As a homebuyer, District 19 may be perceived as family-friendly as it encompasses a large area of the north-east region which includes Serangoon, Hougang, Sengkang, and Punggol. Both Serangoon and Hougang are considered more established towns with a full range of amenities for residents.

Our Concept Plans and Master Plans are updated regularly so that our scarce land resources are equitably planned and allocated. It is especially important as this gives clarity to everyone for land use decisions. Notably, the Government continuously invests huge amounts of resources to improve the infrastructure like MRT network, amenities and green landscapes so that the country and residents’ living environment are improving. In another article we have discussed the price trends for condominiums in proximity to MRT stations. We reflected that the proximity to an MRT station does play an important role in the property’s value, but to some degree.

In the past, we have also seen a small number of developers see D19 as a favourable location. 2017 and 2018 were good years for en bloc sales, with more than 60 projects put up for collective sale in a sudden spike from previous years, before the property cooling measures introduced by the government in July 2018 put a curb to it.

For instance, private housing developers began to seek collective sales opportunities within D19 in 2017. In Hougang, the 99-year leasehold Rio Casa, a privatised HUDC estate, was sold for S$575 million to a joint venture company Oxley-Lian Beng Venture.

However, with the recent government’s decision to moderately increase the supply of private housing on the confirmed list, we believe the measured approach taken by the government could ironically encourage developers to turn to en bloc sales instead. Presently, it remains yet to be seen if developers will throw caution to the wind or remain conservative.

In the last five years, we have witnessed a few districts had high price growth. So what are some developments in this district for you to explore? Specifically, Punggol in District 19 will be designated to be a Town Hub as it will be an integrated community hub featuring a regional library, hawker centre, community club, child care centre and health service centres. With its central location and ease of accessibility to the city center, this town is a sought-after area for buyers. In the 2019 Master Plan, the Government has also planned to develop a new employment node at Lorong Halus. With the development of Punggol Digital District and Sengkang West, residents from all the towns in the North-East will have more choices for jobs near homes.

These upcoming new plans in district 19 also means that residential homes will potentially continue to enjoy upside in coming years. So far, District 19 has seen good growth, and is likely to remain the darling of local investors. In this article, we will find out how they have performed, why it is one of the popular districts and why prices are likely to remain resilient over the next few quarters.

No doubt housing prices across Asia-Pacific are surging in some cases. Many are taking advantage of continued pandemic-induced stimulus, while international investors are looking for a place to put their money. Singapore, known as the Asian financial hub and for its high cost of living, has emerged as the most expensive place to buy property, according to CNBC’s research. To get a better picture of where real estate prices are going in Singapore, we will also be comparing median sale prices of one to four bedroom private residential properties in District 19 specifically.

Courtesy CNBC

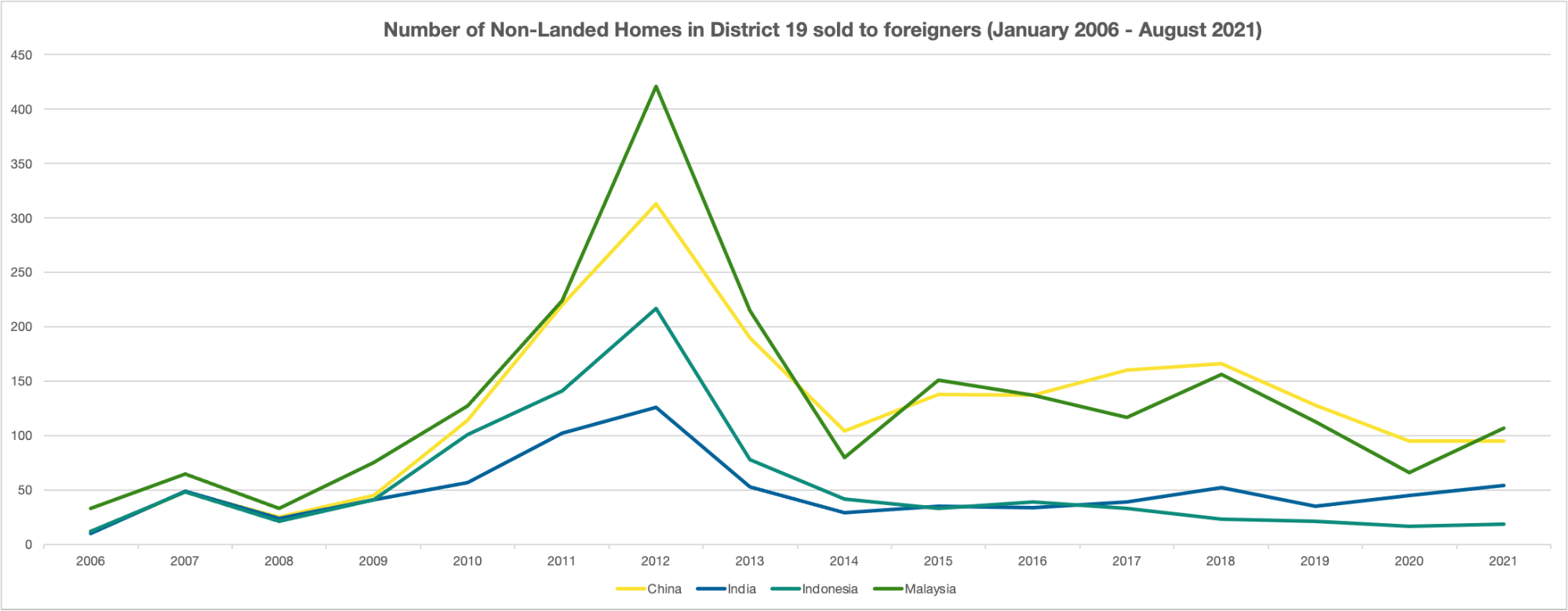

We have also discovered that foreign buyers purchase the most homes in locations like Buona Vista, West Coast, Clementi New Town , Sengkang and Punggol. This is evident from URA data dated from January 2006 to August 2021. District 19 (Serangoon Garden, Hougang, Punggol) was popular among foreigners. We found out that this trend is led by the Malaysian, which is the largest group of foreign buyers in District 19, accounting for almost 25% of property transactions by foreigners in the past 20 months. They bought 173 homes in District 19. Chinese buyers, the second largest group of foreign buyers, also show a preference for District 19.

Image courtesy URA Realis

As for District 19, the high number of transactions could stem from the fact that it encompasses a large area of the north-east region, which includes Serangoon, Hougang, Sengkang, and Punggol. In the past, many foreigners bought luxury properties. But in recent years, more foreigners seem to be moving outwards from the city centre to the city fringe and suburban areas, possibly due to the price affordability of these properties.

We reflected that the prices of properties in Singapore have proven to be resilient despite the current pandemic. It might be possibly due to the fact that these buyers are increasingly convinced with investing in good long-term assets. We think the properties in good locations/districts like D19 are generally of good holding value in spite of the macroeconomic uncertainties. Also, Singapore as a key financial centre in Asia, it is no wonder many foreigners would be reassured of the stability and assurance of home ownership here.

