With the recent developments of Singapore’s Property Market, it seems like everywhere is “Primed for Growth”. It does not help when there is so much information out there, and every piece of information on each area is overly enthusiastic. Surely, some places stand out more than others. We decided to take a look at District 20 to understand a little more, given the much-reported GLS sites in Ang Mo Kio Ave 1 and in the neighbouring Lentor Central. Why did the developers bid so enthusiastically for these lands? And is it really “Primed for Growth”? District 20 is one of the most highly sought after areas for choice of residence, which includes the towns of Thomson, Ang Mo Kio and Bishan. We are sure many will be interested in knowing the Insights into this District.

The GLS site in Question

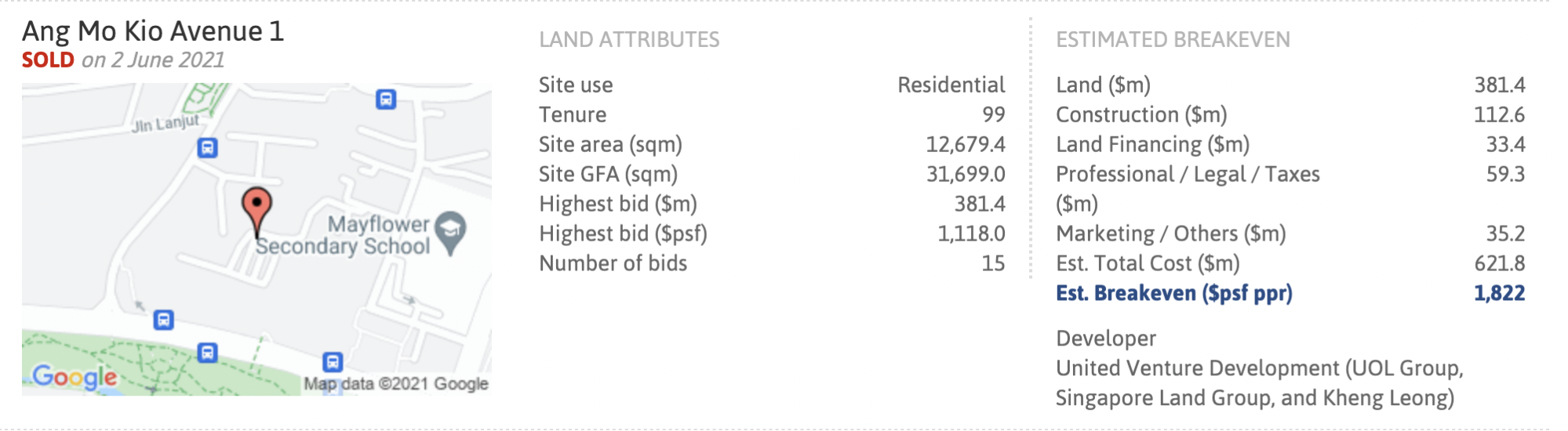

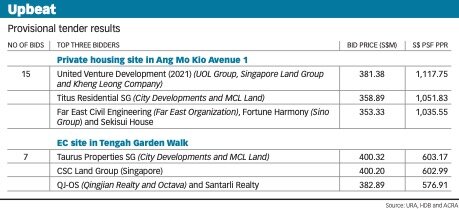

Before we get down to the significant numbers of this Government Land Sales (GLS) site, we would like to highlight that a total of 15 bids were made for this specific 99-Year leasehold plot of land. That is almost twice as many as another heavily reported GLS transaction in Lentor Central, which was successfully bidded by Guocoland . Another GLS site in Tengah, an Executive Condominium GLS site, also received 7 bids.

This disparity in enthusiasm draws down to 1 conclusion. Demand. In order to motivate developers to go through the process of bidding for the land, they first and foremost need to determine the profitability of the site that they would bid for. So in a sense, receiving more bids is a direct representation of the popularity of the area. The developers recognise that the demand for residential housing in District 20 has been very popular historically and do not seem to see it decreasing any time soon. Hence, the overwhelming number of bids for the land. There were two other developers that bidded above $10xx PSF PPR for the plot of land. Namely, Titus Residential SG (JV between CDL and MCL) and a JV between Far East Organization, Sino Group and Sekisui House.

After reviewing all the bids, the plot of land eventually went to United Venture Development, a joint venture between developers UOL Group, Singapore Land Group and Kheng Leong, for $1,118 PSF. As an estimate, after accounting for the various costs of development, the Estimated Break-even price would be around $1,822 PSF. This is before accounting for any profit margin set by the developers. A realistic overview of the expected selling price could possibly range from $2,0xx to $21xx. At this point, you may be wondering, “$20xx PSF for Ang Mo Kio? Am I seeing this right?”. Well, perhaps, perhaps not. If you have been keeping up with property news, surely you would have heard of the heated sale of Pasir Ris 8. Prices that started out gradual increased to an eye-catching $2,000 PSF. So the caveat for the Ang Mo Kio site would be that if there are consumers ready to pay $2,000 PSF for a unit in Pasir Ris 8, then $2,0xx PSF for a unit in a Central Area like Ang Mo Kio would probably be a steal! At this point, it is still speculation, but given the locale and the estimated prices, we foresee that whatever the theme of the project the developers choose, it will be highly contested come its launch.

