In this episode of our investors series, we dive into how your age affects your eligibility to take up a Mortgage Loan. How will this affect your Loan Tenure, Loan Quantum and Monthly Installments? We started this series to share useful insights and tips for those who are keen to start investing or are already investing and would like to know more about it. Watch our video to know the ins and outs on how to prep your eligibility to invest in property!

There are four important aspects that you should understand before you decide to put your money into your first property investment, and your subsequent property investments: the current property market scene in Singapore, your eligibility, factors that might affect your investment decision, and factors to note to maintain this mid to long-term property investment.

Eligibility first and foremost

Let’s focus on the second factor: your eligibility. The government implemented the TDSR (Total Debt Servicing Ratio) measure a couple of years back to ensure buyers do not over-leverage and over-commit to a property investment. The TDSR measure considers your eligibility to make a property investment, after taking into account your income, age and debt obligations.

Financial institutions (i.e. banks) are required by the Monetary Authority of Singapore to check that a borrower’s TDSR is below 60% before they can agree to loan out a sum as mortgage. This protects both the borrower and the lending banks as it lowers the risk that a borrower defaults on their loan. Let’s walk through the steps to determine your TDSR:

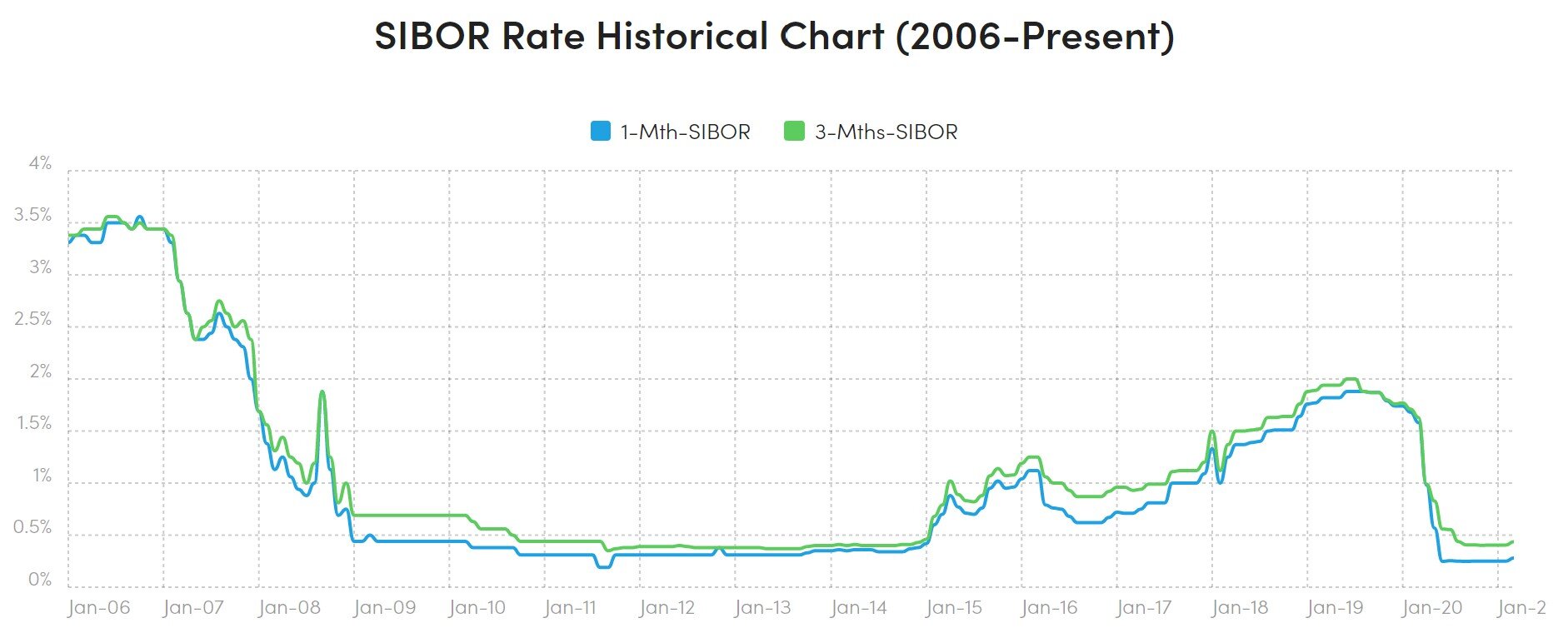

The TDSR is calculated by taking your total monthly debt payments as a percentage of your total monthly income. Total monthly debts include property-related loans, including the loan being applied for, car loans, student loans, renovation loans, credit card loans, and any other secured or unsecured loans. Depending on the exact nature of each loan, different interest rates from 3.5% to 4.5%, which are well above historical rates, are also applied to make the calculation more conservative.

