Just five years ago, Singapore was grappling with an oversupply of private homes, with a supply overhang of 31,948 units by the third quarter of 2019. At that time, several news outlets reported extensively on this supply glut and many were concerned that it would take years to clear.

In response to both the pandemic and the oversupply, the government reduced the supply of private residential housing by limiting confirmed Government Land Sales (GLS) sites in 2020. Combined with rising housing demand, the oversupply was resolved within approximately 2.5 years.

Now, with the issue of “oversupply” resurfacing—especially in light of the housing glut in China—it raises the question: could “oversupply” once again become a significant concern in Singapore’s housing market?

Before diving into an analysis of Singapore’s current housing landscape, let’s first explore what oversupply is and its broader implications.

The Supply Glut in China and Its Impacts

Property oversupply or a supply glut occurs when the number of available housing units exceeds the demand from buyers or renters. It can result from a combination of reasons such as over construction, weak demand due to economic downturns or poor market sentiments, slower-than-expected population growth etc,.

In reality, China is currently facing this very issue of property oversupply.

China’s housing glut since the second half of 2023, driven by a double whammy of weak sales and a declining population, has placed immense strain on the country’s housing market. Across China, particularly in Tier 2 cities, millions of newly built homes remain vacant. As of April 2024, there were 391 million square metres of unsold residential property, according to the National Bureau of Statistics. This oversupply has driven housing prices to their steepest decline since 2011 as developers slash prices to attract buyers.

The sheer scale of the glut has raised significant concerns, shaking confidence in the world’s second-largest economy. What was once considered a safe haven—property investment—has now sparked anxiety in the country.

This is a big problem. Overleveraged property developers, with their capital now locked in unsold housing stock, have been pushed to the brink of bankruptcy—some already crossing that threshold. The inability to generate sufficient cash flow from sales has exacerbated their financial instability, threatening not only the real estate sector but also the broader economy, which relies heavily on property investment as a growth engine.

Additionally, the decline in property valuations poses another significant challenge. Based on an analysis by Nomura using proprietary data from the Beike Research Institute, home prices in 25 major Chinese cities have plummeted nearly 30% from their 2021 levels.

This sharp drop in property values risks triggering the issue of negative equity, where homeowners owe more on their mortgages than the current market value of their properties. This scenario further erodes the already-low household confidence, leading to more conservative spending behaviours. Homeowners trapped in negative equity tend to prioritise saving over spending, reducing discretionary consumption and weakening overall consumer demand—a key driver of economic growth.

The oversupply in China’s property market has wide-reaching effects, significantly impacting household wealth, curbing consumption, and creating strain in the job market which results in higher unemployment rates.

Price and Supply Trend of Private Housing in Singapore

Now, let’s look at what is happening at home.

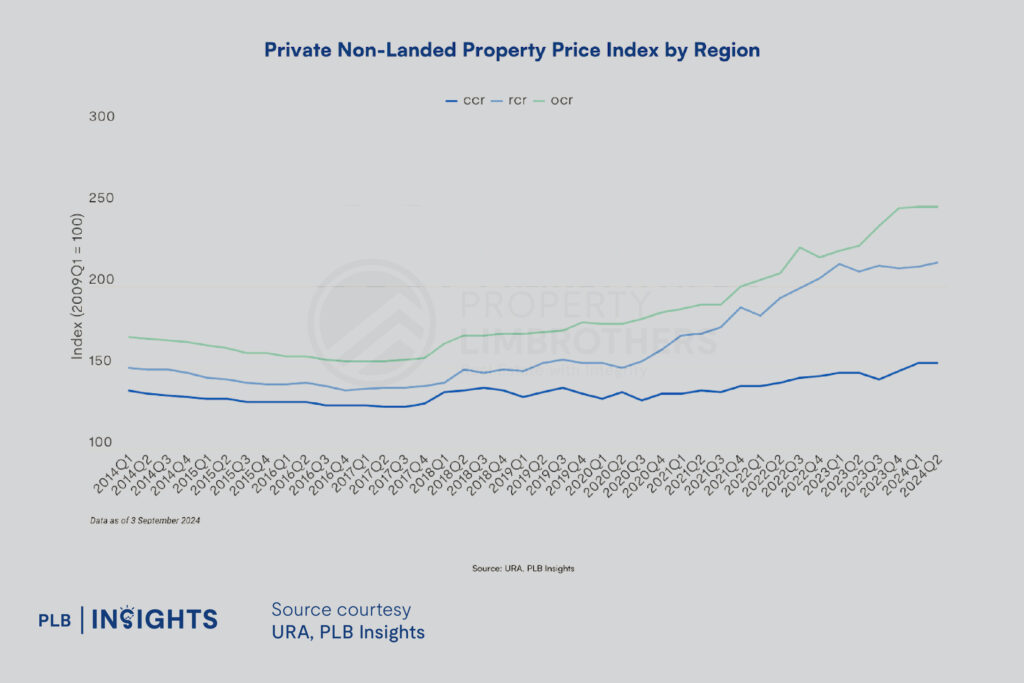

Prices of private non-landed properties have steadily increased over the years, driven by rising demand, as shown in Figure 1. This price surge was particularly sharp following the onset of the COVID-19 pandemic. The disruption in the construction sector which delayed home completions and the government’s cautious approach in releasing land for development contributed to a perceived shortage of new homes. This, combined with robust demand, drove housing prices to record highs. However, there was a slowdown in price growth recently which signals a stabilisation. The easing of price momentum is attributed to the ramp-up in the GLS programme over the past two years.

