Geylang has been a happening locale with a history and a compelling story. Across the history of Singapore, these back alleys have been the start and end of many secrets. However, its time as a red light district in Singapore is close to the end. The pandemic has caused many brothels in the area to move out into other areas in Singapore.

Perhaps what Geylang is known most for nowadays is the sinfully good food. With the reputation of Geylang in District 14 getting “cleaner”, could it possibly offer some great opportunities for residential and commercial activities?

District 14’s close proximity to the CBD makes it an attractive location. In District 14, we can find many freehold studio suites. The Aljunied, Paya Lebar, Geylang area is home to many of such options. In this article, we will be covering Shophouses in District 14. Are they a better option now in the post-pandemic world?

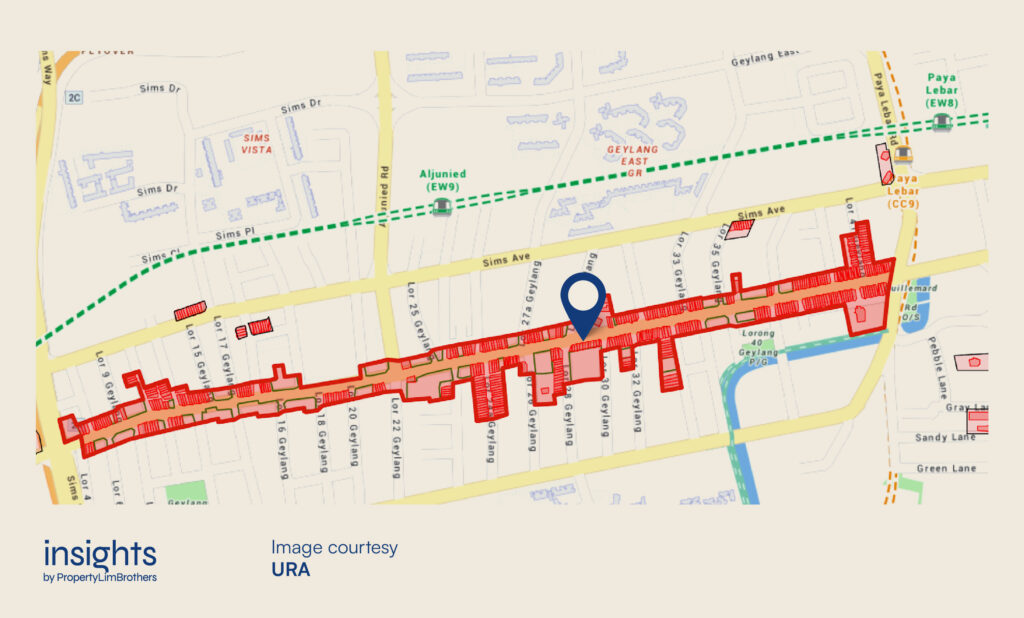

Where are the actions for D14 Shophouses?

District 14 is much larger than just the Geylang area. Although it is the main area where conservation shophouses are found in the district. The Geylang Conservation Area covers most of Geylang Road. Yet, there are still a handful of shophouses along Geylang Road that are not within the conservation area and some lie deeper into the Lorongs.

