With inflation roaring and home prices soaring in the US, there are real concerns about the formation of a housing bubble. Are the high prices of homes justified? Is it sustainable to keep climbing up like this? Or is this a housing bubble that is going to pop like the one in the mid 2000s? We look at the housing market in the US and compare the situation there with the one here in Singapore.

In this article, we will look at how the Dallas Fed (US Central Bank) monitors their housing market and what we can learn from them. We look at how the rental market and income level grow, in tandem with housing prices. A bubble forms when the rise in housing prices is not supported by the rental and income level. This could be driven by FOMO buying behaviour, which can be catastrophic if done on a huge scale. Government intervention would be needed if the early signs of a housing bubble are in motion.

U.S. Housing Bubble 2.0

Inflation in the U.S. is more of a horror story than it is in Singapore. Not to mention how their real estate market has grown over the past 3 years. While real estate investments might be a good hedge against inflation, it is not immune to the formation of a bubble. When buyers pile into the asset class due to FOMO or a high volume of emotional transactions with little to no holding power, that is the sign of an unhealthy bubble growing.

Many financial institutions, investors, and even the central bank are worried about the formation of such a housing bubble. The previous housing bubble of 2006 and the subprime mortgage crisis that caused the Global Financial Crisis in 2008 was arguably a traumatic experience for the economic system. The market has evolved since then. Financial institutions have put in place many safeguards to make sure that home-buyers are not over-leveraged with no collaterals.

