When you hear the term “En Bloc”, you might be reminded of the heated season of developers snapping up older properties in the mid-late 2000s. Back then, en bloc were considered to be serious windfalls, akin to winning Toto or 4D. For some, it was possible to get two to three times the amount they paid for the home. This might seem like an unbelievable exaggeration. And for the same reason, it was why en blocs made a huge impression on public memory.

The property market and the economy are in a starkly different situation today than it was back in 2017 or early 2000s. Likewise, the en bloc market is expectedly different from the past few iterations. Can homeowners who go through the en bloc process now reasonably expect to get as much as what people got in the past?

In this article, we focus on en blocs for private property and cover some of the reasons why homeowners should lower expectations of en bloc profits. Additionally, we also cover the developer’s side of the story on how the en bloc market is different from the past.

En Bloc Windfalls of the Past

The en blocs that most people remember are the ones that profited on the order of two to three times the previous purchase price. Typically, these are highly sought after land parcels. With multiple developers bidding to obtain that prime piece of land. Getting a property that has such en bloc potential is akin to winning the lottery. It is hard to predict exactly when an en bloc would occur and how much profit it could generate.

As a side point, the introduction of Seller’s Stamp Duty (SSD) and how it is revised across time affects the risk factor for some buyers targeting to purchase private properties with en bloc potential. Should it go through an en bloc within the SSD time frame, those buyers might end up having to pay a potentially hefty sum.

Back to en blocs, when a collective sale of a private property happens, its reserve price is typically above the market rate. This is to incentivise homeowners in the same property project to agree to the collective sale. En blocs will usually require 80% or more of the owners to agree to the collective sale with many other intricate rules to abide by.

In the cases of en blocs reaping tremendous profits, offers for the collective sales are way above the reserve price. En blocs with impressive 3-digit percentage returns were made before the Global Financial Crisis (GFC) of 2008, mostly in the years of 2006 and 2007. These returns are calculated as the estimated en bloc premium above the market prices before the en bloc. Over the past 10 years, the average en bloc premium above the market price has been modest at best.

The fortunate few who were able to enjoy the golden age of hot en blocs of the mid-2000s definitely have the last laugh. Since then, Government Land Sales (GLS) and Property prices have risen significantly. This is especially after a prolonged period of depressed property prices after the GFC and the implementation of multiple different cooling measures.

Simultaneously, the prices of new launches have skyrocketed above resale prices. Coincidence? Probably not. The rising cost of land coupled with the expensive en blocs for developers all factor in as costs to newer developments. It is no wonder that there is an established price gap between new private property projects and existing ones.

Given how the market conditions are remarkably different from the pre-GFC era, it is unlikely that we will see a feverish en bloc season like those of the past. Even if there are en blocs that clock triple digit percentage gains, it will likely be only a selected few with great locations and high potential for future growth, with the probability of intensifying the land use. Such developments are few and far between.

Why Should Homeowners Expect Less Exciting En Blocs?

Should homeowners then adjust to the times and lower their expectations of mega-profit making en blocs? Perhaps. How profit is calculated in different articles will matter. Some look at the premium above the market price. Others look at when the property was bought and how much profit was made when it was sold en bloc (conventional method of calculating profits). Using the en bloc premium is a fairer way to compare between en blocs. Whereas the conventional method of calculating profit will depend heavily on when the property was bought.

For extremely profitable en blocs, it is likely that they were purchased in early 2000s and before thus benefiting from the housing bubble of 2008. Similarly if properties were bought while property prices were depressed by Cooling Measures and the housing crash around 2011-2014, the profit reaped in better economic times could be substantial. If you did not purchase your property during these periods (or before 2000), you are better off paying more attention to the en bloc premiums instead.

A lot of the glamour and the attention is focused on the en blocs with incredible returns. Few look at the mediocre collective sales which may have more than a few disgruntled or regretful homeowners. The cost of moving is not to be underestimated. This might be the minority of residents but they do have a valid point. Finding and moving to a new place is often a time consuming and stressful process. Even if your en bloc nets you a positive gain, you would be entering the present property market at much higher prices.

En bloc beneficiaries should be aware of the much higher property prices when they look for their new place. This in itself presents a reinvestment risk, when the market is now already at elevated price levels. The tedium of the entire process might already make the sound of en blocs less enticing to homeowners.

The primary reason behind less exciting en blocs this season is mostly the economic and regulatory situation we are in. Within declining volume in the transactions in the market, developers are becoming more selective and cautious of an impending slowdown. Homeowners who are still hung up on reaping huge profits through en bloc should pay key attention to whether their property fits the bill of what developers are looking for, which tend to be rather centrally located small freehold developments around 3 decades of age.

