The idea of spending one’s retirement in a spacious condominium or, even better, in a landed home with a private garden has undoubtedly crossed the minds of many Singaporeans. However, the reality is that condominiums and landed homes have become unattainable for many. To make matters worse, property prices in Singapore continue to rise, with no signs of slowing down in the foreseeable future. As a result, the notion of retiring in Johor Bahru has become increasingly appealing to some locals.

On the surface, Johor Bahru offers an attractive alternative, with its slower pace of life and substantially lower cost of living, bolstered by the strength of the Singapore Dollar. But is it truly a feasible option, or simply a case of ‘the grass is always greener on the other side’?

In this article, we’ll delve into the practicality of retiring across the causeway, the necessary visas, and key considerations for making this vision a reality.

Required Visas

In theory, under the Social Visit Pass which every Singaporean automatically qualifies for, a stay of up to 30 days in Malaysia is allowed each time a Singaporean goes through the immigration customs to cross the border. So all Singaporeans would have to do is to clear immigration customs anytime within this 30-day window to renew their stay in Johor Bahru. However, this approach isn’t the most foolproof for ensuring a peaceful retirement. To enjoy a truly relaxed and worry-free retirement, it’s essential to follow the proper legal procedures, starting with securing a valid long-term visa.

Malaysia My Second Home (MM2H) Programme

While there are several options for Singaporeans to secure long-term visas or Permanent Residency in Malaysia, the Malaysia My Second Home (MM2H) programme was specifically designed to attract retirees and offer them a pathway to establish Malaysia as their second home. For retirees, this programme is arguably the most straightforward route to obtaining a long-term visa.

The MM2H programme was initially launched in 2002, suspended in 2018, and then relaunched in 2021 with significantly stricter requirements. After the most recent review in December 2023, a 3-tier system was introduced, offering Silver, Gold, and Platinum categories for retirees seeking the MM2H visa, each with its own set of requirements.

All tiers share common requirements: applicants and their spouses must reside in Malaysia for at least 90 days each year, and the minimum age for applicants is 25. A key change in this new 3-tier system is that proof of minimum monthly income or liquid assets is no longer required. Previously, applicants needed to produce proof of at least RM40,000 in monthly income and RM1.5 million in liquid assets, making the new rules more accommodating to retirees.

For the Silver category, applicants must place a minimum of USD $150,000 in a Fixed Deposit with a Malaysian bank and purchase a property valued at least RM600,000. The Silver MM2H visa is valid for 5 years and can be renewed for another 5 years upon expiration. The Gold category requires a Fixed Deposit of USD $500,000 and a property purchase of at least RM1 million. This visa is issued for 15 years and is also renewable. As for the Platinum category, applicants must deposit a minimum of RM1 million and buy a property worth at least RM2 million. The visa is valid for 20 years and can be renewed upon expiry.

A Practical Example: Retiring in Malaysia with MM2H

To keep things straightforward, we’ll focus on the Silver category of the MM2H visa. Our practical example will feature a couple, both aged 55, who own a 4-room HDB flat valued at SGD $600,000. We’ll explore the feasibility of retiring in Johor Bahru for this couple, considering two scenarios: selling their HDB flat to fund their retirement, or keeping the flat and renting out two rooms to generate a steady monthly income to support their retirement.

Scenario 1: Sell Off HDB Flat

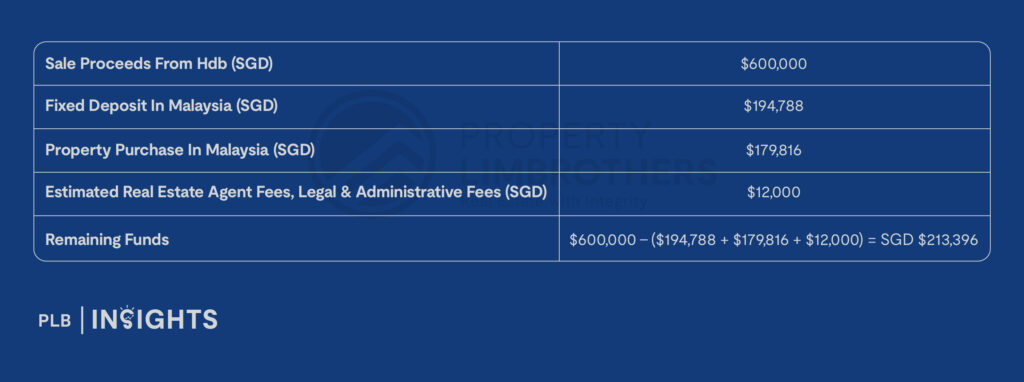

Given that the Silver category requires a minimum Fixed Deposit of USD $150,000 (around SGD $194,788 at the current exchange rate) and the purchase of a property in Johor Bahru valued at least RM 600,000 (approximately SGD $179,816), we’ll walk through some rough figures to assess whether retiring in Johor Bahru is easily achievable.

