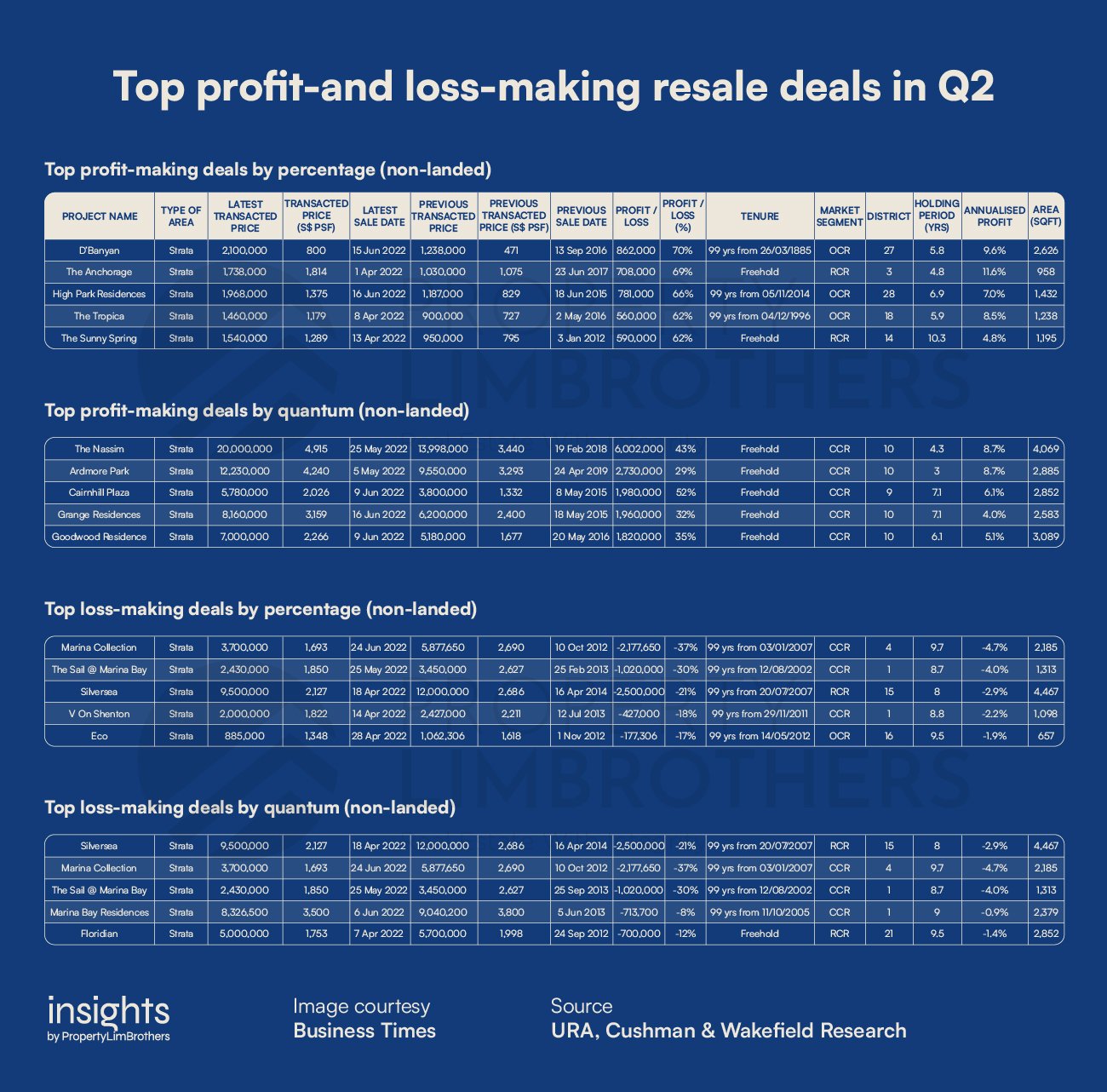

Everyone loves a good underdog story. The recent top resale performers of Q2 have just the story for leasehold OCR properties. Out of the top 5 profit making deals by percentage for non-landed properties, three of them were leasehold properties from the OCR. Even though the top profit maker by quantum was a unit at The Nassim selling for $20 million in the CCR, leasehold OCR properties still had their chance to shine in terms of percentage gain.

Headlines love big numbers and prestige. Which was probably why The Nassim grabbed it with the $20 million price tag. This does not mean that leasehold properties in the OCR should be ignored. In fact, we should pay more attention to the phenomenal gains made by these OCR leasehold properties which are within reach for more Singaporeans.

In this article, we will cover two top profit makers for resale leasehold OCR, High Park Residences and The Tropica. We will cover how each of them might have bagged such huge gains, and demonstrate how our MOAT Analysis can help in the process. Perhaps we can learn a thing or two from these gems, and spot future winners in the OCR.

How well did High Park Residences and The Tropica do?

Although three of the top five profit makers by percentage were from the OCR and are leasehold, one of them holds a 999-year lease. Which, to most humans, would be considered almost equivalent to freehold (since it lasts over 10 lifetimes and over 17 times Singapore’s current age).