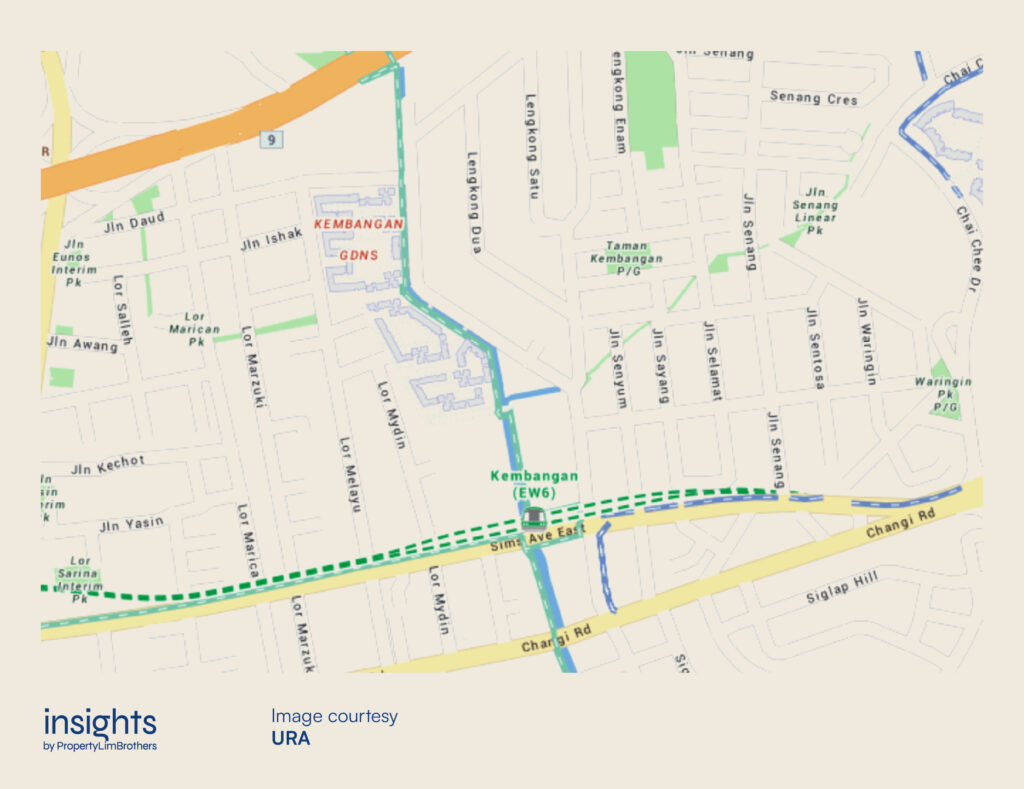

Atrium Residences also has an interesting shophouse marked on the map above. Other Shophouse areas that do not fall under a conservation status include parts of Changi Road, Guillemard Road, Sims Avenue, Geylang Road, some Lorongs in Geylang, Jalan Kembangan, Jalan Masjid, and Jalan Ismail.

While a lot of the transactions are taking place around the Geylang area, there are also some transactions further east, near the Eunos and Kembangan areas. This includes Changi Road, Jalan Kembangan, Jalan Masjid, and Jalan Ismail. These other areas of D14 account for around a quarter of the shophouses transactions in this district.

A bulk of the transactions are still located along Geylang Road, be it conservation or not. One of the appeals of the shophouses in D14 is that an overwhelming majority of shophouses here are freehold in nature. This allows for the gradual appreciation of the commercial property without it having to suffer from lease decay.

This is one of the key selling points of the shophouses here over other commercial properties. The freehold nature is a great pairing with the rental yield strategy. Moreover, the freehold nature allows you to ride through property market cycles without suffering from lease decay. If there are bad economic conditions that depress the prices of shophouses, you would feel less pressured to sell on impulse.