While the returns from property investment are not comparable to emerging cities, Singapore sure makes up for it in terms of political and financial stability.

How do the private condominium properties in District 19 generally fare?

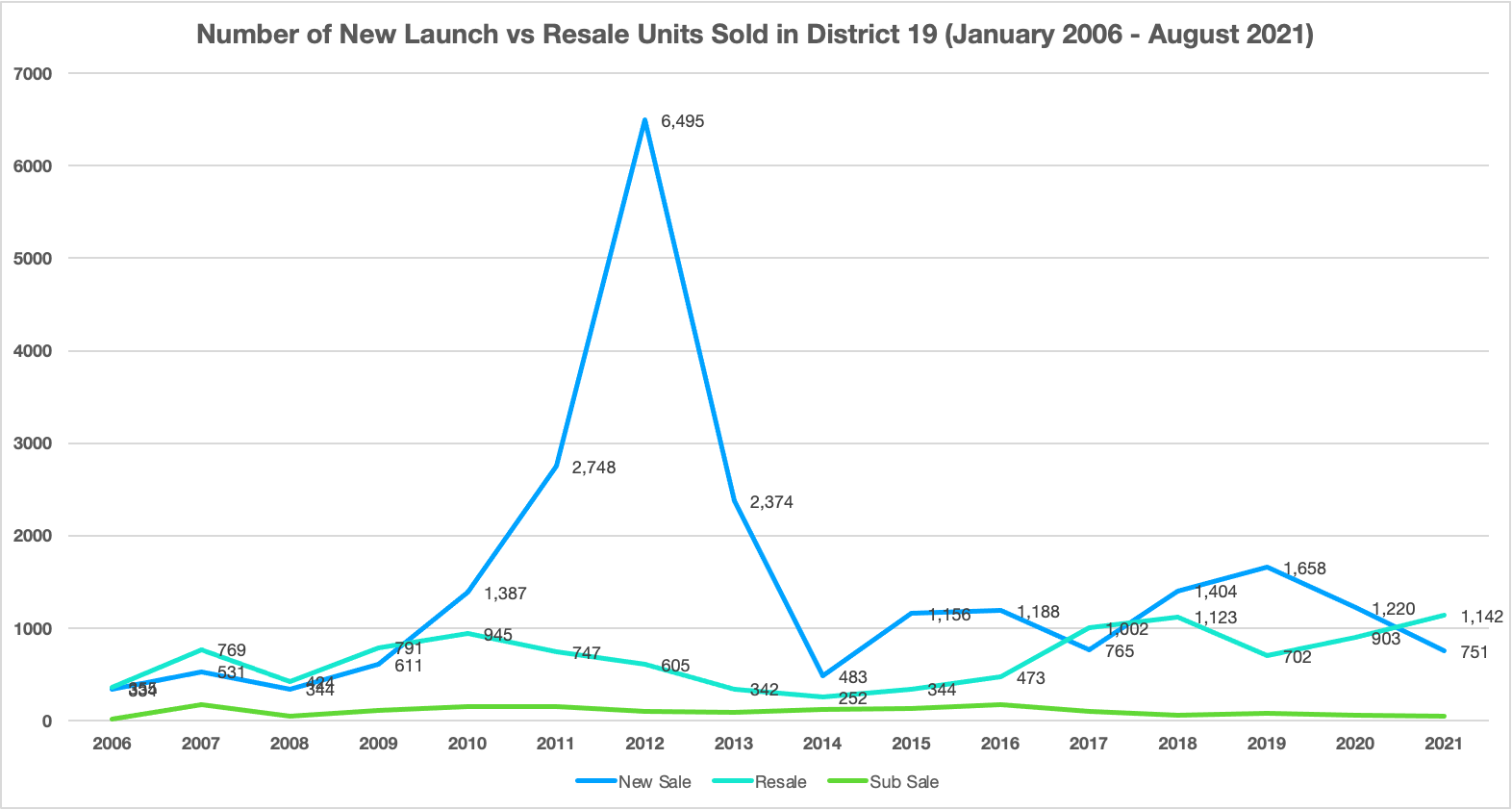

What happened in the past decade was the huge number of transactions accumulating. With a volume of nearly 6,500 new sale transactions in 2012, it’s more than twice the number of transactions in full-year sales from 2019-2020. 2012 saw some mega projects and integrated development launches. That would explain strong sales generated as condominium projects linked to an MRT station and with a sizable commercial component are generally good long term investment assets.

