Image courtesy: Private Home.

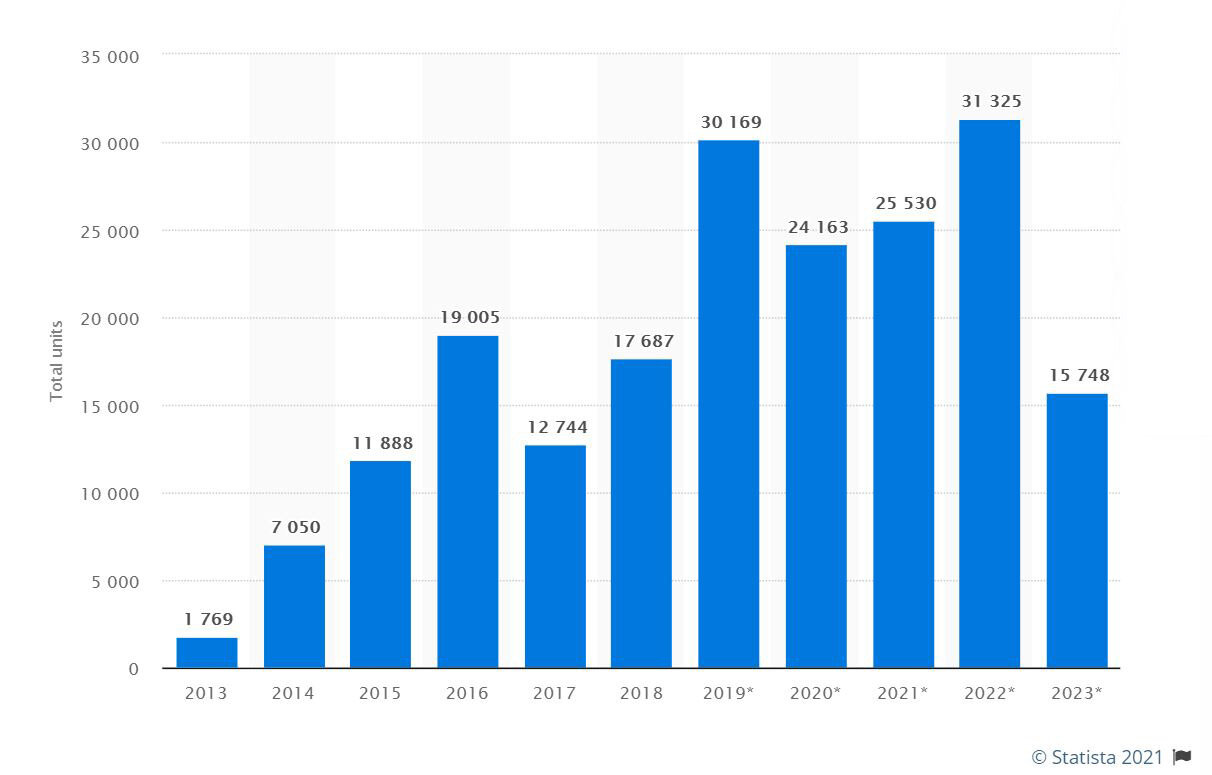

With close to 57,000 first-time HDB flat owners about to fulfill their Minimum Occupation Period (MOP) in 2021 and 2022, a major portion of these HDB owners are expected to consider a property upgrade — releasing their MOP flat into the resale market while their flats are still relatively new. Some may simply consider an upgrade to a better abode for themselves, while others are aspiring property investors. Previously, we covered what 2020 meant for the property market, and what we can expect this year in 2021. Check it out here!

Graph showing number of HDB MOPs per year from 2013 to 2023, courtesy Statista.

Property investments in Singapore have been widely known to deliver promising results in the long run, which easily piques the interest of many who seek stable ways to grow their wealth. The properties we refer to here are not the ones you’d use as your main residence, but rather properties purchased purely for monetisation. While on the surface it may seem as simple as buying a property and selling it for profit, the intricacies of effective property investment are very much like an iceberg – rather daunting for people who are completely new to the market.

If you’re one of those who are excited to begin your journey in property investment and would like to seek some clarity first, PropertyLimBrothers is here to help. In this guide, we hope to simplify some key things essential to become a property investor.

How can property be a good store of value in Singapore?

Through the appreciation of a property’s value

This is one of the most common ways you can make money through property – by selling a property when its market value has increased over the years, usually at a much higher price than it was at purchase.

Image courtesy: Find a Home Loan.

The price of a property is of course constantly subjected to the volatility of the market’s demand and supply, and it can also be affected by factors such as location, loan rates, future developments in the area, and upgrades to the property itself.

While property assets are indeed rather stable investments due to the lower risks involved, the downside to this type of property investment however, is the lack of any tangible returns until the property has been successfully sold. Selling a property isn’t all smooth-sailing and has its own challenges too; these are highly illiquid assets – meaning that these assets cannot be readily converted into cash without any substantial losses. As such, you will need to bear the hefty cost of the property’s mortgage, all without expecting any consistent returns during your possession of it.

Additionally, property investment requires you to have quite substantial capital to be financially ready for it.

Rental Income

Another common way investors make money through their property assets is through monthly rental income for residential or commercial purposes.

Image courtesy: Tower Hill Insurance.

Typically, this involves long-term rental contracts ranging from a few months to years forged between the landlord and a tenant following an agreement of a fixed sum that is to be paid monthly to the owner of the property as rent. Depending on the location, type of property, number of rooms included, and the property’s physical state at the point of agreement, the income that you may earn from rent per month can range from a few hundred to even thousands of dollars.

