Our 2022 Q2 report has highlighted some incredibly interesting findings. Out of all the districts in the OCR, District 27 (Yishun, Sembawang) performed the best in terms of its Compound Annual Growth Rate (CAGR). Why is this so? People might have expected slightly more “central” OCR districts to perform better. Yet, Yishun and Sembawang in District 27 have pulled off a strong underdog victory in terms of their growth from 2019 to 2022 Q2.

In this new short series, we cover the Top 5 Condos in OCR districts by their CAGR. This series is motivated by some interesting findings in our Q2 report and we are keen to find gems in the OCR as we explore the top growth condos all over Singapore. Please note that this does not constitute a buy or sell recommendation. Such a decision would need to be made while taking into account your personal situation, goals, and finances.

This article will introduce you to the Top 5 Growth Condos in the Yishun and Sembawang area. We will also make use of PLB’s MOAT Analysis to show you how each of these properties has excelled during the recent 3 years of growth in the post-pandemic boom for Singapore’s property market. Some of these projects might surprise you, so stay on for the ride.

Coming in at Number 5: Eight Courtyards

Eight Courtyards came in fifth place (actually joint fourth) in terms of its CAGR within district 27. It is a 99-year leasehold private condominium located along Canberra drive. The lease started in 2010 and the project was completed in 2014, with a total number of 654 units.

In the period we are looking at (2019 to 2022Q2), Eight Courtyards did an average psf of $1,127 with a cumulative volume of 104 transactions. The CAGR for this specific project is 5.5% and the absolute growth in these two and a half years was 17.3%.

Eight Courtyards is approximately 600m away from Canberra MRT and 1.2km away from Yishun MRT, both on the North-South Line (Red Line). It is located between the new Canberra estate and the mature Yishun Central estate.

