Singapore’s property market is a dynamic ecosystem that follows distinct cycles. Understanding these cycles is key for buyers and investors looking to make informed decisions in the real estate landscape.

Let’s explore the intricacies of Singapore property market cycles and how they impact new launch condo pricing.

The Four Seasons of Singapore’s Property Market

Just like the natural seasons, the property market in Singapore experiences four distinct phases. These phases, while not always perfectly defined, provide a framework for understanding market dynamics and potential opportunities. Let’s take a closer look at each season and what it means for buyers, sellers, and investors.

Spring: Planting and Sowing (Land Acquisition)

During this phase, developers actively acquire land through Government Land Sales (GLS) programmes and en bloc sales. It’s a period of preparation and planning for future developments.

For potential buyers, spring might not seem like an exciting time, but it’s crucial to pay attention. The land parcels acquired during this phase will determine the location and potential of future developments. Savvy investors often start researching upcoming areas during this time.

Summer: Reaping and Harvesting (Project Launches)

This is when new projects are launched. Developers unveil their latest offerings to the market, and buyers have a wide array of choices.

Summer is often the most exciting time for buyers, with numerous options and potentially attractive launch prices. However, it’s important to approach this phase with caution and thorough research to avoid getting caught up in the hype.

Autumn: Continued Harvesting (Selling Units)

Developers focus on selling remaining units in their projects. This phase often sees promotional activities and potential price adjustments.

For buyers who missed out during the summer launch phase, autumn can present good opportunities. Developers may be more willing to negotiate, and there’s more data available on the project’s performance and surrounding developments.

Winter: Recovery and Preparation

The market cools down as developers clear inventory and plan for the next cycle. It’s a time for reflection and strategising.

While winter might seem like a dormant period, it can be an excellent time for buyers to find good deals, especially on remaining units in projects that are nearing completion.

