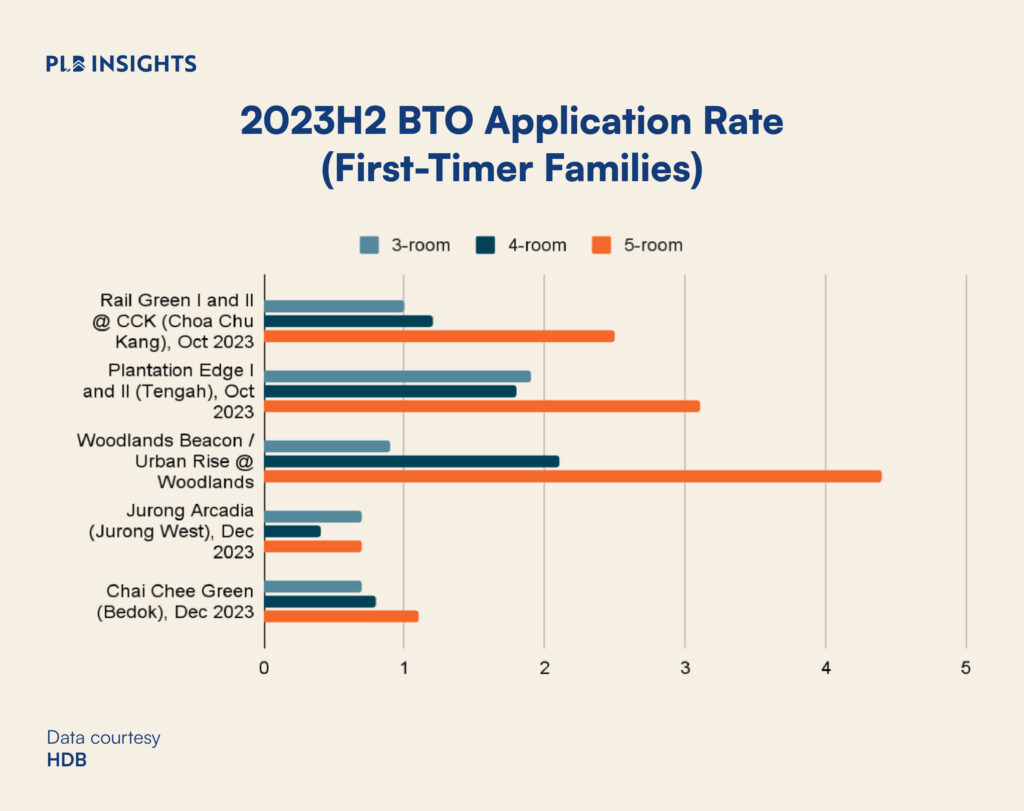

Throughout the latter half of 2023 BTO launches, a notable trend has emerged- the demand of 5-room flats consistently surpasses the number of available units. At its peak, the number of applicants surpassed the available units by more than fourfold. What could be fueling the demand for these bigger flats?

The allure of more spacious living has led many to assume a direct correlation between square footage and gains. This article seeks to challenge assumptions surrounding flat sizes and their perceived impact on returns. Let’s go!