Image courtesy URA Realis

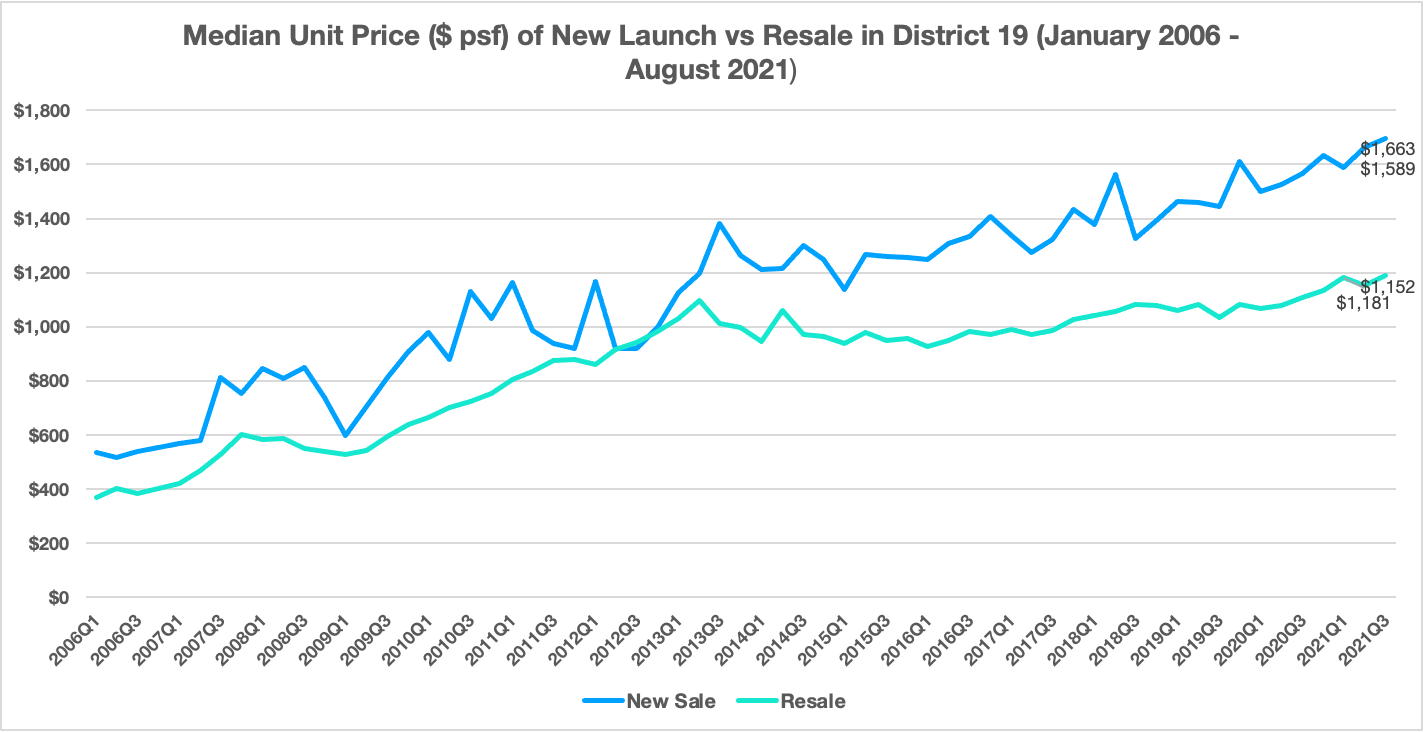

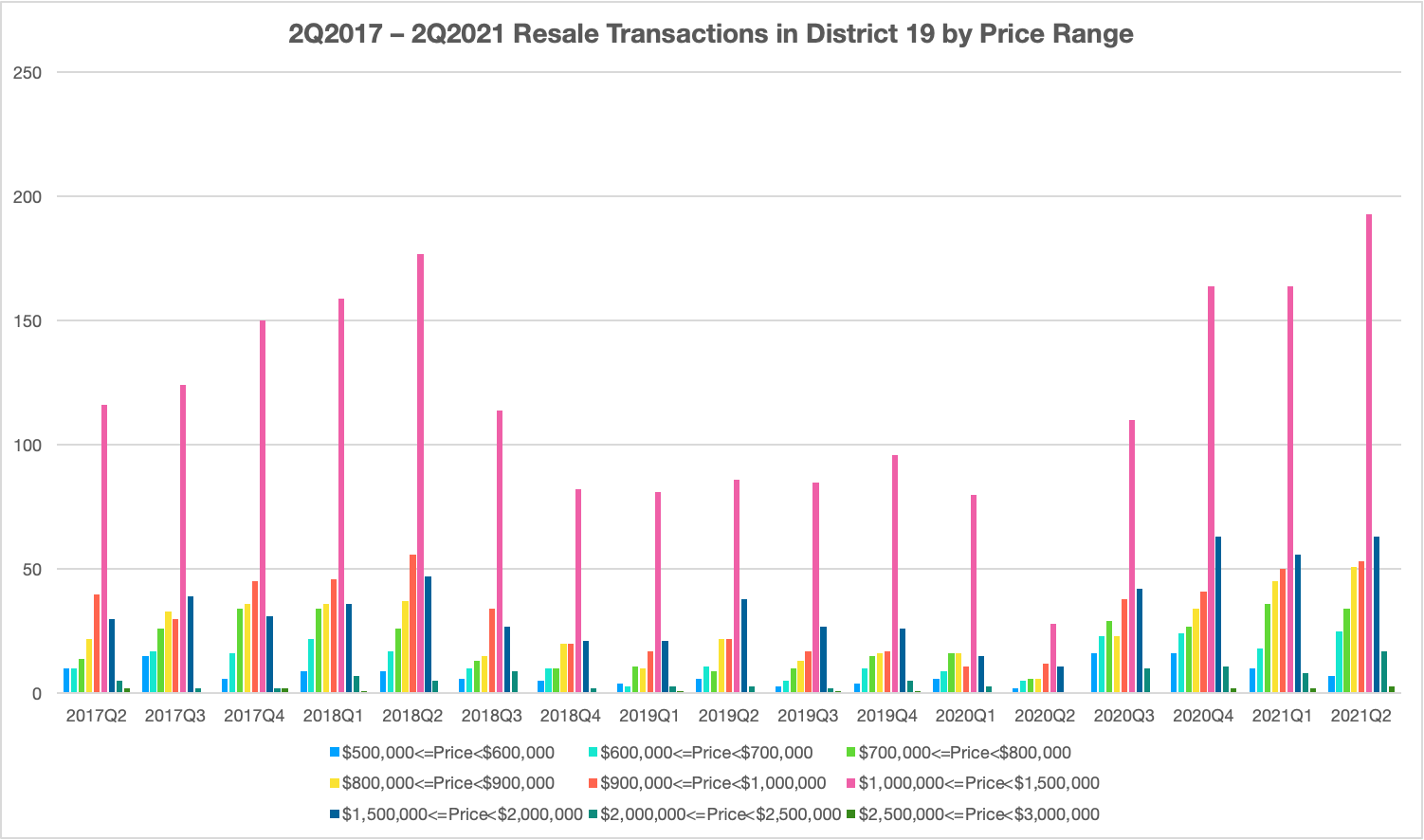

Based on the charts, we have also noticed that the resale market revealed a rebound after a two-year hiatus. Vaccine optimism and an anticipated global economic recovery renewed investor confidence could possibly explain this surge in property buying activities and an uptick in sales.

We observed demand for private resale condominiums in specific, rose strongly amid the pandemic. According to caveat records from the Urban Redevelopment Authority (URA), 1,142 private non-landed homes excluding Executive Condominiums were sold in District 19 this year to date. This is more than the 903 units moved last year and higher than the 702 units sold in 2019.

The good sales performance that we are seeing now is in stark contrast to the third quarter of 2018 when resale volume dipped quarter on quarter after cooling measures were implemented. Resale demand remained low and recovered since 2019. Hence, the sales turnaround is a positive sign for the secondary market.

Many buyers have been struggling to find new homes in the suburban areas since supply has been diminishing. We expect the supply will likely remain low as most developers have yet to replenish their land banks. The land supply in the suburban and city fringe has reduced to a new low since the end of the collective sales cycle in 2018. Thereafter, we have observed a few successful en bloc deals, and supply from the government land sales have been kept at a moderate pace.

Could there be potential for further price growth in D19?