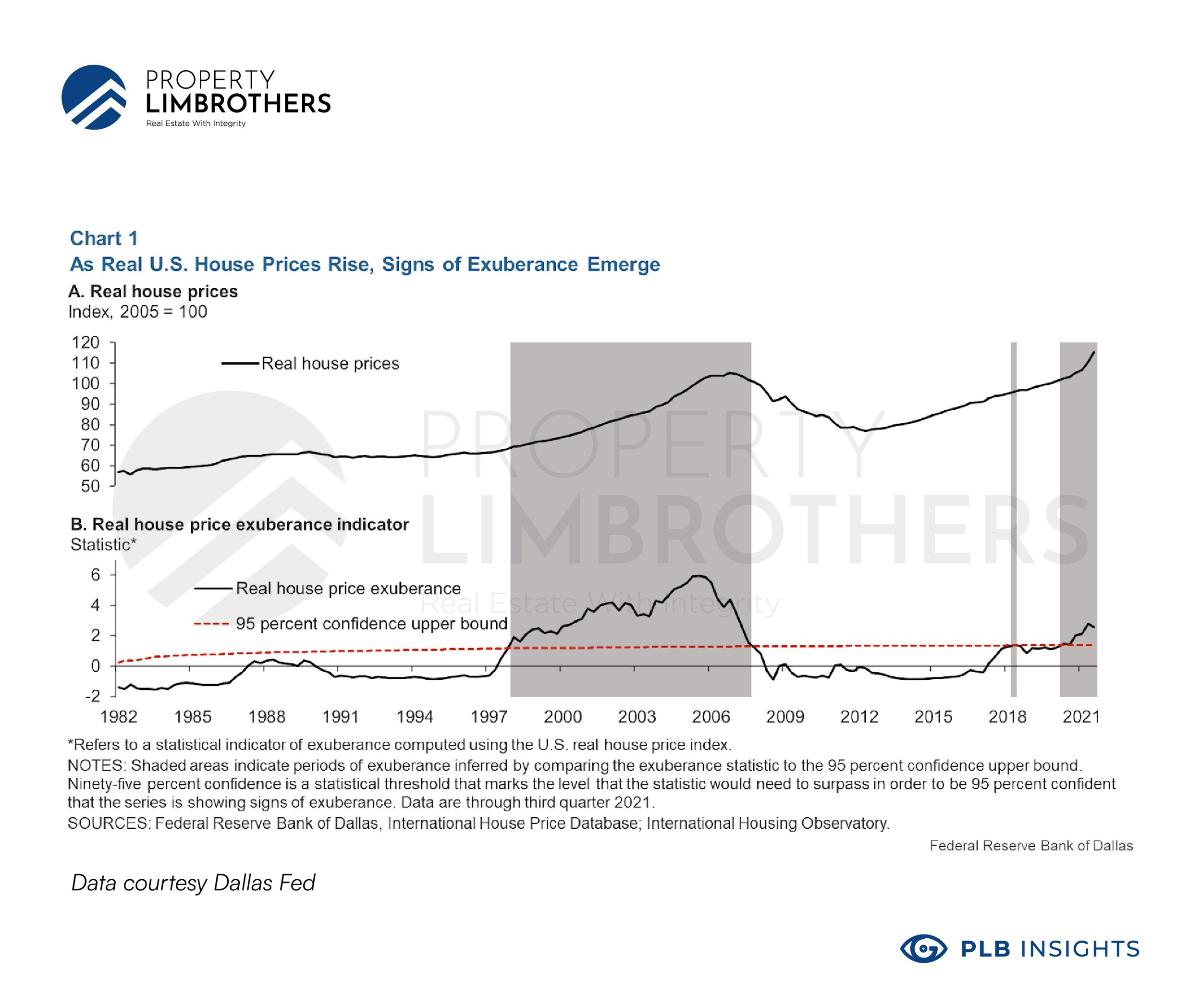

The Dallas Fed is actively monitoring the growth of the housing market. They have an exuberance indicator and price ratios with rent and income growth accounted for. The numbers in the charts are adjusted for inflation. Here is a look at some of their charts.

The real house price index has risen above 115% as of 29 March 2022. In January 2022, the year-on-year growth for the housing market in the U.S. was 11.2%. This double digit growth is considered abnormal. While some investors might be laughing their way to the bank, it is a worrying sign for regulators and financial institutions. The current home prices have risen above the previous high of 2006. And the start of a housing bubble might be in motion.