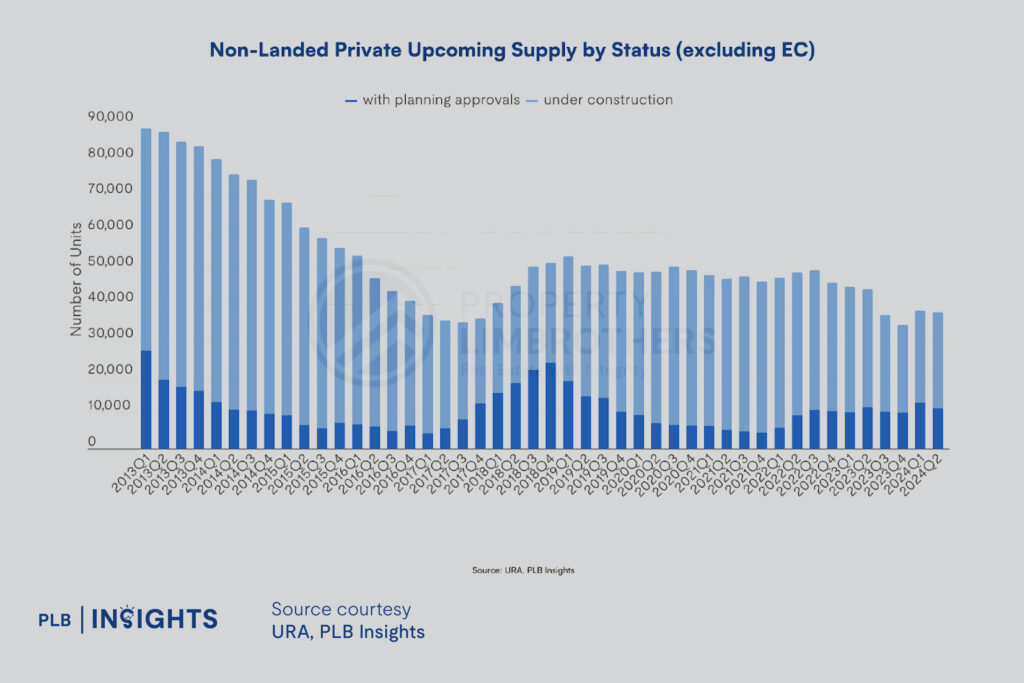

More recently, the Ministry of National Development (MND) announced plans to release land that will generate approximately 5,050 private housing units (excluding ECs) through the confirmed list of the H2 2024 GLS programme. This will bring the total supply for the year to 11,110 private housing units, the highest since 2013 when 12,895 units were made available, as seen in Figure 2.

However, despite this increase in total supply, the confirmed list for H2 2024 saw a 7.3% decline, or 400 fewer units, compared to the 5,450 private residential units offered in the first half of the year. This is the first drop after seven consecutive increases and is largely due to developers becoming more cautious amid a cooling property market.

The scaling back of confirmed list supply is largely driven by a developers’ weaker response to recent state land tenders amid rising interest rates between 2020 and 2023 and subdued consumers’ demand. Additionally, new launch sales also paint a tepid picture. The cumulative number of newly launched but unsold private homes increased by 2.7% in August, reaching 3,595 units, up from July. Since December 2023, this figure has grown by 6.8%, according to data from JLL.

Oversupply or Not?

In addition, the Summary of Economic Projections anticipates a fed funds rate target of 3.4 percent (or 3.25 to 3.50%) by the end of 2025 and a rate of 2.9 percent (or 2.75 to 3.00%) by the end of 2026, further lowering the cost of borrowing.

Many analysts also expect new sales volumes to rebound, driven by several upcoming property launches and a combination of potential economic recovery and lower borrowing costs, which could further boost buyer demand.

Therefore, it is unlikely that Singapore is heading toward an oversupply in the housing market as long as demand remains stable. And if an oversupply were to occur, it would likely be a shorter-term issue compared to the situation in China.

Singapore’s regulated housing market, limited land availability, and stable demand (as well as those from HDB upgraders) suggest that excess supply could be absorbed quickly. As long as these factors remain in play, oversupply is unlikely to pose a significant concern for Singapore’s housing market.

Conclusion

We discussed the housing glut in China and its far-reaching consequences, illustrating how oversupply can negatively impact an economy, particularly when real estate plays a critical role in driving growth. In contrast to the housing glut in China that has persisted over several quarters, Singapore’s real estate market remains resilient and well-regulated, with oversupply unlikely to become a significant long-term issue.

While short-term fluctuations in supply and demand may occur, Singapore’s proactive government policies, controlled land availability and urban planning, as well as steady demand provide a safeguard against prolonged excess supply. With careful management of these factors and a stabilising economy, Singapore’s housing market is expected to maintain its balance, minimising the risk of oversupply becoming a major concern.

Our goal is to provide insightful and helpful content that can help you make informed decisions. Whether you’re a first-time homebuyer, an experienced investor, or just exploring your options, our team of consultants is here to guide and support you through every step of the process.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.