There is always news of new BTO flats being constructed but not so much for Executive Condominiums. However, they still remain a hot commodity for many Singaporeans looking for the next tier of public housing. Designed specifically for the “sandwiched” market, it appeals to the likes of homeowners who are above the income ceiling for BTOs but are still outpriced by the private condominium market. Is there merit to this demand and why are so many people still drawn to ECs despite its low supply?

Difference between Executive Condominiums and Private Condominiums

For the uninitiated, ECs and private condominiums are vastly different. ECs have an Minimum Occupation Period (MOP) of 5 years, the same as MOPs for Standard HDB flats. And after 10 years, the owners are free to do as they wish with their EC as they will become fully privatised. Private condominiums on the other hand do not have any MOP as they are part of the private market. What makes them attractive is that they are developed and sold by private developers but are classified as public housing and can enjoy subsidies akin to BTOs. While there are many fewer subsidies, there are still CPF grants such as the Family Grant and Half Housing Grant, which can be found on the HDB website. The sandwiched class who are over the income ceiling of S$14,000 will inevitably look to the next tier which is ECs, with an income ceiling of S$16,000. Currently, there are 67 completed ECs with 8 more still under construction.

Homebuyers have a higher chance of securing a unit as well, as investors are not allowed to buy ECs since they are only for owner-occupancy. There are also restrictions on purchasing eligibility, as only Singaporeans can purchase new ECs from the get-go.

Private and executive condominiums still fetch a premium over BTOs, due to the additional security, amenities and exclusivity it offers. Take for example Piermont Grand and Punggol Bayview which are both situated in Sumang Walk in Punggol District 18. Comparing a 3-bedroom apartment spanning 1001 sqft, Piermont Grand fetches S$1,154,000 compared to Punggol Bayview at $920,000. The EC fetches 20% more than the BTO in terms of resale price for the same amount of space in the same vicinity.

Why ECs?

