Congratulations on beating the odds! With a fateful date for your First Appointment, you must have already seen the long list of documents and application forms you need to prepare before you select your flat.

Yet, sometimes even after ticking all the boxes in the document checklist provided, triple checking still falters to curb the nervousness and fear of blundering; and that was exactly how I felt as well. Going to the flat selection appointment alone was daunting, and I certainly made my fair share of mistakes. So, if you are as rattled and nervous as I was during my first appointment, here are some tips I have learnt along the way so you don’t have to make the same mistakes I did.

1) Download Mobile@HDB for convenience

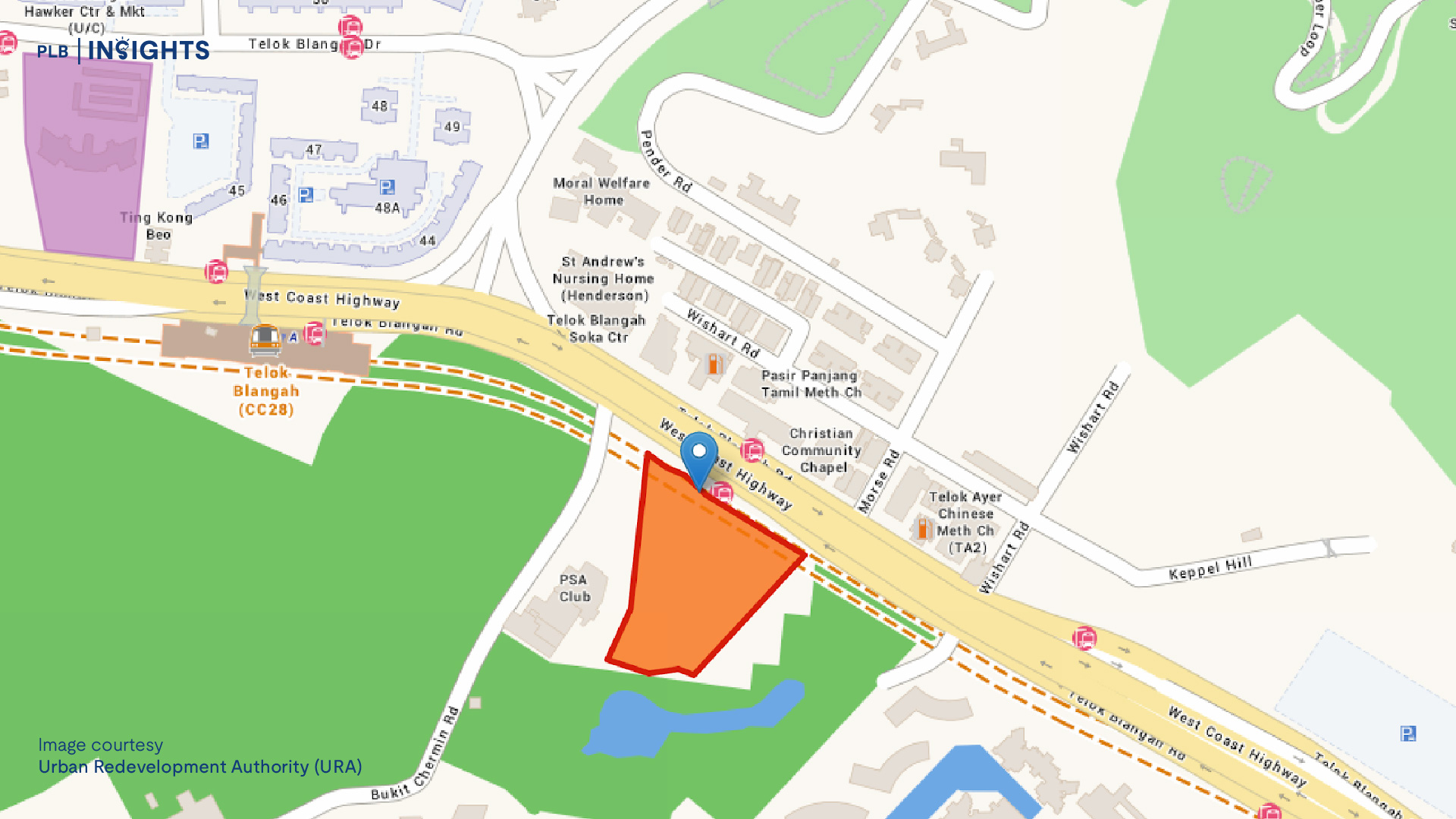