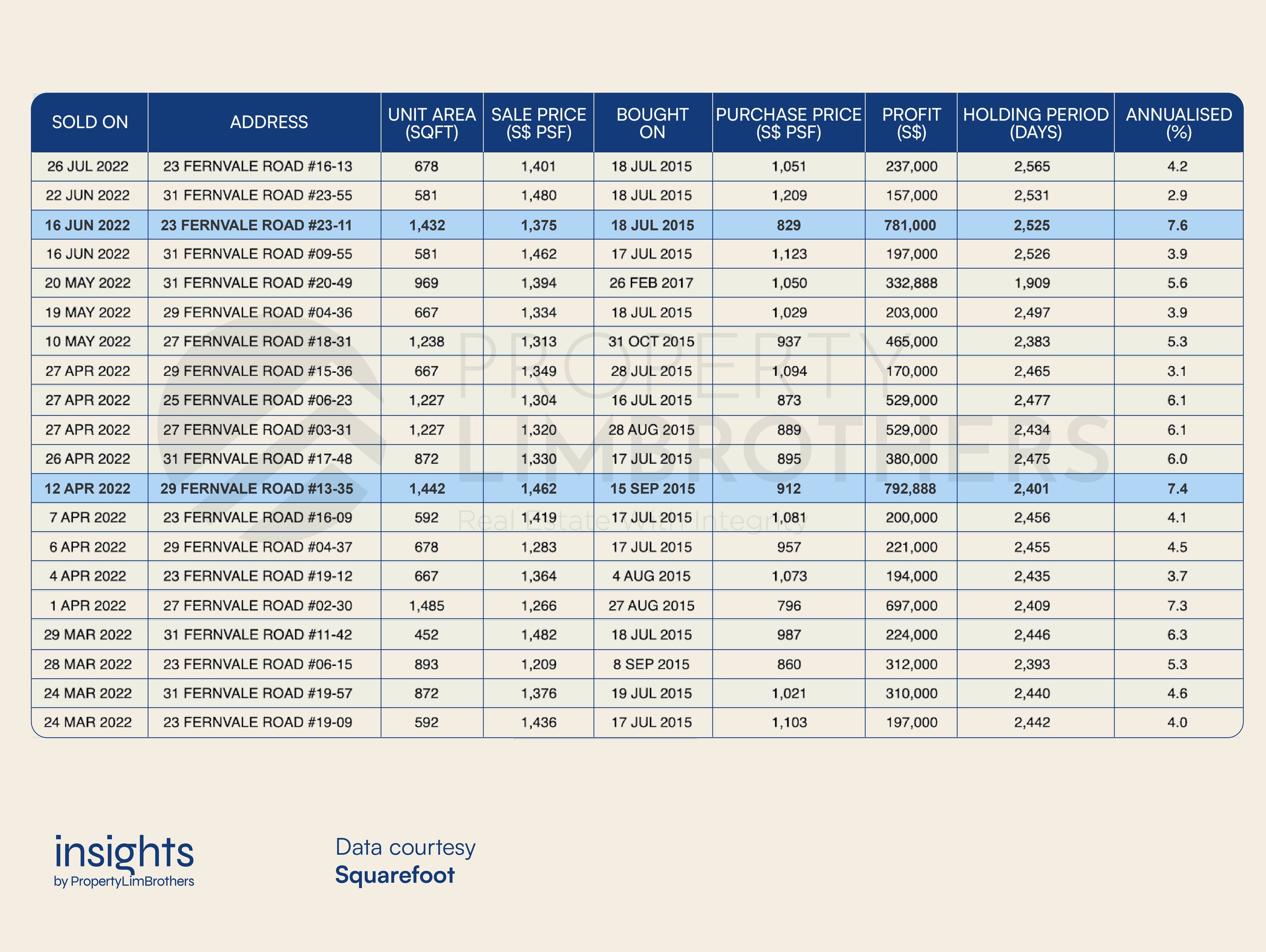

High Park Residences was sold at $1,968,000 on 16 June 2022 with an annualised profit of 7.6%. That particular unit was bought on 18 July 2015 for $1,187,000. Excluding all other fees, it booked a total profit of $781,000 around 7 years of holding, which is near the average holding period of a property in Singapore.