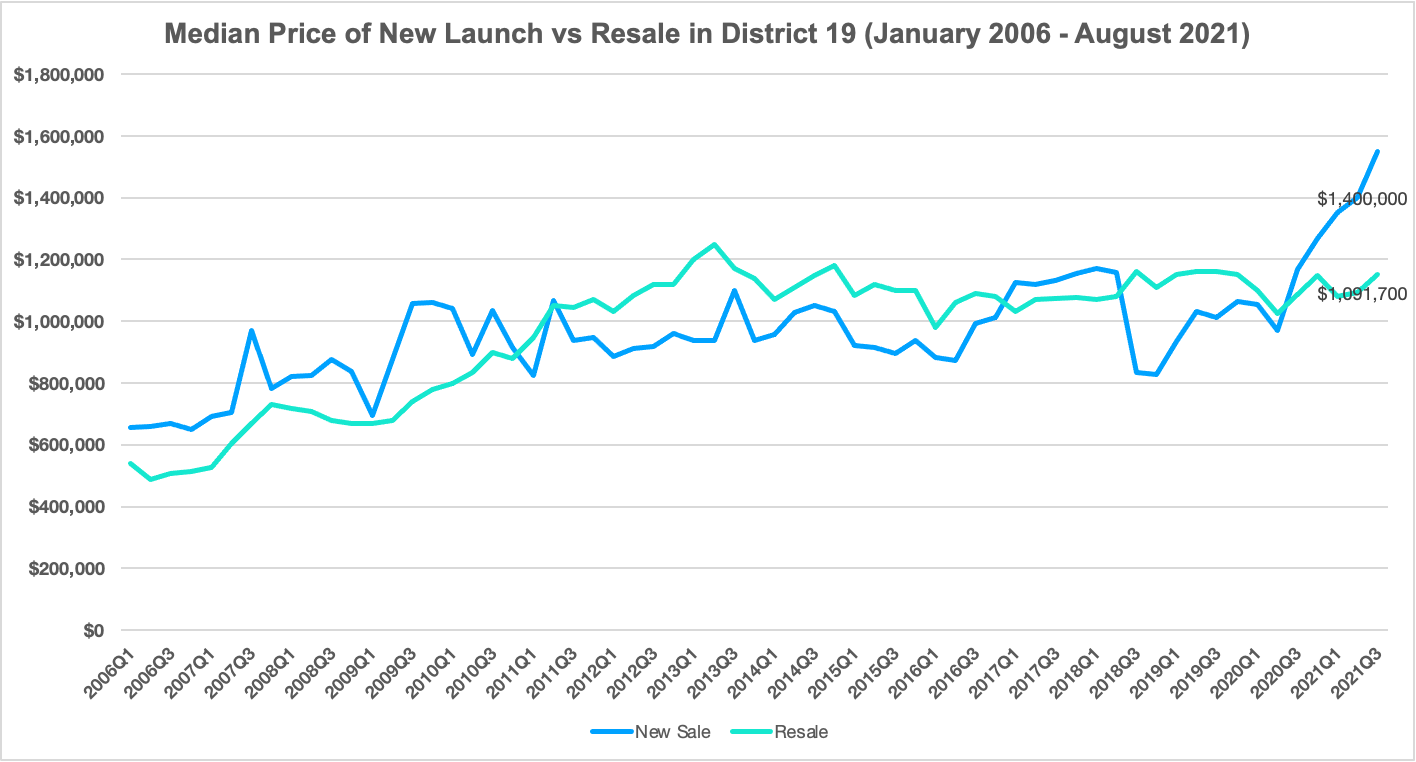

Image courtesy URA Realis

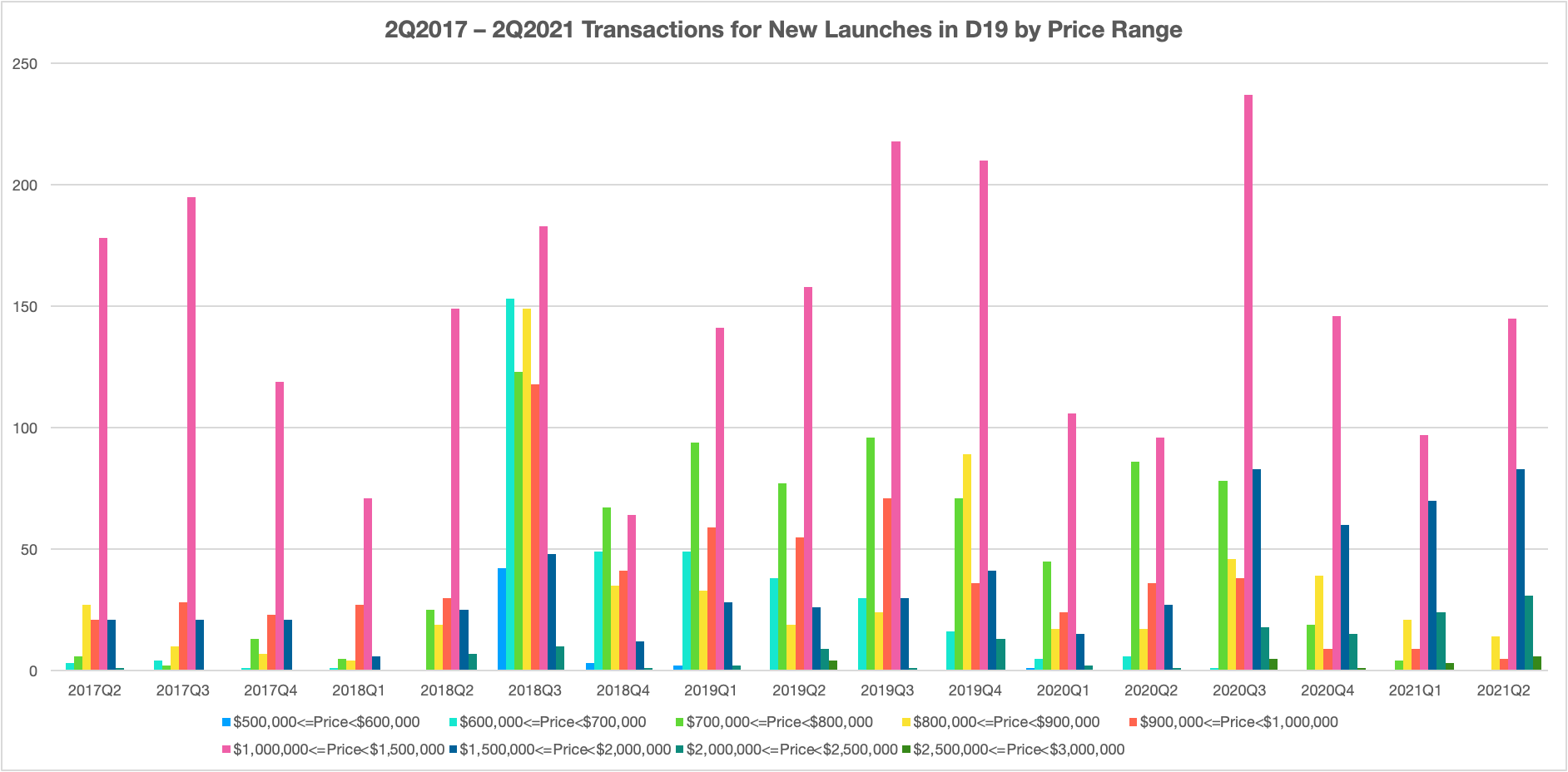

New launch condominiums drove demand for units in the secondary market in January this year with resale units being relatively more affordable. Our chart implies that some buyers have turned to the resale market as prices of new homes have been rising in recent months. Many buyers are entering the resale market now as they may be expecting prices to rise further since Singapore is likely to perform better this year.

Looking at the charts, we think resale prices could continue to inch up, but likely at a slower pace compared to new launches in view of underlying demand. The surge in resale volume which we spoke about earlier, could have ignited a price recovery. Compared to Q2 2020, resale condominium prices in D19 rose 6.5 per cent in Q2 2021 to $1,091,700. From Q2 2020 to Q2 2021, new condominium prices grew at a much faster pace of 44.1 per cent. As a result, the price gap of new and resale condominiums in District 19 widened further to 28.2% in Q2 2021. Therefore, we believe some resale condominiums could be undervalued, and there could be potential for further price growth.