Image courtesy: Airbnb.

With the founding of Airbnb in 2008, the online platform for listing and renting local homes has gained massive popularity in recent years. While tenants can also source for long-term stays with Airbnb, the service is more targeted at tourists who are seeking short-term accommodation. This option however, does have its limitations in Singapore due to strict housing regulations on short-term rentals – defined as stays of less than three consecutive months. You could risk facing pretty heavy fines for violating these regulations, so we definitely don’t recommend listing your local properties on Airbnb for now. Nonetheless, this is a popular practice more commonly found overseas and could reap potentially high returns too. However, in light of the unrelenting pandemic, it is unlikely that Airbnb rentals will see much business anytime soon; so Singapore’s not missing out on anything.

Being able to earn some decent passive income from rentals sounds pretty neat, but it comes with its own set of issues. If you’re unable to find a tenant, that means not yielding any income from your property. You will also have the responsibility of maintaining the property and pay for repairs whenever necessary.

While most tenants are generally decent people, Singapore does have its fair share of “tenants from hell”. Some tenants will attempt to delay their monthly rental payments or even refuse to pay, owing the landlord up to thousands of dollars cumulatively, or perhaps incessantly complain about the property for no apparent reason – a nightmare for investors just looking to grow their wealth.

Image courtesy: Mashvisor.

Other issues involve deliberate and/or accidental physical damage to your property by the tenant, or perhaps complaints of your tenant’s misbehaviour that has perturbed neighbouring units. As the property owner, you’re responsible for most of these problems. Even if you want to have your problematic tenant evicted, it may not be so simple for you if they refuse to comply.

What will you need to become a property investor?

For first-time HDB owners

You MUST complete your 5 years of MOP first before being eligible to purchase second and subsequent private residential properties. This is applicable to both local and overseas property.

Your MOP fulfillment is calculated from the date you collect the keys to your flat and excludes any period of time in which you do not occupy the flat, such as when you temporarily live overseas for work, or rent the whole flat out to other tenants. It also depends on the purchase mode, type of flat and date of flat application. For more information on MOP, you may find out more here.

Image courtesy: HDB.

Moving on from MOP

Once you have cleared your MOP, you have the options to purchase more premium housing types, such as Executive Condominiums (ECs) and other private properties. You can also buy another HDB, however you should take note of certain ownership restrictions when it comes to HDBs.

Generally in Singapore, aside from the requirement that at least one of the applicants must have a Singaporean citizenship, no one is allowed to own more than one HDB at a time. If you want to buy a resale flat or a new Build-to-Order (BTO) flat, you will be required to dispose of your current HDB flat and any other private property (both local and overseas), within 6 months of the purchase.

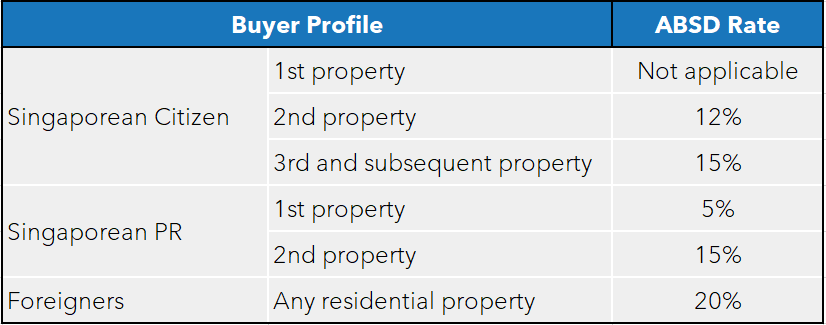

As for private properties, there is no limit to the number of private properties you can own in Singapore as long as you can afford it. But there are measures put in place by the government such as the Additional Buyer’s Stamp Duty (ABSD) tax which requires buyers to pay a tax above the existing Buyer’s Stamp Duty (BSD), on their second and subsequent residential property purchases. With such hefty taxes imposed, it potentially discourages buyers from purchasing multiple properties. The purpose of these measures is to curb any excessive demand for properties in Singapore, thus preventing inflation and manipulation, ensuring property prices will continue to remain regulated and affordable for all.

While there’s no income ceiling for you to buy a resale HDB flat, you should take note of the income ceiling for the CPF Housing Grant and the HDB housing loan; if you own any private property, you won’t be eligible for either of these.

Ensuring that you’re truly financially ready

Image courtesy: Entrepreneur.

Buying any property is a major commitment and you should be well prepared to take responsibility for it to the very end. We always recommend to leverage within your means and consider investments only when you’re financially capable enough to afford it. Don’t fully depend on just a stable income to finance your investments. You should also try to pay off your outstanding home loan first even before considering the next step to become a property investor.

Elaborating further on the ABSD, it applies to your second and subsequent properties; an additional cost that you will have to account for into the total cost of your property transaction. It sure isn’t a negligible amount, so it’s something you should definitely be prepared for.

The current ABSD rates are as follows:

So let’s say if you are a Singaporean citizen who currently owns a HDB flat but plan on purchasing a private property while still holding on to your first property, you will be required to pay the ABSD. For example, if you intend to purchase a private condo valued at S$1 million, you will be required to dish out an additional 12% of that cost which sums to a whopping S$120k.

