other hand, both projects scored only a 1 out of 5 for Exit Audience. As the area is predominantly a private estate, there are not many HDB enclaves nearby to capitalise on the pool of potential HDB upgraders. And although there are new BTO plots coming up in the nearby Dover Forest, they are all classified under the Prime Location Housing (PLH) model and will only reach their Minimum Occupation Period (MOP) in 12-14 years. However, according to data from RealInsight, the demographics of buyers buying into Pinetree Hill is largely made up of those making a lateral advancement (private to private) in terms of real estate portfolio. The MRT Effect score will also improve once the nearby Maju MRT and Clementi interchange of the CRL is operational.

For Nava Grove, we expect a similar or higher score as it will likely perform better in several metrics including the Bala’s Curve Effect (due to the newness of its lease as a new launch). However, its higher PSF prices relative to other developments in the area could translate to a lower District and Region Disparity Effect scores as well as a lower Quantum Effect score.

Growth Potential

Buyers looking into District 21 will also be aware of the ongoing en bloc attempts at Housing and Urban Development Company (UDC) sites in the vicinity of Nava Grove, namely Pine Grove and Kent View Park. Out of the 18 former HUDC estates built between 1974 and 1987, Pine Grove ranks second in terms of land size after Braddell View. If this en bloc goes through, the massive plot of land has the potential to yield a mega development, which will greatly impact the valuation of properties and drive property prices in the area.

The ongoing rejuvenation plan for Ulu Pandan includes several BTO sites at Dover Forest and near Buona Vista MRT. This will inject a fresh pool of potential HDB upgraders in the future and improve the Exit Audience scores in the area. Expats or families with children schooling at international schools in the vicinity, like UWCSEA, or those who wish to reside near their workplace at Buona Vista, one-north, NUH, and NUS will also be attracted to the locale.

The Verdict

Nava Grove is set to be a highly attractive development for both investors and homebuyers, offering a rare combination of tranquillity, connectivity, and thoughtful design. Positioned in Ulu Pandan, a district experiencing significant rejuvenation, Nava Grove presents a unique opportunity to own a home in a well-established private residential enclave, surrounded by nature and close to educational institutions and employment hubs.

The inclusion of diverse unit types, from 2-bedroom configurations to exclusive 5-bedroom layouts with private lift access, ensures that this development caters to a wide range of buyers—from young professionals and small families to multi-generational households and hybrid investors. The dual-key 4-bedroom units, in particular, stand out as a smart option for those seeking flexible living spaces or rental income potential.

While Nava Grove’s PSF pricing is expected to be on the higher side compared to resale properties in the vicinity, the development benefits from modern design standards under the URA’s GFA harmonisation rule, which results in more efficient use of space. With the future Cross Island Line (CRL) enhancing connectivity and the area’s steady growth, Nava Grove has strong potential for appreciation, making it a compelling choice for those looking to invest in District 21.

Let’s get in touch

Are you keen to explore District 21 for your own-stay or investment purposes? Join us at our upcoming seminar at the Nava Grove Sales Gallery! Melvin Lim, Co-founder and CEO of PropertyLimBrothers, will be providing a data-driven analysis of the 2025 real estate landscape and exploring the pricing disparity between new launches and resale opportunities within the district. For more information and to register for the event, do RSVP at bit.ly/plbnava.

If you’re considering buying, selling, or renting a unit and are uncertain about its implications on your property journey and portfolio, please reach out to us here. We would be delighted to help with any market and financial assessments related to your property, or offer a second opinion.

We appreciate your readership and support for PropertyLimBrothers. Keep an eye out as we continue to provide detailed reviews of condominium projects throughout Singapore.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.