In a move that has become typical of the government when introducing new property cooling measures, the latest round has hit the market right before the stroke of midnight on 26 April 2023 and will take effect on 27 April 2023.

In our latest NOTG episode, we brought up the topic of foreign buyers seemingly undeterred by ABSD and whether the government will take action to deter foreign investment. And here it is.

This comes just over half a year after the previous round of cooling measures on 30 September 2022, which saw the revision of stress test interest rates, HDB Loan-to-Value (LTV) ratio, and the introduction of a 15-month wait-out period for current and ex-private property owners downgrading to non-subsidised HDB resale flats. This is also on top of the additional housing measures introduced during Budget 2023, which saw the increase in Marginal Buyer’s Stamp Duty (BSD) rates for higher-value properties. According to the government press release, the latest round of cooling measures aims to promote a sustainable market by managing investment demand.

If you have just woken up to this piece of news, fret not, we are here to break down the details for you and explain how the new property cooling measure may affect you.

In a move that has become typical of the government when introducing new property cooling measures, the latest round has hit the market right before the stroke of midnight on 26 April 2023 and will take effect on 27 April 2023.

In our latest NOTG episode, we brought up the topic of foreign buyers seemingly undeterred by ABSD and whether the government will take action to deter foreign investment. And here it is.

This comes just over half a year after the previous round of cooling measures on 30 September 2022, which saw the revision of stress test interest rates, HDB Loan-to-Value (LTV) ratio, and the introduction of a 15-month wait-out period for current and ex-private property owners downgrading to non-subsidised HDB resale flats. This is also on top of the additional housing measures introduced during Budget 2023, which saw the increase in Marginal Buyer’s Stamp Duty (BSD) rates for higher-value properties. According to the government press release, the latest round of cooling measures aims to promote a sustainable market by managing investment demand.

If you have just woken up to this piece of news, fret not, we are here to break down the details for you and explain how the new property cooling measure may affect you.