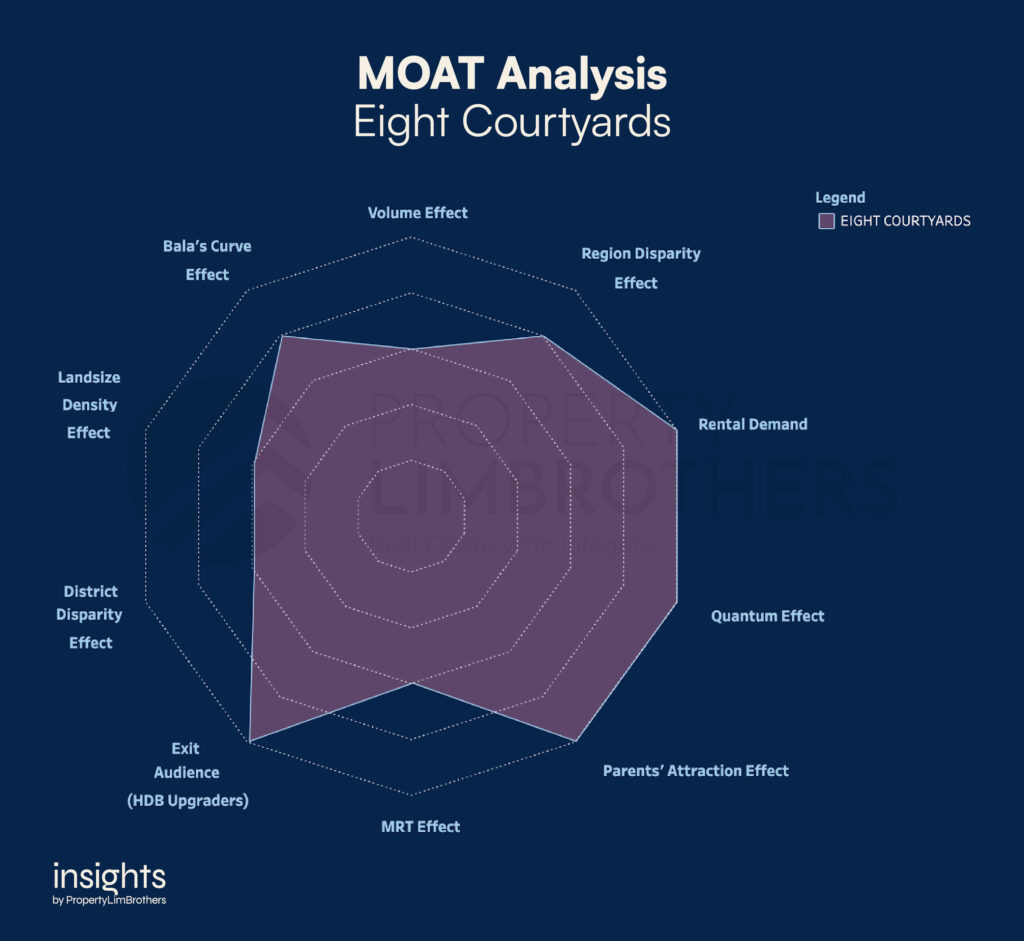

Eight Courtyards not only did great on its growth, it also scored very high on PLB’s MOAT Analysis. With a grand total of 80%, Eight Courtyards definitely puts itself a league above what we usually expect from condominiums and apartments. It excelled at Rental Demand, Quantum Effect, Parents’ Attraction Effect, and Exit Audience, scoring a 5. It also does reasonably well in Bala’s Curve Effect and Region Disparity Effect, with a score of 4.

Eight Courtyards has a solid all-rounder performance, with none of its MOAT components falling below a score of 3. This might be a good option to look at for people looking to make D27 their home. Eight Courtyards might be increasingly attractive as the new launch market heats up to sky-high prices. The persistent inflationary forces will continue to price out market participants.

Eventually, more affordable resale condos in the OCR such as Eight Courtyards and the other projects we will introduce might attract demand and continue to appreciate handsomely. Coming in currently at $1,1xx, it is definitely at a tempting price point even for a 99-year leasehold property.

Fourth Place goes to: Yishun Emerald

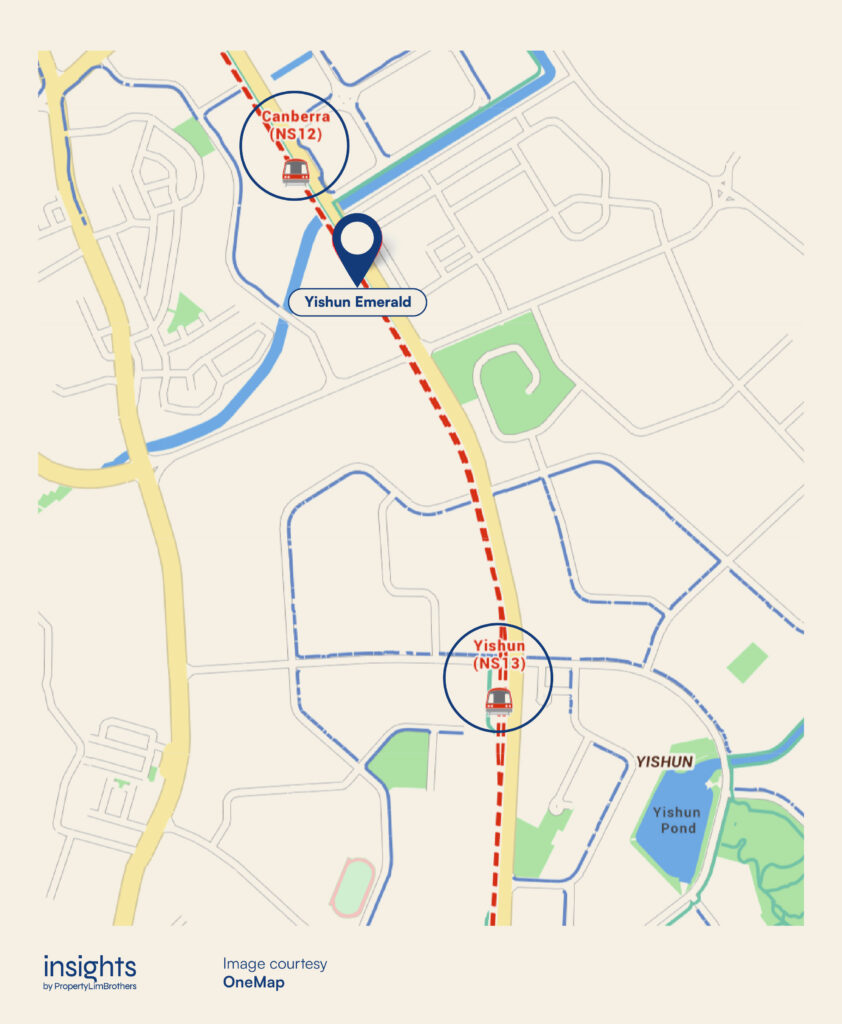

The joint fourth highest CAGR for condos in district 27 goes to Yishun Emerald. Not so surprisingly, this 99-year leasehold condominium is located right next to Eight Courtyards. This affirms the location’s growth performance and its potential.

