District 28 has one of the smaller landed enclaves in Singapore. But interestingly enough, there are more landed residential areas than areas with high-rise developments here. Size matters in a lot of things. In this case, having lesser supply will likely cause prices to be more susceptible to each price movement because there are lesser transactions to cushion some large price movements. Sometimes, it can be good news, other times, not so much. Read on to find out more on how D28 has been performing the past decade, as well as our projection for it in the coming years.

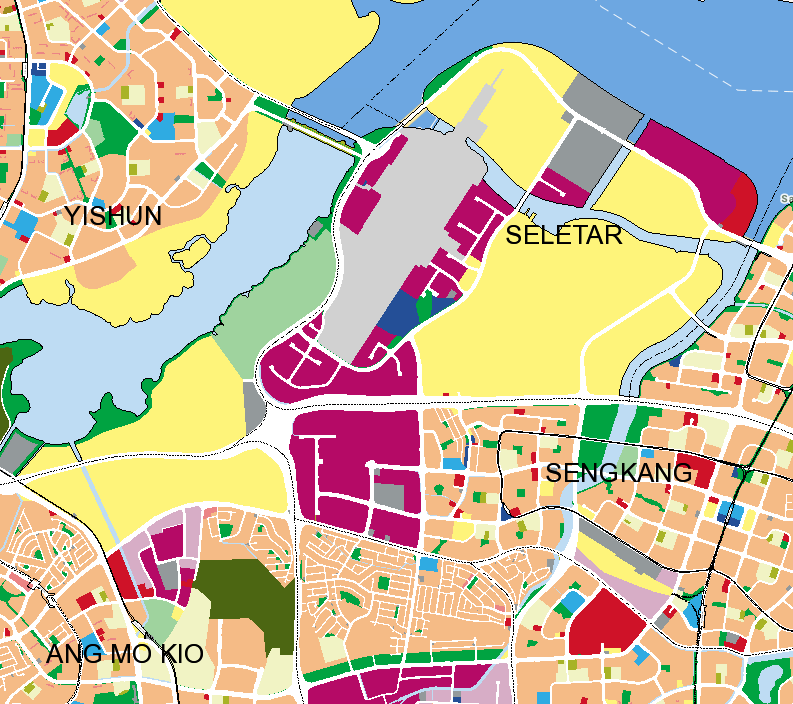

If having fewer residential developments is representative of exclusivity, then it does not get better than District 28. With approximately one-quarter of the land zoned as residential, a large portion of it is utilised by Seletar Airport, and another large portion has been zoned as Reserved sites. The landed enclave in D28 is contained within the perimeter of Yio Chu Kang Road, Ang Mo Kio Ave 5 and the CTE. However, in recent years, it is also one of the only landed enclaves that have had more additions of landed housing BRAND-NEW from developers. The Luxus Hill enclave should be familiar to all, given its rarity of being an entire brand-new enclave. Even more recently, the same developer, Bukit Sembawang Estates, is currently developing the little brother of Luxus Hill, Nim Collection, a 99-year leasehold landed enclave. While most will consider more central areas for their own-stay purposes, why did the developers choose this area for a fresh influx of landed housing? Perhaps, understanding the performance of this area will solve this mystery.