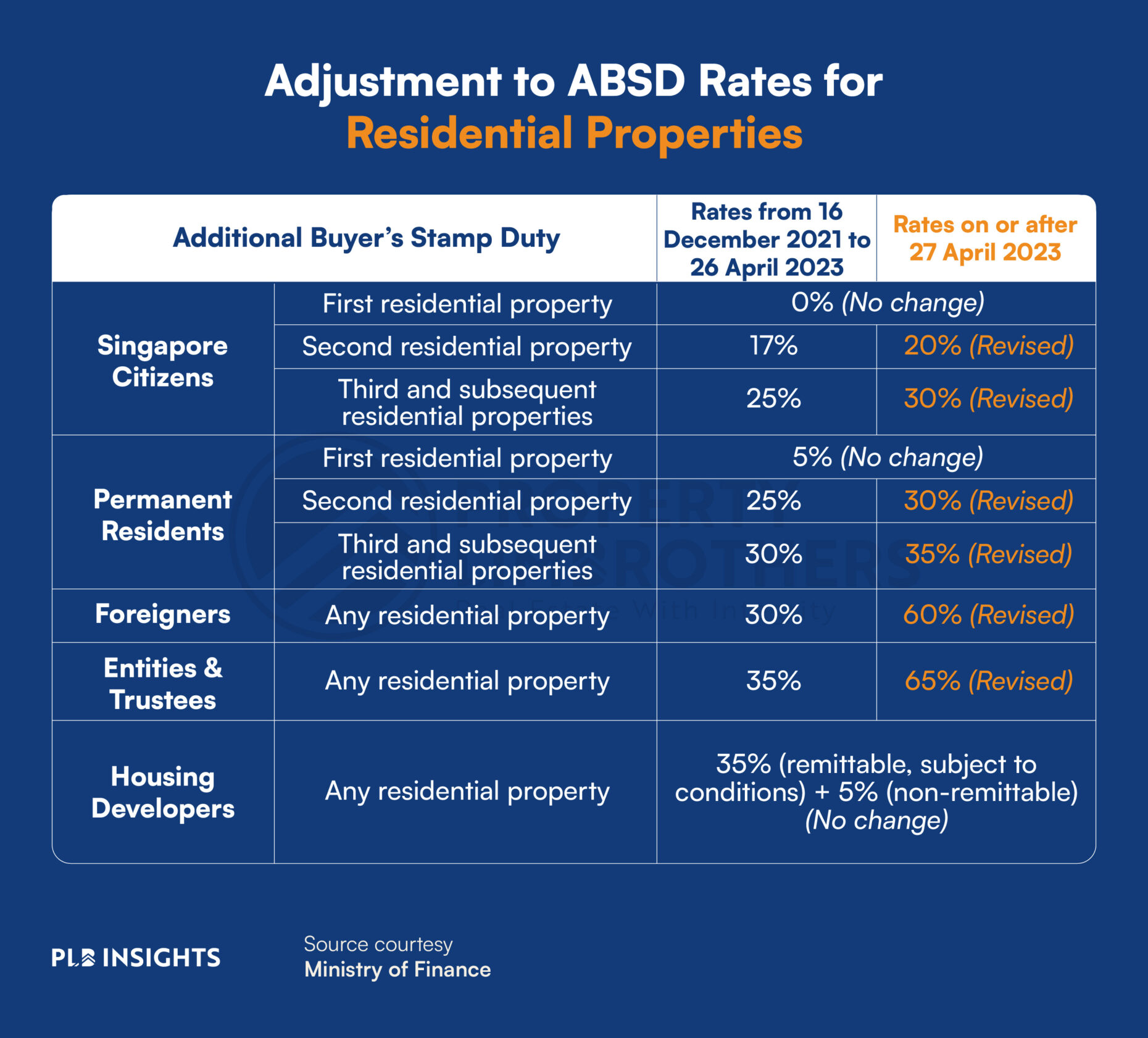

Revision of Additional Buyer’s Stamp Duty (ABSD) Rates

For the uninitiated, ABSD is a stamp duty fee that is levied on the purchase of second and subsequent residential properties in Singapore (for Singapore Citizens). For Singapore Permanent Residents and foreign buyers, ABSD is levied on any residential property that they purchase in Singapore. Note that ABSD is only applicable for private residential properties such as condos and landed homes. It does not apply to HDB properties as you cannot purchase them as an additional property. If you buy an HDB flat while owning a private property, you will be required to sell off the private property within 6 months. The previous revision of ABSD rates hit the market in the cooling measures introduced on 15 December 2021, with the most significant change being the increment of ABSD rates for foreign buyers from 20% to 30%. With effect from 27 April 2023, ABSD rates will be increased across the board, with the following exceptions: ABSD rates for Singapore Citizens and Singapore Permanent Residents purchasing their first residential property will remain unchanged at 0% and 5% respectively. According to the government press release, based on 2022 data, SCs and SPRs purchasing their first residential property make up 90% of all residential property transactions. That means that the following revisions will impact about 10% of all residential property transactions.Singapore Citizens (SCs)

The ABSD rate will be increased from 17% to 20% for SCs purchasing their second residential property, and 25% to 30% for their third and subsequent residential property.Singapore Permanent Residents (SPRs)

The ABSD rate will be increased from 25% to 30% for SPRs purchasing their second residential property, and 30% to 35% for their third and subsequent residential property.Foreigners, Entities, and Trusts

This is the most significant revision for this round of cooling measures. The ABSD rate will be increased from 30% to 60% for foreign buyers purchasing any residential property, and 35% to 65% for entities and trusts purchasing any residential property. That is a whopping 30-35% increment in ABSD on top of the already hefty 30%. This would likely have a drastic impact on foreign transactions in the coming months. If multiple parties with different profiles make a joint acquisition of a residential property, the highest applicable ABSD rate will be enforced. Couples who are married and have at least one Singaporean spouse, and who buy a second residential property together, may still be eligible for a refund of ABSD under certain circumstances. To be eligible, they must sell their first residential property within six months of either (a) the date they purchased the second property if it was already completed, or (b) the date when the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) was issued for the second property, whichever happens earlier, if the second property was not yet completed at the time of purchase. At present, those who buy an HDB flat or an Executive Condominium (EC) unit directly from a housing developer and are given an upfront remission are not impacted by ABSD as long as one of the joint buyers is a Singaporean. This policy will remain unchanged. Below is a table summarising the adjustments to ABSD rates in this round of property cooling measures.