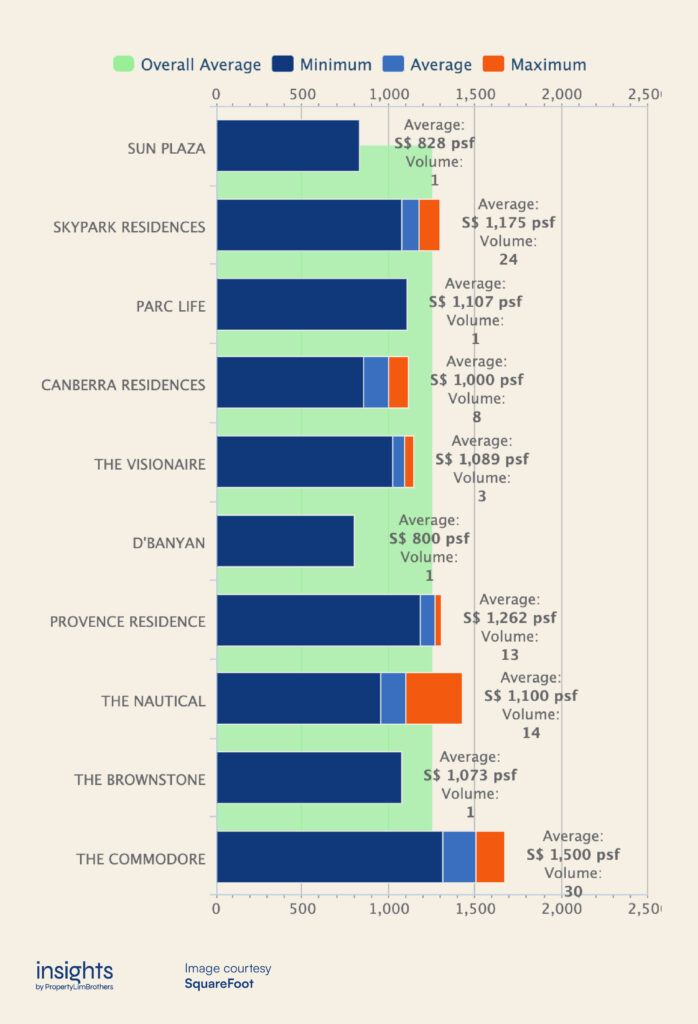

Yishun Emerald has its lease starting in 1998 and was completed in 2002, with a total of 436 units. From 2019 to 2022 Q2, Yishun Emerald had an average psf of $828, with a cumulative volume of 67 transactions. The CAGR for this project was 5.5% and the absolute growth rate for this period was 17.3%.