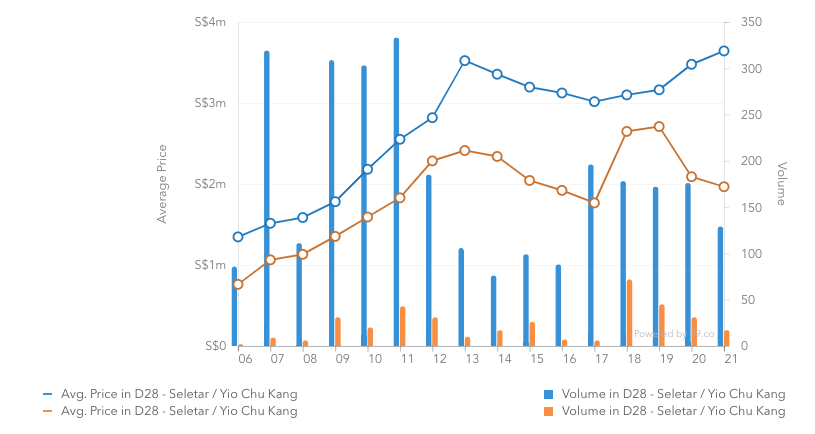

Transactional Volume

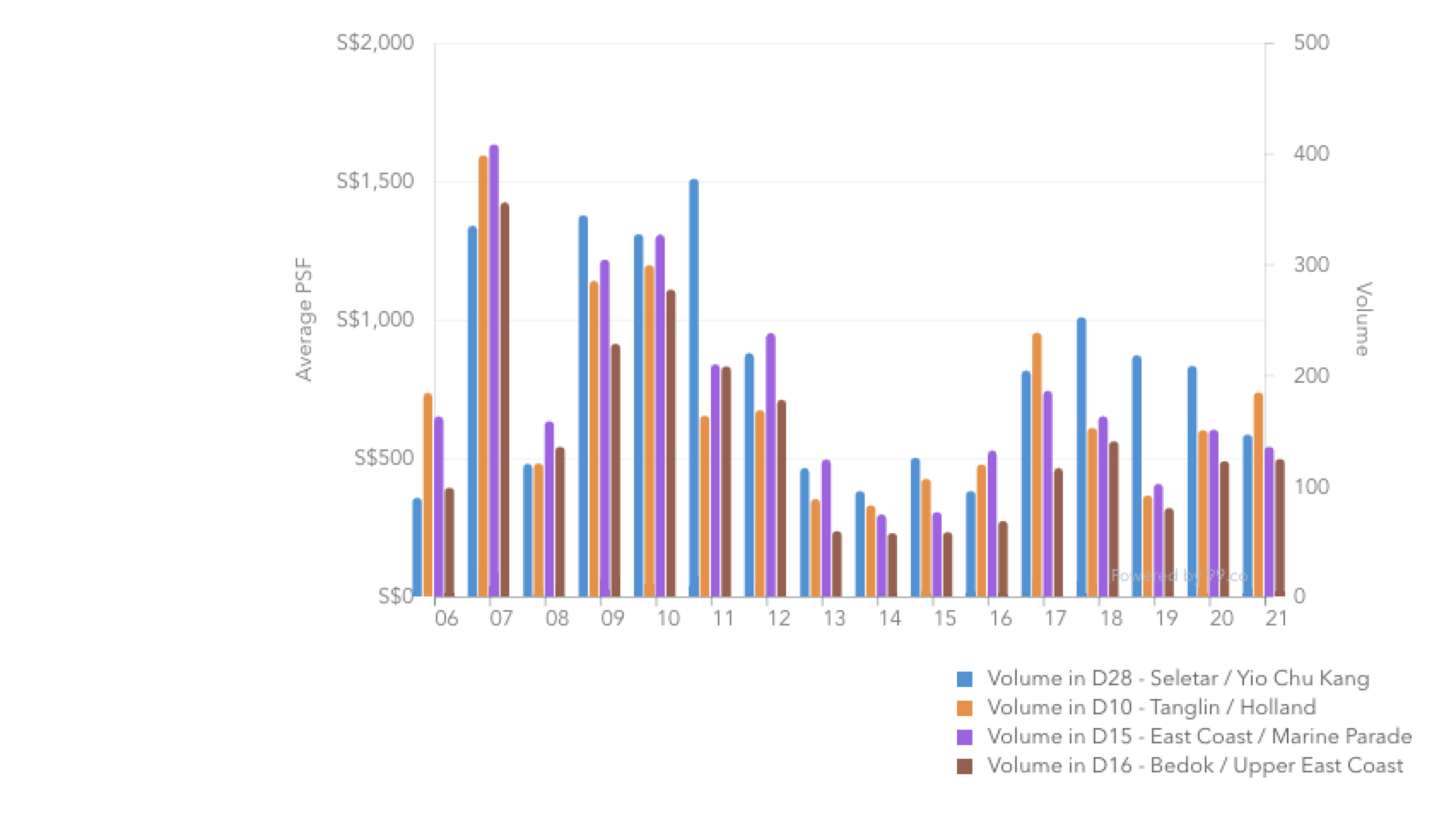

Comparing District 28 to other popular landed housing districts, we have noticed that D28 is one of the top transactors in the landed market. On top of the existing supply, the other contributor to having this volume of transactions is also largely due to the brand-new landed houses that Bukit Sembawang has developed. Being released in phases over the last 10 years, it released its final phase of houses for sale back in 2020. It was also reported on the news platform The Business Times that the final phase was fully sold within a month of the preview. The release of fresh units at different stages has skewed the volume in favour of D28. The next question you may have in mind is, is D28 really that popular? Or was it because it is one of the rare opportunities to buy a unit in an entirely new landed enclave?

Luxus Hill development is not the only development as of late. The same developer has recently launched Nim Collection, which seeks to replicate the outstanding performance of the Luxus Hill development. However, it is a 99-year leasehold. While Luxus Hill, the bigger brother, is a 999-year leasehold, which theoretically is as good as Freehold. The question is, “99-year landed property can buy?”. The answer is, you will have to read on to find out more.

