As a single person in Singapore, finding a flat to call your own can be a daunting task. It’s understandable to feel overwhelmed by the process, especially given the rising interest rates, high housing prices, and competitive market. However, it’s important to know that you’re not alone in this journey, even as you take on the financial liabilities alone. The Housing & Development Board (HDB) has designed housing measures, such as the Singles Scheme, specifically to address the needs of individuals like you who are looking for a flat.

With this in mind, it’s important to approach the process with a positive and proactive attitude, knowing that there are options and resources available to help you achieve your goal of homeownership.

This article is here to provide you with the information and guidance you need to navigate the housing market as a single person and find a flat that fits your needs and budget. Stay with us as we go through the various options available.

Option 1: Buying a new HDB flat under the Single Singapore Citizen Scheme

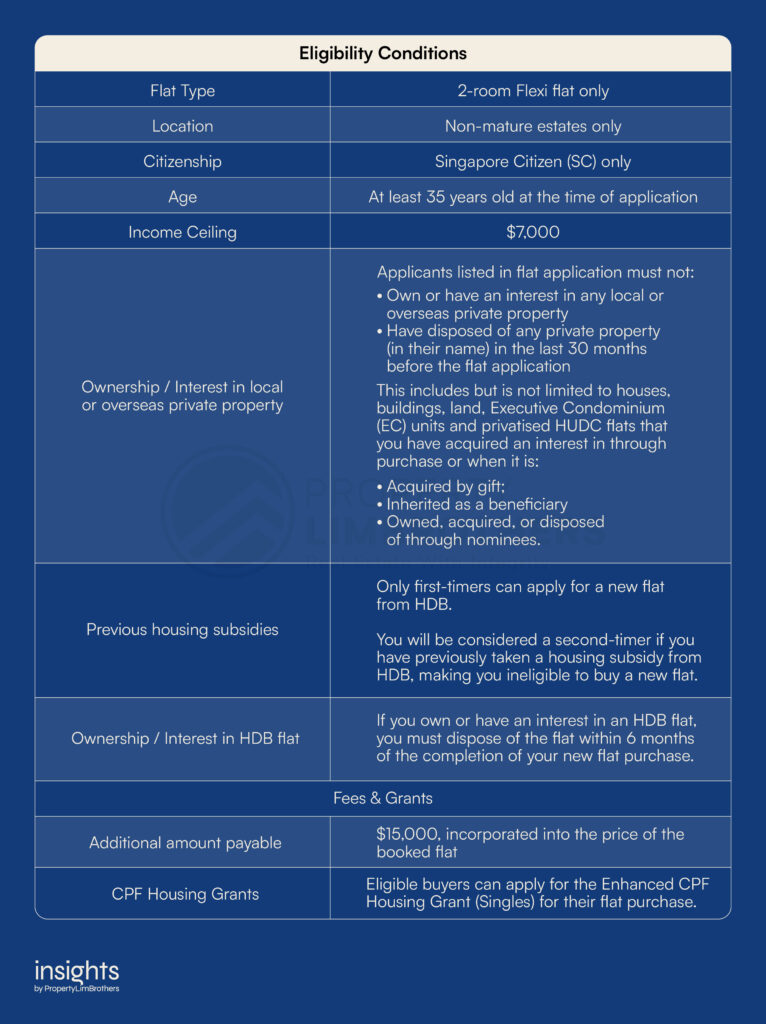

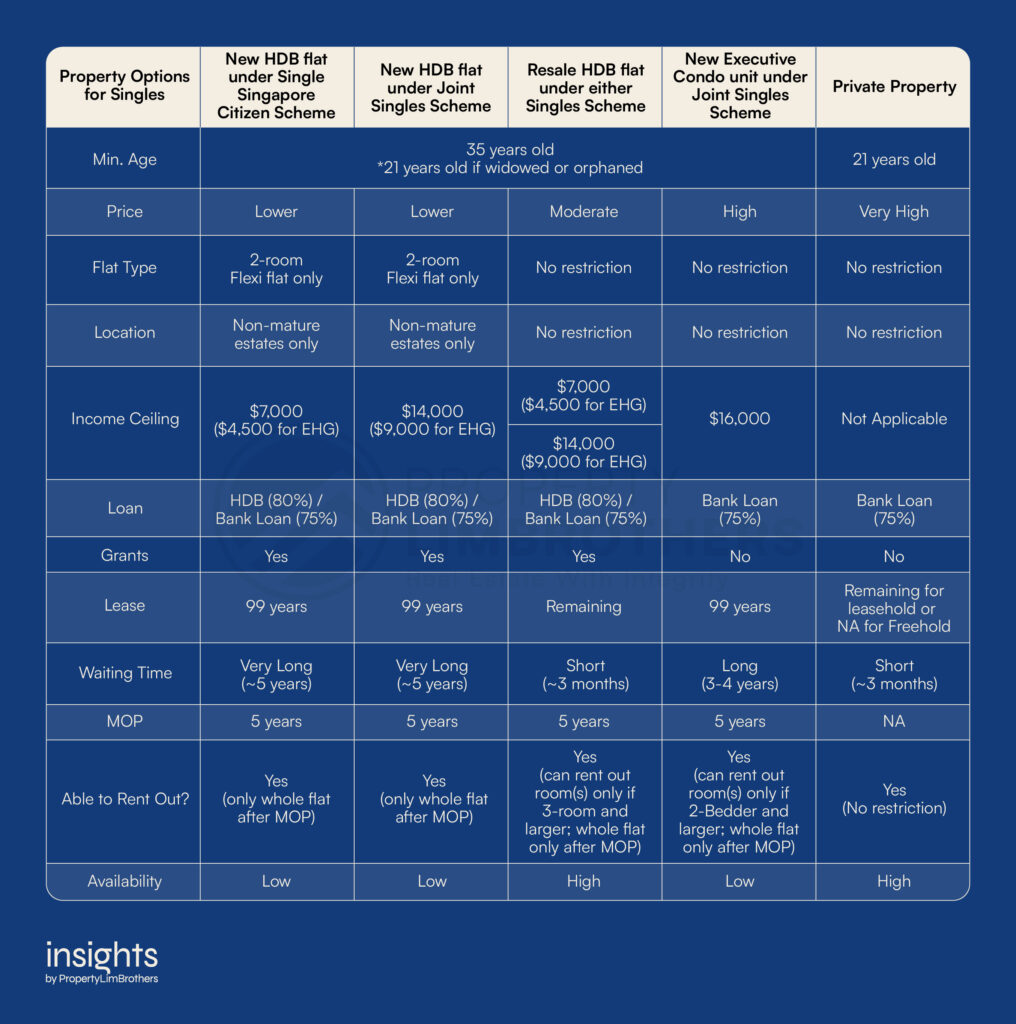

At present, the minimum age to buy a flat as a single in Singapore is 35 years old, unless you are orphaned or widowed. The below table shows the eligibility criteria for singles to qualify for the Single Singapore Citizen Scheme.

As you can see, the only option available to you under the Single Singapore Citizen Scheme for the purchase of new flats are 2-room Flexi flats. Furthermore, you can only apply to estates that HDB classifies as non-matured and must not exceed the income ceiling of $7,000, among other requirements.

While this may seem straightforward, it will be a lengthy process since you’d have to first ballot for a queue number in the BTO sales exercise and wait for the flat to be built. To avoid the waiting time, you may want to apply for the Sale of Balance Flats (SBF) exercise instead, which allows you to ballot for a unit with a shorter waiting time or even immediate key collection.