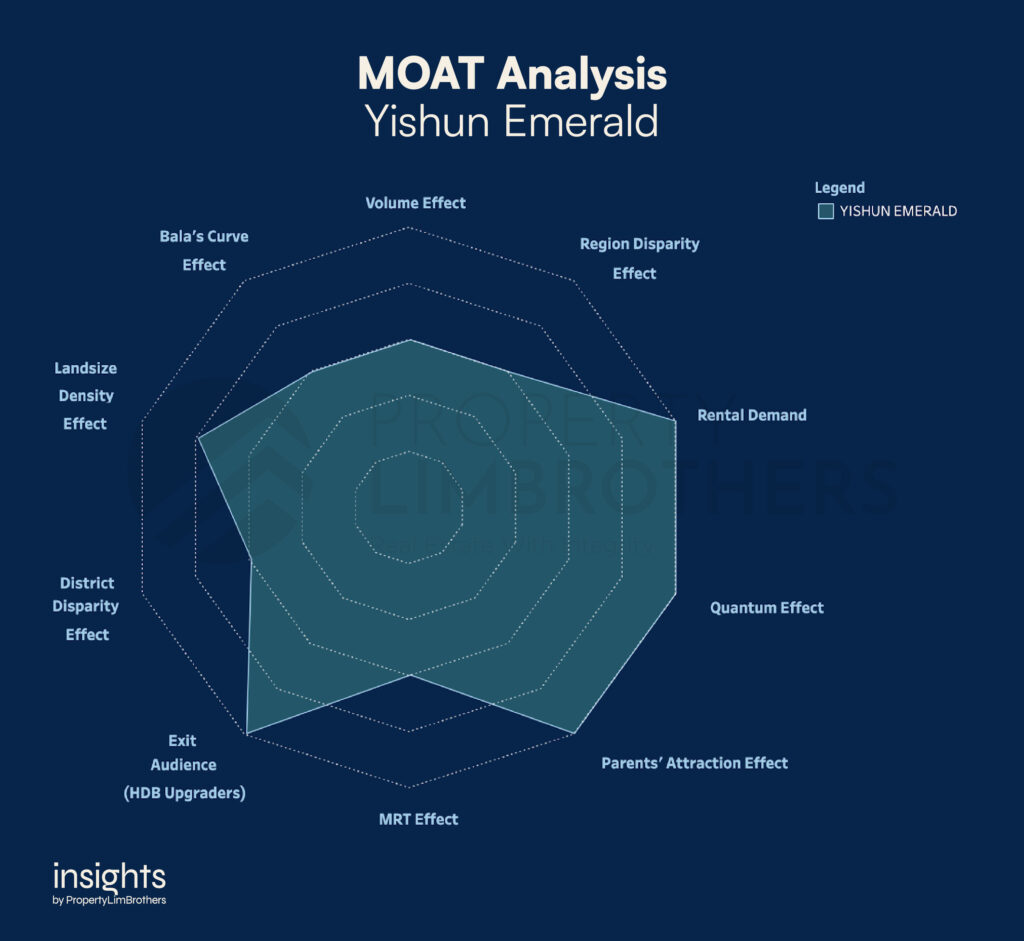

The core difference between Yishun Emerald and Eight Courtyards is that Yishun Emerald has 12 years less in lease. It also scores lower on the Region District Disparity score because its psf is around the median of the condos in the region with a comparable age. In return, it does marginally better than Eight Courtyards for Landsize Density Effect.

In comparison to Eight Courtyards which ties with Yishun Emerald in terms of growth, the Yishun Emerald project still scores a high 78% on MOAT (2% less than Eight Courtyards). For buyers interested in this area, the key tradeoff is between lease and psf. Yishun Emerald has 12 years of lease less but is priced at an average of $299 psf lower than Eight Courtyards. This is an important tradeoff to keep in mind, even though both joint fourth condos have had the same CAGR since 2019.

Reaching the Podium as Third: Canberra Residences

Moving on to the projects that reached the podium, Canberra Residences comes in at 3rd place. With a cumulative volume of 54 transactions from 2019 to 2022Q2, at an average psf of $989. This puts Canberra Residences at a CAGR of 5.6%, and an absolute growth rate of 17.9%. Canberra Residences managed to squeeze out a marginally better capital appreciation as opposed to the joint fourth condos.

Canberra Residences’ 99-year lease started in 2010, and the project was completed in 2013 with 320 units in total. As you can see, the Canberra estate is filled with a large number of HDB and private condominiums. This huge residential cluster is driving the growth we see in District 27.

Canberra Residences is located 1km northwest of Yishun Emerald and Eight Courtyards. It is located between Canberra and Sembawang stations. It is found along Sembawang Road, Canberra Drive, and Jalan Sendudok.