This tip is for the scatterbrained and disorganised. Mobile@HDB is a gateway for all that is necessary on the days of your BTO appointment. Instead of going through the HDB website and Singpass login, the application just requires your IC to access many functions, such as your personalised document checklist for the appointment and flats available in your selected project.

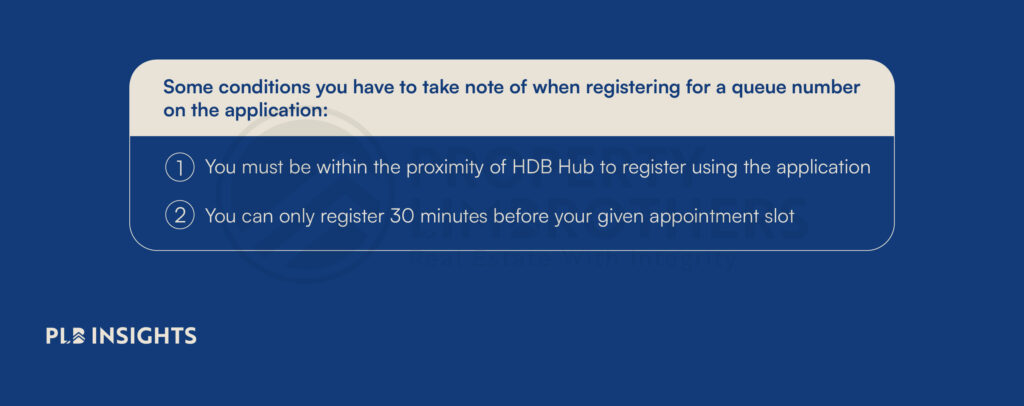

But most importantly, this application allows you to track your appointment. From adding the date to your calendar, all the way down to getting a queue number for your BTO appointments, this application certainly came in handy for my birdbrain.

After registering through the application, it will even send a notification to your phone when it is your turn, so you don’t have to check the screen for your queue number constantly. Instead, you can take the waiting time to consider the Optional Component Scheme (OCS) before making the decision during the appointment.