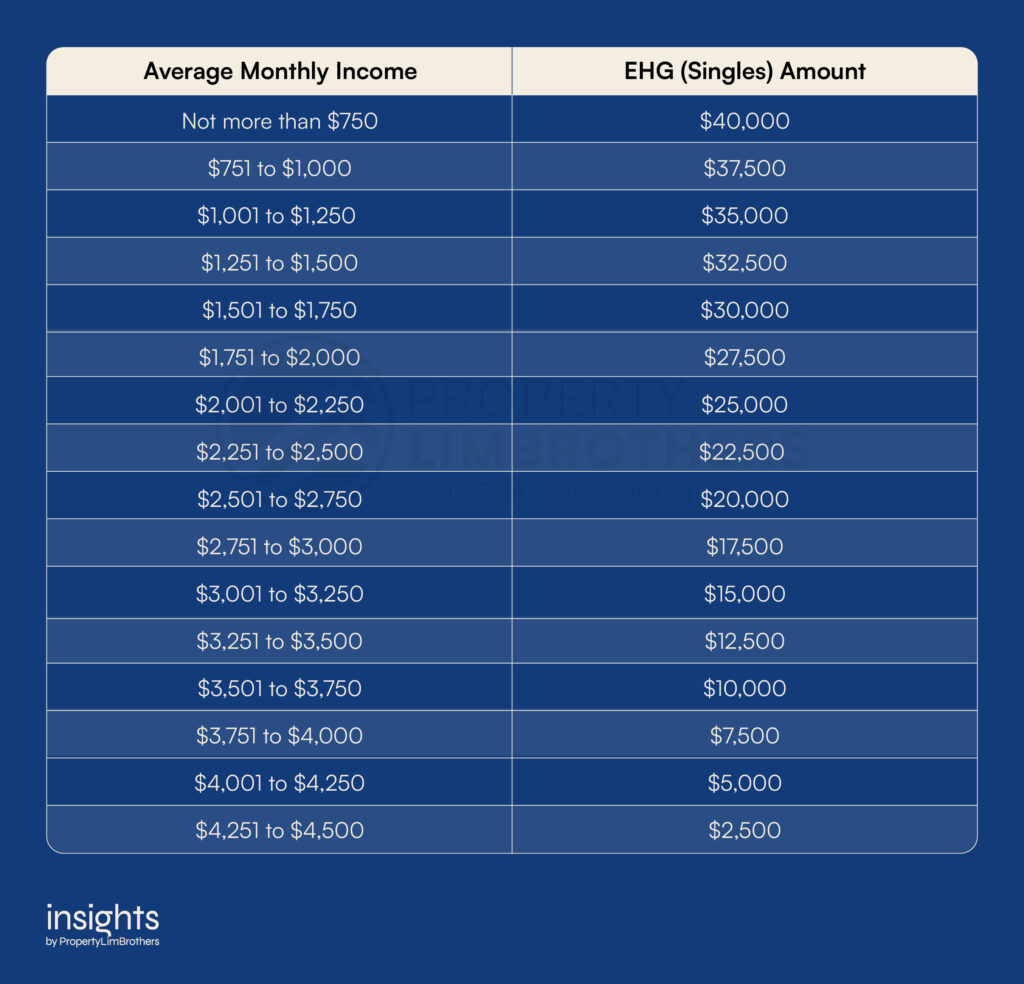

When you apply as a single, you are eligible for the EHG (Singles) of up to $40,000 for your flat purchase if you meet the grant requirements. This includes working for 12 consecutive months prior to your application and being currently employed at the time of application. Below is the breakdown based on your monthly income:

As a single owner of the 2-room Flexi flat, you will also not be allowed to rent out the flat at all.

Lastly, it is possible for you to get a flat as a single first, and upgrade to a larger flat with your partner if you get married in the future.

For this case, you would be applying for your next flat as a First-Timer/Second-Timer couple or as a Second-Timer couple (if your partner has also gotten housing subsidies before). However, do remember that when you sell your flat, you will have to refund the grant amount received and any CPF savings used plus accrued interest back to your CPF OA account. Do also take note that resale levy may apply to those receiving housing subsidies from HDB for the second time.

