In a recent report released on November 27, the Monetary Authority of Singapore (MAS) highlighted a significant reduction in household debt among Singaporeans. The central bank revealed that Singaporeans have been actively reducing their debt due to the deterrent effect of high-interest rates on taking new loans, coupled with healthy income growth that has facilitated the repayment of existing obligations.

Why Do Interest Rates Fluctuate?

An increase in interest rates can be due to a multitude of factors, the most prominent one being the Central Bank Policy. MAS has the authority to control interest rates, and as we approach inflation risks, interest rates increase as a means to control it and manage economic growth. This helps to cool borrowing and spending by individuals as it makes borrowing more expensive. Global economic conditions are another factor, should other major economies be experiencing inflationary pressures, MAS may raise interest rates to align with these global conditions to prevent capital outflow.

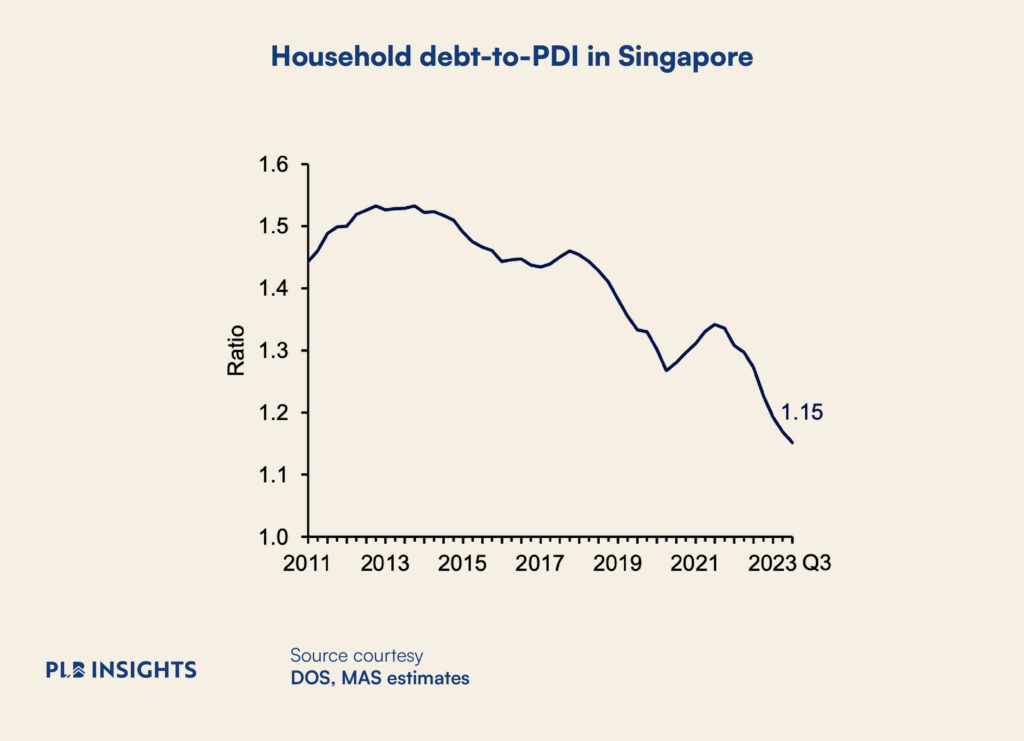

According to MAS’s Financial Stability Review, aggregate household debt has declined for the eighth consecutive quarter, reaching 1.2 times personal disposable income in the third quarter of 2023. This represents the lowest level in over a decade. The cautious approach of households in taking on additional loans, especially in light of increased interest rates since the second half of 2022, has contributed to this decline.