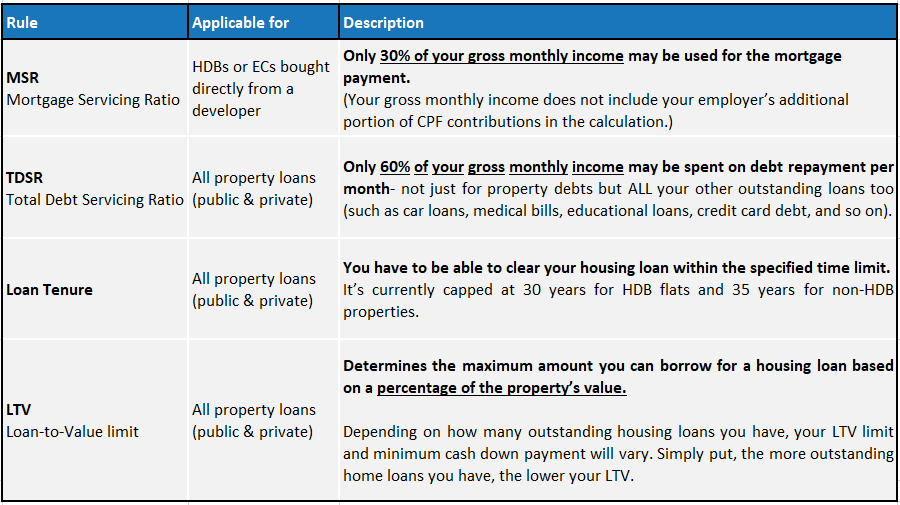

If you don’t have a solid starting capital, it’s unlikely that you will be able to comfortably afford your second property without taking any loans. Mortgage loans help to ease out the financial burden by sectioning your massive bill down into smaller monthly payable sums, but there are certain limitations to loans too. It’s not as simple as asking the bank and being magically granted the amount you need with no T&Cs. So how does it work?

Image courtesy: Vector Stock.

The Singapore government has set some basic rules for new housing loans as a guide to encourage financial prudence and long-term sustainability in the property market. These rules decide the maximum amount that financial institutions are allowed to loan to you based on a variety of factors. They can also work as a guide to help you plan the amount of funds you’ll need before you even consider your second property, so let’s walk you through the basic ones. Before you can even pull out a mortgage loan from any financial institution or the HDB, you will first have to be financially capable of fulfilling the following:

Using these rules as a gauge to tabulate the amount you’ll need per month, if you compare it with the approximate amount you’re able to shell out for your monthly mortgage, you should be able to roughly determine if you’re financially ready to invest in your next property. But even with the help from grants and mortgage plans, properties still come at exorbitant prices.

Photo courtesy: Singsaver.

Even if you do have enough funds to fulfill all of these rules, you should always have substantial reserves in your savings to get through rainy days. Assuming that a mishap occurs, you should at least ensure enough additional buffer funds to cover for all your mortgages, taxes and other expenses for at least another six months to a year.

If you’re thinking about relying on rental income or your day job to fund for everything, we highly suggest that you rethink that too. You should never completely depend on income sources or assume that it’s guaranteed to always be there for you. Nothing is certain and life isn’t always smooth-sailing. – you may unfortunately lose your job or be unable to find a tenant for a prolonged period, which will impede your financial flow. You should avoid getting into these sort of predicaments at all costs.

Image courtesy: Money Matters 101.

It’d be a real bummer if invested in property to make some big bucks only to ironically drown in debt don’t you think? So make sure you’ve really given your finances a lot of proper thought before anything else.

Think you’re ready to start? What’s next?

Now that you think you have whatever’s necessary to become an investor, the next step is deciding whether you plan on selling your current property first.

For HDB owners, If you’re a Singaporean planning to buy a private property for investment next, you won’t be required to sell your HDB flat. Nonetheless, you may wish to sell your first flat so that the CPF funds and cash proceeds can be released from your first flat, providing you with some extra funds for your next purchase.

However, if you plan on buying another HDB resale flat or BTO, or if you’re a PR in Singapore, you MUST sell your HDB flat within six months of acquiring your second property. Do also note that if you own a private property but wish to purchase a HDB flat, you will be required to dispose of your private property first.

Image courtesy: Semonin Realtors.

Selling your first property

The timeline from selling your current home and transitioning to a new home is highly critical and requires a lot of careful planning to ensure a smooth process. So how exactly can you go about it?

Let’s say you’ve just MOP-ed and would like to move into your new BTO flat. As required by the new housing regulations, you cannot have two HDB flats under your name in Singapore, so you will need to dispose of your existing HDB flat within 6 months of moving into your BTO flat. By selling your first property, the CPF and cash proceeds used to pay for it will then be released back to you, providing some extra funds for the next purchase.

Here are some common questions that many of you might have about selling your house:

Should you renovate your old flat before selling it?

You might be wondering whether there is a need to renovate the house before selling it. You don’t really have to, but it’s entirely up to your own discretion. As most people would still want to personalise their new home after they’ve moved in, most owners who are attempting to sell flats wouldn’t invest too much on a mega makeover of the house.

Image courtesy: Stylemotivation.

You should think about how you can improve the condition of the house to make it more attractive to potential buyers when you put your house on the market, but there’s really no need to bomb a whole sum on a full renovation. You could do minor touch-ups such as a fresh coat of paint, repairs for malfunctioning and damaged parts of the house, and decluttering the area. The goal is to appeal to more buyers so that you have a higher chance and a much easier time with selling your house.

When is a good time to start marketing your old HDB flat?