Option 2: Buying a new HDB flat under the Joint Singles Scheme

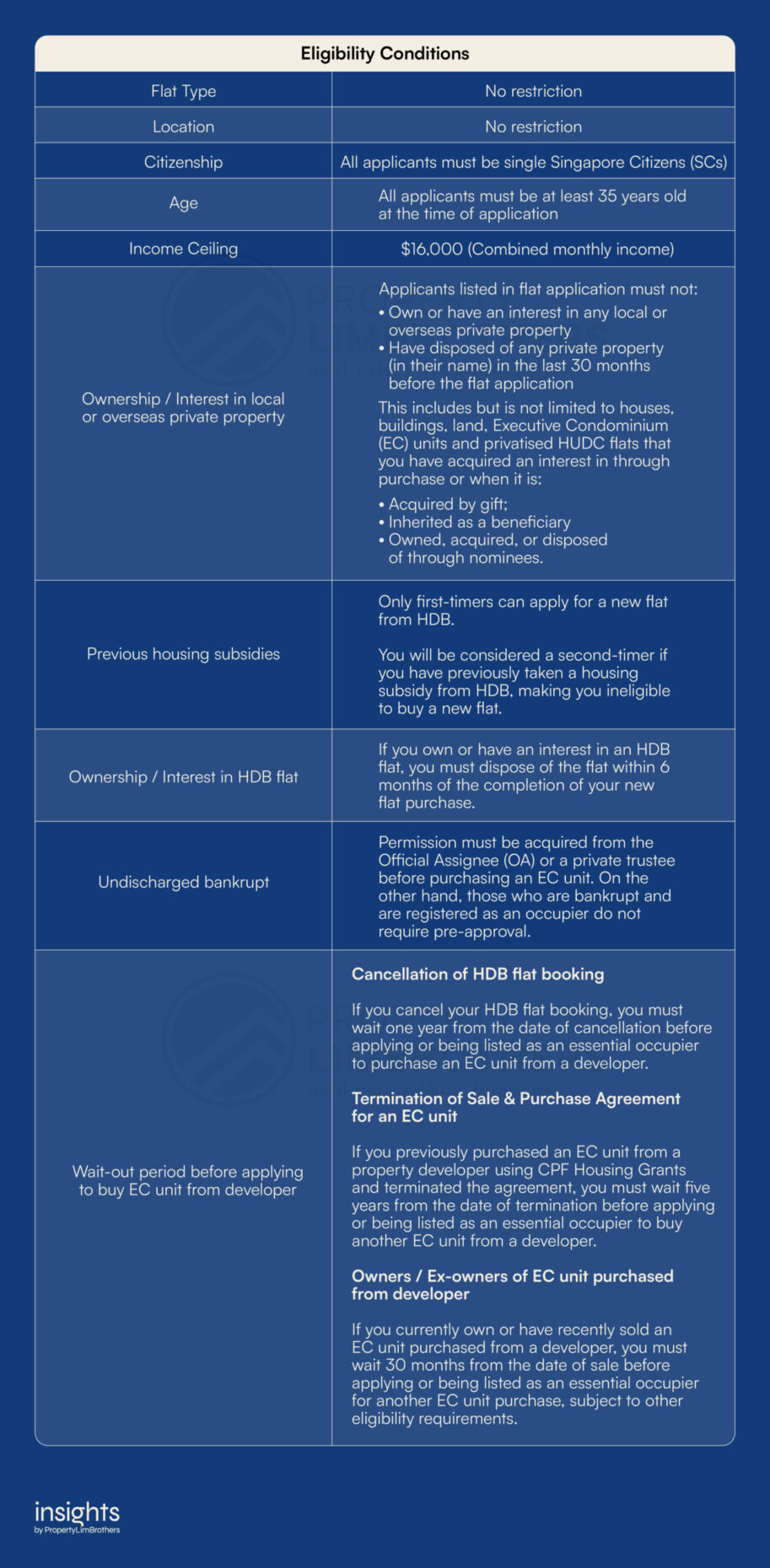

Under the Joint Singles Scheme, you are able to jointly purchase an HDB flat together with up to three other singles. The eligibility conditions are mostly the same as the Single Singapore Citizen Scheme.

The difference between the Single Singapore Citizen Scheme and the Joint Singles Scheme, other than the number of applicants, is the income ceiling as well as the eligibility to apply for an executive condominium (EC) unit.

The income ceiling under the Joint Singles Scheme is $9,000 instead of $7,000 since there are more applicants under this scheme. It is also the only way, at the time of writing, for singles to jointly purchase a new EC unit and without any size restriction. This is the biggest advantage of the Joint Singles Scheme. We will touch on this option later on in this article.