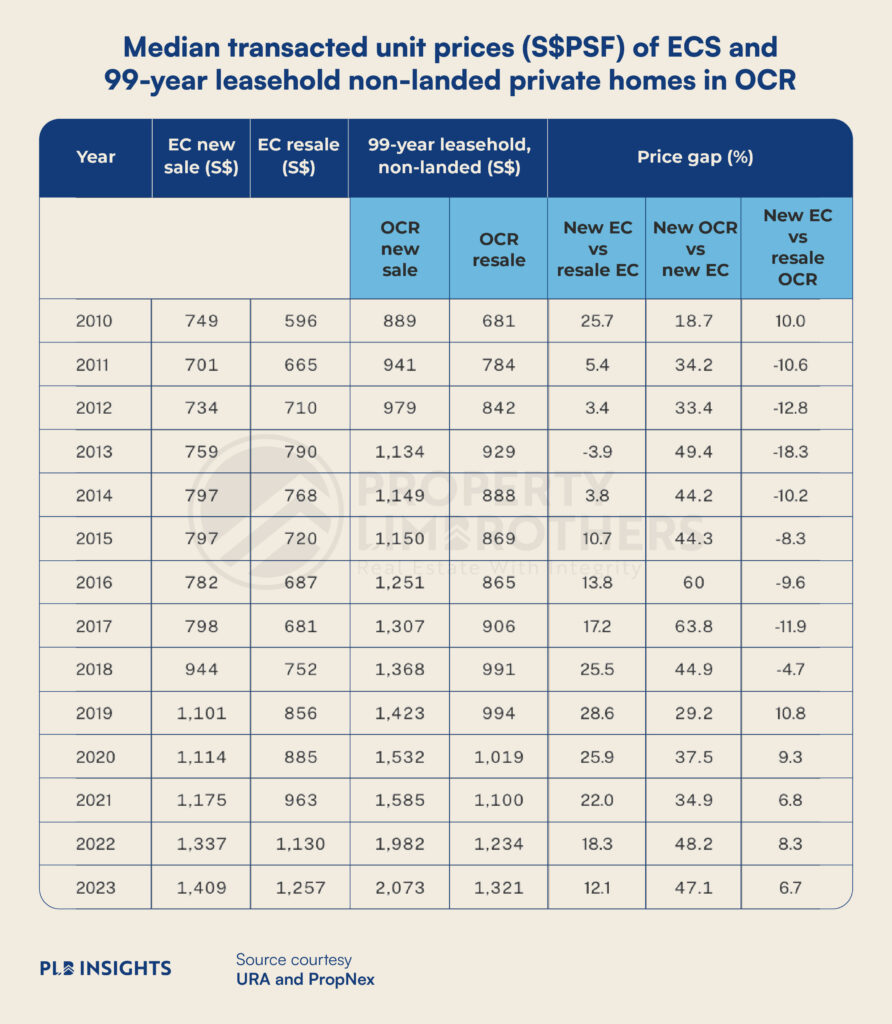

Many turn to ECs as they are more affordable than private condominiums yet they are still able to enjoy almost the same amenities and privacy that private condominiums offer. Based on URA data for the period between January and 20 August 2023, the median unit price of new ECs amounted to S$1,409 per square foot (PSF). In contrast, new 99-year leasehold, non-landed private homes located in the Outside Central Region (OCR) were priced at S$2,073 PSF. This significant price disparity of 47% effectively underscores the advantageous affordability that ECs present.

From 2019, new ECs have been performing better than resale condos in the OCR consistently, in terms of median PSF. Hence while the option of getting a private condominium is there, there are still many who choose to pay a premium for a new EC instead.

Potential in Capital Gains

When evaluating a potential property purchase, prospective buyers should and often take into account the exit strategy by looking at future developments in the area using the URA Master Plan. One example of this is Copen Grand, the first EC in Tengah. Because of its status as a new town with many up-and-coming BTO projects, prospective buyers view this as an excellent pool of future HDB upgraders and exit audience. This gave buyers confidence in the EC, evident from it achieving 73% sales on launch day and is fully sold at the time of writing.

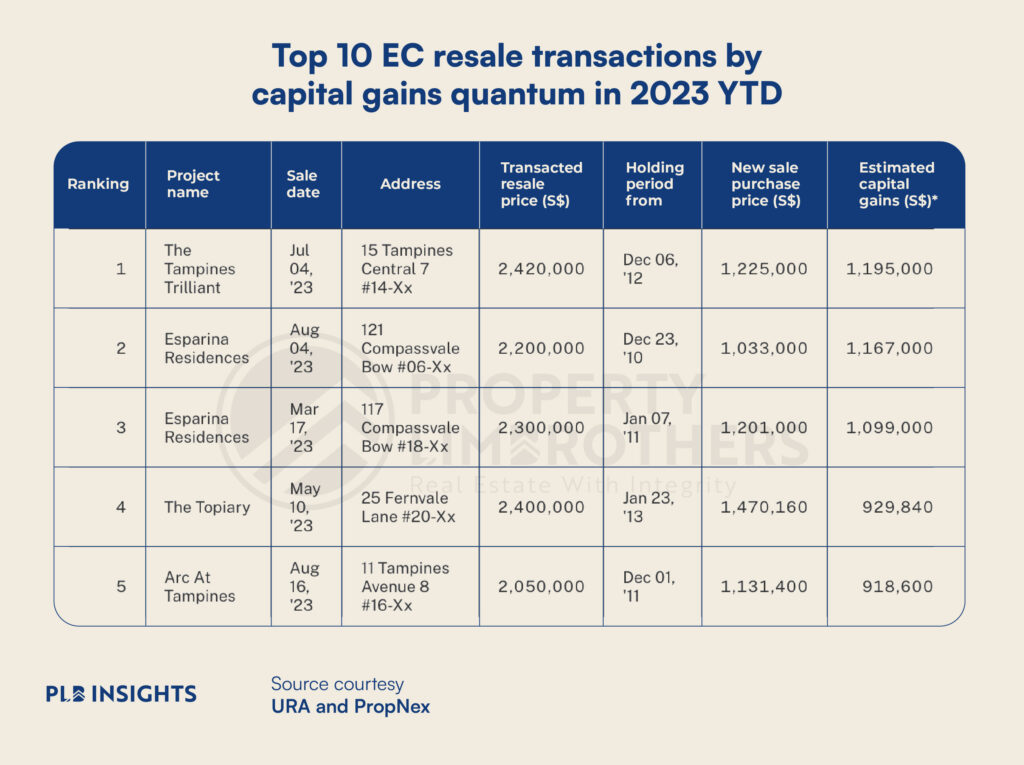

The top five EC transactions reported gains of S$918,600 to S$1,195,000 excluding stamp duty and other costs incurred, based on data gathered from URA Realis. Tampines Trilliant saw the biggest profit of S$1,195,000, with a transaction price ofS$2,420,000, which is almost double the price that the first owner bought it for.