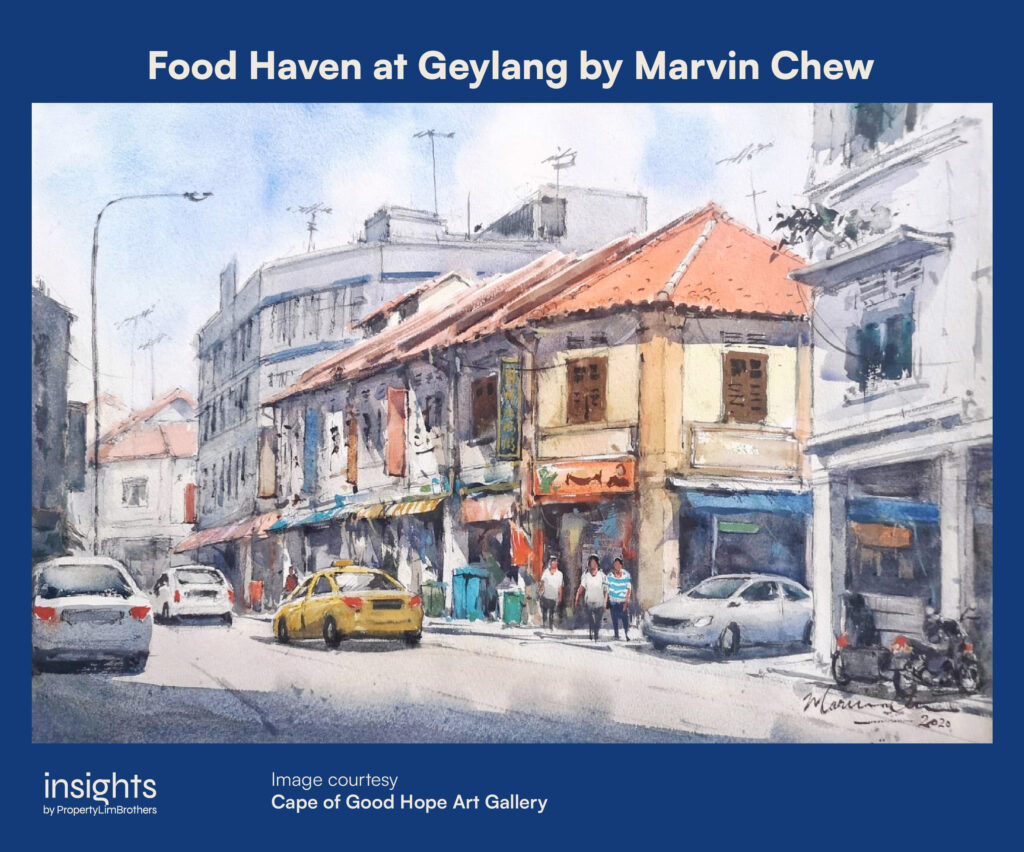

Apart from the obvious economic benefits of owning a shophouse in District 14, shophouses in Geylang have its history rooted in the pre-war and colonial period. The rich heritage of shophouses is a signature aesthetic of Singapore’s developing years and offers a unique low-rise vibe that is distinct from the high-rise residential areas that we see all over Singapore.

This unique combination of perks brings together an interesting opportunity for property investors looking to invest in commercial real estate and a piece of history in itself.

How do D14 Shophouses perform?