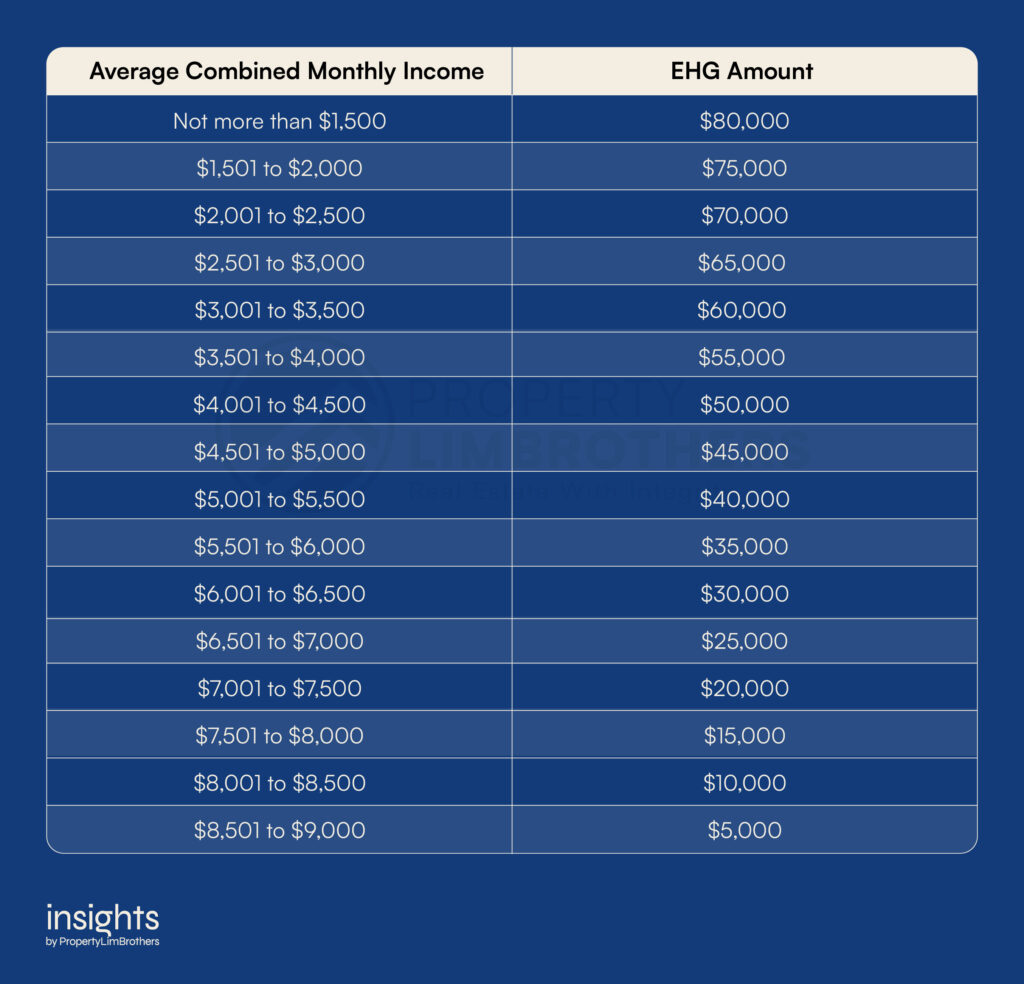

Like the previous scheme, you will also be eligible for EHG (Singles) for your flat purchase if you meet the grant requirements. But since you are applying with two or more singles, the grant amount is up to $80,000 depending on your average combined monthly income. Below is the breakdown:

Regardless of the number of co-applicants, the EHG will be disbursed to only two applicants’ CPF OA with a 50-50 split under the Joint Singles Scheme. For example, if you apply with two of your siblings who are also SCs above 35 years old and are eligible to receive $40,000 of grants, $20,000 will be disbursed to either you and one of your siblings’ or both your siblings’ CPF OA account.

Lastly, you will also not be allowed to rent out any part of the 2-room Flexi flat.

Option 3: Buying a resale HDB flat

The next option is buying a resale HDB flat from the open market under either the Single Singapore Citizen Scheme or the Joint Singles Scheme. The biggest difference between buying from the open market and buying a new flat from HDB is that there is no restriction on the flat type and location for the former. This means that you can buy a resale HDB flat of any size in any location, as long as you meet the other requirements under the scheme.

You will also be able to rent out your whole flat after serving a 5-year Minimum Occupation Period (MOP), and only the bedroom(s) within the MOP if you are purchasing a 3-room or larger flat. If you are purchasing a 2-room Flexi flat, you will not be able to rent it out before MOP.

However, the trade-off is that resale flats are more expensive since you are buying from the open market and they will come with various degrees of lease decay. With effect from 10 May 2019, the property that you purchase must have at least 20 years of lease remaining, otherwise you would not be able to use your CPF at all to fund the purchase. The remaining lease must also be able to last until the applicant (or youngest applicant under the Joint Singles Scheme) is 95 years old. If this requirement is not met, the Loan-to-Value (LTV) limit for your HDB loan and use of CPF will be pro-rated.

Furthermore, resale flats are subjected to a Cash-over-Valuation (COV) if the purchase price is higher than the valuation price. This COV can only be paid in cash.

You will also be eligible to apply for CPF housing grants when you buy a resale HDB flat.

Under the Single Singapore Citizen Scheme:

- Enhanced CPF Housing Grant (EHG) (Singles): The framework for the EHG (Singles) for HDB resale flats is the same as for new HDB flats. The income ceiling for this grant is $4,500, and the maximum amount disbursed based on your income is $40,000.

- Singles Grant: This grant is only applicable for first-timer singles purchasing HDB resale flats. If you are purchasing a 2- to 4-room resale flat, you will receive $25,000. If you are purchasing a 5-room resale flat, you will receive $20,000. To qualify for this grant, your monthly income must not exceed $7,000.