Reasons for Developers to be Cautious in the Current En Bloc Market

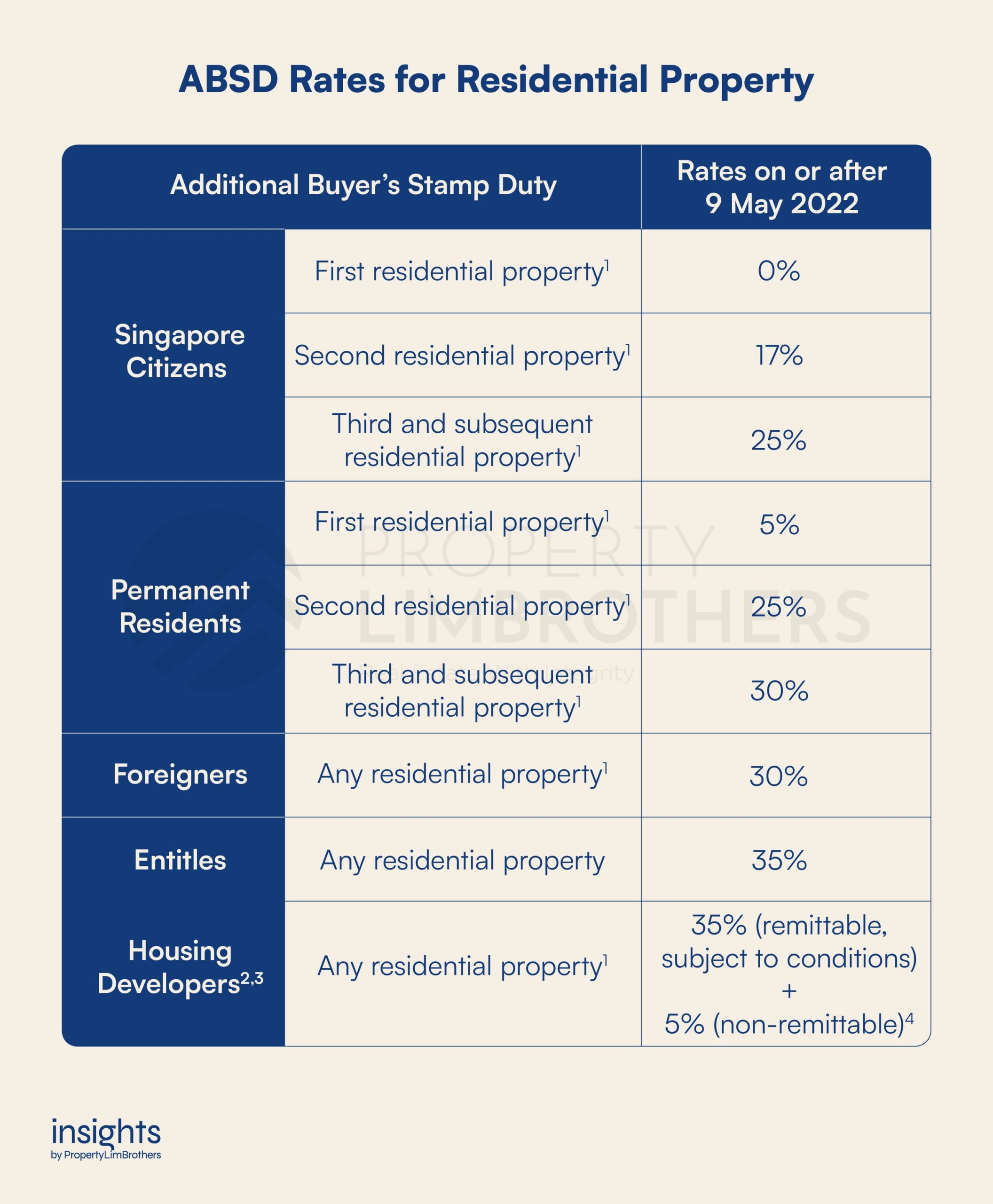

Why are developers so cautious as opposed to the en bloc seasons of the past? Some news outlets point to the possibility of recession as the main reason for caution. But that’s not it. Higher interest rates. Higher Additional Buyer’s Stamp Duty (ABSD) for developers. High property prices. These are all factors playing into why developers are not making big bets on en blocs this year. It would be speculative to think that the government bodies raised ABSD rates in anticipation of a returning en bloc fever. But these cooling measures that were introduced to the market further deters hasty moves from the developers.