Spillover Demand

It is understandable that the Ang Mo Kio GLS site was so popular since the last time a GLS site was released for residential housing in Ang Mo Kio was about 7 years ago in 2014. In these 7 years, if developers were interested in a potential plot of land in District 20, they would have to purchase it through an en-bloc sale. Take Jadescape, for example, the former Shunfu Ville. This further emphasises the demand and popularity of District 20 and plots of land within that are rare to come by.

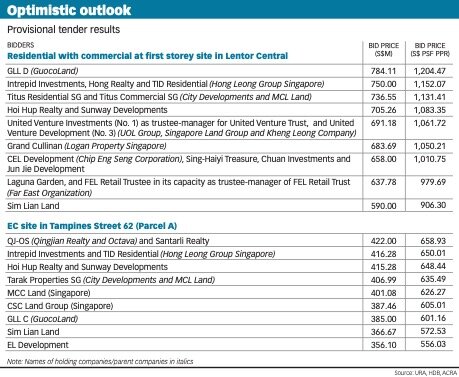

Hence, we do observe a spillover demand in the surrounding areas, such as this Lentor Central GLS site which was also a GLS site. The difference between this plot and the one in Ang Mo Kio is that it is zoned as mixed-use and is in the neighbouring District 26, just outside the borders of District 20. Likely to be an integrated development in combination with the Thomson-East Coast Line station of Lentor, this development will also be a highly popular option for those who prefer a less congested central area.

At this point, we would like to highlight that the date of launch for this plot of land was 15 April 2021 and the date of closing was 22 July 2021. The tender for the plot in Ang Mo Kio concluded on 25 May 2021. These dates are very significant as the developers that bidded for the Lentor Central plot would have referenced the concluded bids in Ang Mo Kio as a benchmark. If you have already noticed, the list of bidders for both plots of land are pretty similar. The enthusiasm of the developers is likely attributed to their hunger for replenishing their land banks, especially so in districts where land is not easily available. Overall, the enthusiasm of the developers is encouraging for those in District 20 that are planning to upgrade or change up their environment with New Launches.

Demand Demand Demand

Developers are not the only ones that observed the high demand for housing in District 20. The Housing Board (HDB) has also observed the same and has increased the supply of public housing in Mature Estates, such as Bishan, in 2020, by almost 50%. In the same article by The Straits Times, which reported this increase in supply, TST also reported that the subscription rate for choice areas like Bishan was 6.7 times as compared to non-mature estates, which were at 4.8 times. It seems like the move by HDB to increase the supply was much appreciated and needed for choice areas.

The demand is not only strong on the BTO front but also on the resale front. Resale Prices in District 20, Bishan Town, have gradually increased over the years with supply maintaining steadily throughout. Understandably, those who failed to be selected in the lottery pick for BTOs have to turn to resale to avoid further wait times. Given the large number of people wanting to secure a flat in the area, prices naturally gravitated upwards in order to appeal to owners to sell their flats to prospective buyers. Thus, fueling the market and some record-breaking transactions such as the 5-Room HDB flat in Bishan, which was sold for $1.295 Million. Given the enthusiasm in the market, those who profited from the sale of their HDBs are likely to want to upgrade into private properties, which has fueled the private market. Hence, the enthusiasm from the developers for both the Ang Mo Kio Ave 1 and Lentor Central sites. District 20 is the perfect example of how a cascading stream of demand could positively benefit the entire market.

Prices in District 20

Perhaps you have profited from the sale of your prime HDB flat, or perhaps you may be interested in a change of environment to District 20. What are some of your options?