- Proximity Housing Grant (PHG): If you are living with your parents or children (must be listed as occupants), you will get $15,000 regardless of flat type. If you are staying alone but within a 4km radius of your parents’ or children’s home (can be either HDB or private property), you will receive $10,000. Unlike the other two grants, there is no income ceiling for the PHG.

Under the Joint Singles Scheme:

- Enhanced CPF Housing Grant (EHG) (Singles): Similarly, the framework for the EHG (Singles) for HDB resale flats is the same as for new HDB flats. The income ceiling for this grant is $9,000, with the maximum amount being $80,000 based on the combined monthly income. This will be disbursed to two applicants (regardless of whether there are more applicants) with a 50-50 split.

- Singles Grant: Like the EHG, the Singles Grant for the Joint Singles Scheme is also doubled in amount. If purchasing a 2- to 4-room resale HDB flat, you and your co-applicants will receive $50,000. If purchasing a 5-room resale HDB flat, you and your co-applicants will receive $40,000. To qualify for this grant, your combined monthly income must not exceed $14,000.

- Proximity Housing Grant (PHG): Individuals who apply under the Joint Singles Scheme may be eligible. The grant is $15,000 if they plan to reside with their parents or kids, or $10,000 if they will live within 4km of their family home.

A quick note for what happens if you get married after getting the Singles Grant to buy a resale HDB flat – you and your partner may be eligible for the Top-Up Grant when you upgrade to another resale HDB flat. This grant is essentially the amount of Family Grant you are eligible for, minus the Singles Grant amount you received previously. The income ceiling for this grant is $14,000.

Option 4: Buying a new EC unit from developer under the Joint Singles Scheme

As mentioned previously, this is currently the only way for singles to purchase an EC unit. Below are the eligibility criteria to meet in order to qualify:

Unfortunately, you will not be eligible for any CPF housing grants when purchasing an EC unit under the Joint Singles Scheme. The only CPF housing grants available are the Family Grant or Half-Housing Grant, both of which are for couples or family units.

The 5-year MOP is also applicable to EC units, which means that you will not be allowed to rent out the entire unit during the period. However, you are able to rent out bedrooms following the usual rental procedures.

Option 5: Buying a private condo unit

The last option would be the private property market, which is the most costly option compared to the rest. However, this is also the only option where you can buy a property before 35 years old.

Some things to note if you are considering this option:

1. You can only take a bank loan

This means that you can only borrow a maximum of 75% of the purchase price. This might not seem that bad considering that the LTV limit for HDB loans has been reduced to 80% following the latest cooling measures.

But do take note that for bank loans, there is a mandatory cash component of 5%, which means that 5% out of the 25% downpayment has to be paid in cash. The remaining 20% can be paid with either cash, CPF OA, or a combination of both.

2. Eligibility for bank loan and Total Debt Servicing Ratio (TDSR)

To qualify for a bank loan, you will be required to submit documentation that you are currently employed and drawing an income. Depending on the type of income (fixed or variable), the loan amount that you will be eligible for will be different.

Under the TDSR framework, your monthly home loan instalment must not exceed 55% of your monthly income less any debt obligations (personal, car, renovation loans, etc). If you are earning a variable income (bonus, commission, allowance, rental income), your income will be subjected to a 30% haircut. The 55% TDSR will then apply to the remaining 70%, less any debt obligations.

Based on the maximum instalment you are able to pay per month, the bank will then calculate how much you can borrow.

3. In-Principle Approval (IPA)

You may want to engage your property agent or a mortgage specialist to help you get an IPA, which allows you to confirm the home loan amount you are eligible for. You would be required to submit personal documents including proof of income.

4. Cash Reserves

Besides the cash component of the bank loan, you will have to set aside cash for the stamp duties and additional fees. This includes any COV, buyer stamp duty, legal conveyancing fees, etc.

As you can see, it is not easy to buy a private property as a single. In fact, it is an extremely costly option. While you can rope in other people to jointly purchase the property, keep in mind that doing so would mean they have a share as well since it will most likely be a joint-tenancy.

In Summary

To sum up the article, here are the pros and cons that come with each option.

It takes a great deal of courage and determination for a single person to pursue homeownership. The road to securing a place to call home may not always be easy, but it is important to remember that the reward at the end is worth the effort. You should be proud of yourself for taking this important step towards a brighter future, and know that you are not alone in this journey.

If you need any help or advice regarding your property options, do contact our PropertyLimBrothers team and we will be glad to help you with your portfolio planning.