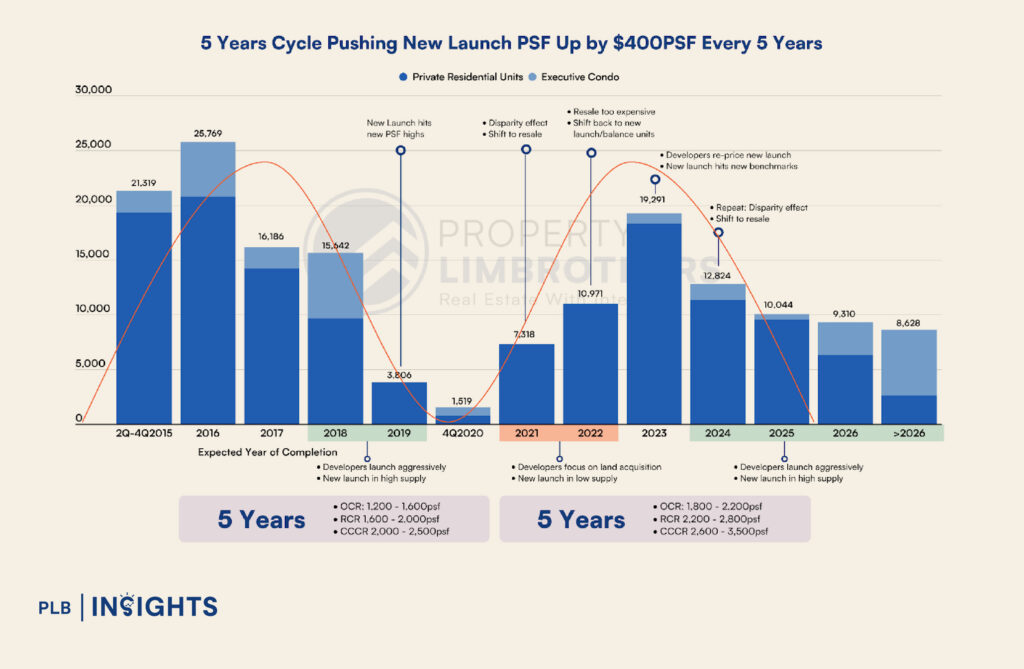

The 5-Year Property Cycle and New Launch Condo Pricing

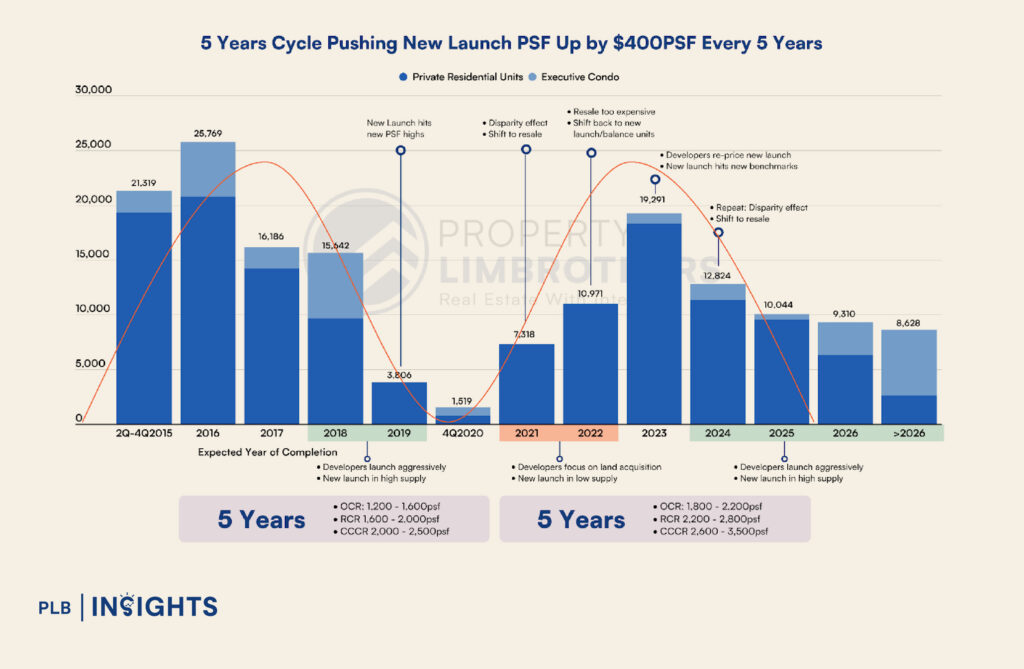

A fascinating pattern emerges when we examine Singapore’s property market: a roughly 5-year cycle that sees significant price increments. This cycle, while not set in stone, provides valuable insights for both buyers and investors.

Understanding the Price Increments

Every five years, there is an observed average increase of approximately $400 PSF. This incremental rise reflects broader economic conditions, market demand, and inflationary pressures that influence real estate prices.

This pattern of price escalation is notably consistent across various regions, despite the differing characteristics and market dynamics of each area:

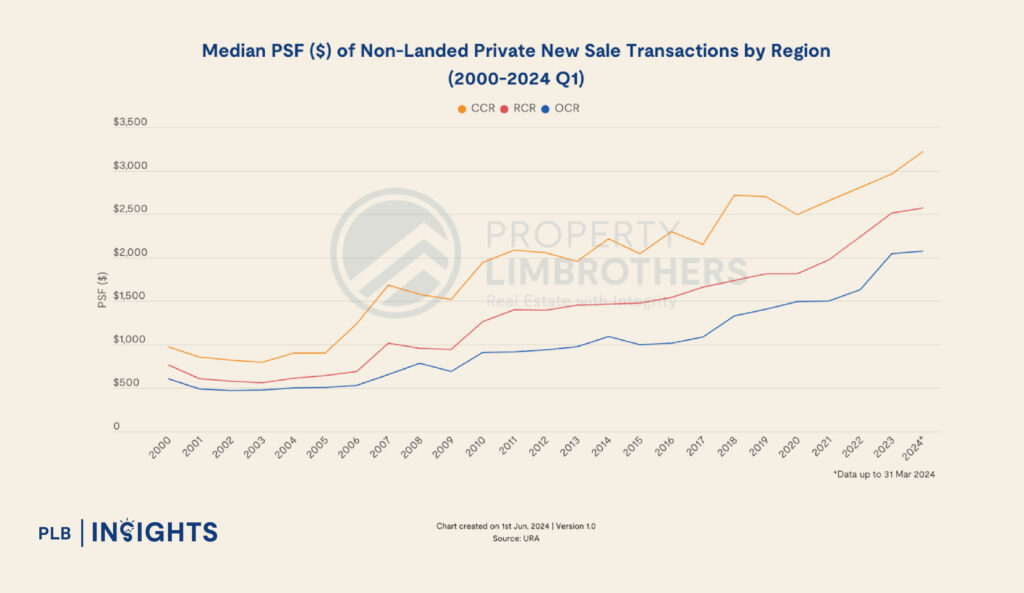

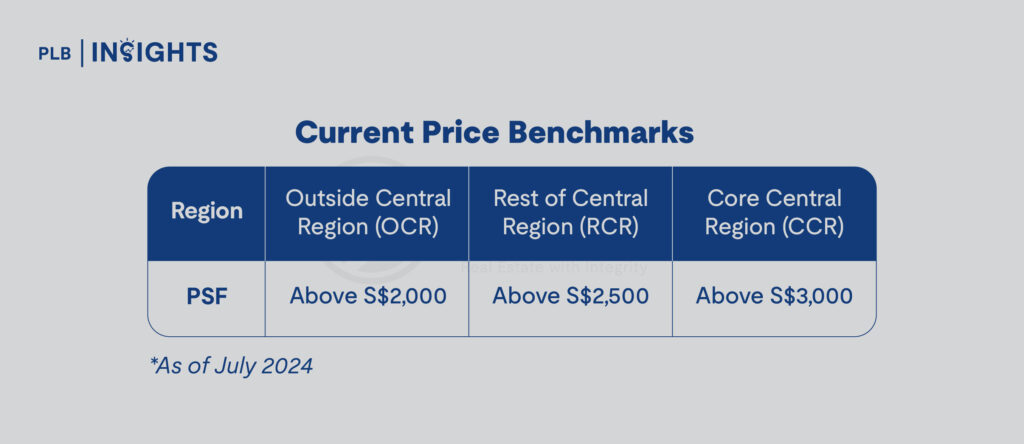

Core Central Region (CCR): The CCR, known for its prime location and high-value properties, sees significant price levels. As of July 2024, the average price in this region has surpassed $3,000 PSF. This high pricing reflects the area’s premium status, with its proximity to key amenities, business hubs, and prestigious neighbourhoods driving demand and contributing to the higher price point.

Rest of Central Region (RCR): This area, while slightly less central than the CCR, still commands substantial prices due to its strategic location and amenities. Prices in the RCR are currently above $2,500 PSF. The RCR benefits from its relative proximity to central locations while often offering more space and modern developments, making it a desirable option for both buyers and investors.

Outside Central Region (OCR): Traditionally, the OCR has been the most affordable of the three regions. However, recent trends show significant growth, with prices now exceeding $2,000 PSF as of July 2024. This increase highlights the growing appeal of properties outside the central areas, driven by factors such as improved infrastructure, expanding urban development, and rising demand for more spacious living environments.

This cyclical nature provides a framework for buyers and investors to time their entry into the market. However, it’s important to note that these are general trends, and individual projects may deviate based on their unique characteristics.

Implications for Buyers and Investors

Understanding this 5-year cycle can be invaluable for decision-making:

- For long-term investors, buying early in the cycle could lead to significant capital appreciation.

- First-time homebuyers might find it beneficial to enter the market sooner rather than later, given the consistent upward trend.

- Those looking to upgrade might consider timing their sale and purchase to maximise gains and minimise additional costs.

However, it’s crucial to remember that real estate decisions should not be based solely on market cycles. Personal financial situations, lifestyle needs, and long-term goals should always be primary considerations.

