Singapore’s private residential segment has long been regarded as a stable asset class, offering not only capital preservation but also the potential for capital appreciation. This stability is expected to persist despite global and local uncertainties, including economic factors, public sentiments, high interest rates, and recent housing measures. The local real estate market is projected to remain resilient, albeit at a moderate pace.

Singapore’s strong governance, business-friendly policies, and low unemployment rate have enabled residents to accumulate more wealth, fostering affordability in property purchases. Cooling measures have played a positive role, strengthening and regulating the real estate market, maintaining resilience in property prices, and preventing a housing bubble.

It then begs the question: “What pricing range should you be considering for an eventual profitable property sale?”

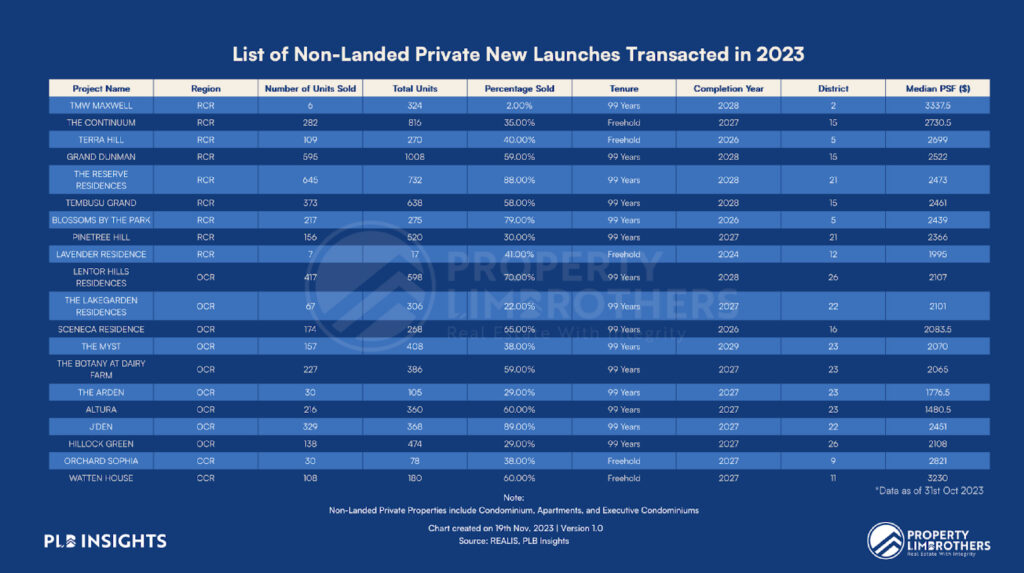

This article conducts an in-depth examination of a few selected non-landed new launch prices in 2023. Building upon this analysis, our focus shifts towards providing insightful commentary on price comparisons with some anticipated new launches in 2024.

Property Trends 2023

Analysing some top-performing 2023 launches, we’ll delve into the average price per square foot (PSF) for the following properties: The Reserve Residences, J’Den, The Continuum, Watten House, Orchard Sophia, and Lentor Hills Residences. This assessment spans freehold and leasehold properties in the Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR). Overall, the transaction volumes for non-landed new launches in Singapore dropped by approximately 9.4% when compared to 2022 figures.

OCR

In 2023, the non-landed private homes segment in the OCR experienced the highest PSF year-on-year price growth, reaching 12.28% compared to the end of 2022. This growth encompasses both new launch and resale properties, excluding Executive Condominiums (EC) sale prices. This increase in PSF occurred despite a 19.8% reduction in transaction volume within the OCR in 2023 compared to 2022.

Examining our chosen OCR new launches, J’Den, a 368-unit leasehold development in Jurong’s District 22, had an average launch price of $2,451 PSF. Lentor Hills Residences, a 598-unit leasehold development along Lentor Hills Road, averaged $2,080 PSF. Despite both being in the OCR, the notable difference in their average PSF prices on launch day can be attributed to their locations. J’Den, located in Jurong Lake District that is set to become the second-largest business district in Singapore, offers connectivity through a sheltered elevated walkway to Jurong MRT Interchange, malls, and amenities. Lentor Hills Residences, in a more quaint neighbourhood, has yet to witness significant developments within its surroundings. Nevertheless, both developments experienced high demand for 1 and 2 bedroom units on their respective launch days—a common trend in OCR projects.

This demand is driven by buyers, particularly young couples or smaller families, aiming to maintain a reasonable overall price by investing in smaller units. For investors, the appeal of 1 and 2 bedroom configurations lies in the manageable quantum price, coupled with high rentability due to a broad tenant pool, especially among young professionals.