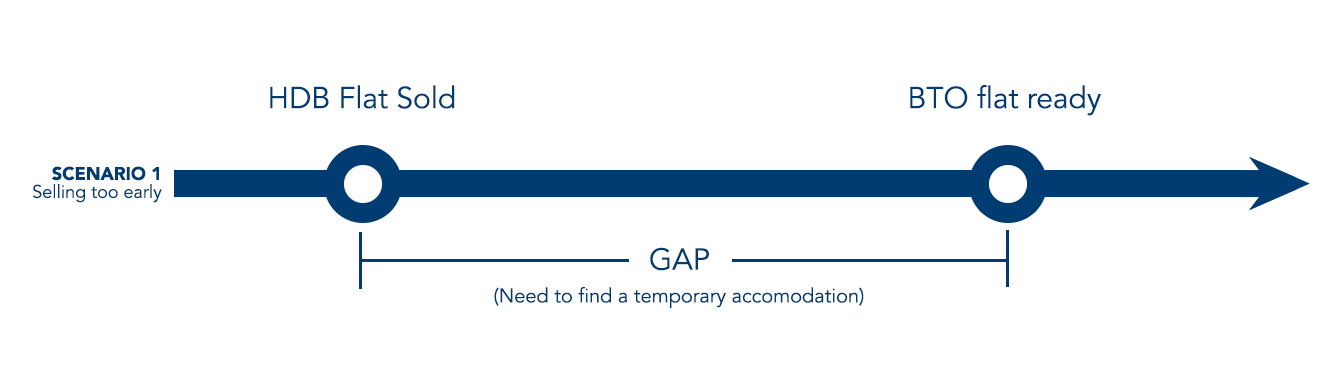

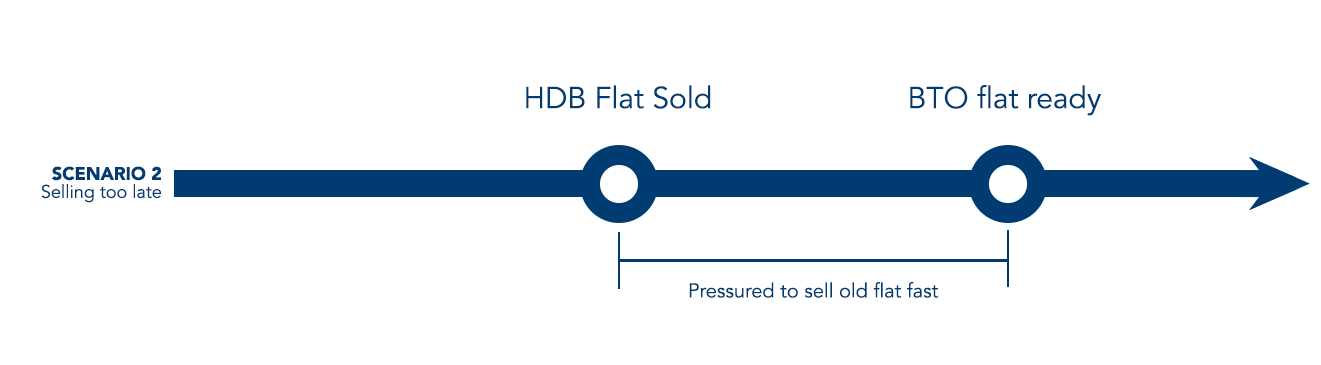

If you market your HDB flat too early before your BTO flat is even ready, you might be troubled not having an accommodation to live in while waiting for your BTO flat.

You could negotiate for an extension stay with your new buyer after you have sold the property, or you may request the HDB to release your BTO keys earlier to you as soon as the development has obtained the Temporary Occupation Permit (TOP), but these are all subjected to the mutual approval of the respective parties involved.

In the case that none of the above work out and if you don’t have a relative or friend who’s willing to take you in, you will have to rent a place to stay and this can require you to fork up quite a sum for rent that can be avoided with smart time planning.

If you market your HDB flat too late and you’re unable to find a buyer quickly, you will face the pressure to sell the house quickly, either to obtain funds for keys to your new BTO or to meet the 6-months time limit you’re given to sell your old HDB.

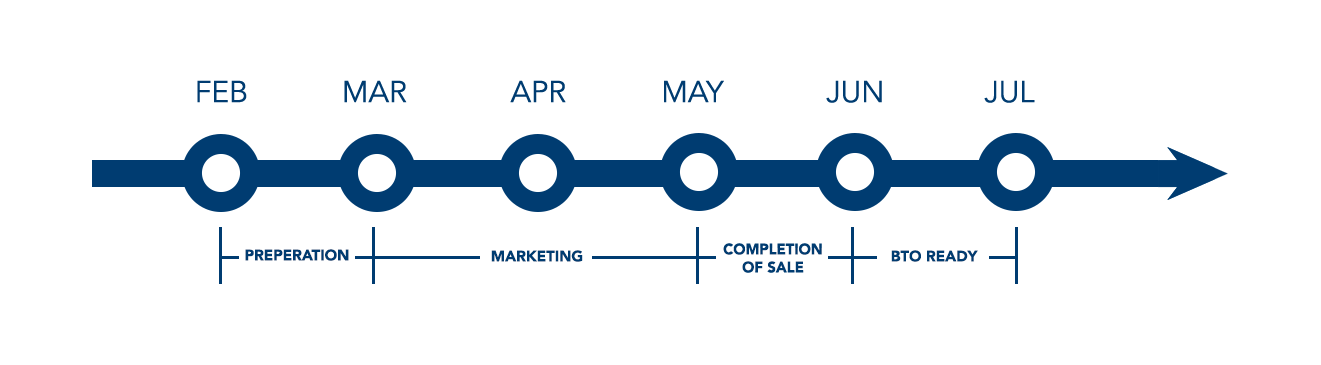

As such, a good time to begin preparing your marketing materials for your old flat would be around six months before your BTO is ready– this includes taking photos and even videos of your house for the actual listing.