The shaded area on the chart covers the time when the housing price is above the 95% confidence interval for exuberance. Such as the period from 1998 to 2007, 2020 has marked the beginning of a new period of exuberance.

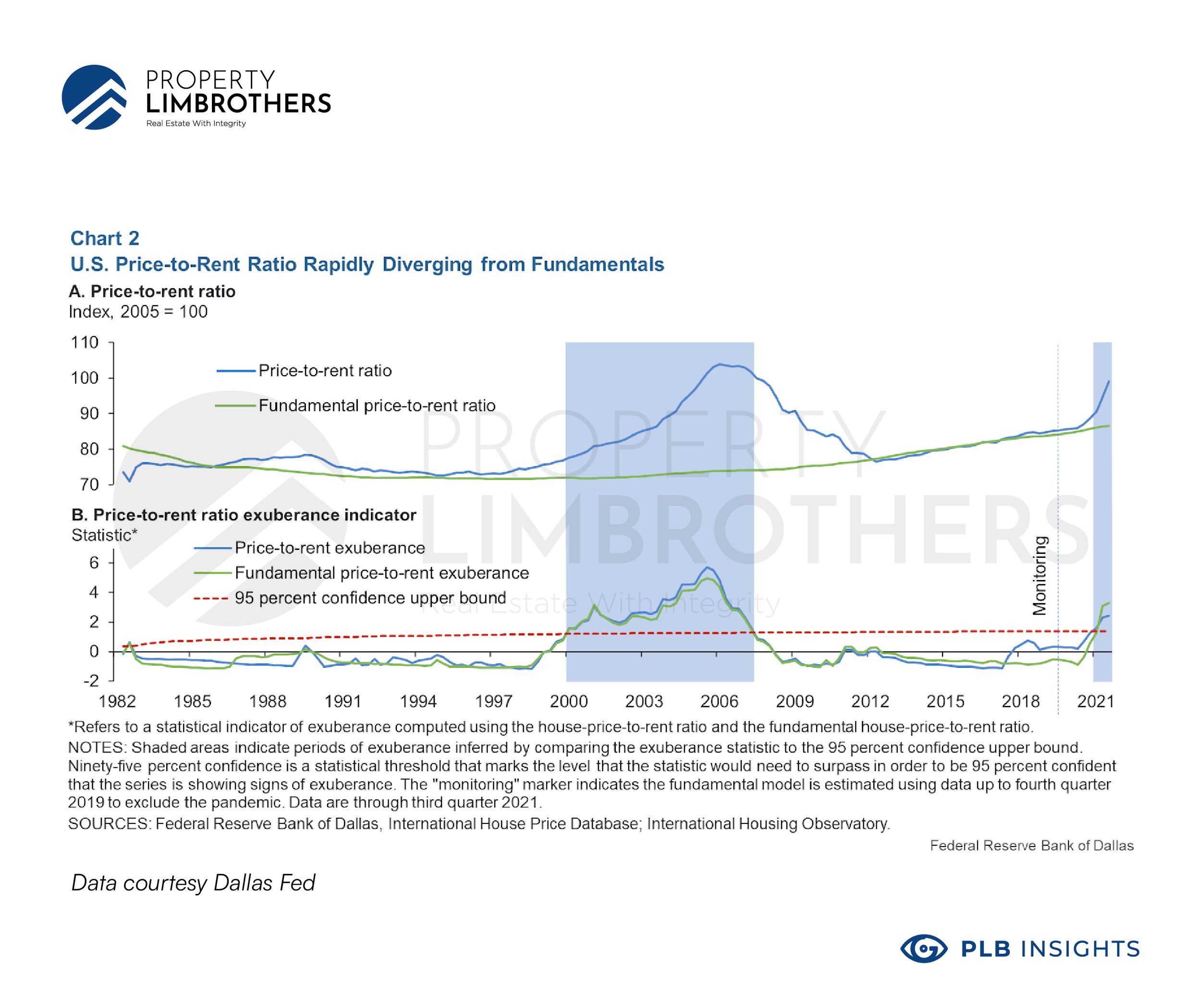

Rent is an important metric to look at in relation to the growth in housing prices. Why is it important? If there is low rental demand, it means that investors would have trouble having rental income to support mortgage payments. If housing prices stretch far above rental demand, investors might be biting off more than they can chew. The investment might not be sustainable unless they are staying in the property and have sufficient income to support the mortgage themselves without rental income.