Historical SIBOR rate chart from: Moneysmart SG

Similarly, monthly income includes stable employment income, variable income such as commissions and bonuses, and rental income. Since variable and rental income are less stable, banks will discount them by 30% to 40% to account for their uncertainty.(Some are at 35-40% now so might want to add some disclaimer). Lastly, most banks are now assessing borrower’s income based on 2 years of history instead of the previous 1 year standard.

A simple example:

Person A wants to take out a $750,000 loan to finance a property. He has no other debt obligations except that he also services a monthly $1,000 car repayment instalment. His loan tenure is 30 years and the current interest rate is 3.5%. Person A would need a monthly income of at least $5,613, of which 60% (maximum TDSR) can go to servicing his mortgage debt.

While TDSR is the main way to evaluate eligibility, there are other factors that support this process.

1. Is your Down Payment and Buyer Stamp Duties (BSD) ready?

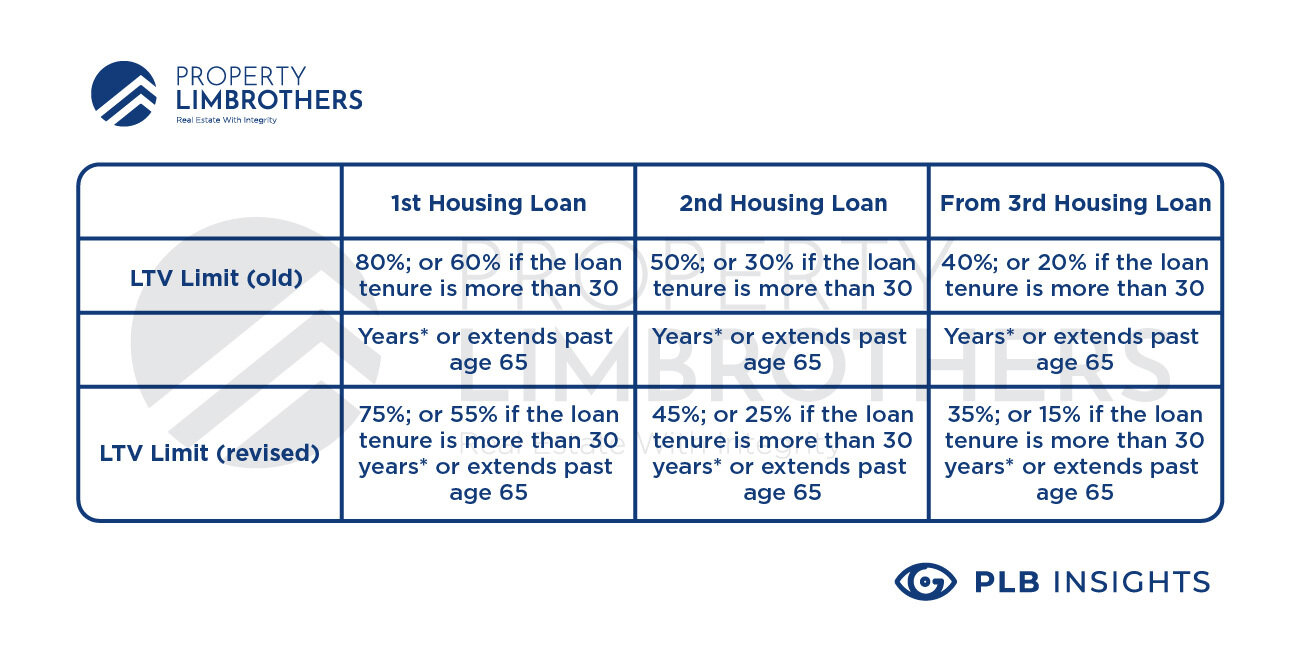

To buy a property you can only take a loan of a maximum of a certain percentage of the property’s value and pay a down payment of the remaining amount upfront. The amount that you can loan compared to the property value is known as the loan-to-value (LTV) ratio Unfortunately for us, LTV is not a constant value. Depending on how many times you have taken out a mortgage loan, and how long you have left to pay off a loan, the LTV can vary from 15% to 80%! This has huge implications on property purchases decisions.

