In the exciting new exhibition put together by URA, “Space for Our Dreams” highlights the Long-Term Plan moving forward. The local press has covered some aspects of the new upcoming towns and the larger developments as well as how the URA plans to solve the future of housing in Singapore. How can we improve on what is already one of the most liveable cities in Asia?

Singapore has been one of the Asian miracle cities. Since its independence, Singapore went from being a small island port to a first world city. Improving an already first-world city is tough. It becomes more difficult to make huge astronomical leaps to something better. Instead, making Singapore more liveable and inclusive is about making refined and nuanced tweaks. Small but meaningful changes are what will help Singapore go from today to a future-ready city.

In this article, we will cover URA’s goals to make Singapore a more inclusive and liveable place. There will be many changing trends and potential challenges ahead, but URA has highlighted some of its intended solutions moving forward. Can Singapore go from great to greater?

Balancing the Future of Housing

The URA plans to build a Singapore that is an integrated, future-ready city. These two simple words host a crazy balancing act of implementing solutions and preparing for a ton of changing trends. Ageing population, smaller families, desire for larger living spaces, flexible work arrangements, social integration, climate change, accessibility needs, land scarcity, and unexpected changes or disruptions. These are all concerns that cannot be solved overnight.

We have covered in our introduction article, how these trends and social issues percolate into the Long-Term Plan. In terms of liveability and inclusiveness, the key purpose is to make sure that residents (especially Singaporean citizens) feel a sense of belonging and deep-rootedness. Great housing policy has been a pride of Singapore’s public policy. And it has been great by design. Many countries, east and west, have tried to emulate the Singapore model with varying levels of success.