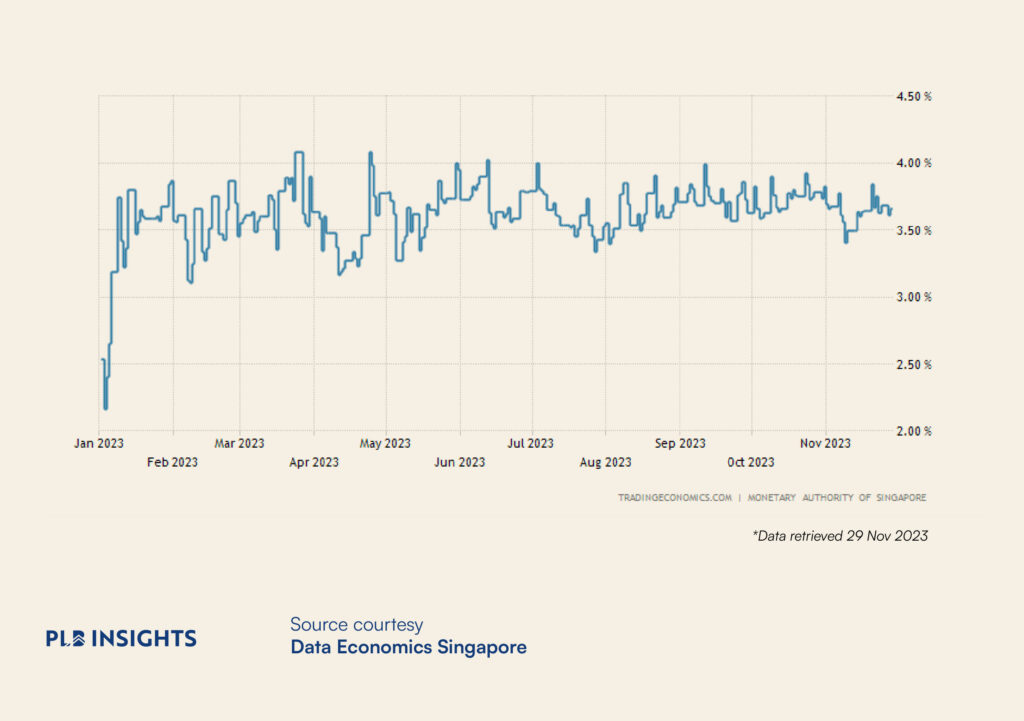

Interest rates in Singapore, measured by the three-month compounded Singapore Overnight Rate Average, have maintained between 3.5% to highs of 4% throughout 2023, compared to 0.5% in the first half of 2022. The impact of these rate hikes is notably reflected in the reduction of personal loans, constituting about a quarter of the aggregate household debt.

Income growth and financial buffers, including extra savings, have played a crucial role in mitigating rising debt servicing costs for households. This has contributed to keeping non-performing loan rates and leverage risks low. MAS conducted stress tests to evaluate borrowers’ resilience in drastic economic scenarios, revealing that most borrowers, particularly those refinancing into more expensive home loans, could handle higher monthly repayments. However, MAS also cautioned that a small segment of highly leveraged borrowers could face challenges in repaying their loans on time. The central bank advised borrowers to exercise continued caution, emphasising the importance of maintaining sufficient liquidity buffers to withstand potential shocks, given the likelihood that interest rates will remain high.