Exploring the Flat Size to Returns Correlation

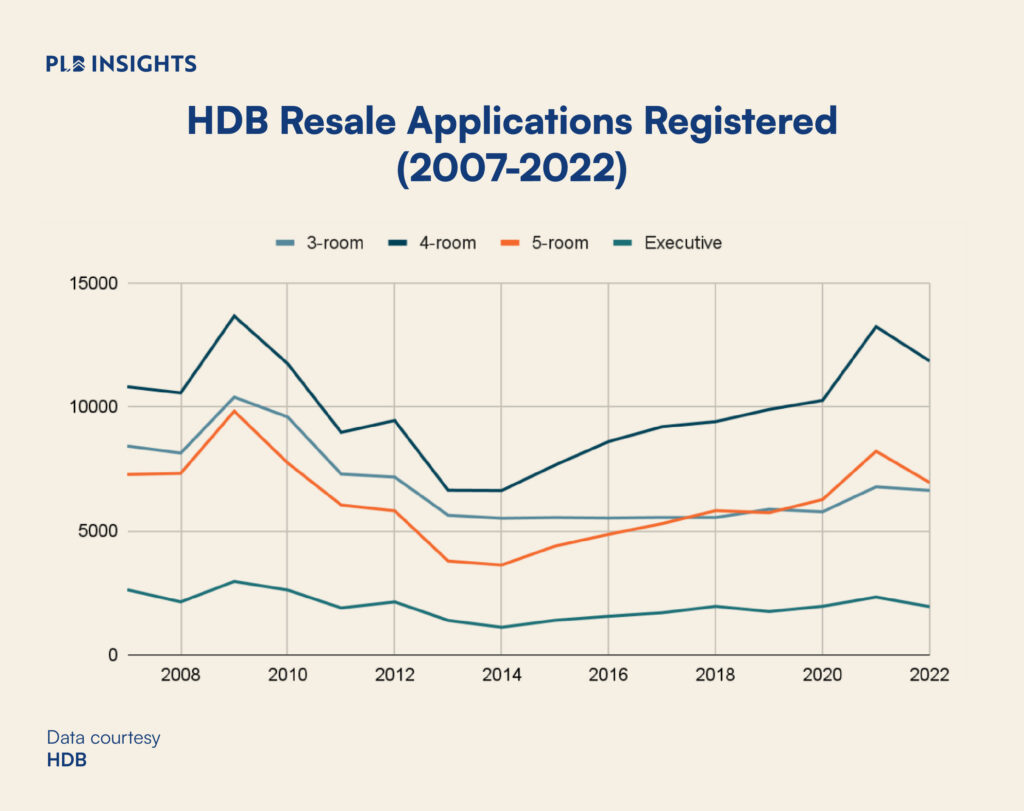

There are many flat types in the HDB resale market. Notably, the 4-room flat category has historically dominated this market, experiencing peaks with over 13,000 applications in both 2009 and 2021. The 5-room flat category exhibits a similar movement, albeit at a lower magnitude. Interestingly, the popularity of 5-room flats surpassed that of 3-room flats in 2017.

Meanwhile, executive flats have consistently the lowest amount of transactions throughout the years. This is mainly due to the limited supply of 3Gen flats and discontinuation of executive apartments and maisonettes in the 2000s.

For an in-depth case study comparison, this article will focus on the 3-room to 5-room flat categories within three distinct towns across Singapore. These towns are Hougang, Bedok, and Ang Mo Kio respectively.

Overall, the resale prices in the towns aligns with the number of rooms the flat has. 5-room flats tend to command the highest transaction prices, followed by 4-room flats and 3-room flats in descending order.