In the above chart, housing prices since 2021 have deviated from the fundamentals of price-to-rent ratio. If the gap continues to grow, it signals an increase in risk of a housing bubble. Above and beyond these numbers, this also means that housing has become increasingly unaffordable for Americans. With housing prices rising exorbitantly and rentals climbing sky high, people from marginalised groups would be less able to afford housing options. We can think of the price-to-rent ratio as a first layer warning of a housing bubble. It is a leading indicator that tells us ahead of time, the health of the housing market.

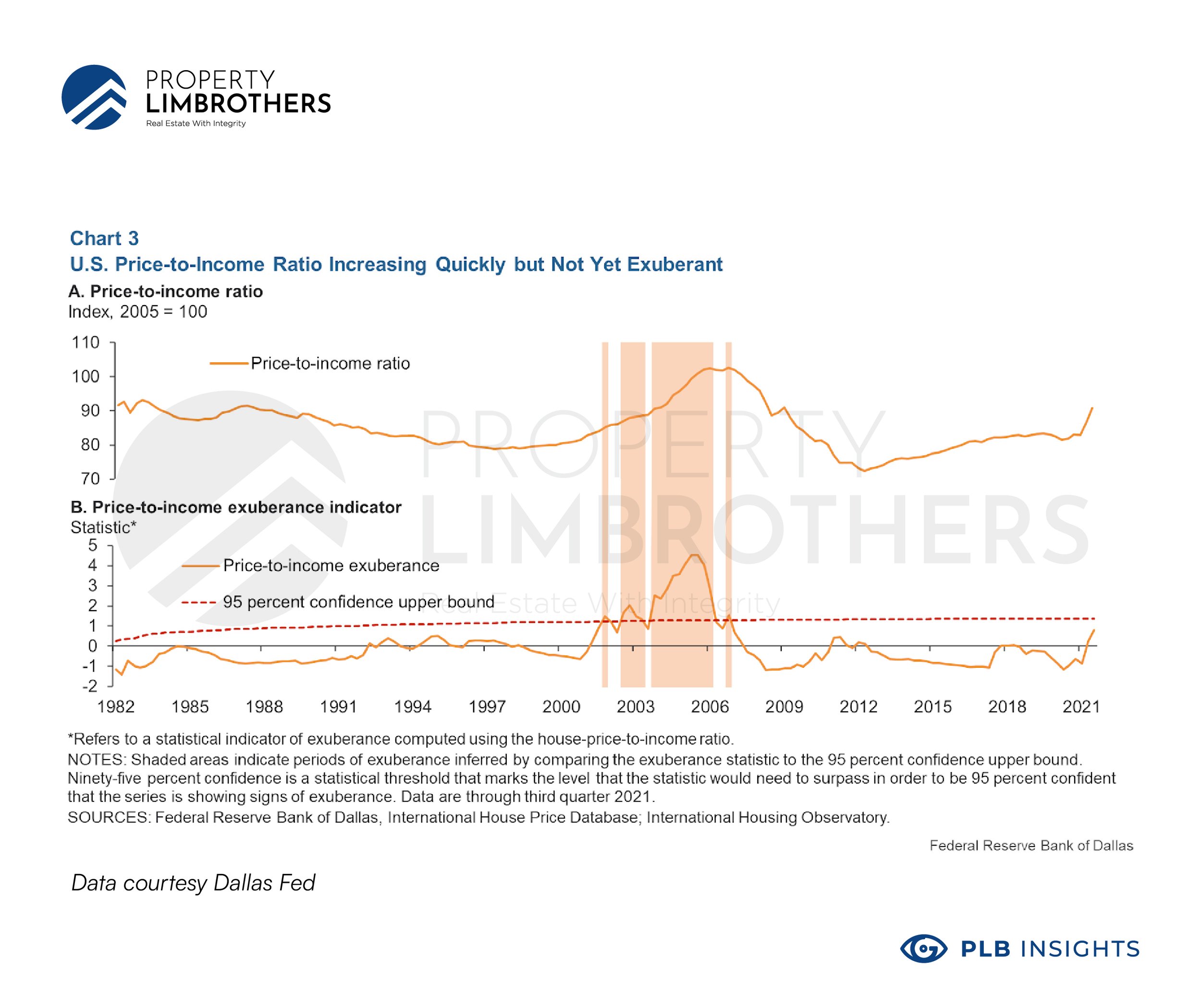

If the price-to-rent ratio is the first layer warning system, then the price-to-income ratio is the second layer warning for a housing bubble. As mentioned above, rent and income should grow in tandem with housing prices because there needs to be a way to afford the high mortgage payments. It has to come from somewhere. In the case of the 2006 housing bubble, there were warning signs more than 3 years prior to the crash that the growth in housing prices were unsustainable. From the orange shaded area, we can see early warning signs since 2002. After 2004, it was clear that housing prices and outgrown income levels.

We see prices in 2022 creeping close to the upper bound of the exuberance indicator. Perhaps we are not in a housing bubble now, but given the steep trajectory of the curve, we might be in the very early stages of forming the bubble. The market is rather different now. One can hope that regulators will take faster action if the housing market shows signs of unsustainable growth. In J.P. Morgan’s research, there is a chance of a real estate correction in certain geographies. The US is experiencing the rapid rise in housing prices mostly in supply-constrained areas. Thus, it is not an across-the-board raging bubble as of now.

Is there a Housing Bubble in Singapore?