RCR

In terms of transaction volume, the RCR experienced the smallest dip among all other regions, registering a 2.7% reduction compared to 2022 figures. This percentage decline encompasses transaction volumes for new launches, sub sales, and resales, excluding Executive Condominiums (ECs). The RCR’s robust performance is primarily attributed to the successful launches of The Continuum, Grand Dunman, and Tembusu Grand—all situated in District 15—each achieving commendable results on their respective launch days.

Comparing RCR new launches, The Reserve Residences, a 732-unit leasehold integrated development in the prestigious and sought-after neighbourhood of Bukit Timah, outshone as the top-performing launch in 2023. It led both in units sold and the percentage of total inventory sold, averaging $2,460 PSF on launch day. The Continuum, a 816-unit freehold development in District 15, achieved an average of $2,732 PSF at its launch.

While a direct comparison may not be entirely accurate due to their distinct neighbourhoods, both developments are in sought-after areas. Bukit Timah, home to The Reserve Residences, is known for its esteemed prestige and integrated convenience, while The Continuum in the vibrant Katong area offers diverse food options and a lively nightlife. The 10% pricing gap aligns with the usual 10-15% premium of freehold over leasehold developments.

On launch day, all 1 bedroom units at The Reserve Residences were sold, and majority of the buyers on launch day were aged 40 years and below. This suggests an appeal to younger couples or smaller families seeking new launches at more affordable prices in smaller-sized units. Similarly, at The Continuum, 61% of units sold on launch day were 2 bedroom configurations.

CCR

In 2023, the CCR experienced the most significant year-on-year decline in transaction volume, dropping by 21%. Notably, the increase in PSF price was minimal at just 1%, comparing 2023 to 2022. These figures encompass transaction volumes and average PSF prices for new launches, resales, and sub sales, excluding ECs. This decline in volume and modest PSF increase was anticipated, coinciding with the announcement of the latest round of cooling measures in April 2023, which increased the ABSD for foreigners to 60%. This adjustment is particularly impactful in the CCR, historically attracting a higher percentage of foreign buyer uptake compared to other regions.

Examining the two selected CCR new launches for our analysis, both are freehold developments in prestigious neighbourhoods. Watten House, a 180-unit project in Bukit Timah, achieved a notable 57% inventory sale on the preview launch day, averaging $3,230 PSF. Orchard Sophia, a boutique 78-unit development in prime District 9, resulted from the redevelopment of Fairhaven and Sophia Ville, averaging $2,800 PSF over its launch weekend.

The strong performance of Watten House on its launch day dispelled concerns about the impact of the latest ABSD rates on demand for larger luxury homes in prime districts. Unlike other 2023 launches, Watten House exclusively offers configurations from 3 to 5 bedrooms, with no 1 or 2 bedroom options. On launch day, 96% of buyers were Singapore Citizens and Permanent Residents. This demand, particularly from locals, reflects a desire for larger units to accommodate family lifestyle preferences in prime CCR areas.

Situated atop Sophia Road near Dhoby Ghaut MRT Interchange, Orchard Sophia attracted a diverse mix of owner-occupiers and investors during its launch weekend, emphasising its appeal as a symbol of ‘city living’ with proximity to the Orchard Shopping Belt and nearby educational institutions. The launch price further boosted its allure, as the average PSF of $2,800, appeared as a bargain compared to RCR and CCR averages in the first half of 2023 of approximately $2,700 PSF and $2,900 PSF, respectively.

Recurring Trends Observed

Having analysed the price trends for our chosen developments above, there are a few consistent trends that we can pick out to be used as a foundation for our predictions for 2024.

OCR & RCR

The strong demand for 1 and 2 bedroom units in these regions suggests a trend where buyers prefer smaller-sized units to maintain a manageable overall price amidst inflation and high interest rates. Additionally, the better-performing new launches in 2023 are often situated close to MRT stations, highlighting the significance of this factor for homebuyers. In general, developments in the OCR are highly sensitive to pricing considerations and tend to be more family-centric.

CCR

From our analysis, the predominant presence of local buyers suggests a potential shift in focus towards them. Luxury new launches in prime CCR areas still attract interest, albeit more cautiously, even with the recent ABSD, as long as they align with buyers’ criteria. A pivotal consideration for discerning homebuyers continues to be securing an entry price that aligns with their long-term goals. Local families who are able to afford the premium in the CCR, will still be attracted if the unit size and location suit their needs. Investors, with an eye on the right entry price, will still be drawn due to a sustained high tenant demand in the city centre. Additionally, the appeal is enhanced if it’s a freehold development, offering an extended runway for potential capital appreciation.