Image courtesy URA Realis

For the longest time, areas like Punggol and Sengkang have had a reputation as remote, inaccessible, and lacking in amenities, but it has all changed with upgrades like the Punggol Digital District in the future.

Despite the area facing an oversupply at this present stage, we do think District 19 will see further pick-up in the future. As part of the Master Plan, this district especially the Punggol Digital District will be Singapore’s global hub for smart businesses. Otherwise, the price movement for new launch and resale properties does show that the demand in the area is pretty strong – with prices rising 8.9 per cent and 6.8% respectively in a year on year basis.

2006 – 2021 District 19 Price Performance By Tenure

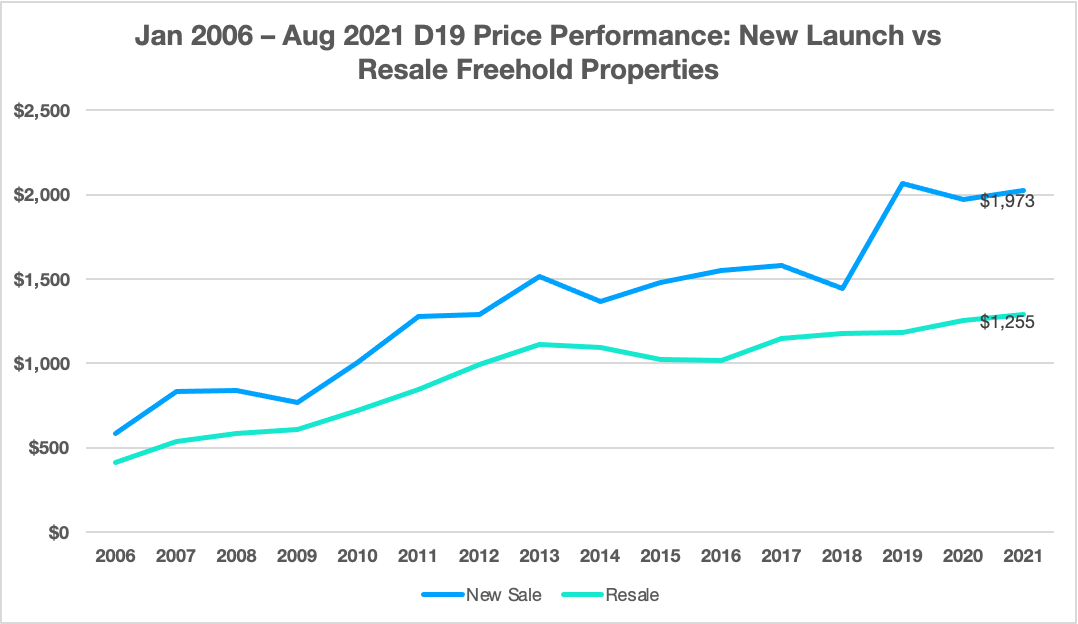

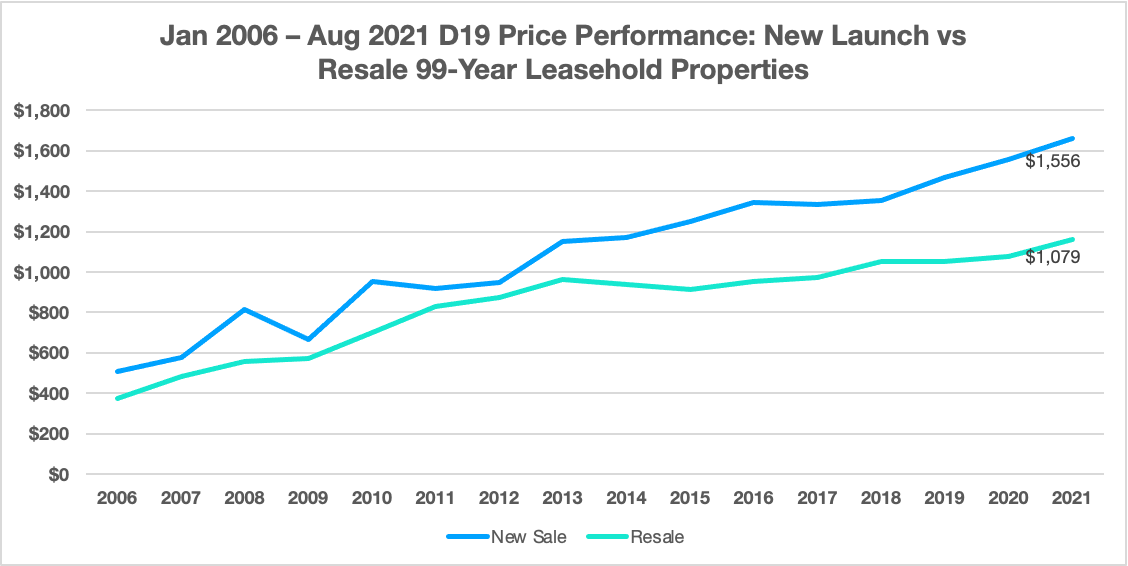

Unarguably, it would be beneficial for Singaporean homebuyers to consider freehold property an asset for wealth preservation and a good hedge against inflation. Let us take a look at the price performance of these condominiums by tenure over the past 15 years.

In terms of price appreciation of freehold properties, the median price transacted of around $1,900 psf is quite expensive considering that these are freehold properties located in the outside central region.

Image courtesy URA Realis

Image courtesy URA Realis

Our charts revealed that when it comes to freehold properties, the new launch also consistently outperformed the resale properties based on median unit price in psf.

