In the midst of Singapore’s bustling urban environment, a significant housing reform is underway, to improve the lives of both single individuals and seniors. Beyond the announcements made by Prime Minister Lee on the reclassification of HDB flats, more updates have been given in Parliament concerning Build-To-Order (BTO) flats.

Due to pandemic worries and a shortage of manpower, the construction of many BTO flats faced delays of up to a year. There has also been increasing frustration over the rising costs of HDB flats and restrictions on singles. Hence, it is interesting to note how the government intends to address current housing concerns, especially as more students graduate and enter the workforce, and our ageing population gets bigger. A big question that has been hovering around would be how singles would be able to purchase BTO flats in competition with couples or families. The government’s decision to prioritise families in the face of an ageing population makes sense, but what happens to those who stay solo?

Increase in supply of BTO Flats

According to National Development Minister Desmond Lee, HDB has announced plans to introduce up to 14,000 two-room flexi BTO flats over the next three years to address the housing requirements of singles and the elderly. This represents a 30% increase from 2021 to 2023. From the second half of 2024, singles aged 35 and above will be eligible to apply for these flats across all BTO projects islandwide. Presently, they are only able to acquire such flats in non-mature estates. The quantity of two-room flats introduced for sale witnessed a notable growth of 5.1% between 2018 and 2022. However, during this same timeframe, the number of applicants for these flats more than doubled which indicates a persistent strength in the market. This is also good news for elderly people who are looking to right-size their housing situation to one that is suitable for their retirement.

This is good news as this results in an increase in chances of successfully balloting a unit as a single or senior. This helps to spread out the demand and hopefully reduce the time taken to secure a unit for singles applying at 35 years old. Singles who have more disposable income will turn to resale flats, however, this initiative will help those who are priced out of the resale market with an increase in supply.

Addressing BTO Construction Delays

A big problem that has plagued the construction industry, especially that of the BTO flat situation, is the delay in waiting time, mostly due to the pandemic. This has frustrated many BTO buyers who are still waiting for their keys due to delays dealt by the pandemic. An example would be Kempas Residences, which was slated to be finished in 4 years and 8 months from May 2019. However, it is now expected to be completed instead by end 2024 to early 2025, almost a year later than projected.

According to The Straits Times, 40% of BTO flats under construction are delayed due to the pandemic. This number is down from 90% in 2021, due to manpower shortages and 2021 taking the brunt of our Circuit Breaker. The good news is that the government is managing expectations by starting construction on BTO projects before announcing them to the public.

In the same vein, for singles who apply for BTOs at the age of 35, the waiting time of up to 5 years could be a cause for concern. This does not take into consideration the possible multiple attempts it would take as well, since singles are not eligible for any additional priority schemes besides the First Timer Priority. The reality would be that many of those who fall in that category may hit 40 years old before they are able to step foot into their own apartment, forcing them to look for resale flats instead.

HDB) is actively engaged in efforts to reduce the waiting period for BTO flats to a range of three to four years by the year 2024. This is a significant improvement from the current average waiting time of approximately 4 to 5 years. With the backlog from the pandemic clearing up, it is optimistic to assume that this will come to fruition, but only time will tell.

Updated Housing Options for Singles

With this new information, singles have more room to figure out what kind of housing they wish to purchase.

1) BTO Flat (New)

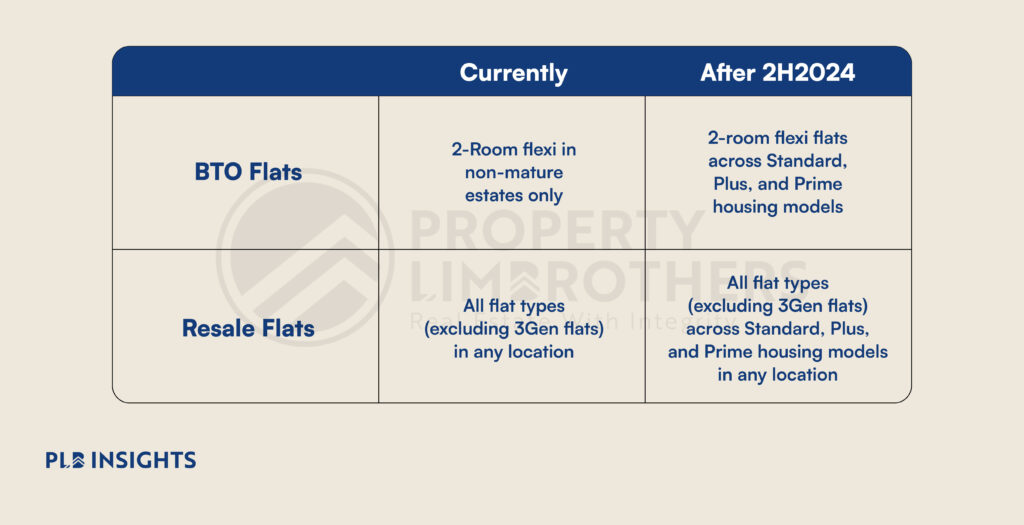

Currently, individuals above the age of 35 who desire to purchase a new HDB flat are limited to acquiring a 2-room Flexi flat solely in non-mature estates. However, under the new regulations, this restriction will no longer apply to singles, granting them the opportunity to purchase new 2-room Flexi flats from HDB in all three categories (Standard, Plus, Prime) regardless of location. This expansion of options will prove advantageous to single individuals, particularly those seeking to reside in close proximity to their parents in mature estates.

2) Resale Flats

With regards to resale flats, singles were previously not able to buy Prime Location Housing flats, even from the resale market. With the recent reclassification and revised framework, singles are now permitted to obtain 2-room Prime Flexi units from the resale market, as well as Standard or Plus resale units of any size (excluding 3Gen flats) in any location, provided they meet the income ceiling requirements.

At present, there are no plans to reduce the age limit of 35 for singles to purchase BTO flats as the primary focus is on meeting the demand for flats before making any additional modifications.

Closing Thoughts

In theory, these new initiatives are promising and seek to address issues that have been plaguing singles and elderly individuals. Housing for singles especially has been a topic that many have pressured the government about, however, with the country’s declining birth rate, it does make sense that they prioritise couples and families. That being said, it is still important that those who are single have options and the availability to have a place to call their own that is affordable. All in all, it is imperative that buyers ensure that their agents are properly updated with the latest developments and policies to maximise their purchasing power, no matter if they are single, married or a family with children. Get in contact with us here and we will be happy to help.