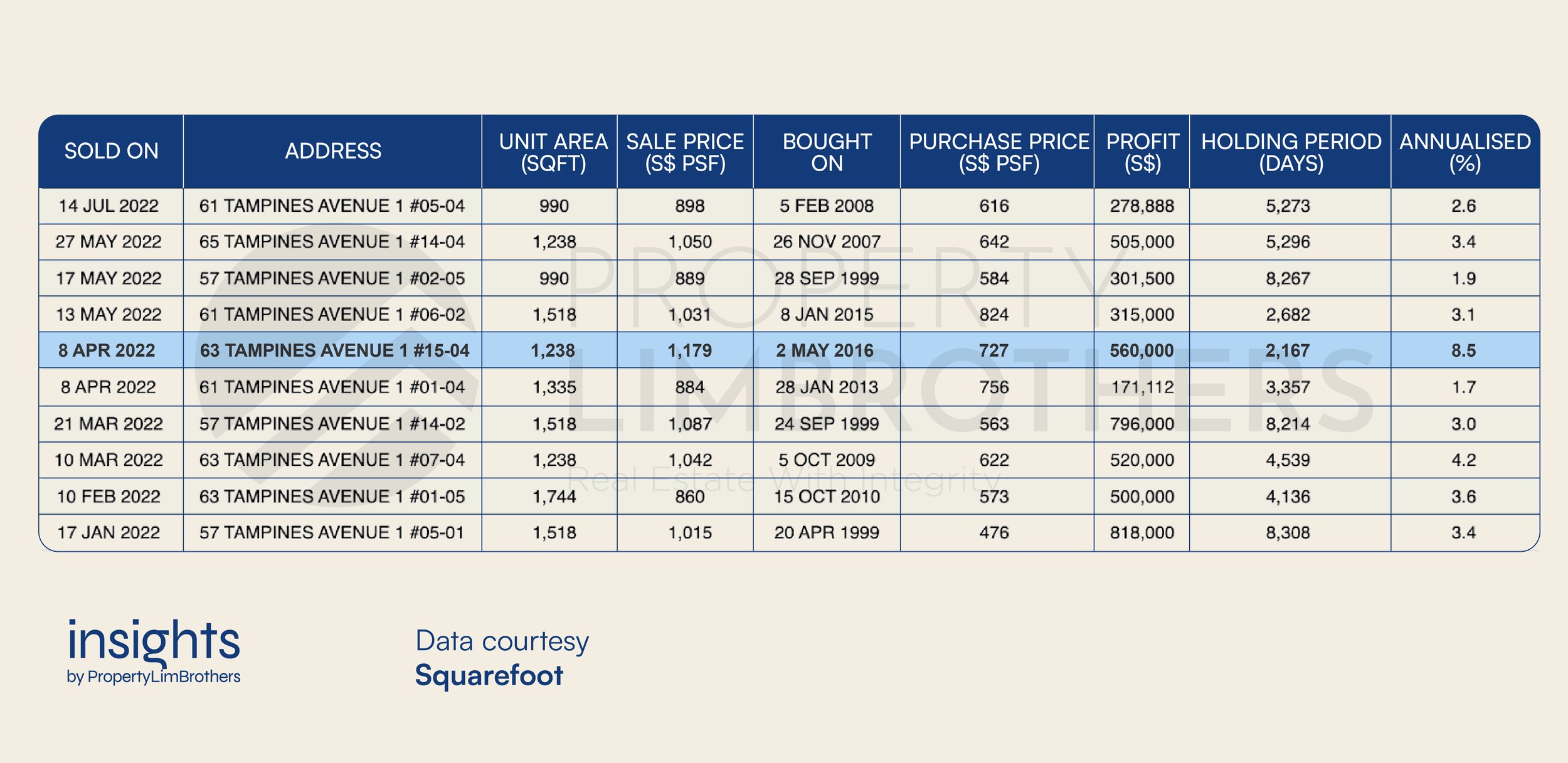

The Tropica, on the other hand, was recently sold for $1,460,000 on 8 April 2022. It booked a profit of $560,000 (excluding other fees), which makes this unit an even more handsome annualised profit of 8.5%. It was previously bought on 2 May 2016, approximately 6 years ago.

Do note that the profit numbers that we use from Business Times, is a simple profit number calculated by subtracting the previously transacted price with the current transaction price of the property. This does not include fees and costs of moving and getting a new place. Nonetheless, these transactions made good gains. Before we jump into analysing those two properties here are some things to consider. As a fun fact, PropertyLimBrothers brokered 3 out of 5 of the top profit-making deals for non-landed by percentage.

While finding the gem in the haystack, properties that you buy should also meet your (family’s) needs and wants in terms of the benefits that the location offers. If there are any particular drawbacks to that particular property, you would need to find ways to mitigate it. While profits and investment gains can be huge headlines and attractive reasons to buy a property, nothing is certain in terms of how a property might perform in the future.

Just like the caveats you see on most financial products, past performance is not an indicator of how well the property may perform in the future. The property may have already been appreciating a lot, even ahead of the market average. If so, it might be harder for these kinds of properties to appreciate further. But if demand doesn’t let up, it is hard to say for sure how high prices could go.

All this being said, there are still many lessons to be learned from these two particular transactions. Out of all the homes being transacted, there must be a reason why these two did particularly well. Is it the timing of entry into the market? Or is it something else about the location that justifies the appreciation of the property?

There are also some lessons we can learn from looking briefly at the top losses by quantum and percentage. Most of them are in the CCR (Marina Collection, The Sail @ Marina Bay, V on Shenton, Marina Bay Residences) or RCR (Floridian, Silversea), with only one on the list from the OCR (Eco). It is hard to say exactly why the owners let go of the property at a loss, it could be due to changes in personal circumstances or other reasons. Nonetheless, if the top losses are consistently the same projects after many months and quarters, it speaks to what price the market accepts as “reasonable” for that particular property.