Image courtesy URA Realis

Image courtesy URA Realis

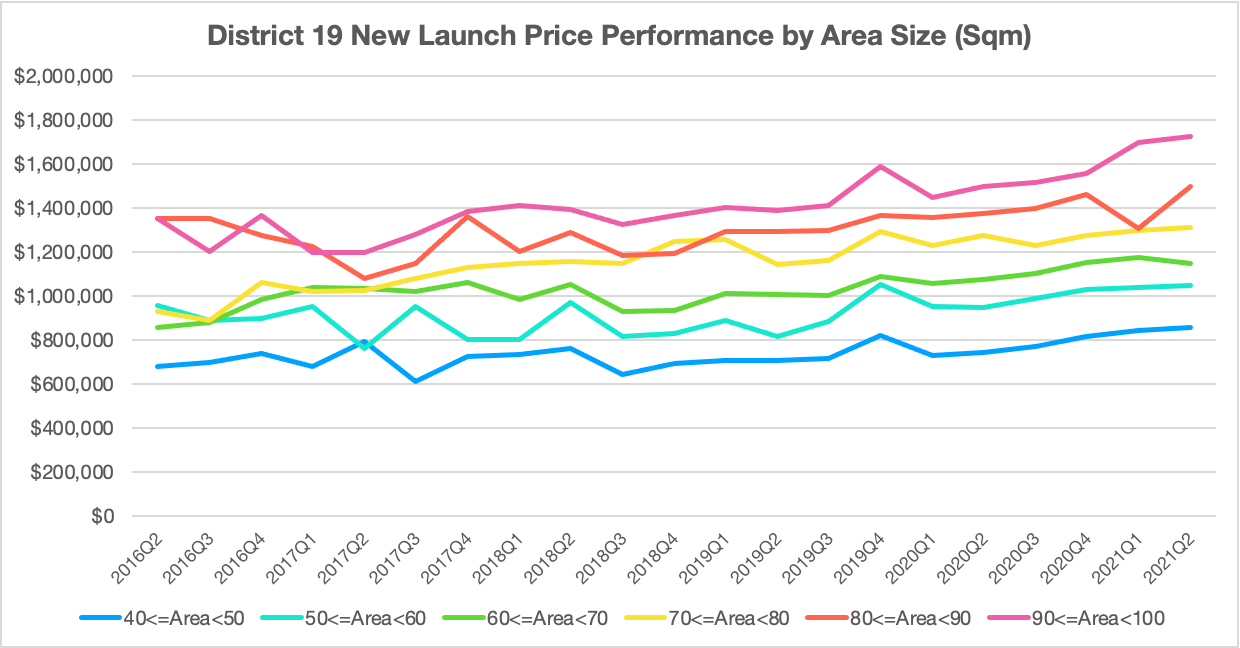

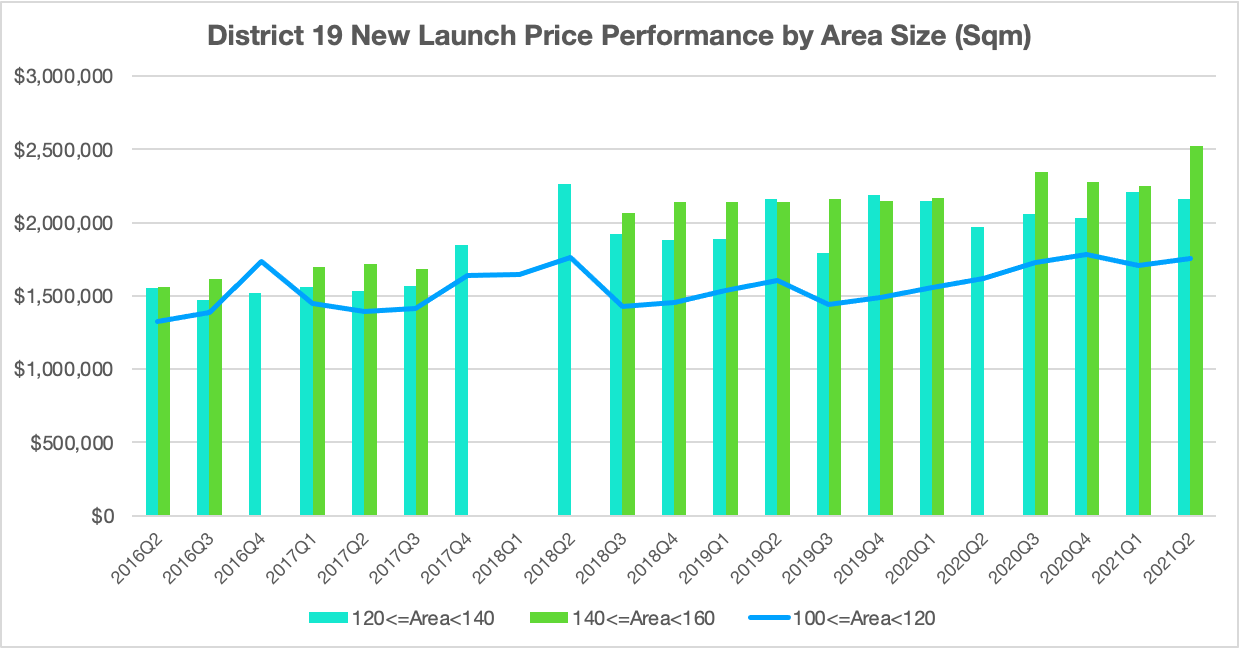

We discovered that the prices tend to fluctuate significantly and perform fairly well over the years as the unit sizes get larger especially for 90 sqm and above. Therefore, some of these condominiums present attractive investment opportunities for buyers.

Image courtesy URA Realis

Image courtesy URA Realis

According to the URA data released, it implies that demand for larger living space has also picked up as more are working from home, so some are going for larger units in the resale market as these are more affordable than new units many upgraders, especially those who have sold their flats recently, turned to the secondary market to find replacement homes.

Predominantly, the market continues to be driven by larger units going at median transacted price range of $1million to 1.5million, though there seems to be growing demand for 2 or more bedroom units with higher quantum in District 19. You might also be wondering what are some of the D19 top-selling developments in recent years, which we will be presenting you next.

Jan 2016 – Aug 2021: Resale versus New Launches Sale Transactions

District 19 is one of the districts within the Outside of the Central Region of Singapore. It comprises a few neighbourhoods such as Hougang, Serangoon and Punggol.

Jan 2016 – Aug 2021 Selected Projects with New Launch Units sold in D19

The Stars: Top Selling Projects are Sengkang Grand Residences, The Florence Residences, Riverfront Residences, Affinity at Serangoon, Kingsford Waterbay and The Garden Residences. Clearly, the top selling projects continue to be dominated by the very large developments exceeding 1,000 units.

The most expensive new launch condominium in D19 is The Gazania with an average price of $2,043 psf, followed by The Lilium at $2,022psf while the most affordable condominium in D19 is Flo Residence with a median price of $904 psf. The Gazania and Lilium are freehold properties which were launched in 2019 and expected to TOP in 2022. Considering they are in an OCR region, we would think that these condominiums have a relatively high price entry point.

Over the past 5 years, the most expensive resale condominium in D19 is The Tembusu, a freehold development with a transacted price of $4,600,000 made for 3885.8 sq ft on 3 Aug 2020. With District 19 being one of the largest and most popular neighbourhoods in Singapore, we can expect to see strong demand continue for the rest of 2021 from young families and upgraders from the Punggol, Sengkang and Hougang estates.