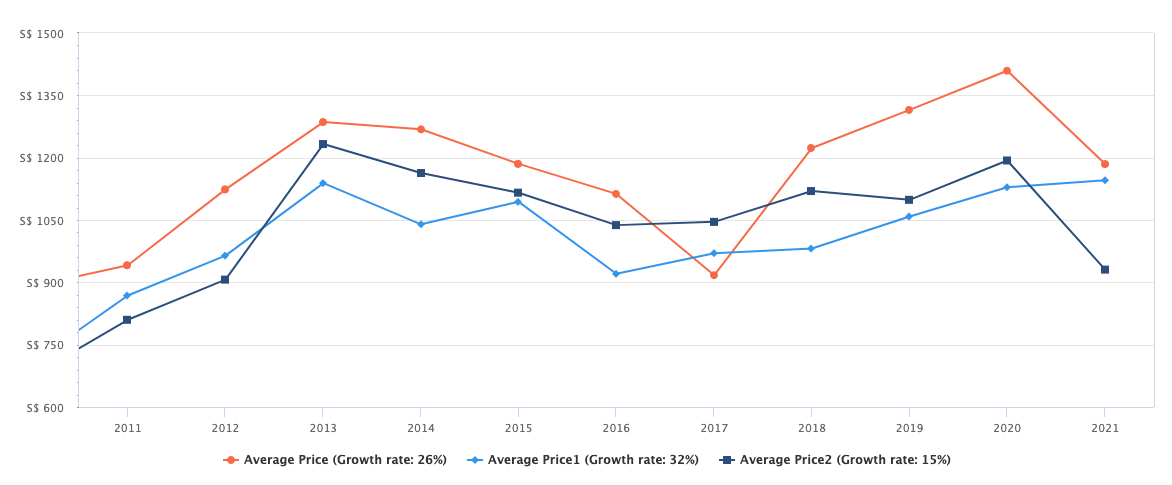

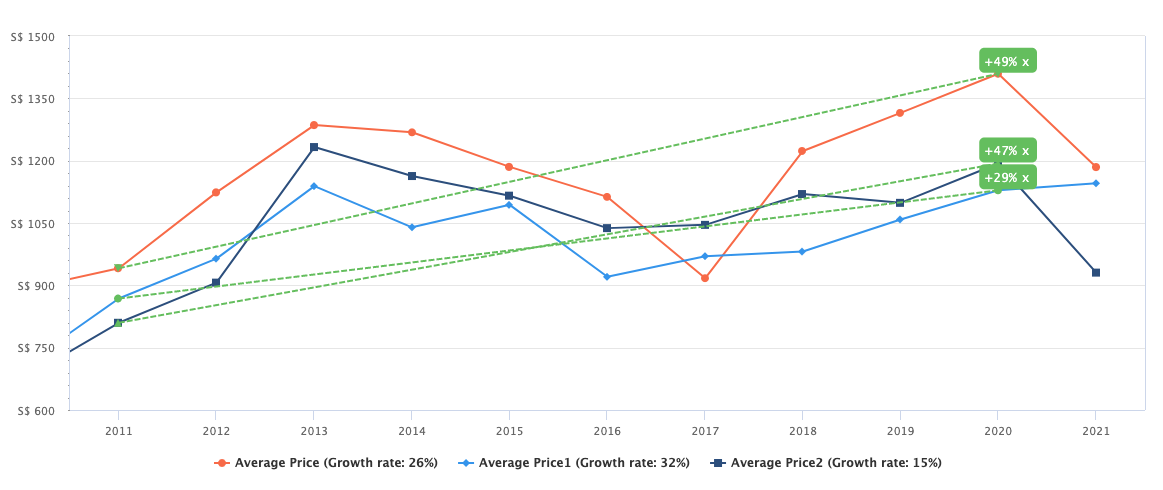

Performance across types

To the untrained eye, this chart probably does not look very encouraging. For reference, orange represents the inter-terraces, semi-detached is represented in light blue, and the final line represents the detached houses in district 28. On first look, it is interesting to observe the similar price movements of inter-terraces and detached houses. Whilst the semi-detached houses have moved in a manner of their own. Typically, we would observe similar price movements across types because ultimately, landed houses are valued for the land it sits atop. Hence, it is usually a collective appreciation or decrease in value. But this is not the case for D28. Generally, in the last 10 years, all types have seen an appreciation in growth rate, with semi-detached making headway at 32%. If we were to purely base our observation from 2011 to 2021, then it would seem that the inter-terraces and detached houses have not performed as ideally as anyone would have hoped for. But, at PLB, it is our job to scrutinise each detail.

With just a difference of 1 year, inter-terraces and detached houses have performed extremely differently. Inter-terraces have seen price appreciation of 49% and detached houses at 47%. Leaving behind semi-detached, which has now become the underperforming type at 29%. Even if we were to place it against the 2021 growth rate of 32%, it still has a 17% difference from inter-terraces in 2020. These figures are relatively comparable to the areas of landed housing in district 19. However, we do believe that the prices in D28 are a little skewed down because of the influx of new landed housing. Why do we say that? Just to give you some references to the figures:

Total Number of Sales Transactions: 1,984

Number of Resale Transactions: 1,339

Number of New Sales Transactions: 618

District 28 is the only district where there is almost half the number of New Sale transactions than there are Resale transactions. To give some context leading up to our point, developers usually have to buy over a piece of land with an existing structure that is prime for redevelopment first. Then they will tear it down and build it back up from scratch. However, in the case of D28, most of the new sale units came from Luxus Hill and Nim Collection, which allowed them to reduce the redevelopment cost and translate that into competitive pricing, which attracted many buyers to buy into the development. Consider this, if you had the option of a brand new inter-terrace at $3.3 million or a resale unit at $2.5 million, which you have to sink in money for rebuilding and perhaps a year for it to be completed. Which would you choose? The answer seems pretty obvious. But wouldn’t that mean that prices are skewed upwards and not downwards? The 618 owners who bought their houses at a premium because they wanted them brand-new are unlikely to sell off their houses (when they decide to) at a lower price—causing the prices to further increase during their resale phases. What about the existing supply of houses? They now have a new benchmark pricing to position their property, given the new prices from the new developments. Because once those new units have found their new owners, the next time they hit the market, they will also be considered as resale units. This also potentially benefits buyers who are looking to purchase a landed house in that area, allowing them to gauge if the price they are entering has a good buffer across the whole area. Thus, this unique district and price movements gives us ground to believe that there will likely be an upward trend in the next few years.