High Park Residences

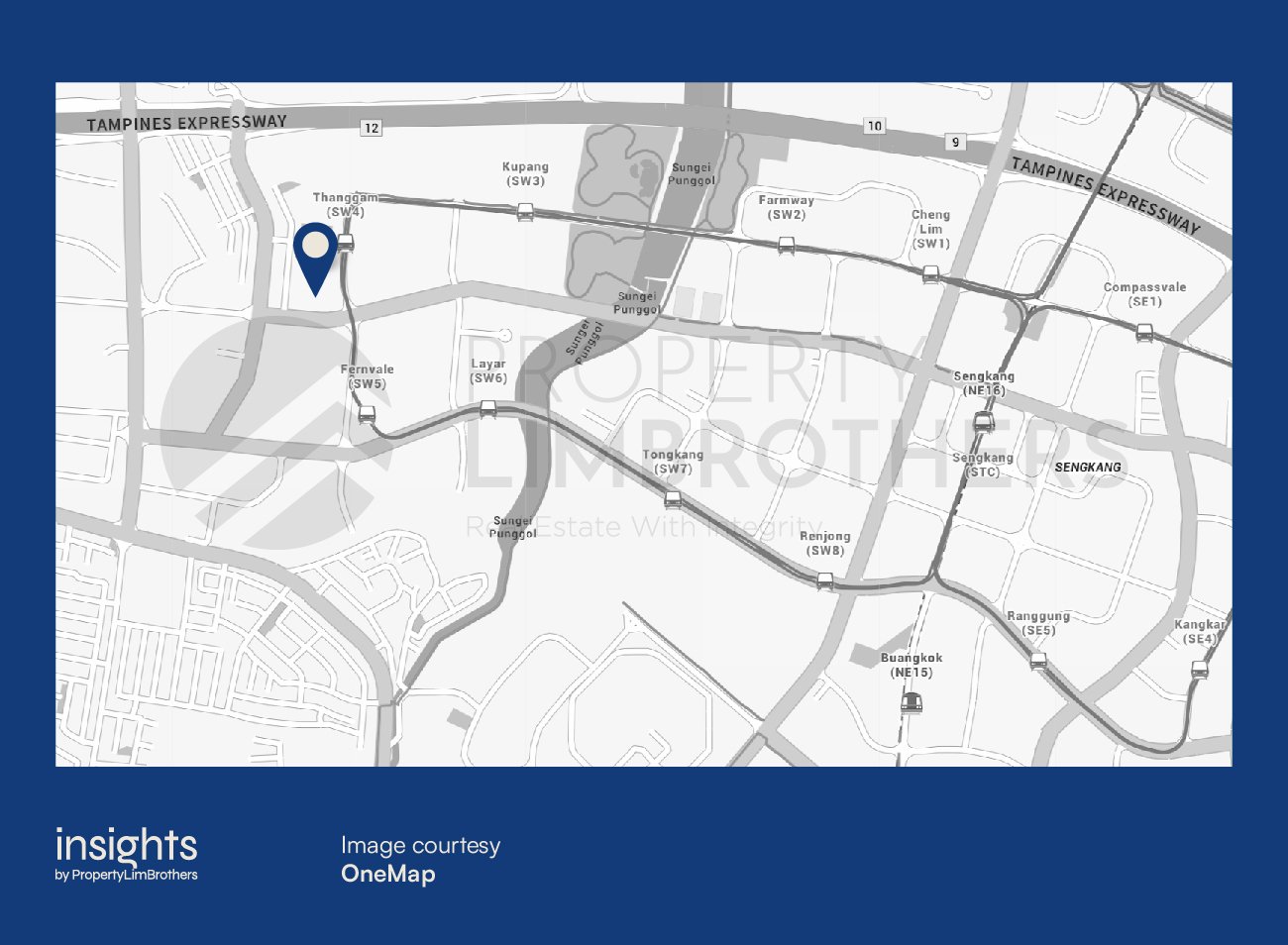

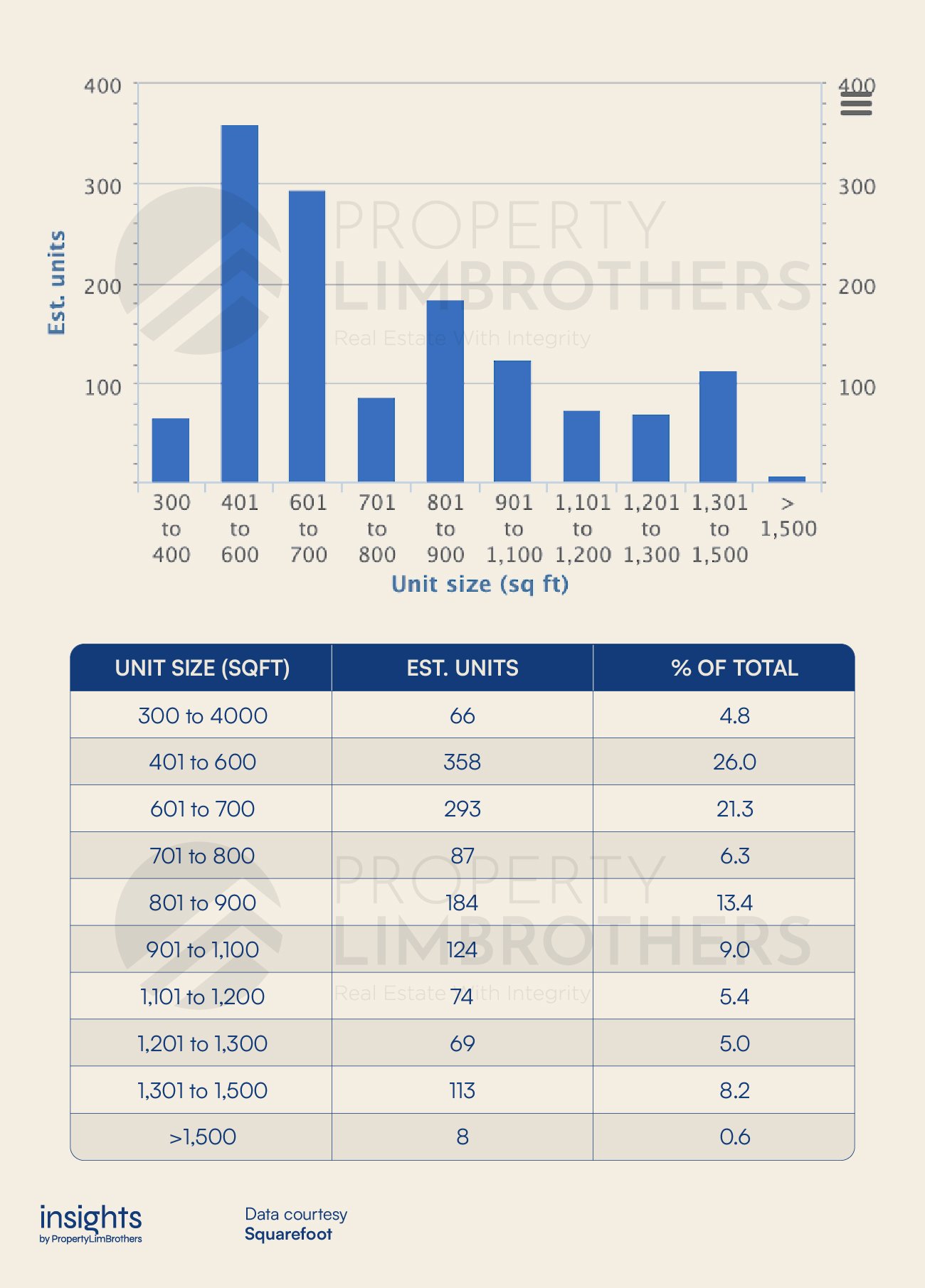

High Park Residences is a 99-year leasehold apartment located in D28 Sengkang area. It is located within 300m of Thanggam LRT station on the west end of Sengkang. Its 99-year lease starts from 2014 and was completed in 2019. This was quite a large residential project with 1,300 units. That particular unit that was sold for a $781K profit was also a large 1,432 sqft apartment.

The High Park Residences launched right after the Cooling Measures benefitted from cheaper land prices. Sold in today’s context, many early buyers of High Park Residences would be able to benefit from the inflation of costs and enjoy the value appreciation of their homes.

The location itself does not strike as a particularly well-connected location. Granted, there’s an LRT station nearby and also the Tampines Expressway (TPE). This location could be considered car-friendly for families.

Looking at the demographics of the buyer, the purchaser’s address is from a private home. One can speculate that a relatively cheaper (compared to RCR and CCR) and larger home in the OCR is appealing to the work-from-home family crowd. Demand for bigger and more comfortable homes has been on the rise since the pandemic.

High Park Residences sell close to the average price of condominiums and apartments in that area. At $1,354 psf on average, High Park Residences is slightly above the overall average of $1,265 psf. It is not the most expensive private residential project here. Parc Botannia sells for a much higher $1,538 psf on average.

On a psf basis, these resale prices are definitely a lot more affordable compared to new launches in 2022. It is also already built, so families can (most of the time) readily move into their resale apartment. High Park Residences also have a more than 90 years of lease left on the clock, which is plenty of tenure for the family in case they decide to exit this property and move again down the road.