The possibility of a recession is a valid concern for developers. It could range widely in terms of the impact. From supply-chain and construction disruptions and delays, to affecting the demand for new properties. A recession could also raise investor concerns about the financials of the developer company. As part of the strategy of being prudent in uncertain times, developers may be holding back on their en bloc purchases.

The higher interest rates are intricately linked to the possibility of a recession. Higher interest rates are the Central Bank’s main way to combat inflation, but at the same time brings down the growth of the economy. Higher interest rates also mean a higher cost of borrowing for individuals and companies alike. This would negatively affect the investment and growth prospects of businesses (developers included).

Higher ABSD for developers since December 2021 also means that developers have to fork out additional cash upfront (40%) for ABSD prior to even starting construction. While a portion of this is remittable if they complete and sell all the units of the project, it does not change the fact that the capital requirement for housing development has increased. If the market slows down and the developers are not able to sell all the units in time, their profit margins could be easily eroded due to the high ABSD. This poses a much higher risk to developers.

Property prices now are also elevated. If we couple this with an en bloc premium, developers might think that they are paying too much for that land parcel. That being said, GLS and New Launch prices are inflating at a much higher rate than resale prices. It is possible that developers are waiting for a price correction in the property market for more reasonable prices. This could be due to developer’s expectations of poor future economic performance, more cooling measures, or more GLS in the future. All of which makes en blocs a less attractive option.

Nonetheless, developers cannot leave their land banks unreplenished. Unsold inventory levels have been dropping for private residential properties. This is more apparent for the OCR and RCR as compared to the CCR, which may hint at the directions in which en blocs take. In response to the rising property prices and lacklustre supply, there is also a possibility that the government would release more land for residential use under the GLS. To sum up, developers have plenty of reasons to be cautious under the current market conditions. The supply situation in the market is also not exactly favourable for developers. As a result, en blocs in 2022 face a precarious situation as developers acquire land much more selectively.

An Interesting En Bloc Case of Chuan Park

Chuan Park is an interesting en bloc case study for 2022. It is the largest en bloc deal of the year thus far, selling at S$890 million but below their reserve price of S$938 million. This basically presents approximately a 5% discount (S$48 million below the reserve price) for the en bloc. We feature Chuan Park in this article due to the peculiar nature of selling below its reserve price, and having potentially unsanctioned social media ads being run on the new development.

Selling below the reserve price happens quite rarely, but this is not to say it never happens. Although from a technical point of view, the reserve price should be the minimum acceptable price. Offers coming in below the reserve price are typically rejected, with the en bloc falling through. That is a more common outcome than accepting an offer below the reserve price. Chuan Park is one of these exceptions that sold below its reserve price. Another example that sold below its reserve price (albeit as a commercial property in 2019), was Realty Centre.

The press reported unhappiness among some residents on the lack of timely updates on the deal. Members of the public can only speculate as to why an offer below the reserve price was accepted. Regardless, en blocs like these tell us the state of negotiating power developers have as opposed to collective sellers. It might be a signal that en bloc bidding is not as heated as before, particularly for larger developments. Developers will have more negotiating power in this less competitive environment for en blocs.

Interestingly, as the news of the deal went on press, social media ads started popping up on the development that would take the place of Chuan Park. Sanctioned or not, we might not know exactly why or who is behind this premature marketing for the new development. Nonetheless, it is also a signal of how heated the new launch market is for residential developments. Spending money on social media advertising for a new development this early in the deal process is a prime example of a potential exuberance that is growing in the new launch market.

These are just some of the observations made from the latest en bloc deals in 2022. It is possible that as more deals fill up the rest of 2022, some of the market conditions in the supply of land might change. Extrapolating our observations to the whole en bloc market from just one deal might also be a stretch, but it at least gives us some brief ideas to test against future deals.

Closing Thoughts

The en bloc market in Singapore is isolated away from the rest of the real estate market, or the economy. Macro headwinds have also permeated into the en bloc market in Singapore, with developers showing a prudent amount of caution in being more selective with en blocs and more conservative with offers. Even so, the supply situation for developer land banks is still very tight. Yet, the competition for new land parcels via en bloc and GLS have not reflected this low supply levels.

If you want to discuss more on the current market situation for Singapore’s property market, or want to find out more about how to optimise your property journey, reach out to us here. En bloc or not, 2022 is packed with a lot of economic and property news to look forward to. We look forward to sharing more of our thoughts with you. Thank you for reading this far!