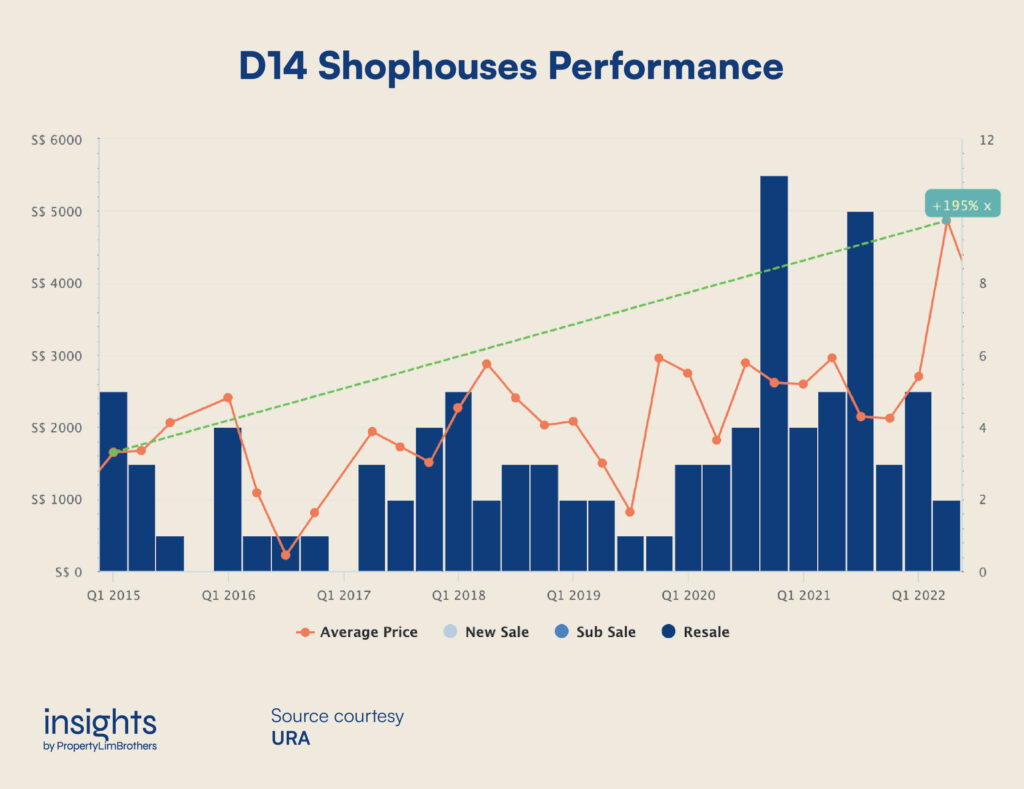

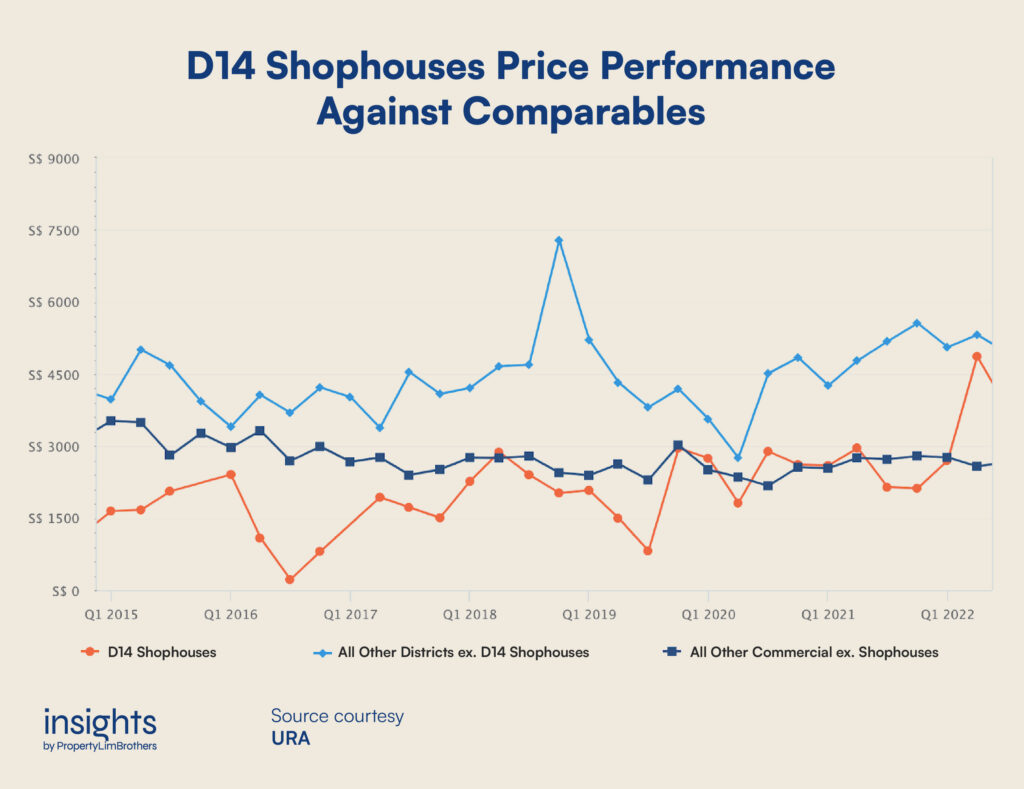

D14 is one of the districts that have carried the performance for the Shophouse segment. Over the course of the past 7 and a half years, prices of Shophouses in D14 have grown by 195%. This is an exceptional amount of growth. On average, this meant a simple annual growth of 26%. Do note that this is purely on the capital appreciation of the real estate and has not included the income from rents.