Interest Rates and Property

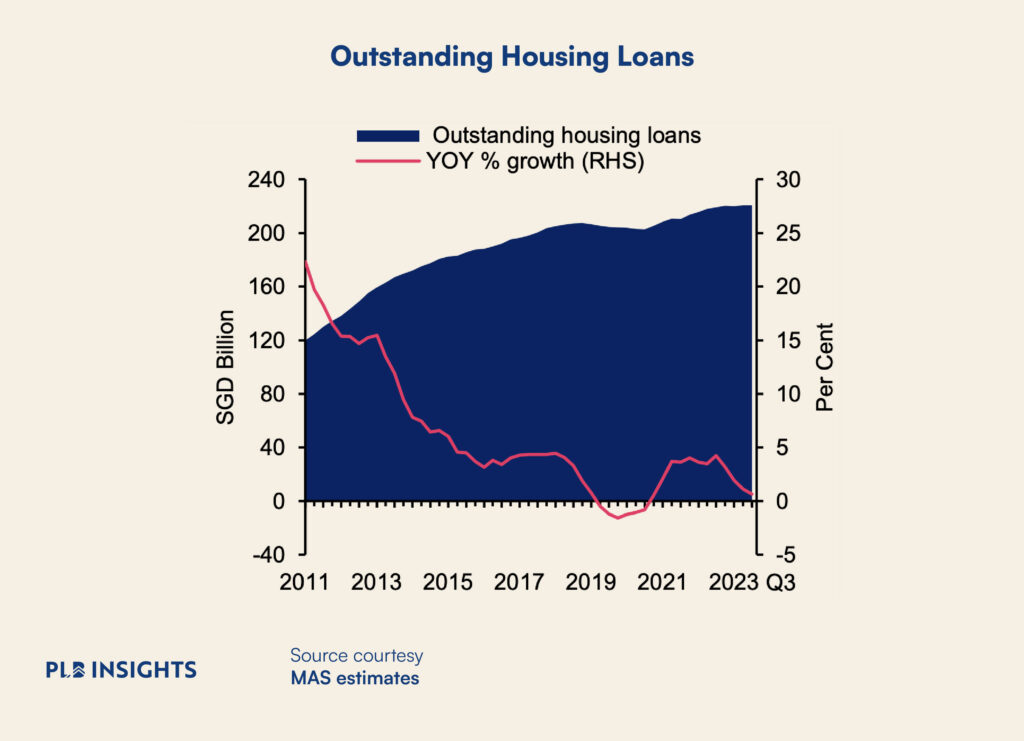

Turning to the real estate market, housing loans, comprising about three-quarters of aggregate household debt, grew at a subdued annual pace of approximately 1% in the third quarter.

Existing housing loan-to-value measures and recent adjustments in total debt servicing ratio limits have contributed to building significant buffers against falling property valuations. As of the third quarter of 2023, the average loan-to-value ratio remained low at 41%, compared to an average of 50% in 2017.

MAS highlighted the resilience of housing loans, with low housing non-performing loan ratios and stable mortgage payments. The number of foreclosed residential units has remained low, indicating a relatively stable market. However, the central bank also pointed out that maturity risk, particularly related to short-term borrowing such as credit cards, has increased.

How Does This Implicate The Real Estate Market?

In the context of real estate, low household debt could imply moderate demand for new mortgages and housing loans. While this might indicate a more stable market, it could also mean slower growth in property transactions, which we are seeing towards the end of the year and in 2023 as a whole. It will also lead to more sustainable property price levels, as it suggests that buyers are not over-leveraging themselves to purchase properties, lowering demand for housing and potentially bringing down the prices of properties.

Developers will also be more wary about households becoming more cautious to take on debt and may rethink future developments and new launches. While having low household debt is generally positive, there is a risk of economic stagnation should it drop too low. A healthy level of borrowing is often necessary for economic growth, especially in the real estate sector, where mortgages play a crucial role in property transactions.

Closing Thoughts

MAS’s recent insights into Singapore’s economic resilience unveil a commendable reduction in household debt, driven by a prudent approach amid rising interest rates and bolstered by robust income growth. The real estate sector, constituting a significant portion of household debt, exhibits stability with subdued loan growth and effective risk mitigation measures. While low household debt signals a more sustainable property market, caution is warranted as excessively low borrowing may impede economic growth.

Striking a balance is key to ensure a resilient real estate market without stifling essential borrowing for continued economic vitality. In a high interest rate environment, how should homebuyers approach their housing loans and mortgage financing? If you have further questions on this topic, or are looking for guidance in your property journey amidst this uncertain market, do contact us here and we will be happy to help. See you in the next one.