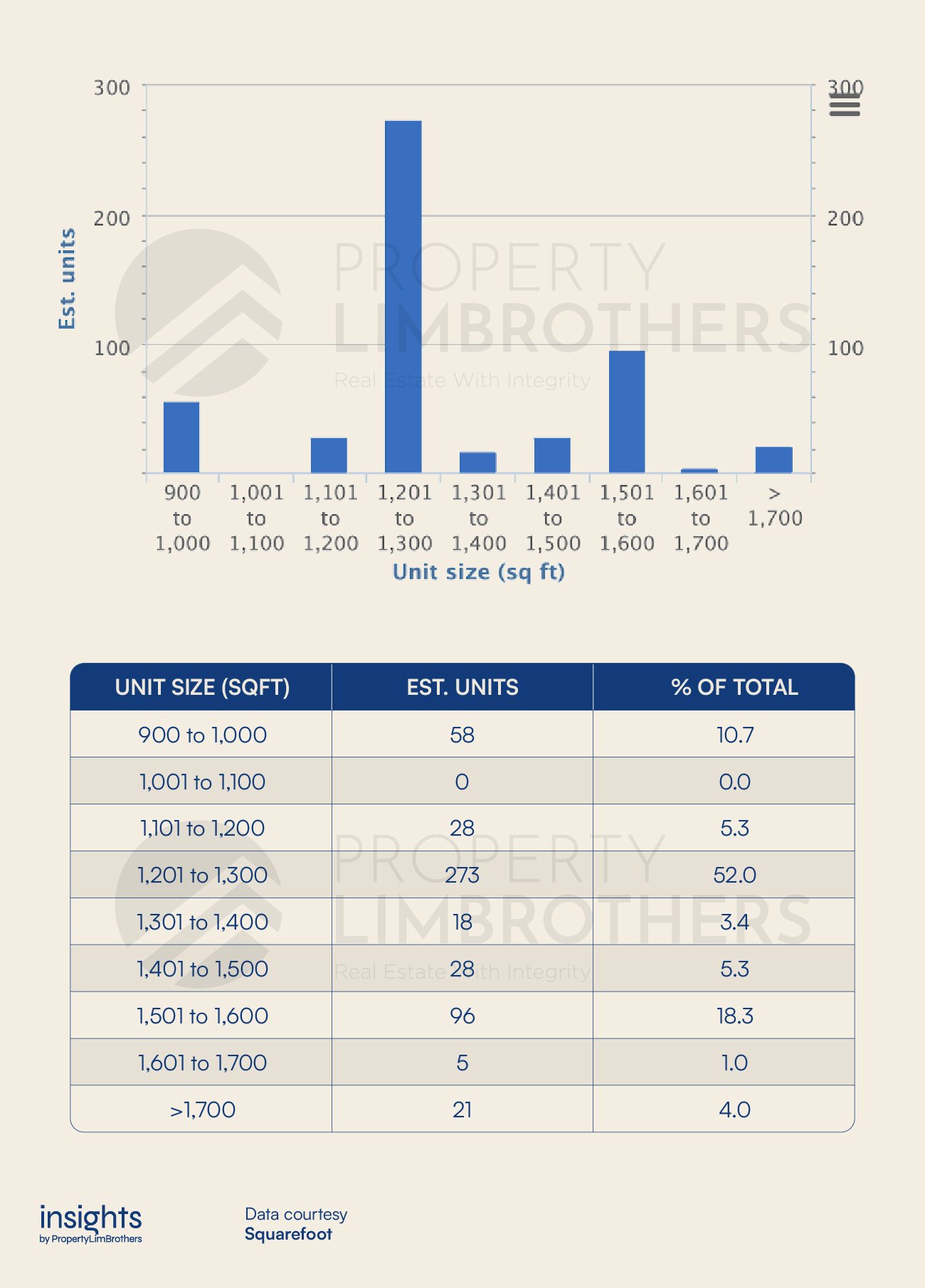

The large apartment was also one of the fewer bigger homes in that complex. Only 113 units were in the size range of 1,301 to 1,500 sqft. Private apartments of this size are typically harder to come by. And often, not cheap. Despite the unit distribution in this particular project, the high number of units still gives a decent amount of units for the buying-side.

There was a similar sized apartment that sold for an even higher price earlier in April. The 1,442 square foot apartment managed to sell at $1,462 psf, at a total price of $2,108,888. For these reasons, the resale apartment that made top gains in Q2 does seem like a reasonable buy for the new purchaser. And even though the other apartment in April sold for a higher price, their annualised gain was only 7.4%.