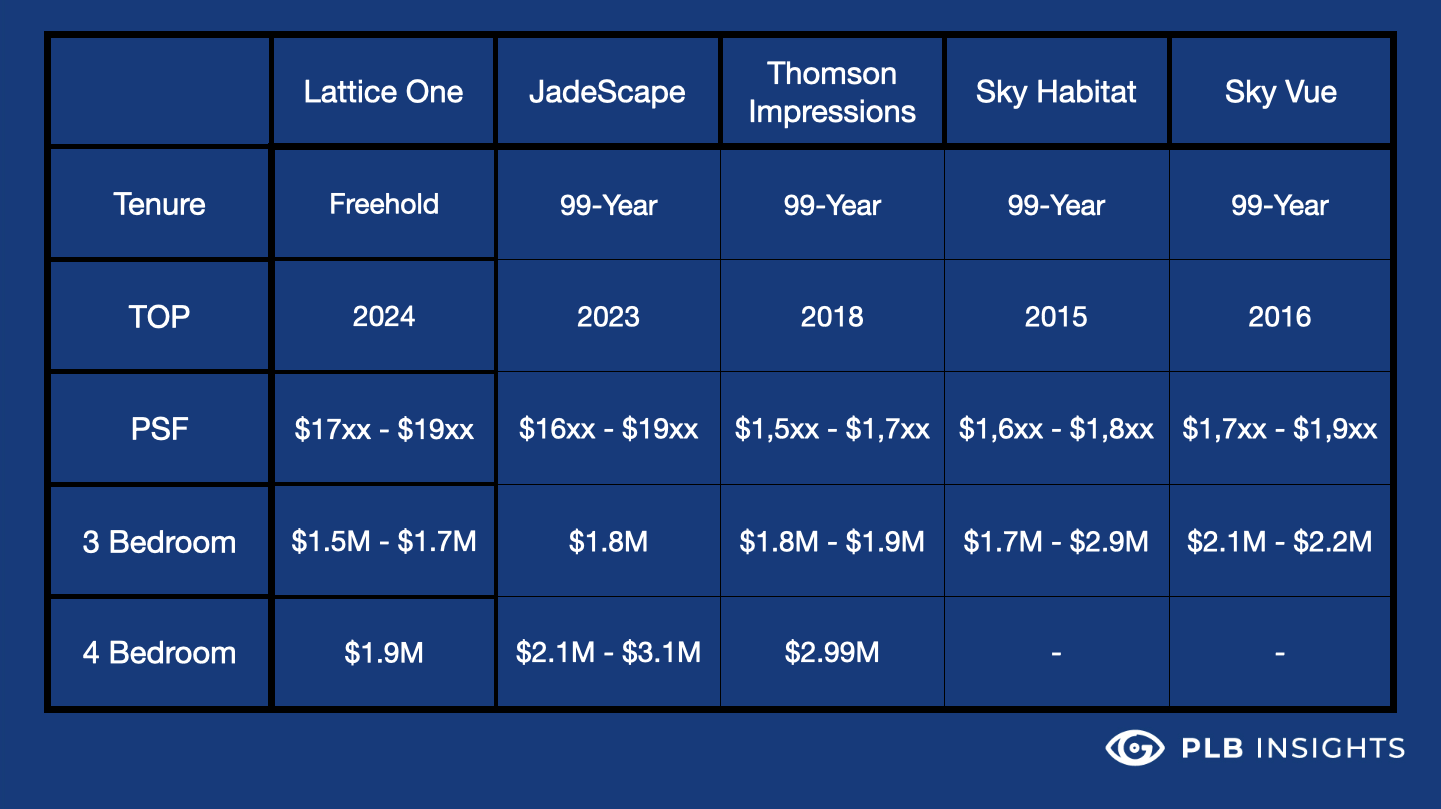

We reviewed some of the more notable developments, New and Resale options around the area, which you may be interested in. The only Freehold New Launch option is Lattice One, a 40 unit development that has sold exceptionally well recently. Only 9 units remain at the time of writing. The other developments that we reviewed are mid to high-density projects, which range from 288 units (Thomson Impression) to 1206 units (JadeScape).

View Remaining Units

In the earlier part of this article, we mentioned the future potential prices for the Ang Mo Kio Ave 1 GLS site, which could possibly see PSF prices from $20xx to $21xx after accounting for profit margins. The prices mentioned in our research are reflective of what is available in the current market. If we were to compare on a Price Quantum basis, Lattice One, at $1.5Million onwards, along with its Freehold land tenure would appeal to many checkboxes. Noting a disparity in comparison to other 3 bedroom units priced at $1.8Million to $2.2Million in a similar District zoning.

Given the current trajectory of the Ang Mo Kio GLS site, if launched at $20XX, a 1,000 Sqft unit will be priced at about a $2Million price tag. This will create a new range of prices to be introduced to the District, and this will potentially support the increase in prices of the current supply in the District.

Our Take

The one conclusion that we can draw from this is the increasing land cost that will potentially push the barrier of entry to the District higher. As we have dutifully and constantly mentioned, timing the market is not advisable, especially in an enthusiastic and fast-moving market. Given the recent developments from the GLS sites in Ang Mo Kio and Lentor, we are excited about the developments in District 20. We believe that the demand for this District will only continue to grow as more look to central areas for their own stay. Prices within the District are still well within a reasonable range given its locale. If you may be interested in this District or even a specific development, feel free to contact us for a second opinion. We would be more than happy to share further on the prices that we have compiled and, at the same time, elaborate on the developments we have highlighted. Till our next article, we will catch you on one of our Signature Home Tour episodes, Take Care!