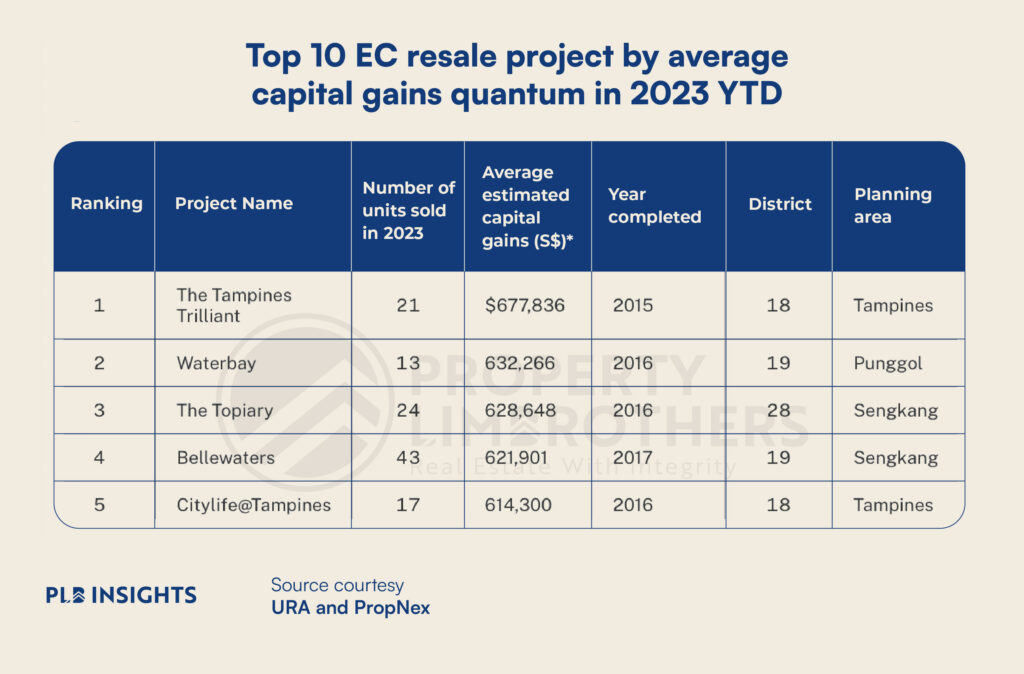

Additionally, the same project had the highest number of units sold in 2023 with an average estimated capital gain of S$677,836. The top 5 projects with the best capital gains all record an average of more than S$600,000 in appreciation as well.

Why is demand so high?

Many view ECs as a perfect entry into the private non-landed market. Many first-time homeowners with higher purchasing power, as well as HDB upgraders with cash proceeds from selling their BTO flat after MOP will be attracted to it for its amenities and future appreciation. Second-time home buyers will be allocated up to 30% of units in ECs, up from 5% in 2012. With higher purchasing power, ECs will see high demand from second-time home buyers as well.

Altura, an EC that was launched in July, displayed this demand from second-time applicants. More than 70% of the electronic applications and ballot tickets received for the new projects were from those who fall under the category of second-time applicants. All 108 units (which account for 30% of the total units available) designated for second-time applicants at Altura were fully taken up within three hours on the first day of the project’s launch on August 5th. This overwhelming demand demonstrates the draw that ECs have on those upgrading from their existing BTO flat, only serving to drive prices upwards.

Despite growing demand, there is limited supply as compared to BTO flats. This is because of the government’s focus on public housing and ensuring a steady supply of flats for Singaporeans. Traditionally, the government only releases two new EC plots for sale through the Government Land Sales Confirmed List annually. Furthermore, developers are prohibited from commencing sales bookings for new EC projects until 15 months after the site award date. This scarcity of available ECs is also a factor contributing to the high demand.

Final Thoughts

It is interesting to note this market darling and how it performs once it hits the market, due to its scarcity and the type of buyers it draws. While they fill the gap between the public and private housing market, its prices are comparable to some private condominiums and should not be mistaken as just a wholly more affordable alternative.

Just as regulations surrounding HDB flats are subject to changes (as per this year’s National Day Rally), the same could be enforced on ECs without warning in the form of cooling measures or changes in eligibility criteria.

While ECs are still high in demand and maintain a good capital appreciation in general, buyers should still consider all their options before making an informed decision on their next housing purchase. Talk to any of our consultants and let us help you make your next property decision a comprehensive one.