Freehold vs 99-Year

By now, you would have probably heard the overused comparison of Freehold Condos versus Leasehold Condos many times over. The ultimate conclusion is that it is never about whether it is Freehold or leasehold, but the driving forces behind the property. However, we would also agree that leasehold properties would face lease decay issues after a few decades. But the key factor that needs to be discussed first and foremost is the purpose of the property. The motivation behind purchasing a property will determine the duration of stay and ease of exiting. Without these considerations in mind, you may end up on the losing end because of the stick. For reference, orange represents the 99-103 year leaseholds while blue represents the freehold/999-year prices. Using Nim Collection as an example, prices in 2018 and 2019 likely perked up due to the sale of this 99 year landed development. Next, we would like to bring your attention to the price gap between the two types. Prices for 99-year leaseholds are still well below the average prices of freehold types. Furthermore, prices for Freehold landed properties are on an uptrend. In the current climate, $3 million will likely be able to get you a freehold inter-terrace suitable for rebuilding. This is very crucial, as this will allow 99-year leasehold types to get some buffer from the growing prices of the freehold types. Hence, potential buyers who want to get something below $3 million and are in move-in condition will likely consider developments like Nim Collection because it hits the right boxes for them. Another underlying factor is that D28 is sandwiched between D20 and D19, which houses highly populated estates which may be popular with senior residents. For homeowners looking to stay near their parents within this area, D19’s growing price tag may be a challenge for them. Hence, they will likely look towards D28 and developments with a lower entry quantum to suit their needs. So to sum it up and answer your question, no, it does not matter if it is 99-Year or Freehold. What matters is the driving forces behind the property, like we have mentioned.