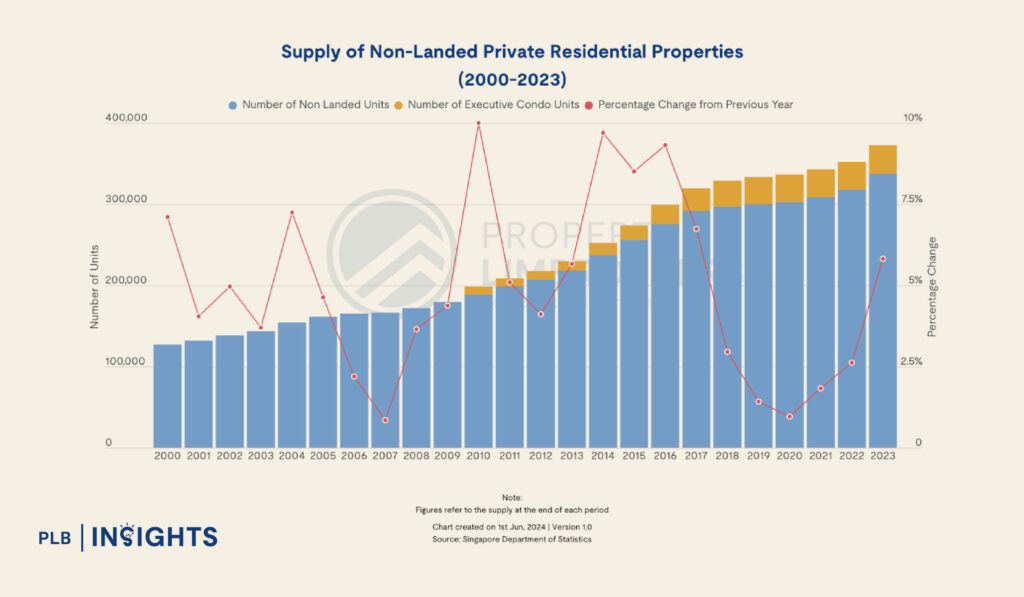

Analysing Private Property Supply Trends in Singapore

Understanding supply trends is crucial for gauging market conditions. The Singapore government plays a significant role in managing the supply of private residential properties to maintain market stability.

Current Supply Landscape

The total supply of non-landed private residential properties in Singapore is experiencing a steady increase, but this growth is being managed with precision to ensure market stability. As of 2024, the number of private residential units has reached approximately 370,000. This figure constitutes around 20% of Singapore’s total housing stock, with the remaining majority of Housing and Development Board (HDB) flats, which account for about 75% of the housing market.

The Singaporean government plays a crucial role in regulating this supply to avoid market fluctuations. This is achieved through the Government Land Sales (GLS) programme, which strategically releases land parcels for development. By controlling the pace and scale of new land sales, the GLS programme helps to balance the demand and supply dynamics, preventing excessive price volatility and ensuring that the property market remains stable and sustainable.

In summary, while the supply of non-landed private residential properties is on the rise, the government’s proactive management through the GLS program ensures that this increase occurs at a controlled pace, thereby maintaining overall market equilibrium.

Impact on Market Dynamics

The controlled supply has several implications:

- It helps prevent oversupply situations that could lead to sharp price declines.

- Limited supply in prime areas can contribute to price resilience in those locations.

- New supply is often strategically located to support urban planning goals and infrastructure development.

For buyers and investors, understanding these supply trends can help in identifying potential hotspots and areas with good growth prospects.