A Closer Look at Chosen 2023 Launches and Handpicked 2024 Prospects

In 2023, we observed a slowdown in sales due to economic uncertainties, cooling measures, high interest rates, and an increase in housing supply. Despite this, the local real estate market remained resilient, with high property prices sustained, even in the CCR in spite of reduced foreign investments. Looking ahead to 2024, we anticipate subdued sales activity across all regions, and the market to be primarily driven by owner-occupiers. Affluent investors will still engage in property acquisitions, but at a moderated pace. Based on several experts’ estimates, new launch sales volume this year will be somewhere between 7,000 to 8,000 units, and price growth within the range of 3-6%.

In this section, we’ll compare the average launch prices of the 2023 new launches we discussed with a select few developments anticipated for 2024.

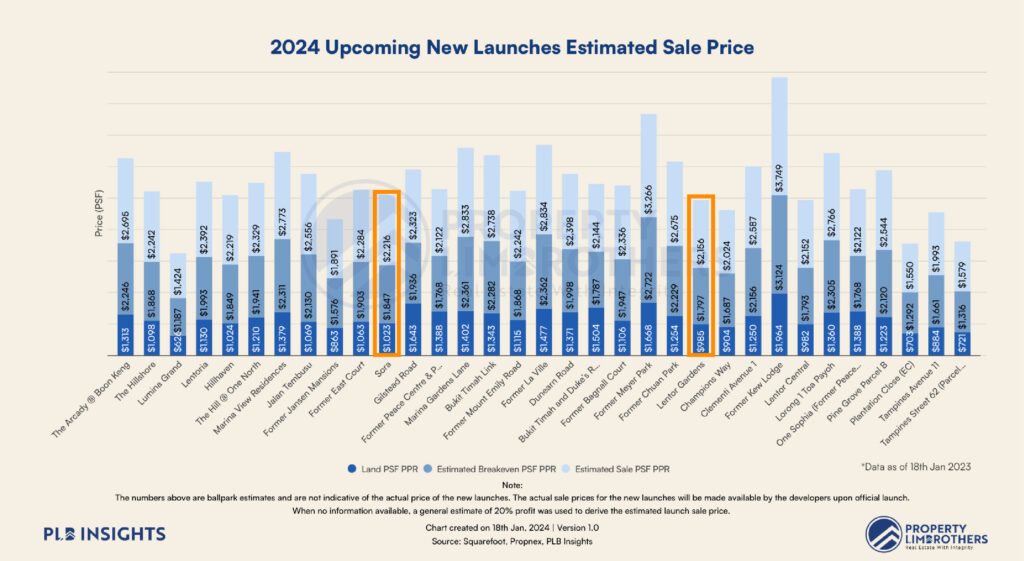

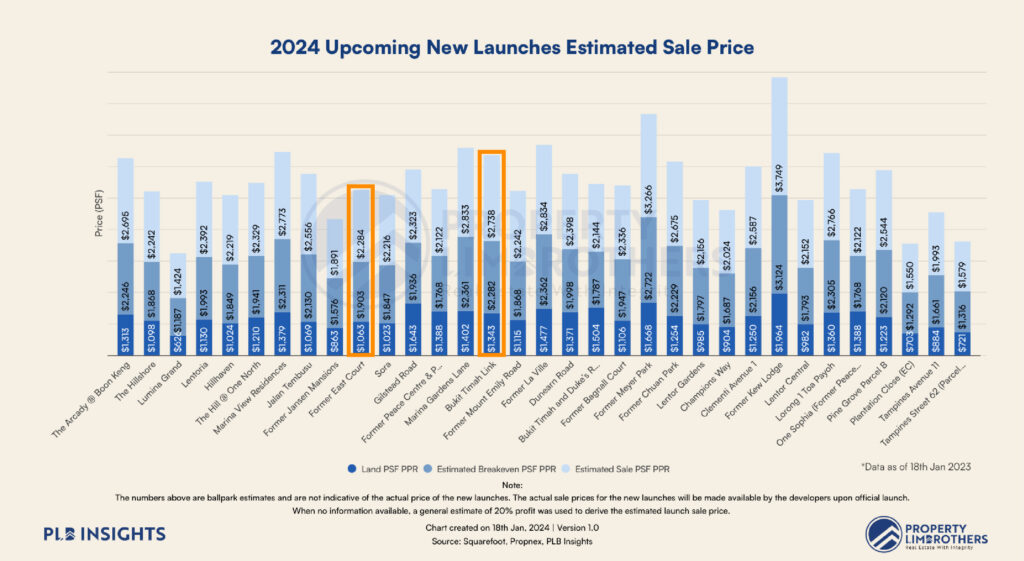

The chosen 2024 launches include Sora, Lentor Gardens, an upcoming Government Land Sale (GLS) development along Bukit Timah Link, a redevelopment on the former site of East Court, a redevelopment along Mount Emily Road, and a development along Bukit Timah & Duke’s Road. These selections align with our 2023 analysis, covering the same regions and encompassing freehold and leasehold developments.