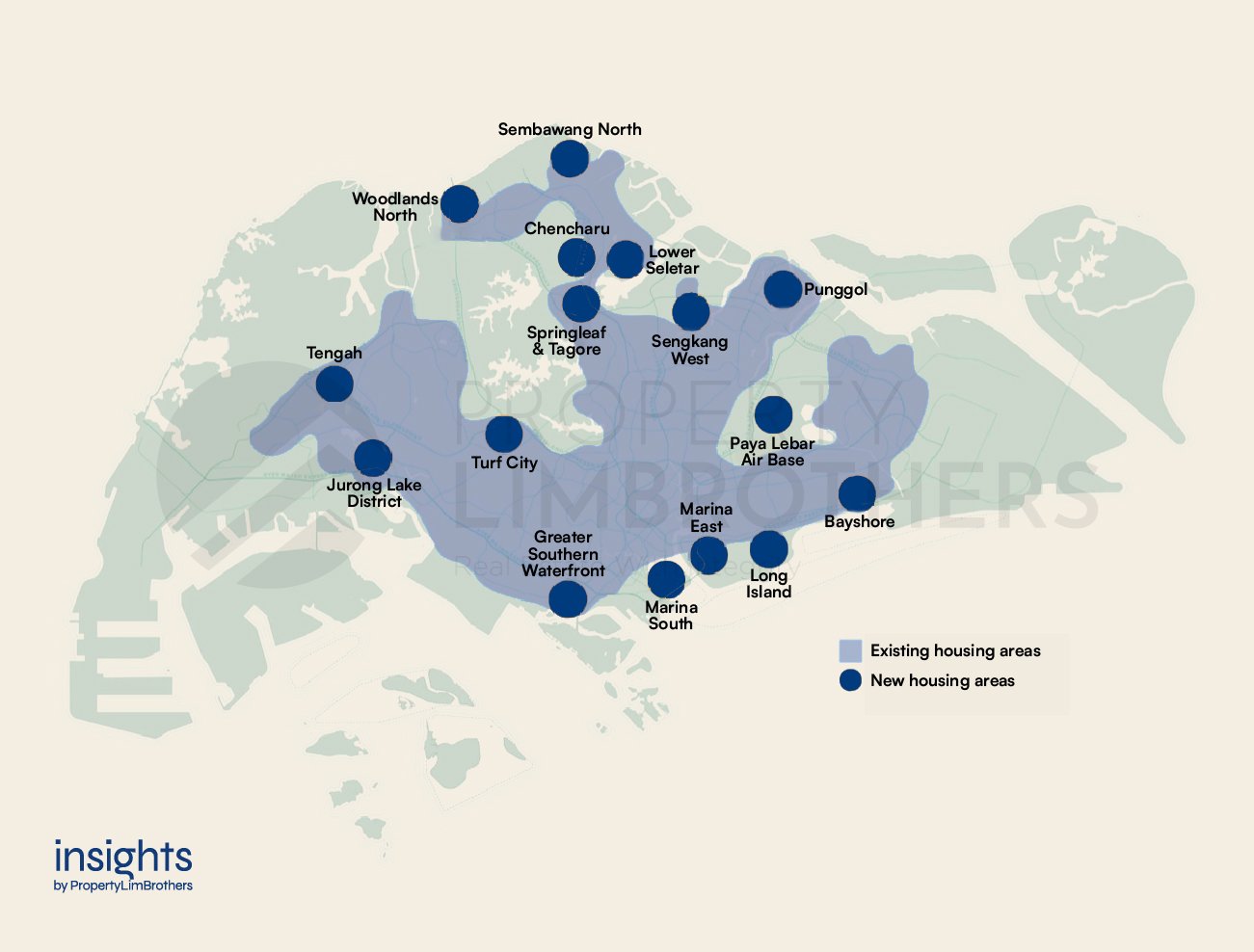

What was considered “liveable” to present generations might not be the same for generations of the future. More notably, the government has acknowledged that families are getting smaller and want more living space. This translates into a need for more housing space (both private and public). To accommodate this growing need for housing, 16 areas have been highlighted in the Long-Term Plan for future development.

A few exciting projects to look out for are the Greater Southern Waterfront, Bayshore, and Paya Lebar Air Base. Of course these projects are contingent on the relocation of the port and airbase, which might take time before we see the fruition of the Long-Term Plan. Nonetheless, the URA has declared their focus on making more homes available in convenient locations. We will likely find more HDBs in the city fringes under the PLH model and near the new upcoming Thomson-East Coast Line stations. Flexible layouts and senior friendly features were also highlighted as priority aspects of living.

Interestingly, however, there was no mention of affordability in the URA Long-Term Plan. This ought to be the tradeoff moving forwards. If million dollar HDB flats are still causing you to raise your eyebrows, you’re probably going to get wrinkles. Million dollar resale flats are likely the new normal. With a burgeoning demand for flats in mature estates on the city fringe, prices are likely to stay high even for the slightly older HDB flats.

Upcoming BTOs are likely to suffer from cost-push inflationary pressures. The recent geo-political instability in the world has pushed commodity prices up. The cost of materials and labour is inflating at a much higher rate than before. While the Long-Term Plan might offer more “liveable” spaces for residents, we must be prepared for the higher price tag. After all, you get what you pay for.

This is a delicate balancing act between quality and affordability. Even if private and public spaces are more integrated with amenities to promote social encounters, some form of social segregation will still be present simply from the price tag of homes closer to the city centre. This is not to say that social integration is just lip service, but that marginalised communities need more help from grant facilities as inflation kicks into overdrive.

There is reason to believe that the government and city planners are aware of the rising cost of living in Singapore (including housing). We cannot possibly hope for lower prices. Rather, that the rate of increase for income levels can keep pace with inflation. Policies to reduce income inequality will also help with the issue of social segregation (although economically speaking, higher wages will eventually lead to higher prices as well). The hope is that the income disparity is not so great that specific communities suffer disproportionately more. As much as possible, the rise in the cost of living should be borne by all who benefit from the development of the city-state.

To sum up what we have discussed thus far, here are some of the key pointers:

-

Inclusivity:

-

Senior-Friendly Features & Healthcare Facilities

-

More Public-Private Housing Mix

-

Ground-up Social Activities

-

-

Liveability:

-

More Interconnected with Public Transportation (Car-lite)

-

Shared Mixed-use Amenities, Greenery, Cycling & Walking Paths

-

Conveniently Located Near Work & City Fringe

-

Spare Land allocated for unexpected needs

-

Closing the Gap between Mature and Developing Estates

Those bullet points are probably nothing new to the real estate veterans of Singapore. The plans to prepare for all these changing trends are already in motion. In the 2010s, some newer HDB estates were lamented to have insufficient amenities and too much concrete. The difference between mature and developing estates can be clearly felt and seen.

Moving forward, we can hope and expect that the 16 highlighted housing estates would be built differently. More amenities and greenery would mean that new estates end up feeling more “mature”. Settling into a community that already has the supporting infrastructure in place. If the Long-Term Plan manifests what it promises with the new estates, we might see price gaps between mature and developing estates get smaller.