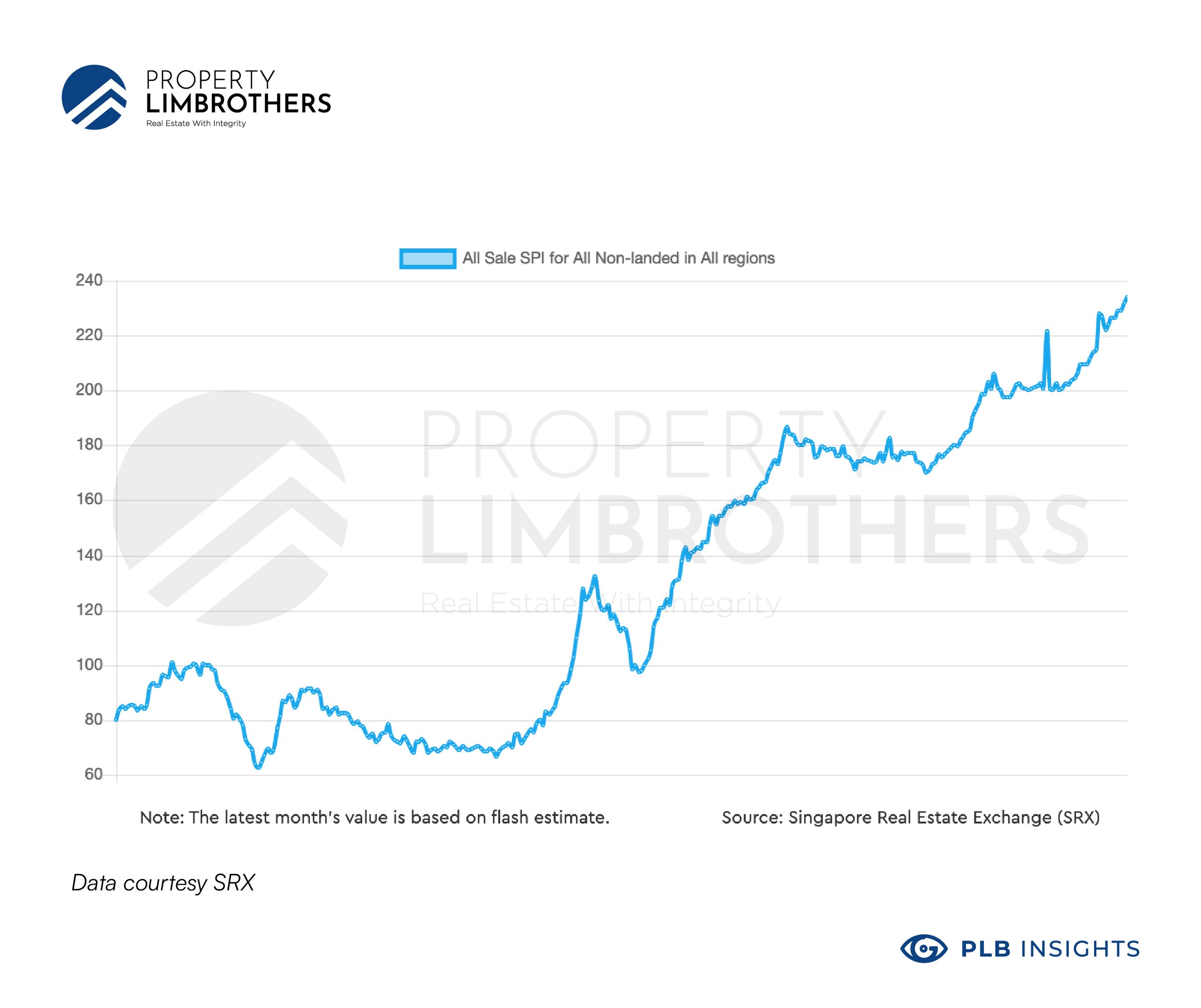

The good thing about Singapore is that regulators take swift action to prevent the real estate market from exuberant growth. The recent cooling measure in December 2021 is a good example. Regular cooling measures prevent the market from getting too hot, and reduces the risk of a large correction. Finding the equivalent measures of price-to-rent and price-to-income ratios in Singapore are difficult. We hope that URA or MAS eventually publishes these indicators as part of the quarterly update on the health of the real estate market. Despite this, we believe that the regulators are actively tracking these metrics as a leading indicator for when to implement cooling measures. Just to get a sense of the real estate market health, we look at SRX’s index for property prices and rental prices. We then look at a separate chart for income growth.