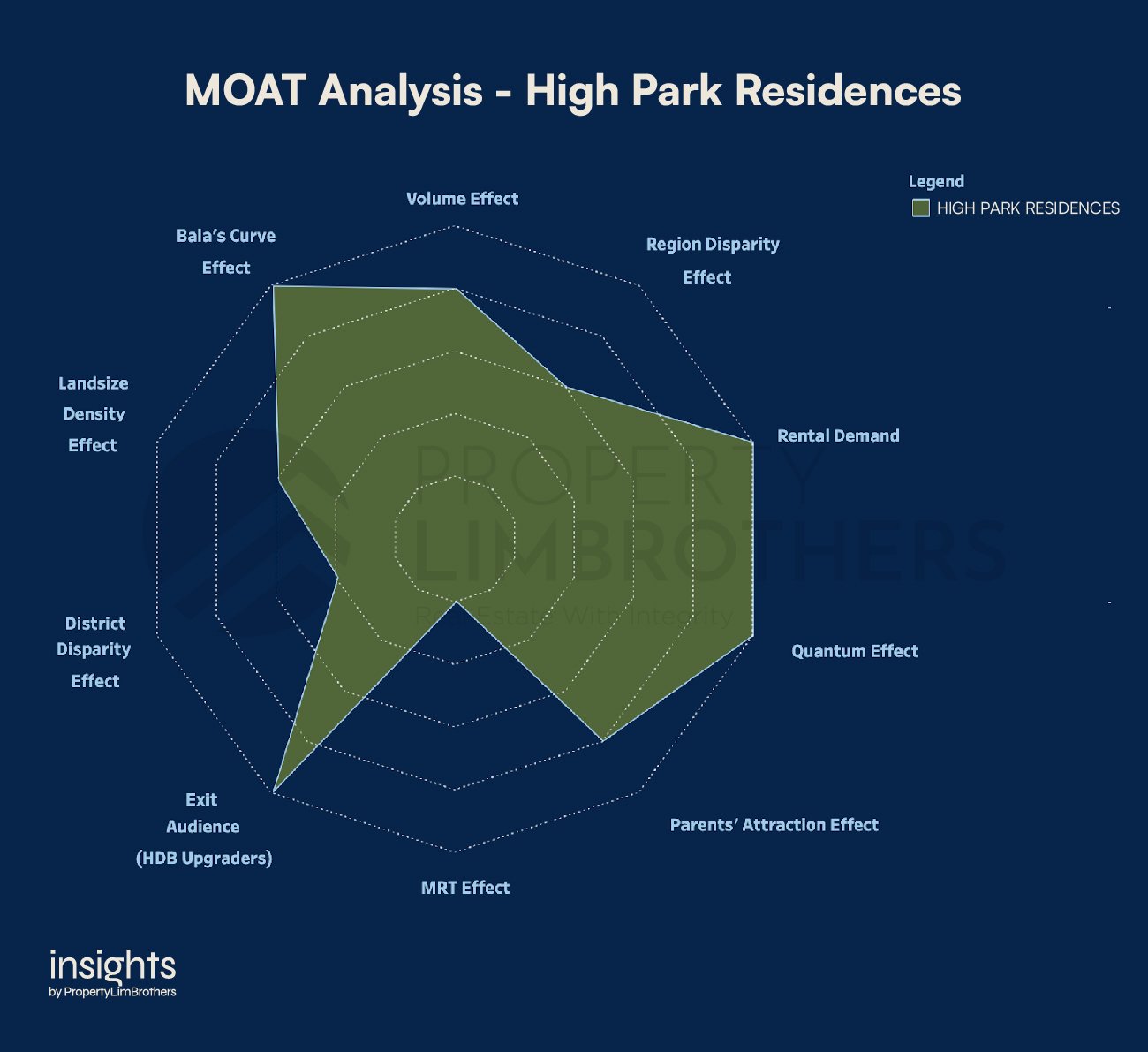

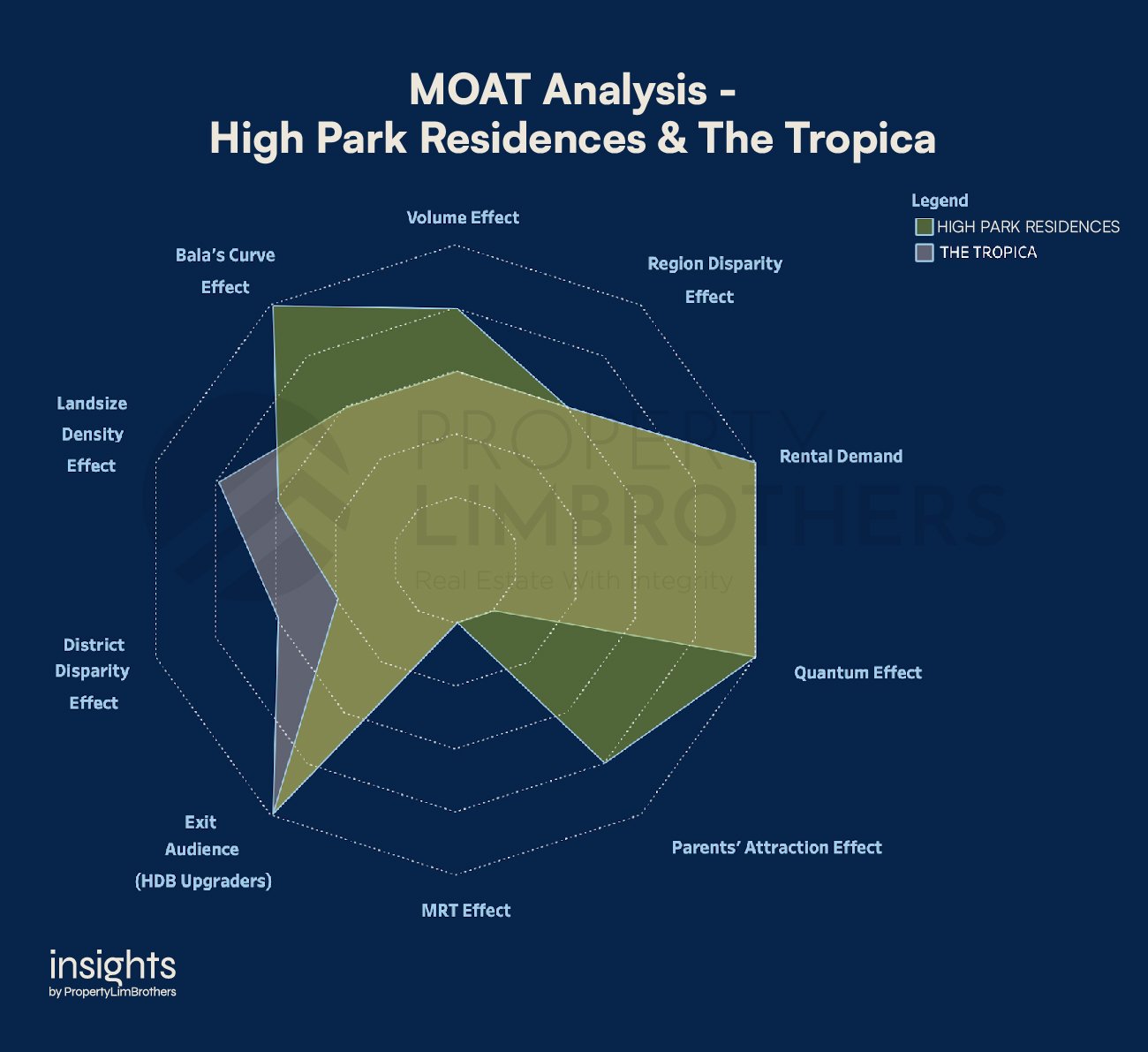

High Park Residences scored a 5 on Bala’s Curve Effect (Lease Tenure), Rental Demand, Exit Audience, and Quantum Effect (Affordability). It scored a 4 on Volume Effect and Parents’ Attraction Effect. It scores a 1 on MRT Effect and a 2 on District Disparity Effect (above the median psf of the district).