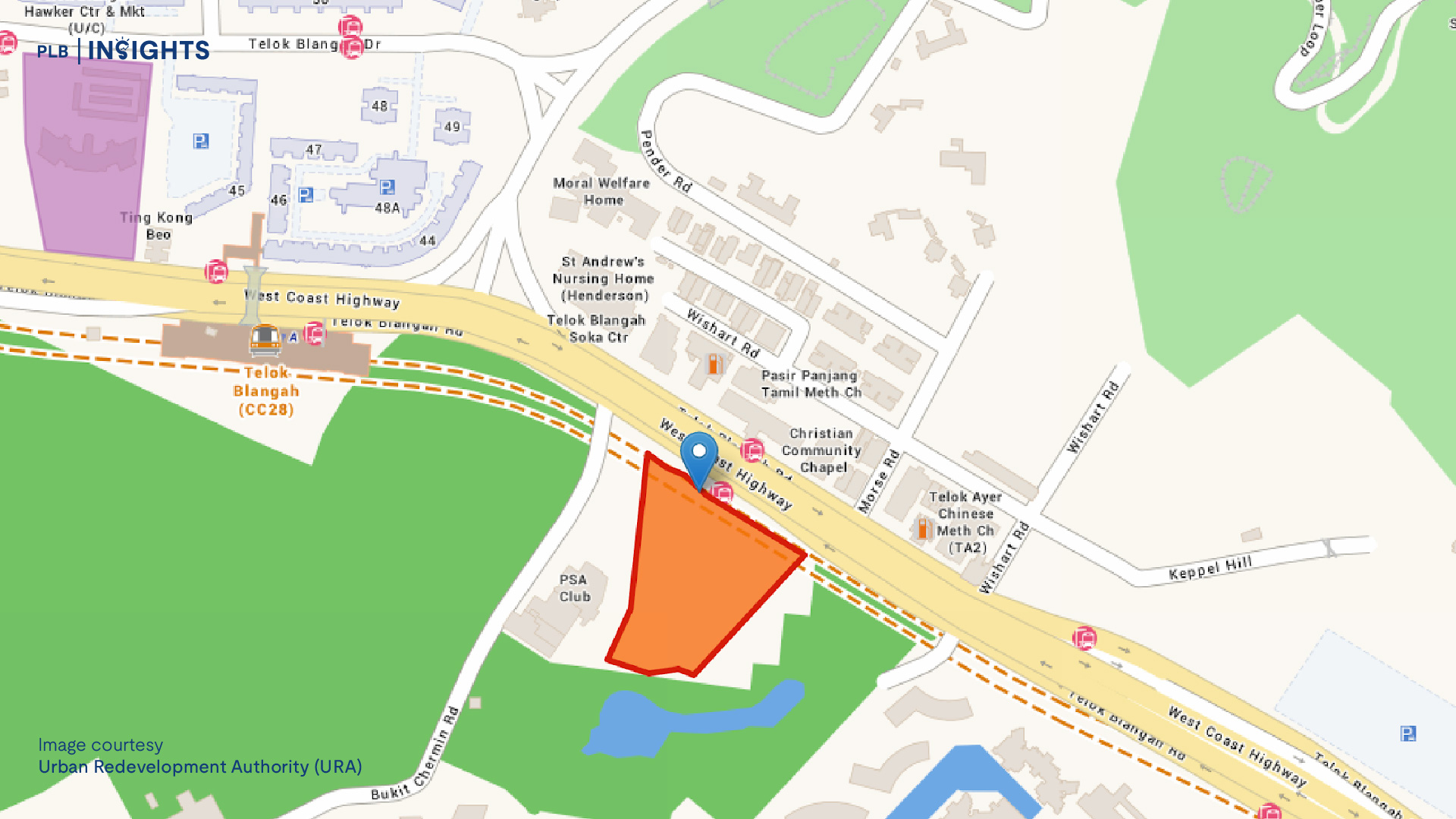

Developer Land Acquisition Strategies and GLS Land Bidding

Developers’ strategies for acquiring land play a significant role in shaping the market. These strategies have evolved over time, reflecting changing market conditions and government policies.

Current Trends in Land Acquisition

Preference for GLS Programs: Government Land Sales (GLS) programs have become the favoured method for land acquisition due to their straightforward and transparent process, compared to the more complex en bloc sales.

Decline in En Bloc Sales: En bloc sales are at an all-time low, driven by increased development charges and high asking prices from existing property owners, making them less attractive to developers.

Strategic Timing by Developers: Developers are timing their land acquisitions to align with the completion of their current projects, ensuring a continuous pipeline of new developments and optimising resource management.

Impact on New Launch Pricing

The land acquisition process directly impacts new launch condo pricing:

Higher Launch Prices: Competitive bids for Government Land Sales (GLS) often result in higher land costs, which can lead to increased launch prices for new developments.

Smaller Unit Sizes: To manage affordability despite rising land costs, developers may choose to build smaller unit sizes, optimising land use while keeping prices within reach.

Strategic Land Banking: Developers use strategic land banking to acquire land and time their project launches for optimal market conditions, ensuring better returns and market positioning.

Buyers should be aware that land costs are a significant component of new launch prices. Understanding recent land sales in an area can provide insights into potential pricing for upcoming launches.