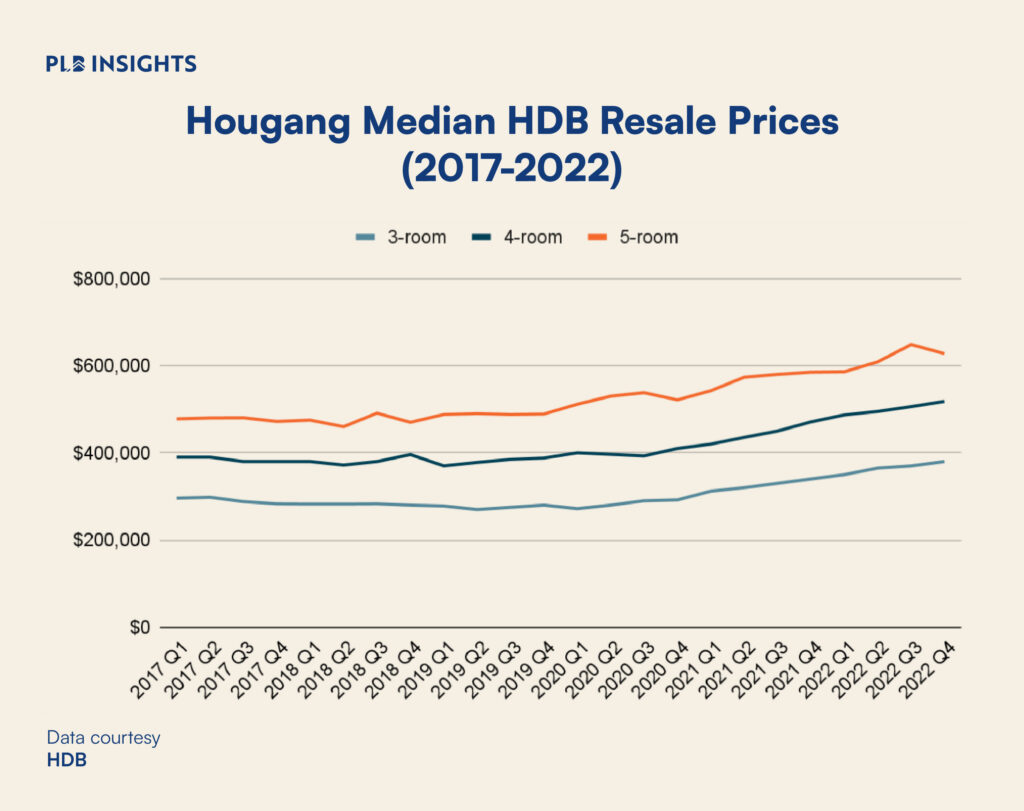

Hougang (D19)

Across all housing types, 2017 to 2022 indicates a period of overall growth in the Hougang HDB resale market. The initial prices in 2017 were relatively stable, with some fluctuations.

Despite the challenges posed by the pandemic in 2020, HDB resale prices in Hougang remained resilient, and there were even notable increases in some quarters. Prices continue to rise in 2021 and into 2022 especially in Q2 and Q3.

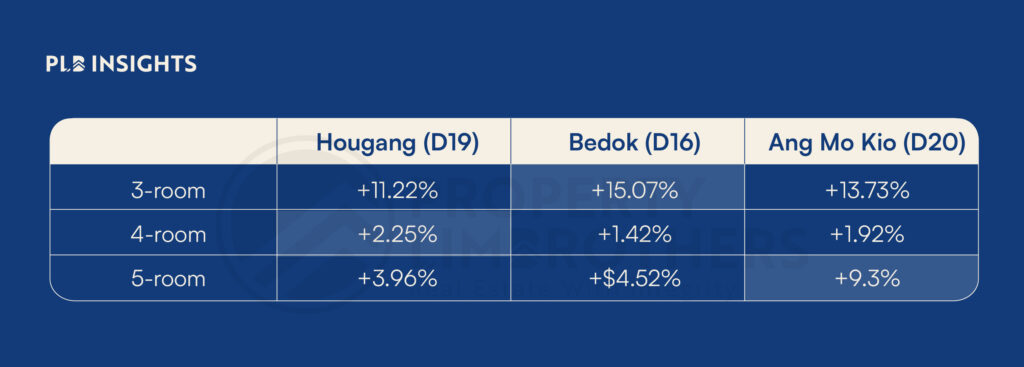

Examining the median prices of flats in 2017 and comparing them to 2022 reveals a positive correlation between the size of the HDB unit and its resale price. In general, larger units tend to have higher resale prices. The gains from 2017 (adjusted for inflation) to 2022 Q4 show that all unit sizes experienced positive price appreciation. The larger the unit, the higher the absolute gains.

Zooming in on Hougang’s 3-room flats, they showed the smallest absolute gain but still had a significant percentage increase (11%). This demonstrates that even smaller units experienced substantial appreciation in value.

Moving up in size to 4-room units, we observe a moderate increase in absolute gains. This reflects a common trend where additional space often translates to a higher resale value.

The largest in size, 5-room units, exhibit the highest absolute gains, aligning with the general expectation that larger units command higher prices. However, contrary to conventional belief, 4-room flats surpassed 5-room flats in terms of percentage growth.