All Types in D28

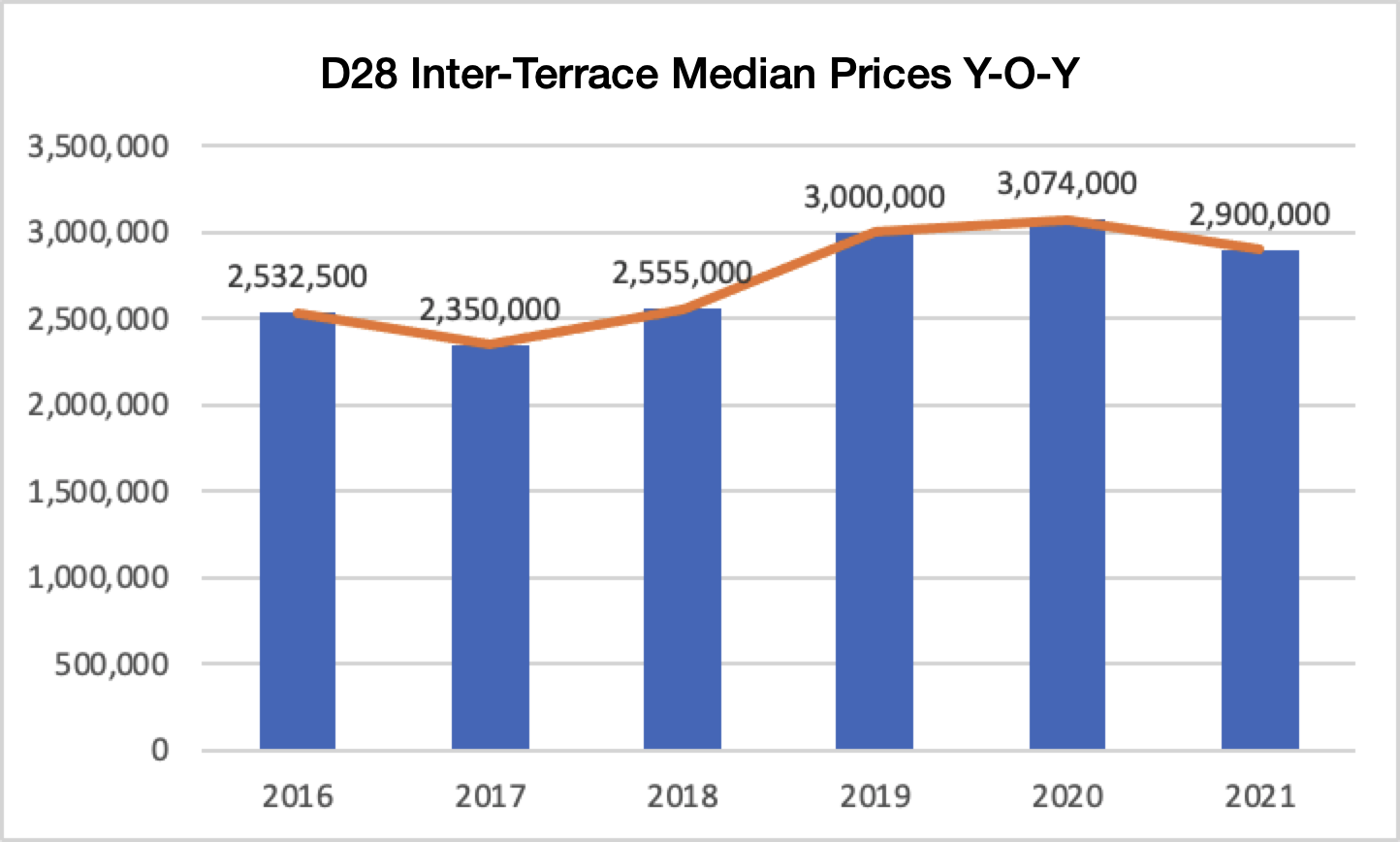

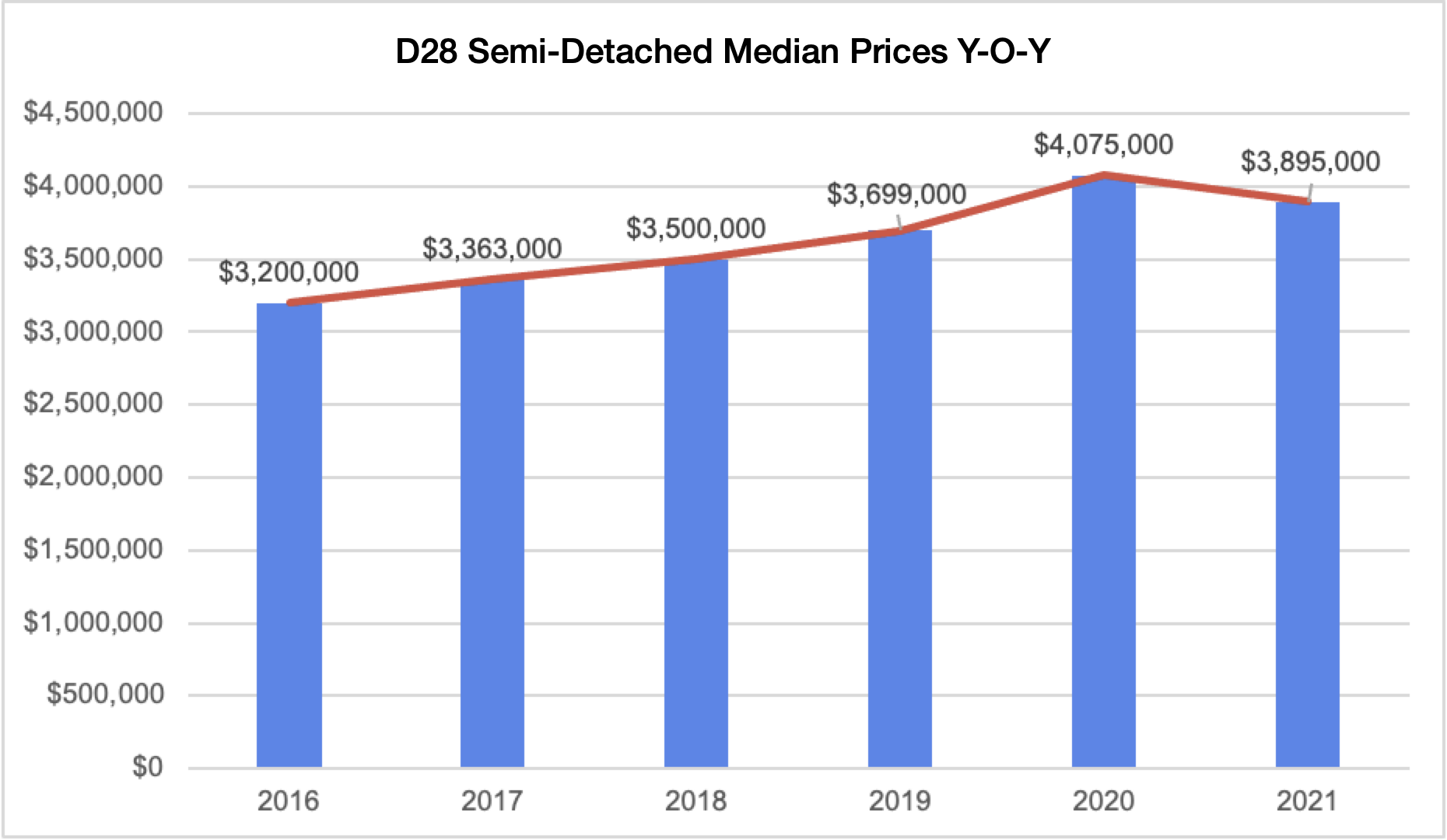

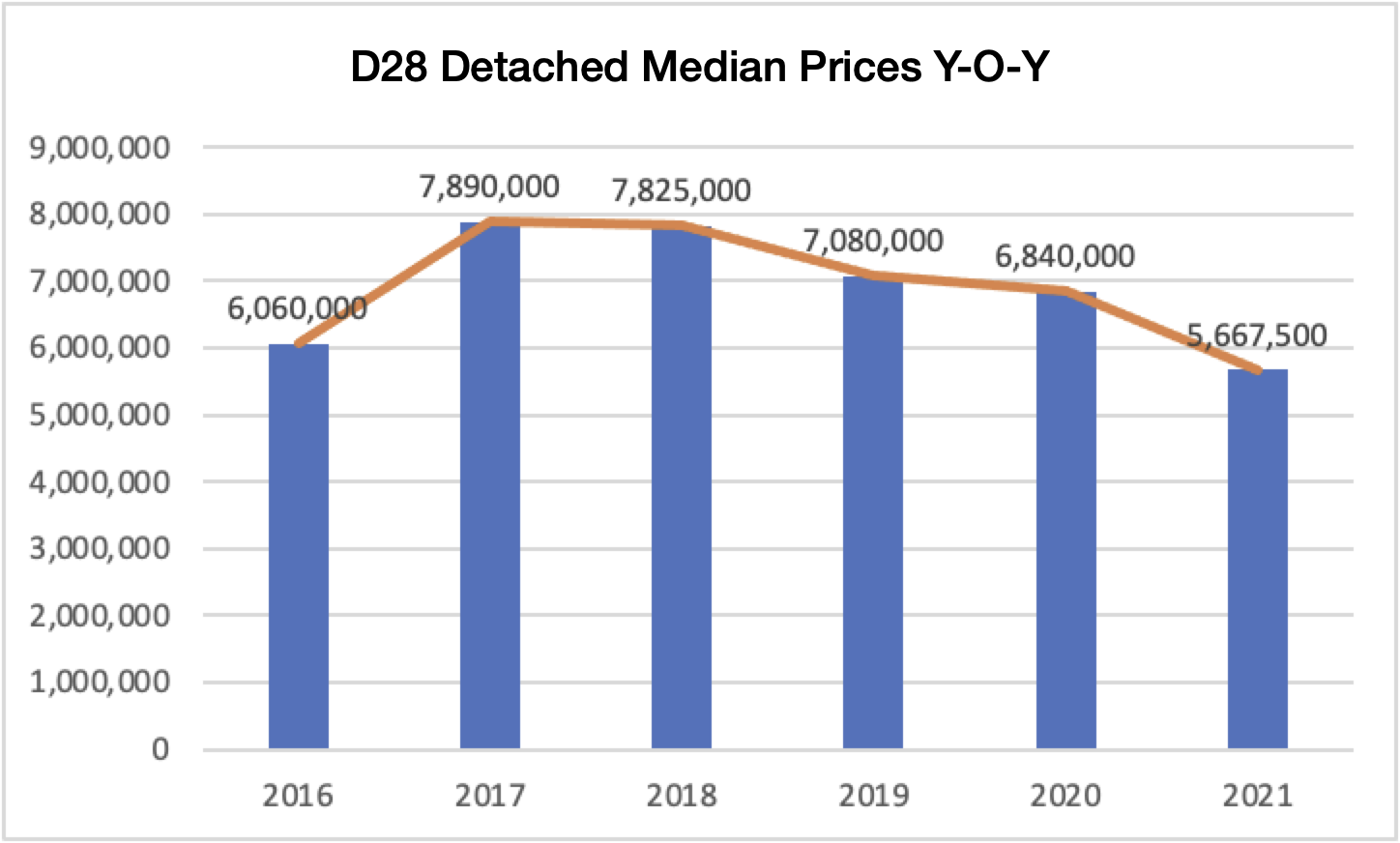

These are the median prices year-on-year across types that our Insights Team has taken the liberty to compile for District 28 landed market. While we believe that the analysis on a 10-year timeframe gives us a good holistic overview of the landed market, it is the more recent prices that would indicate the future price movement.

Inter-Terraces

In alignment with what we mentioned earlier, that we believe the prices of the landed market in D28 are skewed downwards, we have observed that the prices are almost in a consolidation phase in recent years. It would seem from the median prices that there is already a new tier of prices within D28 formed since 2019. Median Prices in the time period of 2016 to 2018 were in the range of $2.3 – $2.5 million. While in the time period of 2019 to 2021, they are now ranging between $2.9 – $3.1 million. That is an approximate $400,000 gain in prices. When the more recently launched units from Luxus Hill and Nim Collections hit the market, we believe that prices will likely reach a new tier. Along with the fact that other sectors in the market where prices for brand new inter-terraces from developers are already at the $4.2 – $4.5 million range. We believe that inter-terraces in the D28 enclave will be quite popular with those who do not mind compromising on having lesser amenities and the proximity to more central areas. For those who would appreciate being closer to nature, having more exclusivity and quietness, prices in D28 would still be considered as one of the lower quantum for entry to landed housing.