The most recent change to LTV limits happened in 2018 and are shown below:

Revised LTV limits by MAS.

In this change, MAS lowered the LTV limits for all categories by 5%, in an effort to stabilise the real estate market. However, this was not the first time it has done so. Up to 20 years ago, the LTV went as high as 90%, making loans much more accessible. Based on these limits, we can see that taking out loans when younger means that we avoid the loan extending past the 30 year/ age 65 limit, effectively giving us a larger loan. We will discuss more about the age issue below.

Other than down payments, buyer stamp duties (BSD) is another fee you need to pay, and calculating it is relatively easy! Here’s how to calculate it according to the value of the property:

For properties worth $1 million and more : (4% x price) – $15,400 = BSD

For properties worth less than $1 million: (3% x price) – $5,400 = BSD

2. Do you have proof of income?

For the mortgage loan to be approved, you need to have proof of income from employment or if you’re self-employed, your annual Notice of Assessment of income, or show you have other means of financing the loan. So do be prepared with the relevant documents. This will allow the lending bank to calculate your TDSR for regulatory purposes.

3. Do you have a property portfolio plan?

Whether it is to stay in or rent out, you need to be certain that you can hold the property in the mid to long run by carrying out a “Mortgage Sustainability Test” – in the event, any of the owner(s) of the property do not have income or lose their jobs, how long are you still able to sustain the monthly mortgage repayments.

The Age Issue

Generally, taking out a mortgage to buy a property at a younger age is more favourable compared to doing it when older. This is due to the 65 years of age limit that determines the maximum loan tenure. To calculate the maximum loan tenure for your property, you just need to subtract your current age (as of purchase) from 65, capped at 30 years. So if you buy a property at 40 years old, you will have a maximum of 25 years to pay back the loan. If there are multiple borrowers, the “Income Weighted Average Age” (IWAA) is used.

Based on the age and income of each borrower, a representative “age” is calculated which will be used for subsequent loan calculations.

As a simple example of how IWAA is implemented, let’s consider a couple where Partner A is 35 years of age and earning $12,000 a month while Partner B is 25 years of age and earning $4,000 a month. The couple’s IWAA is calculated as follows:

IWAA = [Partner A’s (income x age) + Partner B’s (income x age)] ÷ (couple’s combined income)

IWAA = [(35 x 12,000) + (25 x 4,000)] ÷ (12,000 + 4,000) = 32.5 years of age

This presents a fairer way for loan repayments to be calculated when multiple parties are involved in the mortgage loan.

Now, with IWAA out of the way, let’s talk about the effect that age has on your mortgage loan. Since there are age limits and caps on the mortgage loan repayments, two individuals with the exact same financial situation may have vastly different mortgage obligations based on their age.