2) Take a closer look at the OCS finishings before paying the price

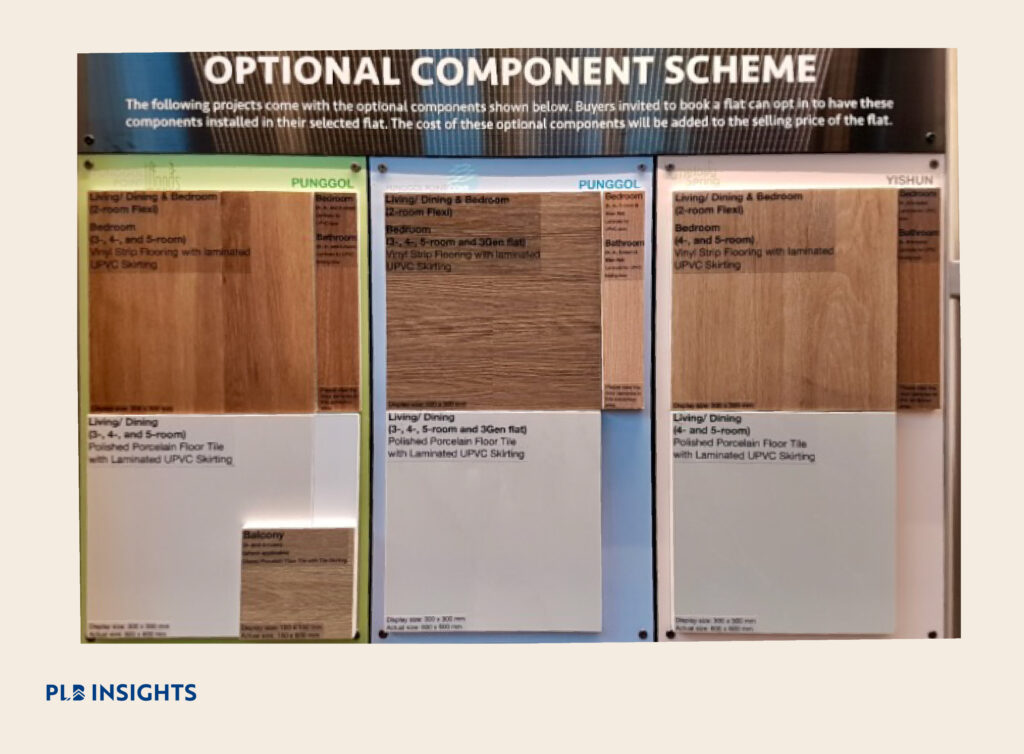

OCS is an opt-in basis plan that includes the installation of essential fittings and fixtures, such as internal doors, flooring, and bathroom fixtures, to save some time and perhaps cost on renovation. Yet, even though this scheme is offered by HDB, the fixtures and components are not standardised across all BTOs.

Take the BTOs at Punggol for instance. Even though Punggol Point Woods and Punggol Point Cove are in the same cycle and are right next to each other, the finishing of the vinyl and tiles used are starkly different. As such, do take more than one look at your specific project because the colours and finishing may differ from the images provided online. And this may influence your previous decision, depending on whether the shade and style are aligned with your aesthetic preference.

Even more so, feel the material to know whether they suit your functional needs. This applies especially to families with young children or elderly parents who might prefer anti-slip surfaces as a precaution.

3) HDB considers full-time students unemployed

As a full-time student, your part-time jobs or ad hoc positions will not be considered by HDB. Your CPF statement may reflect your employer’s contributions and your bank account may show your salary, but to HDB, a full-time student is unemployed. That means when HDB asks for your gross monthly income, it will reflect $0.

This is important because it will affect your entire HDB Flat Eligibility (HFE) application. As a full-time student, you will not be eligible for Enhanced CPF Housing Grant (EHG), even when you have met all of its conditions.