Overall, this development scores a high score of 74%. The Quantum Effect, in combination with Bala’s Curve Effect, and Exit Audience plays an important role in the demand for this development. Even though it is not located near an MRT, or priced at an undervalued level, this apartment is still attractive to buyers based on the affordability and exit opportunities in the future.

The Tropica

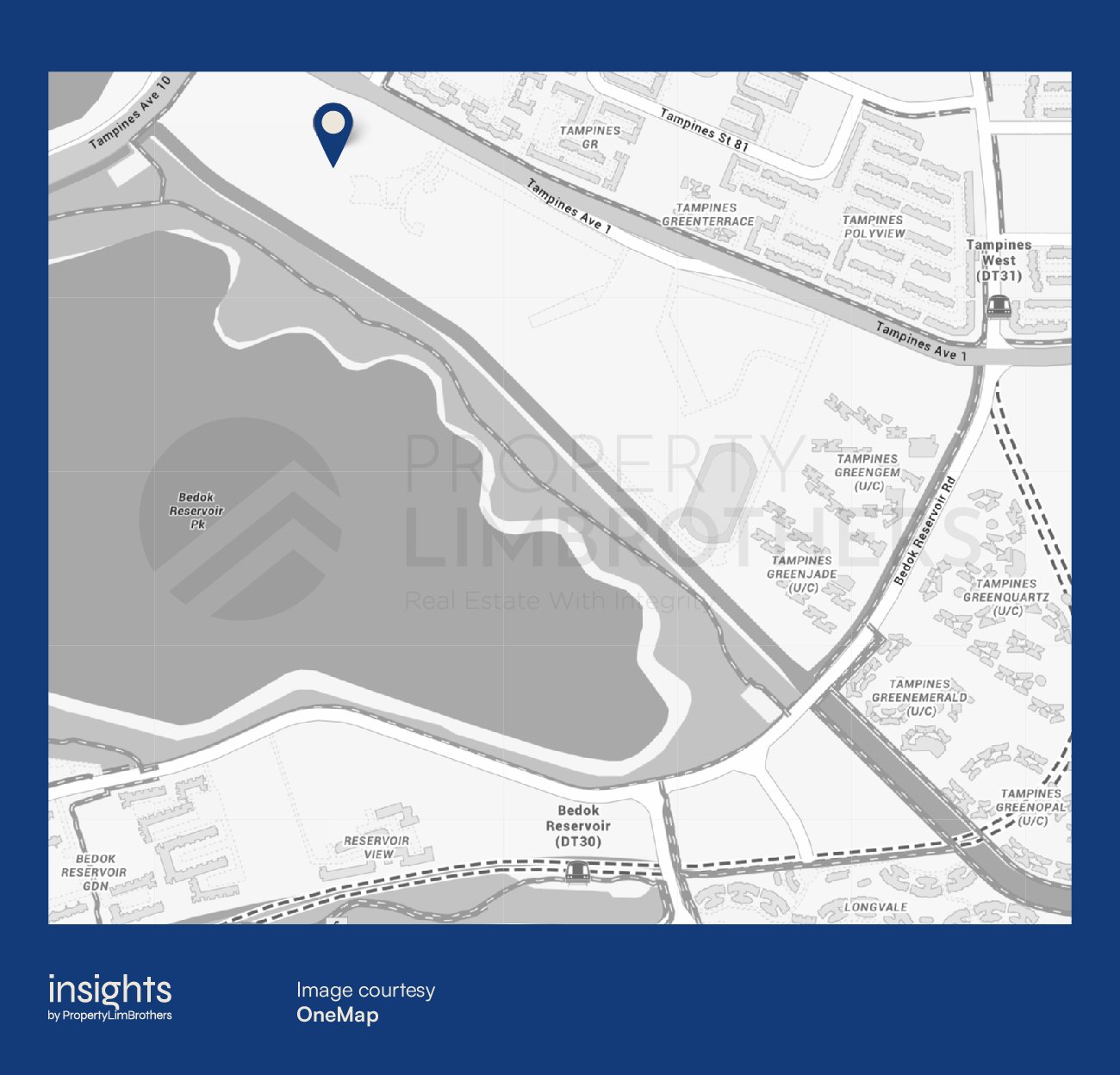

The Tropica is a 99-year leasehold condominium located in D18, Tampines. It is located north of Bedok Reservoir Park, and around 1.2km west of Tampines West Station (Downtown Line). In terms of its location, it is quite similar to High Park Residences in the sense that it isn’t particularly close to the MRT station (walking distance). It would seem that this property is still a better option for families with cars.

Apart from that, The Tropica is rather different in many other aspects. It is located next to Temasek Polytechnic and overlooks Bedok Reservoir. The waterfront property offers access to nature and a view. To a demographic that can’t live without some greenery and nature, this condominium could be rather appealing. And at a much lower price compared to the condominiums on the south-side of Bedok Reservoir Park, closer to Bedok Reservoir MRT station.

Compared to High Park Residences, The Tropica has a slightly shorter lease. Its 99-year lease started in 1996 and was completed in 2000. The difference of 18 years in lease is equivalent to the opportunity to change hands 3 times (assuming each owner holds for 6 years). This is not trivial and might affect the exit opportunities for subsequent owners down the line.

The 1,238 sqft condominium unit that made it to the leaderboards was also the highest floor unit sold in the first half of 2022. It sold for $1,179 psf. The highest in the year for that condominium in terms of psf. The high floor might have played an important role in the sale, allowing it to command a solid price premium above the other transactions.

Compared to the other condominiums in the area which sell for an average psf of $1,214, The Tropica sells at an average psf of $991. For the winning deal, it sold for $1,179 psf, towards the higher spectrum of this key range.

The development was a medium-sized one with 537 units. The deal that made it into top gainers was the most common type of unit between 1,201 and 1,300 sqft. A simple majority of the units in this development were of that size. Pointing to more choices for the buyer, which can translate to more negotiating power.

The Tropica seems like an unsuspecting project to present a transaction capable of clinching top gainers of the quarter. This gem in a haystack might have only been possible thanks to a specific combination of factors that made the buyer willing to pay a good price for the unit. In this case, it might have been a good match of buyer’s preferences with what the seller has to offer.