Private Property Holding Period and Market Stability

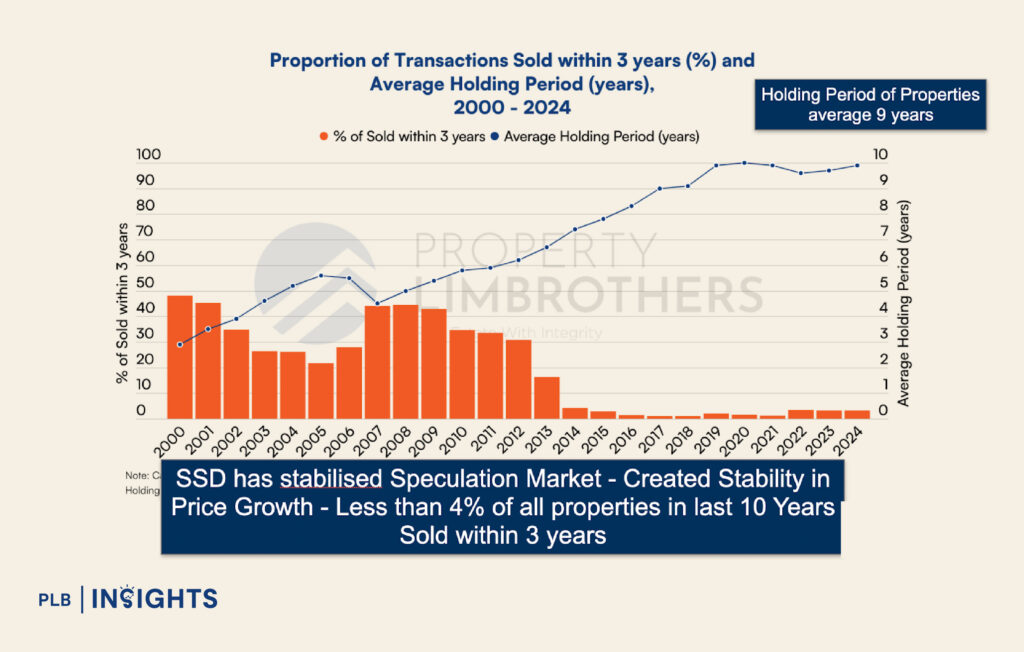

The introduction of the Seller’s Stamp Duty (SSD) has had a notable impact on the market. This policy, aimed at curbing speculation, has influenced how long property owners hold onto their investments.

Trends in Holding Periods

Increased Holding Periods: The average holding period for private properties has risen to 9-10 years, indicating a trend towards longer-term ownership.

Low Turnover Rates: Fewer than 5% of property owners sell within 3 years of purchase, highlighting a commitment to long-term investment.

Market Stability: Longer holding periods contribute to overall market stability by reducing speculative behaviour and promoting a more stable and predictable real estate environment.

Implications for Buyers and Sellers

The extended holding period has several implications:

Encourages Thoughtful Purchases: Longer holding periods promote more deliberate, long-term property investments, as buyers are less likely to make hasty decisions.

Reduces Price Volatility: Extended ownership helps minimise short-term price fluctuations, leading to a more stable market.

Supports Prices: Fewer properties on the resale market due to longer holding periods can help support and potentially increase property prices.

For buyers, this trend suggests the importance of viewing property purchases as long-term investments or homes, rather than short-term trading opportunities.

Singapore Property Price Benchmarks: Present and Future

Current price benchmarks across different regions are setting new records, reflecting the overall strength and resilience of Singapore’s property market.

Current Price Benchmarks

Future Projections

Looking ahead, we can expect these benchmarks to rise further, potentially seeing another $400 PSF increment in the next 5-year cycle. This projection is based on historical trends and assumes continued economic growth and stability in Singapore.

However, it’s important to note that these projections could be influenced by various factors, including global economic conditions, local policy changes, demographic shifts, and infrastructure developments.

Buyers and investors should keep these benchmarks in mind but also consider individual project merits and personal financial circumstances when making decisions.

Navigating the Property Market Seasons for Buyers and Investors

To make the most of the property market cycles, buyers and investors need to adopt strategic approaches tailored to each season. Here are some tips for navigating the market effectively:

Spring Strategies (Land Acquisition)

Summer Tactics (Project Launches)

Autumn Approaches (Selling Units)

Winter Wisdom (Recovery and Preparation)

Remember, while timing is important, it shouldn’t be the only factor in your decision-making process. Your personal financial situation, long-term goals, and lifestyle needs should always be primary considerations.

Understanding these cycles can help you make more informed decisions when it comes to property investment in Singapore. Whether you’re looking for a new home or an investment opportunity, timing your entry into the market can significantly impact your returns.

As we look towards the future, it’s clear that the Singapore property market will continue to evolve. Stay informed, be patient, and always be prepared to adapt your strategies to changing market conditions. With careful planning and a solid understanding of market cycles, you’ll be well-positioned to make the most of Singapore’s dynamic property landscape.

Closing Thoughts

Singapore’s property market operates in a cyclical manner akin to the seasons, each phase offering distinct opportunities and challenges for buyers and investors. By understanding these cycles, especially the 5-year trend of price increases, you can make more informed decisions about when to enter the market or invest in new launches.

Monitoring market conditions, supply trends, and developer strategies will help you navigate this dynamic landscape effectively. While market trends provide valuable insights, always consider your personal financial situation and long-term goals. With strategic planning and adaptability, you can leverage Singapore’s property cycles to achieve your investment and home-buying objectives.

Get in Touch With Us

If you are currently on the hunt for your first home and have any questions or concerns regarding the homebuying process, feel free to reach out to us here for a consultation. From looking at home loans and securing a mortgage to getting the keys to your dream home, our team of experienced consultants will be happy to assist you every step of the way.