A suggested example of a well-planned timeline for selling your old HDB flat.

Then at about five months before your BTO is ready, you may begin marketing your resale flat and hopefully find a keen buyer soon.

Based on the new system, after you have found a confirmed buyer, the official resale process typically takes around six weeks, only counting from the approval of your resale application by a HDB officer. So allow about two weeks before the planned submission date for yourself to prepare the necessary paperwork required.

In total, the expected duration required for the entire sales process is estimated to be about three to four months to completion, so make sure to plan wisely to avoid any unnecessary hiccups.

We also have a video that explains this process in detail:

How do you pick a good property for investment?

When buying a property purely for investment purposes, it’s important to think long-term and always keep an exit plan in mind. Don’t only think about what’s happening now – what happens in a few years’ time when you want to sell your property? Will it still be able to sell well then?

Buying a home may not be so straightforward as it seems, but the true challenge comes in the exit – something that requires some foresight. You would want your property to appeal to a mass market of buyers, so strive to minimise any dilemmas they may have when considering your property. Try seeing things from your potential buyer’s perspective: what will they be looking for?

Stay updated with changing trends and demands in the market

Basically, if your property type aligns with what’s popular lately, you will get you a wider pool of potential buyers and that automatically gives you an edge in the market.

Image courtesy: Pinterest.

For example, following the circuit breaker in 2020 which kick-started “work-from-home (WFH)” practices in Singapore, penthouses and landed properties saw a significant rise in transactions perhaps because people were beginning to value bigger home spaces after being confined with their family for such prolonged periods of time.

Therefore, it’s really important to keep a close eye on the market and ever-changing demands so that you will be able to understand what’s popular in recent years and maybe even deduce the upcoming new trends based on your observations.

Consider the property’s location and proximity to amenities

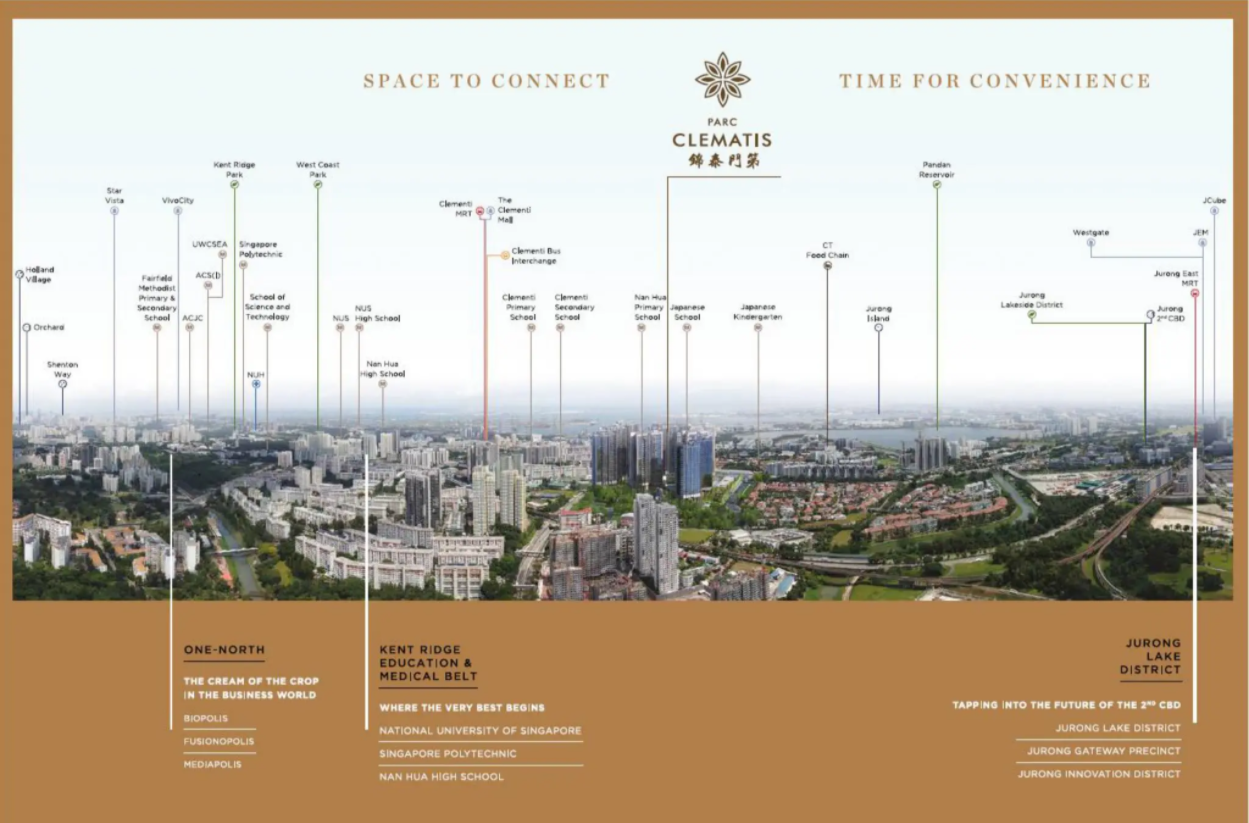

Simply put, the more convenience and access to favourable amenities a location provides, the more it adds value to your property which will appreciate over time, allowing you to put out a higher asking value when you decide to sell it.

Map showing amenities located around the newly launched Park Clematis development, courtesy Parc Clematis.