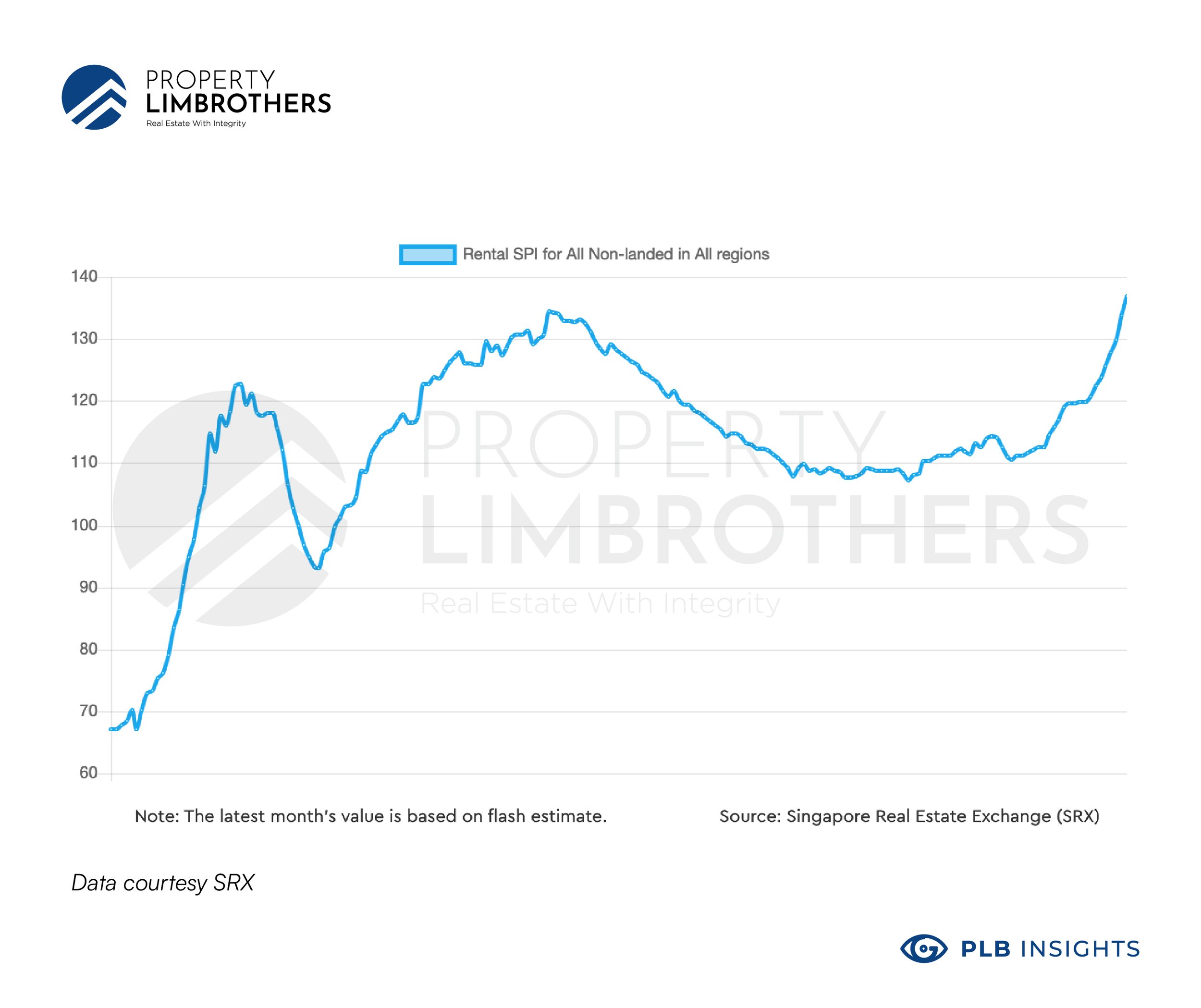

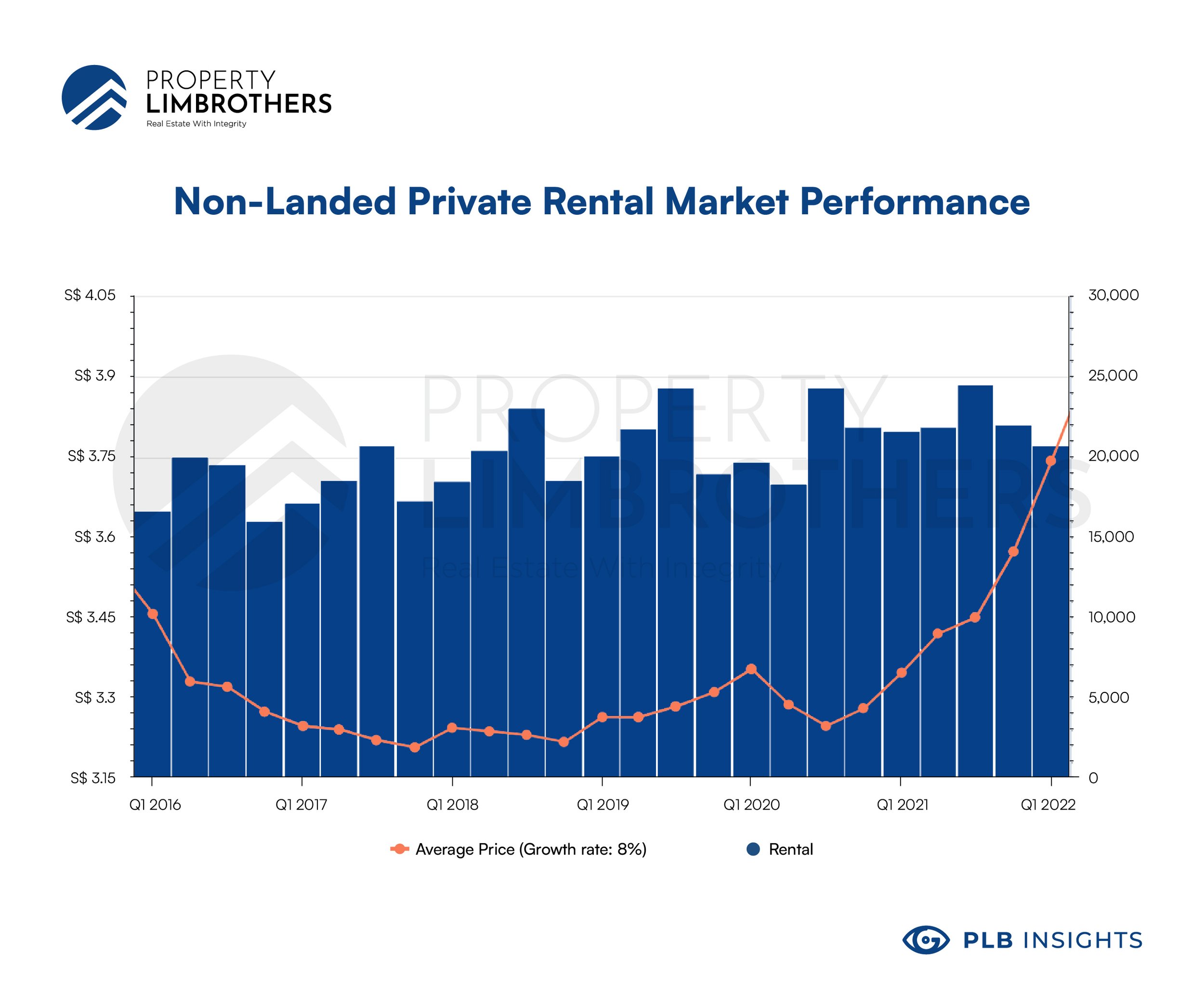

The property price index for non-landed private property has seen tremendous growth since 1995 (start of index) to present. Jan 2006 is indicated at 73.1, at the base of the massive acceleration upwards. The rental price index for non-landed private property (chart below) starts in Jan 2006. As you can see, the subprime mortgage crisis is also reflected in both markets, represented by the steep correction from the sharp run upwards. Generally, we see support from the rental market in terms of price. The rental market is rising in tandem with non-landed private property prices.

Over the past 2 years, the rental price for non-landed private condominiums and apartments grew 11%. Yet, transaction volume remains steady with some seasonal tapering. The question is if the rental market can continue to stomach higher prices. The rental index has recently surpassed the previous all-time-high of 134.4 (Jan, 2013) with a reading of 136.9 in April 2022. If rental demand slows down in terms of transaction volume, we might see the formation of a peak in rental prices.