Semi-Detached

We have mentioned in one of our previous articles that inter-terraces and semi-detached houses have an intersectional relationship. That there are seasons for each, and the prices often move in tandem. Largely attributed to the tendencies of homeowners hunting for a landed house. For a more in-depth explanation, here is the link for your reference. The median prices for semi-detached houses have similarly moved up a tier ranging to about $3.9 – $4.1 million. Just a moment ago, we mentioned that prices for brand-new inter-terraces are in the $4.2 – $4.5 million range currently. Now, the consideration here would be, would you want to pay less for something pre-owned with more land, a swimming pool and a larger yard. Or would you rather buy an inter-terrace direct from developers, a smaller land area with no provision for a pool and yard? That decision is completely up to you. Potential homeowners who prioritise growing the value of their capital will likely choose to buy a larger plot of land, simply because given the same quantum, the semi-detached is at a lower PSF due to the larger land plot. Having lower PSF hits the checkboxes of many buyers who would consider this as paying less for more. Additionally, in some regions, prices of inter-terraces which are well-renovated and about 10 years old, are approaching the $4 million mark. With median prices in D28 for semi-detached homes at about $3.9 million, you not only have a buffer within the district from the newer developments, but you also have a Price Disparity between districts. These are good factors you would want to consider when entering any property.