Naturally when you select a suitable house, convenience is key for practicality and you’d want to be as close as possible or have easy access to good food choices, amenities like the supermarket and medical clinics, transport services like MRT stations and bus stops, or even recreational green spaces like a park.

If you have children, you’d probably pick somewhere close to a school of your choice as it grants you some priority and a better chance for your child to be admitted into the school.

If your house is close to schools, hospitals, and other workplaces, you’ll also have a bigger potential tenant and buyer pool to sell your flat too and it’ll make things a lot easier for you during the exit.

Aside from what’s available in the current landscape, you should also consider how the location is expected to evolve and develop over your planned investment period. Say if you know about the development of a new MRT station or shopping mall nearby make sure to take that into consideration too. It’s very likely that your property will see a great appreciation in valuation due to the addition of such facilities in the vicinity.

The catch is when you make a purchase for a property, do the developers already know of the master plan in future? If they do, you might not be able to leverage as much as you think, as the price has already been factored into the price quantum. This requires a great deal of pricing analysis in the area and setting it just right. PropertyLimBrothers can help you on this, as it is our field of expertise. Do approach us here for more enquiries.

Future Developments at Beauty World, courtesy The Straits Times.

However aside from looking at favourable developments, make sure to avoid areas with developments, such as factories, that could depreciate the value of your property. To obtain information about the prospective developments in any town, you may consider contacting the respective town council and other public agencies in charge of zoning and urban planning in Singapore. Alternatively, you can check out URA’s master plan maps here.

Know which factors to compare

Just like how you’d compare products at the supermarket down to the nitty-gritties, you should also compare between the few properties that you’ve shortlisted for a potential investment before picking the best property type for you.

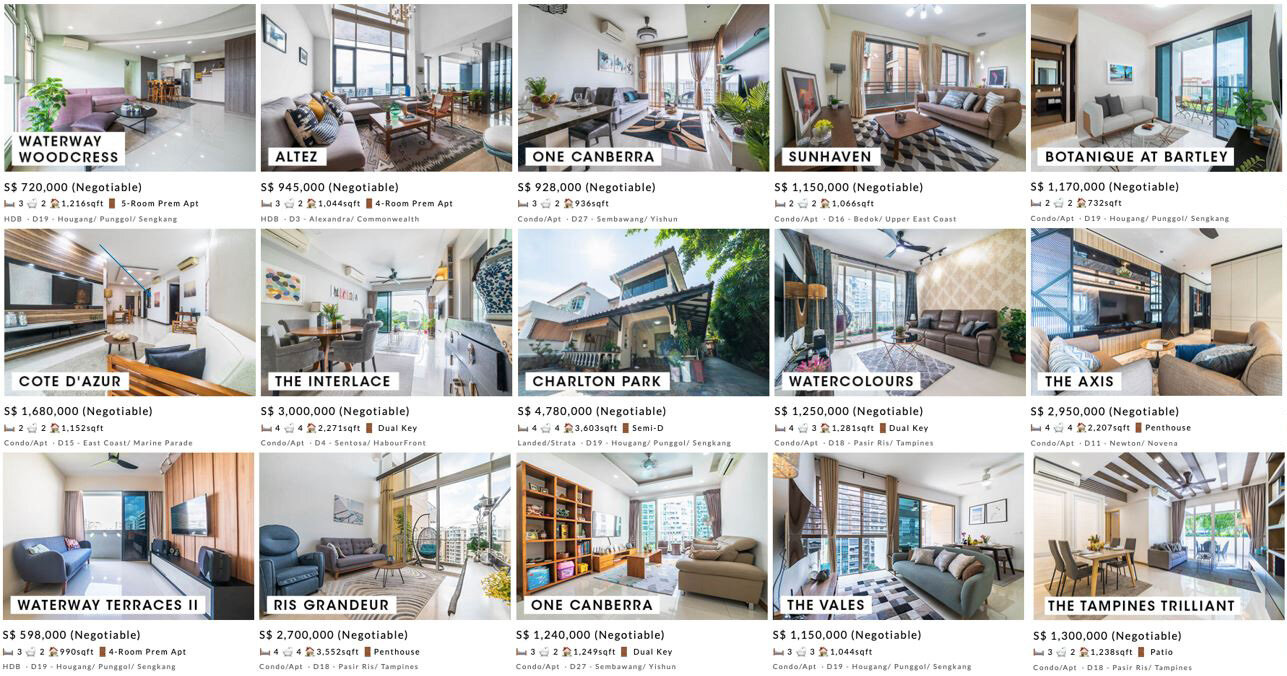

Some of the many property listings for your comparison at PropertyLimBrothers, courtesy PropertyLimBrothers.

To effectively compare between two properties, pick units that have similar layouts (2-bedroom, penthouse, etc.), as well as total floor areas. These are some of the many different factors you should consider comparing between properties:

Property’s valuation in relation to their development and launch dates

Look for any disparity between the valuation of properties that were developed and launched around the same time. Some properties have a much higher valuation than others, even if they were launched only one to two years apart from each other.