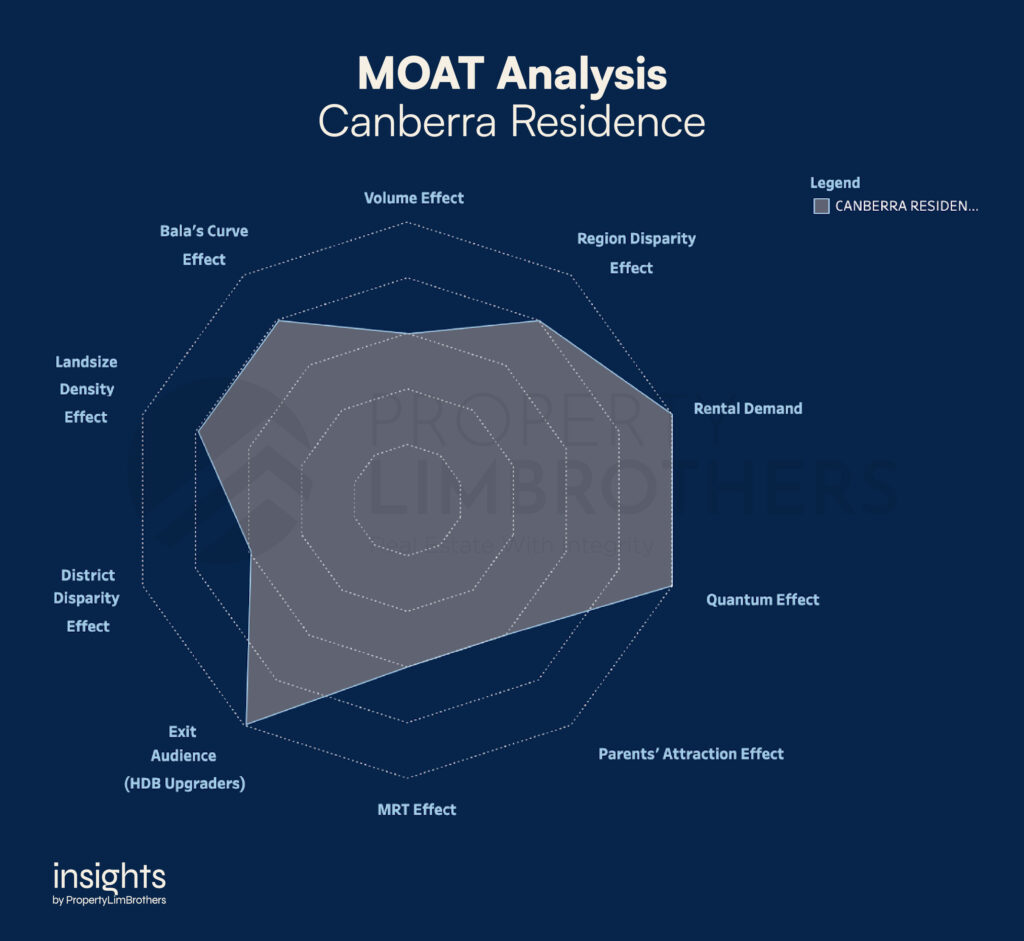

It has the same overall MOAT score as Yishun Emerald, sitting at 78%. It is also an all-rounder, but does better in Bala’s Curve Effect and Region Disparity Effect at the expense of Parents’ Attraction Effect score. Overall, Canberra Residences is another in the district that provides affordable private housing and promising growth prospects at the same time.

What people are looking for in property can be found in the OCR if they keep an open mind in their search process. Although not the most accessible or ideal location (which is a fair trade-off), it comes in at an attractive price point and still has room for improvement as property prices continue to climb.

The MOAT Analysis that complements our search of the Top 5 Growth Condos in the Yishun and Sembawang area has so far gone hand in hand. So far in this article, the properties that do well in terms of their CAGR also have very high MOAT scores of greater than 75%. This is not to say that MOAT is a great predictor of growth, but it does give us more confidence in the growth potential of Condos we are researching.

To take this a step further, factors of the MOAT Analysis are not as dynamic as price movements in the market. MOAT Scores are relatively stable although it is updated as we receive more information through caveats lodged in the project. Thus, if we can consistently use stable MOAT scores to find properties that will eventually hit a high growth rate one day, it would be an absolute win.

Properties with high MOAT scores may not necessarily perform well throughout their entire lifetime. But when properties with high MOAT scores are strangely priced around or below median, it is a sign that we should dig deeper if it is a great value-oriented property.