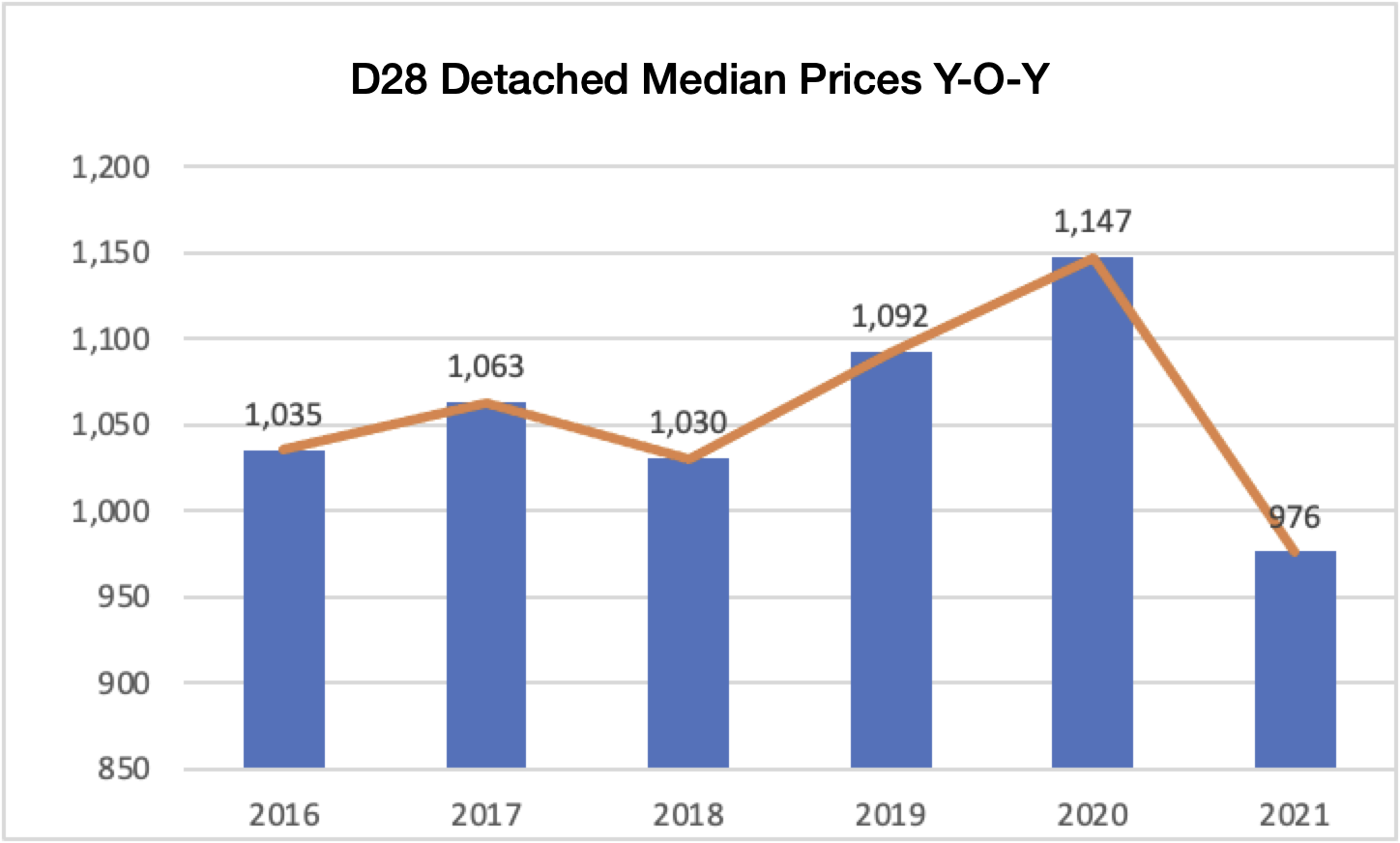

Detached

Detached houses are relatively unique in terms of their pricing analysis because there are so many variations of land plot size. They are also the most scarce supply of landed housing, which translates into having the least transaction volume. The drawback of that is that every transaction has a higher weightage and will move the median prices around more. This is very well presented in D28, where there is already a very limited number of landed housing units in the district. Thus, using PSF prices will be a more accurate analysis to determine the performance. The added scarcity of detached houses has affected the uniformity of price trends in this area. Generally, the PSF trend in D28 was in an upward trend from 2016 to 2020. The decline could be due to other districts gaining more traction, which is supported by the upward trend in the PSF prices of some popular districts. Added with the recent spotlight on the brand-new inter-terraces and semi-detached houses in D28, detached houses may be slightly overlooked in this area. However, this has, in turn, created a big Price Disparity for detached houses between regions. For your reference, median PSF prices for detached houses is $1,374 in D15, $1,296 in D16, $1,231 in D20 and $1,376 in D21. That’s a $300 – $400 difference in PSF pricing and is a Price Disparity that may potentially benefit those who are looking to buy into this area.

To put things in perspective with an example of a 5000 sqft land for detached housing:

D15 $1,374 PSF — Quantum: $6,870,000

D16 $1,296 PSF — Quantum: $6,480,000

D20 $1,231 PSF — Quantum: $6,155,000

D21 $1,376 PSF — Quantum: $6,880,000

D28 $976 PSF — Quantum: $4,880,000

The prices in D28 are being depressed with a $2 million difference in quantum compared to the other districts. For buyers who are looking for a permanent long stay or even estate planning for retirement, this is very significant. Because the $2 million can be put to use for renovation costs, future-proofing the home or even reinvesting into another property to gain passive income via rental yield. We believe that this is a good entry point for buyers, especially those who are looking for a rebuild possibility. This will indirectly benefit sellers because when there is a demand, prices will proportionally increase with the trend.

Strata Landed Houses

Though not exactly pure landed housing, it would still be considered by many who would want a compromise between a condominium development and a 3.5-storeys of floor area to live in. We have seen an increase in popularity with this type of housing among those who do mind not legally owning the land that comes with the house. Ultimately, the motivation is just to have more space and have that exclusivity of living in landed housing. At the same time, there is the added benefit of common facilities like pools and clubhouses. Some Cluster developments even offer private pools attached to the house. There are dedicated parking spaces. You do not need to fight with your neighbours for parking space by the road if you have guests over.

The reason we chose to bring up this topic in this review is that D28 is one of the districts with several Strata Landed Housing developments. Belgravia Villas, Este Villa, Cabana, the upcoming Belgravia Green and Belgravia Ace, just to name a few. These types of “landed” properties are very competitively priced because developers will analyse the entire landed market climate of that particular district and price their units to attract potential homeowners. The current quantum of inter-terrace cluster houses in D28 is around the range of $2.7 – $3.2 million, depending on floor area, availability of lifts, the facilities offered and the size of the development. Earlier, we mentioned that median prices for inter-terraces are at the $2.9 million quantum from the Research done by our Insights Team. This will then cause a dilemma for buyers when they are priced so similarly. Should I buy a pure landed inter-terrace and pump in some money for the renovation? Or should I buy something brand-new or relatively new(resale) with facilities, future-proofed provisions, ready to move in condition? This dilemma is becoming increasingly prominent in the current climate, and we have feedback from the ground that cluster houses sometimes make more economic sense. However, we believe that both pure landed houses and strata landed houses will have their own dedicated audience because there are homeowners who would still prefer to own the land that comes with the house.

Future Development

There are several land plots in D28 that are zoned as Reserved Sites. This potentially means that there may be redevelopment in the area. However, the specifics are not clear at the moment as there has not been any release of information on this. On a speculative basis, the likelihood of development will be commercial in nature. In order to support the activities of Seletar Airport and to further enhance Singapore’s Aerospace industry. However, if the reserved sites do become commercial areas, the landed housing will gain some traction in the rental demand amongst professionals working in the area. When rental demand rises, prices will rise in tandem because of the investment potential. Another factor that will further support the commercial development would be the good volume of public housing in the neighbouring districts. The residents in these areas will be a good supplement to the workforce needed to support such a development. Overall, these are still quite speculative in nature. We can only keep our eyes peeled for what is to come.

Our take

D28 is a very unique district with its pros and cons given its curated numbers of landed housing. We foresee that the newer developments will continue to be well sought after by potential homeowners. Brand-new and well made, and below the premium in comparison to the entire market, these are just some of the drawing factors that will attract buyers. This new influx of houses will, in turn, help along with the prices of the existing volume. Median prices for Detached houses in D28 are low enough to consider rebuilding and yet still priced reasonably across the whole landed market. This will attract those who want a tailor-made house to suit their needs. We remain optimistic about D28 and are curious about what is to come in the future, given the development potential. If you have any general questions or perhaps considering D28 for your next home, feel free to contact our consultants, and we will be more than happy to help you along the way. Till our next article, and we will catch you on our next Signature Home Tour Series! Take care.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice. PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.

PLB On Telegram

Home tours and property news — straight to your device.

Insights On Telegram

Fresh articles, market trends and news — right to your device.

Subscribe to our YouTube Channel

PLB Newsletter

Stay up to date with the latest property news and development

The PLB Seller Experience