With the higher quality of life in newer estates, location will play a crucial role as well. Newer estates closer to the CBD would likely follow the PLH model (for HDBs). The addition of PLH flats would probably slow down the speculative price rise of resale HDBs in the more popular estates. When it comes to reaping gains, non-PLH flats or private property might have an added advantage in these popular estates. Since the supply of properties in the area is reduced by the fact that PLH can’t enter the resale market as early, relatively more “liquid” properties will sell better.

The injection of amenities into developing estates would also mean added value to existing properties in those areas. Many of the highlighted estates are in the OCR. While they might not reap the same benefits as city-fringe properties, it is very likely that price will still appreciate. This will be especially true when city-fringe alternatives are too expensive. The OCR resale properties will stand out as a more affordable move-in option for many young couples.

The gap between mature and developing estates might close with the addition of amenities, and accessibility options. But the distance from the CBD will still be a major factor affecting property prices. As amenities and distance from public transportation options become less and less of a deciding factor, the location of the property in terms of how far it is from the city might become more prominent. Underlying this logic is the differentiation factor between estates. If each housing estate becomes more similar in terms of its amenities and quality of living, then the distance from the city centre becomes the immutable differentiating factor that stands out.

What Property Segments will Benefit the Most?

Apart from enjoying a higher quality of life in Singapore, property owners are definitely looking out for how their home will appreciate in value. As probably the largest ever investment made early in their lives, people want property to be a store of value for later on when they want to upgrade their property. Based on the plans URA has in store, there are a few potentially high growth areas and properties to look out for over the next 5 to 10 years.