First Runner Up: Sun Plaza

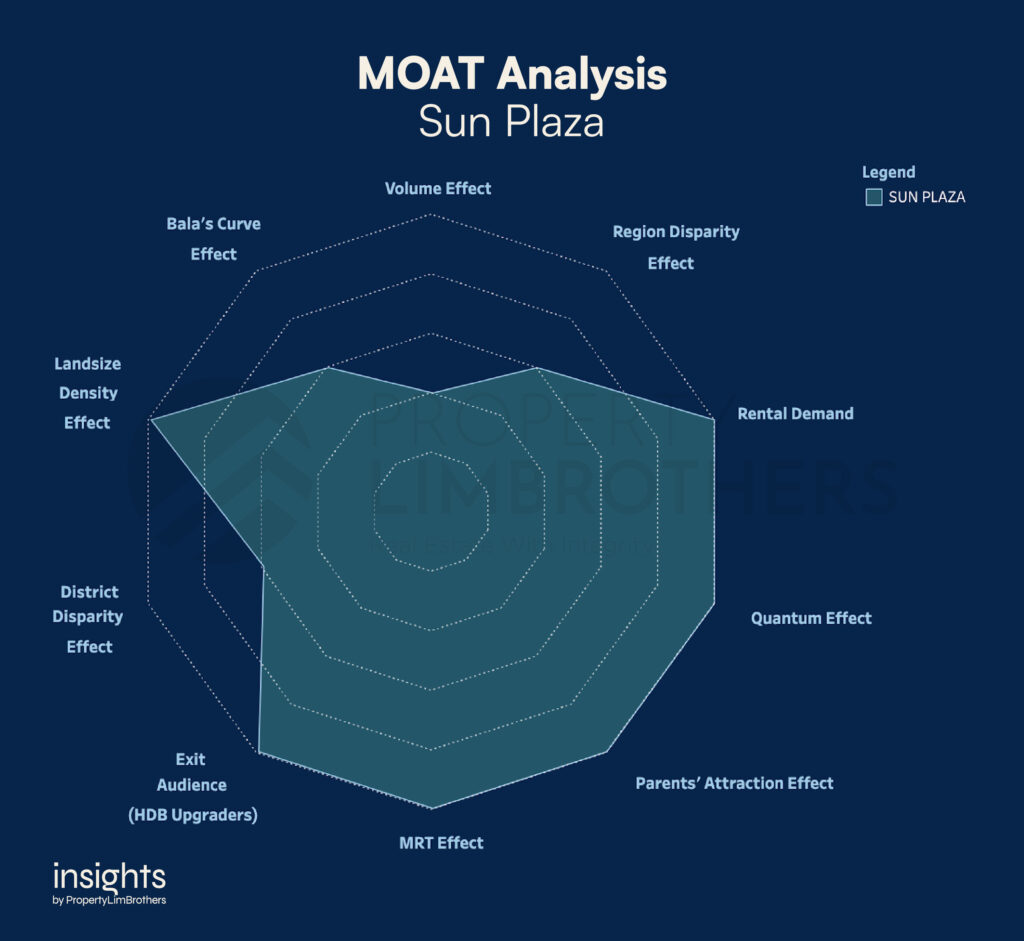

Now onto the runner up to the growth race in District 27, Sun Plaza takes it home with an average psf of 828 from 2019 to 2022 Q2. It has a cumulative volume of 10 transactions in this period, and a CAGR of 8.3%. It has an absolute growth rate of 26.9%

Sun Plaza is a mixed-use development located next to Sembawang MRT. It is a 99-year leasehold apartment with its lease starting from 1996. It has a total of 76 units. Although 26 years have passed since, Sun Plaza is still going strong with 73 years of lease. Part of this may be due to the integrated development status. With a mall right below your home, and an MRT station and bus interchange beside it, the property might still be very desirable despite the lease decay.

The larger area surrounding Sun Plaza is the large residential estate of Sembawang, which has both HDBs and private properties in the area. From a glance, the Sun Plaza seems to be the core shopping and transport centre for the area. The footfall and demand to stay nearer to this area.

The MOAT Analysis gives us a surprisingly high reading of 82%. The highest in the article so far. It does very well with a score of 5 in Rental Demand, Quantum Effect, Parents’ Attraction Effect, MRT Effect, Exit Audience, and Landsize Density Effect. Despite the low Volume Effect score of 2 and the decaying lease putting Bala’s Curve Effect at 3.

The growth of Sun Plaza occurred despite the disadvantages of decaying lease and low volume. With an average psf of $828 over the three and a half year period, it would seem that having a lower psf price compared to the average prices of nearby comparable properties.

A lower average price relative to the market average for that location gives the property’s price room to advance upwards. When housing prices become increasingly unaffordable and out of reach from the median income earner, it is more likely that the demand will be concentrated among more affordable properties.