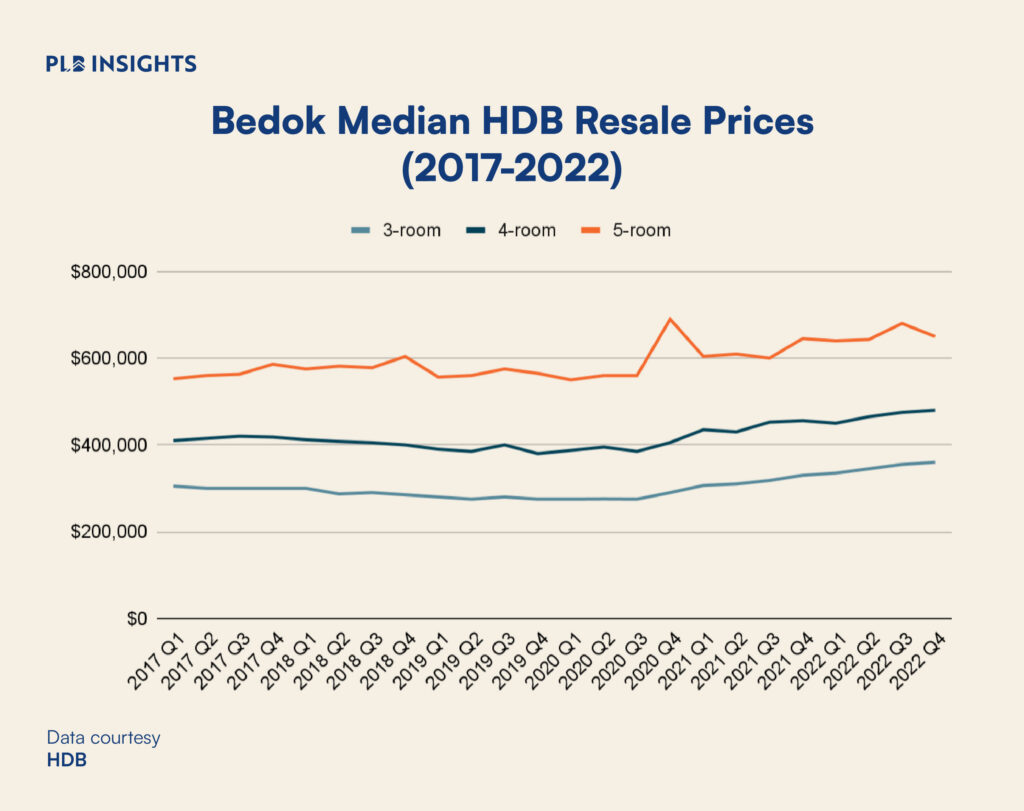

Bedok (D16)

The dynamics of the 3-room and 4-room market prices in Bedok resembles that of Hougang but at a higher magnitude. Notably, there is a larger disparity between 4-room and 5-room flat prices as compared to Hougang. The market was resilient throughout the pandemic and even had a sudden surge in pricing for 5-room flats in 2020 Q4.

Upon comparison, a positive correlation is observed between the size of the HDB unit and its resale price as well. Larger units generally command higher resale prices, aligning with the broader market trend. However, while positive, the gains from 2017 (adjusted for inflation) to 2022 Q4 deviate from initial expectations. The absolute growth falls short of anticipated levels, and the overall percentage growth is notably lower compared to the market performance observed in Hougang.

Turning our focus to Bedok’s 4-room flats reveal the smallest absolute gain and the lowest percentage increase (1.42%). 3-room flats experienced higher absolute gains followed by 5-room flats with the highest gains. Aligning with the general expectation that larger units command higher prices, 5-room flats saw the most appreciation.

Surprisingly, 3-room flats in Bedok brought about the highest percentage growth over the years and surpassed 4-room flats in absolute gains. This challenges the conventional belief that larger units consistently yield the highest percentage gains and smaller units have lower absolute gains.