How does this affect you?

If you are a first-time homebuyer going for an HDB flat or EC, or are considering buying a private property as your first property, fret not. This round of cooling measures does not affect you directly (it does affect your long-term plans if you want to expand your property portfolio in the future). The purpose of this cooling measure is to manage and hamper investment demand, especially from foreign buyers, in order to prioritise housing for owner-occupation. If you fall into any of the categories with the revised ABSD rates, there will be a transitional provision, where the previous ABSD rates will apply. However, you have to meet all of the following conditions:- The OTP was granted by the sellers on or before 26 April 2023;

- This OTP is exercised on or before 17 May 2023, or within the OTP validity period, whichever is earlier; and

- This OTP has not been varied on or after 27 April 2023.

Significant Increase in Housing Supply

In addition to the revision of ABSD rates, the government has also ramped up the supply of both private and public housing. According to the press release, the supply of private housing on the Confirmed List has been increased to from 3,500 units for 2H2022 to 4,100 units for 1H2023. Furthermore, the government has launched 23,000 public housing flats in 2022 and is slated to launch up to 23,000 this year, part of a total of 100,000 new flats in the pipeline to be launched between 2021 to 2025. While the government acknowledges the construction delays brought on by the COVID-19 pandemic, it has also highlighted that they are making good progress to get back on track. Over the next few years, a substantial amount of housing supply is expected to be added, with nearly 40,000 public and private residential properties set to be completed in 2023 and close to 100,000 units expected to be completed from 2023 to 2025. The increase in housing supply will largely benefit first-time homebuyers, which make up around 90% of the market. The government’s effort to meet the housing demand from first-time homebuyers come at a time where the availability and affordability of HDB flats has become a hot topic for debate. With a two-pronged approach by aggressively moderating demand and significantly ramping up supply, this could be one of the most significant cooling measures to date, in terms of tapering foreign demand.Closing Thoughts