While the performance of D14 Shophouses has been indeed stellar, it is important to remember that a lot of the growth has been driven by much higher prices based on the transactions in Q2 2022, which sold at a record average of $4,866 psf. However, there was a low volume of 2 transactions in 2022 Q2. So this growth is largely driven by the higher prices specifically in the Geylang Conservation Area.

There are a total of 94 transactions over the 7.5 year period, but we do see a lot more transactions in the post-pandemic era as compared to before. Arguably, this is considered to be on the lower volume side of transactions. On average, there are around 3 transactions a quarter (or 1 transaction a month). This spaced out transactions might be contributing to the volatility we observe in the prices of Shophouses in D14.

Comparing D14 Shophouses to all other shophouses in Singapore, D14 shophouses have grown more than other shophouses by more than 5 fold. The impressive rise in D14 Shophouse prices may be due to the overall lower psf between D14 shophouses and the rest of the shophouse segment. In the recent Q2 performance, this disparity gap between D14 prices and the rest of the shophouse segment has been dramatically reduced.

Overall, all other commercial properties (not including shophouses) have been declining in the long term. Other commercial properties have fallen by 27% in the same span of time. This lacklustre performance in commercial properties might be disheartening to some property investors. The key to succeeding in this segment is to find the right opportunity and stick to strong performers, rather than simply buying the lowest quantum commercial properties.

Shophouses are a niche in this commercial property category that has clearly outperformed the average with a very high margin difference. With the right choice, the opportunity for capital appreciation can be massive, as shown with the D14 Shophouses example.

That being said, past performance is not an indicator of future performance. This does not mean that you immediately go for the buy decision when we see appreciation hitting 195%. Ultimately, the most important key to success is a good strategy. Following our Disparity hunting approach when it comes to property search (be it residential or commercial), we are able to identify opportunities that have a higher potential for growth.

Why invest in D14 Shophouses?

Apart from all the attractive features we have mentioned about D14 shophouses and their performance, there are even more reasons to be interested in shophouses of this particular district. As we have mentioned earlier, a bulk of the action happens in the Geylang Conservation Area along Geylang Road. The conservation shophouses here have a keen aesthetic and there are regulations revolving around how they should be maintained and there are specific ways to renovate the property.

The URA follows the “3R” of conservation. Their principles include “Maximum Retention, Sensitive Restoration and Careful Repair”. The property should clearly retain its historical image, and the restoration and repair should be done with the spirit of preserving the heritage of Singapore.

These “constraints” are arguably more beneficial than they are limiting. Clear guidelines are given on how to go about restoring. You do not need to crack your head open on renovating the property. In addition, because this is a joint effort of all the conservation shophouse owners, the district will be able to have a unified image of the restoration. Together, this gives D14 Conservation Shophouses a unique and instagrammable front for tourists and locals alike.

Another well-known fact about District 14 is the great food that can be found in the Geylang area. Food guides posted by local foodies and bloggers introduce a world of goodness when it comes to the local food culture that can be experienced in this district. There is a wide range of local delicacies that can be found in this area. This eventually translates into footfall in the district.

Coupled with the attractiveness of the conservation aesthetic, local food culture is able to shine together with the historical aesthetic of D14 shophouses. This is a perk for businesses looking to D14 Shophouses as rental options. For commercial property investors, who your tenants are may be an important part of your rental strategy.