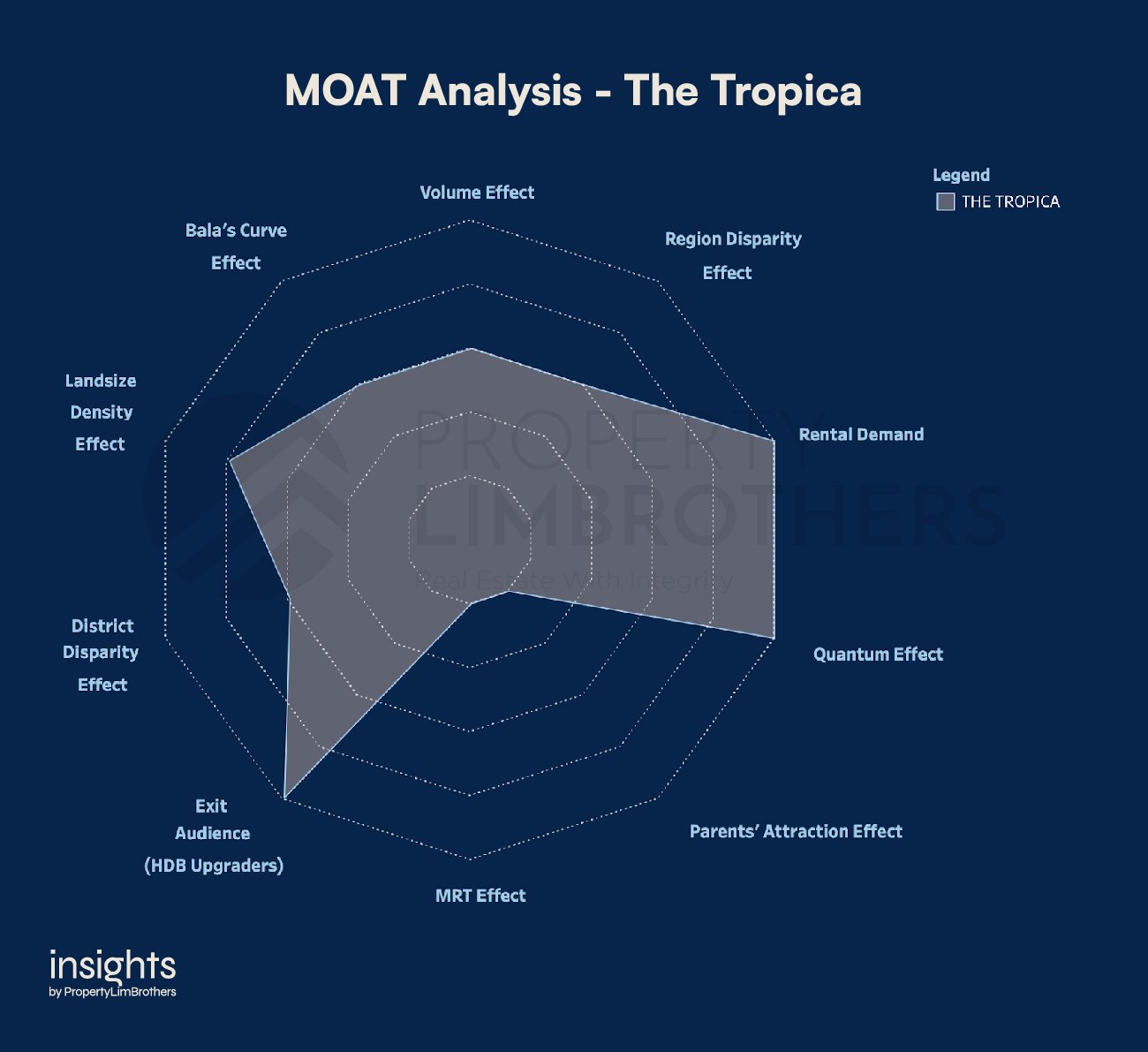

The PLB Moat Analysis gives The Tropica a moderate score of 66%. It performs well on Rental Demand, Quantum Effect, and Exit Audience, scoring a 5. It scores a 4 on Landsize Density Effect. It scores a 3 on Bala’s Curve Effect and Volume Effect and a 1 on MRT Effect and Parent’s Attraction Effect.

For a suitable buyer, the aspects which scored low on the MOAT Analysis must have been either mitigated or not a priority in the property buying decision. The buyer demographic was also from a private residence. We can speculate that the buyer was probably with a more mature family unit, with no children attending primary school and owns a car (hence mitigating the low MRT Effect and Parents’ Attraction Effect scores)

Interestingly, there seem to be some things both OCR winners have in common. They seem to be located some distance away from the MRT. The key factor in the MOAT Analysis seems to have been again the Quantum Effect (affordability), Rental Demand, and Exit Audience as well. The combination of these factors seems to suggest that they were able to achieve a sweet spot between price and size, that was very attractive to buyers in the current market.

Looking at how the two MOAT charts overlap, we can see what they have in common and how they are different. The Tropica offered a better value (District Disparity) and less dense condominium complex (Landsize Density). High Park Residences offer more longevity and exit options (Bala’s Curve, Volume) and options for younger families (Parents’ Attraction Effect).

It is quite possible that the buyer demographic was rather different for the two winning OCR deals. Nonetheless, the location and its performance are rather unexpected to most. In terms of price growth, it would seem that some specific locations, even though they are further from MRT stations, can still provide good gains relative to the RCR and CCR areas.

Closing Thoughts

The OCR has really shone in Q2’s most profitable transactions. Moving forward, it is quite possible that we see more and more winners from the OCR Resale segment. Prices are mostly moving upwards. And the more price gaps there are in the market, the more likely it is for some of these OCR underdogs to catch up in the future.

If you would like to discuss where the opportunities are in the OCR Resale market, reach out to us here for an in-depth session. Please reach out to us as well if you are thinking about whether it is the right time to sell in this hot market to realise impressive gains. With tools like PLB’s MOAT Analysis, we will easily be able to ascertain the target market for sellers and assist in the gem search for buyers.