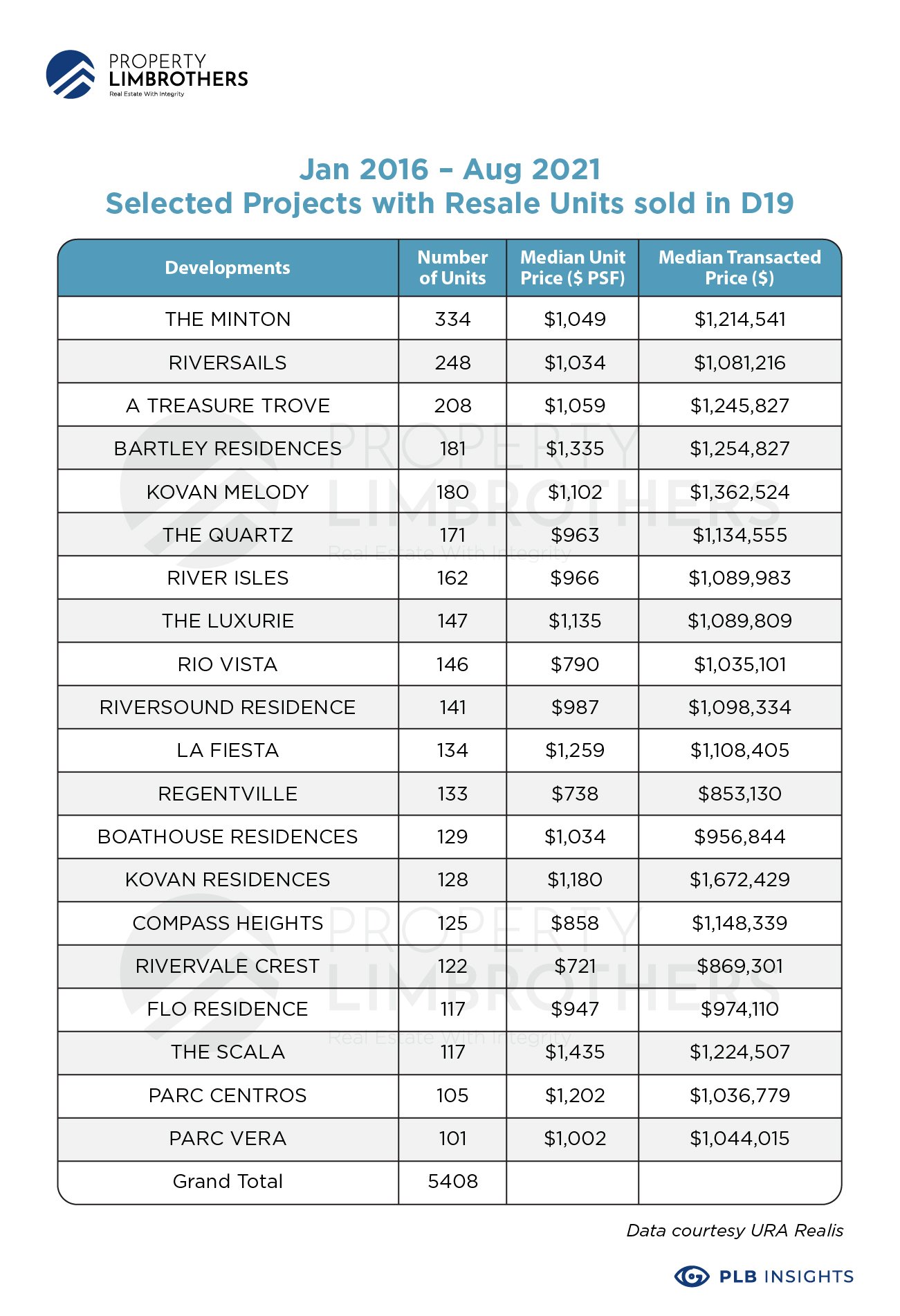

Jan 2016 – Aug 2021 Selected Projects with Resale Units sold in D19

Most of the top-selling projects were attractively priced; transacting below the S$1,335 median price for resale condominiums in District 19. As supply of new homes remains limited in the suburban and city fringe areas, we expect demand for resale homes to remain resilient. Buyers looking for affordable homes may turn to the resale market in this district.

Future Development

Condo buyers may perceive D19 as family-friendly with renowned schools that cater to different levels of learning such as Rosyth School (Primary) in Serangoon North, Holy Innocents’ High School in Hougang, and Nan Chiau Primary and High School in Sengkang all located in the district, as well as the French international school Lycee Francais de Singapour. The Singapore Institute of Technology (SIT), the Republic’s fifth autonomous university, will establish its permanent campus in Punggol in 2023.

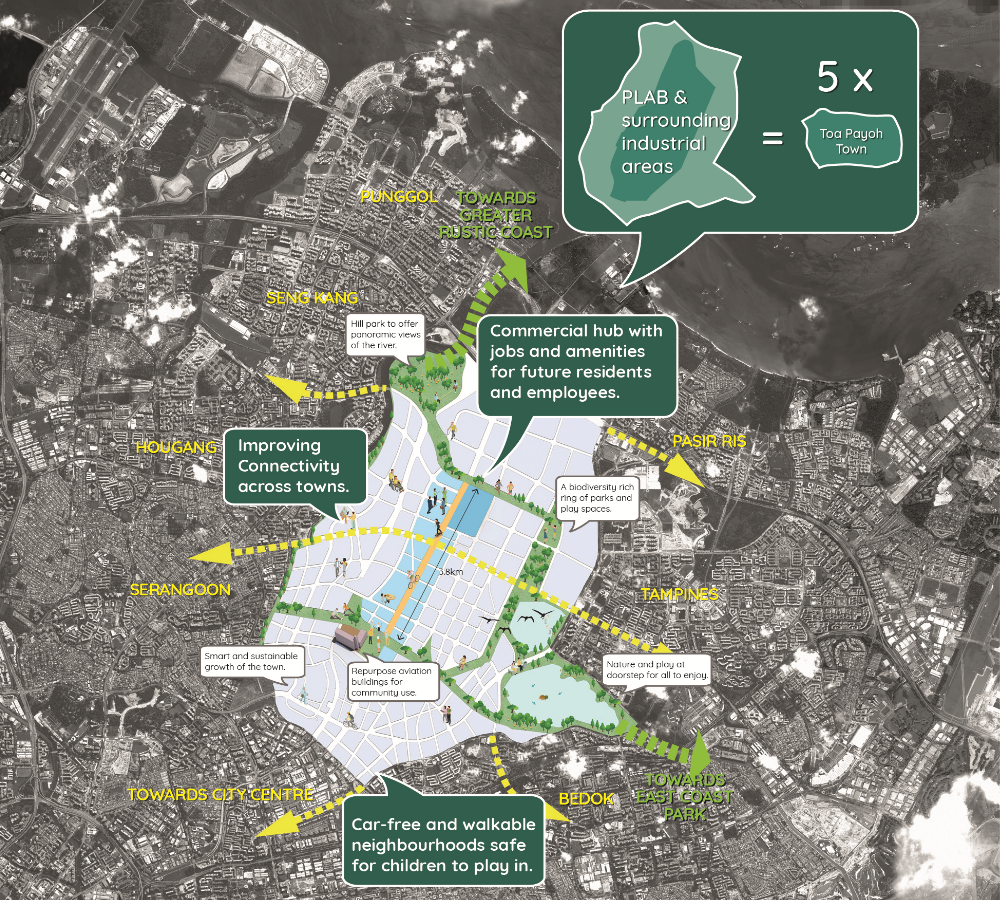

Incidentally, SIT will be located within the proposed Punggol Digital District business park, which is identified as a Growth Area by the Urban Redevelopment Authority. Like the Jurong Lake District and Paya Lebar Central Growth Areas, the prospect of a business hub in D19 might raise the appeal of living there and further boost the area’s demand for housing.