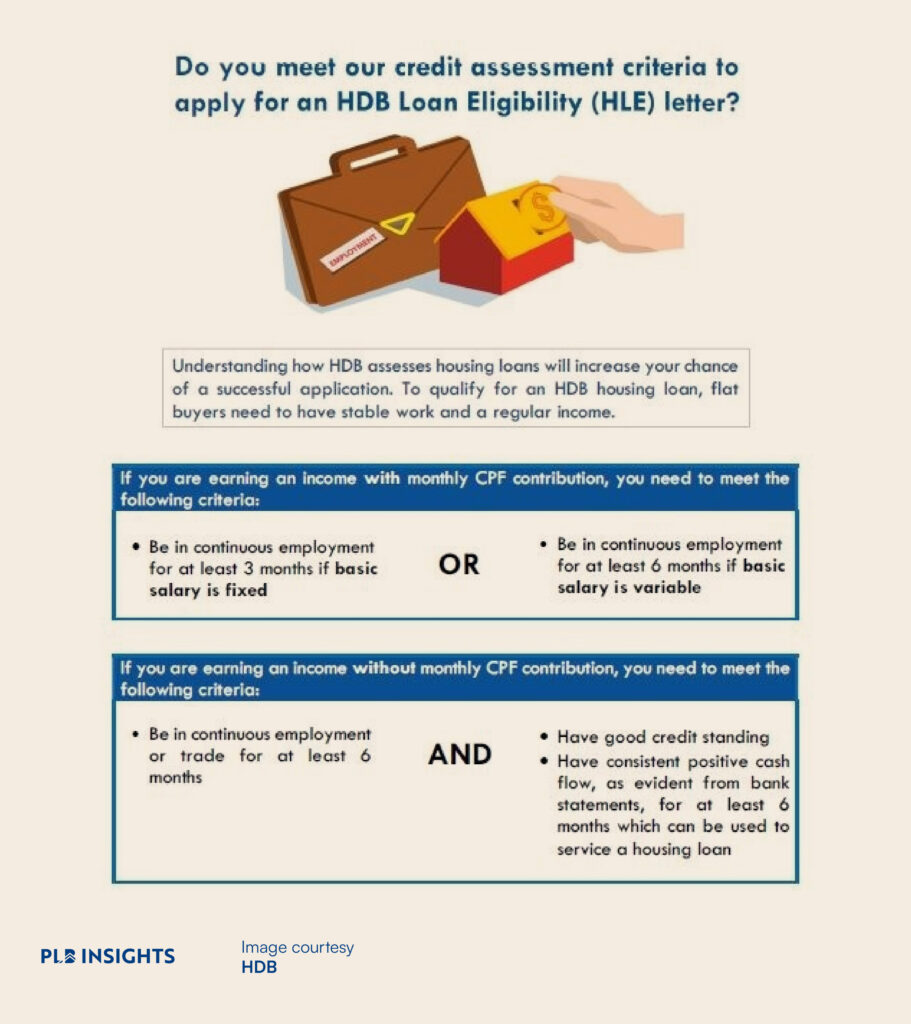

Furthermore, you will also not be eligible for an HDB loan, even when you have met the credit assessment criteria. As such, you cannot apply for an HDB Loan Eligibility (HLE) letter during your HFE. That being said, this only applies to couples who are both full-time students.

On the bright side, couples who are both full-time students (or a couple consisting of a full-time student and a full-time National Servicemen) are both eligible for deferred income assessment.

On the other hand, if you are a full-time student and your partner has been working, and they meet the credit assessment criteria, HDB will only consider their income and issue the loan and grant accordingly.

If you are like me, who only discovered that a full-time student’s income would be excluded, a few days before the appointment, I am glad this article found you. This will save you from the hassle of preparing any income documentation and allow you to rethink your repayment plans.

4) Your HDB loan amount will likely change

In the case where your HDB loan does not cover the entire cost of your flat during your application of HFE, do not panic, as HDB requires another income assessment closer to the date of key collection.

You will be asked to reassess your loan eligibility based on your current income, and hopefully the combined income of your household has increased since your first appointment to secure a larger loan.

At the same time, do not worry about your EHG. Once your EHG has been approved in your HFE application, it does not adjust based on the new gross monthly household income. HDB will inform you of its approval within 21 days of its submission, and before your first appointment. You will also know when your EHG is approved when you see the grant monies deposited into the corresponding CPF account, and it will be untouchable.

5) Do not worry about forgotten documents

While HFE streamlines the eligibility check for housing grants and HDB housing loans into one application before the appointment, there are still some documents you would have to submit during the appointment itself. If you happen to miss some out, do not panic as well.

Your attending officer will advise you to submit these documents online and will usually give you a grace period of 2 weeks. However, if you find the duration too tight, do not hesitate to ask for an extension.

During the period of my appointment, my partner was away for a month; as such we definitely needed more than 2 weeks to submit all the documents and signatures. A simple explanation of our situation was enough for the attending officer to understand and extend the deadline. Hence, do not hesitate to explain your circumstance.

Closing Thoughts

From the lack of information online to my own carelessness, I hope my mistakes have become lessons so you will feel more confident going to your first BTO appointment. If you have more enquiries, do not hesitate to contact us.

All the best for your flat selection, may your desired unit be available!