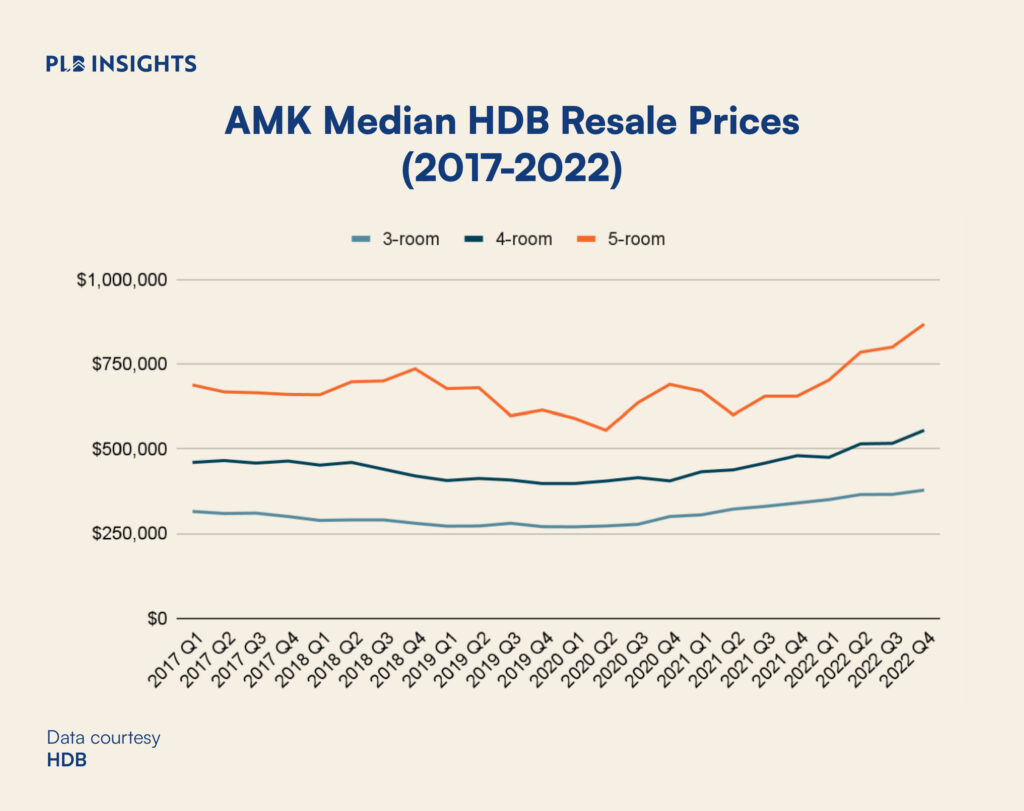

Ang Mo Kio (D20)

In Ang Mo Kio, 3-room and 4-room flats mirror trends observed in Hougang and Bedok with a gradual dip followed by a rise in prices. The 5-room flats demonstrated a distinctive price change in growth and fluctuations compared to the other two towns. The market was resilient and price movement increased, and subsequently dropped during the pandemic.

The principle holds true here that larger units tend to have higher resale prices. The gains from 2017 (adjusted for inflation) to 2022 Q4 showcase positive price appreciation across all unit types, with the larger the unit, the higher the absolute gains.

In terms of percentage change, the expected hierarchy is maintained, with 3-room flats showing the smallest percentage gain and 5-room flats exhibiting the largest. The overall percentage growth is the average of the three towns

The largest in size, 5-room units, exhibit the highest absolute gains, aligning with the general expectation that larger units command higher prices. Similar to the Bedok market, 4-room flats surpassed 5-room flats in terms of percentage growth, challenging the traditional belief in the market dynamics of these unit sizes.

Percentage of Gains

Analysing these price movements introduces nuances to Singapore’s market dynamics. Although larger units generally yield higher absolute returns, the appreciation in value is not proportional to unit size. Different unit sizes across towns had the highest percentage gains, challenging preconceived notions about the flat size and return correlation. It is crucial to remember that correlation does not equate to causation and there are other factors to consider.

Beyond Square Footage

Across the three towns, the range of median prices for 3-room and 4-room are similar. The price disparity between each unit type grows over the years. There are many possible reasons behind the growth and fluctuations in the various market segments. Each town has its distinct features and amenities which attract different demand among homebuyers. While we have analysed returns based on historical data, it is crucial to note that past percentage growth does not guarantee a similar pattern in the future.

Strategies for Maximising Returns

To maximise returns, homeowners can consider smart renovation to boost a unit’s appeal in the resale market. In today’s environmentally conscious and smart market, energy efficient and smart features may allow a unit to stand out. Thoughtful and well-executed renovations often yield higher returns than extensive but mediocre upgrades.

For prospective homebuyers, considerations should extend beyond monetary gains. Aligning a property with lifestyle preferences and future plans can provide non-monetary returns that are equally valuable. Return on investment encompasses more than capital appreciation. Factors such as an expanding family or the convenience of proximity to a loved one’s home also play a significant role in assessing a suitable property.

Final Thoughts

In this article, we have challenged the preconceived notion about correlation between flat size and returns, revealing nuanced market dynamics across Hougang, Bedok, and Ang Mo Kio. The analysis suggests that larger units may not always translate to proportionally higher returns. While larger units might offer higher absolute gains, smaller units can sometimes exhibit more significant percentage growth.

So, is one unit type superior to another? The answer is nuanced and depends on each homebuyer’s unique preferences and circumstances.

As you navigate the housing market, be mindful of budget constraints and ensure your investment aligns with your financial capabilities. Consider various factors beyond square footage and capital appreciation, including future-proofing for family expansion or proximity to loved ones, which adds intrinsic value to your investment.

Should you seek personalised guidance or wish to discuss your future housing plan, our team of experienced consultants is at your service. Feel free to reach out here, and let us navigate the path to homeownership together.

TLDR; Myth busted! Till next time!