This price disparity creates an upward pressure on the lower priced condos in the same area. Yet, the price is appropriately discounted by factors such as a decaying lease. Most importantly, just because a property is priced relatively low does not mean that they immediately have a high potential for growth.

Ultimately, the potential for growth is still driven by the desirability of the location and the project. More importantly, reasons are needed for the price to continue to appreciate into the future. That’s part of the reason why people look at URA Master Plans and the larger estate in general. To find out if the property will become more desirable in the future.

1st Place goes to: Euphony Gardens

The first place with the highest CAGR since 2019 is Euphony Gardens. This might take you by surprise, as it certainly did surprise us. Euphony Gardens is a 99-year leasehold condo with its lease starting in 1998. It was completed in 2001 with a total of 304 units. It is located along Jalan Mata Ayer, which is around 1.2km southwest of Yishun MRT.

Euphony Gardens had an average psf of $803 since 2019. It had a total cumulative volume of 53 transactions. The CAGR of this project is 8.7% and it did an absolute growth of 28.6% in this period. This high CAGR is surprising for a condo of this age and location. In some sense, it can be considered as an unexpected underdog victory for Euphony Gardens.

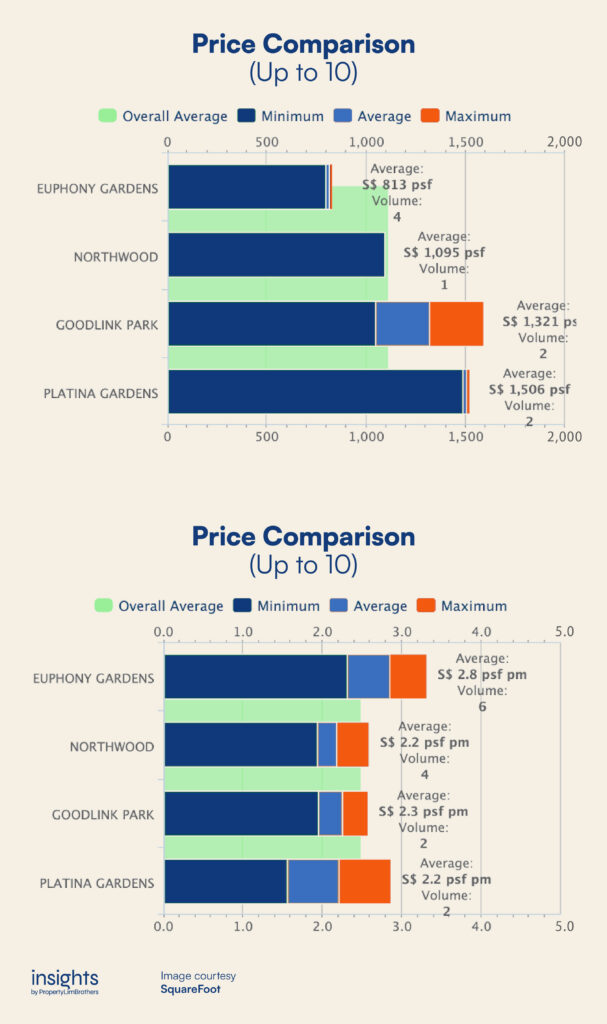

Euphony Gardens is located near a part of Sembawang Road. There are only 3 other condominiums in this vicinity. Otherwise, due east is Chong Pang HDB estate, which can be considered to be a matured area of Yishun.