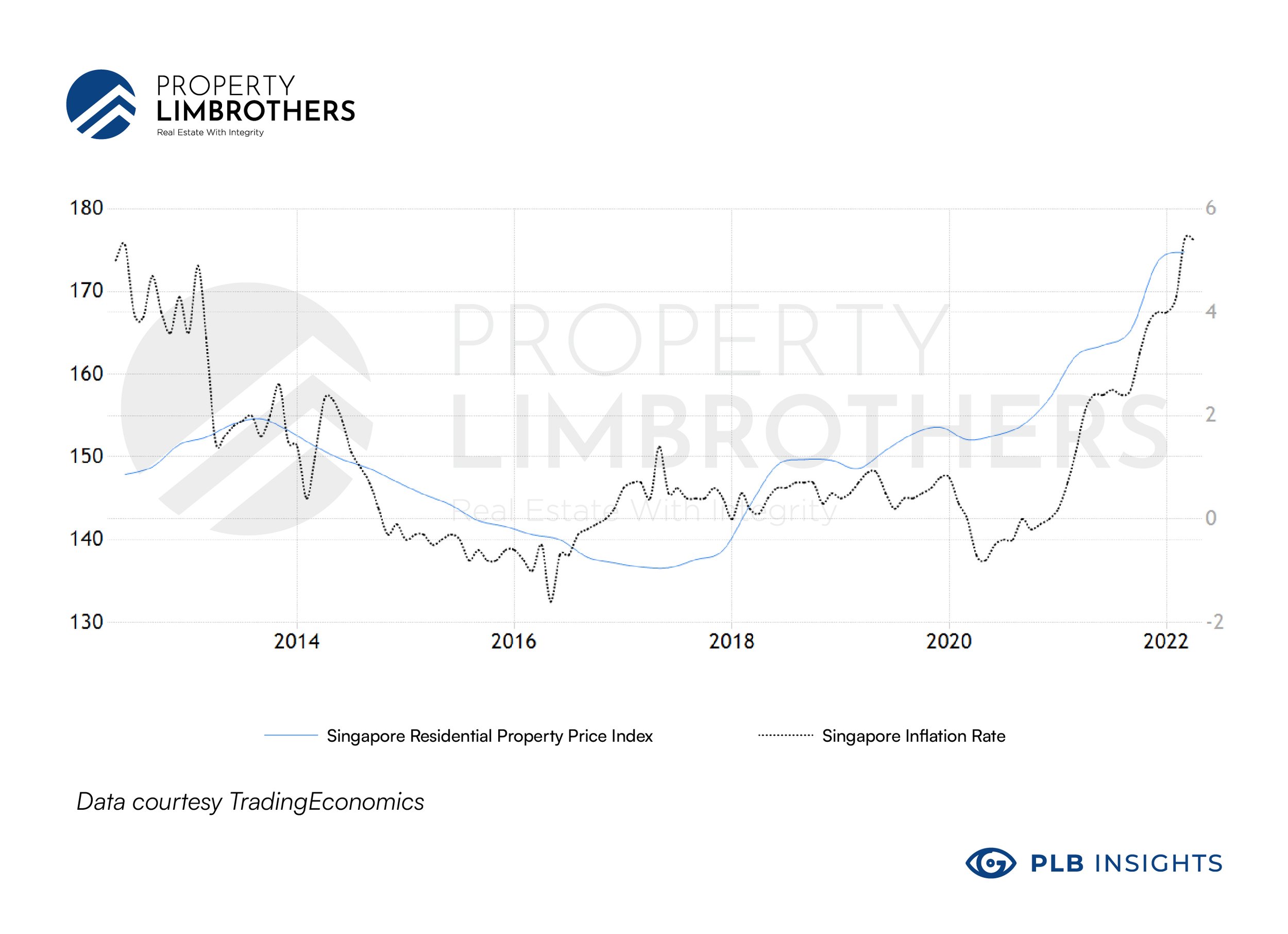

Undoubtedly, the inflation story has a large part to do with the real estate market. Be it prices of homes or rentals, inflation is a core driver. In the chart below, inflation (black) is plotted against another rendition of the residential property index (blue). We can visually identify that the two lines are rather closely correlated. With inflation sometimes giving lead indication of the direction of housing prices. From 2012 to 2014 and from 2017 to 2018, inflation numbers were declining or stagnating a few years in advance of housing prices.