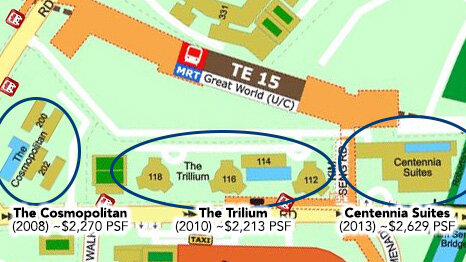

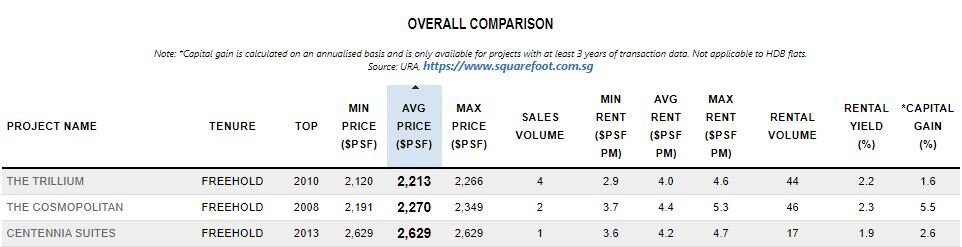

For example, let’s take a look at three developments located close to each other along the same street at Great World City which have been pretty popular in the market. The Cosmopolitan, The Trillium, and Centennia Suites are all freehold private condominiums released just 2 years apart from each other.

Map of developments along Kim Seng Road at Great World CIty, Image courtesy: Street Directory.

When comparing the average price per square foot (PSF) between these three developments, there’s a noticeable price gap of approximately $400 between Centennia Suites as compared to the two other developments, despite being launched just 2 years apart from each other.

So while you may be able to get a good 3-bedroom unit at Centennia Suites, for the same price you could possibly obtain a 4-bedroom unit instead at The Trillium or The Cosmopolitan.

As for picking between The Trilium and The Cosmopolitan, their average price PSF isn’t very significant. But considering that The Trilium was launched two years after the Cosmopolitan, the newer status of the development would be more appealing to most buyers. While your final decision should be made based on a variety of other factors too, if you’re simply looking at the numbers, the entry price at $2,200 PSF at The Trillium seems to be the better option here.

