If you are thinking about applying for a Build-to-Order (BTO) flat, you might already be aware of the various schemes that HDB offers to help young couples in their journey to homeownership. The existing schemes, such as a staggered downpayment scheme and deferred income assessment, allow young couples, including students and NSFs, to afford the initial costs of booking a new flat.

On 5 March 2024, the government announced additional support to help lighten the initial financial burden for eligible young couples buying a new flat. Details of the temporary rental vouchers that were announced during Budget 2024 by Deputy Prime Minister Lawrence Wong were also unveiled.

In this article, we go through some of the changes announced and weigh in on the potential impact on the public housing market.

Reduced Initial Downpayment for Young Couples

Starting from June 2024, young couples looking to buy a new HDB flat will receive additional support. Eligible couples will only be required to make an initial downpayment of 2.5% of the flat’s purchase price, and defer their income assessment to just before key collection.

The deferred income assessment is tailored for young couples. Specifically, those who are either full-time national servicemen (NSFs), students, or have recently completed their studies or national service within the last 12 months before applying for their HDB Flat Eligibility (HFE) letter.

The policy allows these couples to apply for a flat first and delay their income assessment for housing grants or loans until just before they collect their keys. This delay is strategic, considering that income assessed at the application stage might render them ineligible for certain grants, such as the Enhanced CPF Housing Grant (EHG), which demands that at least one partner has been in continuous employment for at least 12 months.

By postponing the income assessment to a later stage, couples enhance their chances of qualifying for grants and potentially secure a larger loan amount. This makes homeownership more accessible and financially manageable for young couples embarking on this significant life milestone.

Enhanced Staggered Downpayment Scheme

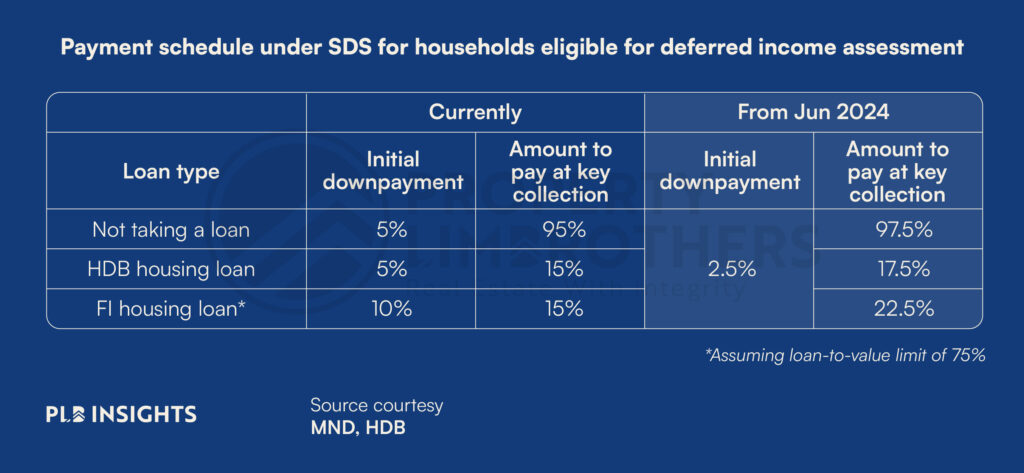

The current staggered downpayment scheme breaks the minimum downpayment of 20% into two instalments. The first downpayment of either 5% or 10%, depending on the type of loan taken, is paid during the signing of lease (second HDB appointment) and the second downpayment of the remaining 15% or 10% is due at key collection. With the new change implemented from June 2024 onwards, this is how the staggered downpayment will look like for eligible young couples:

We believe that this change will allow more young couples, whose main obstacle to applying for a BTO flat is the initial downpayment, to feel more confident about affording a new flat. With the new HDB classification framework rolling out possibly from June 2024 onwards as well, the average price of a 4-room BTO flat under the standard model should be in the ballpark of $400,000. This means that for a $400,000 flat, the initial downpayment by an eligible young couple will be around $10,000 – an amount that can easily be covered by CPF savings. This new change will very much ease the initial financial burden for these couples in buying a flat.

Temporary Rental Vouchers

During Budget 2024, it was announced that the government will be rolling out 1-year temporary rental vouchers to help more families that are eligible under the Parenthood Provisional Housing Scheme (PPHS) rent an HDB flat or bedroom in the open market.

Under the PPHS, eligible families can rent a flat from HDB while waiting for their BTO flats to be completed. HDB recently announced that it will be increasing the supply of such rental flats to meet demand, aiming to double the current 2,000 units to 4,000 by 2H2025.

More details on the rental vouchers have been released, including its quantum of $300 per month. This quantum was carefully calibrated to offer a measure of relief to eligible families, while also taking into account any possible inflationary effects on the rental market.

To be eligible for the rental voucher, families must be eligible for the PPHS and have a rental tenancy registered with HDB at the point of application. The voucher will be on a reimbursement basis within the stipulated one-year period and the duration of their tenancy, and families renting from immediate family members or relatives will not be eligible.

With the voucher slated to start from July 2024, final details will be shared by the authorities closer to the date of implementation.

While the rental vouchers are unlikely to have a significant impact on the HDB rental market, we do not rule out the possibility of landlords raising their rents in anticipation of this government subsidy. Furthermore, because of the low quantum, high rental costs in the open market, and the intended beneficiaries (families with an income ceiling of $7,000), these vouchers might ultimately not do much for families that require long-term interim housing if the waiting time for their BTO flats is 3-4 years.

Closing Thoughts

The introduction of the reduced initial downpayment for young couples seeking to purchase a new HDB flat, alongside the temporary rental vouchers, represents a thoughtful and balanced approach by the authorities. These measures are designed with dual objectives in mind: to make homeownership more attainable for young couples at the start of their journey together, while also carefully managing the broader economic implications, such as minimising inflationary pressures on the rental market. These initiatives underscore a commitment to supporting family formation and providing financial assistance in a manner that maintains market stability.

What do you think of these changes? Will these announcements give you more confidence to apply for a flat now? If you are still uncertain about your housing options and need help navigating the market, we will be happy to offer a second opinion and weigh your options. Do reach out to us here and we will get back to you shortly.

Till next time, take care.