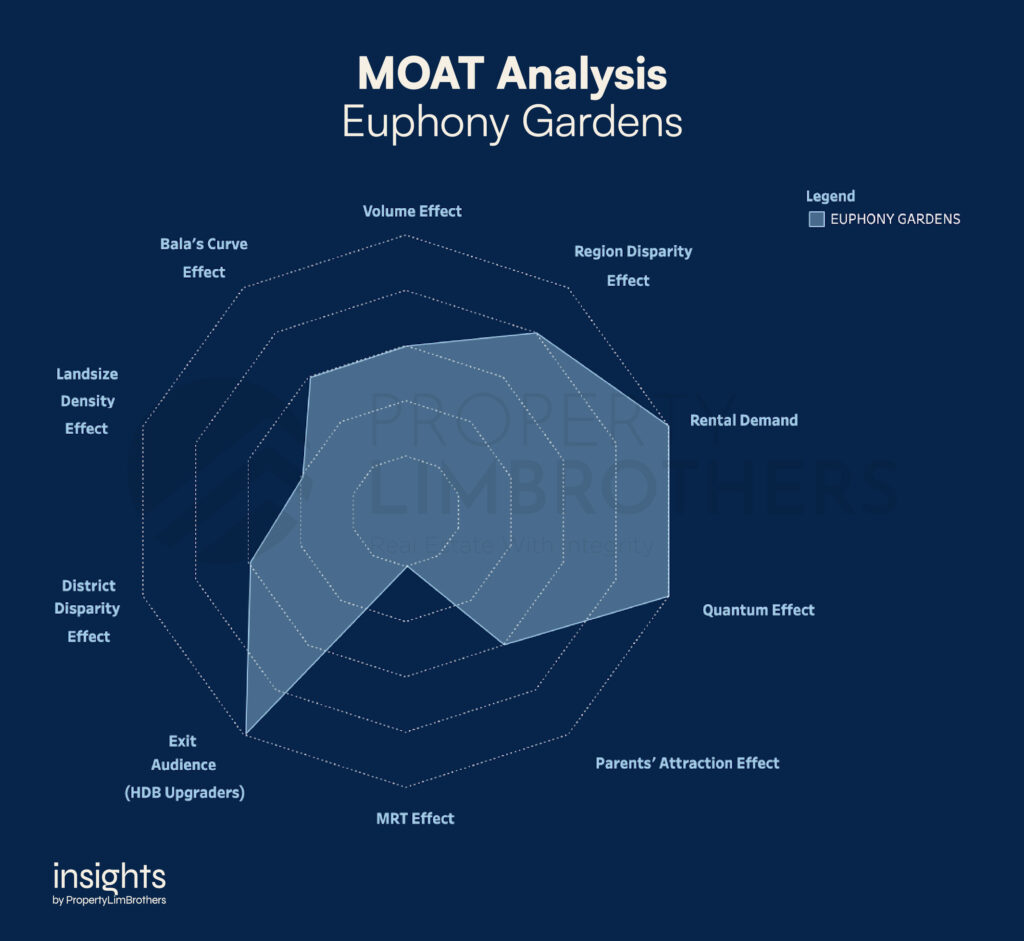

Surprisingly, Euphony Gardens only has a MOAT score of 68%. It excels in the Rental Demand, Quantum Effect, and Exit Audience. However, it has a low score on Landsize Density and MRT Effect. Transportation options in this location are more scarce but not entirely isolated.

Contrary, to the previous condos that made it into the top 5 highest CAGR, Euphony Gardens is the only one with a MOAT score of lower than 75%. Yet, it is the one with the highest growth in this short period. Perhaps for Euphony Gardens more so than the other entries, the price growth is mainly driven by the larger macro forces on inflation in the property market rather than the intrinsic locational and project benefits and USPs.

Interestingly, this condo commands a similar rental price to other projects nearby. Because of the lower psf of the project, the rental yield ends up being much higher than the rest. Again the high growth number may be a result of the lower psf.

Closing Thoughts

To conclude this article on the Top 5 Growth Condos in District 27, there are a few important caveats to remember. First, this is not a buy or sell recommendation. We are sharing our findings on the top growth condos to see if we can find out what they have in common and whether we can identify these condos before the growth materialises.

There are two important caveats you should consider on these Top 5 Condos. Note that there is a non-negligible number of unprofitable transactions for some of the top growth condos. Perhaps the reason why the growth materialised is because previous owners of the property were willing to sell the property at a loss, giving a value surplus to the next owner.

Next, lease decay in these condos does not indicate an automatic decline in prices. Because of inflation, prices also face an upward pressure despite this lease decay. As a result, we see a form of volatility in price as the two forces battle each other. The result is high growth for buyers who were able to buy the property at a discounted price. Other tangible reasons for the demand of older projects include the size of the units and the size of the development, which are generally larger due to lower land cost during the time of development.

Some additional things to take into consideration is how most of the MOAT scores of the high growth properties in District 27 are very high. A high MOAT score of greater than 75% may indicate that the property has a high potential for growth. This is a criteria we will continue to explore as we look at the other Top Growth Condos in the OCR. If you are interested in a property in the promising District 27, feel free to reach out to us!