After setting aside the required Fixed Deposit and purchasing a property in Johor Bahru, you would initially have $225,396 remaining. However, after factoring in additional costs from selling your 4-room HDB flat, such as real estate agent commissions, legal fees, and administrative fees, the remaining balance would be approximately $213,396. It’s important to note that these figures are estimates, and the actual fees for the agent, legal services, and administration could vary, potentially affecting the final balance.

Assuming Malaysian banks offer an interest rate of 2.6% per annum, the required Fixed Deposit of SGD $194,788 would generate approximately RM 16,969 in annual interest, which translates to about RM 1,414 (SGD $423) per month.

Additionally, if the couple invests the remaining balance of SGD $213,396 from the sale of their HDB flat into a Fixed Deposit at an interest rate of 2.6% per annum, along with the required SGD $194,788, the total deposit would amount to SGD $408,184 (equivalent to RM 1,363,149). This combined deposit could yield an annual interest of approximately RM 35,441, or about RM 2,953 per month.

While these interest earnings wouldn’t fully cover the estimated monthly expenses of RM 5,150 (SGD $1,542), they are still considerably lower than the average household expenses in Singapore, which are about SGD $4,906 per month. Moreover, if the couple has met the Basic Retirement Sum (BRS) in their CPF, they would start receiving a monthly payout of at least SGD $840 to $900 from the age of 65, providing additional support for their retirement in Johor Bahru.

Scenario 2: Retain 4-room HDB Flat and Rent Out Two Bedrooms

Now, let’s assume the couple in our example has enough savings to cover both the property purchase and the required Fixed Deposit without needing to sell their 4-room HDB flat. Instead, they choose to rent out two of the common bedrooms, keeping the master bedroom for themselves during occasional trips back to Singapore.

If both common bedrooms generate a total rental income of SGD $2,400 per month, this translates to approximately RM 8,010 at the current exchange rate. This amount would more than cover their estimated monthly expenses of RM 5,150. Additionally, with the interest from the Fixed Deposit providing RM 1,414 per month, the couple would have extra income to enjoy a more comfortable lifestyle and even fund travel plans.

However, it’s important to note that the combined cost of the Fixed Deposit and the minimum property purchase adds up to a significant amount. Not all retirees would have the financial capacity to afford this without selling their property in Singapore.

Property Prices in Johor Bahru

A quick search on Malaysian property portals reveals that 2-bedroom condominiums near the causeway are typically priced between RM 750,000 and RM 850,000, which is approximately SGD $223,836 to $253,681. This is significantly more affordable compared to condominium prices in Singapore.

When it comes to landed properties, prices vary depending on location and condition. Inter-terraced houses can be found within the range of RM 550,000 to RM 1 million. For those looking for more space, a move-in ready semi-detached home is available for RM 1.25 million to RM 2 million. At the current exchange rate, these prices are comparable to the cost of a 4-room HDB flat in Singapore’s Outside Central Region (OCR) or Rest of Central Region (RCR).

Considerations To Take Note

Insurance Coverage

As you approach your retirement years, having adequate insurance becomes increasingly important, as healthcare needs are likely to rise. While it’s advisable to consider insurance from a Malaysian provider, your current Singapore-based insurance should generally be sufficient, especially given the favourable currency exchange rate and the short distance between Johor Bahru and Singapore. However, it’s crucial to ensure that your existing insurance policy covers medical treatments in Malaysia, particularly for emergencies.

Transportation Options

Public transportation in Johor Bahru is less extensive compared to Singapore, making it almost essential to have your own vehicle. While cars in Malaysia are generally more affordable than in Singapore, the costs of ownership and maintenance can still add up over time, impacting your retirement savings. Alternatively, you could rely on e-hailing services, but this may not be a cost-effective option in the long run, as frequent use can also accumulate substantial expenses.

Pedestrian Access

The ability to easily reach amenities and necessities on foot is an important factor to consider. In Johor Bahru, the convenience of walking to nearby eateries, shops, or essential services can vary greatly depending on where you live. In many areas, walkability is limited, which may require you to rely on private vehicles for most errands.

Personal Safety and Home Security

In Singapore, it’s generally safe to walk around at any time of day. However, in Johor Bahru, certain areas or times may pose higher safety risks. Additionally, you may need to invest in extra security measures to reduce the risk of break-ins and ensure your property is well-protected.

Travel Convenience For Family Visits

While living in Johor Bahru may offer a lower cost of living, the commute to Singapore to visit family and friends can be challenging. Travelling times can be long, especially during peak hours, with frequent traffic jams on the Causeway. Additionally, the roads leading to immigration checkpoints in Johor Bahru are often congested, making the journey even more time-consuming.

In Summary

On paper, retiring in Johor Bahru seems financially feasible. However, several key factors must be considered to ensure a comfortable and stress-free retirement. Lifestyle preferences play a crucial role in such a significant decision, and it’s important to remember that the MM2H requirements may change over time, potentially impacting your plans.

Have questions or need help with retirement financial planning? Reach out to us today. Our expert consultants are ready to guide you through every step, ensuring you enjoy a smooth and fulfilling retirement.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.