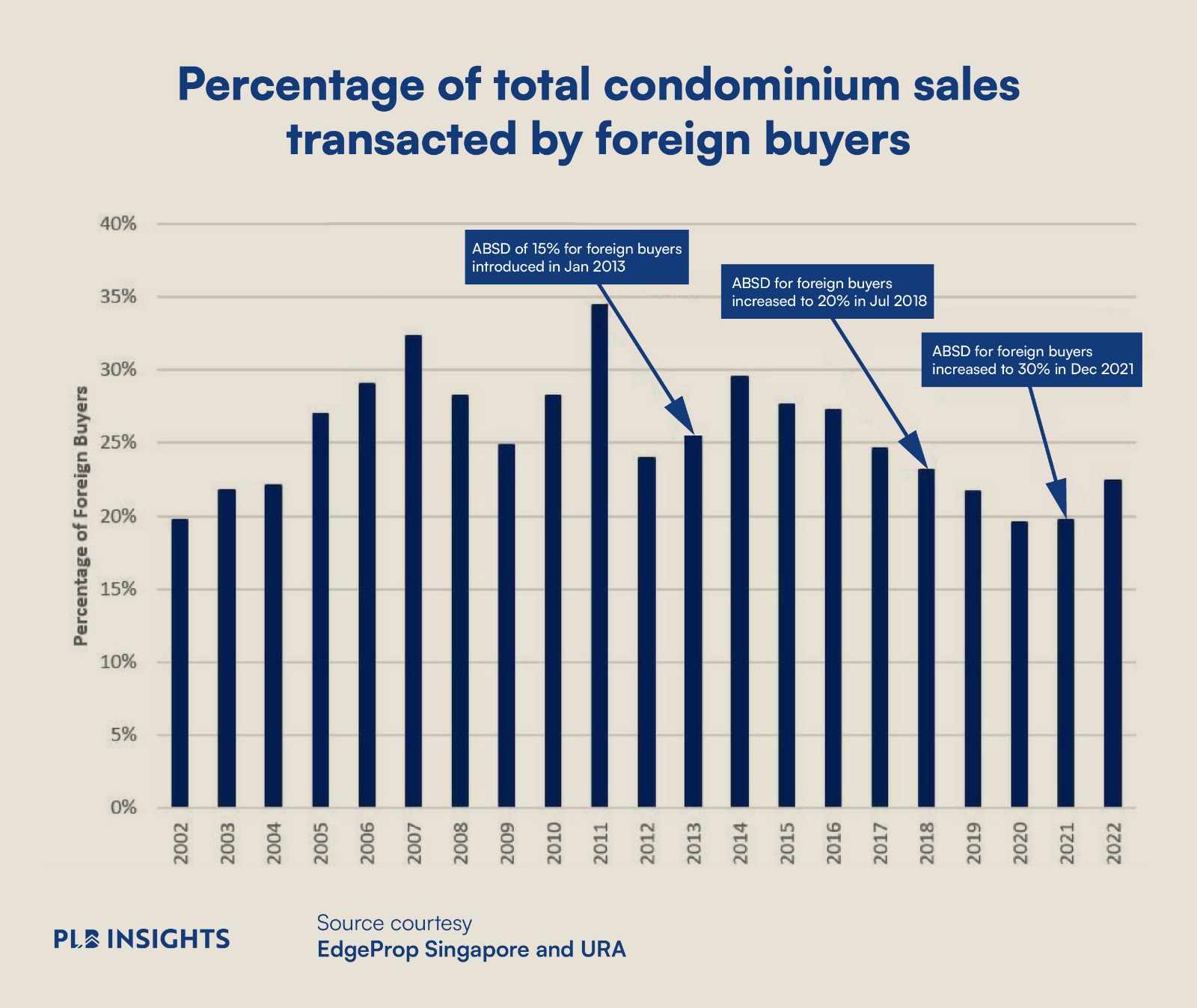

The property market is closely monitored by the government, evident from it being the hot topic in parliamentary debates. And given the spike in investor interest and demand recently, we are not surprised that this move came so soon after the previous round of cooling measures. However, although this move effectively hampers investment demand, it comes at the expense of foreign buyers who were already dealing with a hefty ABSD rate of 30%. On top of that, the government is also trying to deter SCs and SPRs from acquiring multiple properties by raising ABSD rate on subsequent properties. Historically, foreign investor interest in Singapore real estate has been strong because of its reputation as a safe haven with a stable political climate. Because of the booming foreign transactions between 2010 and 2012, ABSD was introduced at the start of 2013. Despite several rounds of ABSD increment since then, foreign investment in Singapore real estate remained strong, with many large purchases of luxury properties making the headlines. It remains to be seen whether this trend will persist with the doubling of ABSD for foreign buyers, given that they see real estate as a store of wealth.

But as the government has pointed out, the revision of the ABSD rates will only affect 10% of the residential property transactions, based on last year’s data. Even so, this round of cooling measures is an aggressive move by the government that has sent the market into a frenzy, and we will likely see the effects in the coming months. If you would like to learn more about how cooling measures change the way our market operates, do check out our article here. And if you have further questions regarding the latest round of cooling measures or need some guidance on how to navigate the property market from here, feel free to contact us here. Our consultants will be more than happy to offer a second opinion. Till the next one, take care!

Historically, foreign investor interest in Singapore real estate has been strong because of its reputation as a safe haven with a stable political climate. Because of the booming foreign transactions between 2010 and 2012, ABSD was introduced at the start of 2013. Despite several rounds of ABSD increment since then, foreign investment in Singapore real estate remained strong, with many large purchases of luxury properties making the headlines. It remains to be seen whether this trend will persist with the doubling of ABSD for foreign buyers, given that they see real estate as a store of wealth.

But as the government has pointed out, the revision of the ABSD rates will only affect 10% of the residential property transactions, based on last year’s data. Even so, this round of cooling measures is an aggressive move by the government that has sent the market into a frenzy, and we will likely see the effects in the coming months. If you would like to learn more about how cooling measures change the way our market operates, do check out our article here. And if you have further questions regarding the latest round of cooling measures or need some guidance on how to navigate the property market from here, feel free to contact us here. Our consultants will be more than happy to offer a second opinion. Till the next one, take care!