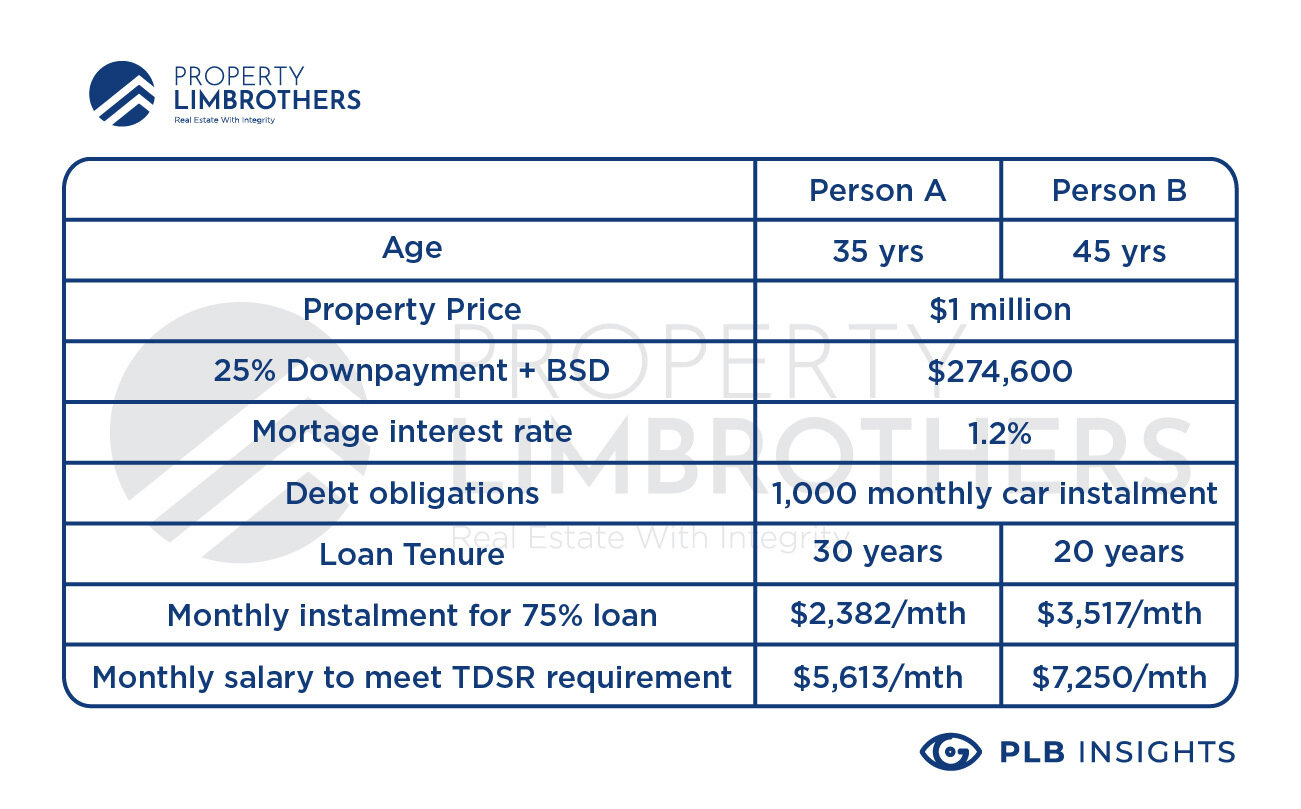

For example, consider again Person A who is 35 years of age and Person B who is 45 years of age. Both have decided to pay a 25% down payment and BSD on a $1 million property at 3.5% interest rate. They are seeking a $750,000 mortgage and both service a $1,000 car repayment instalment monthly.

Person A would have 30 years to repay the mortgage while Person B would have 20 years to do so. In fact, Person A could minimally earn a monthly income of $5,613 to meet the TDSR. On the other hand, Person B would need a minimum income of $7,250 monthly to meet the TDSR, almost $1,600 more than Person A!

Comparison of age and minimum monthly salary needed to meet TDSR.