Our estimated new launch prices as shown in the tables below is derived from a 20% markup for profit after considering the Per Plot Ratio (PPR) price the developer paid for the land, and our estimates for the associated development or redevelopment costs.

OCR

In our 2024 OCR analysis, we focus on two developments: Sora and Lentor Gardens. Sora, situated in District 22 adjacent to Jurong Lake Garden, is right in the mix of URA’s plan to transform Jurong Lake District into Singapore’s second CBD. It’s a 10 minute drive from J’Den and is estimated to feature 440 units. Lentor Gardens, a 533-unit development, is a mere 4 minute walk from Lentor Hills Residences, offering a first-mover advantage in an area with ongoing and upcoming developments.

Our estimated launch price for Sora is $2,216, slightly below J’Den’s average PSF on launch day, reflecting the perceived advantage of J’Den’s more convenient location. Lentor Gardens, with an estimated launch price of $2,156, represents a 3.65% premium over Lentor Hills Residences’ launch day average.

RCR

In our 2024 RCR analysis, we’re focusing on a Government Land Sale (GLS) project along Bukit Timah Link and a freehold boutique project on the former site of East Court, acquired through a successful En Bloc sale. The Bukit Timah Link development, featuring 160 units with a 99-year lease, holds potential as an investment gem amid the Beauty World area’s anticipated transformation. The Former East Court redevelopment, a freehold boutique project in District 15 with an estimated 19 units, is situated in the vibrant Joo Chiat area.

Comparing our estimated launch price for Bukit Timah Link at $2,738 PSF with The Reserve Residence’s average PSF on launch day, it reflects an approximate 11% premium. The PPR price the developer paid for the site may signal confidence in marketability, considering recent demand in the area.

The estimated launch price for Former East Court at $2,284 PSF is roughly 19% lower than The Continuum’s average on its launch day. This could be attributed to The Continuum being one of a mid-large development, which are often associated with higher demand, and unit size configurations available may also contribute to this variation.

CCR

In this CCR analysis, we’ll focus on the redevelopment of three adjoining freehold properties along Mount Emily Road and an upcoming freehold mixed-use development along Bukit Timah and Duke’s Road, both acquired through successful En Bloc processes. The Mount Emily development is expected to comprise 16 units, conveniently located near Little India and Rochor MRT Stations, and just a 9 minute walk from Orchard Sophia. The Bukit Timah and Duke’s Road development, zoned for residential and commercial use, is anticipated to have 40 units and is a 10 minute walk from Watten House.

Our estimated launch price for Bukit Timah and Duke’s Road at $2,144 is significantly lower than Watten House’s average PSF on launch day. This difference may be attributed to Watten House offering configurations starting from 3 bedders, while the upcoming development, a boutique project, is expected to predominantly feature 1 and 2 bedders and with smaller unit sizes overall. Despite this, being a mixed-use development, high demand is anticipated. For the Mount Emily Road redevelopment, our estimated launch price of $2,242 is also notably lower than Orchard Sophia’s average PSF on launch day, approximately 25% less. While each development has unique selling points, the pricing difference may be influenced by Orchard Sophia’s closer proximity to the city centre and the Orchard Shopping Belt.

In Summary

Our estimated 2024 launch prices for the discussed developments fall within the expected pricing range for their respective regions. As the current demand for resale non-landed properties continues to drive prices upward, we anticipate a pronounced shift towards new launches in Q3 and Q4 of 2024. In this article, we featured some selected 2024 new launches with lower estimated launch prices compared to the average PSF prices achieved on the launch day of their 2023 counterparts, signalling potential opportunities for your next family home or investment. Check our recent reviews for leasehold and freehold 2024 launches if you’re exploring options this year.

In closing, we emphasise the importance of conducting thorough research and financial evaluations before investing your time and money in any property. Consideration of the property’s alignment with your family’s lifestyle, along with factors such as entry price, resale potential, proximity to amenities and schools, and the formulation of an exit plan, is crucial for a well-informed decision, whether you plan to stay in the property indefinitely or consider selling in years to come.

If you’re in the market for a new launch or have any burning questions in your real estate journey, reach out to us here. Our friendly expert consultants are ready to assist you and provide the answers you need.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.