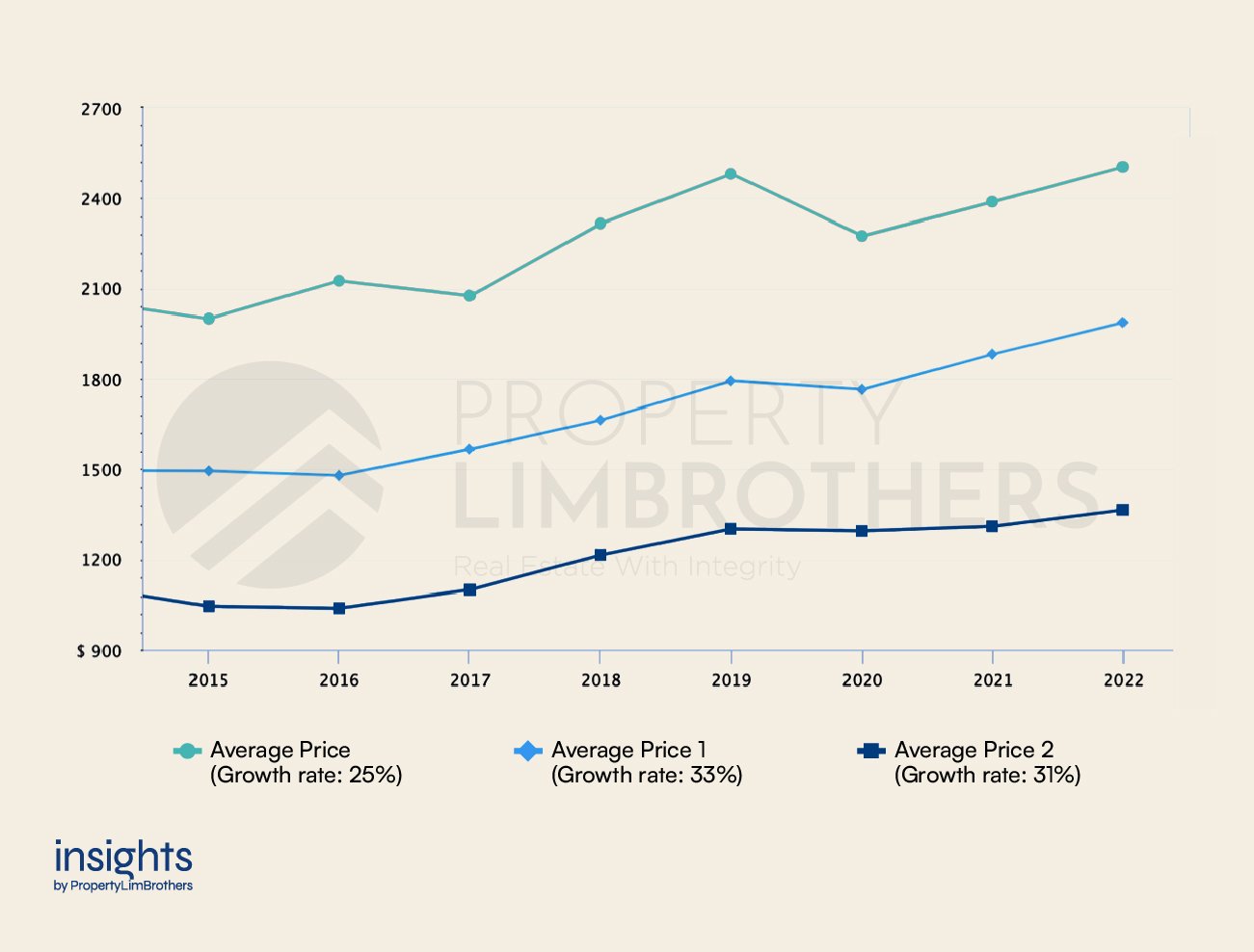

City Fringe New Launches & Resale Condos

The city fringe area and the RCR have been the fastest growing segment over the last 7 years. It is very likely that this trend will continue to persist with the new estates and developments planned. Among all the housing options available in the RCR, new launches and resale condos will stand out as a better investment option as compared to PLH flats and older resale HDBs.

PLH flats have a 10 year MOP, severely extending the exit duration and pushing buyers to use the property for their own stay rather than to flip and upgrade. Not to mention that the PLH model is very new. This under certainty might put off some buyers from taking up the choice as they want to keep their upgrade options open. On the other hand, resale HDBs might be a more affordable option for moving in, but its lease decay would have a severe impact on the property as a store of value (most of the resale HDB on the city fringe tend to be older). Either way, public housing options in the RCR might not be as attractive as private options for the purposes of investment.

On the other hand, new launches and resale condos grant more flexibility on the exit time of less than 5 years. Property investors would be able to capitalise on the growth of selected RCR districts and to exit when the new estates have “matured” with the amenities and accessibility options all in place. For new launches as an investment property, buyers can take advantage of the Progressive Payment Scheme to aid with affordability concerns in terms of cash flow. Alternatively, resale condos can be used immediately for rental income to subsidise the mortgages.

OCR Resale HDBs & Condos

The OCR segment is the second fastest growing group of properties in Singapore. It only falls behind RCR properties by a small margin on aggregate. As compared to RCR options, the public housing options are not limited by longer MOPs (PLH model) or shorter remaining leases (older HDBs). Many estates in the OCR have new HDBs built near MRT stations. These resale HDBs will be a good growth segment due to their availability for buyers to move in and their affordability when compared to alternatives in private housing.

As mentioned earlier in the article, affordable housing will be a primary concern despite the lack of a focus on this in the Long-Term Plan. Fortunately, amenity injections, the decentralisation of workspaces, and more transportation options would mean that the OCR would remain attractive and more affordable as compared to RCR and CCR properties. The lower psf in the OCR would also serve to accommodate the people’s growing need for bigger spaces without compromising on too much.

Over the next decade, it is likely that the growth of OCR would exceed that of the RCR. After the development of the city-fringe area, the marginal changes in price for RCR properties would decrease over time. As you can only get developed to a certain extent. On this longer time horizon, OCR properties will really start to shine in terms of growth. Even before this happens, the 16 highlighted estates include many OCR areas. The Long-Term Plan will definitely serve to elevate the price levels of these estates after the amenities and new developments are in place over the next 5 to 10 years.

Final thoughts

Plans often just stay as plans. That is until someone takes it upon themselves to do something about it. The URA Long-Term Plan is full of wonderful news, presenting many things for residents to look forward to and get excited about. Beneath all this splendour, much of the development details are not set in stone just yet. The Long-Term Plan sets out themes and ideas that they have already been pursuing for quite some time now.

Above all, a stronger focus needs to be placed on the affordability of properties in the future. As much as it is a liveable and more inclusive city, we must make sure that the inclusion doesn’t stop at people’s net worth. That being said, the OCR will still be the host of good growth for many, more affordable public property options.

The future holds many growth opportunities for property investors looking to capitalise on the Long-Term Plan. The city fringe seems to be in prime focus in terms of development. With many public housing options now popping up in the RCR, more liquid private property options will also be dragged along for the hype.

We hope that this article has been helpful in highlighting some of the features of the URA Long-Term Plan 2022. If you would like to discuss more on how Singapore’s improved liveability and inclusiveness will impact your property journey, reach out to us here for a chat.