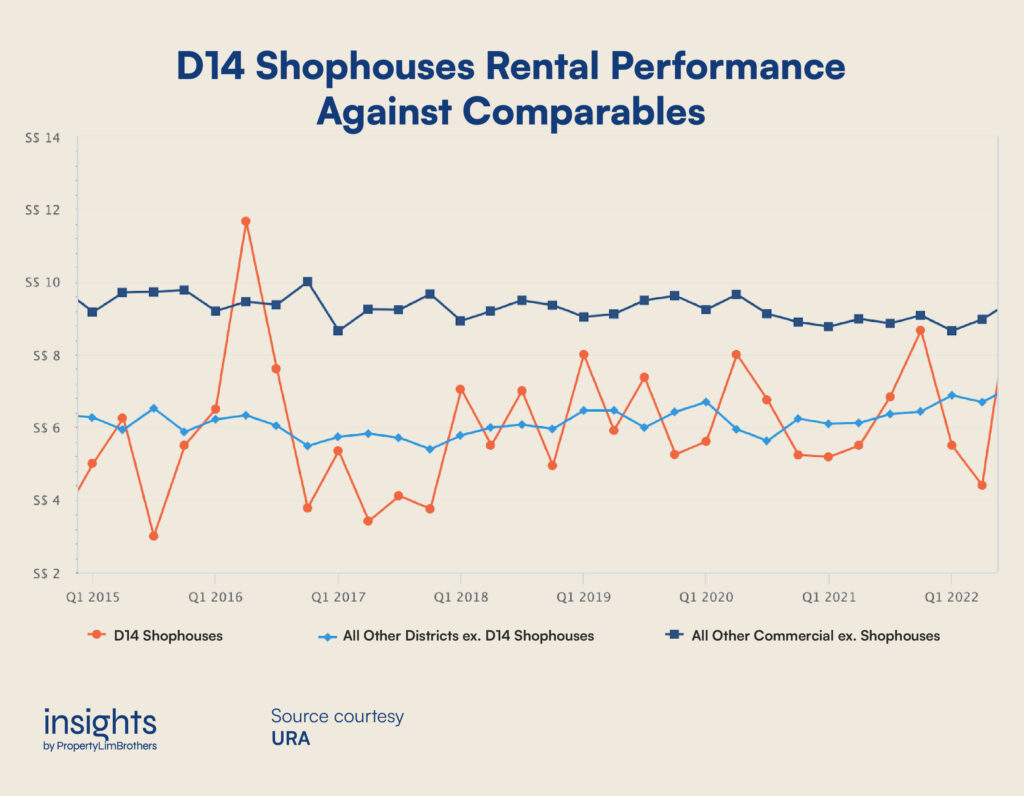

Speaking of rent, we took a look at the rental performance of D14 Shophouses against their comparables. Because of the high volatility in rental contract prices, the Quarterly Rental growth rate was -12% from 2015 to Q2 2022. This is due to the fact that there are a lot fewer rental contracts as compared to the larger segments of all other shophouses, and all other commercial properties.

The rental prices will be determined largely by the conditions of the shophouse and the relative location in D14. Nonetheless, with a strong rental strategy it is possible to score above average prices for rental income based on the upside volatility we see in the charts. This is important because rental income helps to offset the loan repayments which may grow over the next few quarters as the US FED continues to raise interest rates.

Closing Thoughts

D14 Shophouses have a clear and special combination of Unique Selling Points. The food culture and eating options in the Geylang area are enviable. Its location is considerably close to the CBD and partially in the RCR area. There is a rich history of the Geylang area which dates back to the 1840s era. The conservation shophouses also provide a signature aesthetic to these particular shophouses in the D14 Geylang Road area.

Although the high disparity gap has recently closed in the Quarter 2 transaction data, there might still be future opportunities to hunt for disparity. The long-term trend sees D14 shophouses to be priced below the average psf for Shophouses all over the country. In the future, when prices dip to the $1,500 range, it might be a great price point to hunt for disparity.

Compared to its comparables, D14 shophouses posted a solid performance with strong gains in 2022 Q2. This points to the high potential of the area when it comes to future growth. Whether or not these higher price points can be sustained will be a key thing to look out for in the shophouses segment.

Despite all these great signals, prospective commercial property investors will need to be keenly aware of the economic slowdown and rising interest rates. These macro factors might threaten affordability, cashflow, and profitability. Regardless, the lower psf in this area may offer reasonable quantums for some shophouses in this area as compared to the other commercial properties across Singapore. The freehold shophouses in D14 also present a great opportunity to ride through the troughs of the property market without suffering from lease decay.

If you wish to know more about the Shophouses Segment as an investment niche and whether it fits your property portfolio and journey, reach out to our experts here. We would be happy to guide you through this process of discovery.