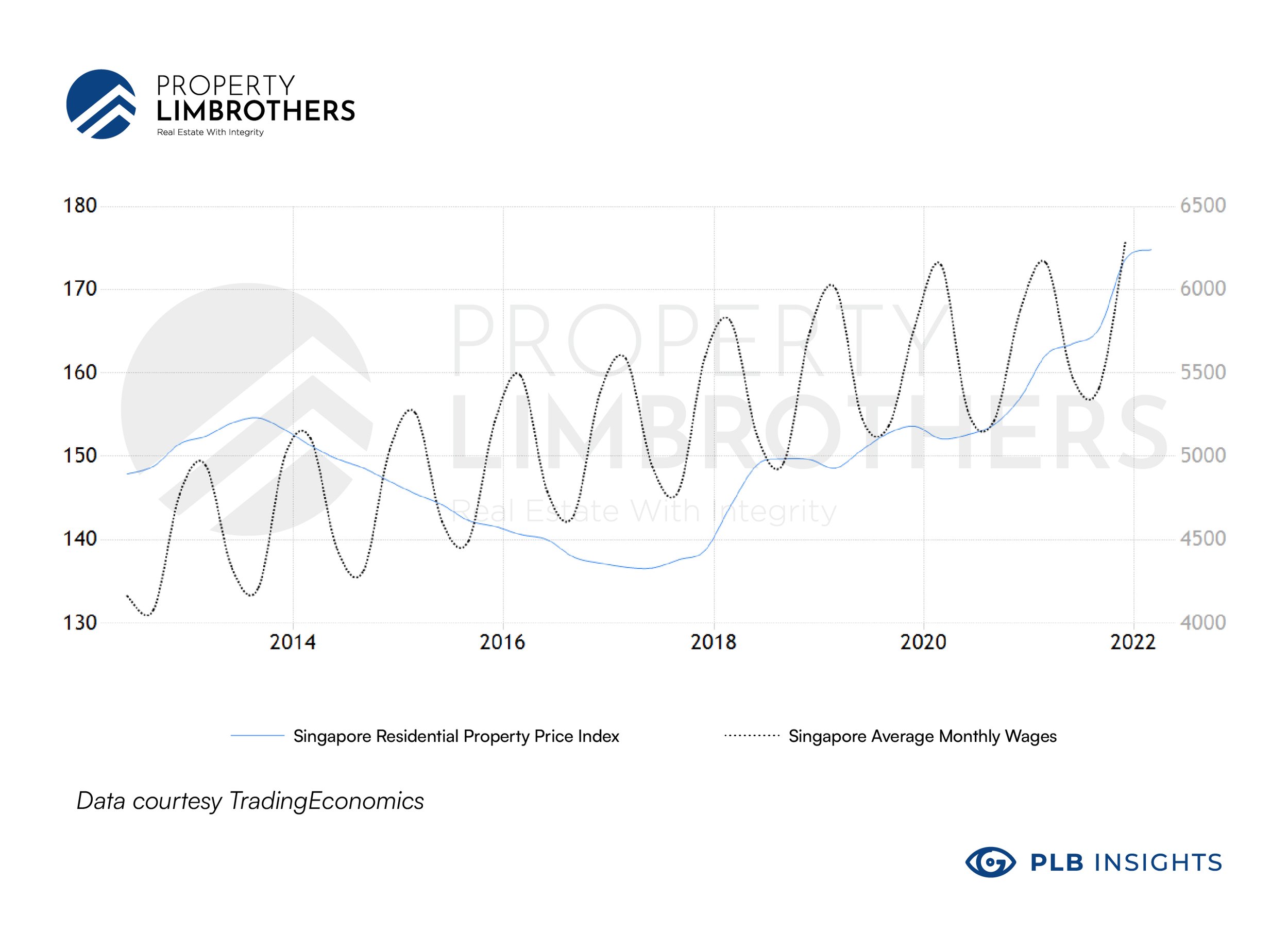

We were not able to find a good price-to-income ratio for the Singapore housing market. Instead, we plot the residential property index against the average monthly wages (chart below). We can see the natural cyclical fluctuations in the wage levels. This is typical of hiring cycles reaching its peak around the start of the year.

Here, we want to point out two things. Housing prices exhibited exponential growth from 2020, whereas wages have only grown logarithmically. In other words, wages grow faster at lower levels and decelerates at higher levels. Housing prices have done the opposite, their growth accelerates over time, with a faster speed at higher levels. Given these differences in growth rates, housing prices would outpace wage growth if there is no timely intervention from regulators.

Closing Thoughts

We have taken a look at property prices, rental prices, wages, and inflation charts. While it is not as accurate a comparison when compared to price-to-rent and price-to-income ratios, we use a very crude approach to approximate the relationships. Nonetheless, we hope that the insights generated are still useful for anyone looking to participate in Singapore’s real estate market.

There might be a moderate risk that we are at the early stage of forming a real estate bubble. While inflation might drive prices up, properties will soon become unaffordable at the current rate of growth. Unless wages grow at the same rate, it would be very difficult to sustain the current pace of property price growth.

If you wish to know more about how the Singaporean real estate market is doing, you can reach out to our experts here. We hope this helps on your property journey!