Image courtesy: Squarefoot

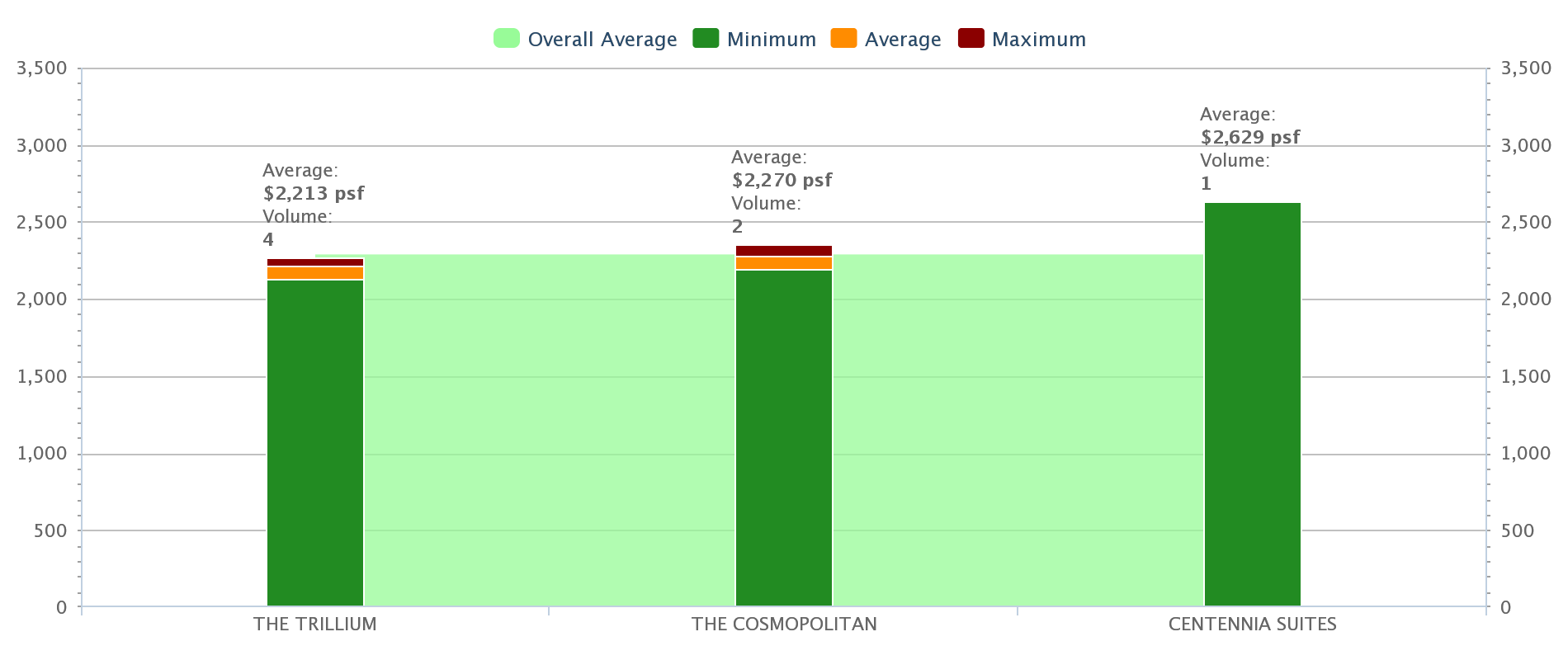

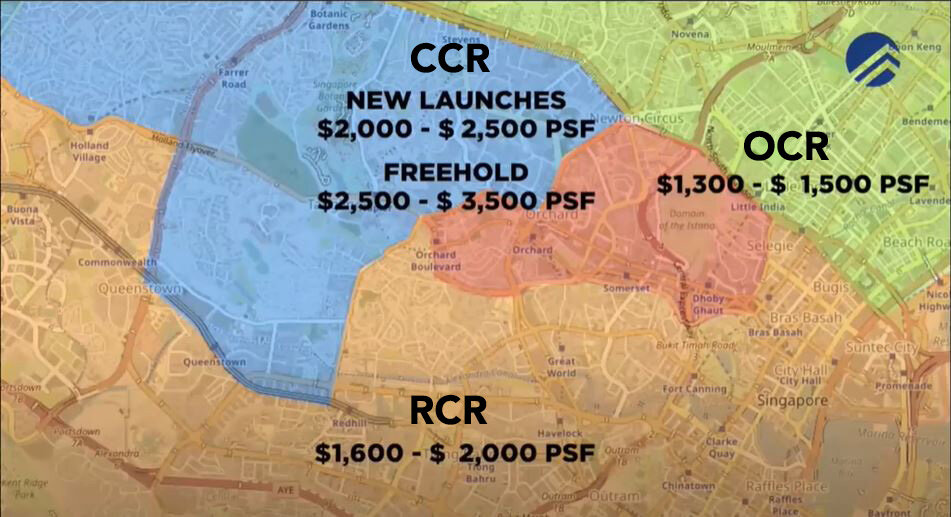

Price disparities between OCR / RCR / CCR zones

Singapore is split up into three main regions – the Core Central Region (CCR) which includes prime spots in the town, Rest of Central Region (RCR), and the Outside of Central Region (OCR) which is made up of the suburban areas of Singapore.

Image courtesy: Singapore Home.

While CCR prices are expected to be on the higher end, followed by RCR and then OCR, in some cases, the differences for prices between different zones in Singapore may be negligible if you’re able to find a good deal.

Image courtesy: PropertyLimBrothers.

For example, if you’re looking for a property in the OCR that you’ll have to pay about close to $1,500 PSF to $1,600 PSF for, you may be able to find deals for similar units within the RCR zone for around $1,700 PSF. In that case, you may want to consider whether it’s worth the upgrade because properties in more premium zones are likely to see greater appreciations in value in the long run.

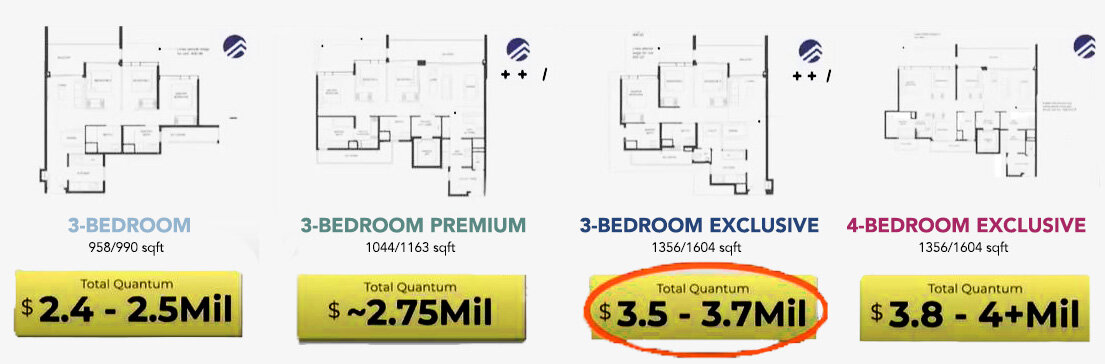

Price disparities between different types of floor plans layouts and total floor area

As a general rule of thumb, when you’re given three different floor plans of varying aspects and sizes, it’s not advisable to pick whatever’s in the middle – just go for the other options.

This is because in cases when the middle category’s overall quantum is rather close to either the upper or lower category, it’s very likely that many buyers will find it more worth to pay just a little more for a reasonably good upgrade to the more premium option instead of considering the middle option.

Image courtesy: Propertylimbrothers.

For example in the image shown above, the 3-bedroom exclusive has a quantum that is a lot higher than the 3-bedroom and 3-bedroom premium options, making it an unlikely consideration for buyers who budget lower around the $2 million range.

However, the 3-bedroom exclusive’s quantum isn’t too far off from the 4-bedroom exclusive and most buyers will likely consider if the top-up for an upgrade to the 4-bedroom exclusive could be more worth their money; thus, it could make the 3-bedroom exclusive appear as a less convincing choice and a tougher unit to sell in the future too.

Keep your options open and explore around more

While we know new launches are all the rave now, it’s not necessarily the best for every investor and it shouldn’t be the only option to consider. There are some pretty good deals on the resale market too if you know where to look, so we recommend keeping your options open and exploring more around with different types of property first before you seal any deal with your agent.

Image courtesy: Carousell Blog.

Ultimately, you should only consider property investments when you are 100% sure that your financial situation is comfortable enough for you to afford it. If you’re still dreaming big but don’t have pockets deep enough for it, we highly suggest not to impulsively dive into the market. Hold off the investment dream for a while and reassess at a later time. Meanwhile, you should continue to work hard at your day job and also find other ways to make more passive income on the side.

Image courtesy: The European Financial Review.

Even with all this information at your fingertips now, you may still have some hesitation about taking your first big step into property investment. It’s a huge commitment that can be challenging after all. If you’d like some guidance to find a property that’s most suitable for your first investment, here at PropertyLimBrothers, we have a team of highly experienced and dedicated real estate professionals at your service. You may contact us here.

We hope this article has been helpful on your journey to a more comfortable life ahead. Stay tuned for our next article in which we will be diving more in-depth on how to profit in a volatile market like 2021 for intermediate property investors!