Future developments aside, 2018 was a landmark year for D19 with the opening of the Sengkang General and Community Hospitals. D19 is one of the few districts that offer a comprehensive suite of medical services. This and other key amenities are evidence pointing towards the fact that D19 is transforming into a fully self-sufficient place to live.

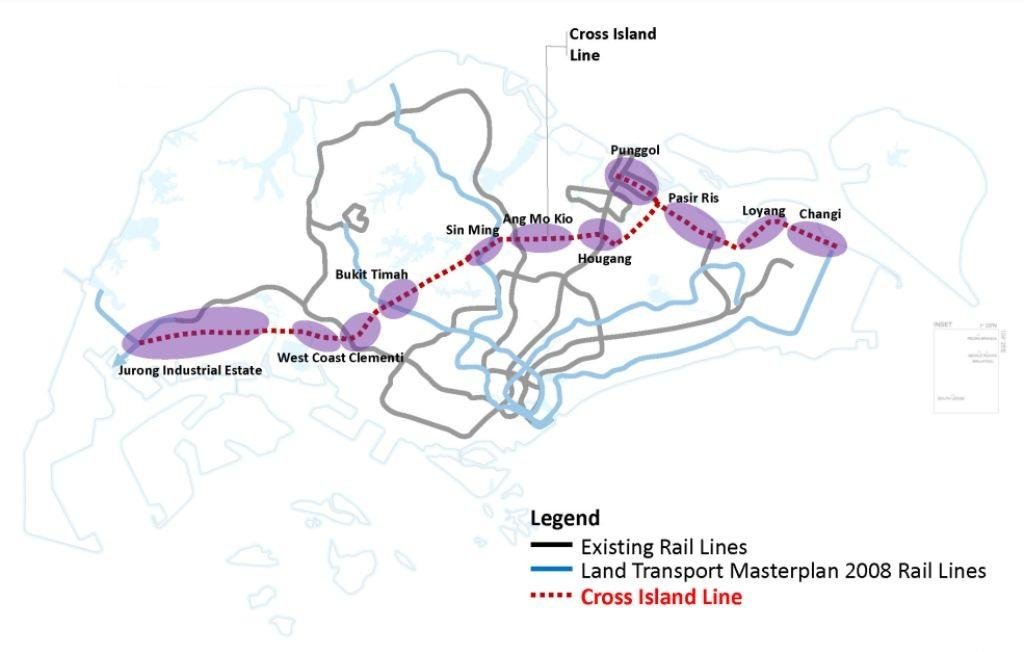

In addition, we also have Lorong Halus Industrial Estate that will be progressively developed as a Food, Lifestyle and Logistics cluster, next to the upcoming Defu MRT Station on the Cross Island Line. It will be catered and designed to be pedestrian-centric, with access to waterfront parks and open spaces for workers and nearby residents to enjoy.

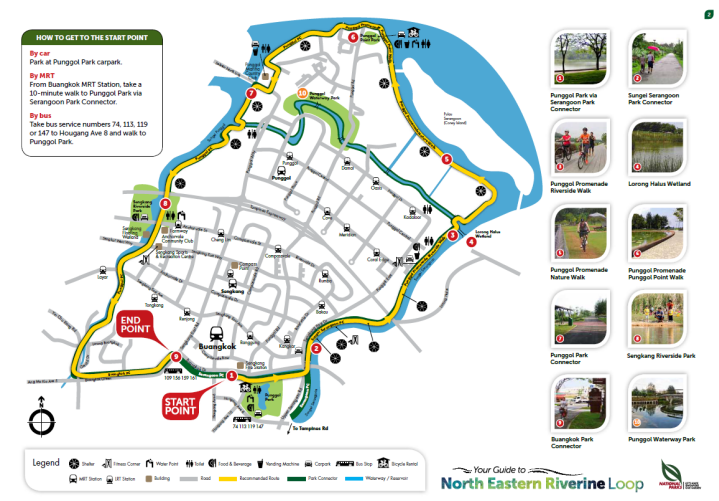

For outdoor-lovers, you will be delighted that there will be a 26km North Eastern Riverine that links four parks and runs through the heartlands of Buangkok, Sengkang and Punggol. This Riverine loop is Singapore’s most scenic park connectors alongside reservoirs and waterways and to the open waters of Sungei Dekar and the Johor Straits. In hustle and bustling living, you may like the idea of staying near the scenic park connector.

Image courtesy National Parks

The upcoming transformation in Hougang and the upcoming Cross Island Line (CRL) that brings one from east to the west region is also one of the key highlights in District 19. Residents in Hougang will enjoy the connectivity, not forgetting that Riverfront residences are within walking distance to existing Hougang MRT station (NE14) and upcoming Hougang Cross Island MRT Line.

Image courtesy URA

Transformation of Paya Lebar Airbase New Town: With the relocation of Paya Lebar Airbase from 2030 onwards, the airbase and its surrounding industrial developments can progressively be transformed into a liveable and sustainable new town.

Image courtesy URA

Our Take

Singapore’s housing market is one of the sectors that are defying gravity. Despite the pandemic, we observed healthy sales for landed properties and the private and Housing Board markets.

We expect housing demand and buying sentiment to pick up further in the coming months on growing vaccine optimism and potential macroeconomic recovery. On a macro level, we have seen many economies could emerge stronger from the worst global recession, although some are expected to bounce back faster than others. Some may have observed a K-shaped, bifurcated recovery where some sectors are rebounding more quickly than others and it is something we are experiencing now.

In the real estate market, with a healthy net absorption of new homes over the past three years, we have seen the higher take-up numbers against a conservative supply have resulted in fewer unsold, uncompleted private homes across all market segments. The cumulative number of unsold units may be nearing its peak, and could start receding this year. With diminishing stock and the improvements in the macroeconomic outlook, hence we believe home prices may continue to prop up for the rest of the year.

As we have discussed in another article separately, the prices of private homes increased quarter on quarter by 2.1 per cent in the fourth quarter of last year, based on the data released from the Urban Redevelopment Authority, after rising 0.8 per cent in the previous quarter. Overall private home prices rose 2.2 per cent for the whole of last year. These data suggest that the broad-based trend is likely to continue for the rest of the year.

We know for sure house price growth can be a good thing for the economy because people who already own homes feel richer and they can spend more due to the valuation of their assets. While the returns from property investment are not comparable to emerging cities, Singapore certainly makes up for it in terms of stability and assurance of ownership.

At the end of the day, doing your own market research and understanding the dynamics at play will help you pick the right condominium for investment and most importantly avoid losses when you do sell them later.

We hope that with our article on the District 19 non-landed property market, you will have a better understanding of the performances and trends in the area. Stay tuned for our next PLB latest research and featured insights! For those who are interested in finding out more or would like to start planning for your property portfolio, you may contact our PropertyLimBrothers team! Take care.