The CPF issue

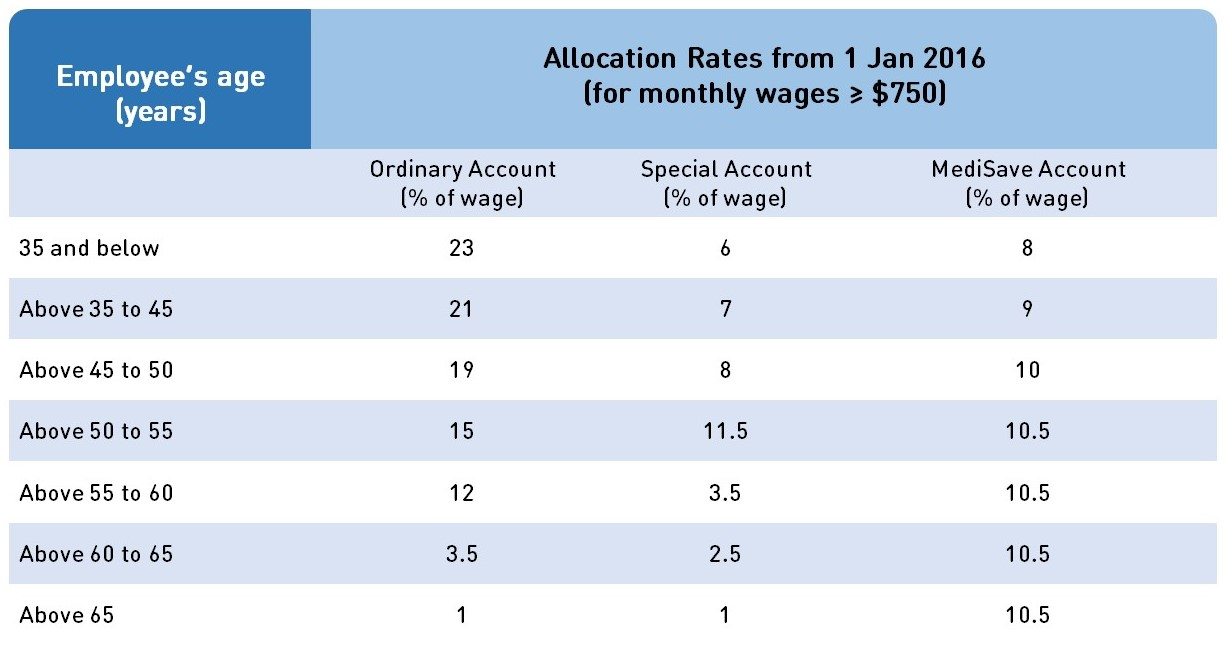

For Singaporeans and Permanent Residents (PRs), age also affects the amount of savings that go into your CPF Ordinary Account (OA). The rate your OA grows in turn affects how much you have available to spend on housing as you age. We are focusing on the OA as the other two accounts – Special and MediSave – cannot be used for property purchases.

As you age, the proportion of your income that is put into the OA decreases from 23% to 1%!

CPF allocation rates from: CPF

The retirement sum is another important number to consider as it determines the monthly payouts that you will receive as part of the CPF scheme when you reach 65. The Basic Retirement Sum (BRS) is the determining factor in how much you can withdraw from your combined OA and SA when you turn 55.

At age 55, two things can happen:

If the combined OA/SA sum is less than the BRS, you may only withdraw $5,000 and the rest of the sum gets put into a Retirement Account. However, if the combined OA/SA is greater than the BRS, then the BRS amount gets put into a Retirement Account and you can withdraw $5,000 plus any excess remaining.

In a way, the BRS acts as a barrier to maintain a minimum monthly CPF payout after retirement so that people do not withdraw everything once they hit 65. However, this barrier gets higher each year to keep in line with inflation – it will rise 3% yearly over 2020 to 2022.

Since the amount came from your OA and got locked into the Retirement Account can no longer be used for spending, there is a final opportunity to use the amount in your OA for property purchase before it gets put away at age 55.

Loan tenure

As we have discussed earlier, when it comes to loan tenures, 30/65 is the golden number.

We want to stretch the loan longer to 30 years because it lowers the monthly mortgage debt which in turn lowers your TDSR should you ever want to take out a second mortgage loan to buy a second property. On a practical level, paying less per month on mortgage loans also increases your cash flow which can be used for other things like emergency savings or big-ticket purchases. Lastly, having a longer tenure gives you the option of refinancing a shorter mortgage should you have the ability to pay higher monthly loans.

However, as a trade off for these benefits, longer tenures mean that a larger amount is used to pay off interest rather than the capital loan.

In some cases, you may want to stretch a loan to 30 years even if you are past age 45 for the reasons above. In this case, the LTV limits kick in and the amount that is required for down payment drastically increases. For example, a 45 year old taking out a 30 year mortgage to purchase a $1 million property is only eligible for a 55% LTV rather than 75%. Thus, the amount that can be loaned is now capped at $550,000. The down payment required is $450,000 instead of $250,000 – almost double!

For many, a high LTV can be very favourable and so we recommend that people buy property when they are younger to take advantage of the 30/65 rule.

Conclusion

In summary, property investing is complex with many factors to consider, none being more important than the first step of being eligible to finance your purchases. Just within the eligibility criteria, there are also many conditions to fulfil and many categories that a buyer can fall into. However, the general guideline is to purchase early and to make full use of favourable loan limits and repayment schedules to maximise your cashflows, stay flexible with your property purchases, and protect your investments.

Some property buyers wait too long on the side lines with no limit in mind. This then translates to them not taking action and they might potentially miss out on opportunities.

Truth be told, the right time to enter the market is dependent on your age, income ability and the understanding of the right property to purchase – not trying to “time” the market. Ask yourself if the numbers and rental yield make sense and whether your income and age eligibility is an advantage or bane for your purchase as well.

Need more guidance? Feel free to reach out to our PropertyLimBrothers Buyers’ Consult team. Click here to contact us now!

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.

Ps: Place this hashtag #InvestorsSeries in front of any questions you might have for us in our comments section below, or feel free to email us at [email protected]. We would love to answer your queries surrounding property investing in Singapore!

Why is investing in real estate more efficient than other asset classes? We delve into that in our insights article here!